Up to this day, many accountants spend large amounts of time manually processing invoices, registering taxes or updating their books. It is a lengthy and time-consuming process, which is why many companies have turned their attention to automating the accounting process.

Automation helps accountants save up to 52 days per year by automating repetitive tasks like tax processing, invoice management, and bookkeeping. Whether you’re looking for a full accounting platform with automation features or a tool that can enhance your existing accounting software, automation can make a significant impact.

In this blog, we will explain what accounting automation software is, discuss the different benefits it provides, and present you with a list of some of the most efficient software for accounting automation on the market.

Key Takeaways

The 5 Best Accounting Automation Software for 2025 are:

Comparison of the best receipt scanning apps in 2025:

What is Accounting Automation Software?

Accounting automation software is a digital solution that allows companies to automate various accounting processes. This software typically handles tasks such as accounts payable and receivable, bookkeeping, and tax processing. However, not all accounting automation software is the same.

Some accounting automation tools are full-fledged accounting platforms, designed to replace manual processes entirely. Others, known as “pre-accounting” software, integrate with your existing accounting system, adding automation features to enhance your current workflow. This means you don’t need to replace the software you’ve used for years; instead, you can simply synchronize the new automation tools with your familiar system.

Instead of manually entering financial data and updating the books, accounting professionals can facilitate their job by passing these tedious tasks into the hands of automation – following some of the best practices in AP. This way, the automated accounting system takes off a load of processing paper documents and minimizes the risk of invoice fraud, and lowers processing costs.

By leveraging automation, whether through a complete platform or a pre-accounting integration, businesses can significantly reduce manual input, minimize errors, and streamline financial operations.

5 Best Accounting Automation Software

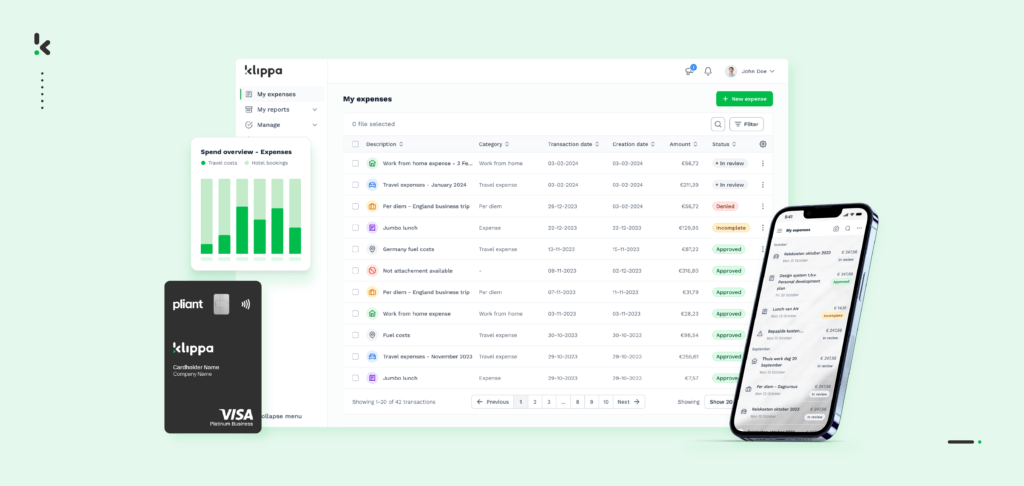

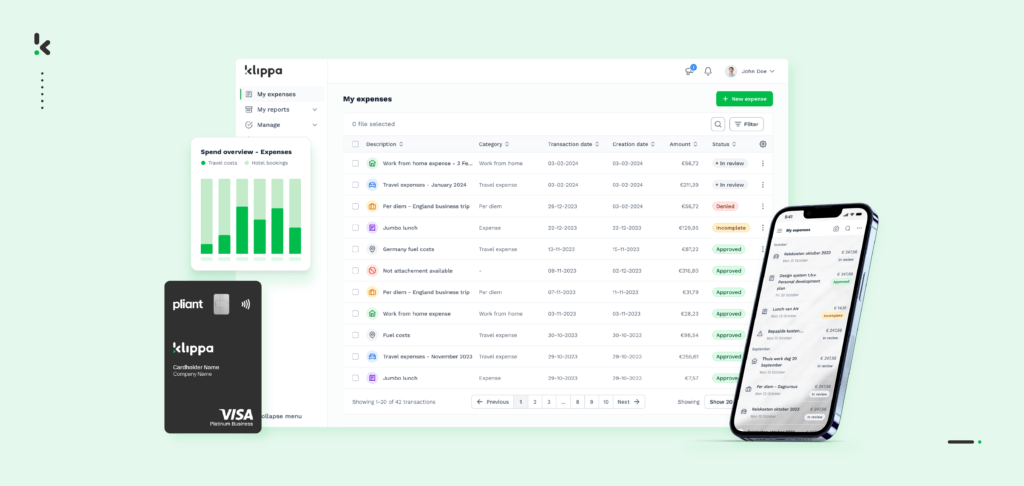

Klippa SpendControl

Klippa SpendControl is an all-in-one digital pre-accounting software that combines invoice processing, expense management, and business credit card modules.

Our software utilizes OCR technology to ensure accurate data capture and enable invoice scanning, approval, archiving, and booking directly to your financial administration.

Pros

- Manage your vendor invoices, employee expenses, and business credit cards in one platform

- Scan, submit, process, and approve transactions via web or mobile app

- Achieve 99% document data extraction accuracy with Klippa’s OCR

- Regain control over your finances with intuitive dashboards

- Customize your approval management with multi-level authorization flows

- Automatically reconcile credit card transactions

- Never fail to comply with tax and data privacy regulations with our ISO27001-certified and GDPR-compliant solution

- Rely on automatic multi-currency support for international payments

- Prevent invoice and expense fraud with built-in duplicate and fraud detection

- Integrate SpendControl with your accounting and ERP software, like Quickbooks, NetSuite, or SAP

Cons

- No integration options for travel or productivity systems

- Currently no 2-way matching (Coming in 2025)

Pricing

- Effective plan: Spend management platform with automated submissions, approvals, and reporting features as well as a credit card module, $5 per user/month

- Premium plan: Spend management module with additional comprehensive customization and financial regulation compliance features, $6 per user/month

- Custom plan: A customizable solution tailored to your company’s needs. Contact us to learn more about pricing

Ideal business type and size: Klippa SpendControl is best suited for small to medium-sized companies that will benefit from invoice, expense and credit card transaction processing in one centralized solution.

FreshBooks

FreshBooks is a bookkeeping platform that automates all accounting processes within an organization. From balance sheets to accounts payable, FreshBooks keeps track of all financial processes.

Despite their focus on accounting and financial reporting, this digital solution cannot be integrated within an already-existing bookkeeping system.

Pros

- Customizable chart of accounts

- Allows for expenses and asset tracking

- Scans financial documents and extracts important data

- Automated bank reconciliation

- Invoicing and payment collection

Cons

- Does not perform 2-way or 3-way matching

- According to reviews, the software is not suitable for large business (Forbes)

- No accounts payable feature outside of the premium plan

Pricing

- Lite plan: Unlimited expenses with performance dashboards, $7.60/month

- Plus plan: Double-entry accounting reports and bank reconciliation, $13.20/month

- Premium plan: Accounts payable and project profitability feature, $24/month

- Select plan: Dedicated account manager and customized onboarding, pricing upon request

Ideal business type and size: Freshbooks is best suited for small companies that prioritize collecting payments and invoicing.

Xero

Xero is an expense management software that lets companies digitally process and manage financial documents, without additional manual processing.

It is best used to facilitate transactions and create smooth communication between companies and vendors, therefore its main focus is set on automated invoicing and inventory management.

Pros

- Keeps track of payment statuses

- Batch payment to multiple suppliers

- Monitors employee spending

- Job tracking tools for project planning, budgeting, quoting and invoicing

- Allows bank reconciliation feature

Cons

- Xero doesn’t allow creation of custom reports

- Based on client reviews, users have a hard time accessing customer support (TrustRadius)

- No built-in 2-way or 3-way matching

- Users need to purchase additional software integrations to access features such as approval workflows

Pricing

- Starter plan: Upload of 5 invoices and reconciliation of bank transactions, $29/month

- Standard plan: Reconciliation of bank transactions in bulk, $46/month

- Premium plan: Additional multi-currency support, $62/month

Ideal business type and size: Xero is best suited for small to medium sized businesses with not overly complex accounting needs.

Accounting Seed

As the name suggests, Accounting Seed is an automated accounting platform designated to facilitate financial processes in organizations. Accounting Seed is designed to work within Salesforce, a popular CRM platform. It provides a seamless accounting and financial management solution for businesses by leveraging Salesforce’s robust ecosystem.

Pros

- A full general ledger system

- Enables to generate profit and loss statements, balance sheets, cash flow statements.

- Automated bank reconciliation tools

- Features to create and send invoices

- Native integration with Salesforce CRM

Cons

- Since Accounting Seed is built natively on Salesforce, users must have an additional Salesforce subscription

- Based on client reviews, users are experiencing issues with the quality of customer support (GetApp)

Pricing

- Pricing available upon request

Ideal business type and size: Accounting Seed is best suited for small to mid-market companies who are using or plan to use the Salesforce CRM.

Tipalti

Tipalti is an automated data entry system, specializing in accounts payable automation. Its OCR technology accurately extracts data from invoices, helping streamline invoice management and inventory management processes.

Pros

- OCR for automated document scanning

- Automated 2-way & 3-way PO matching

- Self-service supplier management portal

- Multi-entity management capability

- International tax information validation, with full compliance with UK and US tax authorities

Cons

- Based on client reviews, users have often experienced OCR inaccuracies during invoice processing (TrustRadius)

- Does not provide 2FA or user sync

- Inability to customize reports

Pricing

- Starter plan: Basic AP platform with supplier portal, from $129/month

- Premium plan: 2- & 3-way PO matching with multi-entity and multi-currency support, custom pricing

- Elite plan: Customized approval rules for purchase requests and budget management, custom pricing

Ideal business type and size: Tipalti is best suited for medium-sized businesses with complex accounting needs.

Why Use Accounting Automation Software?

Financial teams know all too well the pressure that comes with managing multiple tasks during busy periods, like month-end and year-end closings. From chasing down invoices to reconciling accounts, manual processes can overwhelm even the most experienced professionals.

Accounting automation software offers a way to avoid these pains, making daily operations smoother and closing periods far less stressful. Here’s why it’s worth considering:

Save Time on Routine Tasks

Financial teams often spend hours on repetitive tasks like data entry, invoice matching, and reconciliations. In some cases, such as with pre-accounting software, automation tools will work alongside your existing software, taking over these processes and allowing your team to focus on more strategic activities, such as financial analysis and forecasting.

Reduce Errors in Financial Data

Manual processes are prone to mistakes, and even small errors can have big consequences, especially during audits or financial reporting. Automation ensures that data is consistent and accurate across all systems, reducing the risk of errors that could lead to compliance issues.

Stay Compliant with Changing Regulations

New regulations, such as e-invoicing mandates or sustainability reporting requirements (like CSRD), are reshaping financial reporting. Automation software helps ensure your reports are accurate and compliant, without the need for constant manual updates. Whether it’s tax compliance or ESG reporting, the software keeps you covered.

Cut Operational Costs

The more you automate, the less time your team spends on tasks like manual data entry or invoice filing. This frees up their time for more valuable work, such as financial analysis or strategic planning. Automating these processes not only boosts productivity but also helps avoid the extra costs of temporary staff during high-pressure periods like year-end closing.

Scale Without Stress

As your business grows, so do the complexities of managing financial data. Automated software scales with you, making it easier to handle increasing transaction volumes, additional reporting requirements, and more complex financial structures—all without overwhelming your team.

Identify and Prevent Fraud

Automation can quickly detect irregular patterns in your financial data, helping to identify potential fraud before it escalates. By using smart algorithms, the system flags anomalies for review, giving you peace of mind during periods of increased activity or when processing a high volume of transactions.

For financial teams looking to simplify their workflows and improve accuracy, accounting automation software offers a practical solution. Whether dealing with new regulatory requirements or simply trying to streamline day-to-day operations, automation frees up time, reduces errors, and helps you focus on what really matters—strategic financial management.

How to Choose Automated Accounting Software

It is important to choose accounting automation software that fits your business needs. But with so many options available, it’s essential to know which features will provide the most value for your company and financial team. Here are the top features to consider when evaluating accounting automation tools:

Automated Data Entry

Manual data entry is not only time-consuming but also prone to errors. Look for software that can automatically capture and process data from invoices, receipts, and bank statements. Optical Character Recognition (OCR) technology is a must for extracting accurate data from scanned or digital documents.

Real-Time Reporting

Real-time reporting tools allow you to generate up-to-date financial statements, balance sheets, and cash flow reports. Having this information available instantly helps you make informed decisions on the go, particularly during audits or forecasting sessions.

Bank Reconciliation Automation

Bank reconciliations can be one of the most tedious accounting tasks. The best software should be able to automatically match bank transactions with your accounting records, saving time and ensuring accuracy. This feature is especially useful for businesses with high transaction volumes.

Expense Management

Tracking employee expenses, receipts, and reimbursements can easily become a headache. A good accounting software will have built-in expense management features that allow you to capture receipts digitally, categorize expenses, and automate approval workflows.

Tax Compliance

Staying compliant with local and international tax regulations is crucial. Look for software that can automatically calculate taxes, generate compliant e-invoices, and ensure that you’re prepared for tax season without needing extensive manual input.

Integration with Existing Tools

To maximize efficiency, ensure that your accounting automation software can easily integrate with your existing ERP, CRM, payroll systems, or other business tools. Seamless integration reduces the need for manual data transfers and ensures all your systems are in sync.

When choosing accounting automation software, consider the unique needs of your business. Whether you’re looking to streamline data entry, enhance reporting capabilities, or simplify compliance, focusing on these key features will ensure you choose a solution that provides long-term value for your financial operations.

Conclusion

Picking the right software to automate your business accounting can be discouraging, especially when you’re considering a shift from software your team already knows well. But with Klippa SpendControl, there’s no need to make a complete switch.

You can automate your pre-accounting tasks and easily sync structured, validated financial data with your current accounting software. No big investments. No steep learning curve. Just a straightforward app that turns hours of work into a few clicks!

FAQ

Automation in accounting software refers to the use of digital tools to handle repetitive accounting tasks such as data entry, invoice processing, and tax calculations. This reduces manual input, minimizes human errors, and speeds up tasks, allowing financial teams to focus on higher-level strategic activities.

To automate your accounting job, start by identifying the tasks that consume the most time, such as data entry, bank reconciliations, and invoice processing. Then, choose accounting software with automation features or a pre-accounting tool that integrates with your existing system. Automation tools can handle tasks like expense management, transaction matching, and reporting, significantly streamlining your workflow.

The three main types of accounting systems are:

Manual Accounting Systems: Traditional, paper-based systems where all accounting processes are done manually.

Software-based Accounting Systems: Digital systems where accounting processes are handled through specialized software.

Automated Accounting Systems: These systems use advanced software to automate various accounting processes, reducing manual intervention and human error.

To automate bookkeeping, use software that integrates Optical Character Recognition (OCR) technology and other automation tools. These systems can automatically extract data from receipts and invoices, categorize transactions, and update your financial records in real-time. By leveraging automation tools, you eliminate the need for manual data entry, ensuring more accurate and efficient bookkeeping.