All businesses, regardless of their industry, have one thing in common: they all need to do their bookkeeping. Keeping track of expense accounts, assets, and liabilities, is a task that concerns all organizations and generally, it is a tedious and time-consuming chore.

Having to maintain a transparent record of all expenses and revenues of a company, can be quite the hassle for an organization’s financial expert. Keeping track of a company’s cash flow and balance sheet requires precise attention, especially if they are processed manually. One of the expenses that need to be tracked is accrued expenses.

If you are not yet familiar with accrued expenses, keep reading to learn more about this financial term. In this blog, we will explain what an accrued expense is, give some examples of accrued expenses and offer a software solution for automating accrued expenses.

Let’s begin!

Key Takeaways

- Accrued expenses are costs a company has incurred but not yet paid or received an invoice for by the end of an accounting period.

- They ensure accurate financial reporting by recording obligations in the correct period, following the matching principle.

- Salaries, utilities, interest on loans, and taxes that have been incurred but not yet paid.

- Listed as liabilities on the balance sheet and expenses on the income statement.

- It helps provide a true financial picture, ensuring compliance with accounting standards.

- Businesses should track accrued expenses using automated systems, regular reviews, and clear communication with vendors and employees.

What is an Accrued Expense?

Accrued expenses, or accrued liabilities, are expenses that have been registered by an organization, but have not yet been paid or for which a corresponding invoice has not yet been received.

Accrued expenses allow an organization’s financial statement, such as a balance sheet or income statement to be more accurate. They showcase all the expenses of a company, making the income statement more precise.

Understanding Accrued Expenses

Accrued liabilities, as their name states, are displayed under the section “liabilities”, on the right side of a company’s balance sheet. They account for any upcoming payment that the company has to complete, even if the respective invoice has not been created yet.

It is important to note that an accrued expense is always estimated and can differ from the price shown on the vendor’s invoice. That’s why it’s useful to keep an error margin when entering the amount for accrued expenses in the balance sheet.

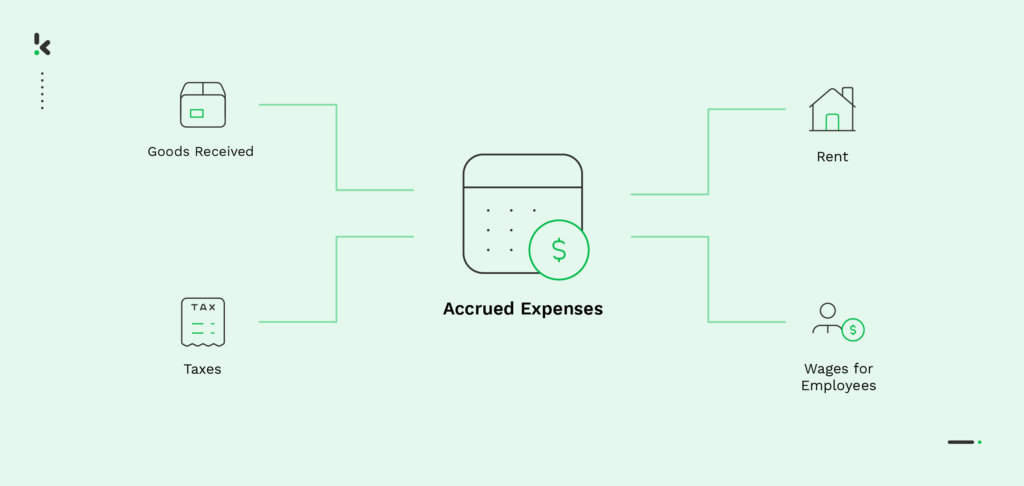

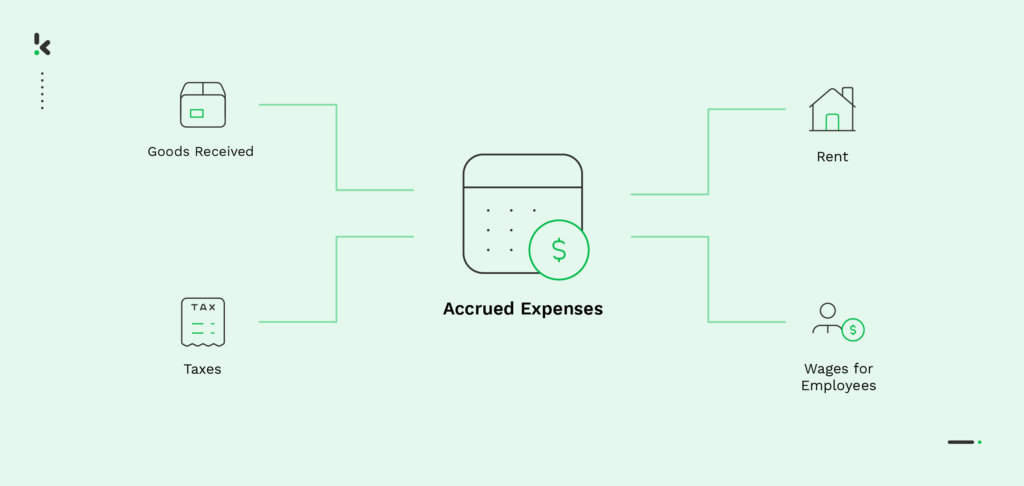

Accrued expenses can be represented in many ways, including:

- Goods or services received

- Wages for employees

- Takes

- Commissions

- Rent

Let’s suppose a business contacts a vendor and places an order for 20 computers for new employees. Two weeks later, the goods are delivered to the company’s headquarters, but the payment request has not been received yet. In this case, the price for all the new computers is an accrued expense, as the payment for the delivered goods will occur later in time.

Accrued expenses can be a real challenge for companies. More often than they would like, financial experts get lost in these expenses, mainly because they cannot match a purchase with its respective invoice. Keeping track of all upcoming expenses without having the ability to account for the goods or services the company has received, can become a burden.

Handling accrued liabilities is a time-consuming process and can get out of hand very quickly. Accrued expenses can either add up, creating a larger sum that needs to be paid later in time, or be forgotten, generating discrepancies in a company’s balance sheet.

As processing accrued expenses is still a manual task for most organizations, the majority of financial records are prone to errors and therefore quickly alter a company’s bookkeeping accuracy and transparency.

Unfortunately, accrued liabilities can also become a gateway for scammers. Invoice fraud is just one of the issues that can occur in a company if the financial department doesn’t keep a close eye on its transactions. For example, a business could receive an invoice with a higher amount than the goods or services that were delivered. This is not only unpleasant but can also cause large financial losses.

A solution to avoid these issues and prevent financial fraud is to automate the management of accrued expenses, using expense management software. This allows businesses to automatically recognize and record expenses in their financial records, as they are incurred, rather than when they are paid.

Advantages and Disadvantages of Accrued Expenses

Advantages

Accrued expenses help companies maintain more accurate financial statements by ensuring that costs are recorded in the correct accounting period. This provides a clearer and more realistic picture of the company’s financial health. Additionally, by recognizing expenses when they are incurred rather than when they are paid, businesses can better plan and strategize for future financial decisions.

This method also ensures compliance with accounting standards such as GAAP and IFRS, making financial reports more reliable for investors and auditors. Furthermore, accrued expenses help businesses measure true profitability by aligning expenses with the revenues they generate, leading to a more precise evaluation of performance.

Disadvantages

Despite their advantages, accrued expenses can be time-consuming and demanding for accounting staff to manage, as they require regular tracking and adjustments. Additionally, this method can blur the company’s actual cash flow since expenses are recorded before they are paid, potentially making the business appear more or less liquid than it really is.

Another challenge is that some accrued expenses rely on estimates, which can introduce inaccuracies into financial reports. Lastly, the complexity of tracking and reconciling accrued expenses adds another layer of difficulty to financial reporting, requiring businesses to constantly update and adjust their records.

Managing Accrued Expenses with Expense Management Software

As mentioned earlier, automation can significantly improve the process of handling accrued expenses. Some of the benefits of automating this process include:

- Increased efficacy: speed up the accrual process, reducing the amount of time to process accrued expenses

- Improved accuracy: reduce the potential for errors, by removing the need for manual data entry and calculations

- Real-time overview: keep track of all expenses from the moment they are accounted for

- Enhanced security: prevent financial fraud by creating a clear overview of expenses and giving only access to authorized individuals

There are many expense management solutions that can help your business, such as Klippa SpendControl. Our platform offers your business all features and advantages it needs to effectively automate financial processes, in just one platform.

Klippa SpendControl is an all-in-one financial management solution that facilitates expense management and helps you keep a clear overview of all financial transactions. Klippa’s expense management software allows you to:

- Submit expenses via the app or website

- Accurately scan and extract information using OCR technology

- Create a secure authorization flow, with advanced approval options

- Easy approval of expense claims, via app or website

- Benefit from a seamless integration with your ERP system, which helps keep the bookkeeping system up-to-date

- Have a clear overview of all expenses

Eliminate the burden of manually processing accrued liabilities and improve expense management in your organization. Our experts would be happy to show you how our solution can help you! Feel free to contact us or book a free demo below.

FAQ – Accrued Expenses

Accrued expenses are costs that have been incurred but not yet paid or invoiced, such as wages or utilities. Accounts payable, on the other hand, are amounts a company owes to suppliers for goods or services that have been received and invoiced but not yet paid.

Accrued expenses ensure that all incurred costs are recorded in the period they occur, providing a more accurate financial picture. This practice aligns with the matching principle, which states that expenses should be recognized in the same period as the revenues they help generate.

Accrued expenses are recorded as liabilities on the balance sheet and as expenses on the income statement. When the expense is paid, the liability is reduced, and the cash account is decreased accordingly.

Common accrued expenses include: 1) Salaries and wages earned by employees but not yet paid. 2) Utilities consumed but not yet billed. 3) Interest on loans that has accumulated but not yet been paid. 4) Taxes incurred but not yet paid.

Businesses can manage accrued expenses by:

1. Implementing automated accounting systems to track and record expenses in real-time.

2. Regularly reviewing and adjusting estimates to ensure accuracy.

3. Maintaining clear communication with vendors and employees to anticipate upcoming expenses.

4. Ensuring timely reconciliation of accounts to reflect the most current financial information.