Is your organization experiencing the hell of processing car titles manually? We can all agree that manual data entry is dreadful, and having different titles in each state is not making car title processing any easier.

As a result, it may take up to 10 weeks to process a single car title, which can be detrimental to customer satisfaction. Long processing times can truly eat up your bottom line and put a brake on your organization’s growth.

So let’s face it. It is far more efficient to leverage technology that automates car title processing. And why not make it a little bit more fun and engaging for your employees while doing it?

In this blog, we will point out how you can automate car title processing with the help of AI-powered car title processing and the three key benefits it will bring to your organization.

The role of OCR and AI in car title processing

The 21st century has welcomed many exciting new technologies to automate various time-consuming processes. One of these technologies is Optical Character Recognition (OCR). It is a technology that converts images to text and can help to automate data extraction from scanned documents, images, or electronic documents.

With OCR software, your organization can automate the processing of car titles. No one in your organization has to manually enter the information from car titles into your system anymore. It opens up new possibilities to digitize documents and work more efficiently without waiting for the physical titles for lengthy periods.

Sounds good, doesn’t it? Let us illustrate how you can extract data from car titles with OCR software.

How does car title data extraction work with OCR software?

With the help of OCR software, data from car titles can be extracted within just a few seconds. The typical process consists of three steps:

- Uploading the car title

- Car title image-to-text conversion

- Parsing the car title text file to JSON

1. Uploading the car title

The first step is to take a picture, upload, or scan the car title using either a web application or a mobile app with OCR functionalities.

2. Car title image-to-text conversion

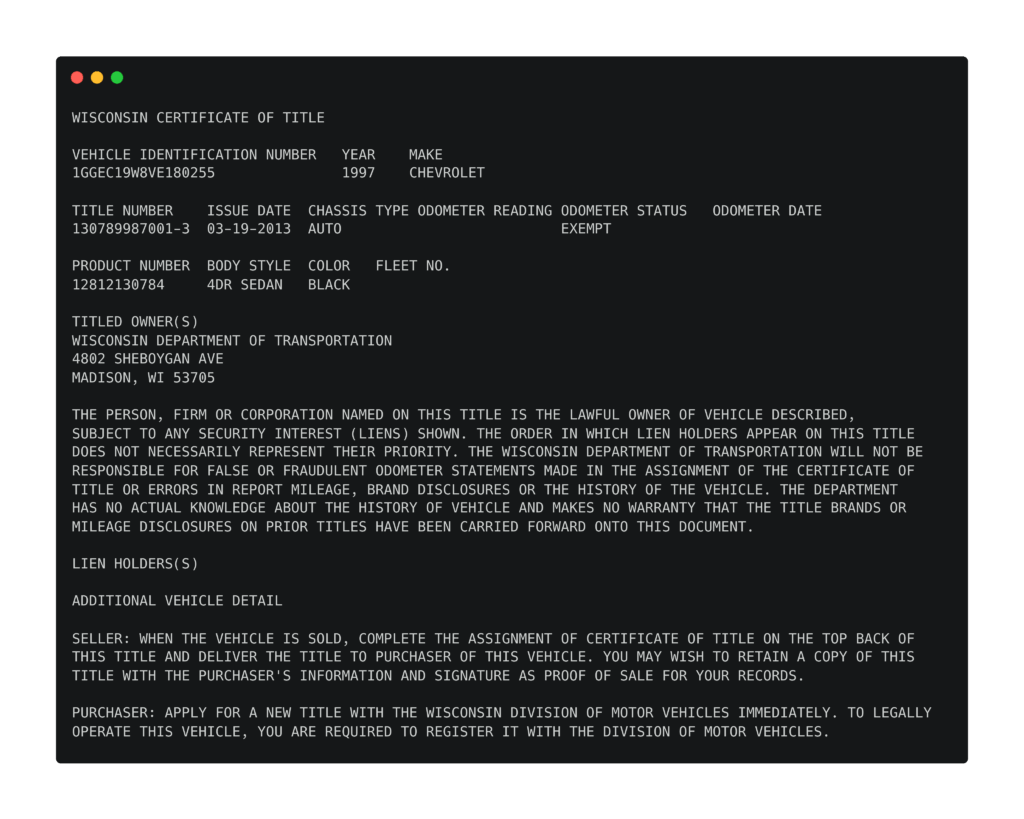

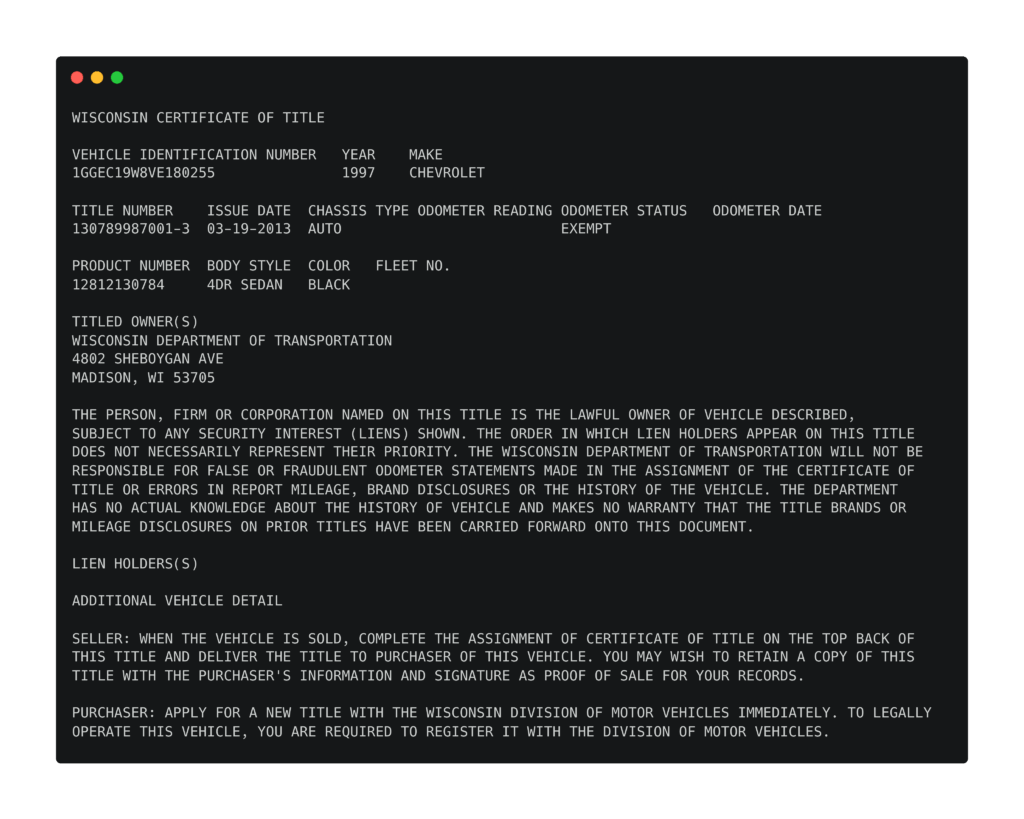

Once the OCR software receives the image or scan of the car title, it analyzes the patterns of the letters and numbers and converts the scanned title into digital text.

While all the text from the car title is extracted in this step, it is not yet structured or processed.

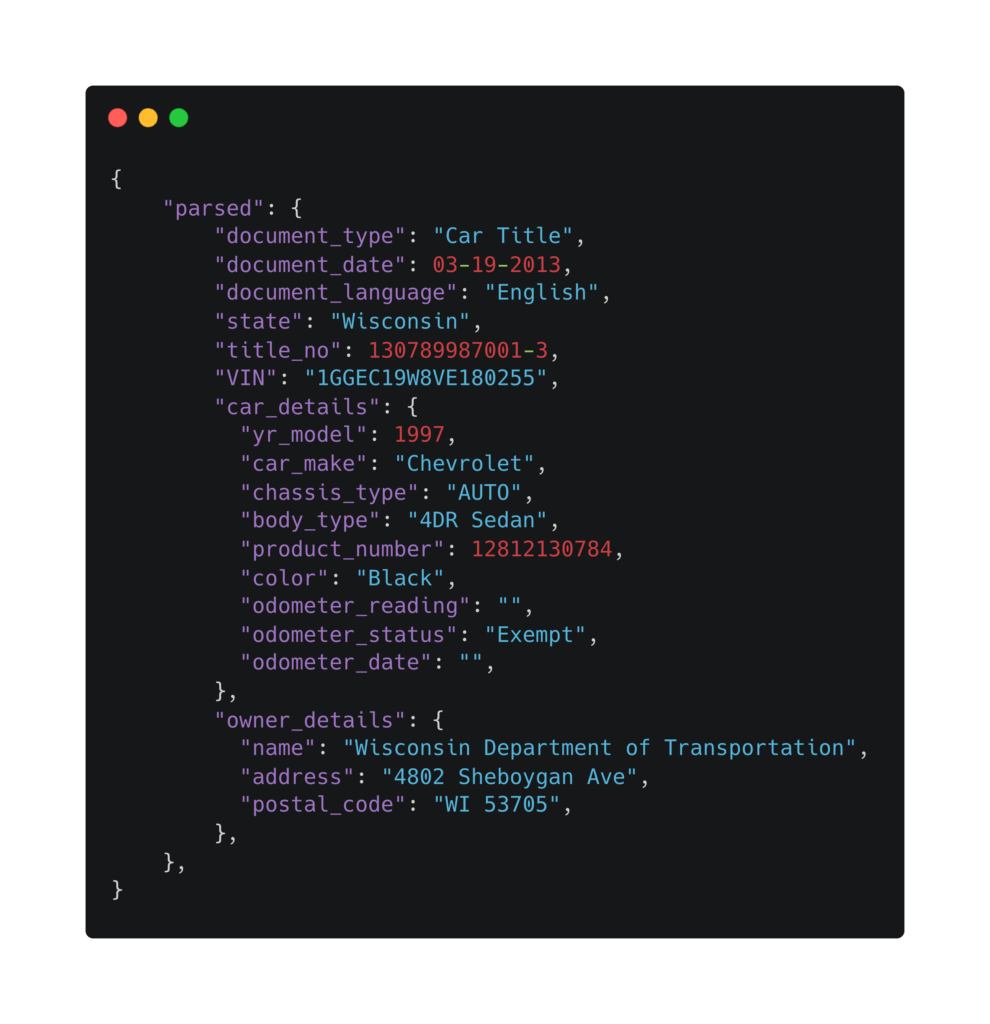

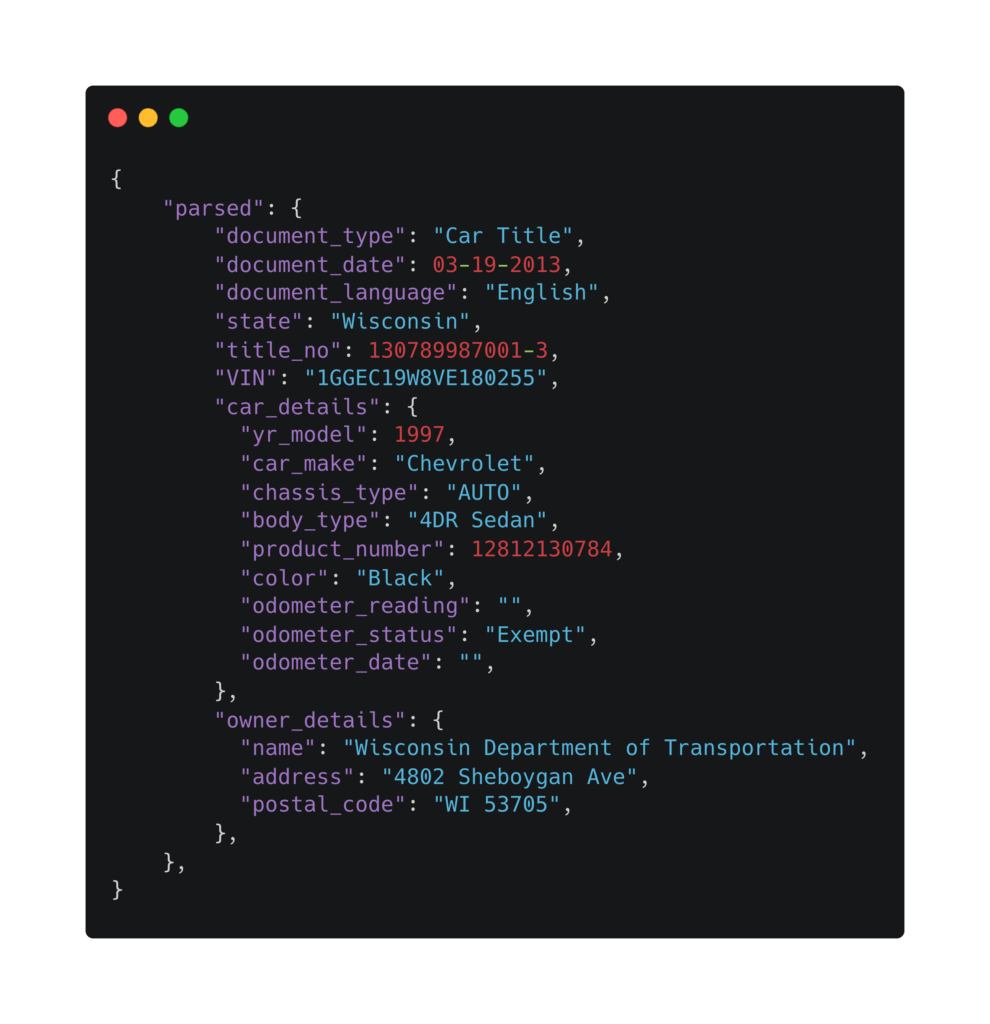

3. Parsing the car title text file to JSON

In the final step, the OCR software recognizes different fields on the car title and converts the digital text into a structured form of data, such as JSON.

After parsing, the output can be easily processed by other business software, stored in your database, or sent to third parties to verify the data.

Now that you know how manual tasks in car title processing can be automated via OCR software, let’s take a look at the key benefits.

The benefits of using OCR and AI in car title processing

Many benefits come with using OCR and AI in car title processing. These benefits can both individually and collectively impact your bottom line positively. Take a look at the three key benefits we have listed below.

Reduced Processing Time

Car title processing involves a hefty amount of paperwork, especially when done manually. It’s already a bureaucratic nightmare, and the Covid-19 pandemic only made it worse. The Departments of Motor Vehicles (DMV) and similar offices were forced to close or reduce their capacity in many states. Naturally, this has increased the processing time of car titles.

One of the main benefits of using OCR and AI technology is reducing the car titles’ processing time. You can extract the data and process it into a specific system by taking a photo of a car title or uploading an electronic car title with OCR software.

This way, your back office can process many more documents within the same time it would take to manually enter the data into the system.

Let’s say that on average it takes 1 minute to check that a car title is valid, another minute to enter the data into the system, and 2 minutes to verify that all the data are correct. That’s four minutes in total.

Now if you would multiply this by 100 car titles a day, it would require your organization 400 minutes to process these titles into your system. With an advanced OCR, you could do this in less than 10 minutes. That’s a time reduction of over 90%.

Handy right?

Prevent Fraud

As there are ways to do business legitimately, there are also criminals looking to find a way to take advantage of those avenues. A good example is car title fraud, which occurs when a car title is intentionally made inaccurate and does not reflect the vehicle’s “true” title history.

In other words, car titles can be “washed” of the relevant history, or critical information is intentionally left out entirely. Due to car title washing, millions of motor vehicles that are “totaled” by insurance companies end up back in the car commerce.

Spotting irregularities

Fortunately, OCR software can prevent the scenario mentioned above and help your organization detect possible fraud and irregularities that occur on car titles.

Specifically, with Klippa OCR API, you can detect inconsistent pixel structures to determine whether there have been altercations or attempts of “photoshopping” done. It’s even possible to cross-check Vehicle Identification Numbers (VINs) to verify them with external databases to avoid fraud.

Some things are challenging and time-consuming to verify manually and detect by the naked eye, so why not couple up with OCR software?

Improved Employee Engagement

According to a report from Gallup, eighty percent of employees surveyed are not engaged at work. Shockingly, the global economy suffers US$8.1 trillion of costs each year due to the lack of engagement of the employees. There is a great chance that your organization is also suffering from it.

Choosing the right technologies to support your employees to meet specific business objectives can go a long way in driving employee engagement and productivity. Are you not convinced yet? A study from PWC found that 73% of people surveyed are aware of systems that could help them do their work better.

Fostering employee engagement

OCR software is one of the tools that can help foster employee engagement. As it is designed to automate manual data entry, employees will have more time to complete meaningful and fulfilling tasks. With an OCR solution, you can foster employee engagement in the following ways:

- Create more opportunities to work remotely

- Workload management

- Increase time for career development

- Update technological skills and knowledge

Now that we have covered the three key benefits of OCR software in car title processing, you might want to know which companies make use of it. We will dive into that in the following section.

Companies that benefit from automated car title scanning

Many industries and companies need OCR solutions to automate their business processes and improve their bottom line. Below we have listed two types of companies that benefit from automated car title scanning.

Automated car title scanning for car dealerships

For car dealerships, the bread and butter have always been sales. However, there are many tools in the modern days that provide consumers with a vast amount of knowledge. This creates a scenario where dealers have to fight each other for margins. Hence, it is crucial to find a solution that improves car sales turnaround times.

OCR software can help car dealerships reduce the time spent on manual data entry and verification processes of car titles. When a buyer comes to your dealership with a car title of a trade-in car, you can simply scan the title and have the information in your system ready to be forwarded to the DMV in just a matter of seconds.

In addition to faster turnaround times, you are able to:

- Detect possible alterations done to the car title

- Increase employee engagement by automating data entry

- Improve customer satisfaction through faster title processing

Automated car title scanning for insurance companies

When a vehicle is declared a total loss, the signed car title must be handed over to an insurance company. In exchange, the insurer has to pay a fair market value of the car based on:

- The make and model

- The age

- The mileage

- The condition

But what if the information is fabricated or the car title is “washed”, resulting in paying a higher price than the market value? It certainly won’t help insurers to achieve the desired bottom line.

To avoid car title “washing”, insurance companies must report on vehicles declared total losses each month to the National Motor Vehicle Title Information System (NMVTIS). The need to process thousands of car titles, and enter the data manually to the NMVTIS, can cause additional bottlenecks.

With an OCR solution, insurers can simply scan the titles, have the data extracted, and send it to the desired destination.

Digitization of car titles for car financing companies

Lenders often need to possess the car titles until the loan is completely paid off. Because of this, they need to keep track of various titles, sort them out, enter data into their database, and store them somewhere until the loan is paid off in full.

With AI-embedded OCR technology, car financing companies can improve data accuracy by eliminating manual data entry, reducing typographical errors, and speeding up the overall data exchange process. Of course, with digitization, there will be a reduction in paper, mailing, and printing costs.

These are also the reasons why the Electronic Lien & Title (ELT) system was created; to streamline car title processes with a digital approach.

Why choose Klippa as your OCR partner?

Whether you are looking for a solution to reduce the turnaround time and costs, increase employee engagement, or simply prevent document fraud that comes with car title processing, Klippa’s OCR software can help you.

Our software is powered by AI and can be integrated into third-party applications using our OCR SDK or OCR API. Klippa’s OCR operates in multiple languages and supports car titles from all 50 states.

With Klippa, you can say goodbye to manual tasks, clerical errors, and long processing times. Schedule a free demo below, or contact us to help you get started!