Millions of receipts and invoices travel through organizations all over the world. In SMEs and corporates it is quite common for employees to receive credit cards from their employer to use for business expenses. Many still manually match data on credit card statements to receipts and invoices. This is very time-consuming and tedious and should be avoided! Why spend your precious time on manual data entry when you can automate the process?

Business/Corporate Credit Cards

SMEs and corporates opt for company credit cards to enable their employees to pay for business hotel stays, flights, meals and tickets without relying on their own credit cards or cash. One of the most crucial benefits of a business card is the ability to manage expenses. Employers can set limits on the amount cardholders can spend (per transaction or overall) and they can control the cover area.

For employees, using a business expense card means no more long waits for reimbursement. According to the report Out of Pocket Employees, one in four employed adults have postponed or cancelled a meeting to avoid having to pay for a business expense. This means that in each small business of just 50 employees, twelve are guilty of this, while in a medium sized business of 150 employees, almost 40 would cancel a meeting.

Keeping your employees happy, means burdening them with business expenses as little as possible.

What are the drawbacks of business cards?

Business cards are not always the best option. They are inherent to some disadvantages and risks, such as fraud. How easy is it for employees to simply use the business card for personal expenses? Even if employees can restrain themselves, they are still indirectly encouraged to spend company money more freely, since there is no direct audit.

In order to check employees’ expenses, employers have to match the line of the credit card statement with the receipt. This is a time-consuming and error-prone activity.

Benefits outweigh drawbacks of Business Cards

Luckily, we developed a user-friendly solution that automatically matches the line of the credit card statement with the respective receipt or invoice. Simple as that, the process contains three steps:

- The employee takes a picture of the receipt/invoice with their smartphone and submit the receipt/invoice to the finance department.

- The finance department receives the document and it is automatically matched with the credit card statement they entered.

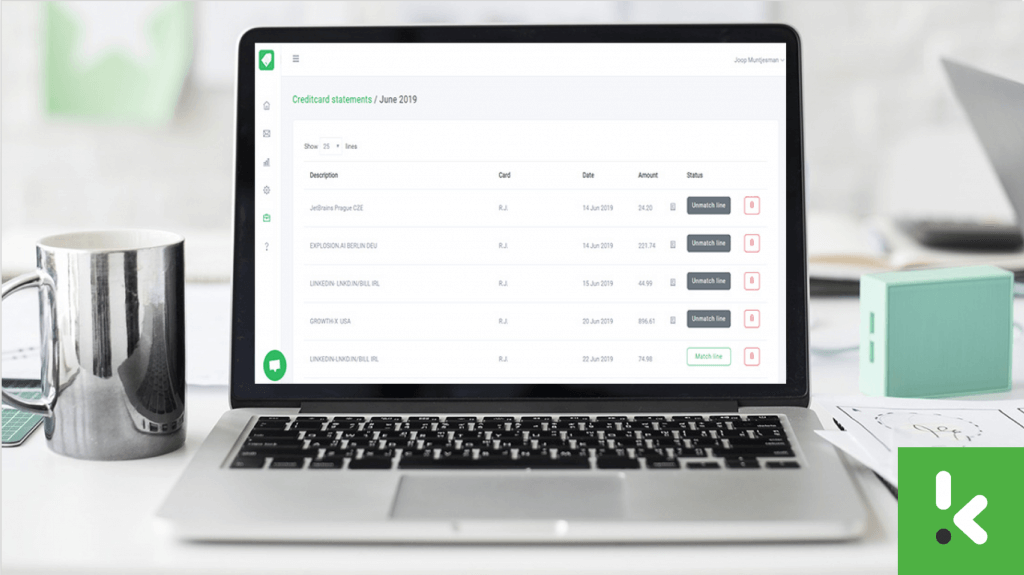

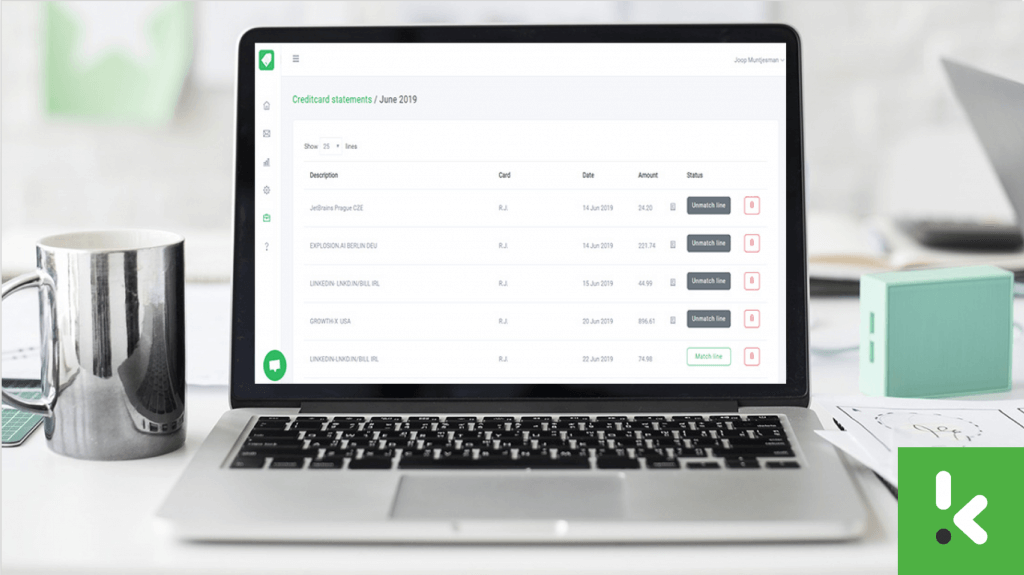

Below is a visual of the credit card module in the Klippa application.

Business processes should be fast, easy and reliable. We developed an OCR (Optical Character Recognition) engine that is exactly that. The engine extracts data from documents/pictures and it matches every line of a credit card statement with the respective receipt. For you this means:

- By automatic line matching, you get a clear overview of when receipts are missing or in case of fraud.

- Automating means saving up to 70% in processing time.

Let’s get in touch

Being in the SaaS industry for more than six years now, we have pretty much dealt with every type of receipt and invoice. We can extract all kinds of data from almost any document. We offer our software both in complete solutions, but also in API form to include in your own software. For example our API for receipt capturing and our OCR API.

If you are interested in decreasing the amount of time you spend on data entry, shoot us an email at [email protected]. You can also reach us by phone: +31 50 211 1631. Or plan a free 30 minute demo below.