With the adoption of bank statement extraction software, businesses no longer have to manually extract data from bank statements. Technologies like OCR, AI, and even intelligent document processing have all become vital parts for organizations to extract information from various documents, including bank statements, without manual data entry.

In this blog, you will get acquainted with the very definition of bank statement extraction software and will get to discover its most important features and benefits. We’ll also present you with the top 7 best bank statement extraction software list, making your decision-making process easier. Let’s begin!

Key Takeaways

The Top 7 Bank Statement Solutions for 2025 are:

- Klippa DocHorizon: Best all-in-one solution for automating bank statement extraction with AI-powered OCR, fraud detection, anonymization, and multi-format export. 🏆

- Docsumo: Best for SMBs in finance, lending, and insurance needing accurate extraction from semi-structured bank statements.

- DocuClipper: Ideal for small businesses needing fast PDF-to-Excel bank statement conversion and reconciliation with QuickBooks or Xero.

- Nanonets: Best for building flexible, AI-driven bank statement extraction models with custom parsing rules and validation.

- DocParser: Great for bulk processing and extracting structured data from bank statements using no-code rule builders.

- ProperSoft: Best for individuals and freelancers converting bank and credit card statements into formats like CSV, QBO, or OFX.

- CaptureFast: Best for teams handling scanned or photographed bank statements, with handwriting and line-item recognition support.

What Are The Best Bank Statement Extraction Software in 2025?

To help you, we’ve selected some of the most popular tools, looked into their features, and explored real user feedback from trusted review platforms. The result is a clear overview of what each software does well and where it might fall short based on what actual users are saying.

1. Klippa DocHorizon – Best all-in-one solution for automating bank statement extraction 🏆

Klippa DocHorizon is a software solution that makes use of machine learning technologies and an AI-powered OCR to automate bank statement processing.

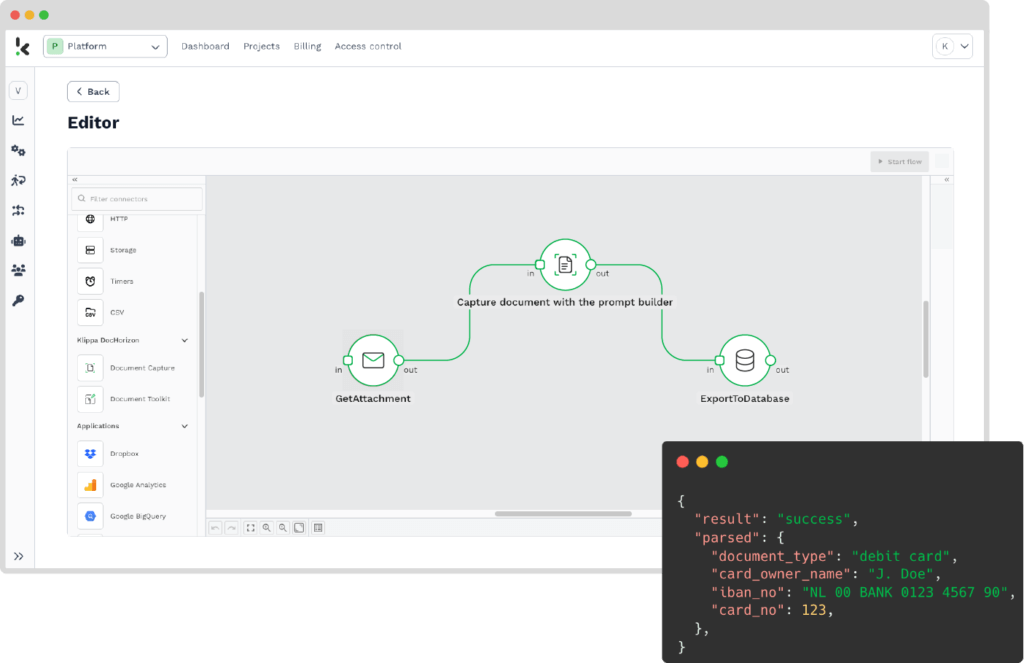

The solution offers a drag-and-drop platform, making it easy for businesses to set up their own bank statement extraction workflow, from defining which data fields need to be extracted to integrating it with cloud storage, such as Google Drive.

Pros

- Extract data from bank statements with 99% accuracy with our AI-powered OCR

- Customize any workflows with a drag-and-drop interface

- Classify, verify, anonymize, and detect bank statement fraud – all within one solution

- Integrate with more than 75+ business applications, such as Google Drive, OneDrive, Xero, Salesforce, and many more

- Process over 100+ other document types in 150+ languages

- Employ human-in-the-loop for 100% accuracy

- Convert PDF into Excel, CSV, XML, XLSX, JSON, and many more

- Sync and access data in real time

Cons

- Requires basic technical understanding of APIs and Webhooks

- No possibility to generate documents

- No built-in e-signature tool

Pricing

- €25 free credit to try out the platform

- License or usage-based pricing model

- Contact the team for pricing details

Ideal business type and size: Klippa DocHorizon is best suited for medium to large enterprises.

2. Docsumo – Best for SMBs in finance, lending, and insurance

Docsumo is an AI-based OCR software provider that has a 95% accuracy in data capture from documents such as bank statements. It automatically classifies document types based on their content and layout.

Pros

- Conversion of unstructured or semi-structured bank statements into machine-readable data

- Specializes in automating workflows for financial documents, such as bank statements

- Able to convert a bank statement PDF into Excel, CSV, or JSON

- Offers real-time validation of extracted data

- Integrates with platforms such as Google Docs, Salesforce, Zapier, and Dropbox

Cons

- Lacks a low-code or no-code workflow builder

- No functionality for real-time collaboration between team members on workflows or documents

- Limited modularity for building workflows with specific features (e.g., approval flows, multi-step document routing)

Pricing:

- Free: Process 100 pages per month

- Growth: Process 1,000 pages per month, $299/mo

- Enterprise: Custom plan; contact Docsumo for more information and up-to-date pricing

Ideal business type and size: Docsumo is best suited for small to medium-sized businesses.

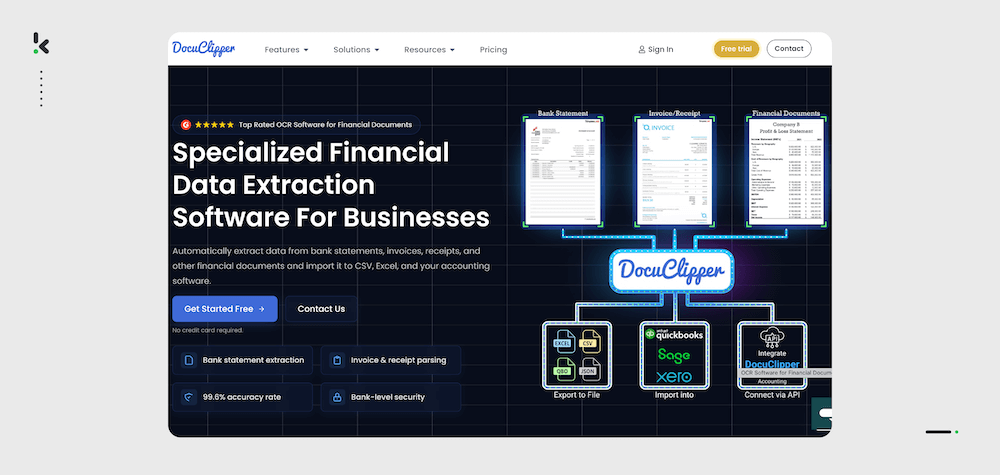

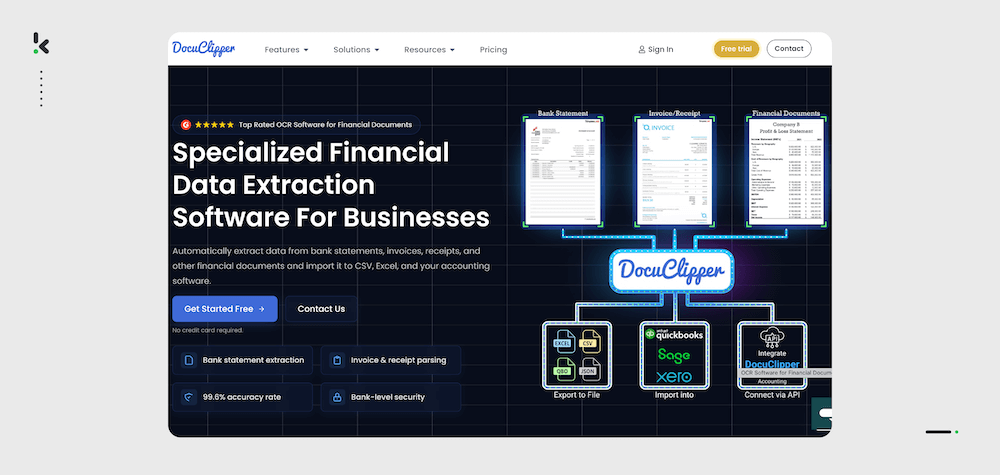

3. DocuClipper – Ideal for small businesses needing fast PDF-to-Excel bank statement conversion

DocuClipper is a web-based application that extracts information from bank statements, mostly in a PDF format. Its OCR has an accuracy level of up to 95% and captures data within seconds.

Pros

- Automatically converts scanned and PDF bank statements into Excel or CSV

- Provides bank statement reconciliation

- Integrates with QuickBooks, Xero, or Sage for data import

- Automatically detects multiple accounts in a single statement

- Provides features such as file inventory, transaction categorization, transfer detection, and flow of funds

Cons

- Limited in features for workflow customization for end-to-end automation

- Based on user reviews, the low-processing plans may feel too costly for small businesses, given the limited number of documents included compared to the cost (G2)

- Based on user reviews, the platform experiences occasional data inaccuracy and OCR issues (G2)

Pricing

- Starter: 200 pages/month for $39/month

- Professional: 500 pages/month for $74/month

- Business: 2,000 pages/month for $159/month

- Enterprise: Custom plan; contact DocuClipper for more information and up-to-date pricing

Ideal business type and size: DocuClipper is best suited for small to medium-sized businesses.

4. Nanonets – Best for building flexible, AI-driven bank statement extraction models

Nanonets is a machine-learning platform that allows businesses to build custom deep learning models with little to no code required. It is used for data extraction, object detection, and image classification.

Pros

- Extracts data from structured and unstructured bank statements

- Converts PDF bank statements to Excel or CSV

- Offers pre-trained templates specifically for bank statements

- Includes tools for validating extracted data

- Allows setting custom parsing rules for specific document types, including bank statements

Cons

- Limited workflow customization, with pre-defined automations more suited to simpler tasks

- Based on customer reviews, the software offers a limited choice of affordable tiers for plans (TechRadar)

Pricing

- Starter: First 500 pages free, then $0.3/page

- Pro: Custom plan

- Enterprise: Custom plan; contact Nanonets for more information and up-to-date pricing

Ideal business type and size: Nanonets is best suited for medium to large enterprises.

5. DocParser – Great for bulk processing and extracting structured data from bank statements

DocParser is a cloud-based document parsing API that helps extract data from bank statements. It allows for workflow automation and can process documents in bulk.

Pros

- Extracts relevant data by creating parsing rules for each layout

- Submission of bank statements via email, drag and drop, or cloud storage upload

- Converts PDF bank statements to Excel, CSV, JSON, and XML formats

- Custom set data points and line items for extraction

- Direct integrations with Excel, Google Drive, Dropbox, Salesforce, and OneDrive

Cons

- Does not provide direct integration with accounting software like QuickBooks and Xero

- Many users report that the sorting function within the platform makes it challenging, or sometimes even impossible, to search through stored documents (Capterra)

- Based on user reviews, the learning curve for the platform could be difficult for non-tech-savvy users (G2)

Pricing

- Starter: 100 parsing credits for $39/month

- Professional: 250 parsing credits for $74/month

- Business: 1,000 parsing credits for $159/month

- Enterprise: Custom plan; contact DocParser for more information and up-to-date pricing

Ideal business type and size: DocParser is best suited for small to medium-sized businesses.

6. ProperSoft – Best for individuals and freelancers converting bank and credit card statements

ProperSoft is a software designed to extract and convert information from bank statements. The output can be easily imported into existing accounting or personal finance applications.

Pros

- Extracts data from PDF bank and credit card statements

- Converts bank statements from PDF, Excel, or scanned images into financial formats like CSV, QBO, OFX, QFX, or IIF

- Allows basic categorization of transactions into expense or income groups

- Provides tools for mapping extracted fields to specific software requirements

- Users can manually review and edit transaction data before exporting

Cons

- Lack of advanced features, such as AI-powered OCR, compliance tools, or workflow automation

- No automated categorization based on transaction history or predefined rules

- Not scalable for larger organizations processing high volumes of bank statements

- No direct integration with ERP systems, CRMs, or advanced accounting platforms

Pricing

- Team Complete Monthly: For 3 users/devices for $49.98 /month

- Annual Team: For 3 users/devices, $299.97 /year

- Complete Enterprise: Custom plan, contact ProperSoft for up-to-date pricing and information on individual plans

Ideal business type and size: ProperSoft is best suited for individuals, freelancers, and small businesses.

7. CaptureFast – Best for teams handling scanned or photographed bank statements

CaptureFast is a data extraction software that captures and converts data from bank statements. It supports various file formats and can be integrated with various accounting and financial applications.

Pros

- Utilizes OCR to extract data from digital and scanned bank statements

- Processes a variety of document formats, including PDFs, scanned images, and photos of bank statements

- Allows line item, table, and handwriting recognition

- Offers templates specifically designed for bank statements

- Integrates with accounting software and file storage solutions, such as QuickBooks, Google Drive, and Dropbox

Cons

- Allows minimal workflow customization; may not be suitable for companies with intricate document processing requirements

- Lacks integration options with enterprise-level ERPs or CRMs

- Based on user reviews, the software lacks features for compliance tracking, audit trails, or adherence to specific financial regulations (Capterra)

Pricing

- Forever Free: 100 pages/month

- Basic: 1,000 pages for $85/month

- Professional: 10,000 pages for $360/month

- Business: 30,000 pages for $950/month

- Custom: Custom plan

- Enterprise: Custom plan; contact CaptureFast for more information and up-to-date pricing

Ideal business type and size: CaptureFast is best suited for small to medium-sized businesses.

Benefits of Automated Bank Statement Extraction

Whether it is used in banks, public financial institutions, or the financial department of businesses, automated bank statement extraction helps:

- Increase productivity: Automation helps reduce repetitive tasks from your employees, freeing up both their agenda and yours, making it possible to focus on more strategic tasks.

- Improve data quality: Bank statement OCR ensures the captured data is accurate and does not present human errors, which could affect the credibility of your ledgers and, therefore, your business.

- Accelerate processing times: Manual data entry is eliminated, which means your organization can process bank statements faster and improve turnaround time.

- Save costs: Employing a bank statement extraction software means lower operational costs, as well as costs associated with repairing human errors or detecting document fraud. By getting rid of inaccuracies in financial reporting, your company can save large amounts of money.

- Improve customer satisfaction: Regardless of your business sector, automation helps carry out business processes faster, delivers better results in record time, and improves the relationship between you and your customers.

These advantages help your business achieve its true potential by minimizing costs and errors and maximizing efficiency and quality. To ensure that your business makes use of the best bank statement software, it’s a must to first thoroughly scan the market for available solutions.

How to Choose the Best Bank Statement Extraction Software

Before committing to one specific software choice, it is advised to keep in mind certain features that enhance the bank statement extraction process:

- Data extraction accuracy: The software should provide high accuracy in capturing information to minimize errors and ensure your business is processing accurate and reliable financial data.

- Processing speed: Look for solutions that can process bank statements quickly, enabling faster access to valuable financial information.

- User-friendliness: The software should be easy to use, even for non-technical employees. This ensures a smooth and seamless integration within your business’s existing applications.

- Data privacy and security: Given the sensitive nature of financial information, the software you choose mustn’t process the data further than allowed. Make sure it is compliant with data privacy and security regulations, such as GDPR or ISO, and that the information is not stored in the provider’s servers.

- Automatic document recognition: Increased efficiency of business processes can only happen if the solution can automatically recognize the document type in question. If the OCR is template-based, chances are the document classification process might have some bottlenecks.

- Good customer service and onboarding support: During the initial setup, it is important that you have good customer service to rely on in case any obstacles occur. The onboarding team should be able to assist you with any inquiries you might have about implementing the software.

- Available documentation: Documentation is an important feature that many providers seem to forget about; whether it is the first time you’re employing the solution or are integrating it within an existing application, extensive documentation is the unsung hero.

Your business should not compromise, especially when it comes to document processing efficiency. Thus, a well-performing bank statement extraction software, such as Klippa, is able to fulfill all your needs and offer quality data capture and bank statement processing.

What Makes Klippa a Top Choice for Bank Statement Extraction?

Klippa DocHorizon isn’t just another document tool – it’s a fully AI-powered document processing platform. Klippa combines AI-powered pre-processing, smart automation, and fraud detection to deliver the fastest and most accurate document workflows in 2025.

It allows you to extract information from bank statements accurately, so you have complete control over the data extraction flow. With our platform, you can easily:

- Select the bank statements you wish to process

- Indicate whether you wish to extract specific line items or data from the whole document

- Get accurate data within seconds with our AI-powered OCR

- Review the captured information

- Download it in your preferred format or export it within existing applications, be it email or an ERP system

What makes Klippa stand out from the rest?

Unlike most tools that specialize in either turning PDFs into Excel, parsing static templates, or converting basic tables, Klippa DocHorizon offers an end-to-end automation suite built for intelligent processing at scale. What sets Klippa apart is its combination of advanced OCR, fraud detection, anonymization, and real-time integrations – all in a customizable, no-code environment.

Now part of the SER Group, a recognized Leader in the Gartner® Magic Quadrant™ for Document Management, Klippa brings enterprise-grade extraction capabilities to teams across industries. Whether you’re in finance, logistics, or healthcare, DocHorizon is the most powerful and flexible bank statement extraction software available in 2025.

Powered by AI technologies, our platform offers you various modules you can mix and match based on your specific use case:

- Shorten document processing times with data entry automation

- Send data to existing applications with seamless document conversion

- Certify the authenticity of documents with document verification

- Stay compliant with personal data protection requirements with smart data anonymization

- Ensure accurate document verification processes with document fraud detection

- Streamline the digital archive of your business with document classification and sorting

Contact our experts to get more insight into our bank statement extraction software, or book a free demo down below and see our solution in action!

FAQ

A bank statement extraction software automates data extraction from bank statements with OCR. It is used to capture important data fields, such as vendor name, IBAN, or final balance, helping businesses automate data entry of bank statements.

You can extract data from a bank statement using specialized software or OCR tools. These tools allow you to upload statements in formats like PDF or images and automatically extract key data fields such as account numbers, balances, and transactions.

That depends on your business size, document volume, and integration needs. Here’s a quick guide:

– If your business processes high volumes of bank statements and needs to extract, verify, and export financial data with maximum accuracy, Klippa DocHorizon is the most comprehensive option.

– For smaller businesses or startups in lending or insurance, Docsumo offers a focused, template-driven approach that handles common bank statement formats.

– Need a quick and simple way to turn PDFs into Excel files? DocuClipper is purpose-built for that. It’s ideal for companies using QuickBooks, Xero, or similar tools and just want clean, import-ready spreadsheets.

– Nanonets gives more control to teams that want to train their own AI models or fine-tune parsing rules which is great if you deal with a wide variety of document layouts or want to build something custom.

– If you’re dealing with large volumes and want to build your own parsing rules in a no-code environment, DocParser lets you define exactly what data to extract and how to route it.

– ProperSoft works well if you’re a freelancer or individual user who just wants to convert PDFs into accounting-ready formats like OFX or CSV without diving into enterprise features.

– Lastly, if your source material includes scanned paper statements or mobile photos, CaptureFast stands out with its ability to recognize handwriting and line-item details — ideal for hybrid or less digitized workflows.

If you want full control, enterprise-level performance, and built-in fraud protection, Klippa DocHorizon leads the pack. But if your needs are simpler or highly specific, the other tools each have their niche.

Automating data extraction involves using intelligent document processing software powered by OCR and AI. These tools can process bank statements, extract required data fields, and integrate with existing systems for seamless workflows, saving time and reducing errors.

Several apps can extract bank statements, including Docsumo, Nanonets, DocParser, and Klippa DocHorizon. These solutions offer features like OCR-powered data extraction, integration with business tools, and export options to formats like Excel or JSON.