Managing expenses can be an overwhelming and cumbersome task. Especially when faced with the challenges of handling out-of-pocket costs and the administrative hassle of expense reimbursements in your company. Virtual credit cards (VCCs) offer a modern solution, providing a convenient, secure, and efficient alternative for business financial management.

This blog introduces the top 6 virtual credit cards for businesses in 2025. We will explore their benefits, including enhanced security, efficient expense management, and seamless software integration. Discover insights on selecting the right virtual credit card for your business, considering fees, spending controls, and system compatibility.

Key Takeaways

- Klippa Virtual Credit Card – The all-in-one SME solution. Combines unlimited physical and virtual cards with SpendControl for expense management, invoice processing, fraud detection, and real-time insights.

- Payhawk Virtual Credit Card – Flexible spend with cashback. Global card management, approval flows, and up to 1% cashback, though fees apply for non-EUR/GBP transactions.

- Tipalti Virtual Company Credit Card – Finance hub integration. Directly connects with the Tipalti Hub for expense control, automatic reconciliation, and cash rebates.

- Airbase Virtual Corporate Credit Card – Unified spend management. Combines AP, reimbursements, and cards in one platform with automated reconciliation and real-time visibility.

- Capital One Virtual Credit Card – Simple and secure online payments. Generates unique merchant-specific cards, integrates with Chrome and Android, and offers customizable limits.

- American Express Business Platinum Card® – Travel-heavy enterprise perks. High-limit virtual cards paired with rewards, global lounge access, and premium travel benefits.

Comparison of the best virtual credit cards in 2025:

Top 6 Virtual Credit Cards for Businesses in 2025

1. Klippa Virtual Credit Card

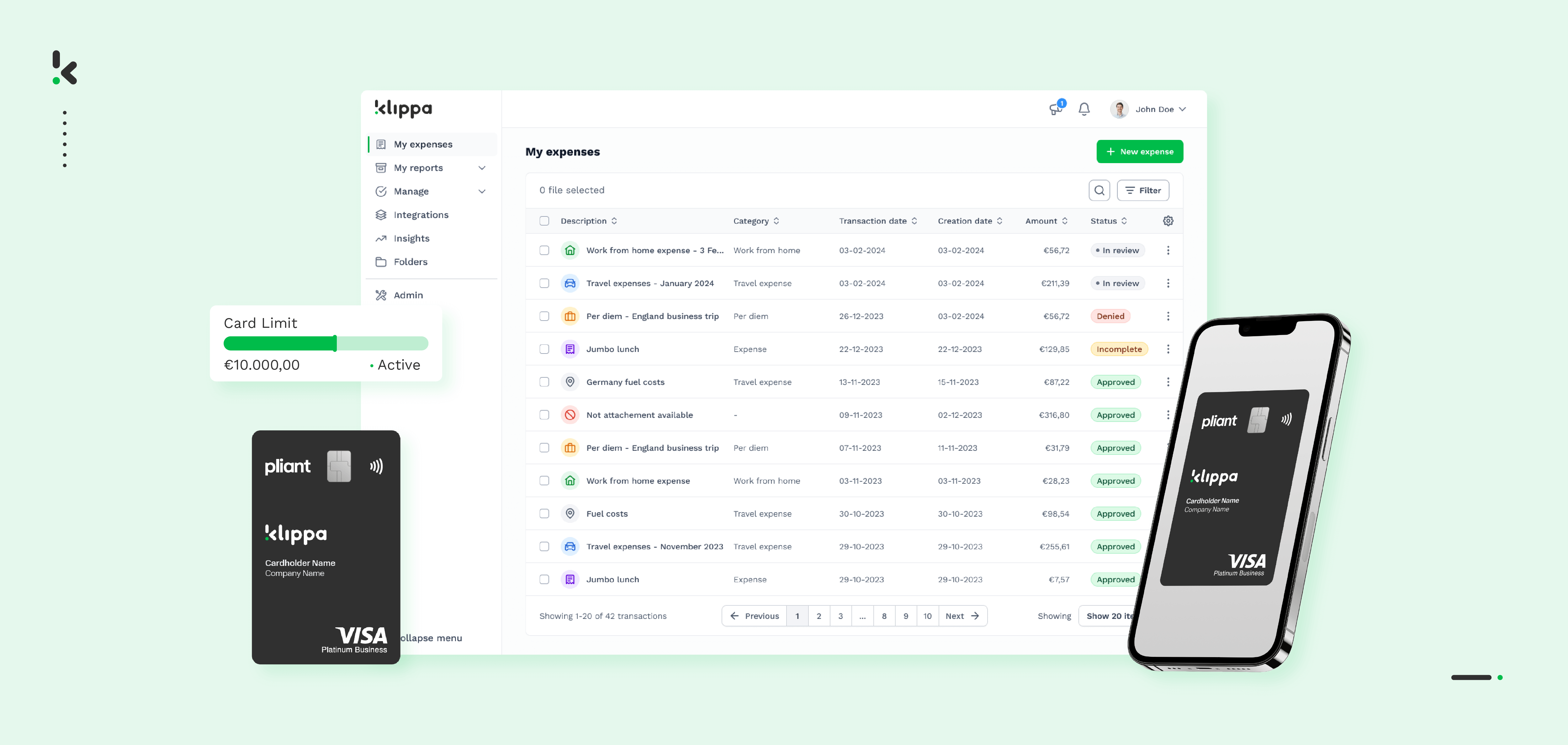

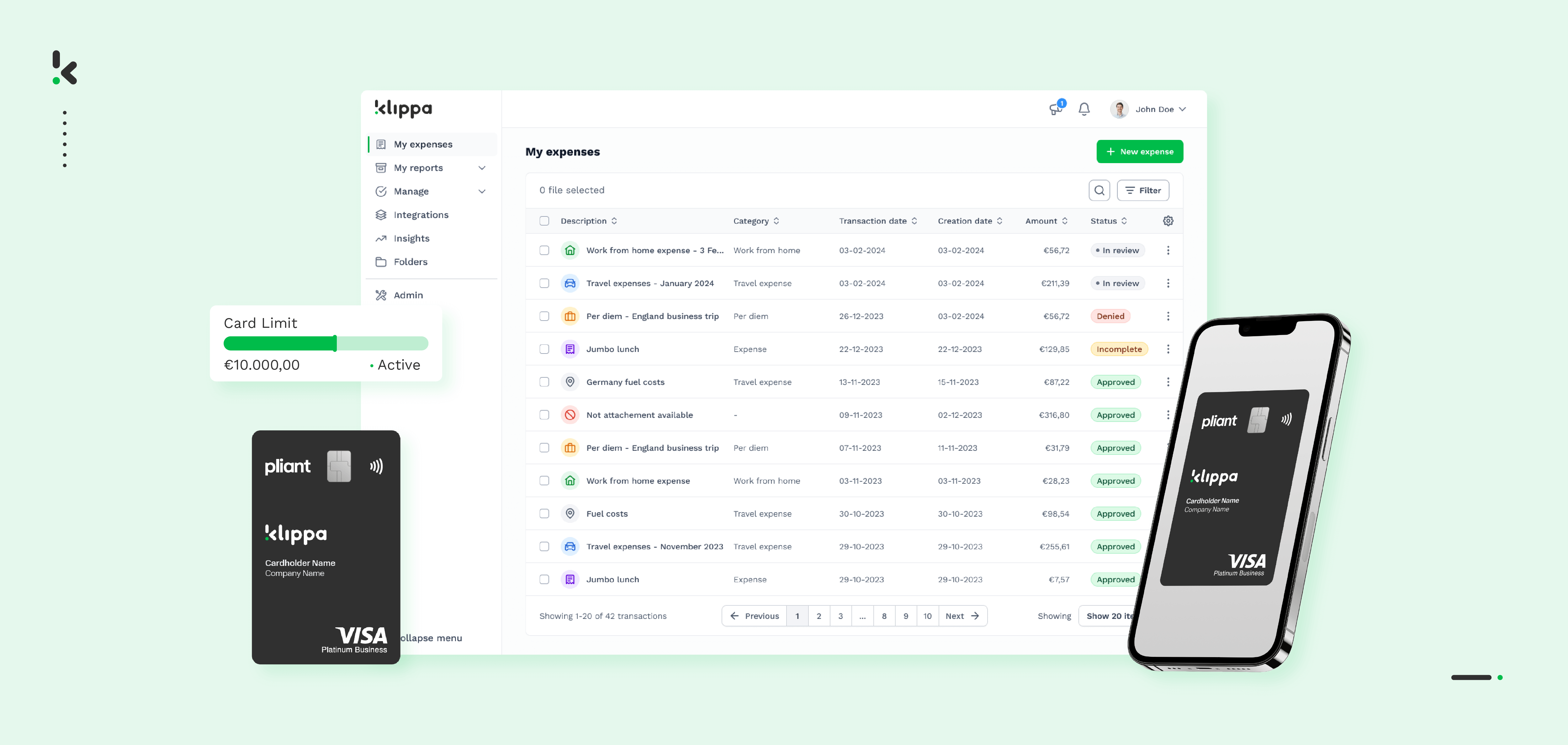

Klippa’s Virtual Credit Cards allow companies to automate financial management with the synergy of corporate credit cards and advanced pre-accounting software – Klippa SpendControl.

Set spending limits aligned with your company’s expense policy, track business spending anytime via the web or mobile app, and manage corporate credit cards with all business expenses and invoices in one centralized system.

Pros

- Physical and unlimited virtual corporate credit cards for your business

- One digital solution with expense management, invoice processing, and a corporate credit card module

- Integration with Apple and Google Wallets

- Tailored spending limits and user-level connectivity

- Advanced approval management with smart business rules

- Worldwide acceptance and 0% foreign transaction fee with Visa card support

- Complete control and insights on real-time spending in a dedicated dashboard

- Single-use cards and separate cards for specific merchants or purchases

- Built-in fraud detection system powered by machine learning and 3-DS protection layer for secure online transactions

- Integration possibilities with many accounting and ERP software

- Customer support via phone or email together with an extensive online helpdesk

Cons

- Credit cards are available only for teams of a minimum of 10 users

- No software integration options for other areas, such as mobility or productivity

Prices

- Price: On request (depending on company size and number of users)

Klippa Virtual Credit Cards are best suited for: Small and medium-sized enterprises.

2. Payhawk Virtual Credit Card

Payhawk is a spend management platform that provides both corporate Visa debit and credit cards that can be either virtual or physical, tailored to streamline business financial operations globally.

Pros

- A single platform for card payments, invoices, reimbursement, expense management, and bookkeeping

- Compatible with Apple Pay and Google Pay

- Option to earn up to 1% cashback on all eligible card spend, capped at the subscription amount

- Custom workflows for fund requests and spending approvals

- Bulk card management of debit and credit corporate cards

Cons

- 1.99% fee for transactions in currencies other than GBP and EUR

- Expense reports can’t be exported as PDFs, and there are extra costs for a consolidated view of all entities

- Limitations to reimbursements, being possible only in EUR, GBP, and BGN

Prices

- Price on request (depending on the package and business needs)

Payhawk cards are best suited for: Small to medium-sized businesses and limited companies registered in the UK (or those with UK entities)

3. Tipalti Virtual Company Credit Card

Tipalti offers a corporate card solution, Tipalti Card, which includes both physical and virtual cards. This solution is integrated into the Tipalti Hub, allowing for streamlined management of corporate spending.

Pros

- Debit and credit card options

- Direct integration into the Tipalti Hub for managing all card-related expenses

- Controls for spending limits, vendor limits, and categories

- Automatic reconciliation

- Cash rebate for every dollar spent via a Tipalti Card

Cons

- Currently available only to customers with a U.S. entity

- Limited customization options within the software, particularly in terms of the user interface and admin controls

- Based on customer reviews, the initial setup and integration process can be complex and time-consuming

Prices

- Price on request (depending on company size and usage)

Tipalti cards are best suited for: Medium to large businesses with a U.S. entity.

4. Airbase Virtual Corporate Credit Card

Airbase offers a comprehensive spend management platform that integrates virtual credit cards, physical cards, expense reimbursements, and accounts payable into a single system. This integration provides real-time visibility into company spending.

Pros

- Airbase combines VCCs, physical cards, and AP in one platform

- Custom approval workflows for spending

- Real-time visibility into all company expenditures

- Automated reconciliation process with automatic matching

- Pre-loading of funds on cards for better budget control

Cons

- No international payments supported

- Based on customer reviews, deleting unused cards and managing one-time VCC limits can be cumbersome

Prices

- Starting at $49 per user per month

Airbase cards are best suited for: Mid-sized to large businesses.

5. Capital One Virtual Credit Card

Capital One offers virtual credit cards that enhance online shopping security and convenience. In partnership with Google, they enable cardholders to generate a unique virtual card for each online merchant, directly integrated with Google Chrome and Android’s Autofill feature.

Pros

- The ability to manage virtual cards directly within Capital One’s app or website

- Direct addition of credit cards to Google Accounts for virtual card use on Chrome and Android apps

- Generation of a unique virtual card per merchant

- Ability to lock, unlock, or delete virtual cards as needed

- Integration with Chrome and Android for a smoother checkout process

Cons

- Requires consistent access to Chrome or an Android device for optimal use

- Based on customer reviews, Capital One cards are not supported by all online merchants

Prices

- Business Spark Card: $95 per year

- Business Platinum card: $695

Capital One cards are best suited for: Small to medium businesses.

6. American Express Business Platinum Card®

American Express offers the virtual version of the Business Platinum Card to its corporate card users, known for many benefits tailored to the needs of frequent business travelers. It is especially valuable for those who prioritize luxury travel comforts and efficient expense management.

Pros

- $200 airline fee credit and complimentary access to the American Express Global Lounge Collection®

- Detailed categorization and tagging of expenses

- Access to more than 1,400 airport lounges across 140 countries

- Multiple rewards points on flights and prepaid hotels, with additional points on purchases of $5,000 or more

- Over $1,000 in annual statement credits on purchases with various partners

Cons

- The card has one of the highest annual fees of $695 per year, plus $195 for each authorized user, which may not be justified for businesses with minimal travel

- Based on customer reviews, rewards, and benefits can be complex to navigate and maximize

Prices

- $695 per jaar

The American Express Business Platinum Card is best suited for: Medium to large enterprises.

What Are Virtual Credit Cards?

Virtual credit cards are digital versions of traditional credit cards, designed to be used for online transactions. Unlike physical cards, VCCs generate unique card numbers for each purchase, effectively protecting users against credit card fraud.

Virtual credit cards offer a convenient way to manage online payments, subscriptions, and employee expenses. Their ease of use and robust security measures make them an ideal choice for modern business transactions.

With features such as spending limits and custom expiry dates, VCCs can easily integrate with existing financial systems, streamlining expense tracking and improving financial oversight, among other benefits.

Benefits of Using Virtual Credit Cards

Virtual credit cards offer numerous advantages to businesses seeking to modernize their financial transactions and enhance their operational efficiencies. The main benefits of VCCs are the following:

- Enhanced security: By generating unique numbers for each transaction, VCCs significantly reduce the risk of fraud and unauthorized use, ensuring a higher level of security for online payments. Moreover, the convenience of digital wallets with two-factor authentication reduces the risk of lost or stolen credit cards.

- Increased control over expenses: Most virtual card providers allow businesses to adjust card settings and monitor all expenses in real-time via web or mobile apps, allowing companies to quickly take notice of any unauthorized expenses.

- Seamless integration with accounting software: Many virtual credit cards are synced with expense management software, which can be directly integrated into existing accounting or ERP systems, streamlining the reconciliation process and improving financial reporting accuracy.

- Customizable spending limits: Companies can customize VCCs according to their needs, applying expiry dates for each card and setting virtual credit card limits on where, when, and how the cards can be used.

- Reduced administrative overhead: With virtual credit cards, the need for issuing physical cards and processing expense reports is minimized, thereby reducing administrative tasks and costs.

- Instant issuance and cancellation: Most virtual corporate credit cards can be issued and canceled instantly through digital platforms, providing businesses with the flexibility to respond to changing needs and situations without delay.

- Environmental benefits: As digital products, VCCs contribute to reducing the use of physical materials, aligning with sustainability goals, and promoting environmentally friendly business practices.

The above-listed benefits highlight the value of virtual credit cards in enhancing financial security, simplifying expense management, and integrating seamlessly with business operations, making them an indispensable tool for modern businesses.

How to Choose the Right Virtual Credit Card

Choosing the best corporate credit card for your business is crucial for optimizing your financial operations and safeguarding your transactions. Here are key criteria to consider to ensure you make the best choice among the abundance of corporate card providers:

Fees

Evaluate the fee structure of the VCC provider, including any annual fees, transaction fees, and foreign transaction charges. Look for options that offer a clear, competitive pricing model that aligns with your business spending patterns. Pay close attention to the following rates:

- Annual card fee

- Interest charges

- Late payment fee

- Foreign transaction fee

- Balance transfer fee

- Over-the-limit fee

- Expense management software subscription fee

Spending Limits and Controls

Assess the flexibility of the VCC in terms of setting spending limits, both on a card and transaction level. The ability to customize controls based on your business needs is essential for effective expense management. The examples of spending limits that you can be on the lookout for are the following:

- Spending limits per administration

- Spending limits per specific card

- Project-based limits

- Period-based limits: monthly, quarterly, or annual

Compatibility with Financial Systems

Verify that the virtual corporate credit card can seamlessly integrate with your existing accounting and financial systems. Integration capabilities are critical for automating expense tracking and simplifying reconciliation processes.

Security Features

Virtual corporate credit cards offer a range of security features designed to protect against fraud, unauthorized transactions, and misuse. These features can significantly enhance the security of corporate finances and provide companies with better control over their expenses.

Here are some of the key security features commonly found in virtual corporate credit cards:

- 3D Secure protection: The additional security protocol used in online credit and debit card transactions, referring to the three parties involved in the security process: the merchant, the bank, and the security infrastructure supporting the protocol

- Tokenization: The process of generating a one-time code that is used during a financial transaction instead of the actual card number

- Single-use numbers: The one-time use card numbers that become invalid after the first transaction, preventing any unauthorized charges

- Merchant lock: Merchant-specific cards encrypted for transactions with one designated vendor

- Time and category restrictions: Cards set to expire after a certain date, for temporary subscriptions, or restricted by the types of purchases, such as travel, office supplies, or software subscriptions

- Real-time notifications and reporting: Instant notifications for every transaction help spot and address unauthorized or fraudulent transactions

Customer Support Quality

Consider the quality and availability of customer support offered by the VCC provider. Check whether your card issuer offers an online manual, customer support phone, email, or dedicated account manager. Responsive and knowledgeable support is vital for resolving any issues promptly and minimizing disruptions to your operations.

For companies that prioritize exceptional customer support in selecting a virtual card provider, it’s advisable to directly engage with their support team through phone or email. This approach allows you to assess the speed and quality of their response firsthand, offering valuable insights into their commitment to customer satisfaction.

Issuance and Management Ease

Look for virtual credit cards that offer a straightforward process for issuing, managing, and canceling cards. Pay special attention to cards that are connected to expense management software, ensuring centralized card control and clear financial oversight of every business transaction.

Rewards and Benefits

Some VCC providers offer rewards programs, cashback, or other benefits based on your spending. Determine which rewards are more beneficial to your business operations, like airline miles and hotel points or discounts on relevant business expenses. While not the primary criterion, these perks can provide additional value to your business.

Vendor Acceptance

Ensure that the virtual corporate credit card is widely accepted by your suppliers and for online transactions. Take into account frequent business travel and overseas entities, and carefully check whether the card is accepted and active in all countries relevant to your business operations.

By carefully considering the criteria listed above, any company can select a virtual corporate credit card solution that enhances its financial security and control. However, certain industries and business models benefit the most from the features of virtual credit cards due to their specific needs for flexibility, and efficient financial management.

Virtual Business Credit Card Use Cases

Selecting, purchasing, integrating, and managing a new expense management solution is a significant commitment that may cause hesitation for business owners. Yet, for some companies, the benefits of virtual corporate credit cards are clear, based on their operations.

The following overview will help you understand how virtual credit cards offer tangible benefits across various sectors, illustrating their versatility and utility in different business scenarios.

Industry-Based Use Cases

Travel and Hospitality: Virtual credit cards streamline payment processes for bookings, enhancing security and simplifying expense reconciliation, vital for managing fluctuating travel logistics and costs.

Professional Services and Consulting: Virtual credit cards streamline expense management for client projects, operational costs, and travel, essential for maintaining profitability and financial transparency in service-based industries.

IT and Software Development: Virtual credit cards enable precise budget control for subscriptions and online purchases, addressing the need for flexible yet secure spending in rapidly evolving technological environments.

Healthcare: In healthcare, where timely and secure payments to suppliers are critical, VCCs provide a reliable solution, ensuring smooth procurement processes and operational efficiency.

Payment-Type Use Cases

Employee Expenses and Travel: virtual credit cards provide a controlled spending mechanism for managing travel and mixed expenses, crucial for accountability and financial oversight in corporate settings.

Online Advertising and Marketing Campaigns: Virtual credit cards allow for detailed budget management across platforms, an essential feature for tracking marketing spend and optimizing advertising investments.

Subscription-Based Services: Offering a secure way to manage recurring payments, VCCs are crucial for businesses relying on software and digital services, ensuring budget adherence without compromising service continuity.

Procurement and Supply Chain Management: VCCs facilitate secure and specific payments to suppliers, a key requirement for maintaining operational integrity and supply chain efficiency.

Freelancer and Contractor Payments: Offering a secure, traceable, and limit-specific payment method, VCCs meet the demand for flexible yet controlled payment solutions for gig economy workers and freelancers.

Business Type Use Cases

Corporate Expense Management: In corporate environments, virtual credit cards enhance the management of travel and procurement expenses by offering detailed control and security, key for auditability and policy compliance.

Freelance and Gig Economy: virtual credit cards enable secure client payments and separate personal from professional expenses, addressing the unique financial management needs of independent workers.

Small and Medium Enterprises (SMEs): Virtual credit cards provide SMEs with enhanced financial controls and fraud reduction capabilities, essential for safeguarding assets and ensuring sustainable growth in competitive markets.

Conclusion

Selecting the best virtual credit card provider for your company relies on thorough identification of the features and criteria that align most closely with your business operations and individual use cases.

Although we’ve outlined some of the market’s leading VCCs, we believe that the simplicity, rich functionality, and security of Klippa’s Virtual Corporate Credit Cards in combination with SpendControl Expense Management stands out as the comprehensive solution for any organization.

Are you ready to automate your expense management with the convenience of our powerful virtual corporate credit cards? Book a free demo to see our product in action, or contact our SpendControl specialists for more information.

FAQ

Which is the best virtual card?

The best virtual card depends on your needs, but Klippa Virtual Credit Card, Payhawk, and Airbase are top-rated for expense management and security.

What is a virtual card solution?

A virtual card solution provides businesses with digital credit or debit cards for online transactions, offering enhanced security and control over company expenses.

How can I generate a virtual card?

You can generate a virtual card through virtual card platforms like Klippa, Payhawk, or Tipalti, by logging into the platform and requesting a new virtual card.

Can I withdraw money from a virtual card?

No, virtual cards are typically designed for online transactions and cannot be used to withdraw cash.

What is the best use for virtual cards?

Virtual cards are best for managing online payments, subscriptions, employee expenses, and vendor purchases with added security and spending controls.

What companies offer virtual credit cards?

Companies like Klippa, Payhawk, Airbase, Tipalti, Capital One, and American Express offer virtual credit cards.

Do virtual credit cards have a limit?

Yes, virtual credit cards come with customizable spending limits, which can be set based on company policies and usage needs.