Managing business expenses with cash allowances or out-of-pocket costs can be overwhelming. These outdated methods are known for causing frustration for employees and finance teams, slowing down your company’s operations with unnecessary complexity.

Business credit cards have long been known as an effective and convenient solution to these challenges, providing faster data processing and enhanced security, among other benefits.

Our blog will provide practical tips on what you can look for in a card provider in 2025, from rates and spending tracking to safety features and customer support. By the end, you’ll have a clearer picture of how to choose a company credit card that best fits your business needs.

Key Takeaways

- Choosing the Right Business Credit Card: Pick a card that matches your spending habits, offers valuable rewards, and keeps fees low. Look for useful perks like expense tracking, employee cards, and accounting integrations.

- To help you make an informed decision, we’ve selected the best corporate credit cards of 2025, each tailored to different business priorities. Here’s a quick overview of the top options:

| Card Category | Credit Card & Issuer | Best For |

|---|---|---|

| Best Overall Business Credit Card | Klippa Corporate Credit Card | SMEs needing an all-in-one solution for expense management and corporate cards. |

| Best Rewards Business Credit Card | Ink Business Preferred® Credit Card (Chase) | Businesses with high spending in travel, shipping, and advertising. |

| Best Cash Back Business Credit Card | Ink Business Unlimited® Credit Card (Chase) | Businesses wanting unlimited flat-rate cash back with no annual fee. |

| Best Business Travel Credit Card | The Business Platinum Card® from American Express | Frequent travelers seeking premium perks and lounge access. |

| Best Credit Card for Small Business | The American Express Blue Business Cash™ Card | Small businesses wanting cash back without an annual fee. |

| Best Credit Card for New Business | Capital One Venture X Business Card | Startups needing flexible spending and travel benefits. |

| Best Mastercard Business Credit Card | U.S. Bank Business Triple Cash Rewards World Elite Mastercard® | Businesses spending on gas, office supplies, and telecom. |

| Best Visa Business Credit Card | Ink Business Cash® Credit Card (Chase) | Small businesses earning cash back on office supplies and utilities. |

| Best American Express Business Credit Card | American Express® Business Gold Card | Businesses with varying spending needs to maximize rewards. |

The Difference Between Prepaid, Debit, and Credit Cards

Besides business credit cards, companies often opt for other simple and safe alternatives to cash allowances: debit and prepaid cards. Each type of card has its advantages and varies in numerous aspects:

Business debit cards

Debit cards allow companies to spend money directly from the bank account and withdraw cash at ATMs without a fee. The advantage of using a debit card is that a company is not borrowing money but rather using the funds it already has.

The downside of debit cards is that since funds are limited to the amount in the checking account, the transaction can be approved with an overdraft fee when the account has insufficient balance. This fee is typically fixed and will be charged even if you overdraw by a small amount.

Prepaid business cards

Unlike bank cards, prepaid cards come with a predetermined balance or an option to load money onto the card. Both options serve as your spending limit and provide a clear budget for business expenses.

The drawback of prepaid cards is that they’re not linked to any financial accounts, making the card inactive once you’ve exhausted the loaded balance.

Business credit cards

With credit cards, companies borrow money from the issuer and pay it back later. This system helps companies to build credit, provides a buffer for unexpected business expenses and is preferable for effective cash flow management.

The flexibility of credit cards makes them an effective financial tool for businesses, as they help to maintain financial liquidity and reduce the use of personal funds by providing access to credit. But does borrowing have limits? And how do companies manage expenses made on credit? Let’s take a closer look.

How Do Business Credit Cards Work?

Companies use business credit cards to make authorized purchases by borrowing capital from a card provider. How much a company can borrow is determined by its credit history and financial information, indicating its ability to repay the loan.

A credit limit is the maximum amount a company can borrow on a specific credit account. As the company card is used, the amount of each transaction is deducted from the limit, making up the available credit. A company can only exceed a credit limit by facing penalties or having its borrowing privileges affected.

With regular business credit cards, employees must save and provide receipts for each transaction for the financial team to track spending. Since there are no real-time updates on card usage, companies must compare receipts with the credit card statement at the end of each billing cycle.

Paying off the credit card balance in full and on time allows companies to avoid paying interest rates. If the company cannot cover all costs, it can make the minimum payment set by the credit card provider. Companies must transfer the minimum payment on time to avoid penalties and keep the account current.

Some card providers connect corporate credit cards to individual users, allowing businesses to easily track all credit card transactions and eliminate poor administration dependent on physical proof of purchase. These are only some of the features that can simplify expense management and follow some of the best practices in accounts payable.

What to look for?

Among the abundance of different company credit card providers, finding the best pick for your business can be an overwhelming task. With that thought in mind, we picked several essential criteria to help you narrow down your options.

Rates

Each card provider determines fixed service fees and variable charges. The tip is to set priority points that will match your business operations. Perhaps a high annual charge is worth the low foreign transaction fee if your employees participate in routine business travel.

In general, these are the rates you should look into:

- Annual fee

- Interest charges

- Late payment fee

- Foreign transaction fee

- Balance transfer fee

- Over-the-limit fee

It is also important to research whether some crucial charges have only temporary low rates. Some card providers may offer interest-free periods but switch to high-standard interest rates post-trial.

Tracking spend

Advanced card providers offer apps or banking services that can strengthen control over business expenses with complete visibility. Linking a company credit card to a tracking tool, like expense management software, substantially aids companies and their financial teams with many benefits.

Real-time spending overview

A tracking tool provides real-time visibility into spending patterns, enabling businesses to make informed decisions, manage budgets, and quickly identify unusual or fraudulent transactions.

Effortless expense reporting

Automated transaction recording and categorization eliminates the need for manual receipt handling and data entry, saving time and reducing errors for employees and finance teams.

Integration with accounting systems

Some spend management software integrates with various accounting or ERP systems, allowing finance teams to simplify the bookkeeping process of accounts payable.

Safety

Safety measures are crucial to safeguard your business’s financial integrity, making fraud protection a non-negotiable feature for any corporate card. Effective fraud protection mechanisms, such as real-time monitoring and instant alerts, are essential in promptly detecting and preventing unauthorized or suspicious transactions.

In addition to fraud protection, spending limits allow businesses to control expenditures, preventing overspending and ensuring compliance with expense policies. Companies can effectively manage cash flow and reduce the risk of financial mismanagement by customizing spending limits according to employee roles or departmental budgets.

Support

When it comes to your company’s finances, issues such as fraudulent activity, billing errors, and technical problems must be resolved quickly. Efficient and reliable customer support is a key factor that can significantly impact your business’s smooth operation, financial management, and security.

The best credit card providers maintain 24/7 communication channels like phone, email, or in-app live chat support, together with self-service portals that could address commonly asked questions on card management.

Although traditional credit cards can include some of the discussed criteria, only company credit cards linked to spend management systems can provide the ultimate control and security over your business expenses.

How to Choose the Right Corporate Credit Card

Choosing the right corporate credit card for your business involves a strategic approach that aligns with your financial goals and operational needs. Here’s how you can make an informed decision:

1. Assess Your Spending Patterns

- Analyze Expenditure: Review your company’s spending habits over the past year. Identify key categories such as travel, office supplies, or digital services. This analysis will help you choose a card that offers maximum rewards in areas where you spend the most.

- Forecast Future Needs: Consider any anticipated changes in spending. For example, if you’re planning an expansion, look for a card with a high credit limit and flexible terms.

2. Evaluate Rewards Programs

- Match Rewards to Spending: Choose a card with a rewards program that complements your business expenses. If you frequently travel for business, a card offering travel rewards or airline miles will be beneficial.

- Cashback vs. Points: Decide whether cashback or points are more valuable for your business. Cashback can provide immediate savings, while points can be redeemed for travel, merchandise, or other benefits.

3. Consider the Credit Limit

- Align with Cash Flow: Ensure the credit limit is sufficient to cover your monthly expenses without risking overspending. A higher limit can help manage cash flow better and avoid disruptions in operations.

- Review Payment Terms: Look for flexible payment options, such as extended payment terms or the ability to carry a balance if needed, which can help manage cash flow fluctuations.

4. Examine Fees and Interest Rates

- Annual Fees: Weigh the annual fee against the benefits provided. Sometimes, a higher fee can be justified by superior rewards or services.

- Interest Rates: Compare interest rates, especially if you plan to carry a balance. Lower rates can save significant amounts in the long run.

- Additional Fees: Check for other fees, such as foreign transaction fees, late payment fees, and balance transfer fees, which can add to your costs.

5. Look for Added Benefits

- Insurance and Protections: Many corporate cards offer insurance for travel, purchases, and car rentals. These can add significant value and peace of mind.

- Employee Cards: Consider cards that offer free or low-cost additional cards for employees, with the ability to set individual spending limits and track expenses easily.

- Expense Management Tools: Look for cards that provide robust expense tracking and reporting tools, which can simplify your accounting processes and improve financial oversight.

6. Read Reviews and Seek Recommendations

- Customer Feedback: Look for reviews from other businesses similar to yours. Their experiences can provide insights into the card’s usability and customer service.

- Professional Advice: Consult with your financial advisor or accountant to ensure the card you choose fits well within your overall financial strategy.

By carefully evaluating these factors, you can select a corporate credit card that not only meets your current business needs but also supports your long-term financial goals.

Top 9 Business Credit Cards of 2025

Navigating the abundance of business credit cards can be overwhelming, given their vast number and variety. To assist your search, we’ve compiled a list of the best business credit cards on the market in 2025. This selection is tailored to meet diverse business priorities, helping you pinpoint the ideal card based on key criteria critical for your business’s financial health and operational efficiency.

1. Best Overall Business Credit Card

Klippa Corporate Credit Card

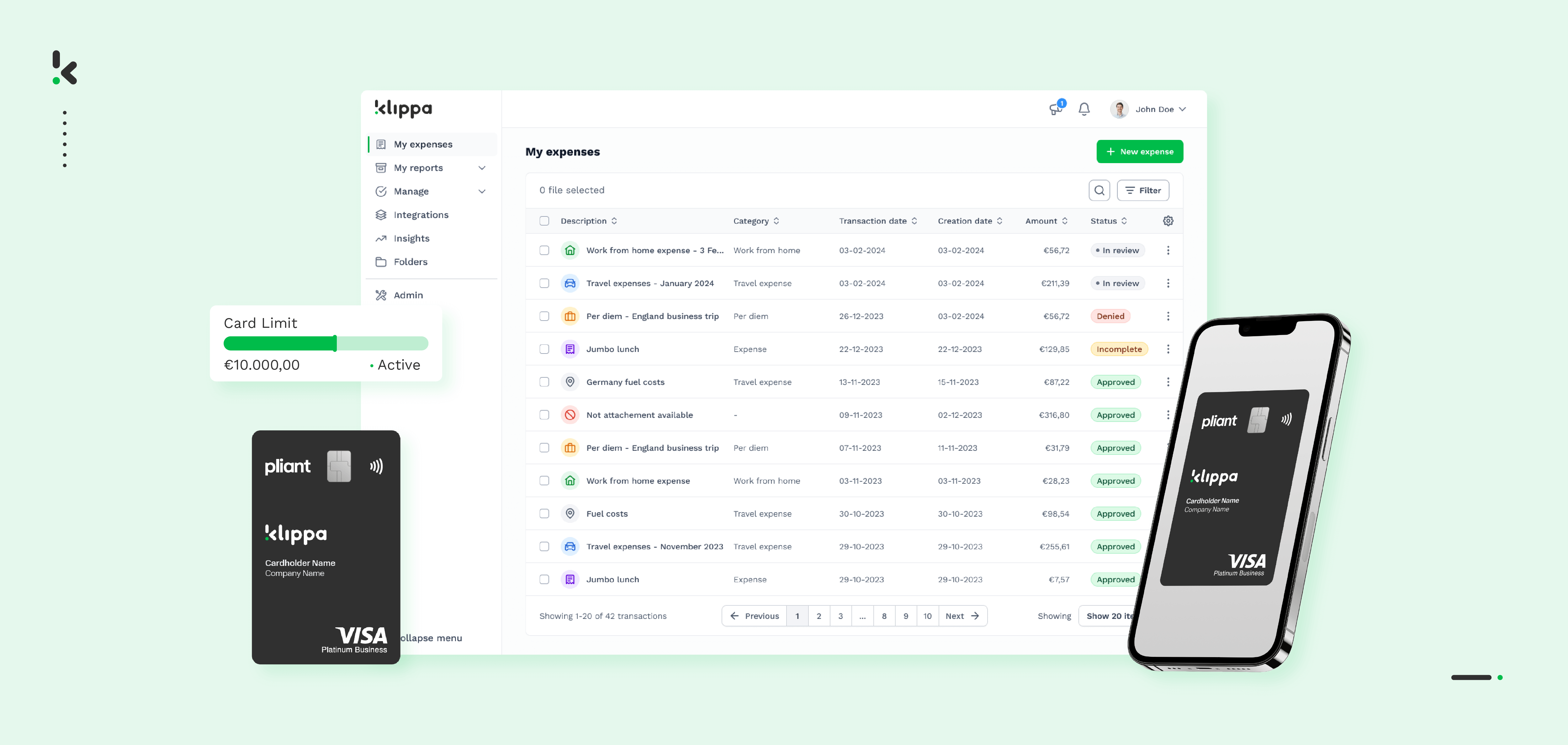

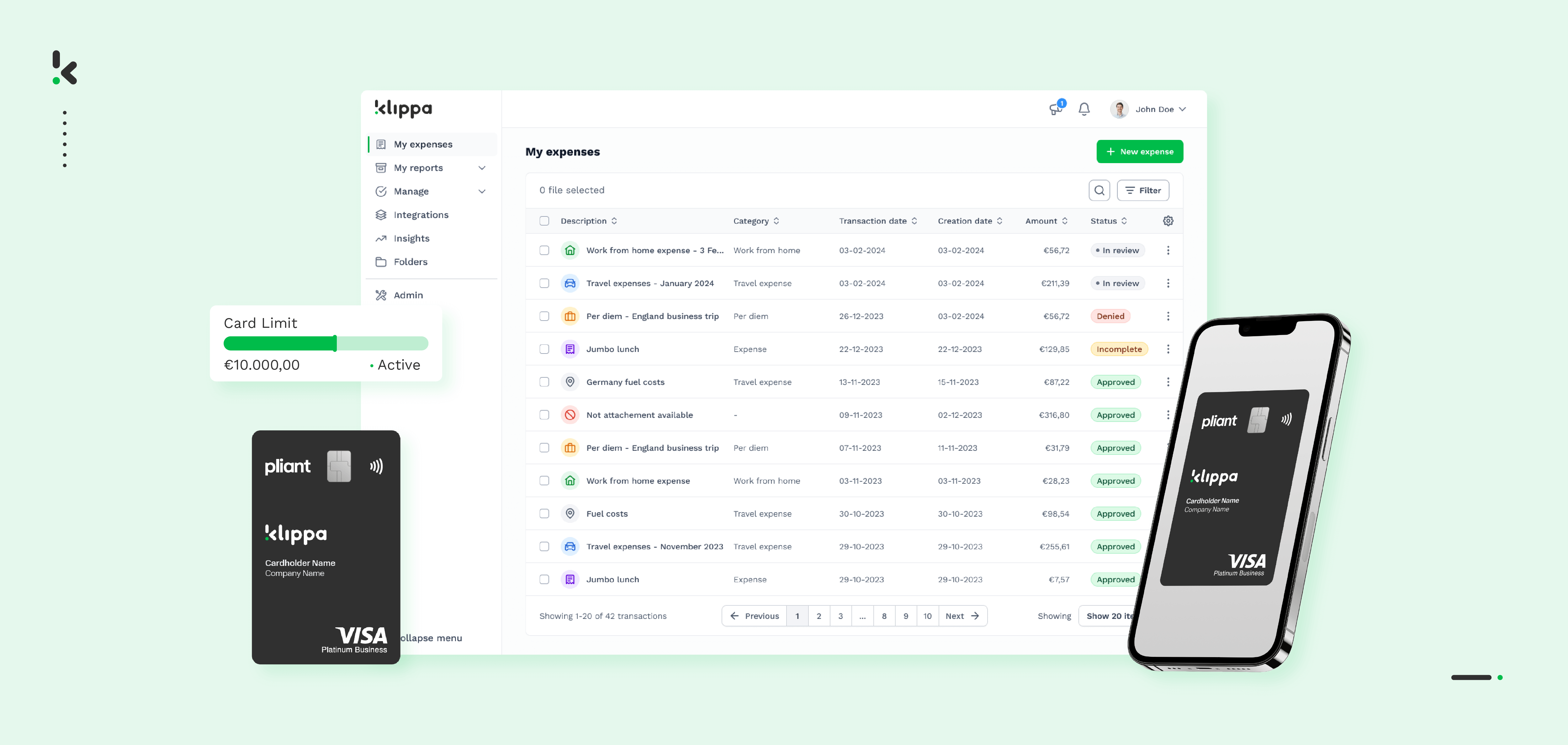

Forget out-of-pocket costs and the hassle of manual receipt processing with Klippa Corporate Credit Cards. Level up your financial management with the synergy of powerful credit cards and advanced pre-accounting software – Klippa SpendControl. Further, save time on manual data entry by integrating our solution with your bookkeeping system.

Set spending limits aligned with your company’s expense policy, track spending anytime anywhere via the web or mobile app, and manage corporate credit cards with all business expenses and invoices in one centralized system. Save time and resources on manual document processing while gaining complete control over your business expenses.

Pros

- Physical and unlimited virtual corporate credit cards for your business

- One solution with expense management, invoice processing, and corporate credit card modules

- GDPR compliant and ISO 27001 certified

- Tailored spending limits and user-level connectivity

- Advanced approval management with smart business rules

- Worldwide acceptance and 0% foreign transaction fee with Visa card support

- Compliance with company and country regulations

- Complete control and insights on real-time spending in a dedicated dashboard

- Built-in fraud detection system powered by machine learning and 3-DS protection layer for secure online transactions

- Integration possibilities with many accounting and ERP software

- Customer support via phone or email together with an extensive online helpdesk

Cons

- Available for teams of a minimum of 10 users

- Credit cards do not provide cash-back rewards for purchases made on the card

This card is best suited for: Small to medium businesses (SMEs) that are in search of one centralized solution for all their expense management and credit card needs.

2. Best Rewards Business Credit Card

Ink Business Preferred® Credit Card

The Ink Business Preferred® Credit Card is a compelling choice for businesses seeking valuable rewards and practical benefits. With an intermediate annual fee, it offers a generous rewards structure, a welcome offer, and several travel benefits.

Pros

- Welcome bonus of 100,000 bonus points that can be used for travel, cash back, Amazon purchases, and more

- Travel and purchase protections, such as trip cancellation/interruption insurance

- No foreign transaction fees

- Employee cards at no additional cost

- Rewards on the first $150,000 spent in combined purchases on travel, shipping, internet, cable, phone services, and advertising purchases

Cons

- Has a $95 annual card fee

- Rewards cap on high-earning categories

- Potential gaps in reward coverage for key business categories

This card is best suited for: Small to medium-sized businesses with significant expenses in the card’s bonus categories and can take advantage of its travel rewards.

3. Best Cash Back Business Credit Card

Ink Business Unlimited® Credit Card

The Ink Business Unlimited® Credit Card is a simple and appealing card choice for businesses seeking straightforward rewards without an annual fee. It offers a flat-rate cash back on all purchases and does not restrict cash-back earnings to specific categories.

Pros

- Unlimited 1.5% cash back rewards on purchases

- No annual fee

- Generous welcome bonus

- 0% Intro APR on purchases for 12 months

- Cash back awarded can be combined with premium credit card accounts for better reward redemption options

Cons

- High 3% foreign transaction fees

- Not the best option for balance transfers

This card is best suited for: Small to medium-sized businesses that appreciate a simple cash-back rewards program.

4. Best Business Travel Credit Card

The Business Platinum Card® from American Express

The Business Platinum Card® from American Express is a premium card designed for business owners and executives who frequently travel and wish to make their business trips more comfortable and rewarding. With a substantial annual fee, this card offers a rich array of benefits that can justify its cost for the right user.

Pros

- High welcome bonus

- 1.5X points on select business categories, such as US construction material and hardware suppliers, electronic goods retailers, and shipping providers

- Broad opportunities for potential statement credits

- Access to over 1,400 airport lounges across 140 countries

- A rich suite of travel perks

Cons

- High spending requirement to earn the welcome bonus

- $695 annual fee and additional cardholder fees are among the highest on the market

- Limited spending bonus categories

This card is best suited for: Medium to large businesses with significant travel expenses and those who can fully leverage the travel benefits and statement credits to offset the annual fee.

5. Best Credit Card for Small Business

The American Express Blue Business Cash™ Card

The American Express Blue Business Cash™ Card offers generous cash back, zero annual fees, and a 0% intro APR on purchases for 12 months, making it a straightforward choice for businesses with limited operations.

Pros

- No annual fee

- 2% cash back on up to $50,000 in purchases per year

- Introductory APR on purchases

- Great extra benefits like purchase protection and car rental insurance

- Business-oriented benefits like employee cards and authorized manager accounts

Cons

- Highest-earning cash-back reward capped after $50,000 in annual spending

- High 2.7% foreign transaction fees

- No low introductory APR for balance transfers

This card is best suited for: Small business owners looking for straightforward rewards and cost savings.

6. Best Credit Card for New Business

Capital One Venture X Business Card

The Capital One Venture X Business Card offers a straightforward rewards structure, making it easy to accumulate points without tracking categories. The card’s benefits, like free employee cards with customizable limits, and a comprehensive suite of travel perks can ease financial management for new business owners.

Pros

- There is no preset spending limit

- Unlimited 2 points per dollar on all purchases

- Impressive travel benefits, like extensive travel insurance and luxury hotel access

- Free employee cards and virtual cards

- Annual bonuses

Cons

- High annual fee

- Most travel perks are limited to options offered on Capital One’s portal

- The full card balance must be paid every month

This card is best suited for: Small to medium-sized businesses that can benefit from provided travel perks of the card.

7. Best Mastercard Business Credit Card

U.S. Bank Business Triple Cash Rewards World Elite Mastercard®

The U.S. Bank Business Triple Cash Rewards World Elite Mastercard® offers a robust rewards program without an annual fee. This card is particularly beneficial for businesses with spending that aligns with its bonus categories, including gas stations, office supply stores, cell phone service providers, and restaurants.

Pros

- No annual fee

- Strong welcome bonus and bonus categories for a no-annual-fee card

- Introductory 0% APR on both purchases and balance transfers for 15 billing cycles

- World Elite Mastercard benefits including cell phone protection

- 1-5% cash back on all purchases

Cons

- High 3% foreign transaction fee

- Relatively high minimum spending requirement to unlock bonus

- Authorized user purchases don’t count toward the minimum spending requirement

This card is best suited for: Small to medium-sized businesses whose spending heavily aligns with the card’s bonus categories.

8. Best Visa Business Credit Card

Ink Business Cash® Credit Card

The Ink Business Cash® Credit Card by Chase is a compelling option for business owners looking for a no-annual-fee credit card that rewards everyday business expenses. It offers a cash-back rewards program on the first $25,000 spent in combined purchases at office supply stores and on internet, cable, and phone services.

Pros

- Broad 5% and 2% cash-back categories

- Bonus cash back at office supply stores, gas stations, and restaurants

- Intro APR offer for purchases

- No annual fee

- You can pair this card with a card that earns Ultimate Rewards to redeem your cash back for travel

Cons

- Annual cap on bonus categories

- Requires good to excellent recommended credit

- High 3% foreign transaction fee

This card is best suited for: Small to medium-sized businesses that incur significant expenses in the categories of office supplies, telecommunications, gas, and dining.

9. Best American Express Business Credit Card

American Express® Business Gold Card

The American Express® Business Gold Card is designed to adapt to the varying spending patterns of businesses, making it a dynamic choice for business owners seeking to maximize rewards on their largest expenses.

Pros

- 4X reward points per dollar spent in the two categories where your business spends the most each billing cycle

- Travel benefits and insurance for frequent travelers

- Expense management tools for day-to-day spending and finances overview

- Flexible spending limit

- No foreign transaction fees

Cons

- Only 2 eligible categories for the highest reward rates

- $150,000 annual spending cap on rewards

- High $375 annual card fee

- No airport lounge access and few additional luxury perks, unlike other premium business cards

This card is best suited for: Medium-sized businesses with variable spending patterns that can take advantage of the card’s dynamic bonus categories.

How to Apply for a Business Credit Card?

Applying for a business credit card can be a strategic move for managing your company’s finances and building its credit profile. Here’s a short guide on the application process and tips to enhance your approval chances:

Pre-Application Steps

- Assess your needs: Determine why you need a business credit card. Is it for managing cash flow, earning rewards, or something else?

- Check your credit score: Your personal and business credit scores can affect your approval odds. Knowing your scores beforehand can help you target the right cards.

- Research and compare cards: Look for cards that align with your business needs. Consider factors like annual fees, interest rates, rewards programs, and added perks.

The Application Process

- Gather necessary information: Typically, you will need to provide several details about your business, including its legal name, type of business, industry, annual revenue, and Tax ID Number (EIN) or Social Security Number if you’re a sole proprietor.

- Choose the right card: Select a card that fits your business needs and credit profile to increase your chances of approval.

- Apply online or in person: Many issuers allow online applications, which can be convenient and fast.

- Wait for approval: Approval times can vary. Some applications might result in instant approval, while others could take a few weeks. During this period, the issuer may contact you for additional information.

Tips for Increasing Approval Chances

- Improve your credit scores: Pay down existing debt and ensure your credit reports are error-free.

- Provide accurate information: Double-check all the details you provide on your application to avoid any discrepancies.

- Consider a secured credit card: If your credit isn’t strong, a secured business credit card might be easier to obtain and can help you build credit.

- Apply for cards suited to your creditworthiness: Applying for cards that match your credit profile can increase your chances of approval.

Once approved, manage your business credit card wisely. Use it for business expenses, pay off the balance on time, and keep utilization low to build a strong credit history. This disciplined approach will help you manage your business finances effectively and improve your chances of getting favorable terms on future credit applications.

Why Should You Choose Klippa Company Credit Cards?

Finding the right business credit cards for your company depends on which criteria and features you deem the most important. While we presented a summary of some of the best business credit cards on the market, we believe that Klippa Corporate Credit Cards connected to our AI-powered expense management solution have it all to help your organization save precious time and money while having even more control over your expenses.

Do you want to improve your expense management with Klippa Corporate Credit Cards? Book a free demo to see our product in action, or contact our SpendControl specialists for more information.

FAQ

Klippa corporate credit cards, also named employee expense cards or petty cash cards, are cards issued to company employees for their work-related expenses. Instead of using their own funds, employees can make purchases with the card and only upload the receipt.

These cards are available in a virtual format and as physical cards. This helps you to improve your company’s reimbursement process and helps ensure transparency and accountability for business expenditures.

Klippa corporate credit cards are issued by Pliant. For more information, check out Pliant’s FAQ page.

Klippa corporate credit cards can be used for a wide range of regular employee expenses. This includes business trips, daily expenses like office supplies or client lunches, and many more.

Whenever a purchase is made, employees are requested to scan the receipt and provide the necessary expense details, allowing the finance team to easily track and manage expenses without any additional follow-up required.

The cost overview of the Klippa corporate credit cards is very simple.

Each card costs €5,- per month per user. Furthermore, an additional cost of the module is a fixed amount of €600,- per year.

When you use the card for purchases in a foreign currency, Pliant applies the VISA exchange rate without surcharges or additional fees.

Yes, Klippa corporate credit cards can be used for both online and in-store purchases. This makes the use of Klippa corporate credit cards very versatile and convenient.

No, Klippa corporate credit cards should only be used for business expenses in adherence to your company’s expense policy.

However, in case of accidental use for personal expenses, you can easily enter the personal expense details in the app to inform the responsible person.