Claims processing takes a lot of time. Sometimes, it can take up to 30 days to evaluate each case based on the amount of required documents. With one or two claims per week, that’s fine. But what if you have tens or hundreds of cases per day?

Manually processing your claims is risky because human error often goes unnoticed, leading to long turnaround times and decreased customer satisfaction. It’s also tough to spot a fraudulent document, or one that was already submitted, exposing you to regulatory compliance disasters.

A report also found that time spent on administrative tasks within the claims process could cause $160 billion in efficiency losses over five years. Fortunately, there is a solution, and that is automation. With modern technologies like intelligent document processing (IDP), you can breeze through all your document tasks by automating data extraction to save time and money.

In this blog, we’ll explore everything you need to know about claims processing automation as well as picking the right solution for your company.

Let’s get started!

Key Takeaways

- Claims processing is time-consuming and error-prone when handled manually, often leading to delays, compliance risks, and dissatisfied customers.

- Automation technologies like OCR, AI, and IDP streamline every stage of the claims process, from data collection and fraud detection to communication and document management.

- Industries such as healthcare, auto, travel, and employment insurance benefit significantly from automated claims workflows, gaining speed, accuracy, and cost savings.

- The right automation solution should offer high data accuracy, built-in fraud detection, human-in-the-loop options, seamless integration, and strong compliance controls.

What are the Steps of the Traditional Claims Process?

Claims processing refers to the series of actions an insurer takes to review, investigate, and resolve a policyholder’s claim. The typical claims process involves six steps, from reporting to the final decision, with each step requiring extensive documentation to ensure accuracy, compliance, and efficiency.

Here are the most important steps in claims processing:

- Reporting: After an incident, the claimant registers a claim, usually by filling out a form to be submitted to their insurer.

- Investigation: Your team conducts a thorough investigation to verify the authenticity of the claim, requesting any additional documentation or evidence necessary to assess its validity.

- Assessment: After collecting the required information from the insured, as outlined in the insurance policy, you evaluate the damage and settlement costs. This step also involves considering any applicable deductibles, followed by making a settlement offer.

- Settlement Offer: Based on your assessment, you offer a settlement to the policyholder. This offer outlines the compensation or assistance you can provide to address the damage sustained, and the insured can choose to accept it or negotiate other options.

- Negotiation (if necessary): If the insured disputes your offer or feels that their needs are not adequately covered, they may engage in negotiations. After concluding any negotiations, the final step is to finalize the claim.

- Resolution and Closure: Upon reaching an agreement, you complete the claim process by providing the agreed-upon compensation or assistance. If any disputes remain, further negotiations are conducted until a resolution is reached. Once resolved, the claim file is closed, marking the conclusion of the process.

While each step in the claims process is essential, manual handling slows everything down. This is where automation steps in to streamline and strengthen the entire workflow.

What is Claims Process Automation?

Claims process automation refers to the use of technology to automate and streamline document processing for insurance claims. With automation, you can easily automate various steps of the claims process, from data extraction to verification, enabling faster decision-making.

How Does Automated Claims Processing Work?

Claims automation relies on technologies like Intelligent Document Processing (IDP), Optical Character Recognition (OCR), Machine Learning (ML), and Artificial Intelligence (AI) to replace repetitive manual tasks with fast, accurate, and scalable workflows.

Here’s how it works across key parts of the claims process:

Collecting Data Efficiently

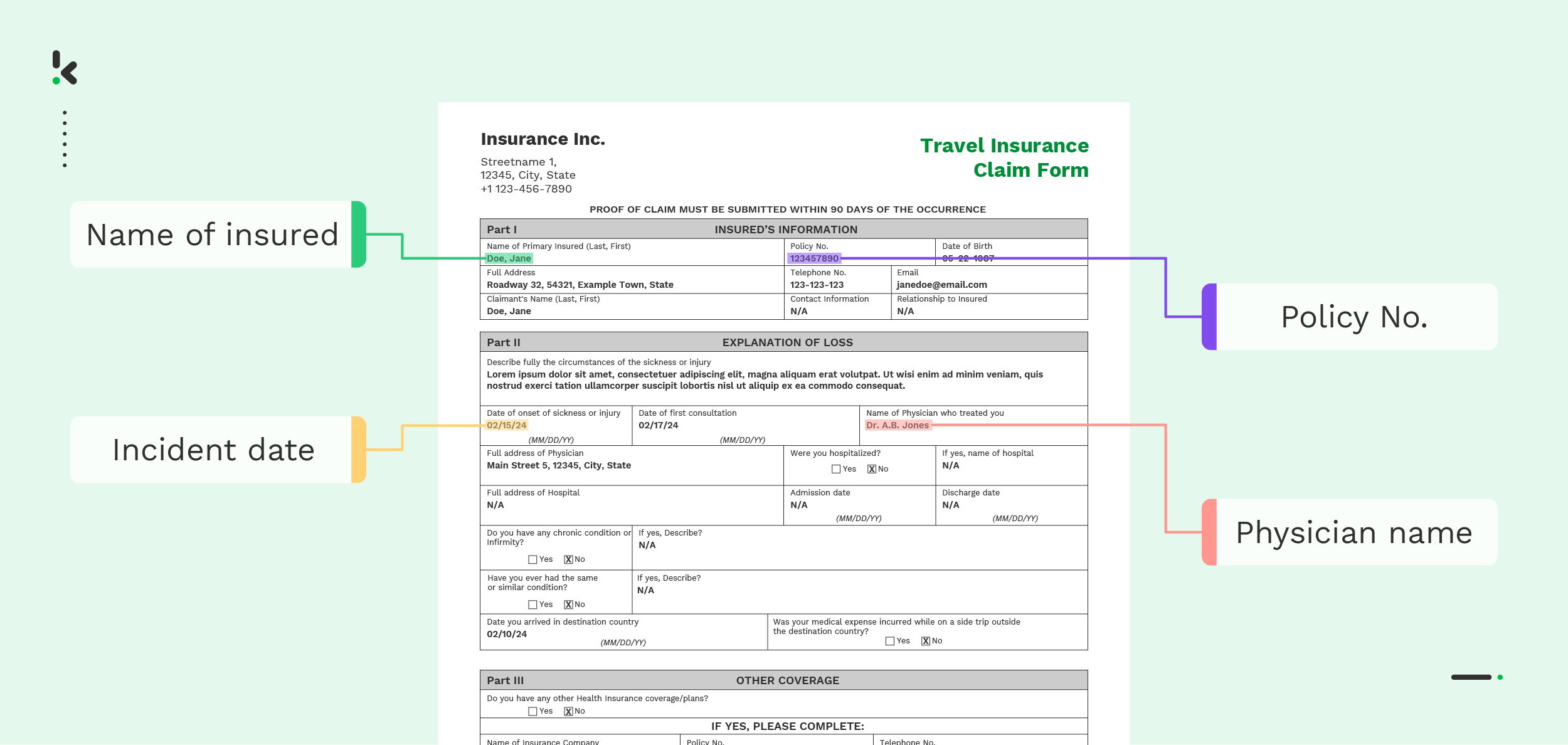

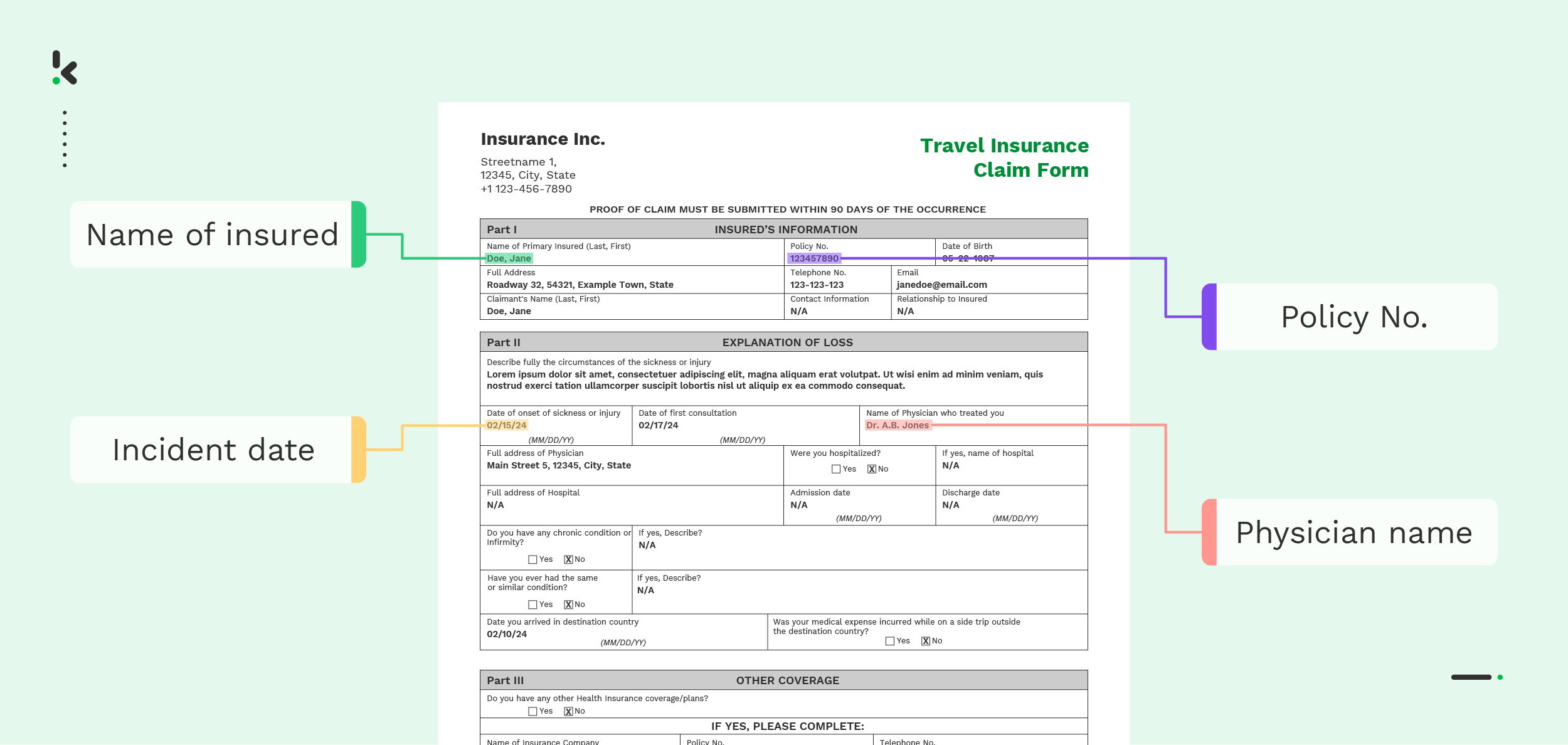

Instead of relying on manual data entry, claims processing automation leverages technologies like OCR and Robotic Process Automation (RPA) to extract information from both structured and unstructured formats. This data is then centralized in an accessible system, allowing claims processors to make informed decisions more efficiently.

Detecting Fraud Automatically

AI and Machine Learning work with IDP to help algorithms identify common patterns that suggest fraud through pattern recognition and document verification. EXIF data analysis can examine the submitted documents and flag any indication of manipulation or modification. It’s a valuable tool in document fraud detection, providing insights into digital document origins and integrity.

Streamlining Document Management

OCR technology plays a crucial role in automating the categorization and indexing of documents. This technology allows for the seamless scanning and digitization of physical documents, which are then stored in a centralized system. This reduces the time spent on managing paperwork and ensures that all relevant documents are easily accessible when needed.

Enhancing Communication

Automation in claims processing can integrate Natural Language Processing (NLP) to facilitate clear and consistent communication between all parties involved in a claim. Automated systems can send real-time updates and notifications to policyholders, adjusters, and service providers, ensuring everyone is informed throughout the process and minimizing delays.

By simplifying complex tasks and cutting out unnecessary delays, automation creates space for your team to focus on what matters most: delivering fast, accurate, and reliable service. Let’s look at the real-world benefits automation brings to your operations.

Benefits of Claims Process Automation

Implementing automation in your claims processing can bring significant benefits to every step of your claims management process. Here are just a few of these benefits and how they can enhance your daily workflow:

- Claims Surge Management: In cases of high claims volumes (such as after a natural disaster or accident), automated claims processing can efficiently and simultaneously handle large volumes of claims, sorting and categorizing them in terms of complexity or other predetermined factors.

- Reduce Operational Costs: Claims process automation reduces the need for manual labor, the human errors that come with it, and operational costs. In turn, your business can process more claims faster and with fewer resources and less overall expense.

- Enhanced Fraud Detection: Claims process automation allows you to better detect suspicious patterns and flag potential fraud for further investigation. The technology can help combat fraudulent claims and mitigate risks, reduce losses.

- Improved Customer Service: Automation can revolutionize your customer service by offering customers speedy and efficient claims resolution processes, and self-service options, such as AI-powered chatbots and online portals for tracking and monitoring the progress of their claims.

- Enhanced Regulatory Compliance: Claims process automation ensures that claims are processed according to regulatory standards, adhering to privacy and security guidelines, protecting Personally Identifiable Information (PII), Protected Health Information (PHI), and much more.

- Optimized Document Management: Through technologies like RPA, automation streamlines repetitive tasks like data entry, document routing, document sorting, and claim validation. Automation makes tasks like digitization, classification, and indexing easier, so you can more efficiently search and retrieve information when needed.

These benefits take on even greater meaning when applied to real-world scenarios. Different sectors face different challenges, and automation offers tailored solutions that meet those unique demands.

Use Cases For Automated Claims Processing

Claims process automation positively impacts all parties involved. Here are some of the industries that benefit the most from automation and how they do so:

Healthcare Insurance

The nature of the healthcare sector means frequent and complex insurance claims. Automating the medical claims process can mean swift data extraction from submitted documents and individual policies for a timely and accurate resolution of a claim.

Auto Insurance

Automation brings efficiency and organization to the auto insurance industry by streamlining document and data management, from accident reports to repair bills. It quickly determines claim validity and policy coverage, helping prevent fraud. The system also calculates settlement amounts, reducing processing time, minimizing human errors, and enhancing customer trust.

Travel Insurance

Travel insurers benefit from automation by swiftly processing travel claims related to trip cancellations, medical emergencies abroad, or lost luggage. Automated systems can quickly validate policy coverage, assess documentation, and process reimbursements, enhancing customer satisfaction during stressful situations.

Employment Insurance

Automated claims processing simplifies worker safety and compensation management by extracting data and cross-referencing documents like injury reports, medical records, and employment files. This speeds up policy verification, calculates compensation accurately, and improves employee satisfaction.

Warranty Claims

Manufacturers and retailers use automation to handle warranty claims efficiently. By extracting and validating data from warranty forms and purchase receipts, automated systems can quickly determine claim eligibility, process replacements or repairs, and maintain customer trust.

As these examples show, automation isn’t one-size-fits-all. Different industries have different requirements, pain points, and priorities. That’s why choosing the right solution matters. The features you need will depend on your specific workflows, document types, and compliance obligations.

Let’s explore what to look for in a claims automation platform that truly fits your business.

How to Choose the Right Claims Automation Solution

To find the right claims process automation solution for your needs, consider several key factors. Your chosen solution should align with your business goals and offer features that address your specific needs. In this section, we’ll explore some of the most important features an automated claims processing solution should offer:

- Accurate Data Extraction: Your automated solution should provide efficient data extraction with over 99% accuracy from a wide range of document types.

- Built-in Fraud Detection: Ensure your chosen solution has a strong record of detecting fraudulent documents across various formats, including identity documents, insurance documents, and forms.

- Human-in-the-loop (HITL) Functionality: Your chosen solution should offer HITL capabilities, which give you the option for human intervention where necessary. It combines the speed and capabilities of automation with the invaluable input of human judgment for nuanced decision-making.

- Integration with Existing Systems: Look for a solution that offers seamless integration with your existing business systems, practice management software, and databases.

- Security and Compliance: Make sure your chosen solution complies with industry regulations, protecting sensitive information from data breaches and unauthorized access. Check whether it provides data masking and anonymization options to help you remain compliant with regulations like GDPR and HIPAA.

- Scalability and Flexibility: As you begin automating your claims processing, decide which steps you need to automate and look for solutions that allow you to scale your automation according to your goals.

- User-Friendly Interface: Ensure that your chosen solution is easy to use with an intuitive interface that enhances productivity and gives you and your employees greater control over every step of the claims processing workflows.

While many solutions are available on the market, not all offer everything you need for success. However, there are a few solutions, including Klippa’s DocHorizon, that provide an easy-to-use and effective platform for automated claims processing.

Why You Should Automate Your Claims Processing with Klippa

With Klippa DocHorizon, you can automate all your insurance claims processing workflows, from receiving a claim to its resolution. The Klippa DocHorizon platform allows you to customize workflows to optimize your claims processing using an easy-to-use drag-and-drop flow builder that caters to your specific needs. You can also incorporate a human-in-the-loop to achieve 100% data accuracy, ensuring you only process valid documents.

For example, you can process every new document uploaded into a Google Drive Folder and have it processed through our document capture model. Select the data that needs to be extracted, the data format (JSON, XML, and more), and the output folder, and let the machines do the work. You can see how it works for yourself in this video:

Here’s an overview of DocHorizon’s features to help you automate your claims processing:

- Create custom document workflows: Take full control over claims processing by defining your input and output sources and connecting our software with any of your existing systems through our 50+ out-of-the-box integrations.

- Achieve up to 99% data extraction accuracy: Automatically extract all relevant data from submitted claims in any format without relying on manual data entry.

- Improve data management: Automate processing to ensure better data organization, making it easier to search, retrieve, and analyze information, enabling you to make informed decisions.

- Enable global reach: Process claims from around the world, as Klippa DocHorizon supports over 100 languages.

- Increase efficiency: Shorten turnaround times by approximately 70%, allowing you to process more claims in less time. Faster processing means quicker response times!

- Scale your business: Let automation take over. Klippa’s bulk uploading capabilities allow you to process multiple submitted documents at once, ensuring you can easily handle your workload even as your business grows.

Are you ready to minimize financial loss while complying with regulatory requirements through automated claims processing? Book a free demo below or contact our experts for more information.

FAQ

Automation solutions can handle a wide range of documents, including claim forms, medical reports, invoices, receipts, repair estimates, identity documents, and more – whether structured, semi-structured, or unstructured.

Not entirely. Automation handles repetitive, manual tasks like data extraction and validation, but human oversight is still essential for complex decisions, fraud detection, and customer interactions. It’s more about support than replacement.

Leading automation platforms use encryption, access controls, and compliance frameworks like GDPR and HIPAA to protect sensitive data. Look for solutions that also offer data masking and audit trails for extra security.

Klippa stands out with its high-accuracy data extraction (up to 99%), support for 100+ languages, human-in-the-loop functionality, and user-friendly workflow builder. It’s built for scalability, security, and compliance, making it ideal for organizations that need both power and precision in their document processing.