Capturing data from identity documents and verifying someone’s identity are necessary procedures for companies in many industries. For financial institutions and banks, for example, these procedures are part of the client onboarding process and are required by strict KYC regulations.

In addition, nearly two-thirds (63%) of customers consider the company’s onboarding program when making a purchasing decision, highlighting the importance of a well-structured onboarding process in influencing customer choices.

In any of these cases, using Intelligent OCR software is the best option for automatically extracting data from ID documents and verifying someone’s identity with it.

If you want to know more about the smartest way to process passports and ID cards, you are at the right place. Let’s look at the use of automated solutions to speed up ID-related business processes!

What is Client Onboarding?

Client onboarding is the process of welcoming new customers and guiding them through the necessary steps to start using a company’s products or services. It typically includes identity verification, document submission, compliance checks, and account activation to ensure a seamless and secure experience.

Smart vs. Traditional Customer Onboarding

No matter what type of business you run, it is necessary to streamline the onboarding process of new clients in the fastest, most practical, and efficient way. It is the key to increase the conversion rate and improve the user experience. But how can you achieve this?

Let’s say a customer wants to open a bank account. Traditionally, they would have to go to the bank and show their ID. The bank clerk would manually copy the information from the ID and they would be confirmed as the person opening the account. This was customer onboarding back in the day. There must be a smarter way to complete this process.

What Is the Smart Solution?

Nowadays, there are smarter ways to capture data from ID cards and passports and verify someone’s identity. With Optical Character Recognition (OCR) and AI, for example, all sorts of documents containing text can be read and data can be extracted from it automatically.

The software takes over the manual process of reading and checking documents. Any kind of document containing information about the potential customer can be run through it. The software automatically recognizes the text that it needs and makes it extractable.

The extracted data can then be used according to your needs, such as passing it on to any desired system, database, or tool for further processing.

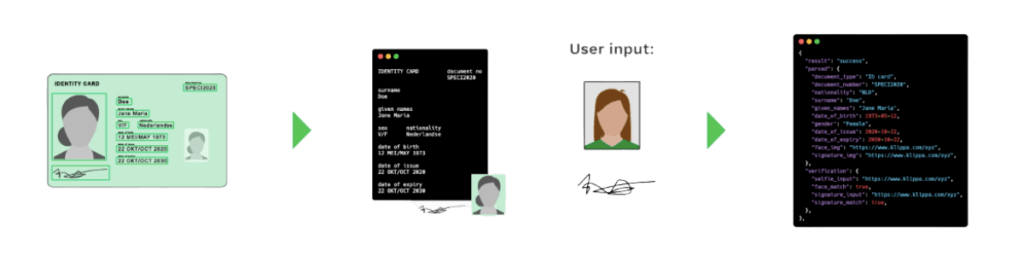

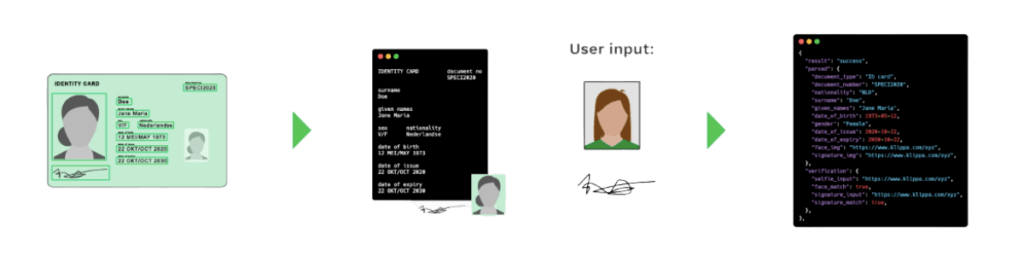

What Does the OCR Process Look Like?

Now that we know about automated document processing solutions, let’s have a look at how these work on ID cards and passports.

The process typically consists of 4 steps:

- Document entry

- Text recognition

- Parse to structured data

- Signature and Photo extraction

1. Document Entry

The first step of the process is to provide a picture or PDF file of an ID document to the software. Nowadays, most OCR software can be used on smartphones. With Klippa’s OCR software for ID cards, for example, you can upload a picture by simply taking a photo with your camera. But it’s also possible to send it in through the web application or e-mail.

The software will automatically crop the image of the document and optimize the image quality.

2. Text Recognition

As soon as the image is received, the OCR software analyzes the patterns of light and dark that make up the letters and numbers to transform the scanned image into text. All the data you need is extracted by the OCR software in a matter of seconds.

In this step also duplicates, errors and fraud can be recognized automatically. Forged images of documents, for example, can be identified with Photoshop detection and EXIF analysis.

All text from the ID document is extracted, but it’s not yet structured.

3. Parse to Structured Data

The text, which was gained from the previous step, is converted into a structured JSON file or an alternative of your choice, ready for you to process.

From this point on, the information from the ID document can easily be processed in the database of your company. One last option is to extract the signature or the picture from the ID document for the verification process.

4. Signature and Photo Extraction

To improve the security of the onboarding process, it is possible to identify, extract, crop, and convert any picture and signature on an ID document into a usable format.

This works as follows. The software uses computer vision and deep learning to analyze the document section by section, dividing it into text and visual components.

After that, it checks what visual components are likely to be a signature or photo. If it finds a signature, the software crops the signature, removes background patterns, and extracts the leftover scribble into a usable format.

In the same way, photos can be cropped and extracted from the document. The signature and photo can then be used for identity verification purposes through signature and selfie comparison.

Common Challenges in Implementing Digital Client Onboarding

Implementing digital customer onboarding can significantly improve efficiency and security, but it also comes with challenges. Businesses must navigate issues such as system integration, data security, and user adoption to ensure a seamless transition. Below are some of the most common obstacles and practical solutions to overcome them.

1. Integrating OCR Technology With Existing Systems

One of the biggest challenges businesses face is ensuring that OCR technology seamlessly integrates with their current CRM, ERP, or compliance systems. Many legacy systems are not built for advanced automation, leading to data silos and inefficiencies.

The key to overcoming this is to choose an OCR solution with flexible API compatibility, allowing smooth integration with existing software. Additionally, companies should conduct pilot testing before full implementation to identify potential technical issues early on.

2. Ensuring Data Security and Regulatory Compliance

Handling sensitive client data requires strict adherence to GDPR, AML, and KYC regulations. Any mismanagement can lead to compliance violations and legal consequences.

To mitigate this risk, businesses should implement end-to-end encryption, secure cloud storage, and regular compliance audits. Partnering with a certified onboarding solution provider that meets international data security standards ensures that all client information is processed securely and following legal requirements.

3. Reducing Drop-Off Rates Due to User Experience Issues

A complex or time-consuming onboarding process can lead to frustration and high abandonment rates. Clients expect a fast and intuitive digital experience, and excessive form-filling or verification steps can deter them.

Streamlining the process with AI-powered data extraction, autofill functionalities, and biometric authentication can significantly enhance the user experience. Providing real-time customer support through chatbots or help desks also ensures that clients complete the onboarding journey without unnecessary delays.

4. Adapting to Various Document Formats and Quality Issues

Clients submit identity documents in various formats, and poor image quality can lead to OCR errors or failed verifications.

Implementing AI-driven OCR that can recognize multiple document types and adjust for low-quality scans improves accuracy. Additionally, incorporating a real-time document verification system that prompts users to resubmit blurry images enhances the overall onboarding experience.

5. Training Staff for Effective Implementation

Even with automation, employees must be trained to handle exceptions, flagged verifications, and system troubleshooting. A lack of training can slow down operations and create compliance risks.

To address this, companies should provide comprehensive training programs that include hands-on system tutorials, regulatory compliance guidelines, and periodic refresher courses to keep staff updated on new onboarding technologies.

By overcoming these challenges, businesses can improve efficiency, security, and user experience in client onboarding. Klippa’s digital onboarding solutions tick many of the boxes above and are already used by thousands of customers worldwide. You can find some use cases below.

Use Cases of Digital Customer Onboarding

Klippa’s automated identity verification solution is used in many industries, usually for KYC and onboarding processes.

- Digital onboarding with ID documents and e-signature

- Identity verification for KYC check with selfie biometric match

Let’s have a closer look at two cases that we come across most often:

Digital Onboarding With ID Documents and E-Signature

To ensure a stable and compliant service, many companies require a person’s ID document at sign-up. Technology and software can make a big impact here.

Take the case of vehicle rental services, for example.

When it comes to renting a car, customers usually don’t want to get inside an office to fill in forms and contracts. The customer wants to pick up the vehicle and leave as soon as possible. ID data extraction and e-signature make the onboarding process and contract signing smooth and efficient.

Car rental companies can perform customer onboarding from mobile devices or the web. Intuitively and quickly:

- Upload a photo of the ID document to the software

- Extract all the data and the customer only needs to confirm it

- E-sign for contracts

- Verify identity with a signature match

Customers can be uploaded into the database remotely even before picking up the vehicle.

Identity Verification With Selfie Biometric Match

Banks must make sure that their clients are genuinely who they claim to be. They are bound to KYC procedures, which are mandatory to verify a client’s identity when opening an account.

KYC procedures defined by banks involve all the necessary actions to ensure their customers are real, and that they assess and monitor risks properly. These processes help prevent and identify money laundering, terrorism financing, and other illegal financial schemes.

Digital ID verification helps banks provide a smooth customer onboarding experience that complies with KYC regulations and minimizes the risk of fraud.

The verification process could look like this:

- Scan or upload the ID document

- Extract information from the ID document

- Verify identity with selfie biometric and signature check

In such a digital and automated process, a customer’s identity can be verified almost instantly. The following video summarizes the steps in this process:

Curious to see how it works in practice? Explore our client onboarding case studies to learn how companies like yours have optimized efficiency and compliance with Klippa’s digital solutions. Read the case studies here:

- How French National Railway SNCF automates ID verification checks

- How Klippa helps online gambling company Play North to process 10K+ identity documents per month

- How online payment provider Online Payment Platform processes 300K+ ID documents per month

- How compliance software provider Compli verifies the identity of 1,000+ construction workers

- How travel tech company Hotelinking processes 20K+ ID documents with Klippa

Klippa’s Solutions for Other Identity Documents

What if you want to extract data from another identity document? Besides passports and identity cards, Klippa is trained for any type of identity document. We support:

- Driving licenses,

- Residence permits,

- Student IDs

- and many more

We got you covered!

How Can Klippa Help in Automating Your Business Processes?

Klippa is the solution for extracting data and verifying someone’s identity with ID cards and passports. Our Identity Verification solution is enhanced with technologies such as OCR, machine learning, and computer vision, which empowers all the features that you need for KYC checks and customer onboarding.

Klippa complies with GDPR and responds to the demands of users and companies.

We would gladly hear about your specific case and talk about how we can help speed up your organization.

If you want to know more about our solutions, plan a demo below or get in touch with us. We would be happy to help!

FAQ

Digital client onboarding is the process of verifying and registering new customers online using automated identity verification, document scanning, and compliance checks. This replaces manual paperwork, reducing onboarding time and improving efficiency.

How does digital onboarding improve security and compliance?

By integrating AI-powered OCR, biometric verification, and encryption, digital onboarding ensures compliance with KYC, AML, and GDPR, preventing fraud and safeguarding customer data.

What are the biggest challenges in implementing digital onboarding?

Common challenges include integration with existing systems, ensuring regulatory compliance, handling poor-quality document uploads, and minimizing user drop-offs due to complex verification steps.

How can businesses improve the user experience during onboarding?

Companies can enhance the onboarding experience by using auto-fill technology, reducing manual data entry, implementing biometric authentication, and offering real-time customer support to guide users through the process.

Can OCR technology help with faster identity verification?

Yes, OCR (Optical Character Recognition) automates data extraction from ID documents, reducing processing time, minimizing errors, and allowing businesses to verify identities faster.

How does Klippa’s solution streamline client onboarding?

Klippa’s AI-powered digital onboarding solution automates document verification, biometric matching, and API integration, enabling businesses to onboard customers quickly, securely, and in full compliance with regulations.