Managing taxes is a task that demands precision and organization. Excel, known for its flexibility and customization capabilities, is everyone’s favorite application when it comes to handling tax-related tasks. Sounds ideal, right?

Well, yes, in theory. However, extracting all the information manually from tax forms, and in an accurate manner, no less, is a rather time-consuming and frustrating process. To simplify it, your business can resort to using Intelligent Document Processing. Employing IDP software means not only automating the conversion process but also the entire document workflow.

In this blog, we will explore the many reasons to use Excel for tax management and offer you a guide on how to convert tax forms to Excel in 5 simple steps. Let’s start!

Key Takeaways

- Manual tax form processing is outdated – Converting tax forms by hand is slow, error-prone, and hard to scale across teams.

- Excel is ideal for tax data management – Thanks to its flexibility, formulas, and analysis tools, Excel is perfect for organizing and analyzing tax data.

- Klippa DocHorizon automates the entire workflow – From document upload to data extraction and export to Excel, all in one seamless flow.

- Secure and compliant by design – Klippa ensures tax data is handled securely, with built-in fraud detection and data anonymization.

Why Use Excel for Tax Management

Excel’s effectiveness in handling numerical data makes it an indispensable tool for tax management. Here’s why Excel stands out:

- Flexibility and Customization: Excel allows you to tailor your tax management needs precisely. Whether it’s organizing deductions, calculating tax liabilities, or forecasting future taxes, Excel’s customization options are limitless.

- Error Reduction: With Excel, you can utilize formulas to automate calculations, reducing the risk of manual errors. The accuracy of calculations is therefore improved, making your final tax information accurate.

- Data Analysis: Excel’s advanced data analysis tools enable you to interpret your tax data, providing insights into your financial health and tax planning opportunities.

- Accessibility: Excel’s widespread use and compatibility across various devices ensure that your tax information is readily accessible and shareable with your accountant or financial advisor.

It’s safe to say that Excel is the go-to application when it comes to processing your tax forms, such as Form 1099, Form 1040, several tax statements based on your region, and many more. So, how can you convert these dreary but necessary documents into analysis-worthy data? Keep reading!

Steps to Convert Tax Forms Into Excel With Klippa

If you’re managing tax forms manually, you know how time-consuming and error-prone it can be. Luckily, there’s a better way.

Klippa DocHorizon is an Intelligent Document Processing (IDP) platform designed to effortlessly handle diverse document types and convert them into your desired output format.

In only five simple steps, you get to benefit from ready-to-use data for all of your business processes requiring Excel.

Let’s walk you through them.

The best part? You can try it out for free!

Step 1: Sign up on the Platform

First things first, create a free account on the DocHorizon platform. It takes only a few seconds and, after signing up, you’ll receive a free credit of €25 to explore all the platform’s features and capabilities.

Also, the interface is user-friendly, so you won’t get overwhelmed by the complex features included in the platform. Taking it step by step, you can make workflow creation a seamless process from the get-go.

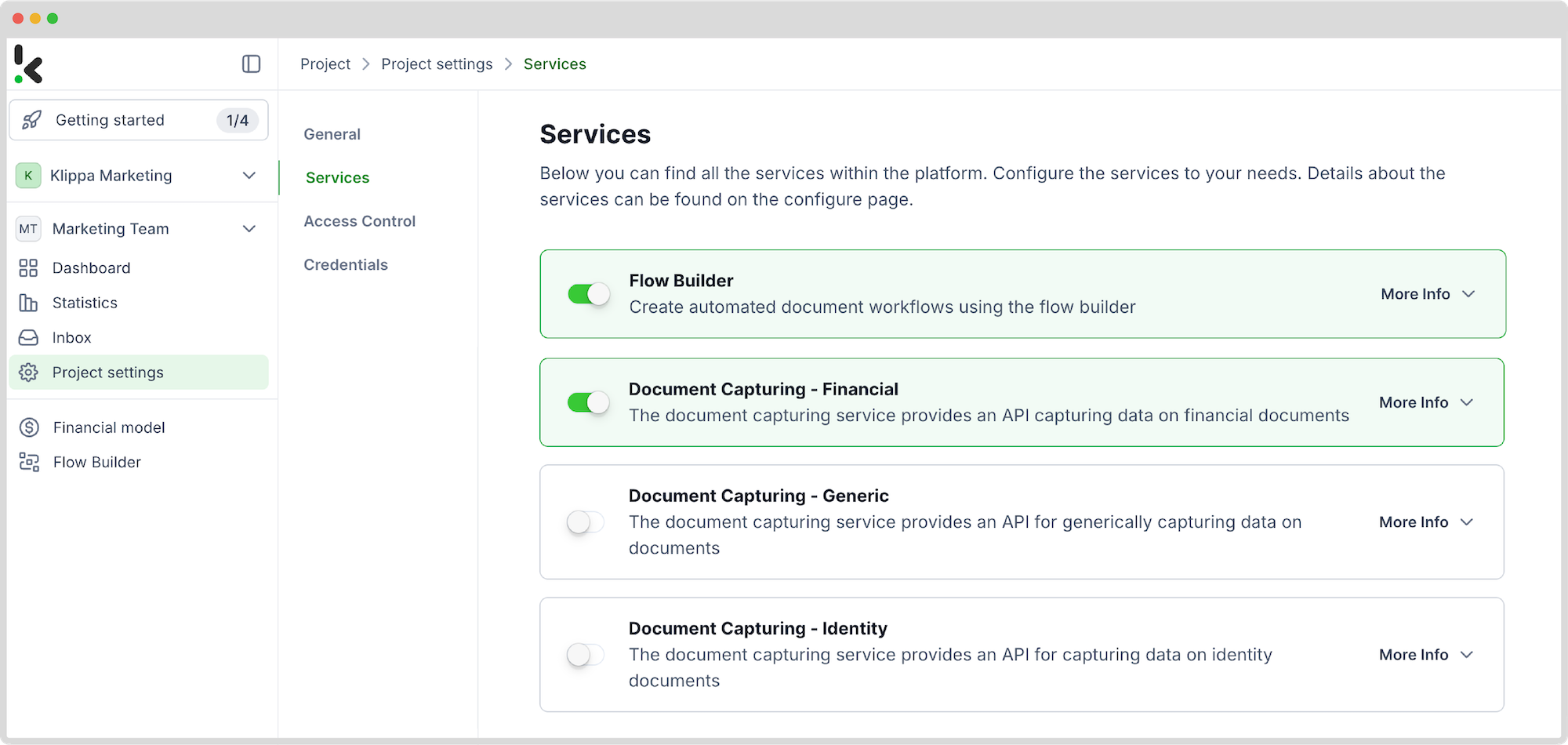

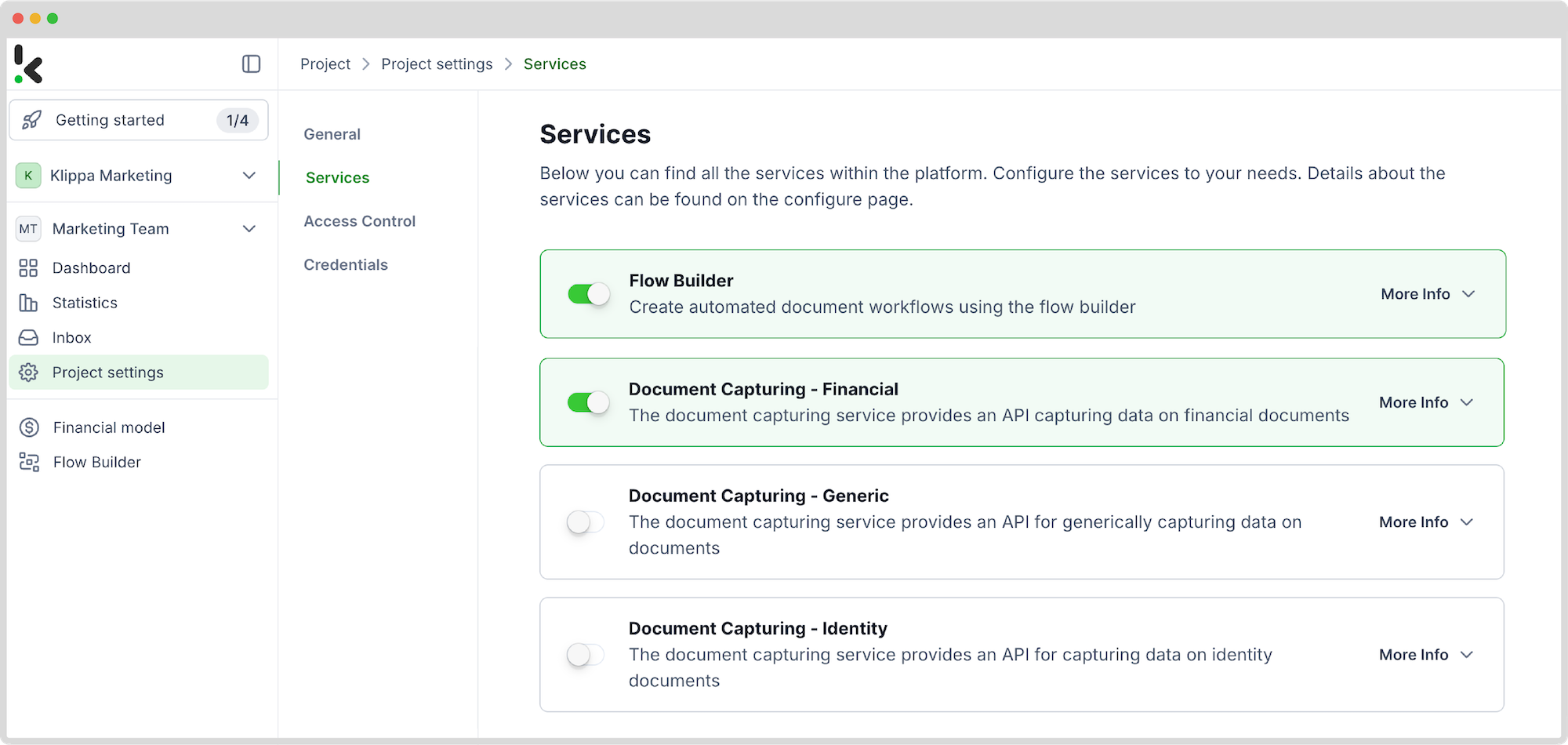

After logging in, create an organization and set up a project to access our services. Do this by going to Project Settings -> Services. To convert tax forms to Excel, you need a specific setup: enable the Document Capturing – Financial model and Flow Builder.

Why the Financial Model? This model was specifically trained on a broad variety of financial documents, including receipts, purchase orders, bank statements, and many more. So its accuracy in extracting, analyzing, validating, and classifying data is high.

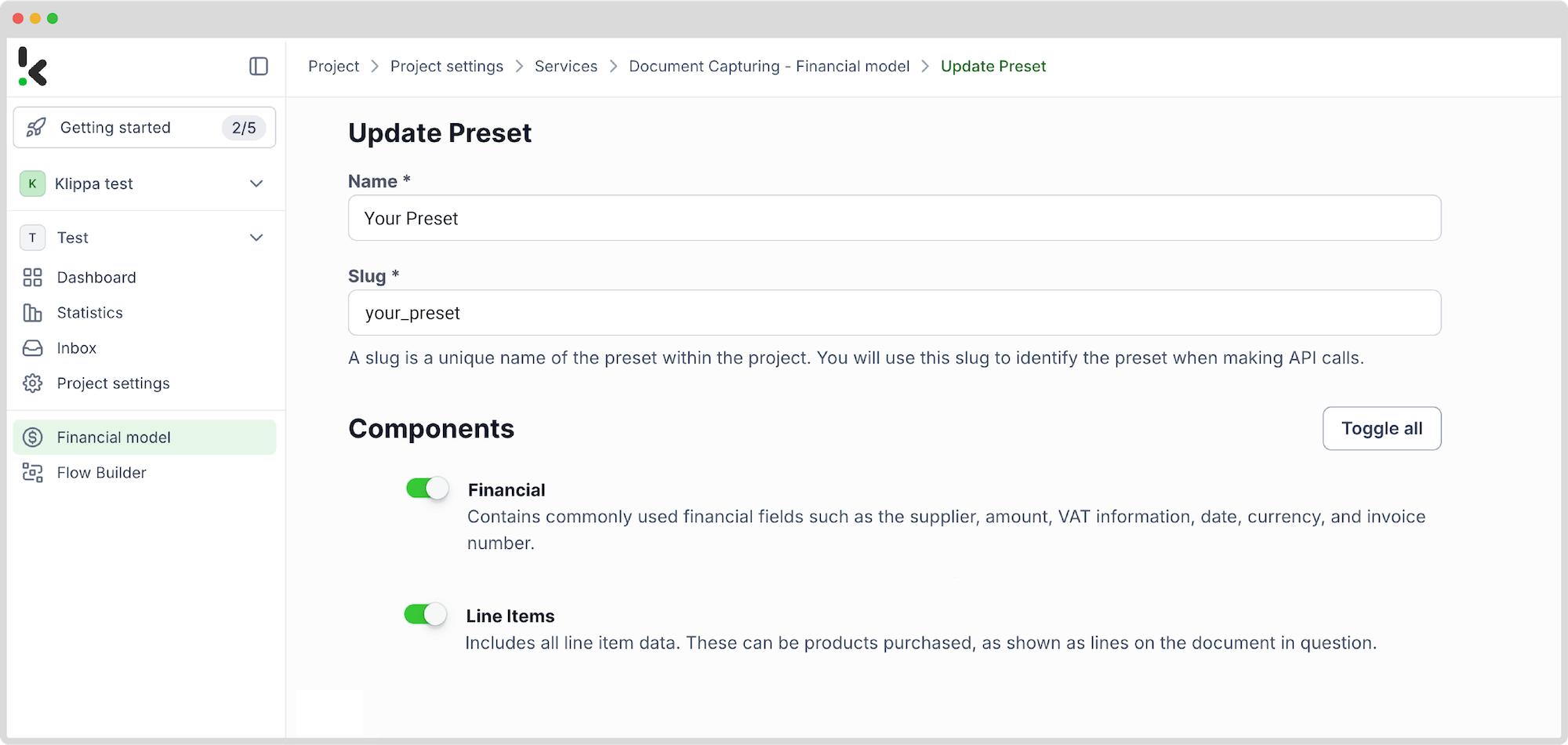

Step 2: Create a preset

Next, define what data you want to extract from your tax forms. You do this by creating a preset – your personalized data extraction template.

Here’s how:

- In the left-hand menu, select Financial Model and then New Preset.

- Hit Create and give your preset a name

- Financial and Line items are the go-to components for this, but you can pick others as well

Once you’re happy with your selection, click Save. Your preset is now ready to use in your workflow.

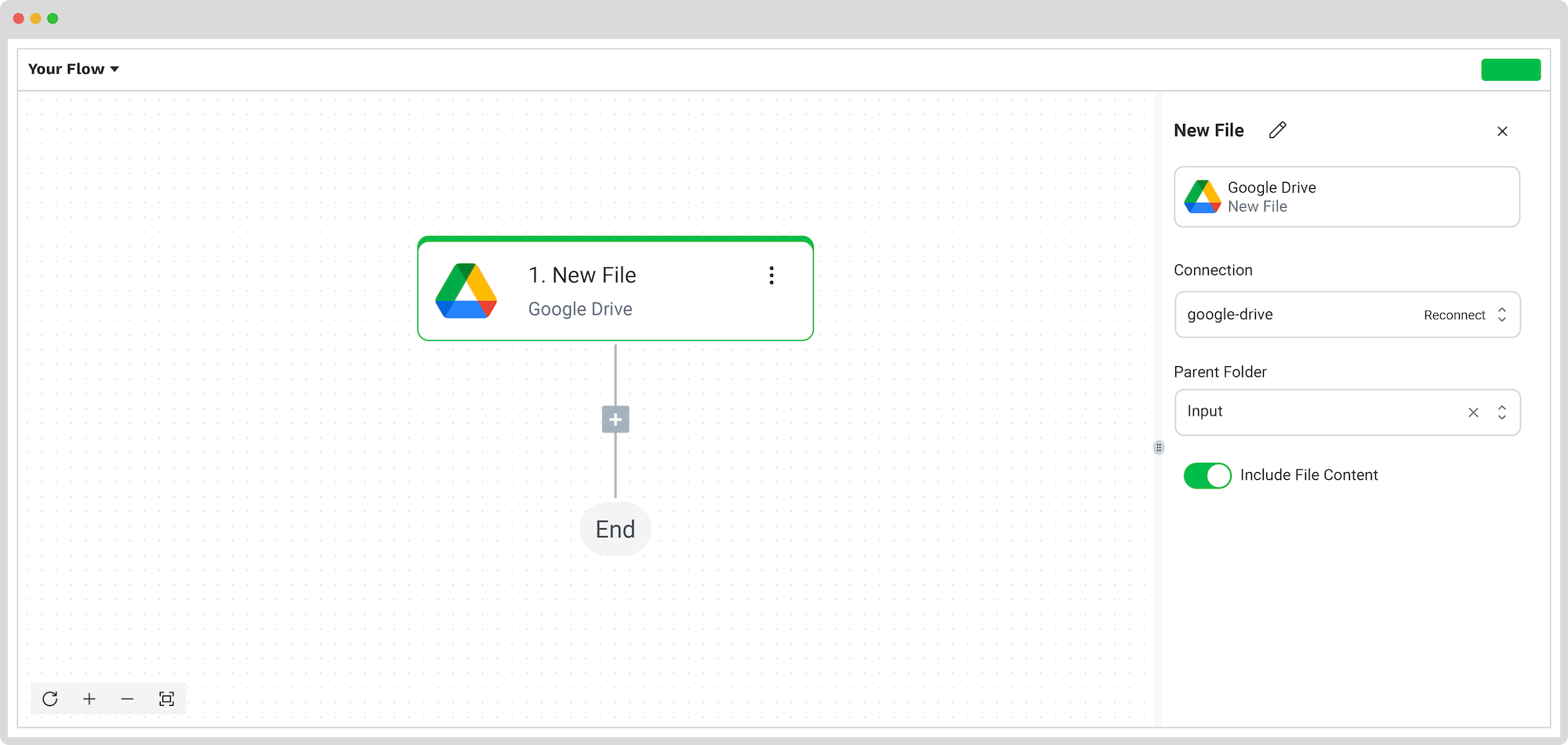

Step 3: Select your input source

Next on the list is to start building the flow. A flow is a sequence of steps that define how your PDF data is extracted into Excel. Let’s do this by clicking New Flow -> + From scratch and assigning your flow a name.

After, it’s time to choose the place where you will retrieve your tax forms to process them. For this example, we will use Google Drive as the input source.

Tip! Make sure you’ve created a folder where you uploaded all of your PDF invoices.

Head to the Flow Builder and choose your input source by selecting Google Drive -> New File as your trigger. This is going to start your flow. On the right side, fill out the following sections:

- For Connection: Assign any name to your connection (e.g. “google-drive”) and authenticate with Google

- For Parent Folder: Input

- Include File Content: Check this box to ensure file content is processed

Test this step by clicking on Load Sample Data, and remember to have at least one sample document in your input folder while setting up your flow!

Step 4: Capture and extract data

For the 4th step, choose the financial document capture mode. This mode is capable of reading, capturing, and extracting data from your tax forms accurately, preparing it for conversion. Simultaneously, the document is verified for authenticity, ensuring any sign of document fraud is detected and signaled.

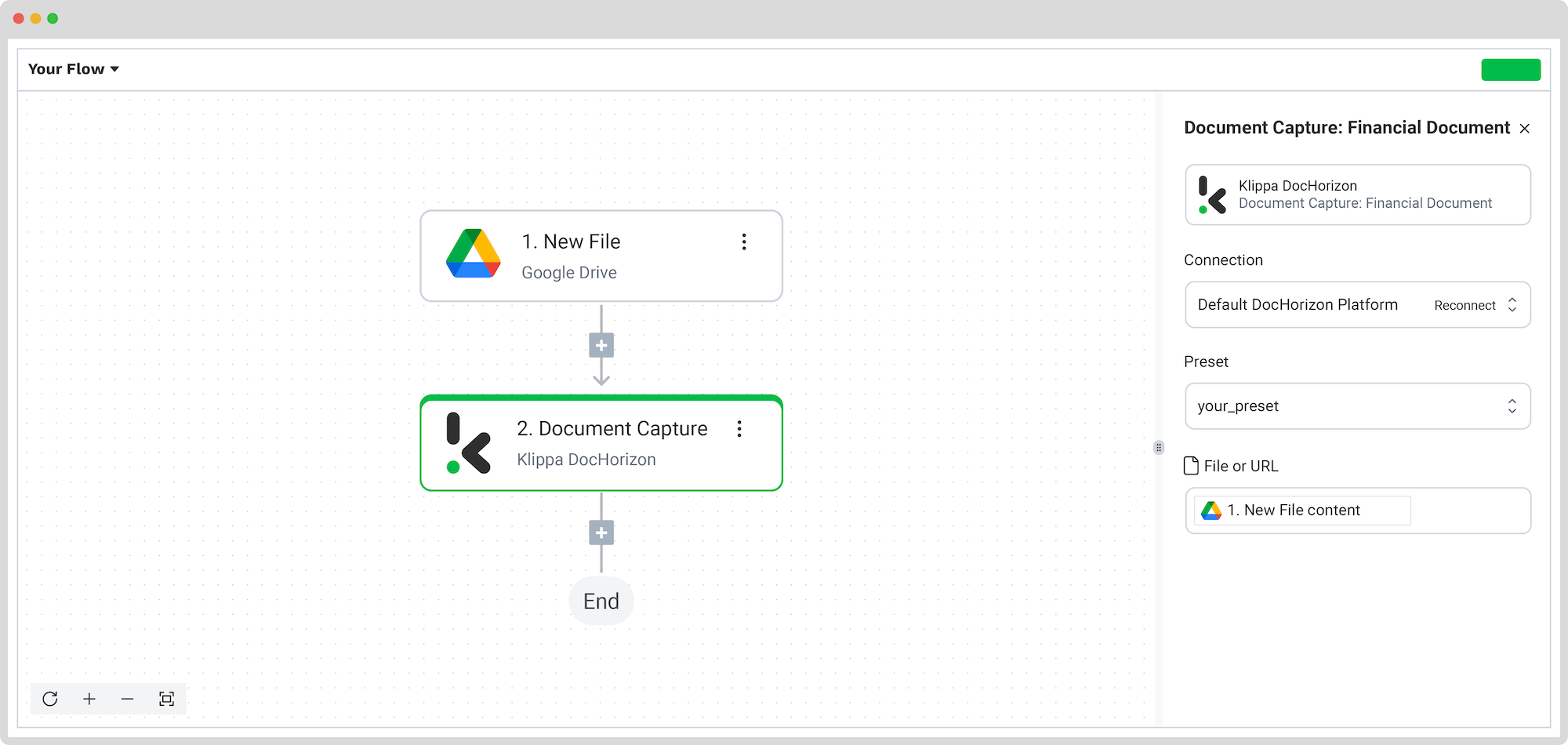

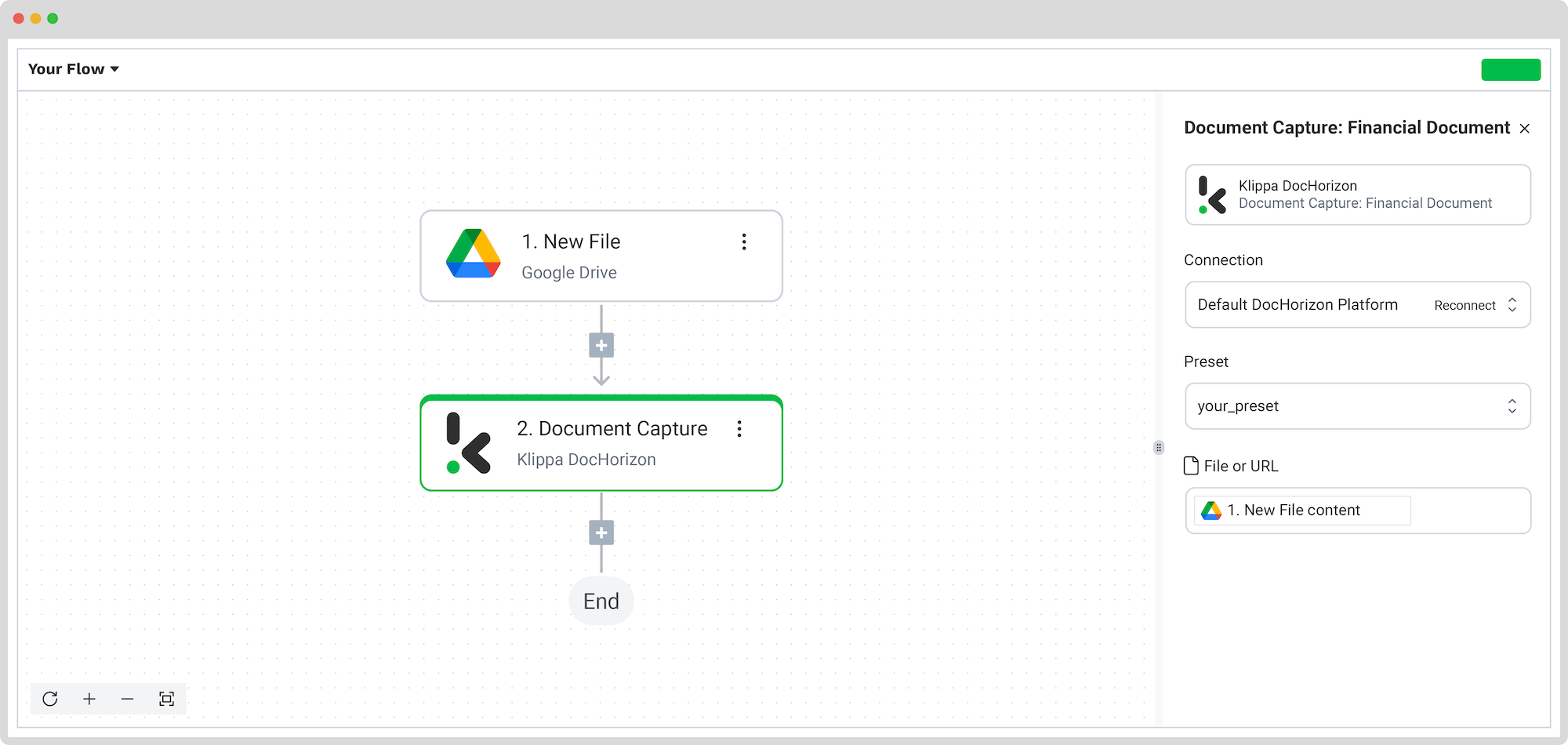

In the Flow Builder, press the + button and choose Document Capture: Financial Document, and configure the following:

- For Connection: Default DocHorizon Platform

- For Preset: The name of your preset

- For File or URL: New file -> Content

This step will read and extract the key details from each tax form. Plus, it automatically checks for document authenticity and alerts you to potential fraud or duplicates.

Run a test to ensure the data extraction works correctly before moving on.

Step 5: Save the file

You’re almost done! Now decide where your extracted data should go. The platform offers multiple output formats, however, for this use case, we’ll choose Google Sheets to leverage Excel’s features in your document management process for tax forms.

Here’s how:

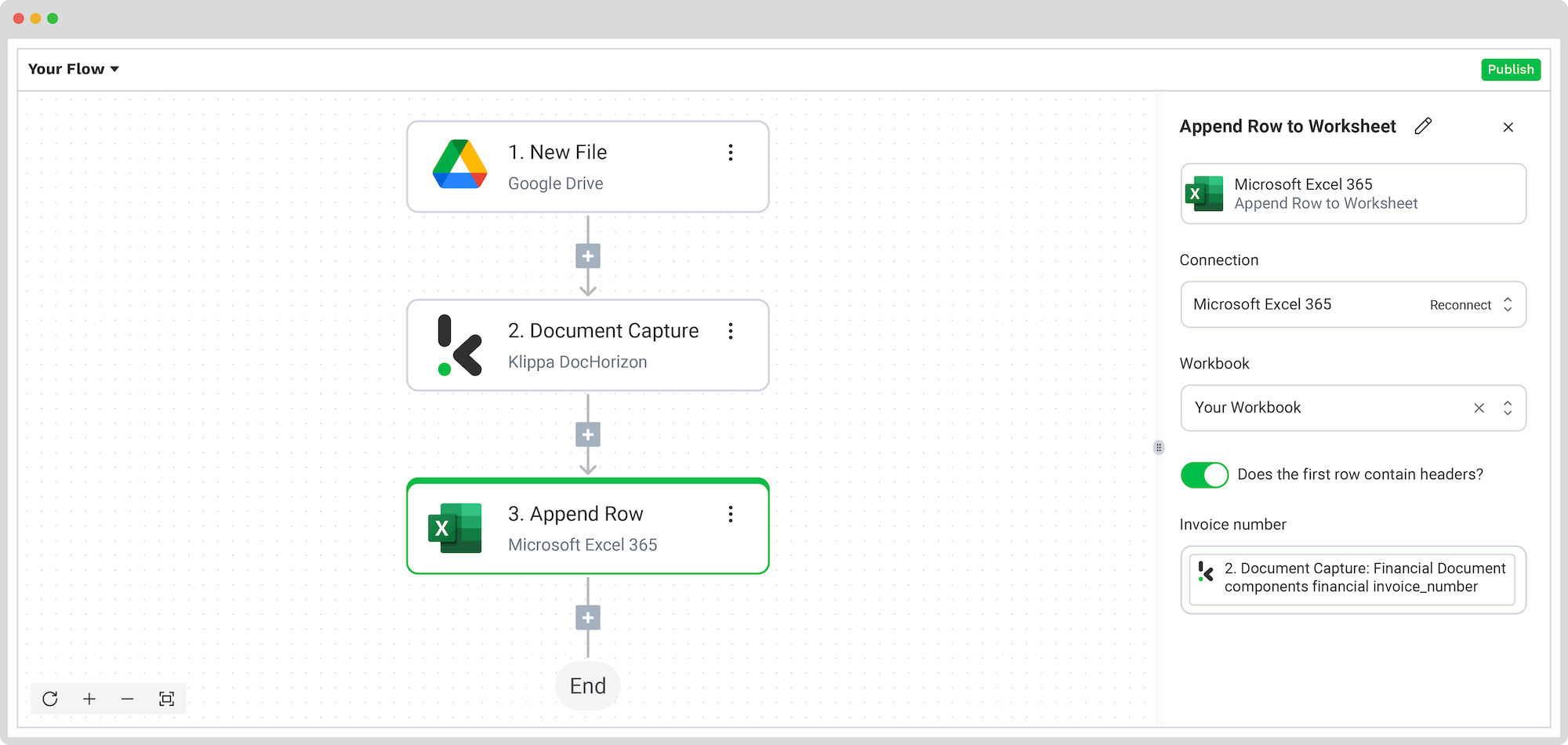

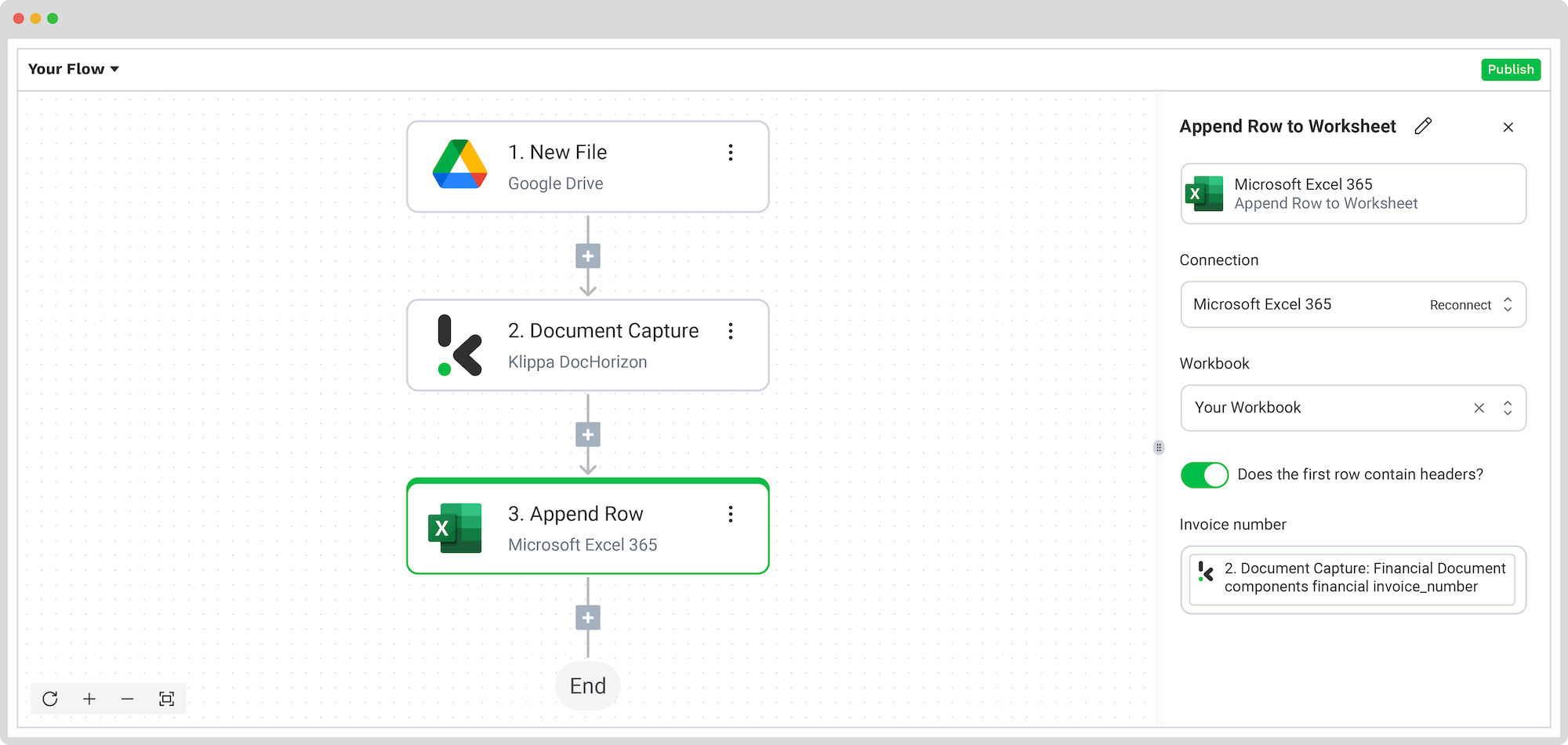

- Select Excel -> Append Row to Worksheet

- For Connection: Connect to your Microsoft account (Microsoft Excel 365)

- For Workbook: The name of the workbook you created for this workflow

- For Worksheet: Name of the sheet

Tip! If your worksheet contains headers, toggle the Does the first row contain headers button. This option will inform the platform that row 1 is occupied.

After, you’ll see another section with the headers’ names in your output file. To map the extracted data to your sheet, do the following:

- Go to the Data Selector menu

- Open Document Capture: Financial Document -> components -> financial

- Select the component and repeat the same steps for the others

Once everything is mapped, click Test – and if it works, you’re good to go!

Congratulations! You’ve now fully automated the conversion of tax forms from PDF to Excel. As new documents land in your folder, they’ll be extracted and appended to your Excel sheet automatically.

And remember: if you’re processing a high volume of documents, you don’t have to set up the flow yourself! Feel free to reach out to us because we’d love to help you out!

Benefits of Automated Conversion of Tax Forms to Excel

Moving on from traditional manual entry to using an IDP platform to convert tax statements into Excel means unlocking a game-changing advantage. It not only streamlines operations, but also significantly boosts your efficiency and accuracy of tax form processing. Let’s dive into the standout benefits.

Simplified Tax Processing

Simplifying tax processing is perhaps one of the biggest wishes of any organization. IDP platforms like Klippa DocHorizon transform the tedious task of manually inputting data from tax statements into Excel into a smooth, automated process. Automating this matter not only saves precious time but also minimizes the effort required to manage tax-related documents.

Enhanced Accuracy

Although accuracy in tax documentation is non-negotiable, it so happens that most times human mishaps occur in tax reporting. With IDP, the risk of these errors taking place is greatly reduced. The technology ensures that data extracted from tax forms and transferred to Excel is precise, thus enhancing the reliability of your tax calculations and submissions.

Increased Efficiency

IDP platforms process documents at a speed no human can match, converting large volumes of tax forms into Excel in a fraction of the time it would take manually. This rapid processing capability means businesses can allocate their resources to more strategic tasks, optimizing overall productivity.

Improved Data Accessibility and Management

Once converted into Excel, tax data becomes more manageable and accessible. Excel’s functionalities allow for better organization, analysis, and storage of tax information. This facilitated access allows for improved tax planning and forecasting but also ensures that data is readily available for audits, financial analysis, and decision-making.

Cost Savings

Implementing IDP for tax form conversion can lead to substantial cost savings. By automating the data entry process, businesses can reduce the need for extensive manual labor and office supplies, thereby lowering operational costs. Additionally, the increased accuracy and efficiency can help avoid costly mistakes and penalties associated with tax reporting errors.

Enhanced Security and Compliance

IDP platforms often come with built-in security features that ensure sensitive tax information is handled securely, adhering to compliance standards. This aspect is crucial for businesses keen on protecting their financial data and maintaining trust with stakeholders.

Scalability

The scalable nature of IDP solutions means that as your business grows, your document processing capabilities grow with it as well. Whether you’re dealing with a slight increase in tax statements or expanding your operations significantly, IDP platforms can accommodate your evolving needs in an instant.

By leveraging the Klippa DocHorizon platform, your business can also enjoy these benefits, all while streamlining the tax management process and changing the document processing as a whole.

Automate Tax Forms to Excel Workflow

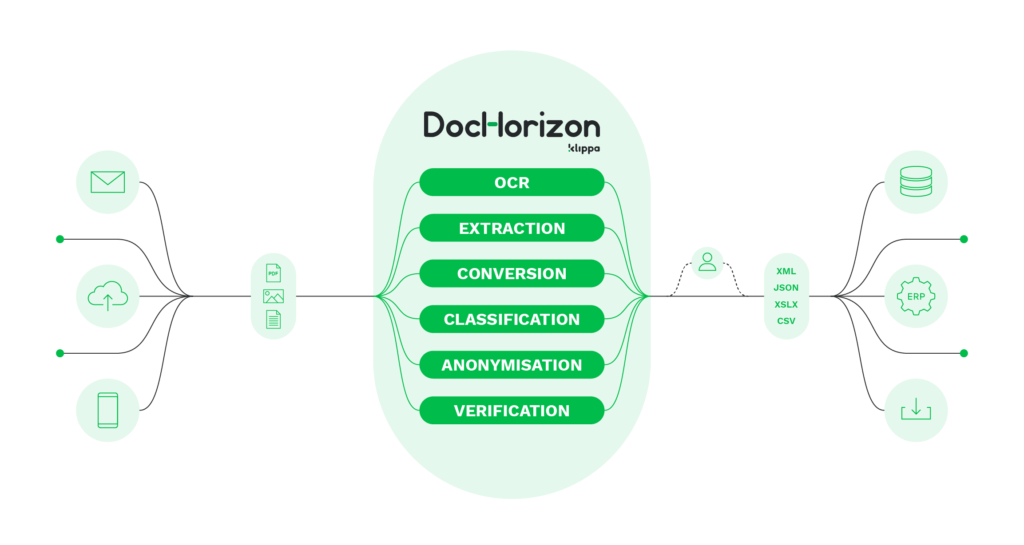

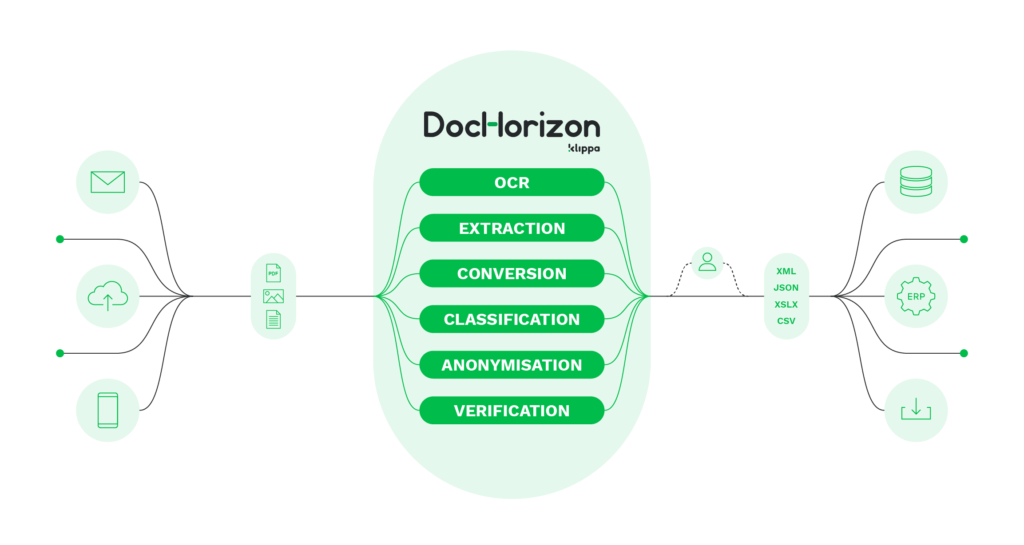

Klippa DocHorizon is an Intelligent Document Processing platform that enables you to completely automate the workflow of converting tax forms to Excel or any other format useful in your daily business tasks. By integrating various Klippa DocHorizon modules and your preferred applications, you can create an effortless and unique workflow consisting of:

- Data extraction – Get data extracted automatically from tax forms of any kind

- Document conversion – Convert tax forms into several business-ready data formats, such as JSON, XLSX, CSV, TXT, XML, and many more

- Data anonymization – Make sure to anonymize privacy-sensitive data, such as personal information or contact details, to ensure compliance with relevant regulations

- Document verification – Automatically verify document authenticity and detect document fraud to minimize the risk of tax evasion

Automating the conversion of tax forms to Excel with Klippa DocHorizon means you can focus more on keeping a transparent company budgeting and less on manual data entry. Contact our experts for additional information or book a free demo below!

FAQ

Yes, but it’s highly inefficient. Many businesses still manually extract data from PDFs, which increases the risk of errors and slows down workflows.

Absolutely. With OCR (Optical Character Recognition) technology, even scanned or photographed tax forms can be converted into structured Excel data.

Yes. Klippa includes document verification capabilities to spot duplicates, forgeries, or inconsistencies in submitted tax forms.

Not at all. The platform is designed for ease of use with a visual flow builder. However, advanced users can also integrate via API.