As companies increasingly use credit cards for business transactions, accurate and efficient reconciliation of credit card spending is essential.

Credit cards are becoming the predominant way to spend money, whether you’re a private individual paying for a business course for personal development or a company procuring office supplies for daily operations.

The shift is motivated by the fact that companies can cut costs, streamline expense tracking, and enhance fraud prevention through improved transaction control, especially with credit cards.

The use of credit cards, however, also results in a more difficult financial administration. Because how do you keep track of and account for every employee’s spending? The answer is credit card reconciliation, and we’ll explain everything about it in this blog.

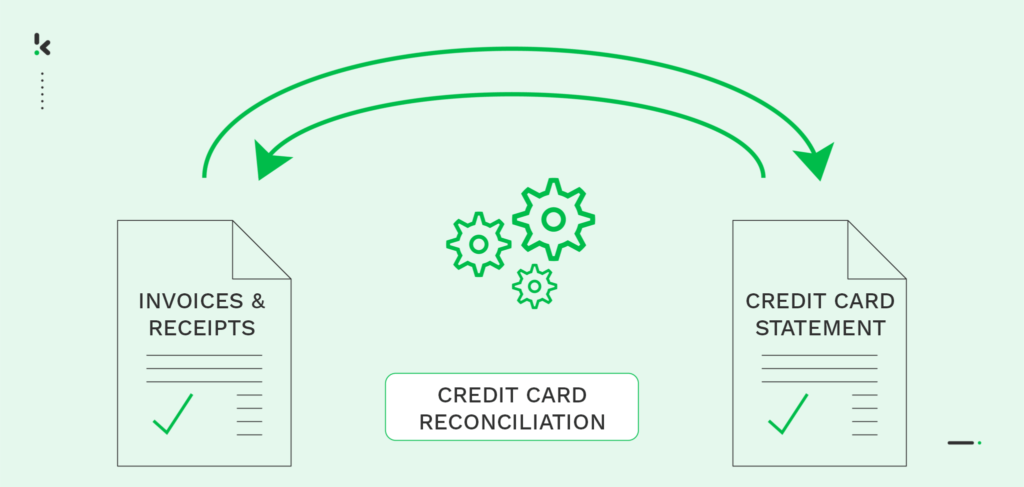

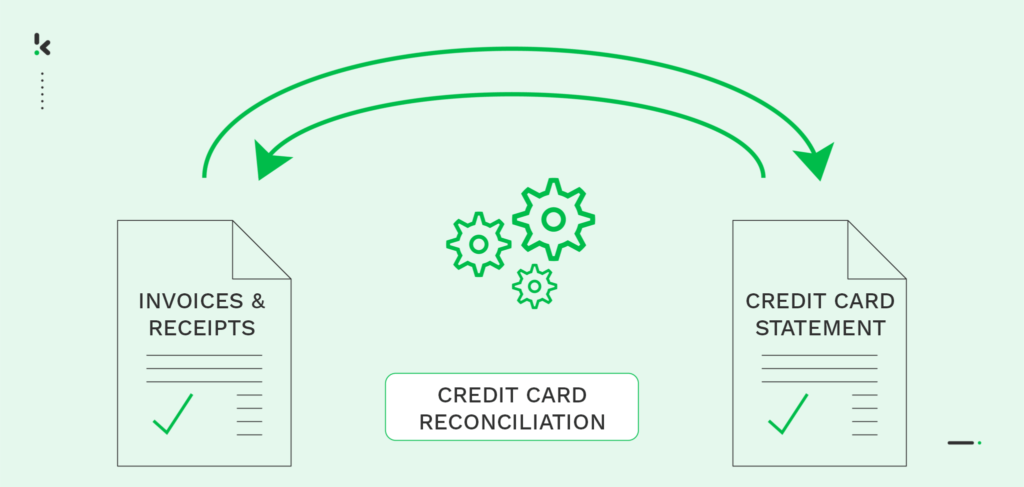

What is Credit Card Reconciliation?

The process of credit card reconciliation entails matching up the transactions listed in the credit card statements of a company with the matching entries in their accounting records.

Confirming credit card statements ensures that the recorded expenses accurately mirror the charges made to the business credit cards, establishing a dependable basis for financial reporting, budgeting, and analysis.

This process assists in spotting differences before they become financial issues and is essential to correct financial reporting for processes like month-end and year-end closing in accounting.

This leaves us with the question of why businesses prefer credit card payments more and more over other payment methods.

Why do Businesses use Credit Cards?

Despite the additional steps involved in reconciling corporate credit card usage, the benefits for businesses are substantial.

In comparison to other payment methods, credit cards hold an unique and essential position. While invoices are suitable for larger transactions and direct debits offer convenience for recurring charges, credit cards excel in handling one of the most frequent company purchases – the everyday expenses typically incurred by employees.

Employees are inclined to utilize corporate credit cards rather than personally covering significant expenses like advertising services and travel costs. Not only are credit cards widely recognized, but they also enhance the convenience of business transactions, eliminating the need for frequent bank visits or navigating complex ordering processes.

These changes align with the current trend of meeting customer wants and becoming more and more sensitive to their preferences.

Let’s discover the different types of credit card reconciliation in the following section.

The Different Types of Credit Card Reconciliation

Credit card transactions affect two aspects of the business: Expenses and revenue. The challenges that companies face in reconciliation therefore include two different types of reconciliation.

Credit Card Statements

Reconciliation involves verifying business expenses, such as payments for goods or services. For instance, if your company regularly issues cards to employees, individual reconciliation is necessary. This process applies to credit card statements, requiring accountants to cross-reference transactions with monthly statements for accuracy, especially when reviewing cards issued to staff.

Credit Card Merchant Service

All of the incoming payments are included in this. Although it takes a little longer to reconcile these transactions than the outgoing payments, there are steps you can take to make the process go more smoothly.

This blog will only cover the business expenses side, which refers to the purchases you or your staff make of products or services for your company.

What Makes Credit Card Reconciliation Important?

Effective payment reconciliation is an important process ensuring financial records’ accuracy. This process involves carefully comparing recorded entries with various documents such as bank statements, credit card statements, and receipts.

By performing thorough checks, companies can ensure the overall financial health of their business. This not only uncovers discrepancies but also ensures the integrity of financial data, providing a solid foundation for sound financial management and decision-making.

The relevance of credit card reconciliation can be attributed to the following:

Fraud detection

Financial auditors expect companies to implement an effective credit card reconciliation system, especially to prevent fraudulent activity. The reconciliation serves as proof of compliance for tax authorities and auditors, and any discrepancies in the general ledger may have legal consequences.

Preventing potential errors

Human errors, including misplacing a receipt, and mistakes with banks or credit card merchant services can occur. It is crucial to promptly investigate any discrepancies to prevent potential harm to your financial records.

Monitoring expenditures

While credit cards simplify the purchasing process, managing numerous cards issued to different employees and departments within the company poses a challenge for financial managers.

The following section explains how traditional credit card reconciliation works and the individual steps involved.

How to Reconcile Corporate Credit Card Expenses?

Businesses must reconcile credit card spending to guarantee accuracy and preserve financial integrity. The procedures for credit card reconciliation are as follows:

Step 1: Collecting & organizing invoices and receipts

Gathering all statements, invoices, and receipts associated with the company’s credit card accounts is necessary. This involves chasing down individual employees to obtain their receipts and subsequently reconciling them with the business credit card bank statements. Without a centralized method of collecting data in an accounting system, this process becomes extremely time-intensive.

Step 2: Cross-checking receipts to transactions

In the process of reconciling transactions, individuals engage in cross-checking receipts against corresponding transactions. This involves a meticulous comparison of each receipt with its corresponding entry on the credit card statement, ensuring precise alignment in amounts and descriptions. This thorough verification step is crucial for maintaining accuracy in financial records.

Businesses can do this with the help of any preferred system for reconciling.

Step 3: Investigating discrepancies

In case of discrepancies, start investigating the issues by contacting relevant parties like vendors or employees for clarification and resolution. Additionally, it might be necessary to dispute transactions with the credit card processor.

Step: 4: Adjust and Reconcile

It may be necessary to reconcile the credit card statement and financial records to ensure that they match. This process includes adding missing transactions, removing duplicates, or correcting errors.

Each of these steps is crucial and should be adhered to for maintaining accurate financial records and ensuring overall financial well-being. However, the credit card reconciliation process presents its own set of challenges that require attention and resolution, as we will explore in the next section.

Challenges in Financials During Credit Card Reconciliation Processes

Traditional credit card reconciliation comes with several challenges, starting with problems that always arise with manual tasks, such as missing receipts that make it almost impossible to link transactions to the associated expenses. Unclear transaction descriptions are also a hurdle.

Furthermore, human errors inherent in manual tasks, such as incorrect data entry and mismatched amounts, though seemingly minor, lead to inaccuracies in financial records, incurring additional costs and time during the manual process.

Moreover, the challenges that financials face during credit card processing can be summarized into three main obstacles:

Ensuring accuracy and efficiency of manual credit card processing

The goal is to ensure that the information provided by the employee, such as receipts and transaction details, matches exactly what the company expected or recorded.

Even small errors or discrepancies in the reconciliation process can lead to problems, especially delays in the reimbursement of expenses.

Scaling to manage large transaction volumes

Managing a large volume of credit card transactions can be a challenge for companies, as it is difficult to handle the extensive data and ensure accurate recording and reconciliation of all transactions.

Recognizing and rectifying violations of corporate policies & guidelines

The traditional credit card reconciliation process does not provide a trustworthy and on-time way to detect policy violations. Instead, workers have to carefully go over every transaction to make sure that it complies with the company’s travel and spending guidelines, which causes more delays.

Optimizing credit card reconciliation and increasing efficiency depends on overcoming these challenges. Automation is key as it enables companies to eliminate obstacles and improve the effectiveness of credit card reconciliation. Using digital tools to scan and organize receipts can significantly reduce errors.

Let’s have a look at the best practice of credit card reconciliation, to make the process as smooth and accurate as possible.

Best Practices for Credit Card Reconciliation

Follow the most important best practices for accurate and efficient credit card reconciliation:

- Keep accurate records and systematically organize credit card statements, invoices, receipts, and other relevant documents.

- Regular monthly reconciliations are essential to identify and rectify discrepancies or errors immediately.

- Thoroughly review each transaction on the credit card statement by checking details such as amount, date, provider, and description, and address any discrepancies immediately.

- To ensure proper recording, you should compare each credit card transaction with the corresponding invoice or receipt.

- Conduct routine internal audits to identify deficiencies and improve compliance with internal controls.

Ultimately, you should consider using dedicated credit card reconciliation software or expense management systems that automate processes, streamline data entry, and facilitate transaction reconciliation to further optimize reconciliation efficiency and accuracy.

Credit Card Reconciliation is Easier Than Ever With Klippa

As previously stated, selecting a financial software solution incorporating technologies like OCR and Machine Learning can streamline and automate your credit card reconciliation process.

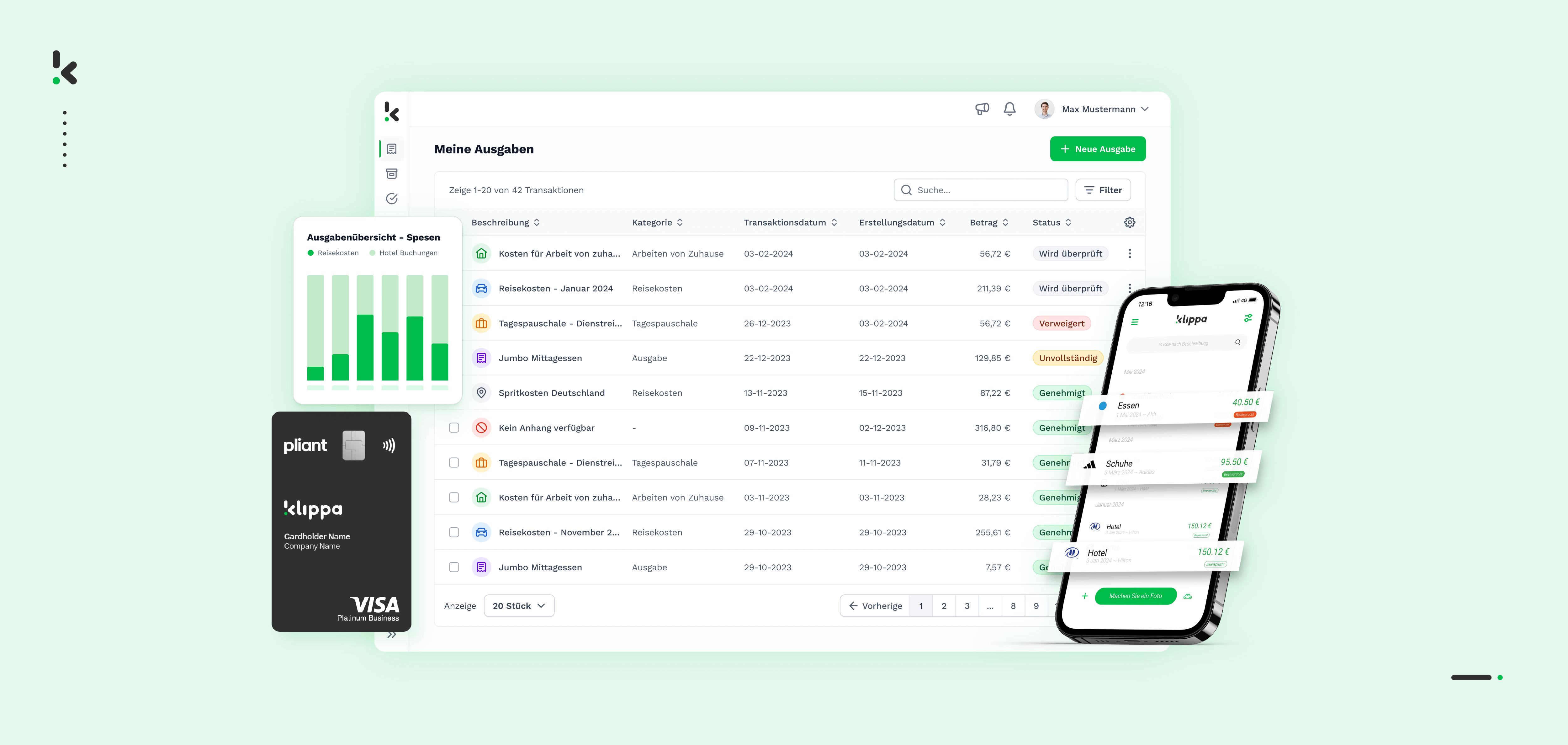

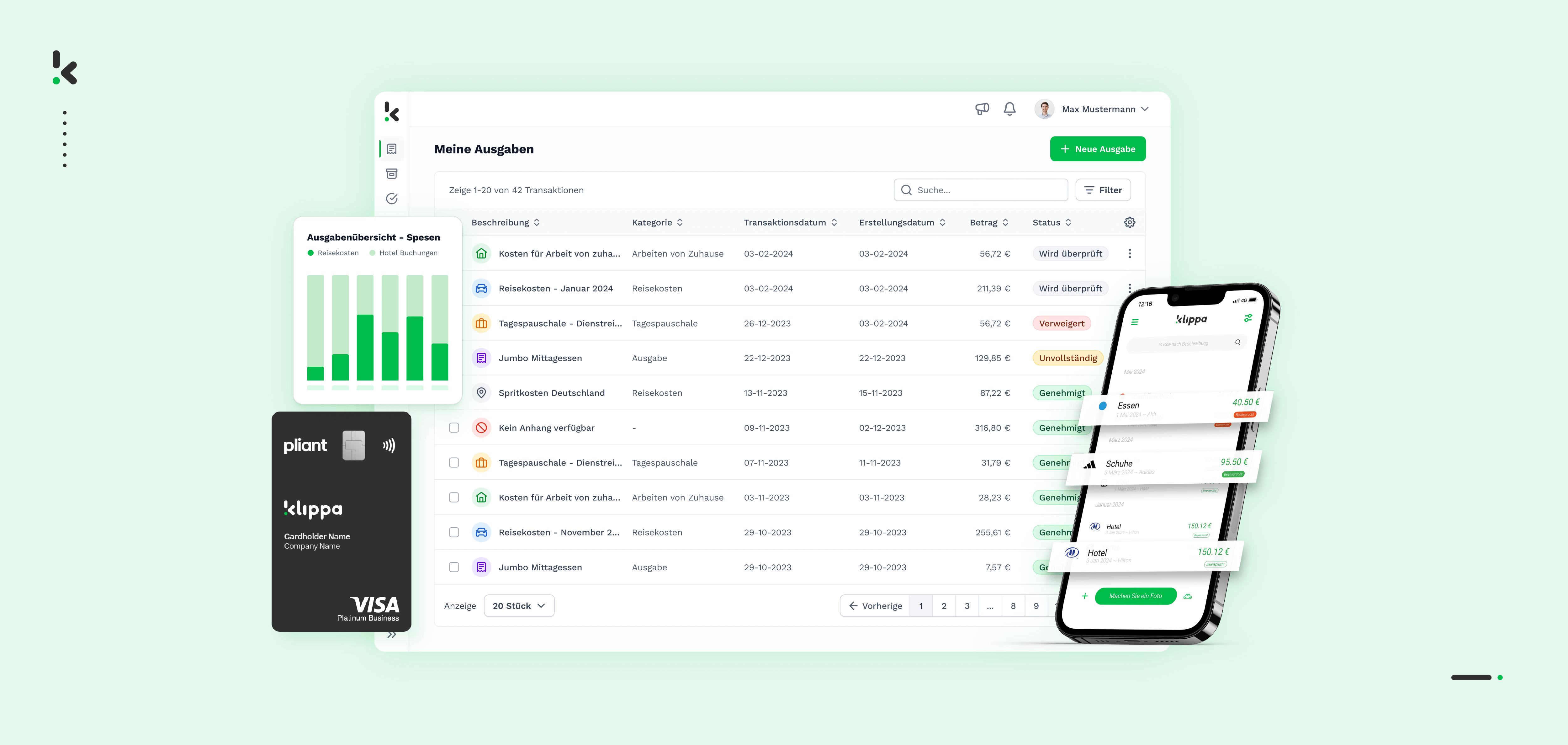

Smart solutions such as Klippa SpendControl seamlessly incorporate both OCR and Machine Learning technologies to automate workflows for expense management and invoice processing, including credit card reconciliation. With SpendControl, you can empower your financial and accounting departments, enabling them to:

- Streamline submission and approval of receipts and invoices through the mobile app or web application.

- Automate expense recording in the accounting system with self-learning journal entries, eliminating manual data entry.

- Enhance fraud prevention through the automatic detection of duplicate claims.

- Improve accuracy in tracking costs, categories, cost centers, projects, departments, and periods by minimizing human errors.

- Integrate the solution easily with numerous ERP, Accounting, or RPA systems, avoiding the need for extensive changes

- Automate payment reconciliation through intelligent payment-invoice matching using Machine Learning.

How can you Incorporate SpendControl into your Credit Card Reconciliation Procedure?

The Klippa SpendControl solution makes the credit card reconciliation process easier than ever before.

- Your team has the option to submit an invoice or receipt through the Klippa mailbox, the web application, or the mobile app.

- Klippa SpendControl employs automated data extraction to transfer relevant document fields into your financial system.

- Automatic reconciliation is performed by comparing the information from payment documents with credit cards or bank statements.

- In case of no discrepancies, you can effectively reconcile payments.

This way, credit card reconciliation is no longer a burden for your finance department. It is secure, fraud-proof, and more efficient overall. In addition, the Klippa SpendControl model is compatible with various credit card providers and is also supported by ICS.

On top of that, Klippa offers an automated expense management solution in combination with corporate credit cards, to your company’s employees for their work-related expenses. Instead of using their own funds, employees can make purchases with physical or virtual cards and only upload the receipt, streamlining the two-way matching process for your business automatically. Ultimately, simplifying the credit card reconciliation process.

Embrace modern technology to elevate your credit card reconciliation process. Take your business to the next step by implementing automatic credit card reconciliation with Klippa SpendControl— schedule a free demo now below!

FAQ

Credit card reconciliation is the process of comparing your credit card statements with your internal financial records to ensure that all transactions are accurate and accounted for. This process helps identify discrepancies such as unauthorized charges, duplicate transactions, or missing entries.

To reconcile your credit card, begin by gathering your statements and comparing each transaction with your receipts and internal records. Check for discrepancies such as missing entries or incorrect amounts. Investigate any issues by reaching out to the merchant or credit card provider. Once resolved, update your financial records to ensure everything matches.

Credit card reconciliation is important because it ensures financial accuracy, prevents fraud, and helps identify errors or unauthorized transactions. It also plays a critical role in maintaining compliance with accounting standards and provides a reliable overview of your financial position.

The debit card reconciliation process involves matching transactions on your bank statement to your internal records. This process ensures all transactions, including payments and withdrawals, are accurately recorded. Any discrepancies, such as fees or unrecorded transactions, are investigated and corrected to maintain alignment with the bank’s statement.

Corporate card reconciliation refers to verifying transactions made on company-issued credit cards. It involves ensuring all expenses are legitimate, supported by receipts, and comply with company policies. This process ensures proper categorization of expenses, resolves any errors, and maintains accountability in company financial records.