More and more companies nowadays simplify and accelerate business processes through some sort of automation. According to McKinsey’s 2024 report, “The State of AI”, AI adoption has surged globally, with 72% of organizations now using AI in some capacity – a significant leap from 50% in previous years.

Klippa’s study, “AI in the Workplace”, reinforces this trend, showcasing how automation powered by AI is transforming business processes. Many organizations report significant efficiency gains by automating repetitive tasks, freeing up employees to focus on more strategic activities and improving overall productivity.

Artificial intelligence (AI) and Machine Learning provide further fuel for market advances in automation. These technologies enable solutions to automate a growing number of business processes, from instant payment initiations to identity verification checks.

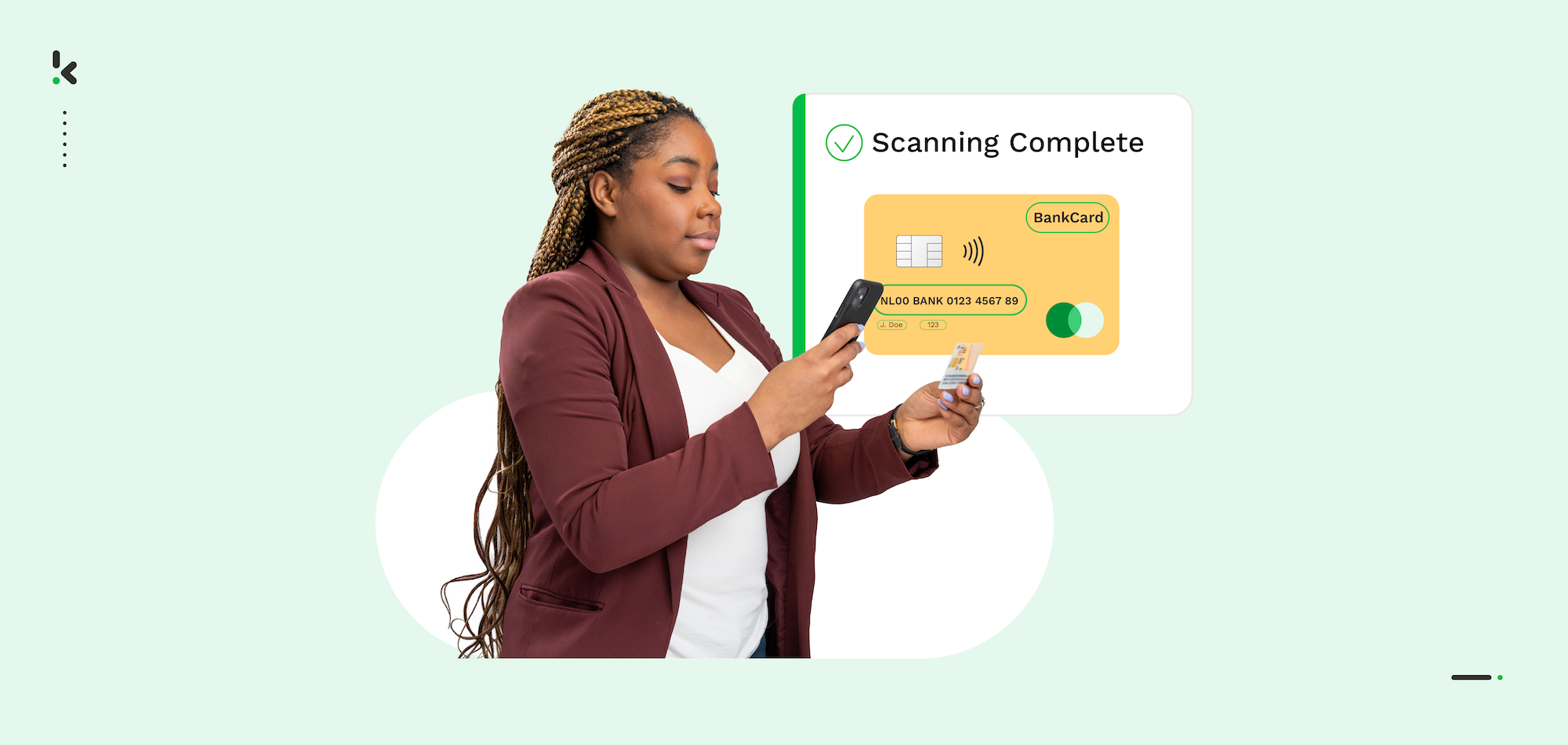

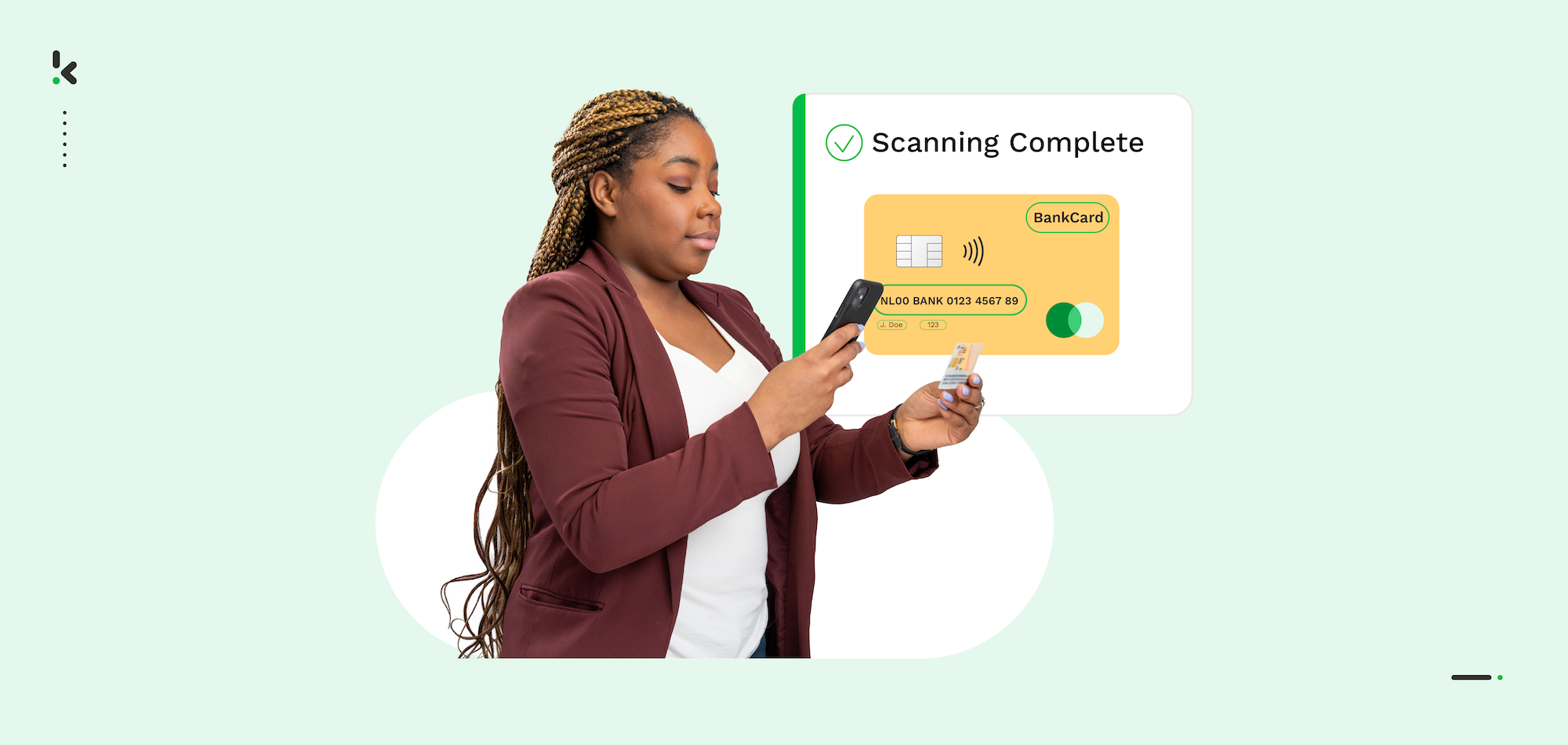

In this blog, we’ll explore how you can leverage automation to streamline five bank card-related business processes using our APIs and SDKs.

Key Takeaways

- OCR and AI automate credit & debit card scanning, instantly extracting key details like cardholder name, number, and expiry date from images or PDFs.

- Automation reduces costs and errors, eliminating manual data entry and minimizing mistakes in financial transactions and customer verification.

- AI-powered fraud detection enhances security, identifying forged cards and cross-referencing data with fraud databases in real-time.

- Easy integration with APIs and SDKs allows businesses to implement automated card scanning into their systems without complex development.

Which Cards Can Be Scanned with OCR and AI?

Before we turn our attention to the business processes that can be automated, it’s good to know which bank cards can be scanned. Well, the answer to that question is relatively simple.

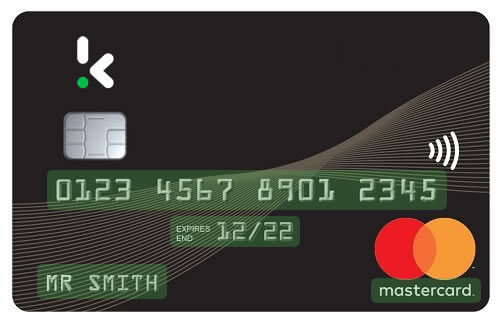

Klippa’s card scanning solution works basically on all sorts of bank cards containing printed or embossed texts, numbers, and logos. These elements can be read and data can be extracted from it automatically.

A smart card scanning solution is therefore extremely handy in taking over the manual process of reading and checking bank cards, and the related data entry, usually performed by clerks.

Credit cards and debit cards are the most commonly used bank cards.

1. Credit cards

Credit cards are convenient for everyday purchases and have the advantage that they are widely accepted for purchase, for example when you travel internationally. They allow you to borrow money from the card issuer up to a certain limit in order to purchase items or withdraw cash.

From credit cards, we can extract the following data fields:

- Card type

- Credit card processing network

- Credit card issuer

- Card holder name

- Card number or PAN

- Expiry date

- CVC (optional)

- Signature

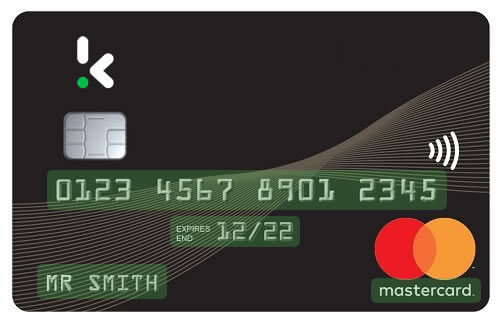

2. Debit cards

Debit cards are generally easier to obtain and set you on a budget, meaning you cannot spend more money than you have. They allow you to spend money by drawing on funds you have deposited at the bank.

From debit cards, we can extract the following data fields:

- Card type

- Debit card network

- Bank name

- Card holder name

- Bank account number or IBAN

- Card number

- Expiry date

- Signature

How Does Automated Credit & Debit Card Scanning Work?

Now that we know which cards can be scanned, let’s have a look at how our solution works. It might become a bit technical from here, but we will try to explain it in layman’s terms.

Step 1: Provide a Picture or PDF of the Card

The first step in the process is providing a picture or PDF file of a debit or credit card to our API. This can be done with the mobile app by simply taking a picture with your smartphone. We will automatically remove the background and correct any rotations. It is as easy as that!

If you do not have camera functionality in your app yet, the Klippa Camera SDK might be beneficial to help with bank card scanning. This is a full-camera scanning kit that has square recognition, cropping, perspective correction and quality detection.

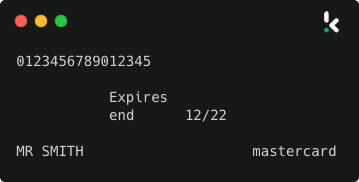

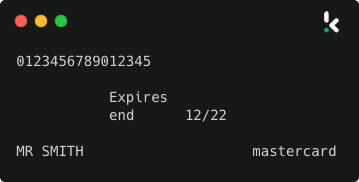

Step 2: Extract Text from the Image

As soon as the picture or PDF file has been received, the image is optimized and converted into a raw text file. In this step, all the text from the card is extracted, but it is not structured yet. You can see an example below:

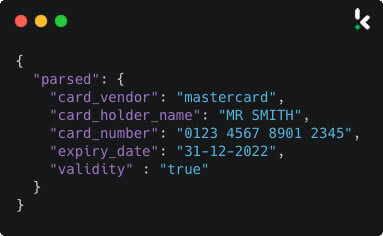

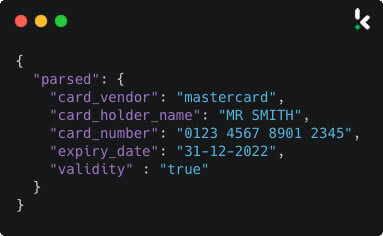

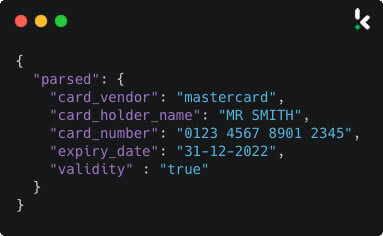

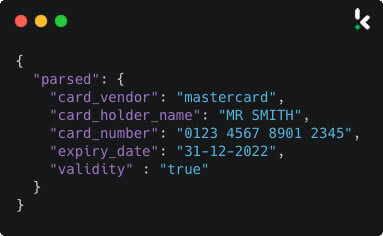

Step 3: Convert Text into Structured Data

Next, the Klippa Parser takes the text file from step 2 and converts it into a structured JSON format. The JSON is then returned as output from the API.

From here, the extracted data can be used according to your own needs, such as passing it on to your database for further processing.

All of this is completed fully automatically in just a few seconds, without any human intervention. That sounds pretty nice, right?

Benefits of Automated Credit & Debit Card Scanning

Next to being fully automated without any need for manual actions, our card scanning solution has many practical benefits that can help your business move forward. We will list the most important ones below:

1. Reduce costs

Manually checking and processing bank cards can be quite a labor-intensive process, both for you and your customers. Just think about the manual data entry, card verification, and archiving requirements that come with it.

Our solution can save you a lot of time, and thus labor costs, in this process by automatically extracting data from bank cards. There’s no magic formula for this, of course, but intelligent automation typically results in cost savings of 40% to 75%, with the payback period ranging from several months to several years.

2. Increase speed

It only makes sense that automated processes are faster than manual processes. Take a process like credit card verification. When done manually, reviewers have to go through several documents, make sure the information is correct and check for fraud. Humans aren’t anywhere close to being as fast as computers and automating this process can save you a lot of time and money.

3. Reduce errors

Did you know that manual data entry inevitably leads to data entry errors? Error rates typically range from 0.55% to 3.6%, although error rates as high as 26.9% have been found. Typing on a smartphone isn’t the most enjoyable experience either, so these rates may be even higher for mobile devices.

Luckily, automated processes and computer programs do this substantially better. With our credit card scanning solution, you are assured of the best data extraction software for bank cards, thereby minimizing the risk of human error.

4. Prevent fraud

Our card scanning solution not only includes OCR technology but also contains AI-based image tampering detection. This involves detecting incoherent pixel structures, such as strange changes in lighting or sudden color changes in text. As a result, the software detects forged images in seconds, making it easier to filter out fraudulent applications before they can cause you any trouble.

In addition, our system can cross-check the information on a person’s card with external resources. If you have blacklists or fraud databases with known fraudulent cards, for example, these can be consulted automatically.

Use Cases of Automated Debit & Credit Card Scanning

We try to extract as much data as possible from debit and credit cards via OCR and machine learning. This ensures that we can support as many use cases as possible. Below you will find the most common ones:

Simplify credit card payments

Entering credit card details manually on websites can be frustrating and error-prone. With our AI-powered credit card scanner, users simply scan their cards with their phone’s camera or upload a PDF.

Using OCR and AI, fields are identified, and the data is extracted and entered automatically, streamlining the checkout process. This improves user experience, increases checkout success rates, and boosts revenues.

Digital customer onboarding with credit cards

Many online platforms require credit card information at sign-up to ensure valid and authorized use. Automating this process with OCR and AI enhances efficiency and compliance.

In industries like cryptocurrency, credit card authenticity and cardholder details are matched with identity documents for verification.

Automated age verification via credit card scanning

For age-restricted services, credit card scanning enables identity and age checks. Methods like CVV, AVS, and 3D Secure verify card ownership, ensuring users meet the age requirements for services like alcohol, tobacco, or age-rated video games.

This is a more robust system than self-reported dates of birth.

Bank account (IBAN) validation through debit card scanning

Manually entering IBANs often leads to errors. Our software automates IBAN validation, ensuring format accuracy and verifying account ownership by matching bank cardholder details with identity documents. This reduces failed transactions and enhances accuracy.

Automatic anonymization of bank card data

Companies with large document collections can anonymize privacy-sensitive data like credit card numbers using Klippa’s OCR API.

Our solution automatically blacklines or removes sensitive details, such as the last digits of IBANs, during scans or from existing records. This transforms a tedious task into a simple, efficient process.

As such, we help businesses to speed up their bank card-related processes, stay compliant and provide a hassle-free experience to their users.

Choosing the Right Card Scanning Solution: Build or Integrate?

When considering a card scanning solution, your first thought might be to build one from scratch. While this may seem feasible with an in-house development team, it requires significant time, resources, and effort. You’ll need to allocate funds for research, testing, and labor, all while diverting your team’s focus from core business activities.

Why take on this complexity when proven, ready-to-use solutions are available?

For instance, the Klippa bank card scanner offers seamless APIs and SDKs that can be quickly integrated into your existing software. This allows you to leverage powerful card scanning functionalities without the hassle of building and maintaining your own solution.

To give you a clearer picture, here’s an example of a simplified JSON response from our API:

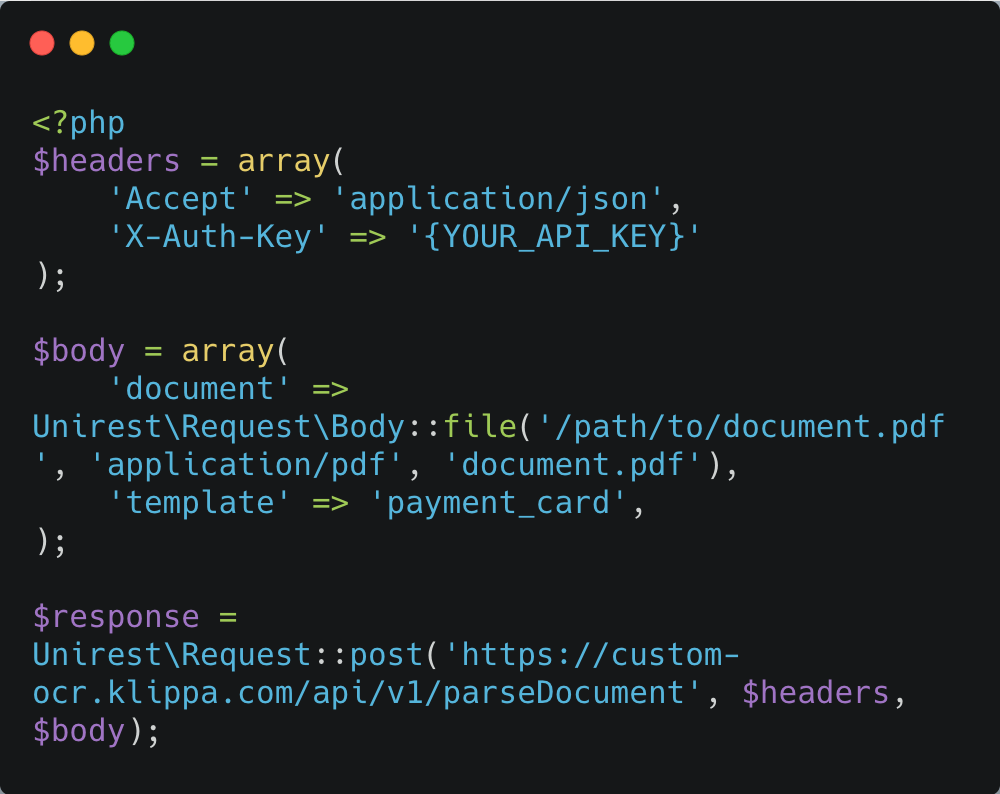

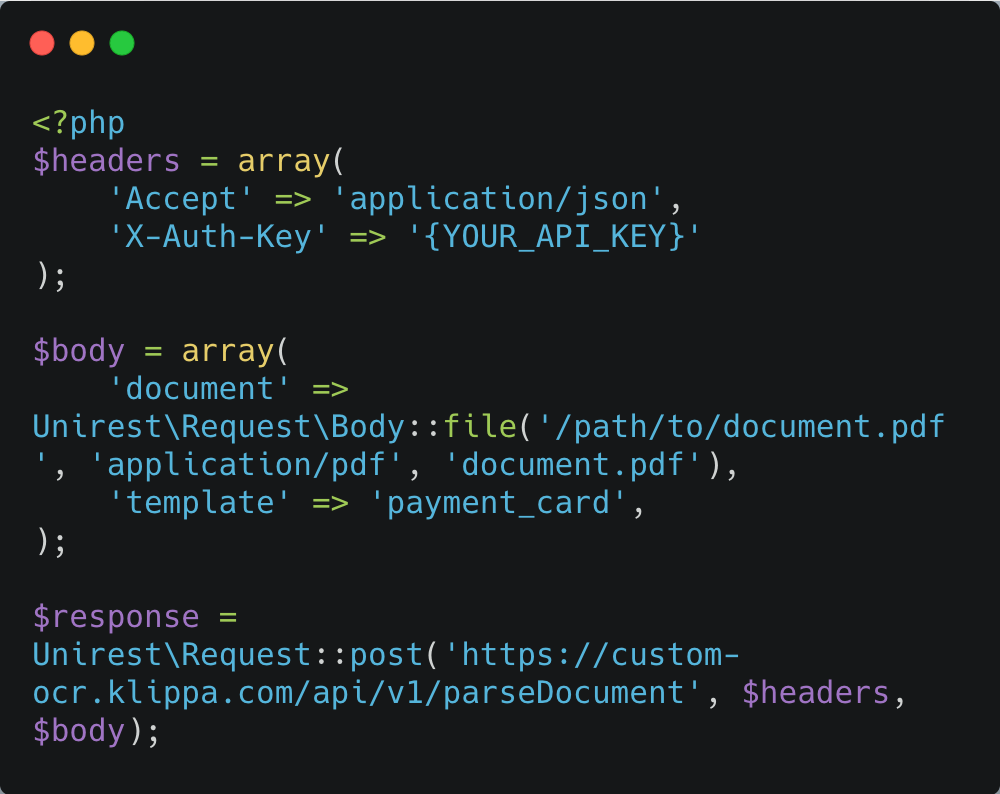

And that’s just the beginning – our API is designed to be developer-friendly and easy to implement. Below, you’ll find a PHP code snippet to demonstrate how straightforward the integration process can be.

Not only is our API adaptable to different programming languages, but we also provide extensive documentation and offer dedicated business and technical support to ensure a smooth implementation.

Automate Credit & Debit Card Scanning With Klippa

We hope that you are convinced of the value of a card scanning solution after reading this blog, but you still might have some questions. Is Klippa the right solution for your business? Can we help you with your unique use case? How difficult is it to implement and start using our software? And so on.

Our experienced product specialists are more than happy to answer all your questions. They can tell you everything about what our solution can do for your company and how you can integrate it seamlessly into your existing systems and operations.

You can reach out to us directly or you can plan a free 30-minute demo below, in which we show you how our software works and how it will benefit your organization.

FAQ

Automated bank card scanning uses AI and OCR (Optical Character Recognition) to extract key details from an image or PDF of a card. The process starts with capturing the card’s information, which is then analyzed and converted into structured data. This eliminates manual data entry, speeds up processing, and reduces errors.

Yes, Klippa’s solution includes AI-based image tampering detection, which spots forged documents by analyzing inconsistencies in lighting, pixel structures, and sudden text changes. It can also cross-check card details with fraud databases.

Klippa’s solution supports scanning all types of bank cards with printed or embossed text, including credit and debit cards. It extracts key data such as cardholder name, card number, expiry date, and more.

Yes, Klippa provides easy-to-integrate APIs and SDKs, allowing businesses to add automated card scanning to their software with minimal development effort.