With the increasing threat of money laundering, terrorist financing, and other forms of financial crime, regulators have enacted laws to prevent such activities. The two most common regulations in this regard are related to KYC (Know Your Customer) and AML (Anti-Money Laundering). While they may sound similar or are used in the same sentence, there are significant differences between the two.

KYC is performed as part of an organization’s due diligence before entering into a transaction with another party, while AML compliance checks are conducted on customers to identify any risk for criminal activities. Don’t worry if the definitions are not crystal clear yet; we will give more details later.

In this article, we will define what KYC & AML are, discuss the differences, and finally reveal how you can stay compliant with a software solution while protecting your business against fraud.

What is Know Your Customer (KYC)?

KYC (Know Your Customer) checks is a mandatory process that business and financial institutions use to identify and verify the identity of their customers. The aim of KYC is to prevent fraud, identity theft, and other financial crimes by ensuring that the customer is who they claim to be.

In order to comply with KYC regulations, institutions collect information about their customers, including their name, address, date of birth, and ID document number from documents such as a driver’s license, identity card, or passport. The collected information is then used to verify the customer’s identity.

KYC is an important part of the customer due diligence process that financial institutions undertake before entering into transactions with their customers. By verifying the identity of their customers, KYC helps businesses and financial institutions establish trust with their customers, reduce financial crime, and maintain regulatory compliance. But then what is AML?

What is Anti-Money Laundering (AML)?

AML (Anti-Money Laundering) is a set of laws and regulations designed to prevent financial systems from being used for illegal activities like terrorism financing, drug trafficking, or tax evasion. AML regulations demand the identification of customers who pose a higher risk of money laundering, the monitoring of transactions to detect suspicious activity, and the reporting of any suspicious activity to the appropriate authorities.

Financial institutions are required to comply with AML regulations and have internal controls and procedures in place to mitigate the risk of money laundering. In addition, AML regulations require financial institutions to perform KYC checks as part of their process.

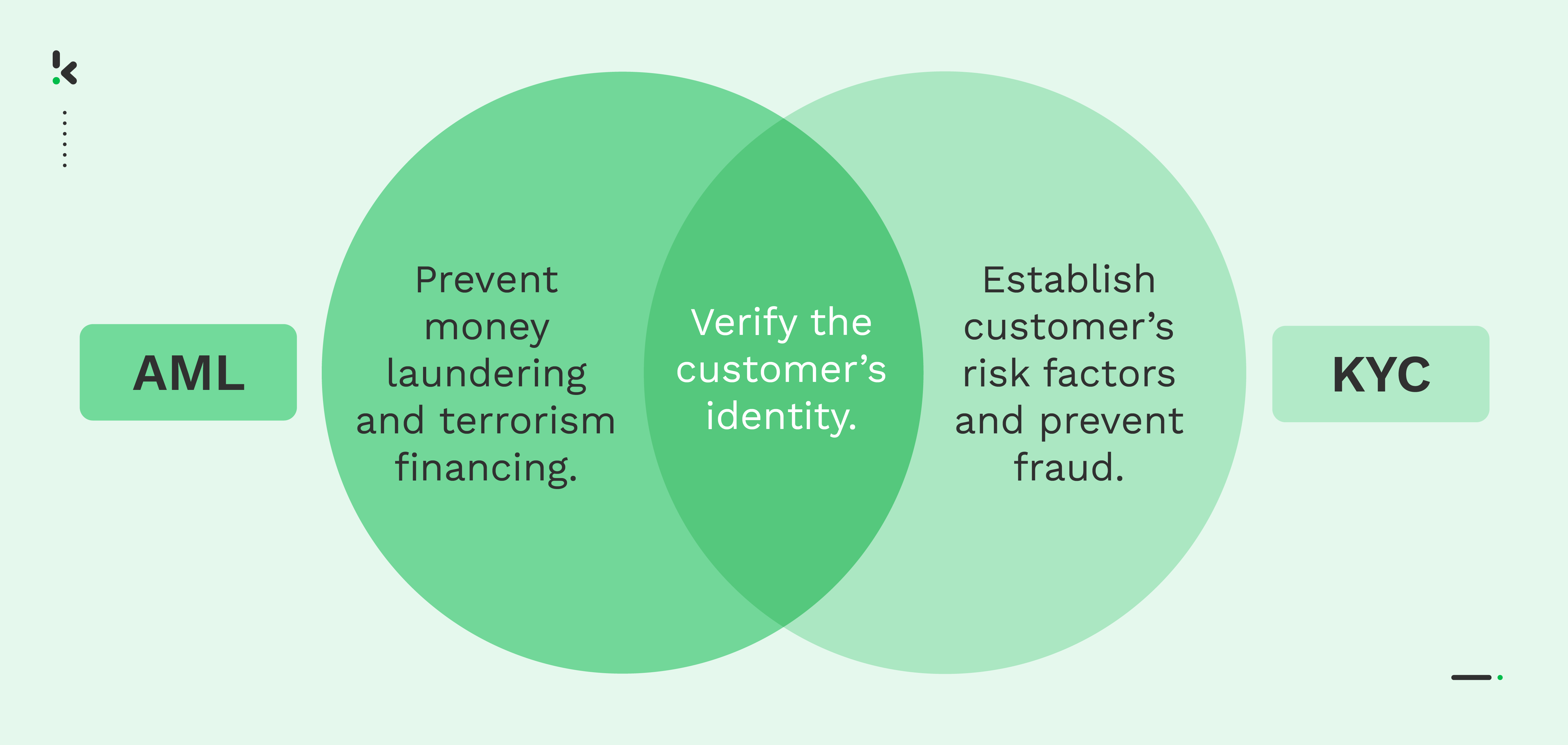

So KYC checks can be part of AML regulations, but can it also be the other way around? And how do they differ exactly from each other? Let’s have a look!

What’s the difference between KYC and AML?

KYC (Know Your Customer) and AML (Anti-Money Laundering) are related but distinct processes used by businesses and financial institutions to combat financial crime. The main differences between KYC and AML are:

Purpose: KYC is performed as part of a financial institution’s due diligence before entering into a transaction with another party, while AML compliance checks are conducted on customers who have already been identified as high risk for money laundering purposes.

Focus: KYC focuses on identifying and verifying the identity of customers, while AML focuses on detecting, preventing, and reporting suspicious activity related to money laundering or the financing of terrorism.

Compliance requirements: KYC and AML both have regulatory requirements that must be followed, with KYC requirements being more straightforward and focused on customer identification and verification, while AML requirements are more complex and focused on risk management, monitoring, and reporting of suspicious activity.

While KYC and AML are often used interchangeably, KYC focuses on verifying the identity of customers, while AML focuses on detecting and preventing financial crimes. KYC is the first step in AML compliance, but it’s only one part of a broader anti-money laundering program.

By understanding the differences between KYC and AML, businesses and financial institutions can better protect themselves against financial crime and maintain regulatory compliance.

When is KYC/AML compliance required?

KYC and AML compliance are both required by law, but the circumstances in which these checks are required differ. KYC is performed as part of an organization to verify the identity of customers before entering into a transaction with another party.

Here are some examples of use cases for KYC:

- Opening an account in a bank or financial institution

- Creating an account in marketplaces or e-commerce platforms

- Onboarding new clients for Cryptocurrency and Blockchain

- Age verification for gaming and gambling

- Check-in for travel and hospitality services

- Onboarding new or existing patients in a hospital

AML compliance checks, on the other hand, are conducted on customers to identify potential risks of financial criminal activities. Here are some examples of use cases for AML:

- Onboarding new customers for banks and financial institutions

- Opening an account for money transfer services

- Opening an account for casinos and gambling establishments

- Applying to buy a real estate asset

- Law enforcement agencies investigate and prosecute individuals and organizations engaged in money laundering activities.

KYC and AML compliance is mandatory for many businesses, especially those in the financial sector. Most nations have relevant legislation or laws to govern anti-money laundering. Let’s have a look at the regulations in different regions next.

AML/KYC regulations

Several regulations rule KYC and AML compliance, and businesses must ensure they are aware of them to avoid penalties and fines. Some of the most important KYC and AML regulations are:

- Bank Secrecy Act (BSA): Requires US financial institutions to establish AML programs to detect and prevent money laundering.

- Fifth Anti-Money Laundering Directive (5AMLD): Implements EU-wide rules on AML and terrorist financing.

- Financial Action Task Force (FATF): International standards on AML and counter-terrorist financing.

FAQ

What are AML & KYC regulations?

What are KYC & AML checks?

How to become KYC/AML compliant?

Often conducting the much-needed customer due diligence process for KYC & AML compliance takes up a lot of time and resources from businesses and financial institutions. Next to that, there is always the fear of criminal activities such as identity fraud.

With the latest advancements in technology, however, these challenges belong to the past. Manual identity verification can be replaced with AI-powered software. Keep on reading to learn more about it!

Automating your KYC/AML checks

Verifying identities manually is not the best approach as it is not scalable, it’s costly, and takes too much time. With software powered by AI, such as Klippa Identity Verification, you can look to automate parts of your customer due diligence process, saving time and money while improving accuracy and reducing errors.

Klippa provides a complete identity verification solution that makes your onboarding and compliance checks simpler. By automating certain aspects of KYC checks, like ID verification, Klippa can assist businesses in adhering to AML regulations.

Our innovative software makes it easy for you to add as many layers of security as you need, such as:

- Selfie identity verification

- Liveness detection

- ID document verification

- NFC ID verification

- Proof of address verification

- Age verification

Our solution can be implemented through API or SDK, making it easy to integrate into your own application making it accessible for your users.

Want to learn more? Book a free online demo or contact one of our experts today to learn more about our solution.