Digital accounting will save your company a lot of costs and time. Digitalization is a global trend and everything can be done faster. This also holds for the accounting processes at companies, which are more and more turning to digital, paperless accounting.

But how do you ensure that the labor-intensive process is transformed into an efficient one, saving both cost and time? And is digital accounting useful for your business? You’ll get the answers to these and more questions in this blog.

What is Digital Accounting?

Digital accounting refers to the process of managing financial transactions and records using digital tools, rather than traditional paper-based methods. This modern approach leverages software to automate accounting tasks such as bookkeeping, invoicing, payroll, tax preparation, and financial reporting.

The core of digital accounting lies in its ability to integrate various financial processes into a single, cohesive system. This integration allows for real-time data entry and updates, significantly reducing the risk of errors and discrepancies.

Benefits of Digital Accounting

Digital accounting offers numerous advantages for businesses looking to enhance their financial management processes. Here are some of the key benefits:

Increased Efficiency

Digital accounting automates routine tasks such as data entry, invoice generation, and reconciliation. This automation reduces manual effort, freeing up time for more strategic activities.

Improved Accuracy

Automated processes minimize the risk of human error. With digital accounting, transactions are recorded in real-time, ensuring that financial data is up-to-date and accurate.

Cost Savings

By reducing the need for paper, storage, and manual labor, digital accounting can lower operational costs. Additionally, the efficiency gains can lead to significant savings over time.

Enhanced Data Security

Digital accounting systems offer robust security features, including encryption and regular backups, to protect sensitive financial information from unauthorized access and data loss.

Real-Time Reporting

With digital accounting, businesses can access financial reports and analytics in real-time. This capability allows for better monitoring of financial performance and quicker decision-making.

Scalability

Digital accounting solutions can easily scale with the growth of a business. As transaction volumes increase, the system can handle the additional load without requiring significant changes or additional resources.

Regulatory Compliance

Many digital accounting tools are designed to comply with regulatory standards. They can automatically update to reflect changes in tax laws and accounting standards, helping businesses stay compliant.

By leveraging the benefits of digital accounting, businesses can achieve greater operational efficiency, accuracy, and financial control, ultimately supporting their long-term growth and success.

8 Steps to Transition to Digital Accounting Systems

Transitioning to digital accounting systems involves several clear, strategic steps. Here’s a concise guide to ensure a smooth shift:

1. Assess Current Processes

Evaluate your existing accounting methods to identify inefficiencies and areas that can benefit most from automation.

2. Choose the Best Pre-Accounting Solution

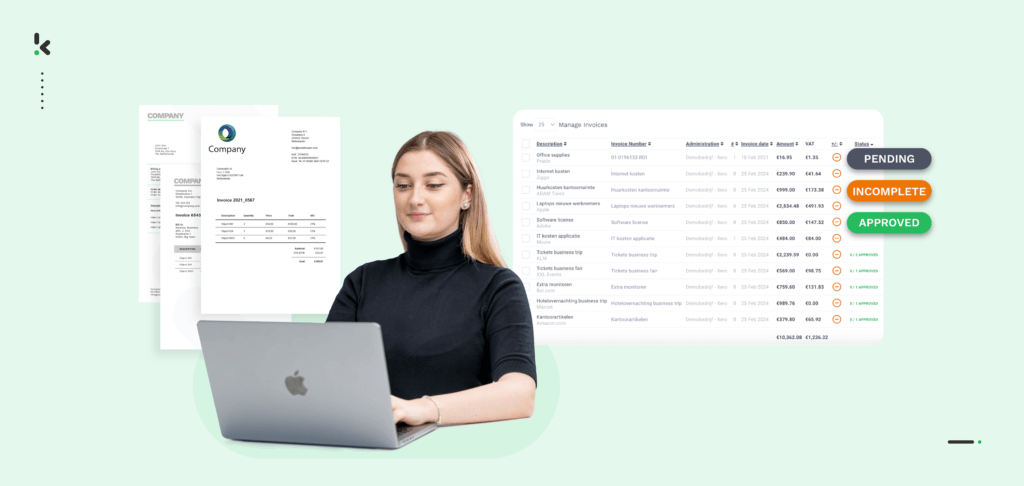

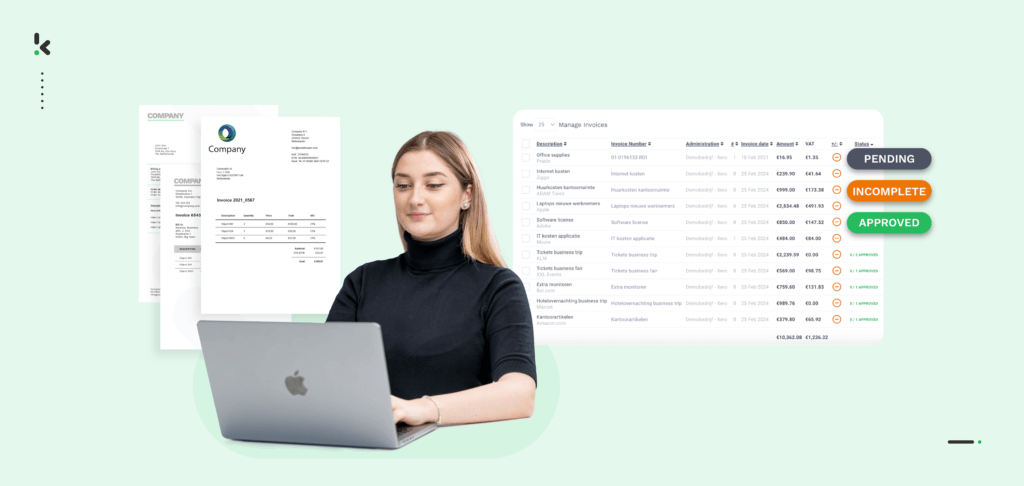

Choose Klippa SpendControl as your all-in-one digital pre-accounting software that combines invoice processing, expense management, and corporate credit card modules.

Our software utilizes Optical Character Recognition (OCR) technology to ensure accurate data capture and enable invoice scanning, approval, archiving and booking directly to your financial administration.

- Manage your vendor invoices, employee expenses, and corporate credit cards in one platform

- Submit, process, and approve transactional documents via web or mobile app

- Achieve 99% data extraction accuracy with Klippa’s OCR

- Regain control over your finances with intuitive dashboards

- Customize your approval management with multi-level authorization flows

- Never fail to comply with tax and data privacy regulations with our ISO27001-certified and GDPR-compliant solution

- Rely on automatic multi-currency support for international payments

- Prevent financial fraud with built-in duplicate and fraud detection

- Integrate SpendControl with your accounting and ERP software, like Quickbooks, NetSuite, or SAP

Use a pre-accounting solution to take complete control of all your business expenses while saving precious time and costs on document processing.

3. Choose the Right Accounting Software

Research and select digital accounting software that fits your business needs. Consider factors like scalability, ease of use, features, and integration capabilities with your existing systems.

4. Plan the Implementation

Develop a detailed implementation plan. This should include timelines, resource allocation, and milestones to track progress.

5. Train Your Team

Provide comprehensive training for your staff on the new digital accounting tools. This will help them understand the new processes and maximize the benefits of the system.

6. Test the System

Conduct thorough testing to ensure the new system functions as expected. This includes testing all automated processes, report generation, and integrations with other business systems.

7. Go Live

Once testing is successful, fully transition to the new system. Monitor the initial phase closely to address any issues that arise promptly.

8. Continuous Improvement

Regularly review the system’s performance and stay updated with software updates and new features. Continuously seek feedback from users to make necessary adjustments.

By following these steps, businesses can transition to digital accounting systems smoothly and efficiently, leading to improved financial management and operational efficiency.

Digital Accounting with Klippa

Forget about the challenges of manual financial data management – entrust your document processing to Klippa SpendControl. Process, approve and manage all vendor invoices and employee expenses with our AI-powered pre-accounting solution. Further, book fully prepared, validated and accurate data into your accounting or ERP system. Reduce the heavy workload into just a few clicks!

Are you ready to completely digitize your accounting process? Schedule a free demo to see our solution in action, or contact our SpendControl specialists for more details.