Have you ever imagined a scenario where your business is leaking money without you even realizing it? It’s not a hypothetical situation – approximately 1% of invoices are being paid twice, posing a potential threat known as duplicate payments. The implications are notable: cash flow disruptions, distorted financial reporting, and strained vendor relationships.

Duplicate payments hit finances hard, draining funds and disrupting cash flow. It’s like money down the drain, a luxury no business can afford. The chaos extends to accurate financial reporting, similar to navigating blindly. Unintentional overpayments strain vendor relationships, eroding trust and causing significant damage to the business’s reputation.

In this landscape, Intelligent Document Processing (IDP) emerges as a safeguard, ensuring precise financial transactions and eliminating the risks associated with duplicated payments.

Continue exploring this blog as we’re about to dive into the ways to prevent duplicate payments, revealing the top 5 factors contributing to these issues, and discovering the best practices that can save you money!

Key Takeaways

- Duplicate payments are more common than you think – Even a 1% duplicate rate can lead to serious financial and reputational damage.

- Two-way matching prevents mismatches – Automating invoice-PO comparison flags issues early and avoids financial discrepancies.

- AI-powered fraud detection spots manipulation fast – Intelligent checks catch altered invoices or receipts before they’re paid twice.

- Klippa offers built-in duplicate detection – DocHorizon and SpendControl use smart tech like image hashing and automated checks to keep your payments clean and compliant.

Top 5 Factors Contributing to Duplicate Payments

Managing payments becomes a huge challenge for companies, especially when grappling with extensive document volumes. The comprehensive paperwork can create overwhelming challenges in maintaining accuracy and efficiency in financial transactions. This often gives rise to a set of key factors:

- Manual Data Entry

- Invoice Fraud

- Expense Reimbursement Fraud

- Multiple Channels

- Data Loss

Manual Data Entry

In the big world of money moves, doing things manually makes it easy for payments to accidentally happen twice. Manual data entry, a traditional but error-prone method, becomes a gateway to unintentional duplicate payments.

Exploring the details of manual data entry reveals its reliance on human effort to input data into systems. Involving the interpretation and transcribing of information, this process is prone to errors, such as oversights. These mistakes, like forgetting or neglecting to record payments, can result in unintentional duplication in payment transactions.

This not only poses an immediate financial strain but also disrupts overall financial reporting and operational efficiency. On the flip side, automated data entry serves as a pivotal shift towards reducing the risks associated with manual processes, safeguarding your business from the costly consequences of duplicate payments.

Invoice Fraud

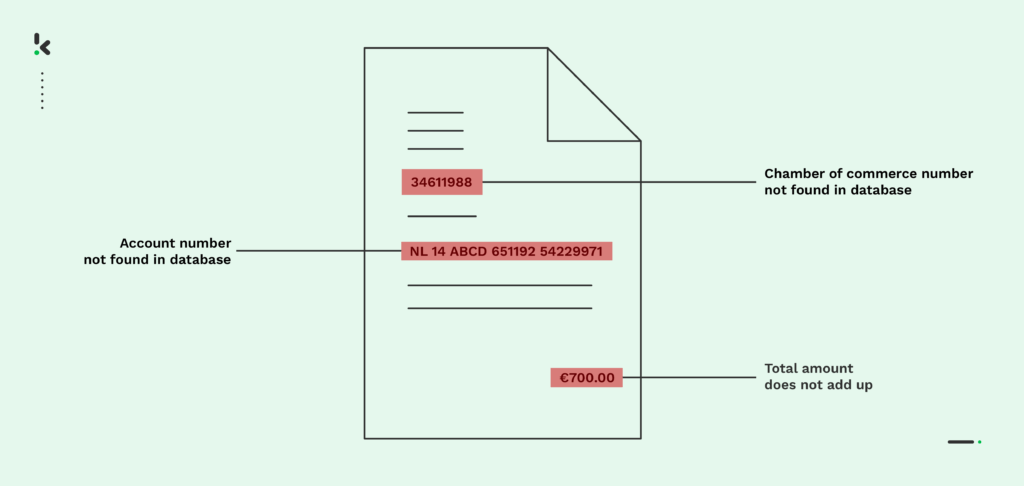

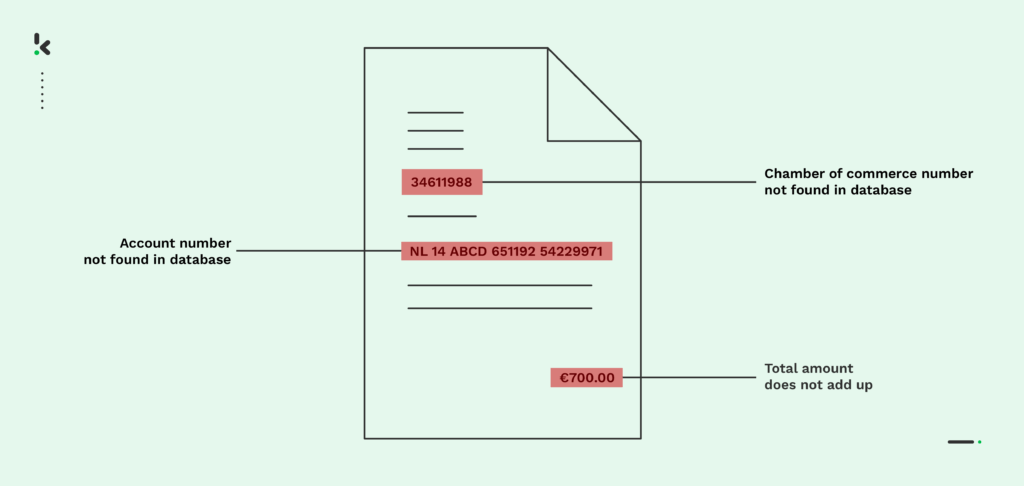

Invoice fraud is a tricky practice where individuals manipulate the invoicing process for dishonest gains. This may include crafting fake invoices, adjusting legitimate ones, or misleading businesses into paying for goods or services that were never actually provided.

This manipulation often leads to double payments, causing financial losses and compromising accurate financial reporting. Invoice fraud exploits weaknesses in payment systems, taking advantage of gaps to extract funds through deceptive means.

To elaborate on the process, imagine a scenario where a fraudster creates a fake invoice or alters a legitimate one. They might then present this manipulated invoice alongside the original to deceive the business into making a duplicate payment.

Businesses must stay vigilant against these fraudulent schemes to safeguard their financial integrity and prevent the harmful impact of duplicate payments on their operations.

Expense Reimbursement Fraud

Expense reimbursement fraud can occur as employees exploit loopholes in the reimbursement system by trying to edit receipts, often altering the date on the receipt, to claim reimbursement for the same meal or business trip multiple times. These actions not only compromise the transparency of financial processes but also erode the trust that underlies the employer-employee relationship.

This behavior, though not widespread, poses a notable risk to the integrity and fairness of the expense reimbursement procedures within a company.

Multiple Channels

When employees receive identical documents through different channels, it sets the stage for confusion and, ultimately, the risk of duplicate payments. The surge of identical information from various sources overwhelms the payment processing system, creating challenges for employees to determine whether a transaction has already been addressed.

To prevent unintentional duplications, businesses should prioritize streamlined communication channels and implement robust processes for clarity in document management.

Data Loss

In times of major organizational changes, such as transitions between accounting systems or server errors, companies may encounter data record loss. This raises the risk of duplicate payments due to challenges in organizing information during these transitions.

For instance, in scenarios like mergers and acquisitions, the complexity of merging diverse data systems can exacerbate the risk of duplicate payments.

Additionally, insufficient data storage practices, often due to employee distractions, can contribute to the risk of duplicate payments. Addressing this involves emphasizing precise data management during organizational changes. Cultivating a culture of concentrated task execution can significantly reduce the risk of unintentional financial redundancies.

As we unveiled the factors contributing to duplicate payments, now it’s essential to explore the best practices to guard against these financial pitfalls.

Best Practices to Avoid Duplicate Payments

Have you ever found yourself wondering how to keep your finances on track and avoid those double payments? This section reveals practical and effective practices to ensure your financial precision. Let’s take a look at these:

- Improve Your AP Approval Workflows

- Integrate Automated Data Entry Solution

- Leverage AI-powered Document Fraud Detection

- Automate Two-Way Matching

Improve Your AP Approval Workflows

Enhancing your AP Approval Workflows is a strategic move to avoid duplicate payments. By refining and optimizing the approval processes, you streamline the path for accurate verification of invoices. Considering having the Marketing Manager approve marketing expenses adds a layer of expertise, promoting more informed decisions and reducing the likelihood of errors.

This not only minimizes the chances of unintentional duplicate payments but also accelerates the entire accounts payable cycle, including efficient invoice processing.

In essence, improving AP approval workflows becomes a strategic move not just to prevent errors but to create a more agile and responsive financial operation.

Integrate Automated Data Entry Solution

The integration of automated data entry solutions serves as a powerful tool in preventing duplicate payments by eliminating the manual handling of financial data. This practice ensures accuracy and efficiency in data extraction and input, significantly reducing the chances of error that often lead to duplicate payments.

Klippa DocHorizon revolutionizes document automation, enhancing collaboration and ensuring transparency. It covers diverse documents, prevents duplicates with entity matching, and ensures precision through industry-leading OCR accuracy. Klippa enhances solution reliability with a Human-in-the-loop (HITL) option for added data checks in streamlined workflows.

By automating the process and leveraging Klippa’s OCR technology, your business enhances the reliability of the financial records, creating a robust defense against the unintended repetition of payments.

Leverage AI-Powered Document Fraud Detection

Utilizing AI-powered document fraud detection is a crucial practice in preventing duplicate payments, as it introduces an intelligent examination of financial documents. By employing artificial intelligence, the system can identify patterns and anomalies associated with fraud, ensuring that only legitimate transactions proceed.

In a practical business setting, an employee might endeavor to resubmit an expense report from the previous month by altering the dates to make it appear current. The AI-Powered Document fraud detection system efficiently detects this anomaly, swiftly recognizing the manipulation of dates on the financial document.

This heightened level of inspection significantly reduces the risk of processing duplicate payments, as the AI system detects irregularities that may lead to financial errors.

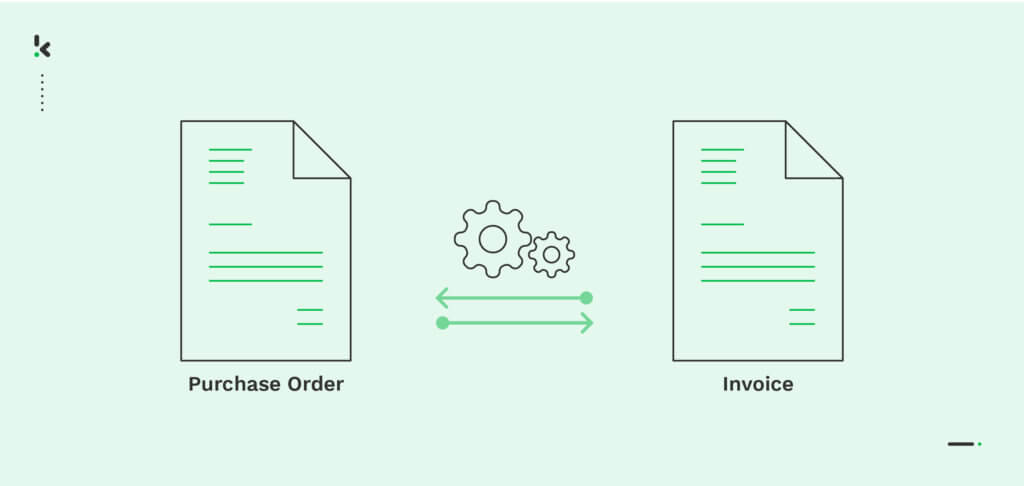

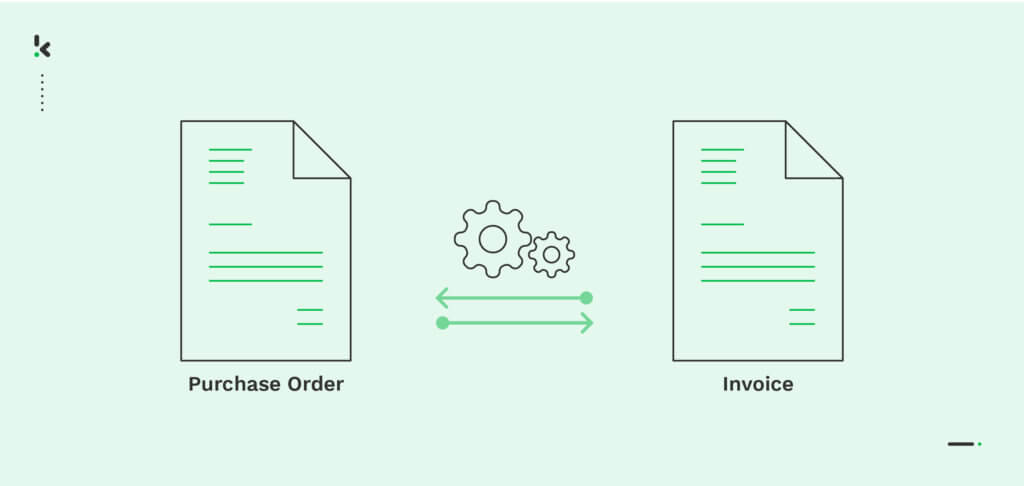

Automate Two-Way Matching

Automating Two-Way Matching deploys systems to seamlessly reconcile purchase orders, invoices, and delivery receipts. This process ensures that the received goods or services align precisely with the initially issued purchase order and the corresponding invoice.

If any discrepancies are detected, such as mismatched amounts or items, two-way matching flags them for review, acting proactive to prevent duplicate payments. This safeguard mechanism enhances financial accuracy, preventing the pitfalls of redundant payments.

Having integrated these savvy practices into your financial toolkit, you’ve built a robust defense against the risks of duplicate payments. Now, let’s move on to the last part of this blog, where we’ll dive into duplicate detection automation with Klippa.

Automate Duplicate Payment Detection with Klippa

Precision is crucial in the complex world of finance, and avoiding potential traps is the secret to success. Klippa’s DocHorizon and SpendControl, two ground-breaking technologies, were meticulously crafted to transform the way you manage your finances.

With DocHorizon, Klippa utilizes advanced AI technologies, including image hashing, to detect document forgery and prevent duplicate fraud attempts. The system provides feedback on fraud detection, allowing users to minimize risks and ensure the integrity of their financial documents.

For SpendControl, whether in automated or manual AP processes, the tool serves as a proactive business asset. It facilitates regular checks for errors, duplicate invoices, and vendor payments, ensuring meticulous examination of financial records to prevent duplicates and maintain financial health.

Are you ready to elevate your financial management? Book a free demo below or contact our experts, and take your duplicate payment detection to new heights with Klippa’s advanced solutions!

FAQ

They often result from manual data entry errors, invoice fraud, poor approval workflows, multiple submission channels, or lost records during system changes.

Yes, automation tools like IDP (Intelligent Document Processing) reduce human error, flag suspicious documents, and automate checks like invoice matching.

DocHorizon uses OCR, image hashing, and AI to identify document similarities and fraud attempts, helping prevent duplicates before they’re processed.

Now part of the SER Group, a recognized Leader in the Gartner® Magic Quadrant™ for Document Management, Klippa offers advanced AI-powered document processing. By combining OCR, image analysis, and pattern recognition, Klippa efficiently detects duplicate payments, making it a leading choice for businesses seeking to safeguard against fraud and streamline expense management.