E-invoicing is becoming essential for businesses as more countries make it mandatory, particularly in Europe. Governments are encouraging adoption by requiring electronic invoices for transactions in both the public and private sectors.

Germany, for example, will require e-invoice receipt starting January 2025, with plans to complete the transition soon. As regulations change and businesses look for efficient solutions, choosing the right e-invoicing software is more important than ever.

In this blog, we’ll introduce six leading e-invoicing platforms for 2025 and guide you in finding the best fit for your business needs.

Key Takeaways

The 6 Best E-Invoicing Software for 2025 are:

Comparison of the best e-invoicing software in 2025:

What Is E-Invoicing Software?

E-invoicing software, or an electronic invoicing system, is a digital solution that helps businesses create and send e-invoices and process incoming ones. This software allows you to manage invoices electronically. You can create, send, receive, process, and track them without paper or PDFs.

You can think of e-invoicing as being similar to online banking since the software replaces writing cheques and manual invoice processing by digitizing them, making the process faster and more reliable.

Top 6 E-Invoicing Software Solutions in 2025

Klippa DocHorizon: For E-Invoicing Workflow Automation

Klippa DocHorizon is an IDP platform that uses AI-powered OCR technology for document scanning, classification, anonymization, data extraction, and verification. Designed for businesses that need an efficient and simple way to extract data from documents, it’s ideal for organizations with established workflows that want to integrate automated invoice processing.

Klippa’s platform is a certified PEPPOL Access Point. It lets users join the PEPPOL network immediately and start data exchange with their assigned ID, ensuring complete compliance with e-procurement standards across Europe. With DocHorizon, users can automatically convert, send, receive, process, verify, and archive all e-documents.

Pros

- Send and receive electronic invoices in any required formats

- Convert PDF invoices into EDI file formats, like XML and UBL

- Extract any data from incoming invoices with Klippa’s AI-powered OCR

- Prevent invoice fraud with a built-in 2-way matching system

- Stay compliant with e-invoicing regulations in over 50 countries

- Securely archive invoices for 10 years

- Ensure data privacy with Klippa’s ISO27001-Certified and GDPR-Compliant software

- Integrate with your existing ERP, CRM, SRM, or other financial systems

Cons

- Can’t generate original or custom invoices

- No built-in e-signature feature

Pricing

- €25 free credit to try out the platform

- License or usage-based pricing model

- Contact the team for pricing details

Ideal business type and size: Klippa DocHorizon is best suited for medium to large enterprises with high invoice volumes.

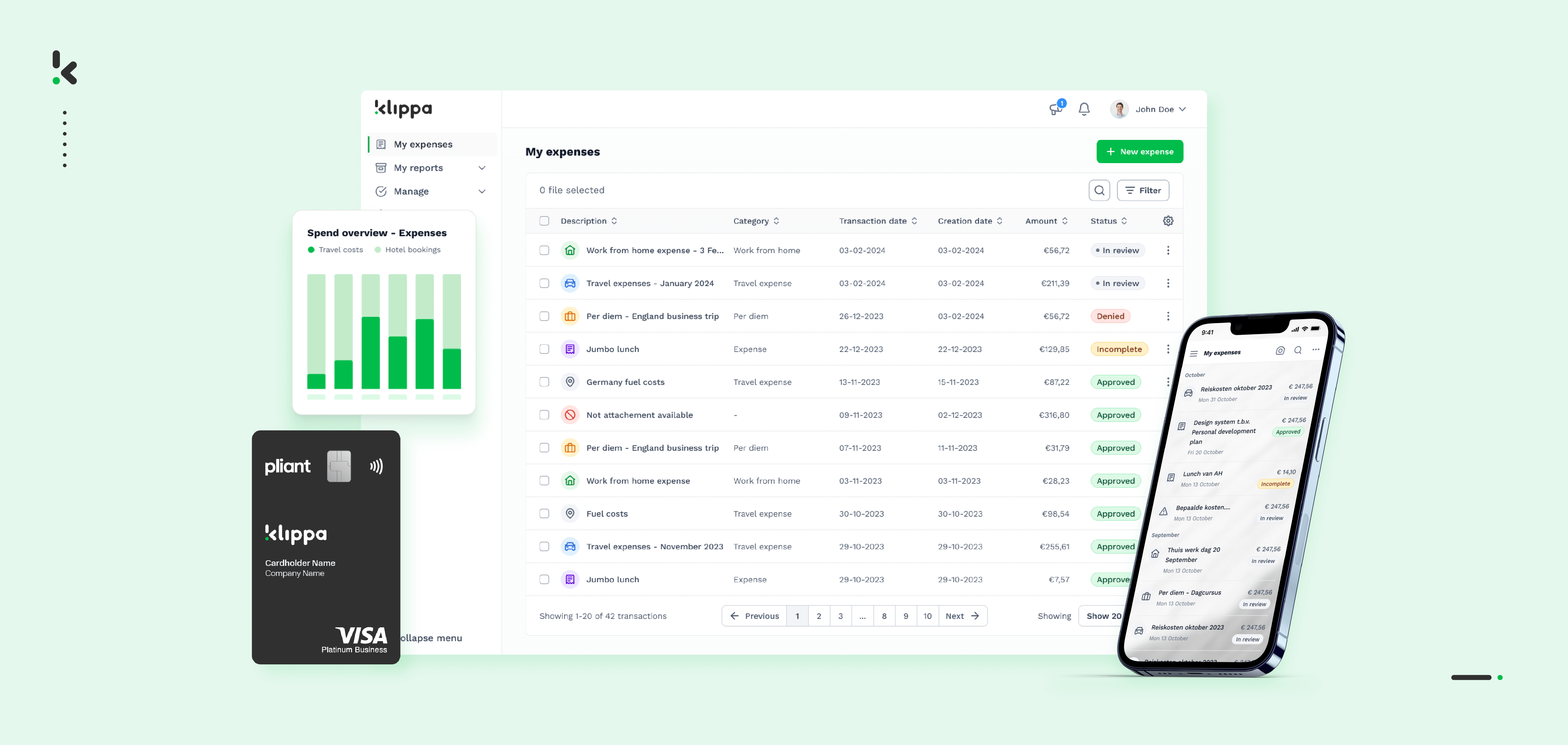

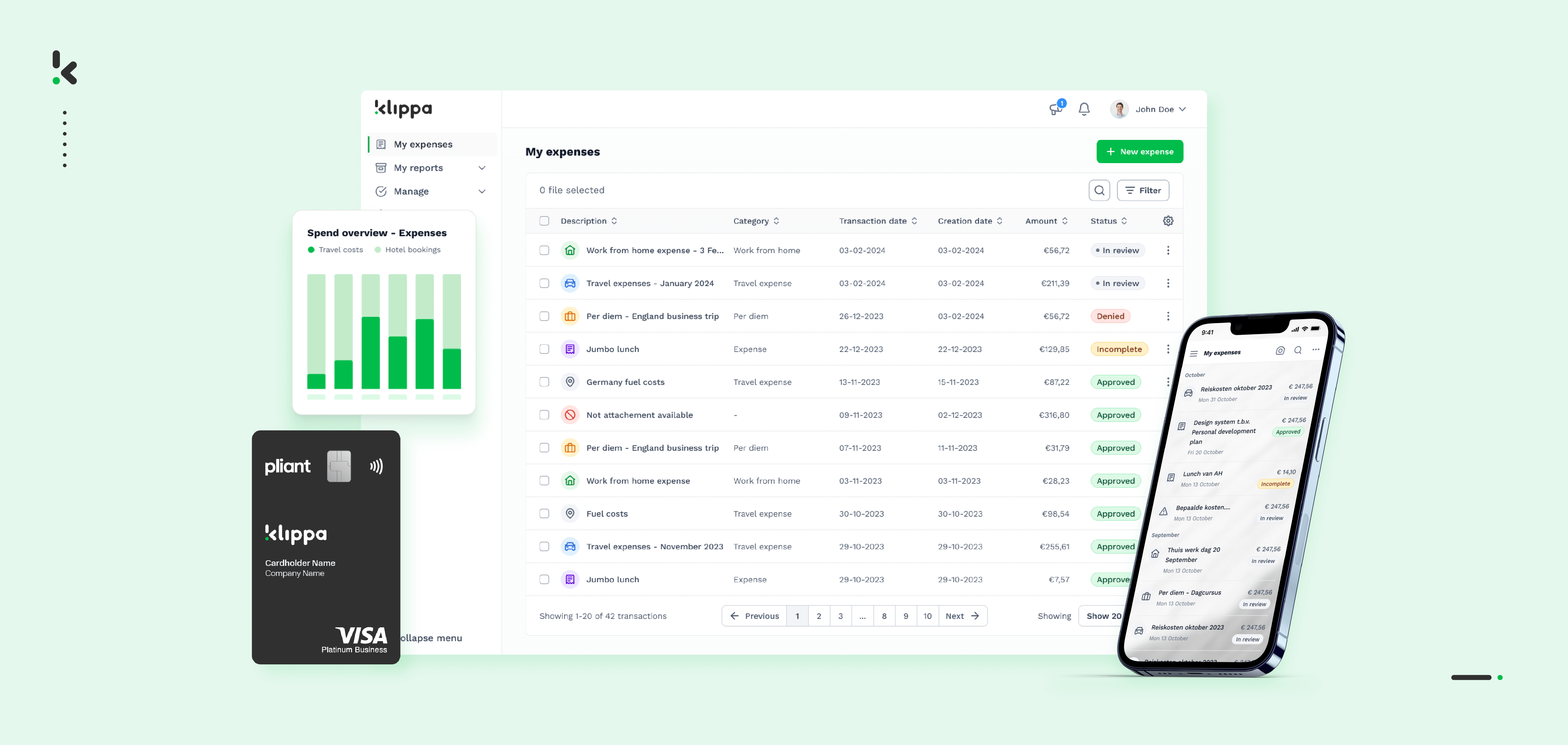

Klippa SpendControl: For Complete AP Management

Klippa SpendControl is a pre-accounting software that combines invoice processing, expense management, and business credit card modules, for end-to-end accounts payable management. It automates invoice scanning, approving and booking, simplifying tasks that once took hours into just a few clicks.

With SpendControl, users can receive e-invoices through the PEPPOL Network, scan them, approve them based on custom business rules, and then book them into their preferred financial administration system.

Pros

- Receive, approve, and book e-invoices with certified PEPPOL Access Point

- Manage your vendor invoices, employee expenses, and business credit cards in one platform

- Control your accounts payable through intuitive dashboards

- Customize your approval management with multi-level authorization flows

- Comply with tax and data privacy regulations with Klippa’s ISO27001-certified and GDPR-compliant solution

- Prevent invoice fraud with built-in duplicate detection and IBAN check

- Integrate SpendControl with your accounting and ERP software, like Quickbooks, NetSuite, or SAP

Cons

- Can’t generate and send e-invoices

- No built-in 2-way matching (coming in 2025)

Pricing

- Effective plan: Up to 4,000 invoices per year with 10 active users, $95/month

- Premium plan: Up to 12,000 invoices per year with 30 active users, $275/month

- Custom plan: Fully customized AP solution with SSO for user and workflow control. Contact us to learn more about pricing

Ideal business type and size: Klippa SpendControl is best suited for small to medium-sized businesses seeking a solution for receiving and approving e-invoices within a complete AP management solution.

Zoho Invoice

Zoho Invoice is invoicing software that is part of a larger integrated business solution offered by Zoho. As a standalone application, Zoho Invoice enables users to create invoice templates, send them to customers, and accept payments online.

Pros

- Multiple invoice templates with customization and personalization features

- Customer invoicing via email, links, or PDF routing on WhatsApp or iMessage

- Invoice payment processing via cards, e-wallets, and ACH

- Automated payment reminders

- Integrations with Zoho CRM, Analytics, Books, and more

Cons

- Lacks invoice receiving and processing features

- Not a certified PEPPOL Access Point, depends on a third-party-provider to access the PEPPOL network

- Based on user reviews, Zoho Invoice lacks advanced personalization features for unique invoices (G2)

Pricing

- Free

Ideal business type and size: Zoho Invoice is best suited for start-ups and small to medium-sized businesses that use other Zoho applications.

Invoice Ninja

Invoice Ninja is an invoicing software catering to small business owners, designed to help with managing invoicing and payments. The platform helps users to create, send, and track invoices.

Pros

- Invoicing via Gmail, MSN, or custom SMTP

- Recurring invoicing and auto-billing clients

- 4 free customizable invoice template designs

- Invoice payment acceptance via credit cards, ACH payments, Stripe, PayPal, and more

- Automated payment reminders and past-due notifications

Cons

- Support of UBL formats and access to the PEPPOL Network only in a high-tear plan

- Based on user reviews, Invoice Ninja lacks fast and easily reachable customer support (Capterra)

- Based on user reviews, many customers had issues with data migration and customer support during software updates, resulting in data loss cases (Capterra)

Pricing

- Free: 5 clients and unlimited invoicing for $0/month

- Ninja Pro: Unlimited clients and invoices for $12/month

- Enterprise: E-invoicing with UBL formats and access to PEPPOL Network, from $16 to $96/month

- Premium Business+: Dedicated developer, priority support and invoice design service from $240/month

Ideal business type and size: Invoice Ninja is best suited for freelancers and small businesses without complex invoicing needs.

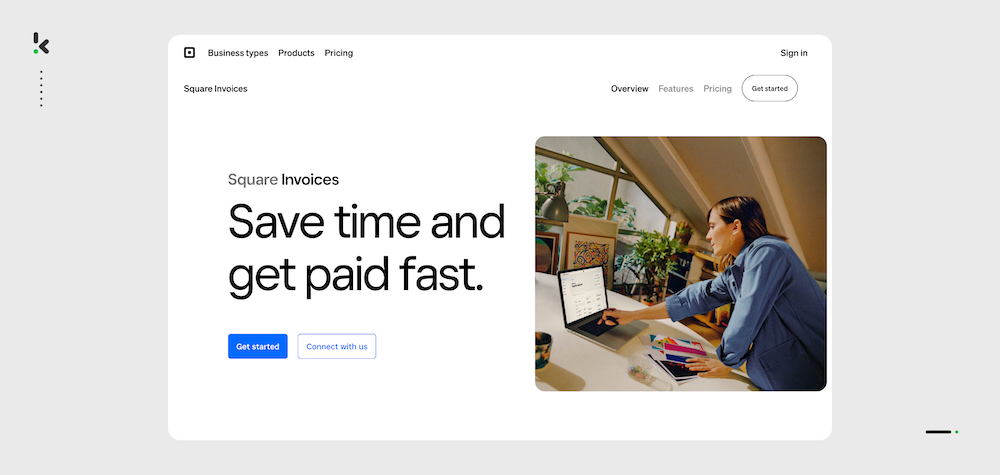

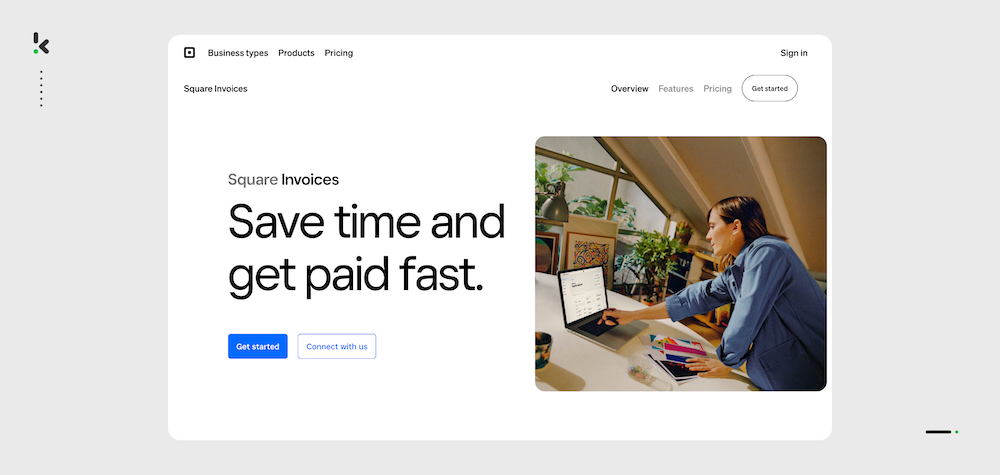

Square Invoices

Square Invoices is an invoicing solution offered by Square, a company known for its point-of-sale systems. The platform helps small businesses, freelancers, and service providers who need a simple solution for creating, sending, and getting paid for their invoices.

Pros

- Invoicing via email, SMS, or a shareable link

- Payment acceptance by credit card, Apple Pay, Google Pay, ACH bank transfer and more

- Custom brand colors and logo on the invoices

- Real-time tracking of invoice statuses: what’s paid, unpaid, and overdue

- Set of recurring billing on a daily, weekly, monthly, or yearly schedule

Cons

- Not suitable for businesses that require PEPPOL compliance for e-invoicing

- Based on user reviews, it can be challenging to track the final monthly cost of the software due to the additional processing fees (GetApp)

- Based on user reviews, the platform can withhold payments (Trustpilot)

Pricing

- Free: Unlimited invoices for $0/month + *processing rates

- Plus: Custom invoices and project management for $20/month + discounted processing rates

*Processing rates: 3.3% + 30 cents for online card payment and 1% with a minimum fee of $1 for online ACH payment.

Ideal business type and size: Square is best suited for freelancers and small businesses that use Square’s payment processing services and don’t require invoicing in Europe.

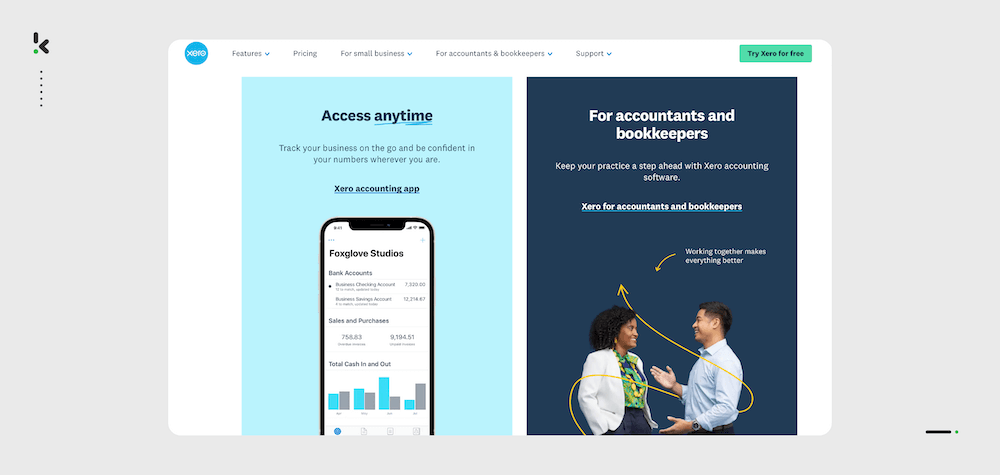

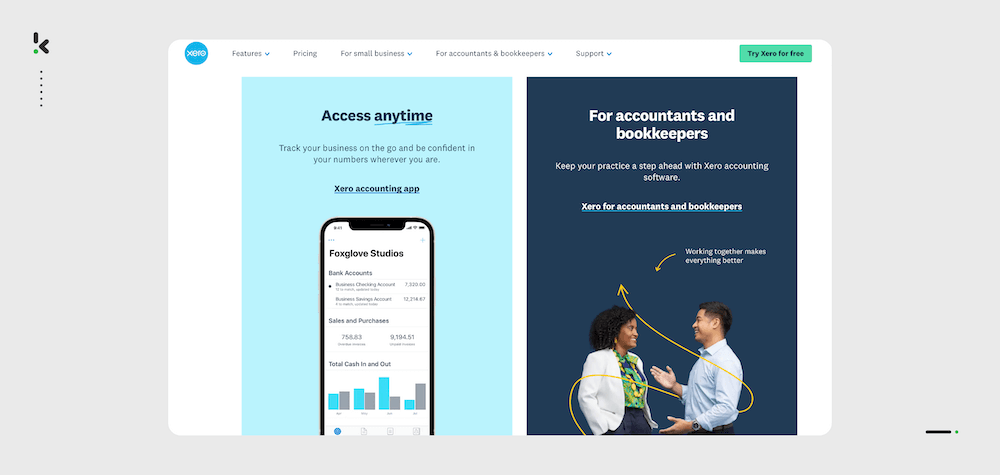

Xero

Xero is a cloud-based accounting software for small businesses that offers e-invoicing features. It allows users to create, send, and receive invoices electronically.

Pros

- Exchange of e-invoices via the PEPPOL Network

- Generation and customization of unique invoices within the app

- Acceptance of payments with debit and credit cards via Stripe or GoCardless

- Automatic reminders for customers before or after the payment due date

- Integrations with inventory, payment, CRM, e-commerce, and a wide range of other applications

Cons

- The invoice data capture feature relies on a third-party app, Hubdoc, which requires an extra fee

- Based on user reviews, most of the new features require an extra add-on charge (Software Advice)

- Based on user reviews, the software can be too expensive for small businesses (Software Advice)

Pricing

- Starter: 20 invoices and quotes for $29/month

- Standard: Unlimited invoices for $46/month

- Premium: Unlimited invoices with automatic conversion of foreign currencies for $69/month

Ideal business type and size: Xero is best suited for small to medium-sized businesses that already use Xero for accounting needs or require an accounting solution with e-invoicing features.

What Features Should You Be Looking For?

Choosing the right e-invoicing software starts with identifying the must-have features that align with your specific business needs. To help with your selection process, we’ve compiled a list of some of the most important and sought-after features to consider:

PEPPOL Compliance:

- Certified Connection: The software should be certified by the PEPPOL Authority to ensure cross-border invoicing within the PEPPOL network. Certification ensures that invoices meet the required technical and functional standards.

- Access Point Integration: PEPPOL requires integration with an Access Point, which is a secure gateway for sending and receiving invoices across its network. Without this, businesses cannot exchange e-invoices with government platforms or other entities in the network.

- Document Diversity: Supports invoices, credit notes, and purchase orders. For instance, if a business needs to send a purchase order before invoicing, the software should manage these documents consistently.

Local Standards Support:

- Country-Specific Formats: Examples include XRechnung and ZUGFeRD in Germany, FatturaPA in Italy, Factur-X in France, and UBL in the Netherlands. Without these formats, invoices risk rejection by tax authorities.

- Mandatory Data Fields: Includes taxpayer-identification numbers (e.g., VAT ID), invoice date, invoice number, buyer and seller details, item descriptions, quantities, unit prices, tax breakdowns, and total amounts. Compliance ensures the invoice is both accurate and legally valid.

Automated Data Exchange:

- Direct Integration with Government Portals: For example, in Spain, integration with SII (Immediate Supply of Information) allows real-time reporting of invoices to the tax authority. Similarly, Italy’s FatturaPA mandates submission through the SDI portal.

- Vendor Communication: Enables receipt of invoices directly into your system, reducing email-based invoice handling.

Data Extraction & Matching:

- Advanced OCR Technology: Automatically extracts text from invoice formats such as PDFs, scanned images, or even photos taken with a smartphone. Look for AI-powered OCR that handles multi-language invoices and complex layouts.

- Intelligent Matching: Compares invoice details with associated purchase orders or delivery receipts with 2-way or 3-way matching. For instance, if an invoice claims 100 items were delivered, the system verifies this against the purchase order and delivery note to prevent overpayments.

- Duplicate Detection: Alerts users if a duplicate invoice with the same number, date, and supplier details has already been processed.

Workflow Automation:

- Routing Rules: Automatically sends invoices to approvers based on predefined criteria like amount thresholds or department. For example, invoices under €500 might go to a junior manager, while larger ones route to senior management.

- System Integration: Direct integration with systems like SAP or QuickBooks eliminates the need for manual data entry, speeding up reconciliation processes.

Real-Time Validation:

- Error Prevention: Verifies that invoices meet country-specific requirements, including a valid VAT rate (e.g., 19% in Germany, 20% in the UK) and correct invoice numbering.

- Schema Compliance: Ensures invoices conform to required technical formats like XML or JSON.

- Automated Correction Suggestions: Highlights issues such as a missing tax ID, incorrect totals, or mismatched invoice numbers, with step-by-step guidance on fixing them.

Digital Signatures:

- Legally Binding: Ensures compliance with regulations like eIDAS (EU) or ESIGN (US), which make digitally signed invoices valid and enforceable.

- Verification Tools: Includes features to verify incoming invoices with digital signatures, preventing fraud.

Certified Security Standards:

- ISO 27001: Indicates the software provider has implemented strict controls for managing sensitive financial data.

- GDPR Compliance: Ensures that personal and financial data is processed following the General Data Protection Regulation (GDPR), protecting the privacy and rights of individuals in the EU.

While this list highlights some of the most important features to look for in e-invoicing software, every business is unique. Use this as a guide, but take the time to carefully evaluate your own specific needs, considering factors like the size of your operations, industry requirements, and future growth.

The right software should not only meet your current demands but also adapt to support your business as it evolves.

How to Choose the Best E-Invoicing Software?

Now that you are familiar with our top choice for the best e-invoicing software and the key features to consider for 2025, you can begin the process of selecting the right software for your business.

To simplify this process, we have divided the selection procedure into six easy steps for you to follow:

1. Assess Your Current Needs

Start by identifying what you need the software to do. Are you looking for a comprehensive solution that can generate, send, and receive invoices with advanced processing features? Or do you need a simple tool to create and send invoices to your small business customers?

List your deal-breakers and negotiable features that can be added through provider support or customization (e.g., specific invoice templates). By understanding the primary function you need the software for, you can quickly rule out tools that lack essential features or avoid those with unnecessary functionalities you don’t want to pay for.

2. Research Your Local E-Invoicing Laws

Research e-invoicing rules in the country or state in which you operate. Are there any e-invoicing mandates you have to follow right now or in the near future?

Check whether the software you consider supports:

- Mandated e-invoicing formats (e.g., XML, JSON) that are compatible with your government systems

- Extraction of specific data fields for accurate tax calculations

- Compliance with security standards, such as certifications and archiving rules (e.g., all data must be stored within the country)

- Integration with government systems through API connection

Important! If you’re dealing with public sector organizations in Europe, or if your country mandates e-invoicing with specific requirements, PEPPOL compliance is often a must-have. The general idea is that eventually, all European countries will switch to PEPPOL for uniform and seamless data exchange.

Look for software that is certified as PEPPOL compliant and verify that the software connects to a PEPPOL Access Point. This is how your system will connect to the PEPPOL network and exchange invoices with other participants.

3. Define Your Budget

First, start by identifying costs. Break down the cost of investment into software licensing, implementation, and ongoing costs:

- Software Licensing: Is the software subscription-based, with per-invoice fees, or a single license fee?

- Implementation Costs: What are the fees for customizations, integrations, data migration, and training?

- Ongoing Costs: What are the costs of tech support, software updates, and bug fixes? If you need payment processing, are there any transaction fees or extra charges?

Next, calculate your ROI (Return on Investment): Identify employees involved in invoicing and invoice processing. Ask them to estimate the time spent creating invoices, sending reminders, chasing payments, and manual data entry. Calculate the cost of this time based on their hourly wage.

Estimate interest from early payments and savings from reduced late fees. Then, analyze past data to find error costs and see how much you can reduce them. Base your calculations on realistic estimates.

Calculate ROI using the formula: ROI = (Net Profit / Cost of Investment) x 100

Given your cost estimate and potential ROI, set a budget for the e-invoicing software. Try to negotiate with vendors for the best prices. Use your volume, usage, and budget as a basis.

4. Research and Shortlist Software

Research e-invoicing providers. Go through review platforms and blogs, like ours. Then, check the software provider’s website for the most up-to-date pricing and features. If the platform provides free demos or trials, use them to test the user-friendliness of the software.

For your convenience, create a checklist or an Excel sheet. Use it to log the priority parameters and your impressions of each platform. This will make comparison much easier. Based on your research and tests, shortlist 2 to 3 top options.

5. Evaluate and Select

Schedule demos with your shortlisted providers. Ask about your specific needs and concerns. For example, how does the software handle integrations with your existing accounting system? Compare the features, pricing offers, and support options offered by each provider. Choose the software that best fits your needs, budget, and long-term goals.

6. Implement and Monitor

Develop a detailed implementation plan, including training for your team. Define and track KPIs, such as invoice processing time, payment rates, and customer satisfaction. This will monitor the actual ROI and leave room for adjustments.

Conclusion

With Klippa, you can automate your invoice processing workflows and directly exchange e-invoices through the Peppol network. Save money and the implementation efforts by acquiring an immediate ID with Klippa as your certified Peppol access point.

Use our IDP platform or accounts payable solution to automate your document workflows and simplify your e-invoicing needs. Ensure compliance with the latest e-invoicing regulations while saving time and money on invoice processing.

FAQ

An e-invoicing system is a digital solution that enables businesses to create, send, receive, process, and track invoices electronically. It eliminates the need for paper or PDFs, streamlining the invoicing process and ensuring compliance with regulations.

A digital invoice is typically a PDF or scanned copy of a paper invoice, while an e-invoice is created and processed in a structured digital format (like XML or UBL) that allows direct integration with financial systems.

EDI (Electronic Data Interchange) is a broader system for exchanging business documents in a structured format between organizations. E-invoicing specifically focuses on the exchange of electronic invoices, often through networks like PEPPOL, ensuring compliance with tax and regulatory standards.

The best invoice software depends on your business size, industry, and specific needs. Popular options include Klippa DocHorizon for automation and compliance, Zoho Invoice for customizable templates and small businesses, Xero for accounting integration, and Invoice Ninja for freelancers. Consider factors like features, pricing, and scalability when choosing the right software for your business.