Managing employee expenses without a clear policy is a recipe for confusion, overspending, and friction between teams. That’s why we created this free expense policy template to give your organization a head start on building a policy that’s fair, compliant, and easy to follow.

Whether you’re trying to avoid unclear expense claims, prevent fraud, or simply bring more structure to your expense process, a well-crafted policy is key. In this guide, you’ll get:

- A downloadable expense policy template you can fully customize

- Real-world examples of what to include (and what to avoid)

- Best practices for implementation that actually work

Use it as a blueprint, make it your own, and start aligning company spending with your strategy without the guesswork.

Key Takeaways

- A clear expense policy helps reduce confusion, fraud, and unnecessary spending

- Set specific rules, limits, and proof requirements so employees know what’s expected

- Keep it simple: focus on what matters, and use plain language

- Use tools to automate the process, speed up reimbursements, and stay compliant

- Ready to go? Download the free template or customize your own with the steps below

Why Your Company Needs a Solid Expense Policy

Even in companies with great culture and trustworthy teams, expense management can quickly spiral into a source of stress and conflict, especially without clear rules in place. A strong expense policy isn’t about micromanaging; it’s about setting shared expectations and removing ambiguity for everyone involved.

What Happens Without One?

Without a clear expense policy:

- Employees don’t know what’s okay to spend on and what isn’t.

- Managers approve reimbursements based on personal judgment, not company guidelines.

- Finance teams spend hours chasing receipts, clarifying claims, or rejecting vague expenses.

- Mistakes, overspending, or even expense fraud can go unnoticed.

This leads to tension, wasted time, and inconsistent employee experiences, all of which can be avoided.

Top 3 Pain Points for Finance & HR Teams

- Unclear Expense Submissions

Employees submit claims without receipts, vague justifications, or missing cost breakdowns, leading to back-and-forth and delayed reimbursements. - Manual Approval Bottlenecks

Managers and HR teams get stuck reviewing individual expenses without a framework, often approving items inconsistently across departments. - Lack of Spend Visibility

Without a centralized policy or tooling, it’s nearly impossible to track where money is going, spot patterns, or flag non-compliant expenses in time.

Klippa’s Expense Policy Template for 2025

Creating a clear expense policy from scratch can be time-consuming, so we’ve done the heavy lifting for you. Download our free, customizable expense policy template, designed to help you implement transparent, company-wide expense guidelines with ease.

What’s Included in the Template

The template gives you a practical structure for building a professional expense policy. It includes:

- A clearly written policy outline to explain the purpose and intent

- Definitions of eligible business expenses

- A checklist of non-reimbursable items

- Proof of purchase requirements (including VAT and receipt rules)

- Travel and accommodation expense guidance with customizable limits

- Steps for submitting expenses and receiving reimbursements

- Policies for business gifts, remote work costs, and client-related expenses

- A section on fraud prevention and how violations are handled

- A disclaimer advising legal review and local compliance

You can easily edit and brand the document using placeholders like [Company Name] and [Enter Amount].

Who This Template Is For

This template is designed for:

- Startups or SMEs that need a ready-to-go policy framework

- Finance or HR teams tasked with improving expense control

- Any company moving from manual processes to a more structured approach

It’s ideal for teams who want a clear, professional, and adaptable baseline without starting from scratch.

How to Customize It for Your Company

You can quickly make this policy your own. Here’s how:

- Replace placeholders (like [Company Name] and [Enter Amount]) with your real values

- Add or remove sections based on your business model

- Align policy rules with your team’s location, size, and internal tools

- Incorporate it into your onboarding documents, employee handbook, or HR portal

—————-

Disclaimer: This policy template is a template and should be tailored to each organization. It may not take into account local laws, and it is not a legal document. Klippa is not liable for any issues that may arise from using this policy handbook.

——————

How to Create Your Own Expense Policy

You don’t need to start from scratch, but if you want to build your own expense policy instead of using a template, here’s a breakdown of the key sections to include, what they’re for, and tips to make them clear and effective.

1. Policy Outline

Start with a short summary of what your expense policy is and why it exists. This sets the tone for the document.

What to include:

- Why expense guidelines are important

- A one-liner about who the policy applies to

- A note that employees are expected to act responsibly

2. Scope

Clarify which employees and types of spending are covered.

What to include:

- Who can claim expenses (e.g., full-time, part-time, remote staff)

- What counts as a business expense

- A disclaimer that all claims must be reviewed before reimbursement

3. Proof of Purchase

Explain what documentation is needed to process reimbursements.

What to include:

- Receipt or invoice requirements (e.g., must include business name and VAT)

- Whether digital copies are accepted (e.g., scanned via an app)

- A reminder not to submit expenses without proper proof

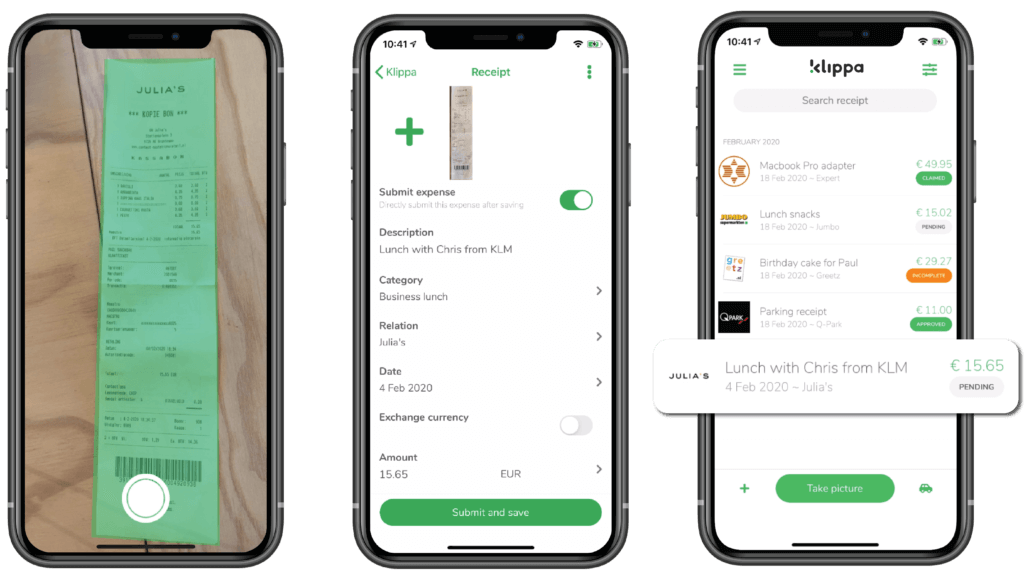

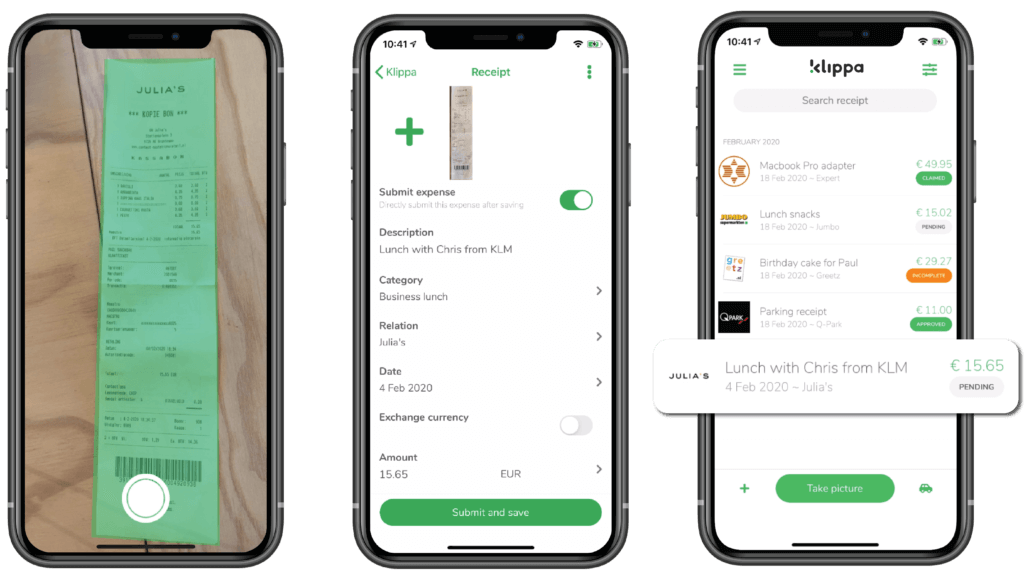

Tip: Recommend an app like Klippa, available on the App Store and Google Play, to make scanning easy.

4. Minimizing Expenses

Encourage smart, cost-conscious spending without being overly strict.

What to include:

- Guidelines for booking flights, trains, hotels, and meals

- A general rule of thumb like: “If it were your money, would you still spend it?”

- Advise to check with HR if unsure

5. Travel Expenses

Break down what’s reimbursable during business trips.

What to include:

- Transport (e.g., flights, trains, car rentals)

- Lodging limits per night

- Meal allowances per day

- Personal car mileage reimbursement and what proof is needed

- Medical/legal travel documents (e.g., visas, vaccinations)

6. Non-Reimbursable Travel Expenses

Set boundaries by listing what won’t be reimbursed.

What to include:

- First-class upgrades, personal items, entertainment

- Expenses by non-employees

- Traffic fines or damages

- A reminder to ask HR if something is unclear

7. Procedure

Walk employees through how to claim expenses.

What to include:

- Who books what (e.g., HR books hotels, employees submit meals)

- When and how to submit receipts

- Deadlines for submitting claims

- How long does reimbursement typically take

8. Business Gifts

Define what’s allowed when gifting clients or partners.

What to include:

- Annual limit per recipient

- Pre-approval requirements for gifts over that limit

- Note on tax implications, if applicable

9. Other Expenses

Cover work-related costs that don’t fall under travel.

What to include:

- Home office setup

- Work phones, laptops, software

- Client dinners or team events

- Reminder that these may be capped and require pre-approval

10. Fraud

Include a short section on trust and compliance.

What to include:

- What counts as fraud (e.g., duplicate claims, inflated receipts)

- How your company handles checks (e.g., random audits)

- Possible consequences of misuse

Expense Policy Best Practices

Even a well-written expense policy can fall flat if it’s too complicated, too vague, or doesn’t match how your team actually works. Here are a few common mistakes companies make and how to avoid them.

Keep It Simple, Not Over-Engineered

One of the biggest traps? Overloading the policy with exceptions, edge cases, and overly formal language. This leads to confusion and inconsistent application.

Tips:

- Use plain language that any employee can understand

- Focus on core categories instead of listing every possible scenario

- Add examples sparingly to clarify, not clutter

Set Clear Caps and Limits

Vague phrases like “reasonable costs” leave too much room for interpretation. Employees and managers need to know the boundaries.

Tips:

- Define daily caps for meals, hotel stays, mileage, and gifts

- Include guidance on when pre-approval is needed

- Use placeholders like [Enter Amount] in your template and customize based on role, location, or seniority

Align Spending With Company Values

An expense policy isn’t just a financial tool, it reflects your culture. Whether you prioritize frugality, sustainability, or employee comfort, your policy should reinforce that.

Tips:

- Mention preferred vendors or travel standards if applicable

- Set expectations that reflect your company’s tone and values

- Encourage employees to act as stewards of company resources

Make Approval Workflows Frictionless

Even the best policy can fall apart if the process to submit, approve, or reimburse expenses is a pain. Bottlenecks lead to delays, frustration, and compliance issues.

Tips:

- Use an expense management tool like Klippa to automate and streamline workflows

- Define who approves what and by when

- Set a realistic reimbursement timeline (e.g., within 14 days of approval)

How to Automate Your Expense Policy with SpendControl

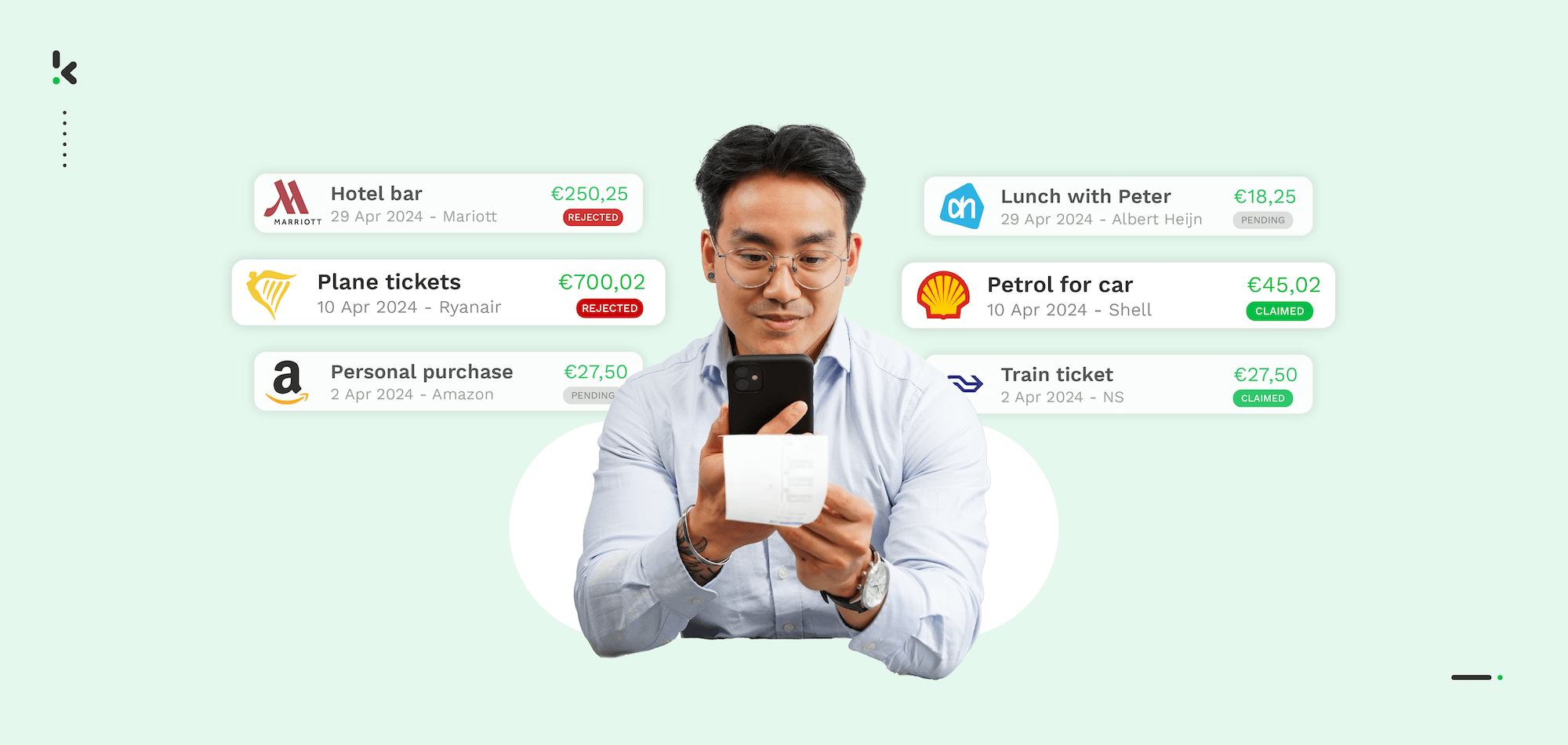

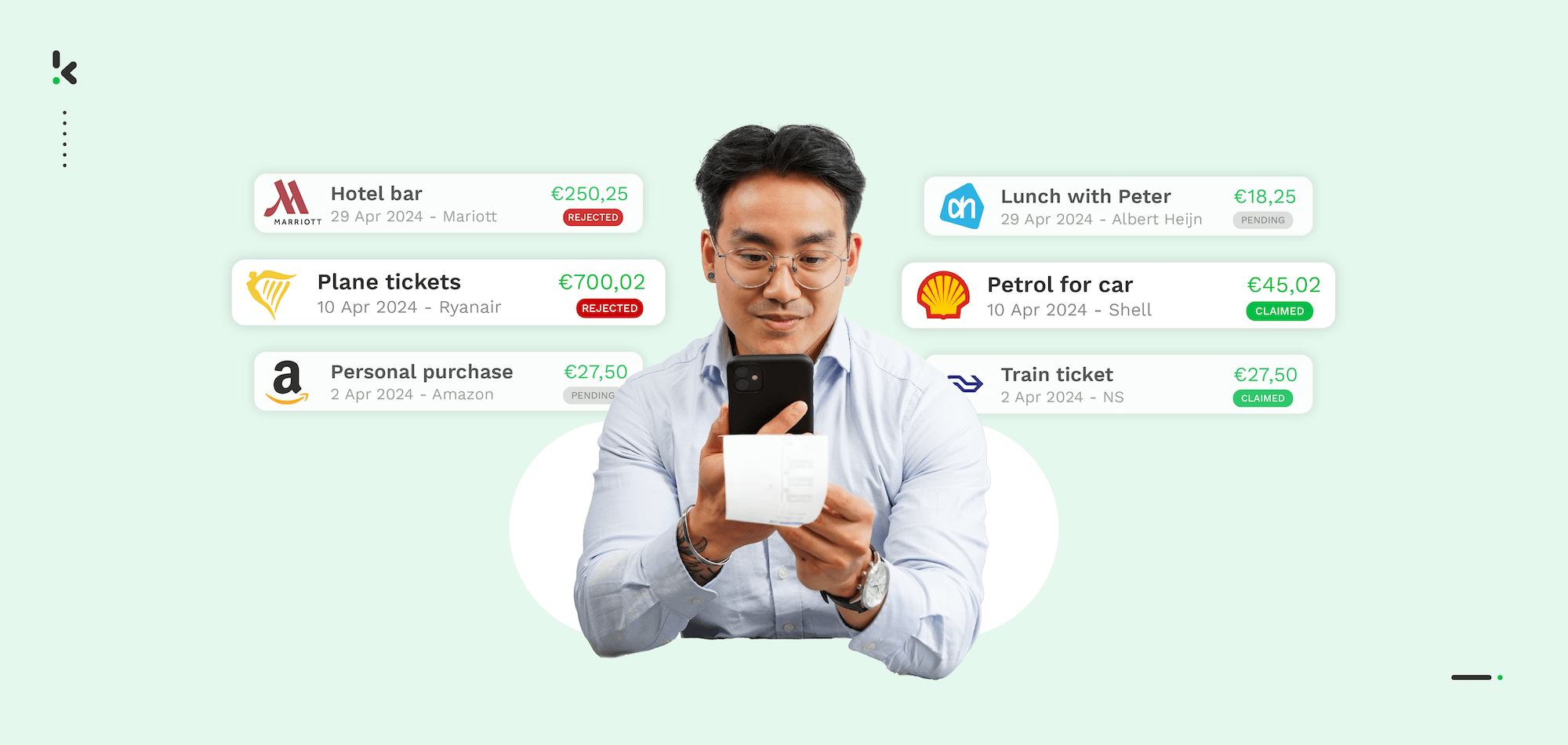

A good policy is a great first step, but managing expenses manually still creates delays, mistakes, and frustration. That’s where automation comes in. Tools like Klippa SpendControl help you put your policy into action with way less admin and way more control.

Klippa SpendControl transforms your expense policy into a seamless, automated process, offering:

- Automated Expense Management: Streamline your finances by automating expense management, ensuring timely payments and reduced hassle.

- Real-Time Spending Insights: Gain complete visibility into your company’s spending patterns, helping you make informed financial decisions.

- Effortless Receipt Handling: Employees can easily upload receipts via the mobile app, reducing manual entry and errors.

- Customizable Approval Workflows: Set up multi-level approval processes that align with your company’s hierarchy and policies.

- Seamless Integrations: Connect SpendControl with your existing accounting and ERP systems for a unified financial ecosystem.

- Enhanced Fraud Prevention: Utilize built-in features to detect duplicate submissions and ensure compliance with company policies.

By automating these aspects, SpendControl not only enforces your expense policy but also enhances efficiency and accuracy across your financial operations. Feel free to contact us or book a demo below to see how it works in action.

FAQ

Ideally, review your policy at least once a year or whenever there are changes in tax laws, company structure, or travel habits. Even small updates can help avoid confusion and keep things compliant.

If your policy requires a valid receipt, the expense may be rejected unless an exception is clearly outlined. Some companies allow a signed statement for small amounts, but it’s best to enforce consistent documentation.

Yes. It’s common to create flexible rules for remote teams, especially for home office setup, internet costs, or coworking spaces. Just make sure these exceptions are clearly defined in the policy.

You can either reject the overage or reimburse only up to the capped amount. Make sure your policy is clear on this point, and encourage employees to get pre-approval if they expect to exceed limits.

Keep it visible and accessible. Add it to your onboarding materials, internal wiki, or HR portal. A quick kickoff meeting or short video walkthrough can also help teams understand how to use it and avoid common mistakes.