Every business deals with expenses, but the way you report these expenses may differ. Many companies use expense reports to itemize expenses. To use expense reports most effectively, it is important to understand what expense reports are and what they consist of.

Also, it is important to know that the traditional way of processing expense claims takes a lot of time. In fact, according to The Global Business Travel Association, it takes an average of 20 minutes to process an expense report. One in five of these claims is rejected due to errors. It then takes another 18 minutes to correct and approve a rejected expense report.

Considering the high processing time and hourly rate of the person processing expense reports, how much does your company spend on processing expense reports?

In this article, we explain what an expense report is, what the pros and cons are, and finally show you how you can automate your claim process with an expense management software.

What is an Expense Report?

Let’s start at the beginning. Company expense reports are a form that employees fill out to itemize the expenses for which they are claiming reimbursement. As proof of expenses, receipts are usually attached to the form.

The employer checks the expense report with underlying receipts for accuracy and validity and pays the employees the amounts requested. Afterward, the employer can book the reimbursed amounts as business expenses, which count toward accounting and tax results.

An expense report includes expenses that can be both taxed and untaxed, such as travel, lodging and meal expenses. A calculation of possible expenses can also be made in advance based on rules established by law. This ensures that the employee is already compensated for the possible costs without having to pay these costs themselves in advance.

When preparing a good expense report, it is necessary to know what the basic components are of an expense report. In the following section, we explain what content is essential for preparing expense reports.

What is Included in an Expense Report?

The employer needs some essential information from the employee that relates to expenses in order to properly process an expense report. At a minimum, an expense report contains the following information:

- Date: Date the product or service was purchased

- Supplier: Location where the product or service was purchased.

- Expense category: Category related to the expense incurred, such as client, project, department, etc.

- Employee: Name of the employee who incurred the expense

- Additional notes: Notes related to the expense incurred

- Subtotal: Subtotal of expenses incurred before tax deduction

- Tax: Forms of tax or VAT related to the expenses

- Total: Grand total of expenses incurred after tax deduction

- Proof: Confirmation of expenses in the form of a receipt or invoice

Nevertheless, there may of course be other information on an expense report that is essential to your business. In that case, you can prepare your expense report in order to collect all the necessary information for proper processing.

Types of Expense Reports

There are three main ways companies categorize expense reports, each offering a distinct view of their spending. These reports track expenses based on the frequency with which they are submitted.

Regular Reports

They are the workhorses of expense reports and are submitted frequently, often weekly or monthly. They record all business-related costs incurred during that period. Think of them as the equivalent of a timesheet.

Long-Term Reports

For projects with ongoing costs spread over a longer period, long-term reports come into play. Spanning quarters or even a year, they help track these expenses and ensure projects stay within budget.

One-Time Reports

Business trips, conferences, or special events often generate unique sets of expenses. One-time reports are specifically designed to capture all T&E costs associated with that singular occasion.

How the Expense Report Process Works

To get a clear view of how expense reports are processed, it is important to map out step by step what happens to an expense report. The procedure of processing an expense report is as follows:

- An employee fills out an expense report to get reimbursed for expenses incurred by the employer.

- When an employee submits an expense report, it often reaches the supervisor first.

- The supervisor reviews the submitted expense report and decides whether it is approved and may be forwarded to the finance department for payment.

- If the expense report does not meet the established requirements, the supervisor may mark the expense report as incomplete or even reject it.

- If the submitted expense report is labeled incomplete, the employee will be asked to amend the expense report or clarify the expenses incurred.

- After the expense claim is approved by all approvers, the claim is forwarded to the finance department.

- The finance department will categorize the reimbursement as a business expense and proceed with the reimbursement process.

A company can also engage an additional approver when expenses incurred exceed a certain threshold. For example, a company may choose to request additional approval from a board member for high amounts above €10,000. As a company, you can establish your own regulations for this in a reimbursement policy.

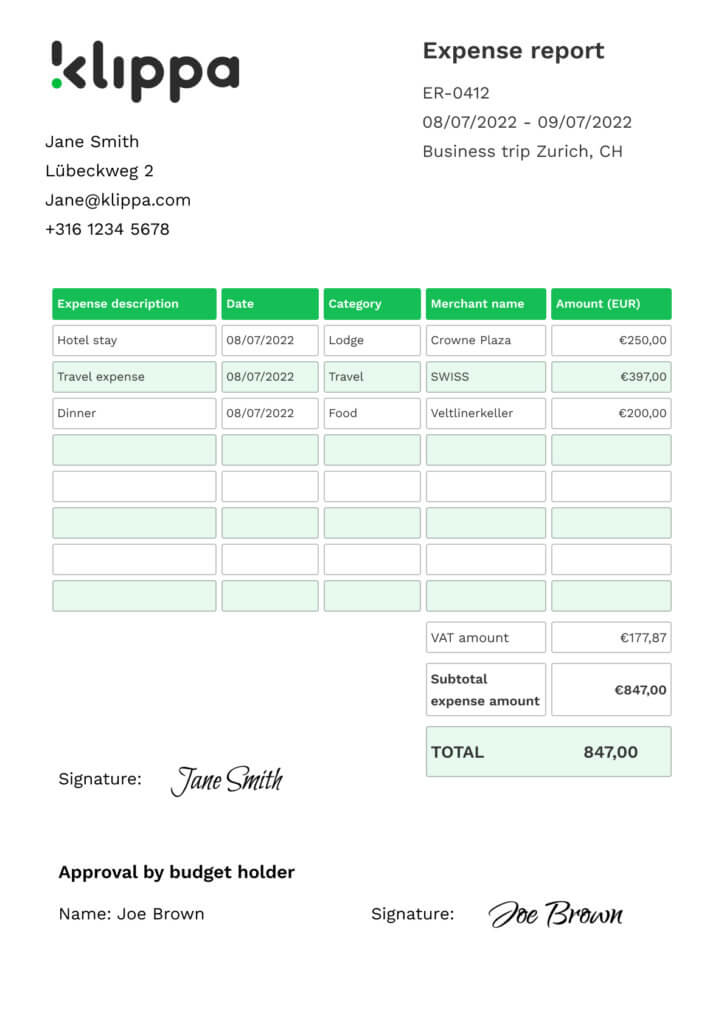

In the following section, we will show you how an expense report is prepared using a fictitious business trip to Switzerland. A business trip is a common situation in which expense reports are used. This is because it allows you to easily itemize all expenses incurred during a business trip and ultimately get these expenses reimbursed by the employer.

Example of an Expense Report

Suppose you are traveling to Zurich for a short business trip. You fly from Amsterdam to Zurich on the 8th of July. The flight ticket booked costs €397. In addition, a hotel is booked for €250, and expenses are incurred for a dinner with a business partner for €200.

After the business trip, an expense report was prepared that reported all of the employee’s expenses. Based on the example given, the expense report looks as follows:

In the next section, we explain the benefits and drawbacks of using traditional expense reports.

Benefits of Expense Reports

Recording expenses through expense reports has several benefits:

- Itemizing expenses incurred

- Budgeting over specified reporting periods

- Strengthening internal control

- Support with tax deductions

- Preparation of financial reports

Itemizing expenses incurred

First of all, expense reports help in identifying and itemizing all expenses incurred. This maintains a clear overview for the finance department, which ultimately processes expense reports and pays out the refundable amount to employees.

This allows the finance department to keep track of the expenses incurred, which ultimately processes expense reports and pays out the reimbursable amount to employees.

Budgeting over specified reporting periods

Also, using expense reports helps your company budget for total company expenses over a given reporting period. This provides insight into spending patterns and helps identify budget overruns.

Strengthening internal control

The use of expense reports strengthens internal control within the company as well. Internal control refers to the procedures and regulations regarding financial processes used by the company. This ensures the accuracy of the financial information.

Support with tax deductions

In addition, preparing expense reports helps to properly identify tax deductions. This can provide financial windfalls for both the company and the employee.

Preparation of financial reports

Lastly, the use of expense reports contributes to the preparation of financial reports by collecting financial data. This provides insight into the company’s financial situation.

Drawbacks of Traditional Expense Reports

In addition to the benefits, there are several drawbacks associated with expense reports:

- High costs and processing times

- Human error

- Accumulation of claims

- Potential for financial fraud

High costs and processing times

As mentioned in the introduction of this article, the processing time and cost of processing expense claims are quite high. Also, one in five expense reports is filled out incorrectly, making the processing time per claim even higher.

Human error

An important drawback of traditional expense reports is that many expense claims are still reviewed manually. In addition to the high cost and processing time, traditional methods of expense reporting processes also lead to a high percentage of data entry errors.

Accumulation of claims

Because of the high processing time, expense claims can pile up and flood inboxes. This causes the person processing expense claims to lose sight of the piles of claims and makes employees wait a long time for reimbursements.

Potential for fraud

In addition, a manual expense claim process easily falls prey to fraud because of the limited oversight. For example, someone might submit a claim twice or even edit a receipt, making the claim higher than the expenses actually incurred.

Expense reports have many benefits, but the drawbacks weigh heavily. Still, getting rid of expense reports completely is not an option. What should you do instead? We have the solution for you.

Automate Your Expense Reporting with Klippa SpendControl

The challenges of using expense reports can be solved by automating the expense reporting process. The best way of doing this depends largely on your company size.

For relatively small companies, it may be an idea to use expense report templates to quickly and easily prepare expense reports. These templates are pre-made and contain all the information needed to reimburse expenses.

However, as your company grows and the number of departments increases, you will deal with a significant amount of expense reports. In such a case, fully automating the expense claim process is a solution to efficiently and quickly process your expense reports.

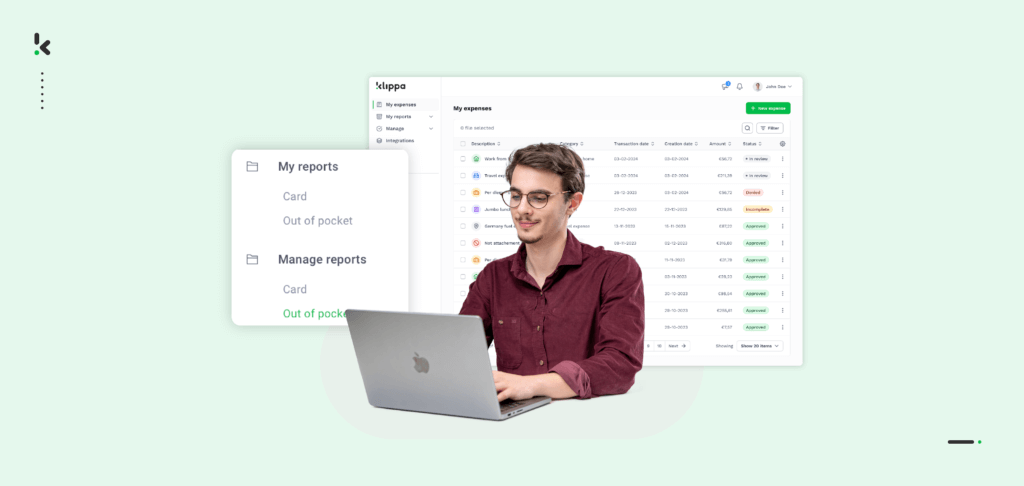

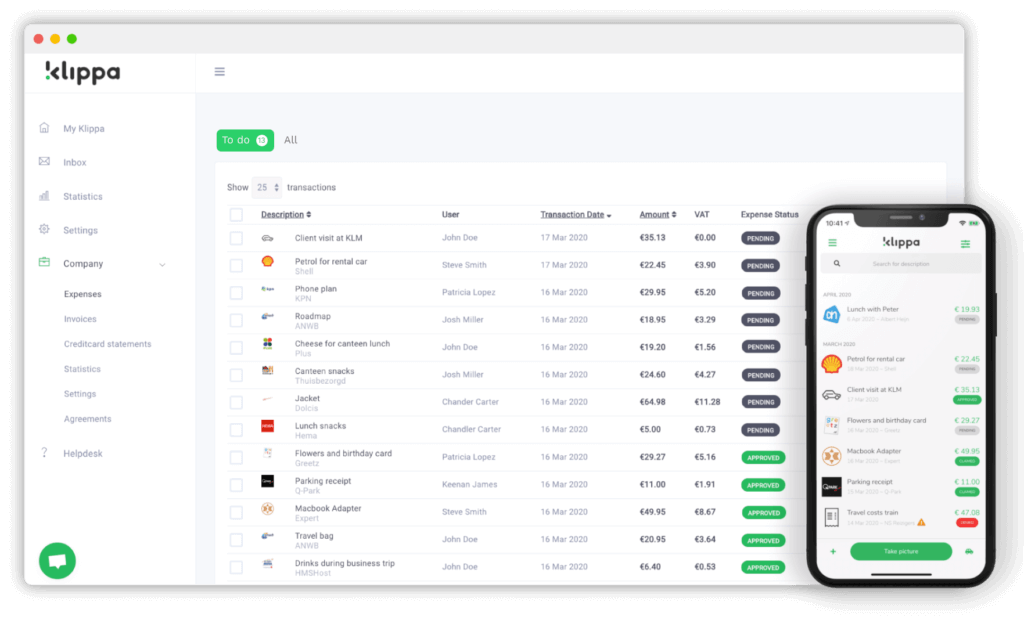

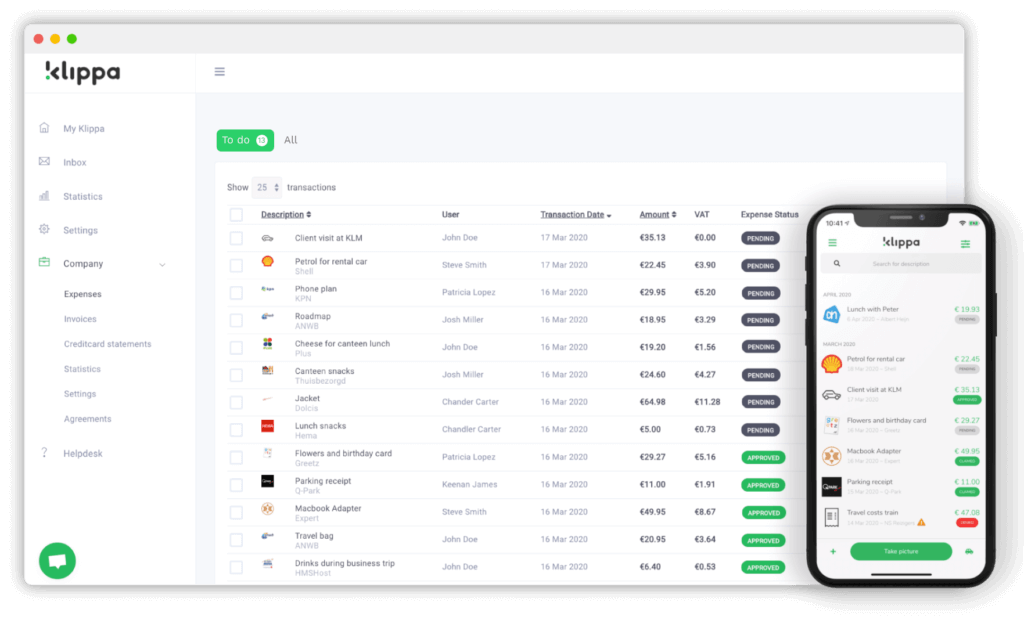

Automating and digitizing expense reports can easily be done through digital expense claim solutions, such as Klippa SpendControl. Klippa SpendControl is a comprehensive expense management solution that lets you effortlessly claim, approve, and book your expenses using either the mobile app or desktop platform. Klippa’s expense reporting module enables to report expenses quickly and efficiently:

- Easily submit and approve expense reports in just a few clicks via the web or mobile application.

- The built-in OCR technology, powered by Klippa’s proprietary OCR technology named DocHorizon, eliminates the need for anyone to manually retype receipts and prevents receipts from getting lost in the process.

- The built-in OCR technology also saves an enormous amount of processing time and therefore costs.

- The amount of data entry errors is significantly reduced because of the OCR technology.

- Implement your expense reporting policy by means of smart business rules and automate the approval process.

- The automatic categorization prevents the loss of overview in the reports.

- Prevent duplicate receipts and/or fraud with the built-in pixel-level analysis and recognition of duplicate and anomalous claims.

By eliminating the manual processing of expense reports, you can save a tremendous amount of time and costs. Also, our built-in OCR technology prevents manual errors when entering expense reports. The OCR technology reads your receipts and converts them into data within seconds.

Want to learn more about our solution or what Klippa can do for your business? Schedule a free demo where we will show you how we can help you digitize your expense reporting process.