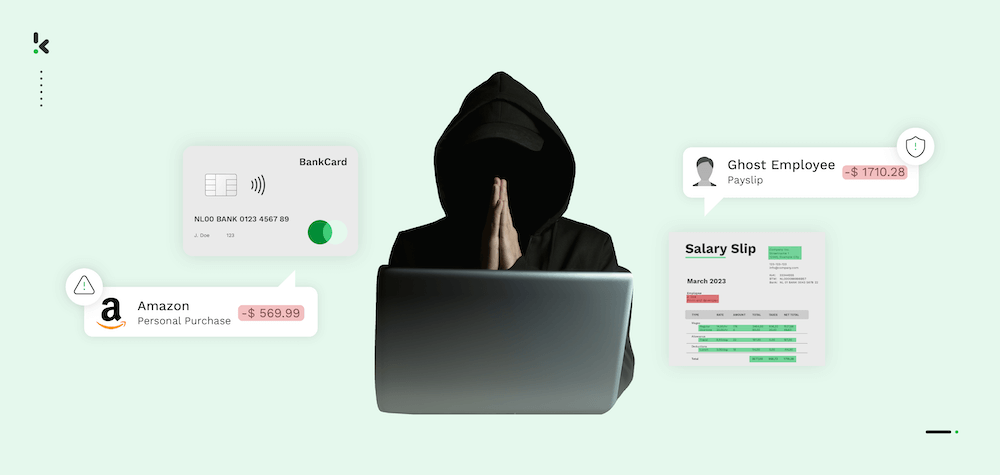

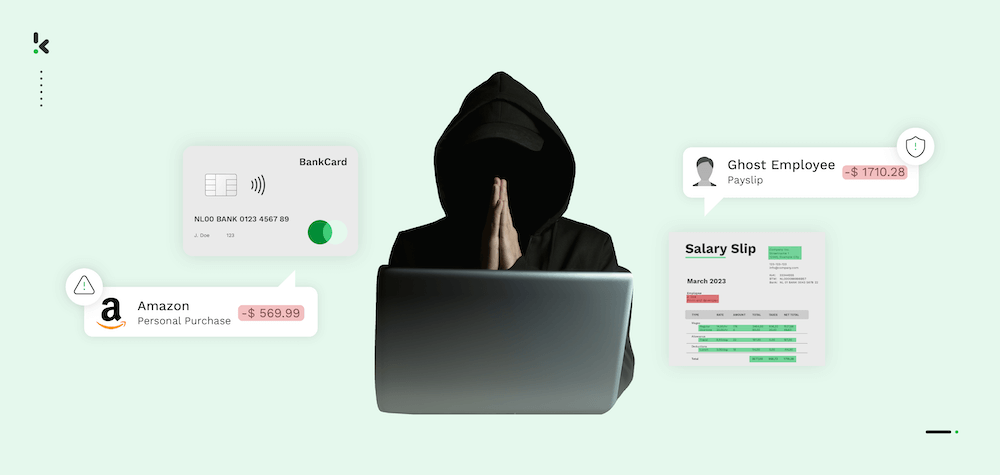

Financial statement fraud seriously threatens any organization, undermining trust, damaging reputations, and leading to severe economic and legal consequences. With deliberate manipulation of financial data, successful fraud schemes result in misled stakeholders, inflated valuations, and compromised business integrity.

But how can companies defend against these fraudulent financial statements? Automation offers a powerful defense by minimizing human error, enforcing consistent policies, and detecting anomalies in real time. Coupled with strong internal controls, companies can build a system that prevents fraud before it takes root.

In this blog, we will explore the various types of financial statement fraud, the warning signs often preceding these schemes, and the steps to address the fraud early. Let’s dive into practical solutions that will help protect your organization’s financial integrity and ensure long-term trust and accountability.

What is Financial Statement Fraud?

Financial statement fraud transpires when employees or stakeholders deliberately alter a company’s financial information to create a false picture of its financial health. Senior management often initiates these actions to meet projected targets, attract investors, secure favorable loan terms, or increase individual bonuses.

Any organization engaging in this behavior can face significant repercussions. Once the internal fraud is discovered, damage to corporate reputation, legal consequences, and a loss of trust among shareholders, lenders, and potential investors inevitably follow.

8 Types of Financial Statement Fraud

Financial statement fraud takes many forms, each designed to deceive stakeholders about a company’s true financial condition. Below we listed some of the most common examples of financial reporting fraud that could help you understand and recognize them in your business:

Overstating Revenue

This type of financial statement fraud schemes involves recognizing revenue before it’s earned or claiming income that doesn’t exist. This tactic gives the illusion of high sales or earnings, making the company appear more profitable than it is. Methods include early recognition of revenue from long-term contracts, fictitious sales, or recording nonrecurring income as recurring.

An example of overstating revenue fraud would be a company reporting revenue from a contract that spans two years entirely in the first year, misleading stakeholders into thinking annual revenue is much higher than it actually is.

In practice: The Enron scandal is likely the largest accounting scandal of the 21st century. Enron Corporation, a US-based energy, commodities, and services company, used deceptive accounting practices to mislead its investors about the firm’s performance.

This case revealed significant information asymmetry between management and investors, likely driven by personal incentives for the C-level executives for reaching high-set targets.

Ultimately, Enron acknowledged that it had overstated profits by nearly $600 million. Within approximately two months, the company declared bankruptcy, and the Justice Department initiated a criminal investigation.

Fictitious Revenue

Fictitious revenue fraud involves fabricating sales or inflating the value of legitimate transactions. This could involve creating fake invoices, using shell companies, or duplicating real transactions to exaggerate income. For example, a company can record sales to fake customers using fabricated invoices. These sales appear in the false financial statements, while no actual transaction or cash flow exists.

In practice: ZZZZ Best, a carpet-cleaning company, reported fictitious revenue from fake restoration projects. The company created false documents and even staged fake offices to deceive auditors, leading to the financial losses for investors and eventual bankruptcy of the firm, once the fraud scheme was uncovered.

Timing Differences

Timing differences are used to manipulate when revenues and expenses are recognized. By shifting revenue into earlier periods or deferring expenses, companies create a false sense of stability or growth. Common tactics include prebilling future sales, delaying recognition of expenses, or reinvoicing past-due accounts.

In practice: An executive at Koss Corporation embezzled over $31 million by manipulating the timing of financial entries and making unauthorized transactions for personal expenses. This fraudulent activity involved falsified entries and led to significant financial losses for the corporation over several years.

Inflating Asset Values

This financial reporting fraud involves overstating the value of assets to create a stronger balance sheet. Techniques include failing to account for depreciation, overvaluing inventory, or including intangible assets without proper justification. For example, a company continues to list machinery at its original purchase price, ignoring years of depreciation, inflating both total assets and equity.

In practice: In 2002, WorldCom, a telecommunications company, was exposed for inflating its assets by more than $11 billion. This was mainly achieved by misclassifying line costs as capital expenditures and by artificially boosting revenues through fraudulent accounting entries. The extensive fraud resulted in significant losses for investors and ultimately led to the company’s bankruptcy.

Concealing Liabilities

Liabilities, or accounts payable, are hidden or bypassed to make the company’s financial position appear much stronger. This includes off-balance-sheet financing, unreported loans, or failing to record obligations such as warranties or vacation pay.

In practice: Lehman Brothers, once one of the largest investment banks in the United States, used accounting tricks to temporarily remove securities from its balance sheet, making the company appear less leveraged than it actually was. In 2008, it was uncovered that the firm had concealed over $50 billion in loans, which ultimately led to its bankruptcy.

Improper Disclosures

Transparency is key in financial reporting. Fraud occurs when significant details, such as contingent liabilities, related-party transactions, or changes in accounting policies, are hidden or overlooked. Misleading disclosures can distort the decision-making process for stakeholders.

In practice: The infamous case of Theranos, a health technology company, serves as a prime example of failed disclosures. Throughout its years of operation, Theranos failed to provide critical information regarding the accuracy and reliability of its proprietary blood-testing technology.

The company operated for over a decade, committing $700 million in fraud against investors and the public. This lack of transparency and the misleading information given to investors and patients ultimately led to Theranos’ bankruptcy.

Falsifying Expenses

By understating or fabricating expenses, companies can artificially boost profits. This manipulation creates an inaccurate picture of operational efficiency and net income.

In practice: In 2003, the HealthSouth Corporation was exposed for recording fictitious revenues and expenses, overstating its earnings by $1.4 billion. It was uncovered that senior executives at the health-care giant had been falsifying financial results for more than five years to meet the stockholder expectations. The case led to legal actions and financial restatements.

Misappropriation of Assets

While often associated with theft or embezzlement, this form of fraud can be concealed within the financial statements. An employee might divert company funds for personal use and hide the theft by recording it as a legitimate business expense, such as travel reimbursement.

In practice: The founder of Satyam Computer Services, a global IT company based in India, admitted to inflating the company’s cash and bank balances by more than $1 billion in 2009.

The founder stated that, “What started as a marginal gap between actual operating profits and ones reflected in the books of accounts continued to grow over the years. It has attained unmanageable proportions.”

This misappropriation and falsification of assets led to a significant corporate scandal in India, often referred to as “India’s Enron”. Former Satyam officials were criminally charged with several offenses, while the accounting firm responsible for auditing the company was fined $7.5 million.

As you can see from all the different cases, by misrepresenting financial statements, financial statement fraud undermines trust, damages reputations, and carries serious legal and financial consequences. Recognizing these tactics is the first step in identifying and preventing them in your company.

What Are the Warning Signs of Financial Statement Fraud?

Detecting financial statement fraud early can save organizations from severe reputational, legal, and financial consequences. Below are detailed insights into the most common red flags that might indicate fraud:

Financial Warning Signs

- Revenue Growth Without Cash Flow Increase: If revenue is rising but cash flow remains stagnant or decreases, it may indicate fabricated sales or early revenue recognition

- Inconsistent Financial Patterns: Spikes in revenue or performance during the final quarter of a fiscal year

- Unexplained changes in assets, liabilities, or equity values

- Unusual Accounting Practices: “Aggressive” revenue recognition methods, such as recording sales before delivery or service completion

- Capitalizing expenses that should be recognized immediately as costs

- Suspicious Transactions: Complex third-party transactions with no clear business purpose

- Discrepancies in accounting reconciliations, such as missing invoices or altered records

Behavioral Warning Signs

- Unusual Personal Behavior: Employees or managers living extravagant lifestyle beyond their means or showing signs of financial stress

- Refusal to take vacations, possibly fearing the fraud will be uncovered in their absence

- Control Issues: Overly controlling management unwilling to delegate financial responsibilities

- Hostile or defensive behavior during financial reviews or audits

- Management Concerns: Obsessive focus on meeting short-term financial targets

- Loans or benefits extended to executives that are later written off

Organizational Warning Signs

- High Turnover: Frequent changes in key personnel, particularly in accounting or finance roles

- Sudden replacement of auditors or financial officers

- Single Decision-Maker: A single individual or a small group makes most operational and financial decisions without oversight

- Weak Internal Controls: Lack of segregation of duties within the accounting department

- Use of outdated or manual processes instead of automated accounting systems

External and Business Warning Signs

- Striking Differences with Industry Norms: Profit margins, revenue growth, or expenses significantly diverge from industry averages without a clear explanation

- Investments in high-risk industries or during economic downturns

- Omissions in Disclosures: Lack of transparency about contingent liabilities, legal disputes, or related-party transactions

- Misstatements or inconsistencies in public financial reports

- Insider Trading: Sudden stock sell-offs by senior management before the release of financial statements

Recognizing these warning signs is crucial for early detection. Organizations should foster a culture of transparency, strengthen internal controls, and prioritize regular audits to mitigate the risk of financial statement fraud.

Financial Reporting Fraud Detection

If you suspect financial statement fraud, taking immediate and decisive action is crucial. Follow these steps to address the issue effectively:

- Document the red flags: Record any anomalies or suspicious activities, including discrepancies in financial records, unusual transactions, or behavioral signs. Collect as much evidence as possible to support your concerns.

- Report internally: Notify your supervisor, manager, or compliance officer. If internal reporting channels exist, such as a whistleblower hotline, use them to ensure your concerns are formally addressed.

- Involve the auditors: Escalate the issue to the audit committee or internal audit team for a review. Provide the evidence you’ve gathered to help them investigate.

- Engage legal and financial experts: If fraud is confirmed or highly suspected, involve external forensic accountants and legal counsel. Their expertise will help uncover the full extent of the fraud and guide corrective actions.

- Isolate the responsible parties: Work with HR and legal advisors to suspend or remove individuals involved in the fraud while the investigation is ongoing.

- Notify regulators and stakeholders: In cases of significant fraud, inform regulators, such as the SEC or equivalent authorities, to comply with legal obligations. Communicate transparently with shareholders, lenders, and other stakeholders to rebuild trust.

- Strengthen internal controls: Conduct a thorough review of internal processes and implement stronger controls to prevent future incidents.

By acting fast and having proper procedures, you can mitigate the damage caused by financial statement fraud and protect the organization’s integrity.

How to Prevent Fraudulent Financial Statements

Financial statement fraud can undermine your company’s reputation and financial health. To address this risk, businesses need strategies that are clear, actionable, and grounded in practical steps. Here’s how you can create a fraud-resistant environment:

1. Automate Your Financial Processes

Automating financial workflows reduces reliance on manual processes, minimizes errors, and provides continuous oversight. Modern accounting automation software and spend management software not only simplify financial processes in your company but also actively detect anomalies that might signal financial statement fraud early on.

What You Can Do:

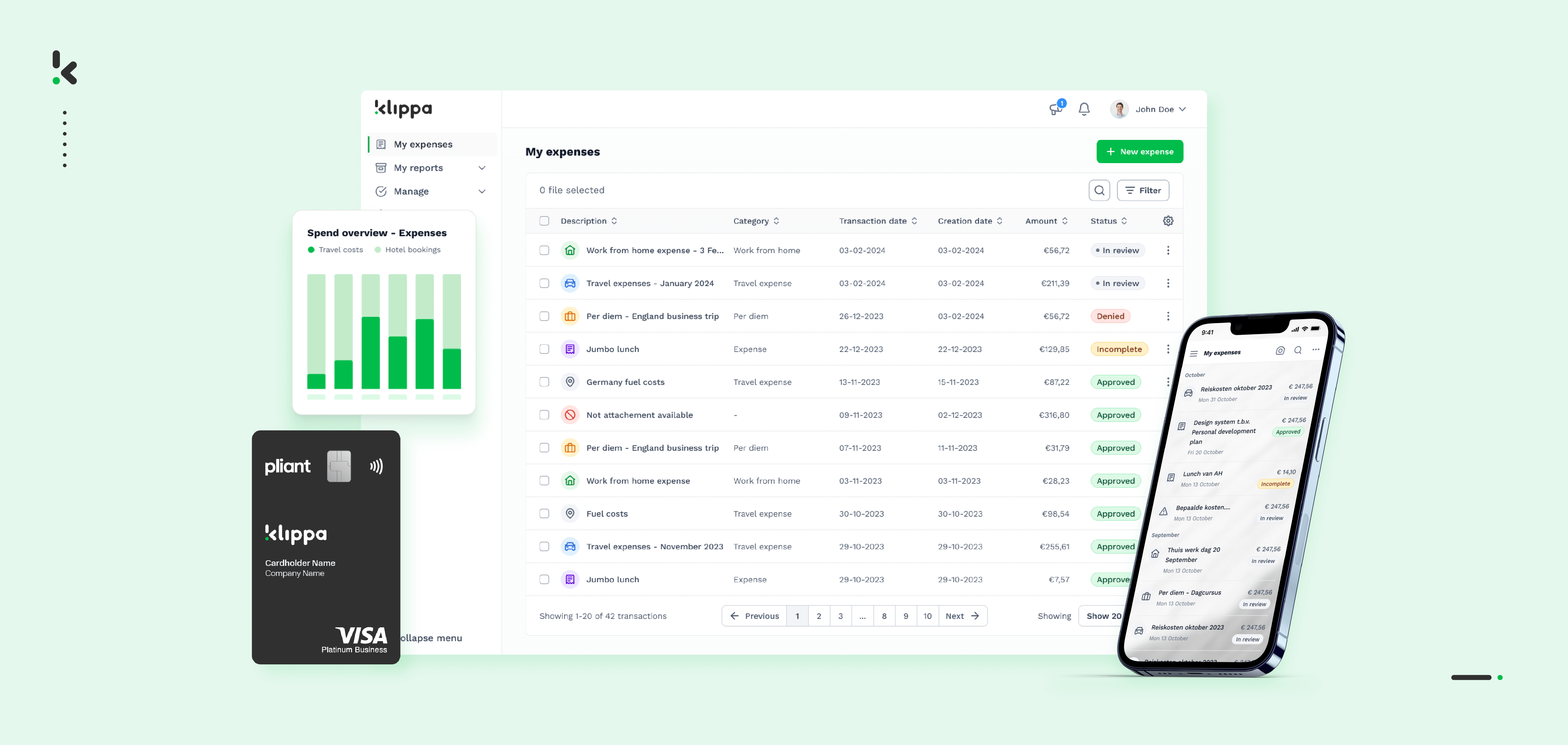

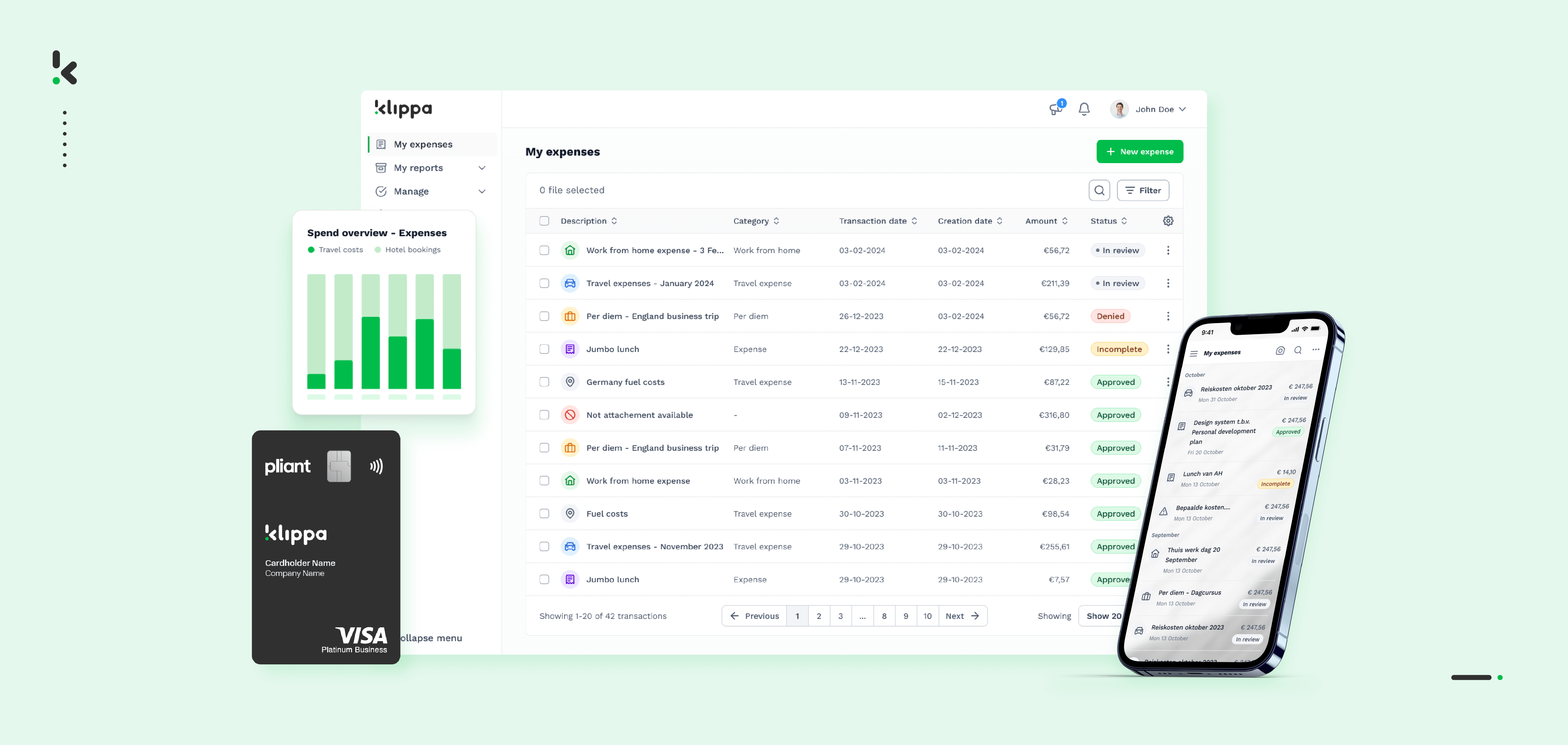

- Implement software like Klippa SpendControl to automate expense reporting, approval workflows, and transaction logging

- Enforce consistent expense policies through business rules and eliminate opportunities for manual manipulation of booked data

- Use software with built-in fraud detection features, such as flagging duplicate invoices, identifying unusual transaction patterns, or alerting users to revenue spikes

- Integrate systems that track real-time financial metrics, such as cash flow and budget compliance, that could help you to detect any sudden irregularities

- Employ automation to maintain accurate audit trails, ensuring every financial entry is traceable and tamper-proof

- Integrate your automation solution with other systems (e.g., bookkeeping or ERP systems) to sync all data and minimize human intervention

Automation not only strengthens financial fraud prevention but also distances unnecessary personnel from critical data, reducing opportunities for internal manipulation. Think of automation as your financial safety net – it works 24/7 to catch issues that might slip through human review.

2. Build Internal Controls That Actually Work

Internal controls should not exist just on paper, they need to function as an effective barrier against fraud. This means designing processes that leave no room for unchecked authority.

How to Strengthen Controls:

- Divide responsibilities for tasks like bookkeeping, approvals, and payment reconciliations so no single person controls the full process

- Require multiple sign-offs for high-value transactions, ensuring decisions are transparent and collaborative

- Conduct regular checks of financial records and policies to identify weaknesses before they can be exploited

3. Don’t Wait – Audit Regularly

Audits are not just for catching mistakes, they also act as a powerful deterrent. Knowing that records are regularly reviewed makes it harder for potential fraudsters to act.

Steps to Take:

- Schedule audits on a consistent basis, covering high-risk areas like revenue recognition and liabilities

- Surprise audits are especially effective, fraud thrives on predictability

- When discrepancies arise, call in forensic accountants to investigate deeply and objectively

4. Lead with Transparency and Ethics

Fraud thrives in secrecy. A culture that values openness and ethical behavior significantly reduces the risk of misconduct. Additionally, if educated on the consequences of the fraud properly (e.g. bankruptcy or financial losses that may affect compensation) employees will develop a sense of duty to report any suspicious activity.

Actions to Foster Transparency:

- Train employees to spot common red flags like altered invoices or unexplained financial gaps

- Set up anonymous reporting systems that protect whistleblowers and encourage them to come forward

5. Stay Ahead of Regulatory Compliance

Understanding and keeping track of the new regulations is not easy, but it’s an essential part of staying compliant and reducing any legal and financial risks.

How to Keep Up:

- Designate a compliance officer or team to monitor regulatory updates and ensure policies are current

- Attend industry seminars or webinars that focus on evolving financial laws and best practices

- Periodically review financial processes to ensure they meet the latest regulatory standards

6. Use Data Analytics to Spot the Unusual

Sometimes, fraud hides in plain sight. Thorough and periodical analysis of financial data can reveal patterns and trends that might otherwise go unnoticed.

How to Harness Analytics:

- Monitor key metrics like cash flow, expense trends, and revenue spikes for irregularities

- Use dashboard tools with real-time alerts for deviations from historical norms

- Combine analytics with human judgment – tools can flag anomalies, but interpretation adds essential context

By combining automated workflows and standardized processes, companies can create a strong defense against financial statement fraud. Because fraud prevention is not just about rules, it’s about creating an environment where fraud has no room to take root.

Prevent Financial Statement Fraud with Klippa

Prevent financial statement fraud by automating expense and invoice processing with a spend management solution. Gain control over your expenses by eliminating paper-based workflow, manual data entry and unsupervised physical approvals with Klippa SpendControl.

Klippa SpendControl is an all-in-one digital pre-accounting software that combines invoice processing, expense management, and corporate credit card modules for all your financial needs.

Our software utilizes Optical Character Recognition (OCR) technology to ensure 99% accurate document data capture, which eliminates manual data entry for secure approval, archiving, and booking of statements directly to your financial administration.

Klippa SpendControl offers many features that can help you prevent financial statement fraud early:

- Manage your invoices, expenses, and credit card transactions in one platform

- Control the submission, processing and approval of transactional documents via email, web or mobile app

- Ensure segregation of duties with custom roles and controls

- Customize your approval management with multi-level authorization flows

- Prevent expense report fraud with built-in duplicate and fraud detection

- Accurately track business mileage through our Google Maps integration

- Set strict business spending limits with our company credit cards

- Get real-time insights into your finances with our statistics dashboards

- Never fail to comply with your local tax and data privacy regulations with our ISO27001-certified and GDPR-compliant solution

- Integrate SpendControl with your accounting and ERP software, like Quickbooks, NetSuite, or SAP

FAQ

Financial statement fraud is the intentional misrepresentation of financial data by employees or stakeholders to portray a false image of a company’s financial health. This can involve practices such as inflating revenue, hiding liabilities, or falsifying expenses to meet financial targets, attract investors, or secure loans.

Key indicators of financial statement fraud include a mismatch between revenue growth and cash flow, sudden spikes in financial performance at year-end, and unexplained changes in assets, liabilities, or equity. Frequent discrepancies in financial records, overly complex third-party transactions, and behavioral signs like reluctance to delegate responsibilities or take time off can also signal potential fraud.

Financial statement fraud encompasses various deceptive practices, including overstating revenue by recording income prematurely, fabricating sales through fictitious transactions, or omitting liabilities to make the company appear more solvent. Other forms include inflating asset values by overestimating inventory or fixed assets and failing to disclose significant financial information, such as related-party transactions or contingent liabilities.

Detecting financial statement fraud involves analyzing discrepancies between revenue growth and cash flow, scrutinizing sudden changes in financial performance, and reviewing organizational processes for errors or anomalies. Regular audits, both internal and external, are crucial in identifying irregularities. Employing advanced data analytics tools can help uncover unusual patterns, while investigating reported behavioral or organizational red flags is equally important.

The repercussions of financial statement fraud are severe, ranging from legal penalties such as fines, criminal charges, and imprisonment, to reputational damage that erodes trust among investors, clients, and stakeholders. Financial losses can include declining stock prices, reduced access to funding, and even bankruptcy. Operationally, fraud can disrupt business processes and lead to the loss of key personnel, further compromising the organization’s stability.