Starting from May 1, 2024, the KSA will introduce new regulations in the gambling industry. The purpose of these regulations is to safeguard users from addiction and prevent them from getting into problematic situations by overplaying. As per the new rules, online gaming operators will have to conduct affordability checks on players to ensure they are not exceeding the new spending limits. These regulations are being implemented to address the rising popularity of gambling and the associated risks.

If you need a brief and easy-to-understand summary of the new regulations and how to comply with them, you’re in the right place!

What Are the New Gambling Regulations in the Netherlands?

Limits of Deposits depending on Players’ ages

Before the implementation of this rule, gambling providers were given the freedom to set their own deposit limits, often allowing deposits that exceeded 2000 euros per month. To address this issue, the KSA has set strict guidelines on the amount that a person can bet, based on their age:

- Individuals who are 24 years of age or older are subject to a limit of €700 in net deposits per calendar month.

- For young adults between the ages of 18 and 24, the limit has been set at €300.

If a user wishes to exceed the limit, they must provide the gambling business with a source of affordability. Let’s explore how this process works.

Request of Deposit’s Limits Extension

As we discussed earlier, online gambling operators allow individuals to place bets within specific limits set by the KSA. However, if someone wants to exceed the limit, they will need to prove that they can afford it.

It’s important to note that the limit cannot be higher than 30% of the player’s net income. Once the person provides all the necessary documents such as an identity document and a payslip or a bank statement, the gambling provider must verify them and confirm the limit that the player can bet within.

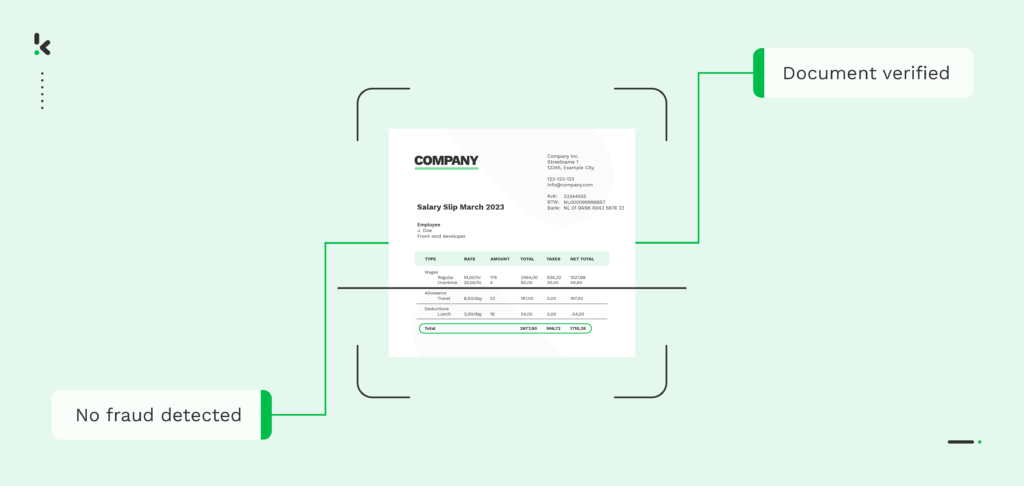

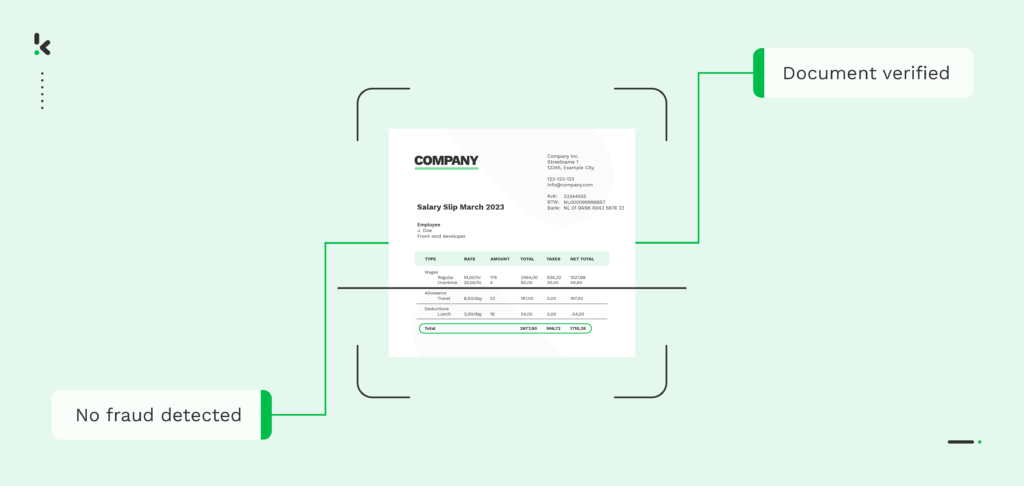

With the new regulations in place, it has become challenging for gambling operators to process these documents manually. Therefore, it’s highly beneficial to use an AI-powered document verification solution to automate document analysis, verification of authenticity, and detection of fraud.

How Klippa Helps You Comply with KSA New Regulations

Document Processing for Affordability check

Klippa assists gaming operators in handling various proof of income documents required by Dutch authorities, such as identity documents, bank statements, salary slips, and tax returns.

The process is quite simple. The players need to submit their relevant documents, and Klippa’s document verification solution will automatically extract the necessary information from each document, verify document authenticity, and cross-validates that information with other documents or databases. After the data has been verified, it can be sent to your database, application, or software to complete the affordability check.

Whether it’s extracting the date of birth for age verification or the salary details from a bank statement affordability checks, Klippa can assist you throughout the entire process. Additionally, our software supports redaction of privacy sensitive information to comply with the GDPR.

The document verification process happens in a matter of seconds, enabling you to minimize manual labor to fulfill your duty of care while ensuring compliance with KSA regulations.

Fraud Detection

As part of our document analysis process, we have measures in place to automatically detect fake documents. If we find any fraudulent activity such as photo editing software used in metadata or text being copied inside the document, Klippa will send you an email as notification. This applies to all document types submitted by our customers.

Our fraud analysis is designed to help identify any manipulated documents that may not be immediately obvious. This helps you fulfill your duty of care more effectively.

Simplify KSA Compliance with Klippa

To sum up, manually verifying documents can be a tedious and time-consuming task for your team. It is also difficult for the human eye to detect fraud in documents. This is where automation comes into play to streamline the process and make it more accurate and efficient for your business. By automating the process, you can enhance the user experience while also ensuring that the verification process is reliable.

If you’re interested in learning more, Klippa can assist you in complying new regulations in your workflows for your team and players effortlessly. Simply contact us or book a demo below.