If your finance team still spends hours manually entering invoice data, chasing missing fields, or correcting typos, you’re not alone. According to a study carried out by Zapier, 76% of AP clerks spend 1–3 hours a day moving data from one place to another, and less than 3 hours of their day on impactful work!

Manual invoice processing remains one of the most time-consuming and error-prone tasks in the accounts payable process. Yet, it doesn’t have to be.

Invoice capture automates the way businesses extract, interpret, and process data from invoices. By combining OCR (Optical Character Recognition) with machine learning, it turns unstructured documents into clean, usable financial data. The result? Faster approvals, fewer mistakes, and complete visibility across your invoice workflow.

In this article, we’ll explore what invoice capture is, how it works, and why it’s a crucial step toward true financial automation and business efficiency.

Key Takeaways

- Invoice capture (or invoice data capture) is the process of extracting, validating, and entering invoice information (e.g., supplier name, invoice number, total) into your bookkeeping system.

- Manual invoice capture is time-consuming, error-prone, and poorly scalable, especially as invoice volumes grow.

- Automated invoice capture uses AI/ML (including OCR) and can cut processing times by 40-70%, improve accuracy, reduce costs, and support scalability.

- A Human-in-the-Loop (HITL) approach combines automation with human review, offering high accuracy even on complex formats, though it still involves some manual effort.

- Key functionalities of an invoice-capturing solution include scanning, OCR conversion, data extraction/structuring, classification, anonymisation, and fraud detection.

- Important invoice fields to capture include: invoice number, date, total amount, VAT number, supplier details, line-item details, currency, due date, PO number, and more.

- Choosing the right solution means considering your invoice volume, format variety, accuracy requirements, and how well the tool integrates with your AP workflow and bookkeeping systems.

What is Invoice Capture?

Invoice capture or invoice data capture is executed by the accounts payable (AP) department and describes the process of extracting data from invoices, validating the extracted information, and entering it into the bookkeeping system.

For a small organization, this system might be just a paper book stating expenses, vendors that receive payments, and further payment details. But even for many AP teams in bigger organizations, the invoice-capturing process is still performed manually, requiring employees to enter data one by one into the bookkeeping system.

The same holds for the approval of invoices. It is often still done manually, involving a paper copy of the invoice moving from desk to desk. Imagine the chaos that is caused in a larger organization by having a manual invoice-capturing process like just described.

Luckily, this doesn’t have to be the case anymore, as Intelligent Document Processing (IDP) solutions, such as Klippa DocHorizon, have been developed for accounts payable teams to capture data from invoices automatically in order to adhere to some of the most effective and best practices in AP.

In the following paragraphs, we will discuss why invoice data capturing is important, followed by the different types of invoice capturing.

Benefits of Implementing Invoice Capture

Invoice capturing is important to avoid mismanagement and inaccuracy in an organization’s expenses. Accurate data and timely processed invoices are absolutely crucial as they impact the ability of an organization to operate. The reasons why invoice data capture is important include:

Better supplier relationship & employee satisfaction

When capturing invoices, it is crucial to minimize errors as the organization’s finances and relationships with suppliers and clients depend on this accuracy. Ensuring timely and correct payments prevents invoice backlogs and frustration among clients and employees.

Minimized data entry errors

Using an invoice data capture solution will provide you with more accurate data for expense tracking and budgeting, leading to better decision-making. It also helps prevent costly data entry mistakes, ensuring smoother financial management.

Prevention of late payment penalties

No one wants to receive late payments, nor want to receive late payment penalties. This is why the invoice-capturing process is important, as it helps you pay your suppliers on time.

Enhanced business scalability

Invoice capturing enables organizations to scale their business, increase the productivity of skilled employees, and reduce costs significantly without additional headcount.

So, in conclusion, a properly functioning invoice-capturing process has a severe impact on an organization. Read on to find out which options an organization has to capture data from invoices.

Different Methods to Capture Invoice Data

In the following paragraphs, we want to give a clear overview of the three different types of invoice capturing and present the advantages and disadvantages of each of them.

- Manual data capture

- Automated data capture

- Human-in-the-loop

1. Manual Data Capture

Manual invoice data capturing has been done for many years and has proven to become more challenging as organizations grow quickly. Accounts payable teams often receive invoices in various formats, such as hard copy, email attachment, or fax. Extracting data from these invoices manually becomes increasingly more challenging.

Let’s discuss the advantages and disadvantages first to help you form your own opinion.

Advantages

- For small organizations, manual data capture might be the smartest option, as no monthly license fee for software to be paid

- Manual data capture is the easiest one to implement

- Organizations with a low volume of invoices can keep an overview of expenses

Disadvantages

- The process is time-consuming, which leads to delayed payments or, even worse, late payment penalties → 45% of invoices take a week or longer to process

- Manual data capture is error-prone, which leads to unreliable information and costly mistakes

- High costs → Research firms like the Everest Group have found that manually processing a single invoice can cost between $12 to 30$ because the process is time-consuming and involves a lot of resources

- Low productivity since skilled employees have to spend their time on tedious, manual operations instead of utilizing their skills for value-adding work

- Poor scalability, as the manual management of invoices becomes almost impossible when an organization grows

- Poor supplier management because of delayed payments, poor communication, or mistakes

- Poor visibility due to paper-based invoices makes it difficult to share an invoice across departments

- Medium to large-sized organizations experience a backlog of invoices because of the volume of invoices, causing a delay in payment

Once organizations grow and experience an increased volume in invoices, manual invoice processing becomes an unpreferred option.

2. Automated Data Capture

Fully automated invoice data capture makes use of a software solution that can extract structured data from invoices without any human intervention. The software is based on artificial intelligence and machine learning, making it possible to improve accuracy, work more efficiently, and save valuable resources.

With the implementation of automated data entry, a lot of the challenges of manual data capture can be overcome. Let’s have a look at the advantages and disadvantages of this AP automation solution.

Advantages

- Enhanced data accuracy because the algorithm extracts the exact data that is presented

- 40 – 70% faster invoice processing, as the process is not limited to employees’ working hours and capacity

- Cost-effective because invoices can be processed quickly, which saves working hours of employees and prevents organizations from paying late payment penalties

- Scalable, as processes are not dependent on humans

- Algorithms don’t get tired or bored from repetitive tasks; no break or sleep is needed

- Increased productivity as accounts payable clerks can focus their time on value-generating tasks instead of repetitive, time-consuming tasks

- Predictable invoice capturing process, which allows organizations to ensure payment of clients and suppliers at a predetermined time and date

Disadvantages

- Algorithms might still experience errors when confronted with more complicated invoice formats

- A fundamental change in management and overall processes would be required

- Technical know-how to maintain the software might be required

3. Human-In-The-Loop (HITL)

Capturing data from invoices with a human-in-the-loop setup combines the best of a fully automated invoice-capturing solution (AI) with the best of human intelligence.

This data-capturing process makes use of software that is powered by artificial intelligence and machine learning, but also involves a human who validates and approves the extracted data. That way, the highest possible accuracy can be achieved.

Advantages

- Errors conducted by the software can be corrected by the human before the data is stored in the database

- The best of human intelligence is combined with the best of artificial intelligence

- The highest possible level of accuracy is achieved because the extracted data is double-checked by a human before it is saved in the database

- Makes use of the speed of automated invoice data capturing

- Even data from difficult invoice formats can be extracted, as both humans and AI work together

Disadvantages

- It still involves the resources of an employee

- The data capturing process is limited by the working hours and the capacity of the human-in-the-loop

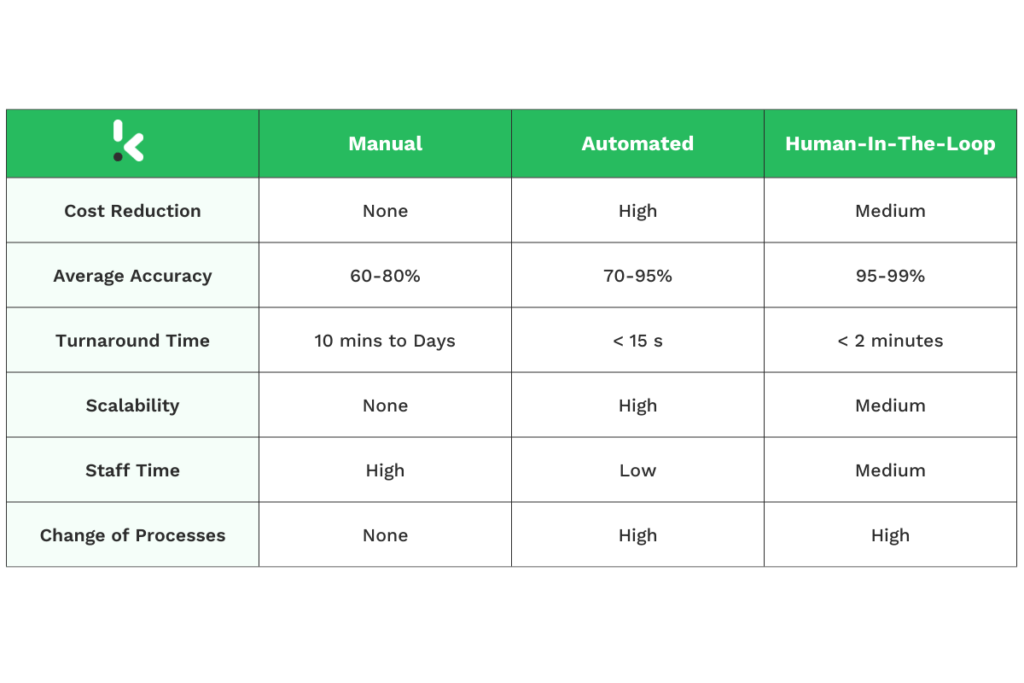

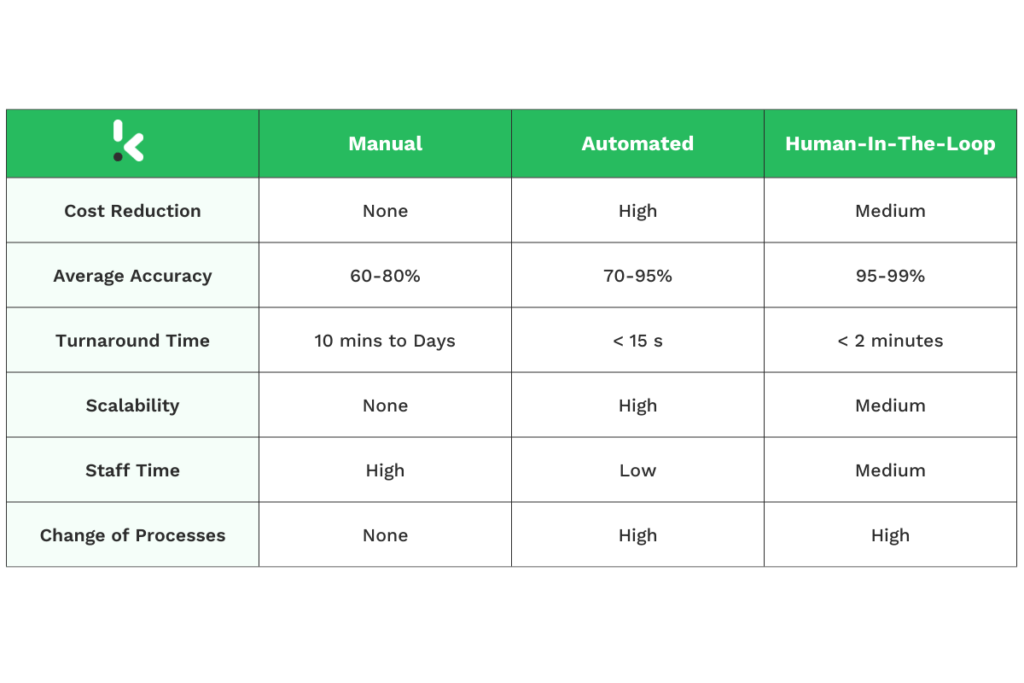

Comparison of the Three Options

The table below shows a comparison between the three different options: manual, automated, and human-in-the-loop data capture.

With this overview, it becomes clear right away which option might be best for your organization.

For many organizations, manual data capture is not an option due to the high volume of invoices that need to be processed. In these cases, an automated invoice-capturing solution becomes a necessity.

In the last sections of this blog, we will discuss the functionalities, working, and implementation possibilities.

Key Functionalities of Invoice Capture Technology

Now that we have discussed the three different types of invoice data capturing, we would like to dive deeper into the details of invoice capture software. We will discuss the following functionalities of the solution:

- Scanning

- Optical Character Recognition (OCR)

- Data extraction

- Conversion

- Classification

- Data anonymization

- Fraud detection

Scanning

An invoice-capturing solution offers invoice-scanning functionality. Here, scanning is referred to as the process of reading an invoice with OCR, which will be further explained in the next paragraph.

Once the scanning process is complete, all relevant information is converted into structured data. Large parts of the scanning process can be automated by smart solutions like the Klippa OCR API or document scanning SDK.

Optical Character Recognition (OCR)

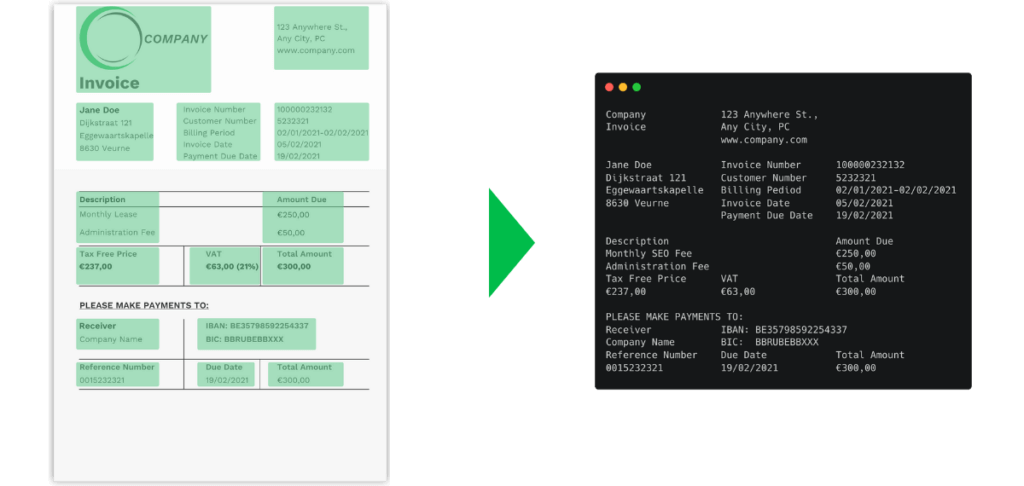

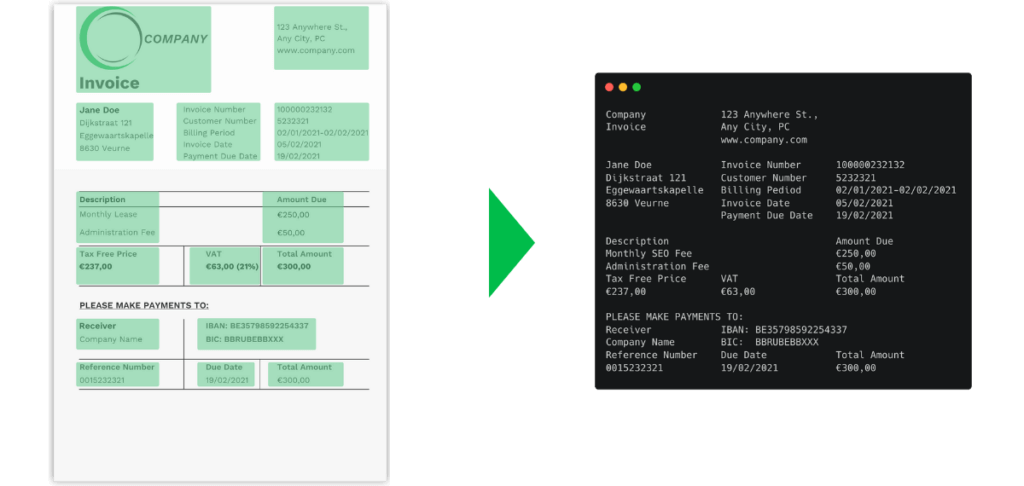

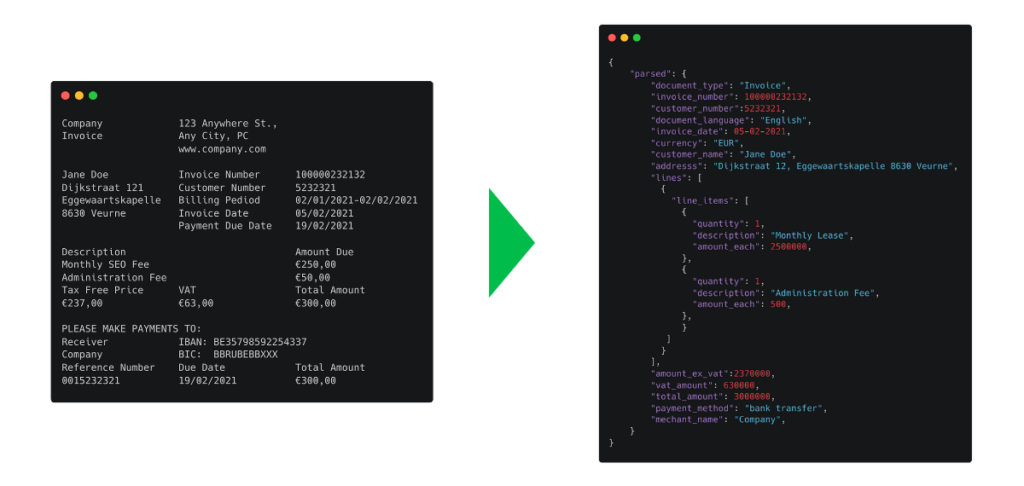

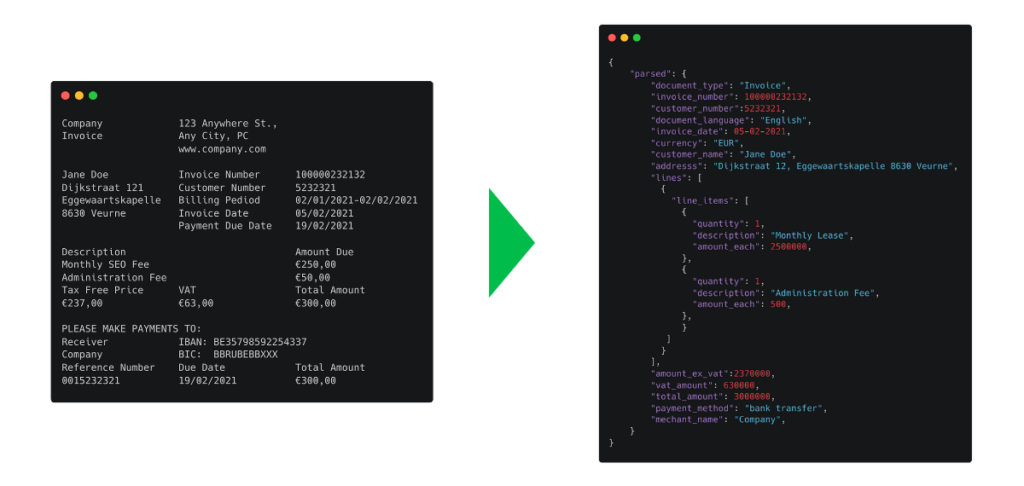

Optical Character Recognition (OCR) works in a way that it turns an image into text and then into a machine-readable format such as CSV, JSON, or XML. With this technology, manual data capturing from invoices is history!

Often, OCR is powered by AI and has proven itself to be very helpful with invoice data capturing, as it helps employees work faster and with a minimal error rate.

Data Extraction

An invoice-capturing solution also offers the functionality of data extraction. The organization’s operations and processes can be further improved by extracting data from an invoice, and then processing, storing, and analyzing this data accordingly.

Conversion

Pictures are sometimes difficult to work with. That is why the invoice-capturing solution has the functionality to convert a picture into a digital text file.

That way, pictures and PDFs can be converted into formats such as JSON, CSV, XML, PDF/A, and XLSX.

Classification

An additional functionality of an invoice-capturing solution is the sorting and classification of unknown documents. This process is also known as document classification and works with the help of smart algorithms.

Characteristics of a document are extracted and sent to an algorithm, which will then determine how to classify the document. This can be useful for a number of use cases. One example could be the classification of a document with sensitive data, such as the name and address of a client on an invoice, resulting in the action of data anonymization.

Data Anonymization

Data anonymization is also known as data masking. With this security technique, sensitive data on documents can be masked and the abuse of information prevented.

Our ultimate guide to data masking offers a more in-depth explanation of the data anonymization process and explains the different techniques that can be used.

Fraud Detection

Sadly, fraudsters are often using technology, such as Photoshop, to create fake invoices or manipulate the total amount of a purchase.

An invoice-capturing solution can be used to detect these attempts of document fraud. The software would automatically flag these invoices and save an organization a lot of money.

How Invoice Capture Automation Works

We all know how the manual process of invoice capturing works, but how does an automated solution like Klippa DocHorizon execute the task? In the coming paragraphs, we will discuss the four steps of the automated invoice OCR capture process:

- Capturing and uploading the invoice to the API

- Converting the image into a text file

- Parsing TXT into JSON

- Verifying the extracted data

1. Capturing and Uploading the Invoice to the API

In the first step, an image or PDF file of an invoice has to be uploaded to the API. This can be done via a mobile or web application.

The invoice can be uploaded either with or without the background. If the image is sent uncropped, the API will automatically cut out the background.

It is important that the image contains the entire invoice, without any noise and with decent quality, to ensure an accurate result. If this is hard to achieve with an existing solution, the image quality can be enhanced by using our mobile scanning SDK.

2. Converting the Image into a Text File

In the next step, our invoice-capturing solution will automatically convert the image into text (TXT). The software recognizes what each part of the invoice actually is. It will determine which part is, e.g., the invoice number, total amount, the address, or the purchasing date.

The data from the invoice is extracted, but not yet structured.

3. Parsing TXT into JSON

In the final phase, the Klippa parser converts the text file into JSON with the help of machine learning.

JSON is commonly used for transmitting data in web applications, as it is a standard text-based format for the representation of structured data.

From here, it will be very easy to process the captured invoice data in your database.

4. Verifying the Extracted Data

This step is optional and used to verify that the data is captured with high quality, accuracy, and consistency.

Usually, the verification process is executed with a third-party source, such as the Chamber of Commerce database.

Which Invoice Fields Should You Capture?

Before you commit to an invoice-capturing solution, you should ensure that the solution can capture relevant fields. Start by listing the invoice fields you need to capture, then compare them with the extraction capabilities of each vendor.

Klippa DocHorizon, for example, can extract the following fields from an invoice:

- Type of the document

- Invoice number

- Language on the invoice

- Country of origin

- Name of the merchant

- Address details of the merchant

- Contact details of the merchant

- Website of the merchant

- Details of the client

- Method of payment

- VAT amounts and the total amount

- VAT number

- Amount of change

- Card number

- The currency and the total amount

- Purchasing date

- Purchase order number

- Due date

- Delivery date

- Chamber of Commerce number

- Line item prices, quantity, description, and category

Besides extracting the above-mentioned fields, the invoice-capturing solution can perform automated checks. Those consist of cross-checks to identify fraudulent invoices and image hashing to find duplicates.

Automate Invoice Data Capture with Klippa

Looking to simplify your invoice capturing, enhance productivity, and reduce costs? Klippa DocHorizon is here to optimize your invoice data-capturing process with cutting-edge automation!

Our solution allows accounts payable teams to focus on high-value tasks by automating repetitive processes. With Klippa, invoices are captured, validated, and converted into structured data quickly and accurately.

What makes Klippa DocHorizon stand out?

- Accurate Data Extraction: Extract key invoice details like supplier names, amounts, VAT numbers, and payment terms with precision.

- Easy Integration: Our API and SDK are developer-friendly and come with detailed documentation, allowing integration into your existing software within a day.

- Scalable Automation: Process high invoice volumes efficiently, eliminating backlogs and manual errors.

- Fraud Prevention: Automatically flag duplicate or suspicious invoices to safeguard your finances.

- Privacy Compliance: Ensure sensitive data is protected and aligns with GDPR requirements.

At Klippa, we provide you with the tools to revolutionize your accounts payable processes. Whether you choose the Klippa API or SDK, our flexible and well-documented solution integrates seamlessly into your existing workflow.

Let Klippa DocHorizon relieve your accounts payable team from repetitive tasks and help you achieve smarter, faster invoice processing. Contact us today or request a demo to see how we can transform your operations!

Frequently Asked Questions

You can capture information from an invoice either manually or with software. Manual capturing involves reviewing the invoice and entering details like the invoice number, total amount, and payment due date into a system, but it can be slow and error-prone. With software, AI-powered tools like Klippa DocHorizon can automate the process by extracting, validating, and structuring data, saving time and improving accuracy.

Automating invoice capture involves using AI-powered tools like Klippa DocHorizon. These solutions use Optical Character Recognition (OCR) to extract key data automatically, validate it, and structure it for integration into bookkeeping systems. Automation speeds up processing, minimizes errors, and reduces manual workload.

Klippa uses AI-powered OCR for automated data extraction, complemented by optional human validation (HITL). This ensures that even complex invoice formats are processed with high accuracy.

The Klippa Document Scanner SDK improves image quality with features like brightness optimization, edge detection, perspective correction, real-time feedback, and light adjustment. It integrates with iOS and Android apps, turning devices into fast, accurate invoice scanners, making data capture easier and more reliable.

The Klippa API processes documents sent via mobile apps, email, or web applications, returning structured data in seconds. It’s the best choice for adding OCR to existing software.

For advanced use, the SDK connects to the OCR API, allowing scanned documents to be processed and returns a JSON response. By using Klippa’s pre-built solutions, your organization saves time, costs, and development resources.