Transferring financial data from your organization’s credit card statements to accounting software or various applications was a challenge until recent times. While the old copy-and-paste method sufficed for the already digitized documents, the real difficulty appeared when dealing with older transactions, PDFs, or scanned images of credit card statements.

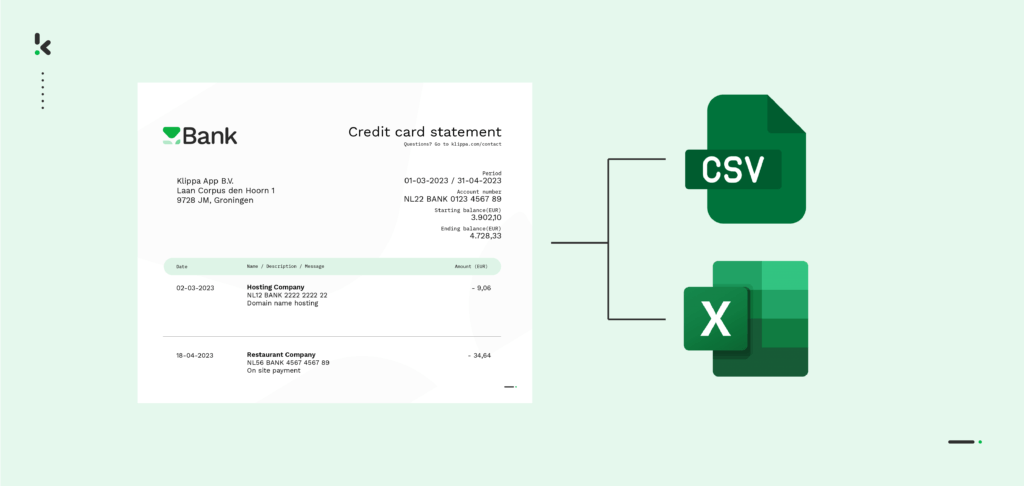

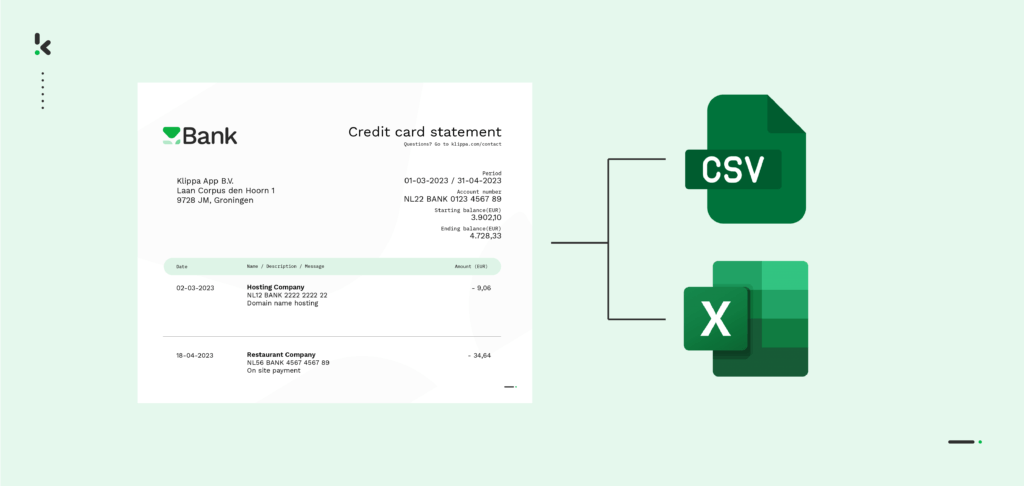

Nowadays, this dire process has become entirely automated, all thanks to Intelligent Document Processing. An IDP platform leverages OCR technology to digitally transform credit card statements, extracting important information. The main advantage? It not only extracts the data but also converts it into Excel or CSV formats, given the financial nature of the information.

In this blog, we will walk you through a step-by-step guide of converting credit card statements into Excel and CSV formats, empowering you to streamline business processes with Klippa’s IDP platform. Let’s get started!

Step 1: Sign up on the Platform

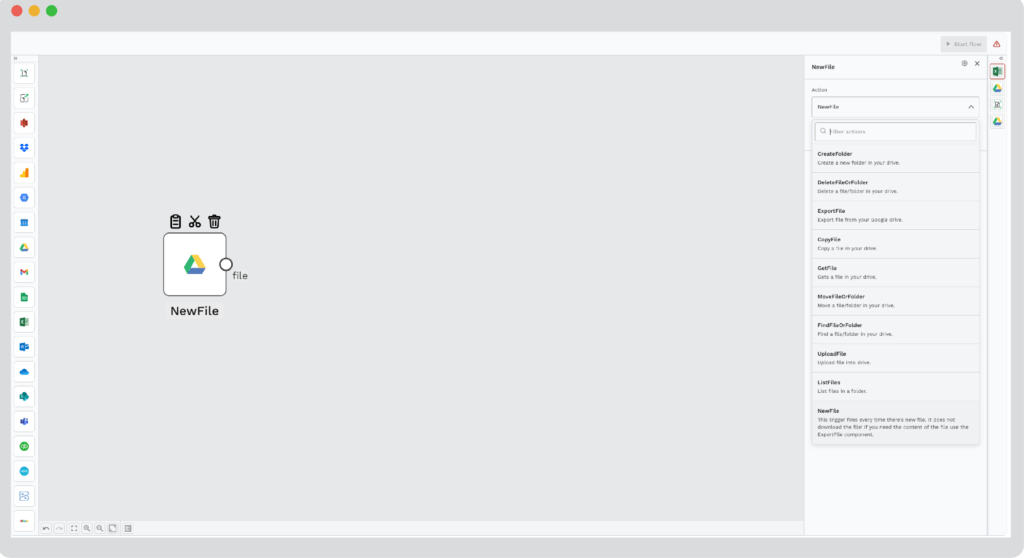

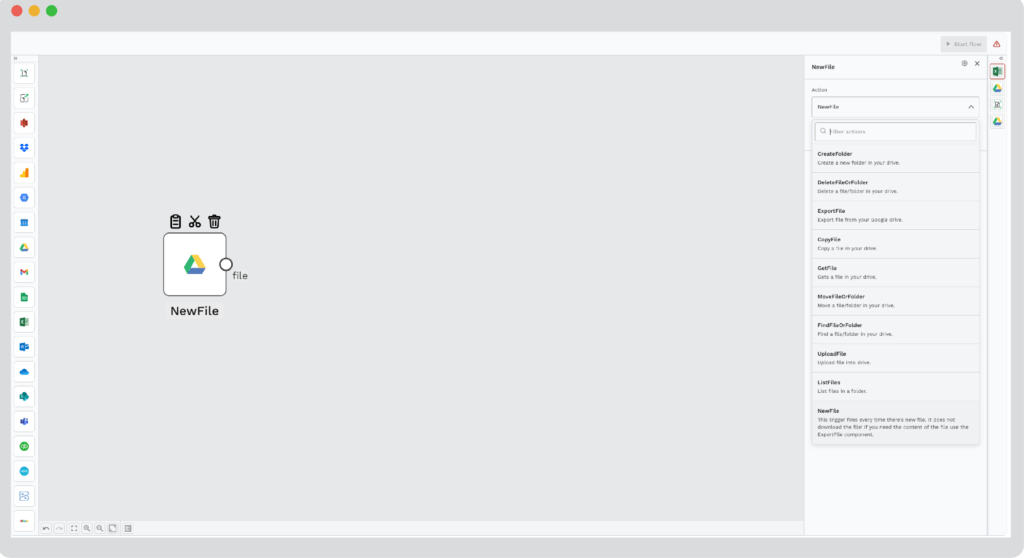

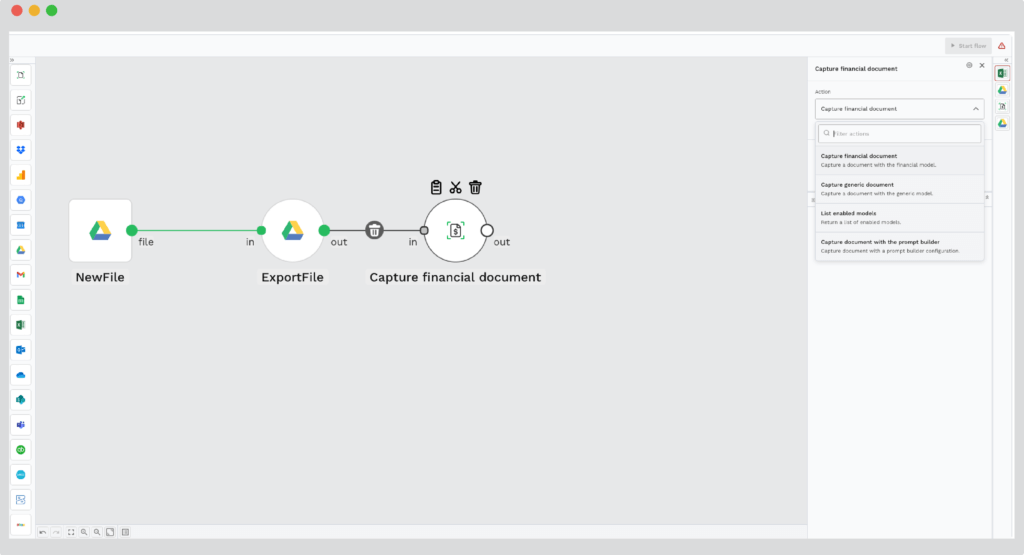

To get the process started, sign up on our DocHorizon Platform and create an account or, if you’ve already done that, simply log in. Once you’re in, navigate to the flow builder and start creating your unique flow. With our builder, you can:

- Define input and output: Select the input data and the output sources, be it email, cloud or ERP software. Sign in with your credentials and connect instantly.

- Pick your modules: Add DocHorizon to your workflow and pick existing modules or select your own modules created with our prompt builder.

- Customize the flow order: With our builder, you are in charge of the sequence of the actions. Join the modules with your connectors, so you can link the items and create the workflow.

- Start your flow: And there it is! Your unique workflow is done and ready to be employed. For more insights into the process, access our documentation.

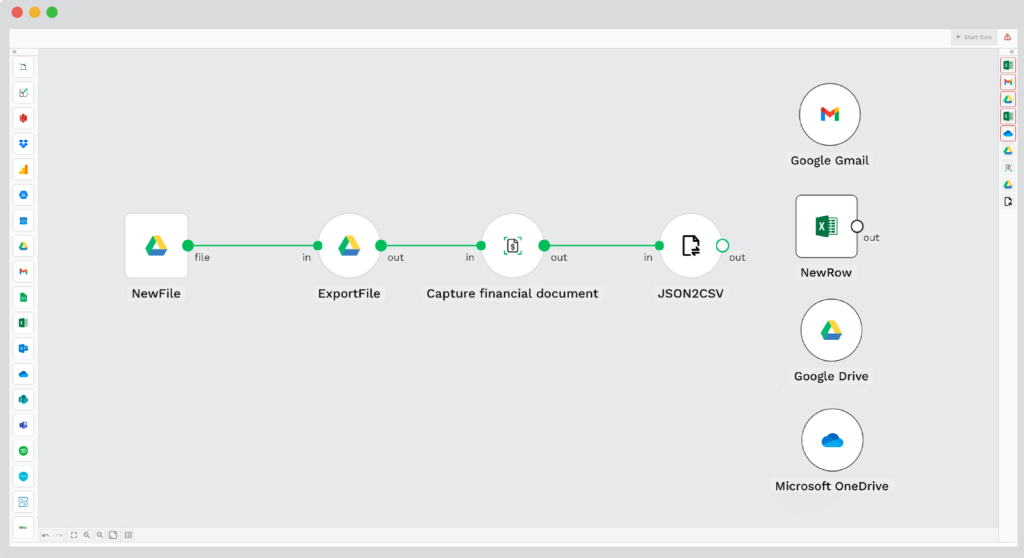

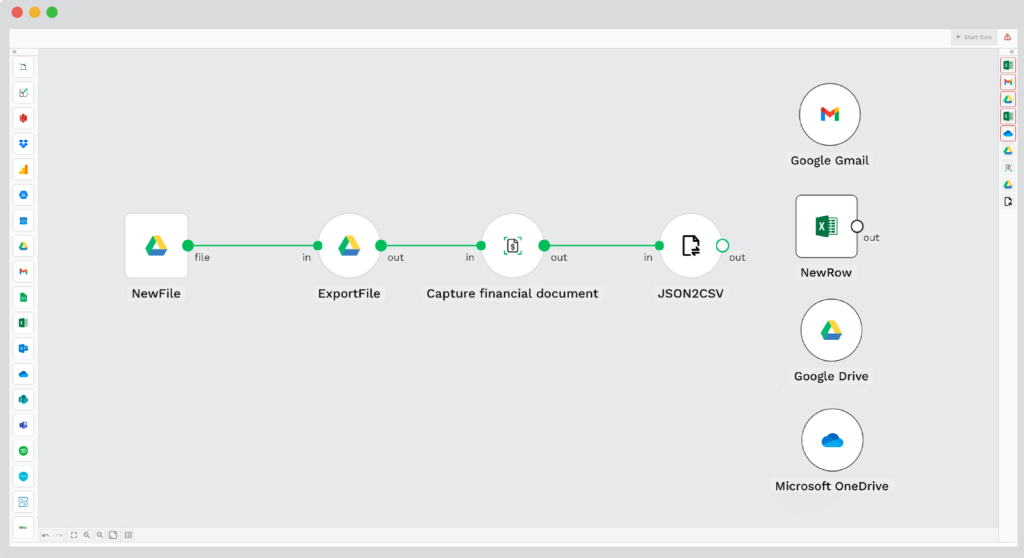

Our builder can be integrated with all your preferred applications, such as Gmail, Drive, Sharepoint, Xero and many other integrations, helping you gain real-time access to files, with our option to sync data with existing applications. Moreover, our user-friendly drag-and-drop interface makes it easy to navigate the platform, so the user experience is not affected, but rather enhanced.

Step 2: Select Source of Input

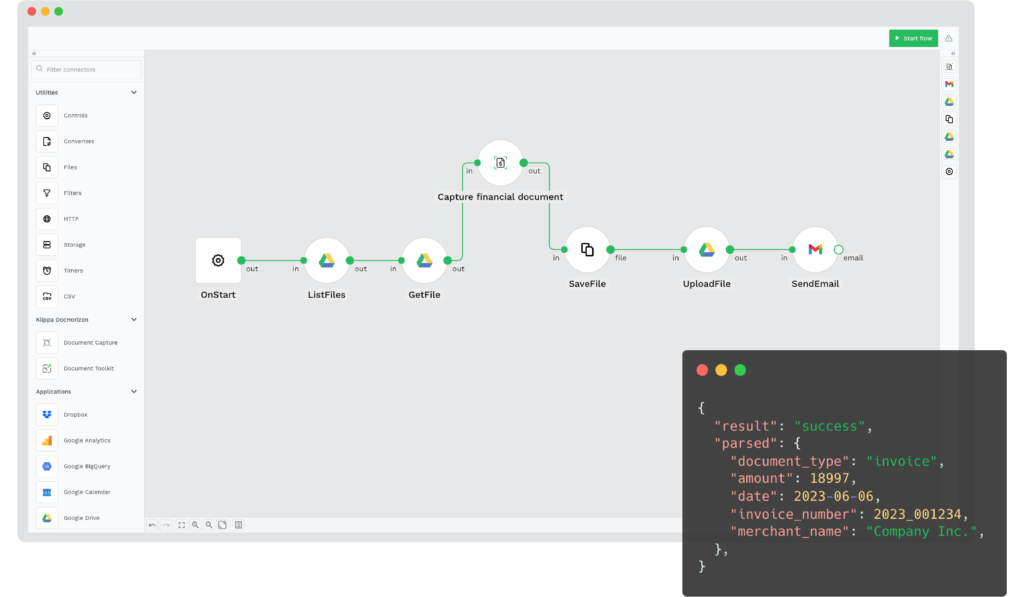

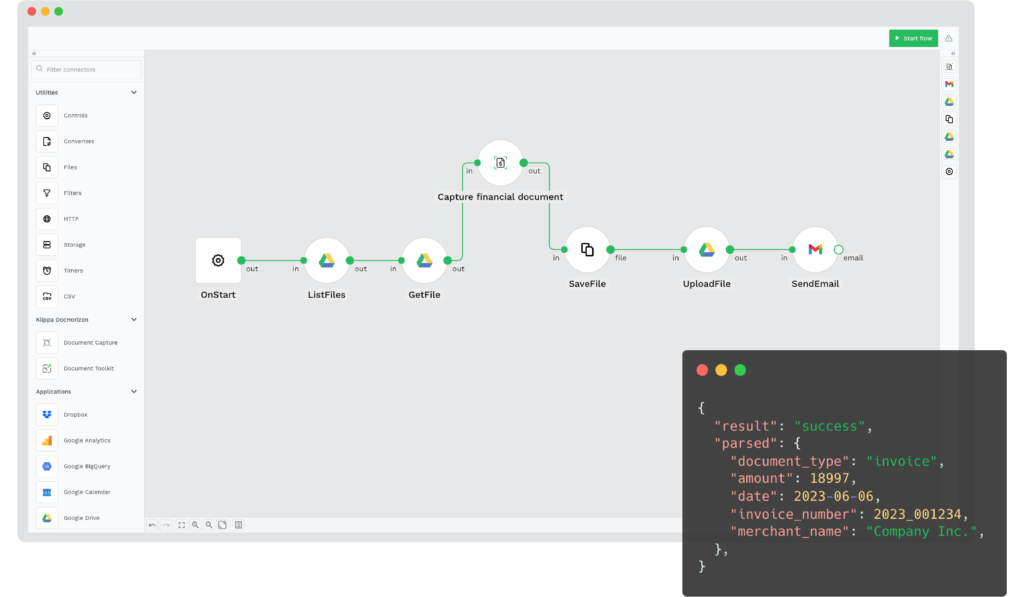

The first step is to determine the source for retrieving your credit card statements. Simply put, you select where you get your documents from. This can mean granting the platform access to the folder where you have your credit card statements.

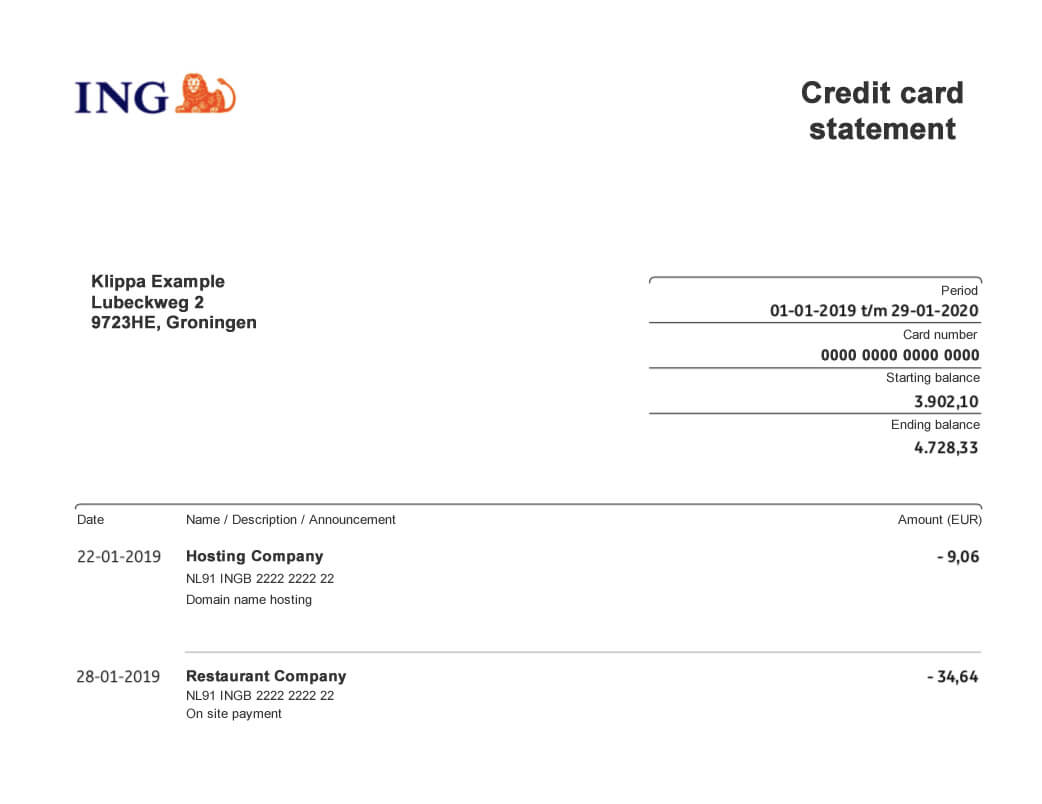

It can also be that you import your credit card statements from Google Drive, email attachments or your organization’s own database. To exemplify this process, we’re going to use a credit card statement and show you the detailed process.

Step 3: Automated Transaction Information Extraction

The next step involves choosing the action you want to perform via the platform. In this case, you’d want to read the document, classify it and extract its content. To accurately process the credit card statement, select the financial document capture component, which automatically extracts the information in your document.

However, you can choose between capturing the whole document’s data or solely specific key-value pairs or line items. To do so, you first need to determine the presets.

The presets available on the platform enable you to gain more control over what information is extracted. If all presets are enabled, you will get all the information from the document extracted. However, if you only want specific fields, you only enable certain presets.

Step 4: Credit Card Statement Data Validation

This third step is needed in order to check the validity of the documents, but also the accuracy of the extracted output. Here, you check if the credit card statements have been validated or not, meaning whether or not the final balance matches the initial one from the document.

To modify the field and validate the credit card statements, simply edit the wrong amount to the corresponding one, thus employing the human-in-the-loop feature. As soon as the credit card statements have been verified, you will be able to get to the next and most important step.

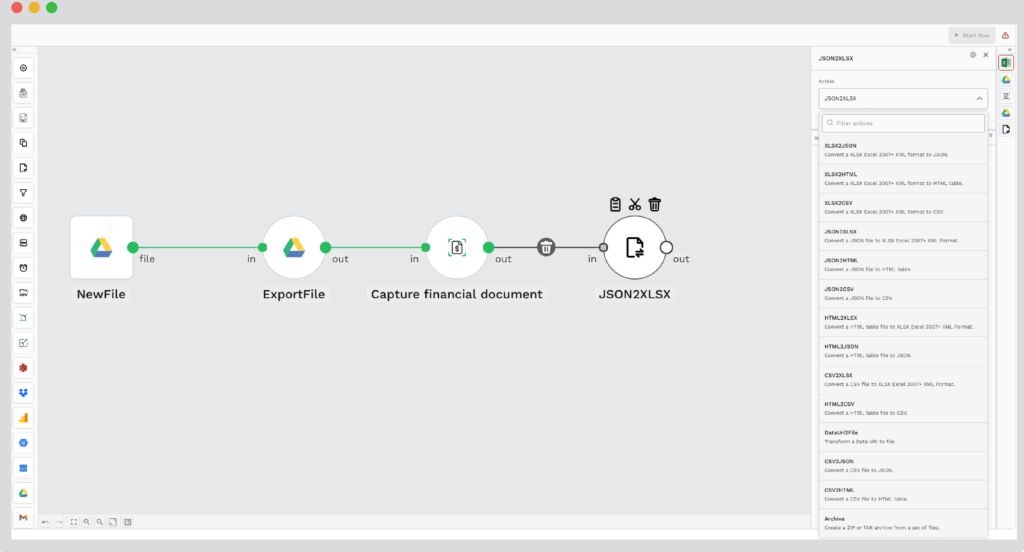

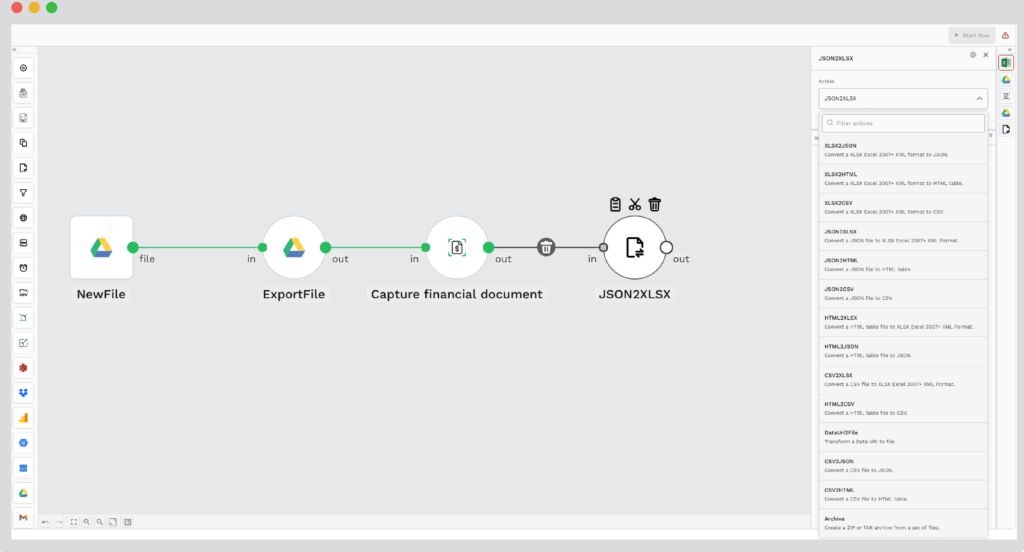

Step 5 A: Convert Credit Card Statement to Excel

This is where the real magic happens. During this part of this credit card statement extraction flow, you can choose to convert the extracted data to the preferred format of your choice. Considering credit card statements contain financial information, thus numbers and ratios, it is most likely that the output will be exported to an Excel or CSV format.

However, before choosing between Excel or CSV, the parser first converts the data to JSON format. From there on, you can choose to further convert the data to your preferred format.

In the case you’d like to convert the extracted information to Excel, simply choose the “JSON to XML” option when selecting the output format for document conversion.

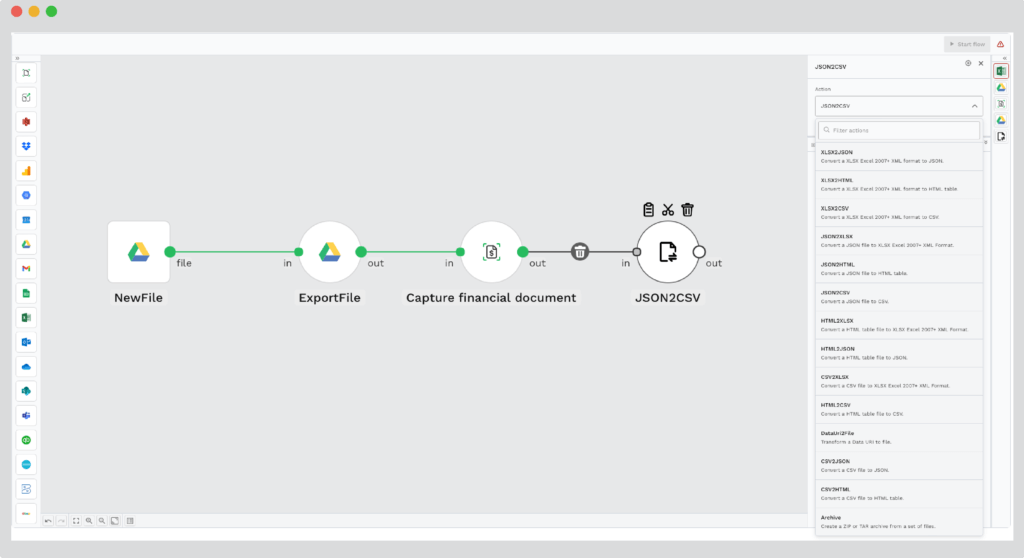

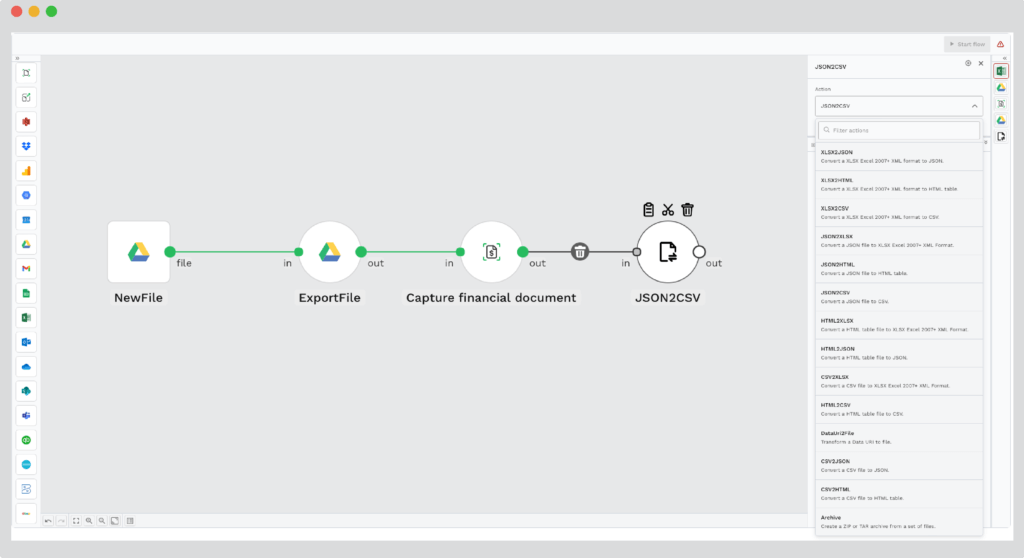

Step 5 B: Convert Credit Card Statement to CSV

This step follows the same principle as the one above. If you’d like to convert your data to a CSV format, simply select the “JSON to CSV” option.

Step 6: Define The Output Location

After having extracted and converted your credit card statements to your desired format, it is time to export it. Choose the location where you want the output to be sent, be it Excel, Google Sheets or Google Drive. You can also export it to an ERP or accounting software, FTP or your API endpoint. Simply drag and drop the component and your flow is ready to be launched.

Automate OCR Credit Card Statements to Excel Workflow

Klippa DocHorizon is an Intelligent Document Processing platform that enables you to completely automate the workflow of converting credit card statements to Excel. By integrating various Klippa DocHorizon modules and your preferred applications, you can create an effortless and unique workflow:

- Data extraction – Get data extracted automatically from credit card statements

- Document conversion – Convert documents into a number of business-ready data formats, such as JSON, XLSX, CSV, TXT, XML and many more

- Data anonymization – Make sure to anonymize privacy-sensitive data, such as client names or financial information, to ensure compliance relevant regulations

- Document verification – Automatically verify documents with numerous ways and detect document fraud

Interested in how to get started with converting credit card statements using a workflow? Book a free demo down below or contact our experts for any additional questions!