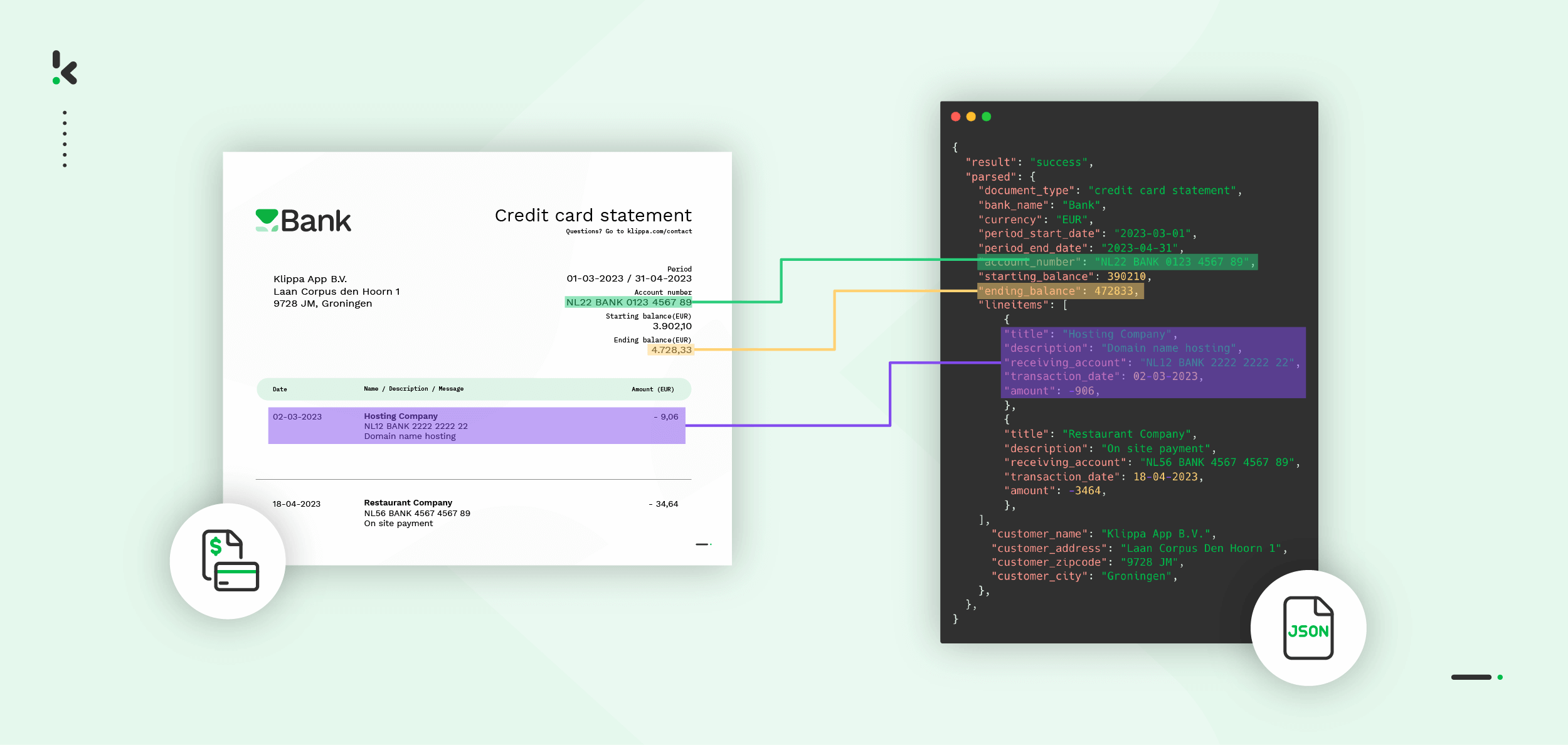

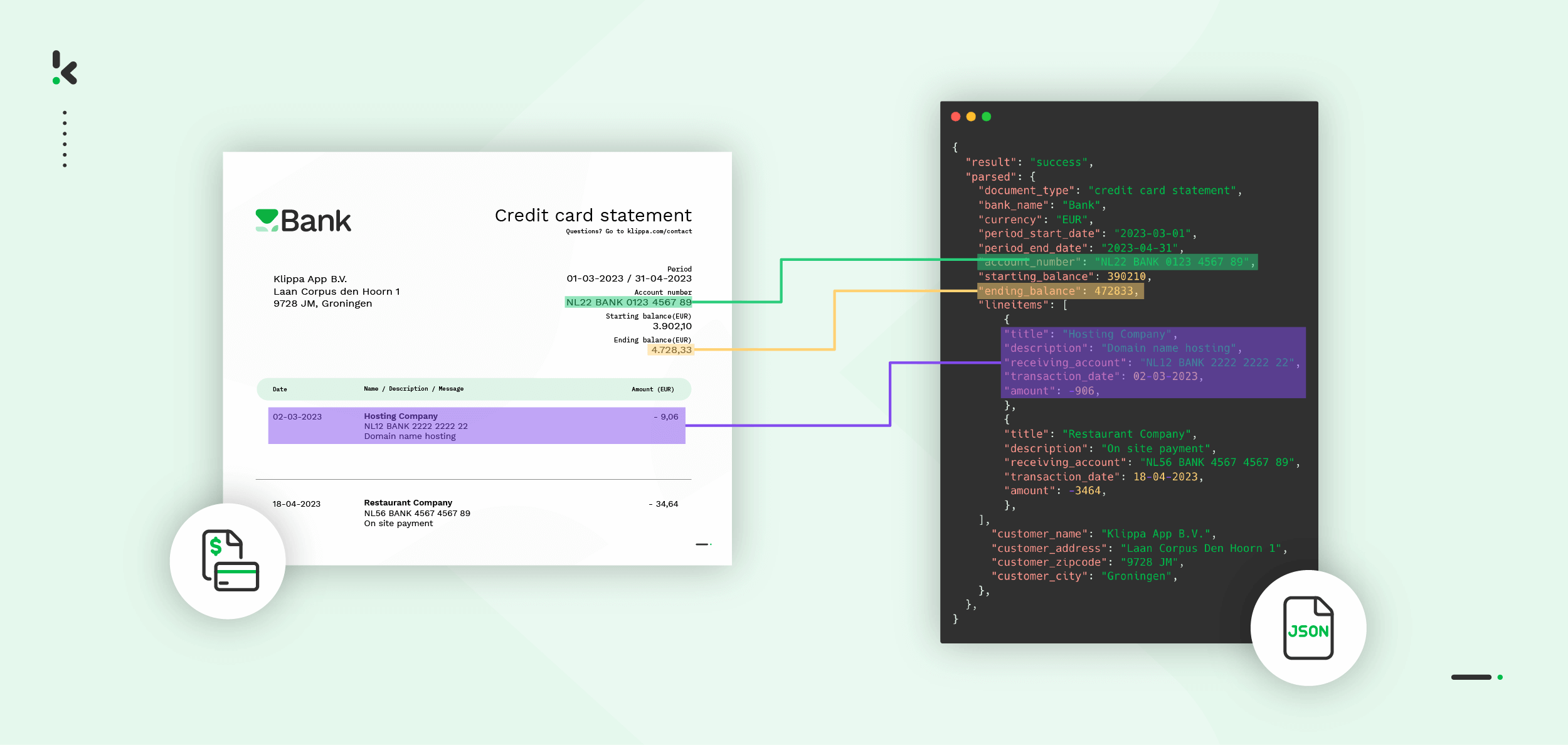

Tracking business expenses and reconciling monthly transactions requires efficient workflows to achieve better business results. However, manually extracting and organizing payment information, fees, and transaction details from credit card statements is time-consuming and error-prone. This process often leads to inaccuracies and workflow disruptions.

This is where automation steps in. Converting credit card statements into JSON or any other format important to your daily business needs allows you and your team to easily transfer the data to different software programs, enabling seamless integration and analysis across platforms.

In this blog, we’ll show you how to streamline the process of converting credit card statements to JSON. Let’s dive in!

Key Takeaways

- There are multiple ways to convert credit card statements to JSON, from easy automated tools to advanced custom scripts.

- Use OCR for scanned or image‑based statements to ensure accurate data extraction.

- No‑code automation platforms offer hands‑free, repeatable workflows with easy integrations.

- Clean and normalize data to make JSON compatible with other systems.

- Choose secure, compliant solutions that protect financial data.

- Klippa DocHorizon shows how an IDP platform can automate the entire process with speed and accuracy.

4 Methods to Convert Credit Card Statements to JSON

When it comes to converting credit card statements into structured, machine‑readable JSON files, there’s no single “best” approach. The right method depends on your technical skill level, the volume of statements you process, and the level of control you need over the workflow.

Below are four proven ways commonly used, ranging from simple, upload‑and‑download tools to fully customised scripts.

Method 1: Using Automated Software (Beginner‑Friendly)

If your priority is speed and ease, automated AI platforms are hard to beat. Services like Klippa DocHorizon let you:

- Upload your statements in PDF, scanned image, or CSV format.

- Their AI + OCR technology detects tables and pulls out structured data such as:

- Date

- Merchant name

- Transaction amount

- Export to JSON in a clean, ready‑to‑use schema.

This route is ideal if you don’t want to code or set up complex integrations.

Method 2: Using No‑Code Automation Platforms

If you need the conversion as part of a larger business process, no‑code automation tools are the way to go. Many organizations set up a Flow that:

- Triggers when a new statement is added to a cloud folder (e.g., Google Drive, Dropbox, OneDrive).

- Uses a document capture component (in Klippa, this is a “Financial preset”) to extract relevant fields.

- Creates a new JSON file in the destination folder, named automatically after the source file.

Think Zapier, Make.com, or n8n paired with an OCR/extraction service. This method gives you end‑to‑end automation without writing a single line of code, and is perfect for high‑volume, repeated tasks.

Method 3: Using Python (Developer‑Friendly)

Python offers flexibility for processing both digital and scanned statements. A typical workflow involves:

- Extracting text — Using libraries like PyPDF2 for native PDFs or OCR for scanned files.

- Parsing transactions — Applying regex or data‑frame libraries to isolate fields like date, description, and amount.

- Exporting JSON — Converting results into JSON format for analysis or API use.

Best for developers who want custom parsing logic or specialised data structures.

Method 4: Using JavaScript

In JavaScript, you can read statement data from CSV or API sources, transform it, and write it into JSON format. The workflow usually involves:

- Reading and parsing data — Using a CSV parser or PDF library.

- Mapping fields — Structuring them into key‑value pairs used in JSON.

- Saving output — Writing the file to local storage or a cloud bucket.

This approach fits well for web‑based integrations or applications already built in JavaScript.

Choosing the Right Method

- Beginner / Occasional Use: Automated AI platforms get you up and running in minutes.

- Business Workflows: No‑code automation keeps conversions hands‑free and repeatable.

- Development Projects: Python or JavaScript give you ultimate flexibility.

- Security Needs: For financial data, ensure whichever method you choose offers proper encryption and compliance with regulations like GDPR.

Key Steps & Considerations

Before choosing a method, keep these practical points in mind:

- Identify Document Type – Native PDFs or CSV files are easier to process; scanned images will need OCR first.

- Select Required Fields – Decide in advance which fields you want to capture (e.g., date, merchant, amount, currency code).

- Clean and Normalize Data – Standardize formats for dates, numbers, and currency to ensure compatibility with other systems.

- Choose Output Structure – Determine whether you need a flat JSON list or nested objects for analytics or API integration.

- Ensure Security & Compliance – Financial data must be handled securely; look for platforms that meet U.S. regulations and offer encryption in transit and at rest.

- Plan for Scalability – If you process statements regularly or in bulk, choose tools or scripts that support automation to prevent manual bottlenecks.

How to Convert Credit Card Statements to JSON with Klippa

Tasks like converting credit card statements to JSON become easier with tools like Klippa DocHorizon. It is a powerful Intelligent Document Processing (IDP) platform that automates document workflows with ease. Designed to support numerous document types and formats, it offers flexibility for various use cases.

The best part is that you can try it for free!

Here’s a step-by-step guide on how to convert credit card statements to JSON, demonstrating just how easy it is to integrate the DocHorizon Platform into your daily workflow.

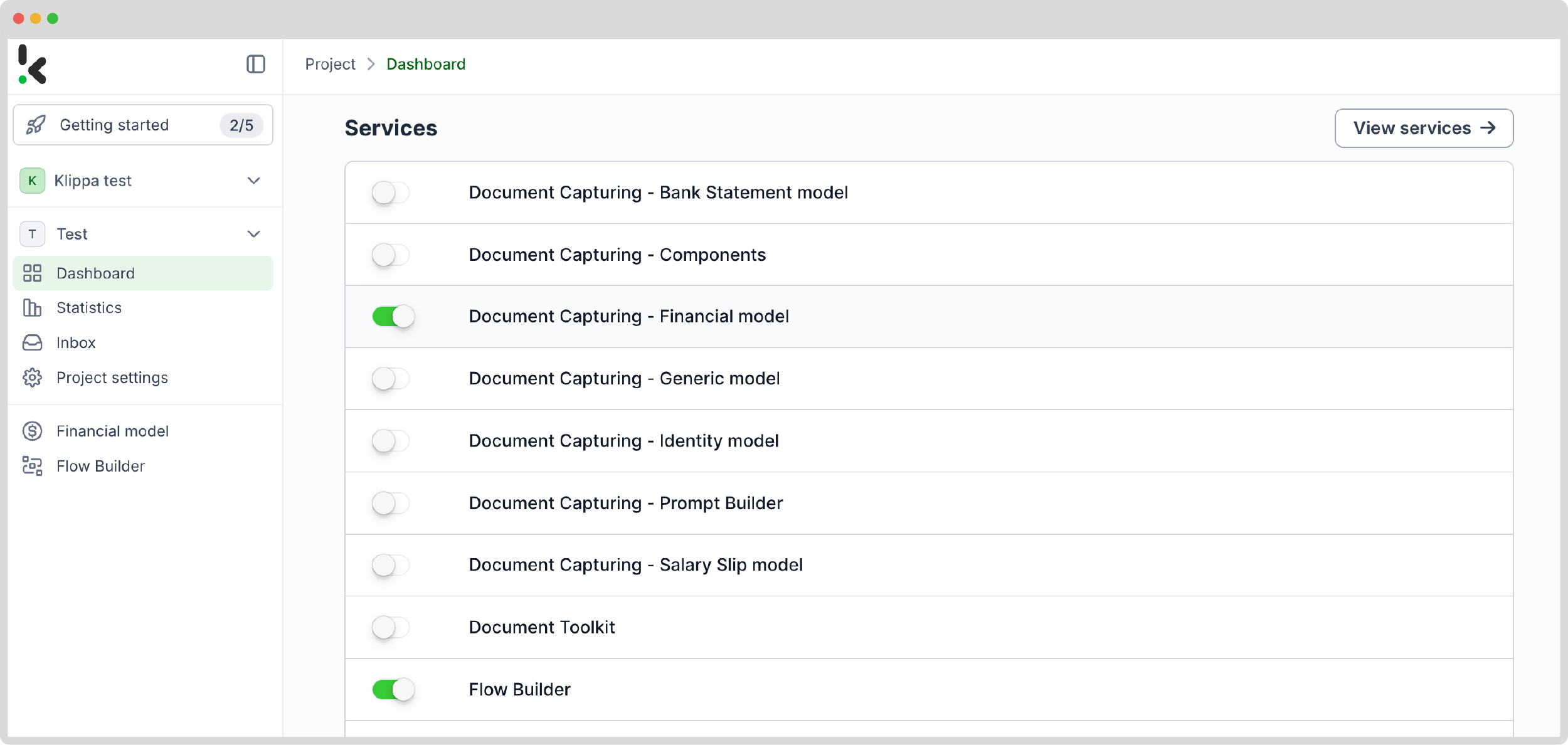

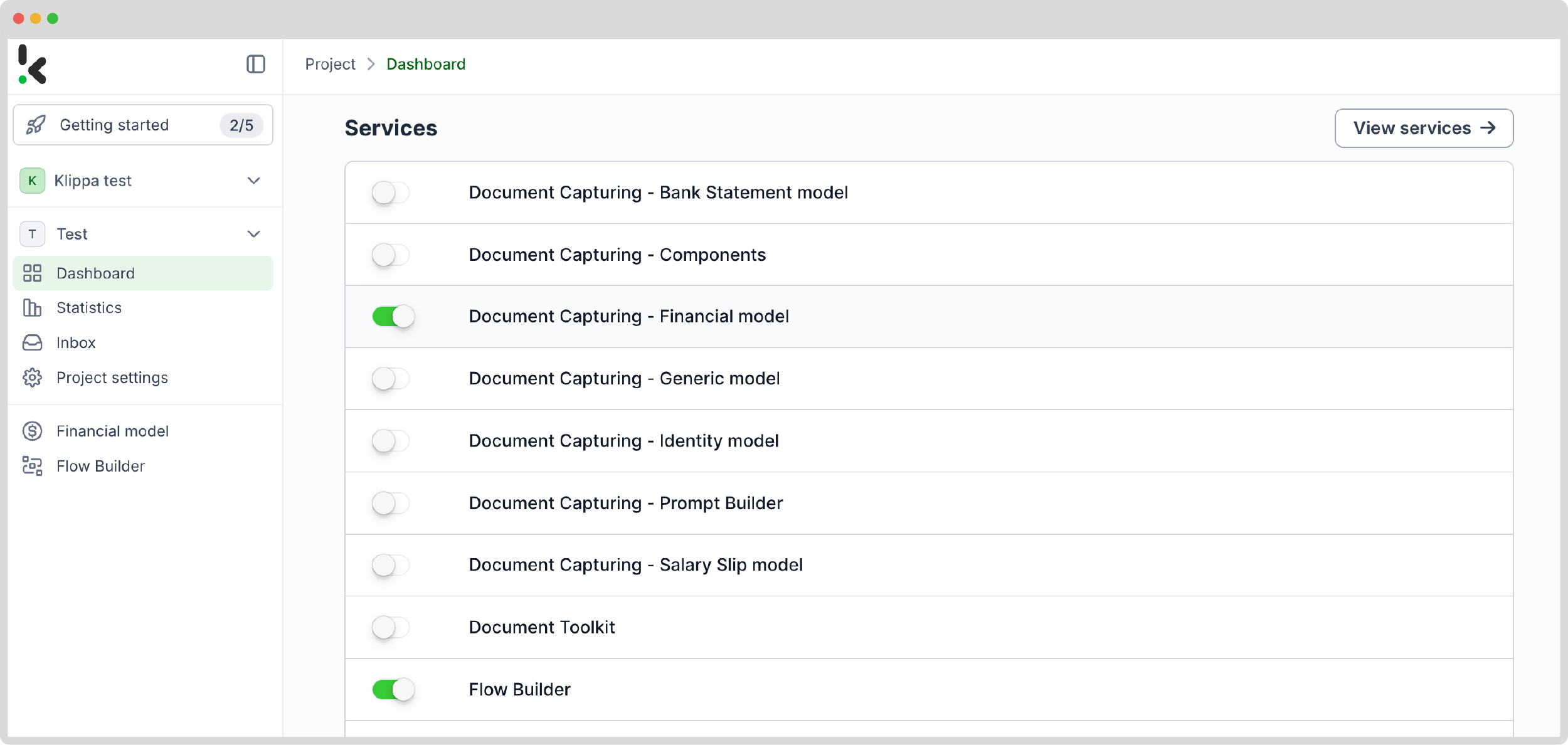

Step 1: Sign up on the platform

To get started on the DocHorizon Platform, you first have to sign up for free, as mentioned before. You can do so, by entering your email address and password, along with a few details like your full name, company name, use case, and volume. When registration is done, you’ll receive €25 in free credits to explore all the platform’s features and capabilities.

The next step is to create an organization and set up a project to access our services. To begin converting credit card statements to JSON, simply enable the Flow Builder and Financial Model services. This ensures you have the necessary tools in place to start your workflow smoothly.

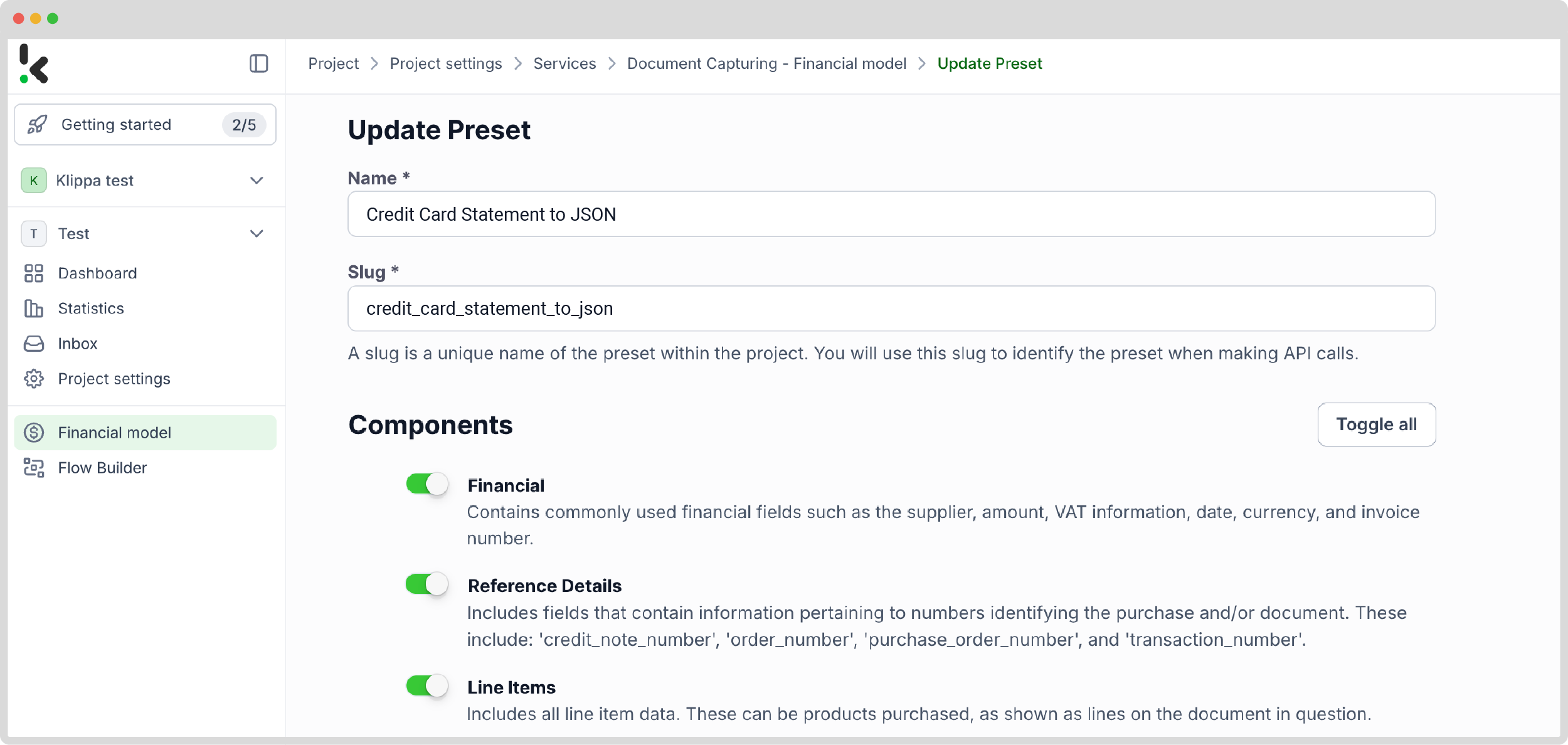

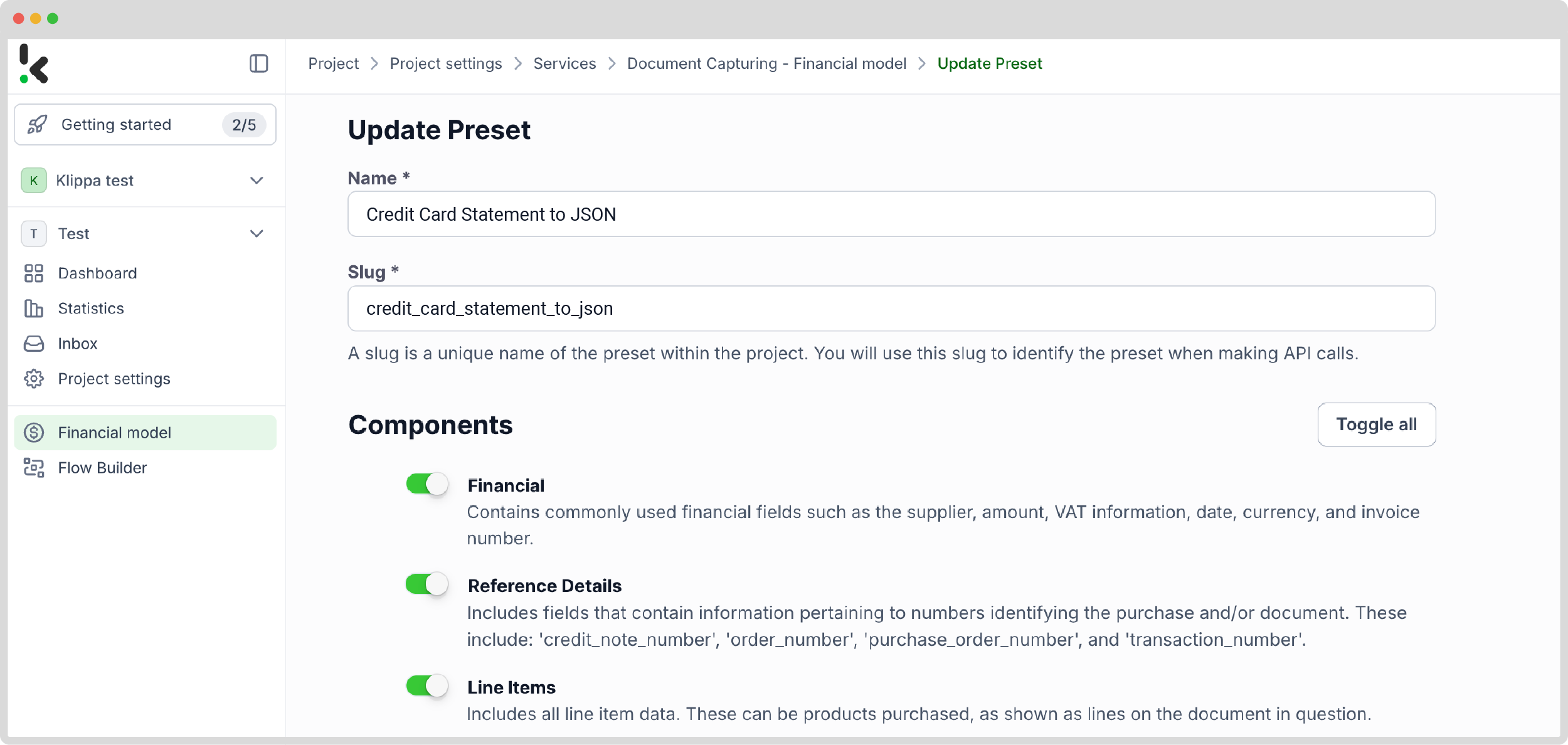

Step 2: Create a preset

The Financial Model is designed to streamline your financial workflows, efficiently processing a wide range of documents such as invoices, purchase orders, bank statements, and more. Once enabled, you can create a new preset tailored to your specific needs and use cases.

The preset name for this case will be “Credit Card Statements to JSON.” This preset allows you to activate the components you need for your specific use case. Let’s give an example by enabling the financial, reference details, and line item components to process specific fields in your credit card statement, such as transaction number, supplier name, and credit card limit.

Here’s a tip: You can customize the preset further based on your specific use case by activating more components such as Date Details, Tax Details, Amount Details, Document Language, Payment Details, etc.

Just a few more steps! In case you want to fully automate the process of taking documents from a folder, processing them through the system, and storing the results automatically, you’ll need to use the Flow Builder. It’s perfect for processing bulk operations efficiently. Let’s dive in!

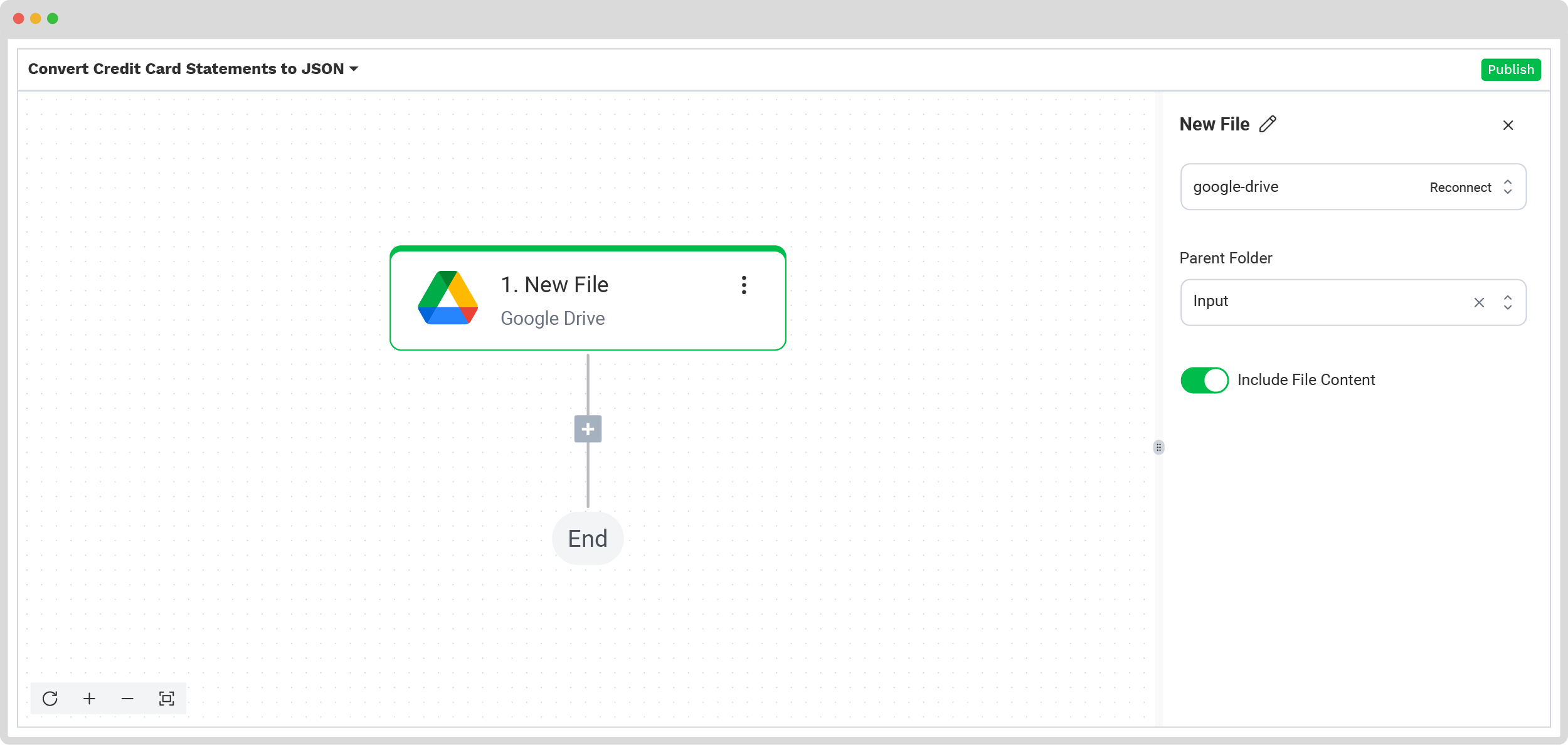

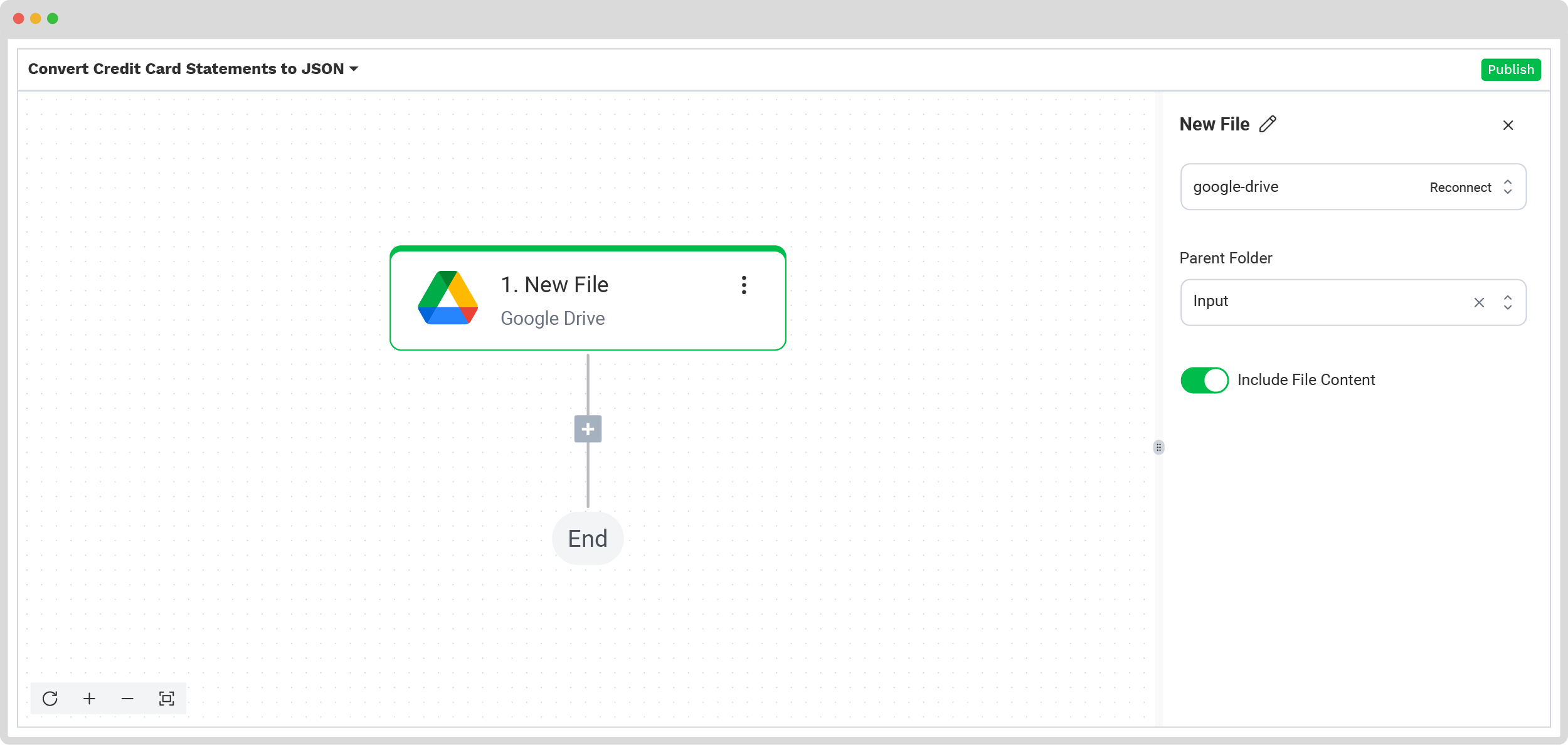

Step 3: Select your input source

After enabling the Flow Builder from the services interface, you can create a New Flow from scratch and assign it a name. For this example, we’ll name it “Convert Credit Card Statements to JSON”.

First, you need to select your input source. You can upload files directly from your device or connect to over 100 external sources like Google Drive, Dropbox, Outlook, Box, Salesforce, Zapier, OneDrive, your company’s database, or even cloud storage solutions like Amazon S3 and iCloud. Make sure to include all the credit card statements in the same folder so they can be processed in bulk if needed.

For this example, we’ll create a folder named “Input” in Google Drive and upload our credit card statements there.

Next, choose your input source by selecting “Google Drive” and then “New File” as your trigger. That’s how your flow will start. On the right side, fill out the following sections:

- Connection: You can assign any name to your connection. For instance, we’ve named ours “google-drive”. Once named, the system will prompt you to authenticate with Google.

- Parent Folder: Input

- Include File Content: Check this box to ensure file content is processed.

Step 4: Capture and extract data

The previously created preset will now be used. It’ll process all the selected data fields from the credit card statements in the input folder. With the help of Optical Character Recognition (OCR) technology, the platform automatically scans and extracts the required data fields from each credit card statement.

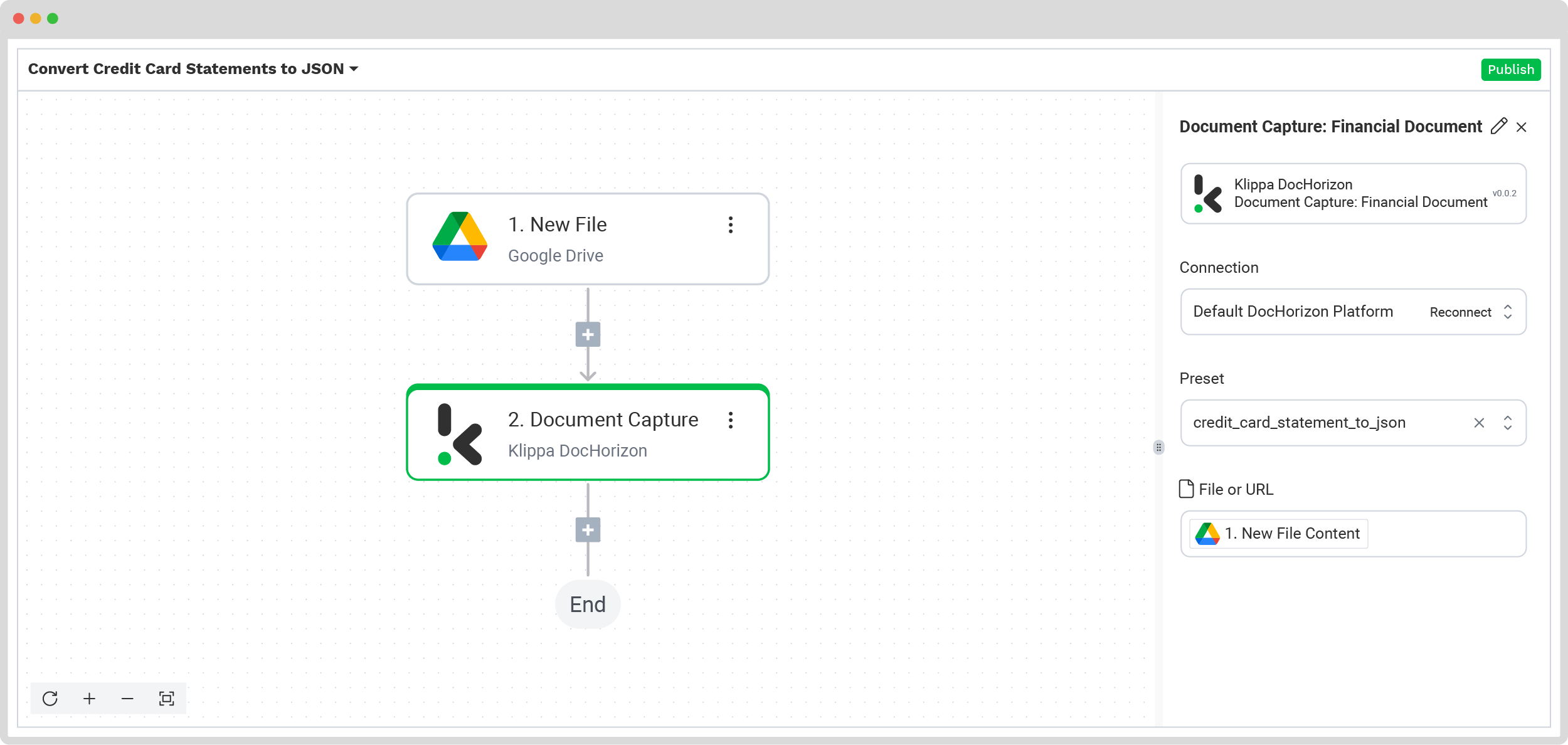

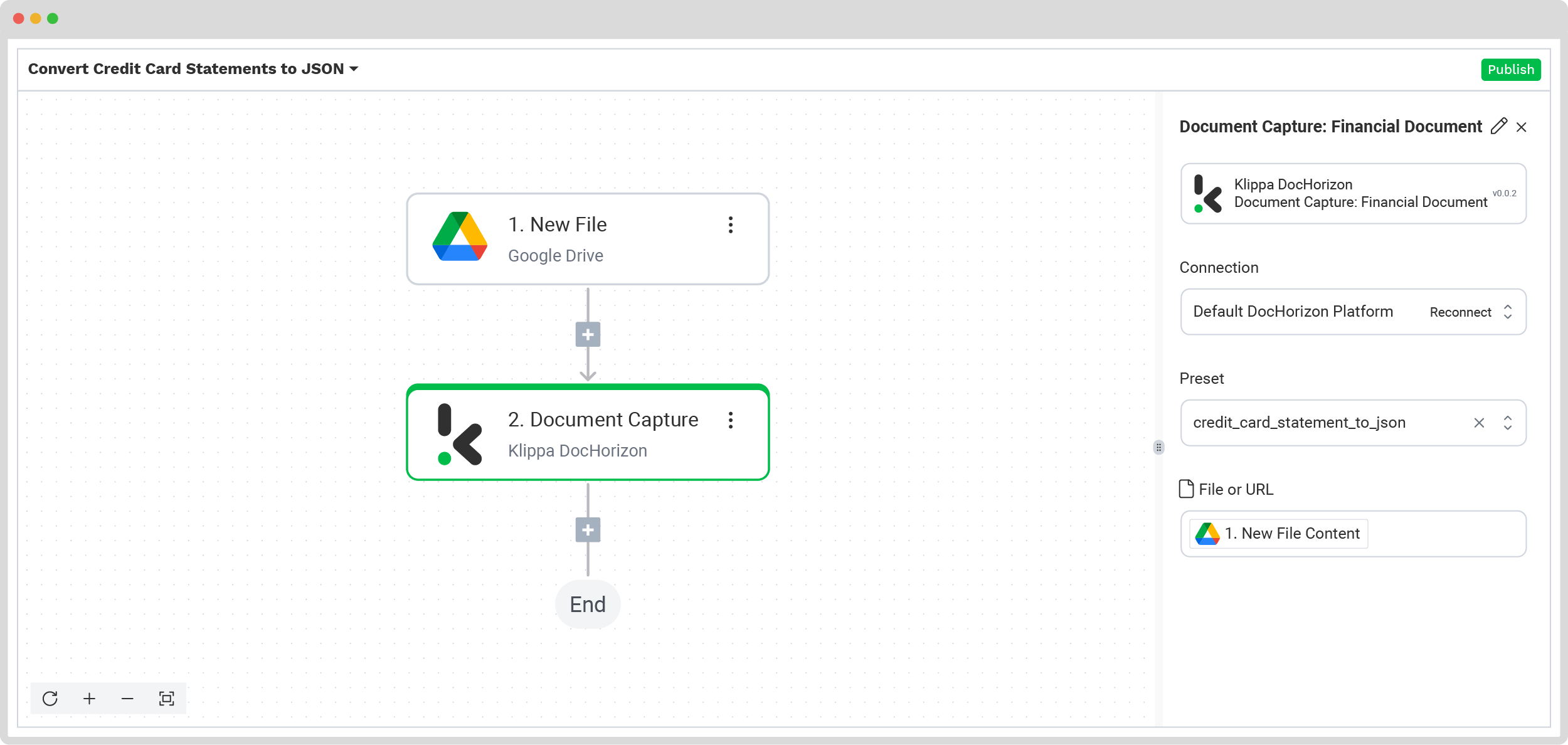

In the Flow Builder, press the + button and choose Document Capture: Financial Document.

To proceed, configure the following:

- Connection: Default DocHorizon Platform

- Preset: The name of your preset (in our case “credit_card_statement_to_json”)

- File or URL: New file → Content

Step 5: Save the file

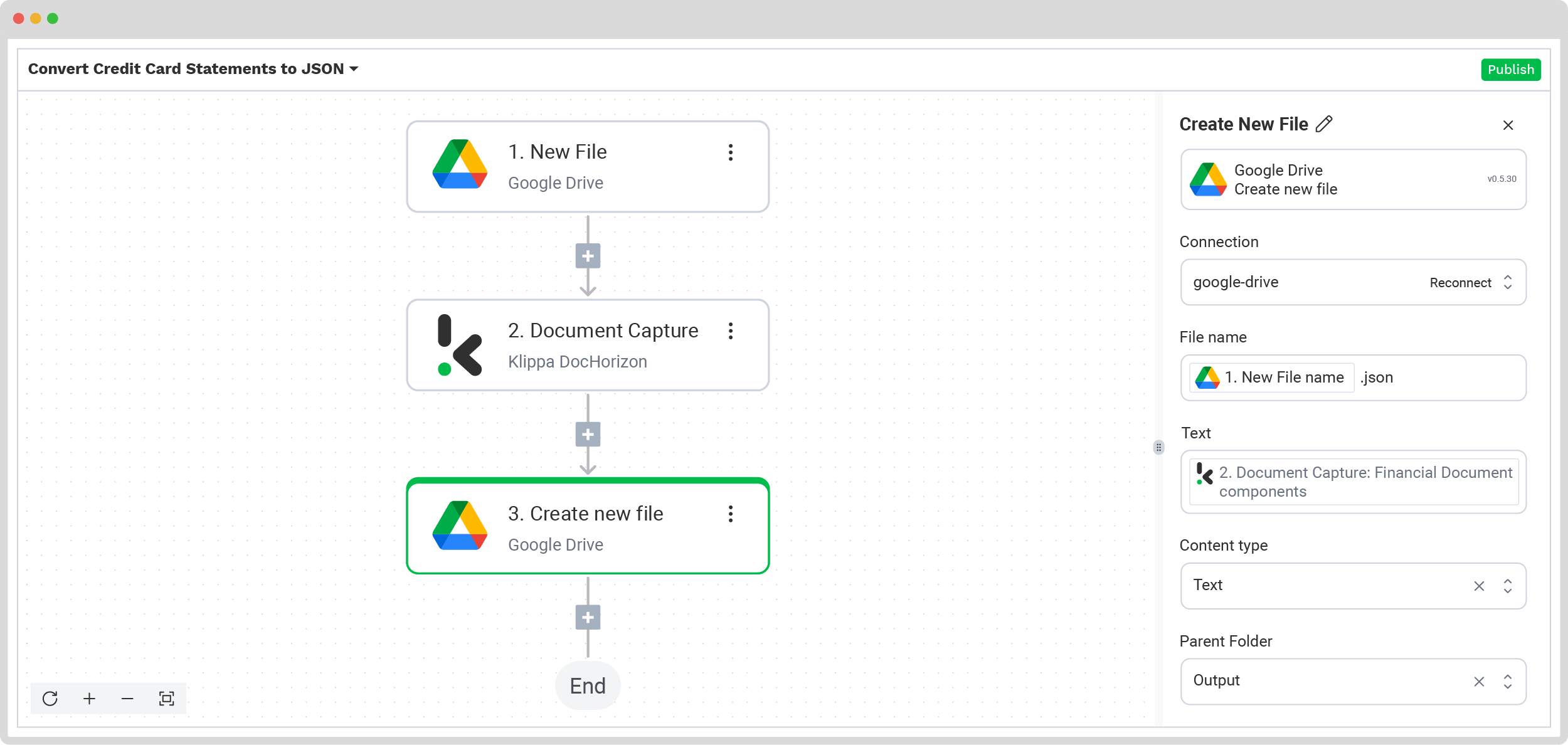

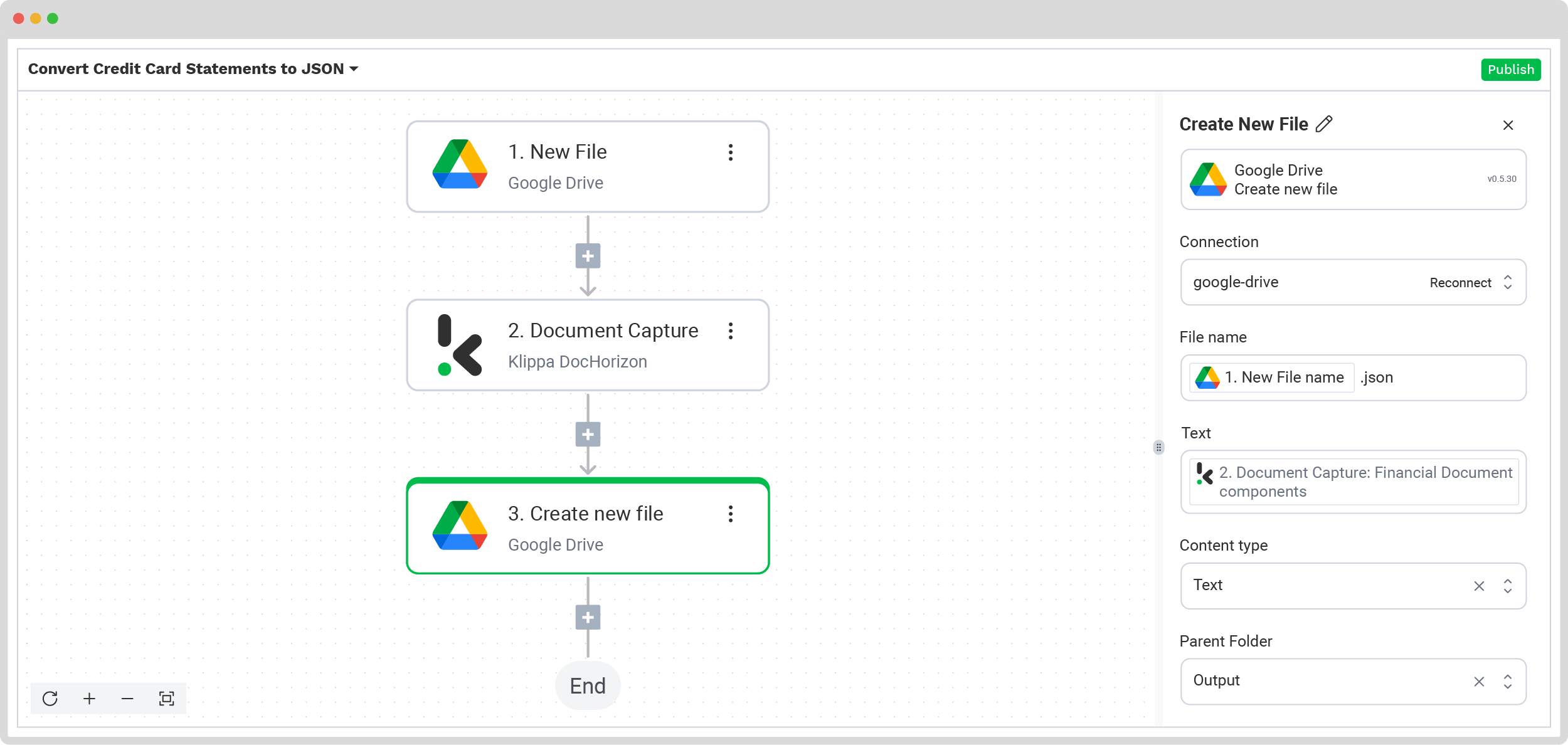

At this stage of the process, all the credit card statements are successfully processed, and it’s time for you to choose how you want to handle the result. In this case, you can create a new file in Google Drive through the platform.

Press the + button and select Create new file → Google Drive

To proceed, configure the following:

- Connection: google-drive

- File Name: New File → name. Next to it, type .json

- Tip 1: This means that your output files will have the same name as your input file.

- Tip 2: Instead of using “.json” for the file name, you can choose other formats, such as PDF, CSV, XML, and more, depending on your preference.

- Text: Document Capture: Financial Document → components

- Here’s a tip: Select the text you want to include in the new document. By selecting components, you choose all the extracted elements.

- Content Type: Text

- Parent Folder: Output (the name of your output file)

Congratulations! Your workflow is now configured, and all processed credit card statements are stored on Google Drive. Once published, the flow will automatically process any new credit card statements added to the folder, saving you time and keeping your data nicely organized.

Practical Applications of Converting Credit Card Statements to JSON

Tracking Spending and Management

Categorizing personal or business expenses and monitoring spending habits becomes easier by automating credit card transactions through the extraction of data fields like merchant names and amounts.

Financial Reporting and Analysis

Generate detailed reports, track spending patterns, monitor trends over time, and identify ways to cut costs by converting credit card statement data into JSON.

Integration with Accounting Systems

Structured credit card transaction data can be directly imported into tools like QuickBooks or Xero to minimize manual entry, improve accuracy, and streamline monthly reconciliations.

Tax Preparation and Compliance

Directly extract information related to taxes, such as VAT or GST, from your credit card statements to streamline tax filings, maintaining detailed records for audits and compliance.

Fraud Detection and Prevention

Analyze JSON data for unusual patterns or suspicious transactions, enhancing security and reducing the risk of fraud.

Why Should You Use Klippa to Convert Credit Card Statements to JSON?

Klippa DocHorizon is an advanced Intelligent Document Processing platform that offers a wide range of versatile document processing modules. Converting different types of documents, such as credit card statements, into multiple formats like JSON becomes easy and efficient. Isn’t that amazing?

With Klippa, you can count on:

- Advanced OCR Technology: Accurate data extraction, even from scanned or complex layouts.

- Customizable Outputs: Generate JSON files tailored to your specific needs.

- Scalable and Secure: Handling large volumes of files efficiently while ensuring data security.

- Seamless Integration: Connection with APIs, cloud storage, and existing systems is effortless.

By implementing Klippa’s comprehensive documentation, you get to set up an easy workflow tailored to your needs. Curious to experience what Klippa Dochorizon has to offer?

Contact our experts today to answer all of your questions and show you how our platform works by booking a demo.

Conclusion

Converting credit card statements into multiple formats can be time-consuming and complex, right? It doesn’t have to be! With the right tool, you can save time, reduce errors, and streamline your workflows. Spending money on automating this task is not just a cost. It’s a smart step that will help you drive your business toward success and positive business results. Are you concerned about processing in batches? No need. Klippa’s solution is here to show you how it’s done effortlessly.

FAQ

Free tools can be useful for basic tasks or occasional use. However, they often lack advanced capabilities such as OCR, bulk processing, and robust data security, making them inadequate for handling complex documents or high-volume workflows effectively.

JSON (JavaScript Object Notation) is a lightweight data format used for exchanging and structuring information. It is widely compatible with programming languages, making it ideal for integrating data into systems like APIs, databases, and web applications.

Klippa can convert a variety of documents into JSON, including receipts, invoices, tax forms, purchase orders, bank statements, identity documents, and contracts. With advanced OCR and data extraction technology, Klippa ensures accuracy and efficiency, even for complex or bulk document processing.

Yes. Klippa offers a free trial with €25 in credits, allowing you to explore the platform’s features and capabilities before making a decision.

Absolutely. Klippa complies with global data privacy standards, including GDPR. Your data is encrypted, securely processed, and never shared with third parties without your consent.