Are you an accountant, tax advisor, auditor, or someone else who works regularly with tax data? Then, converting tax forms to JSON can help you simplify and optimize your tasks.

Why JSON? Its structured and lightweight design makes it ideal for automating workflows and sharing data across platforms. Besides JSON’s simplicity and flexibility, it’s widely used and ensures compatibility with various platforms such as databases, APIs, and cloud services. All these features make it a versatile choice for streamlining workflows.

In this blog, we’ll show you step-by-step how to convert tax forms into JSON, making the process fast, accurate, and easy!

Free Solutions for Converting Tax Forms to JSON

Let’s start with the free options. There are many free and simple solutions available for converting documents into JSON. They do the job if the processed documents are not too complicated, containing standard layouts and simple elements without tables.

For example, if you have tax forms in a PDF format, you could use one of the many free PDF to JSON converters.

Below you’ll find some good options:

Free tools may seem promising at first, but you’ll quickly encounter their limitations. These include restrictions on file size, number of pages, and bulk processing capabilities. Additionally, challenges like password-protected PDFs, limited free plans, and complex layouts can lead to more headaches.

For more advanced needs, premium solutions like Klippa DocHorizon are the answer. They handle large volumes of data with greater accuracy, reducing common errors found in free tools. With advanced features, enhanced security, and reliable customer support, these solutions let you work efficiently without worrying about hidden costs or data security risks. Let’s check this out in more detail!

How to Convert Tax Forms to JSON Automatically with Klippa

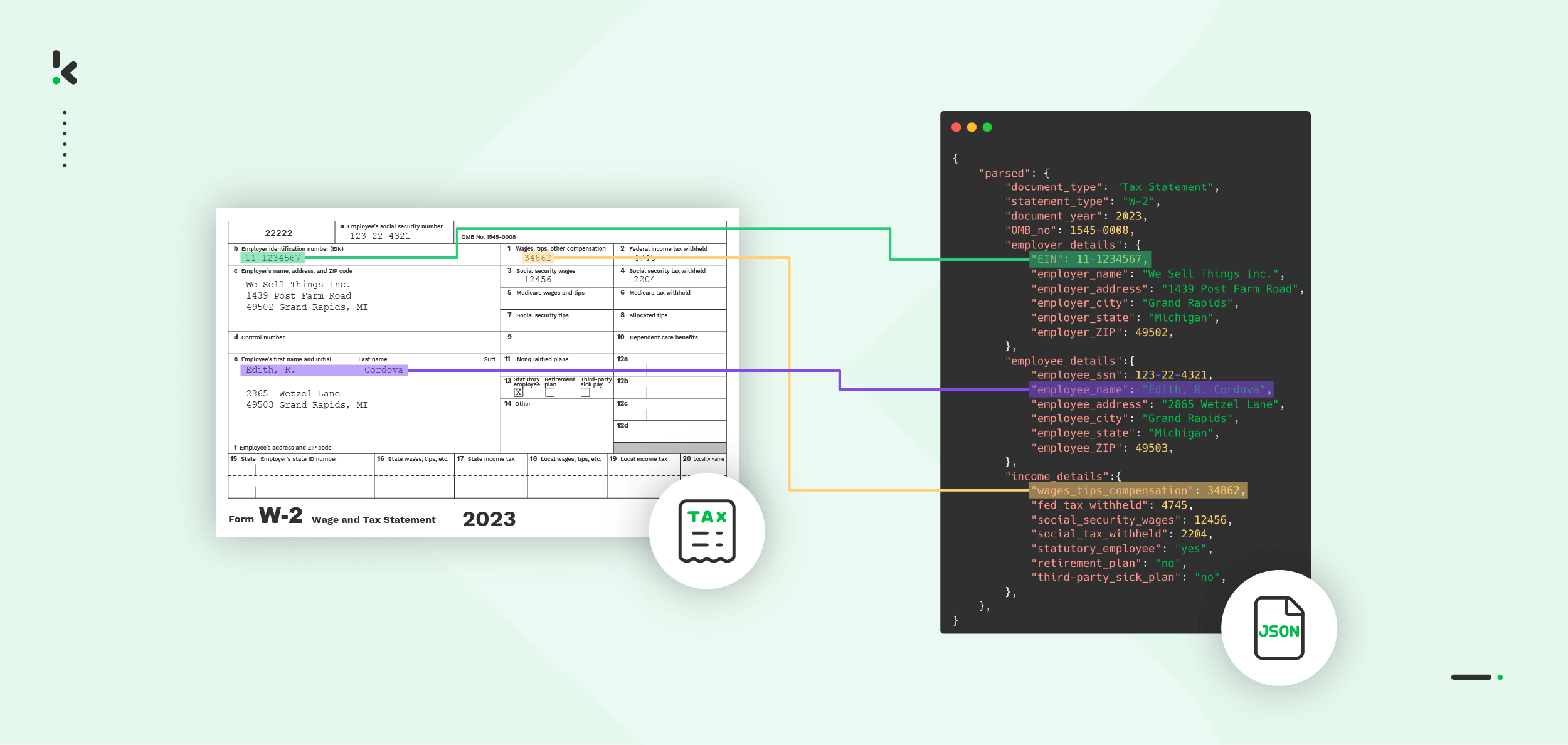

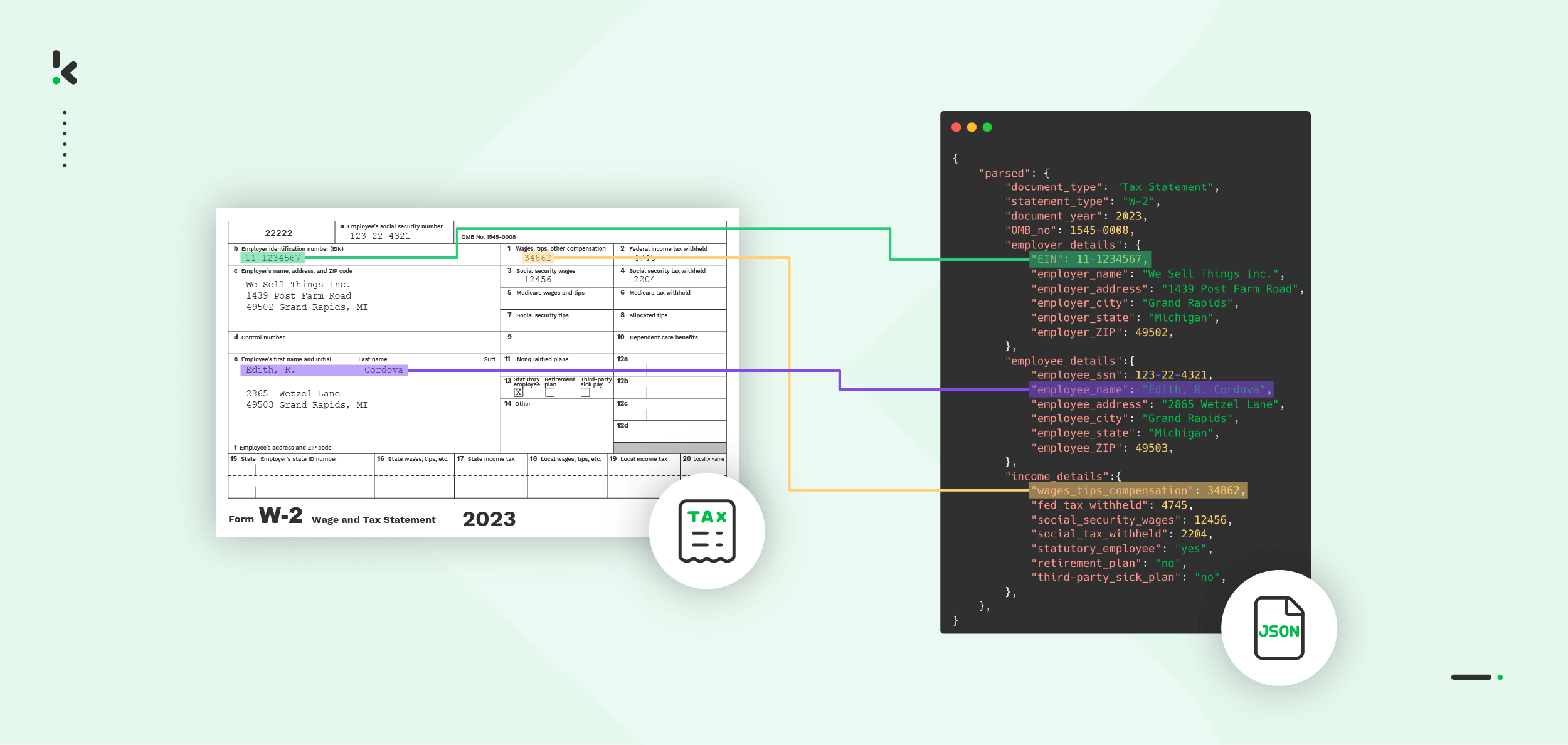

Intelligent Document Processing (IDP) platforms like Klippa DocHorizon can help you automate your document workflows and seamlessly process your tax forms. With Klippa, converting your tax forms to JSON becomes easy and efficient. The platform supports various document formats such as PDF, CSV, and more, ensuring flexibility for various use cases.

Not sure if this is the right tool for you? We’ve got you covered. You can try it for free!

Here’s a step-by-step guide to help you get started. For this example, we’ll show how to convert tax forms in a PDF format to JSON for better clarity.

1. Sign up on the platform

Signing up for free on the DocHorizon Platform would be the first step to take. Simply enter your email address, and password and then provide some details like full name, company name, use case, and volume. Once you’ve completed this step, you’ll receive a free credit of €25 to explore all the platform’s features and capabilities.

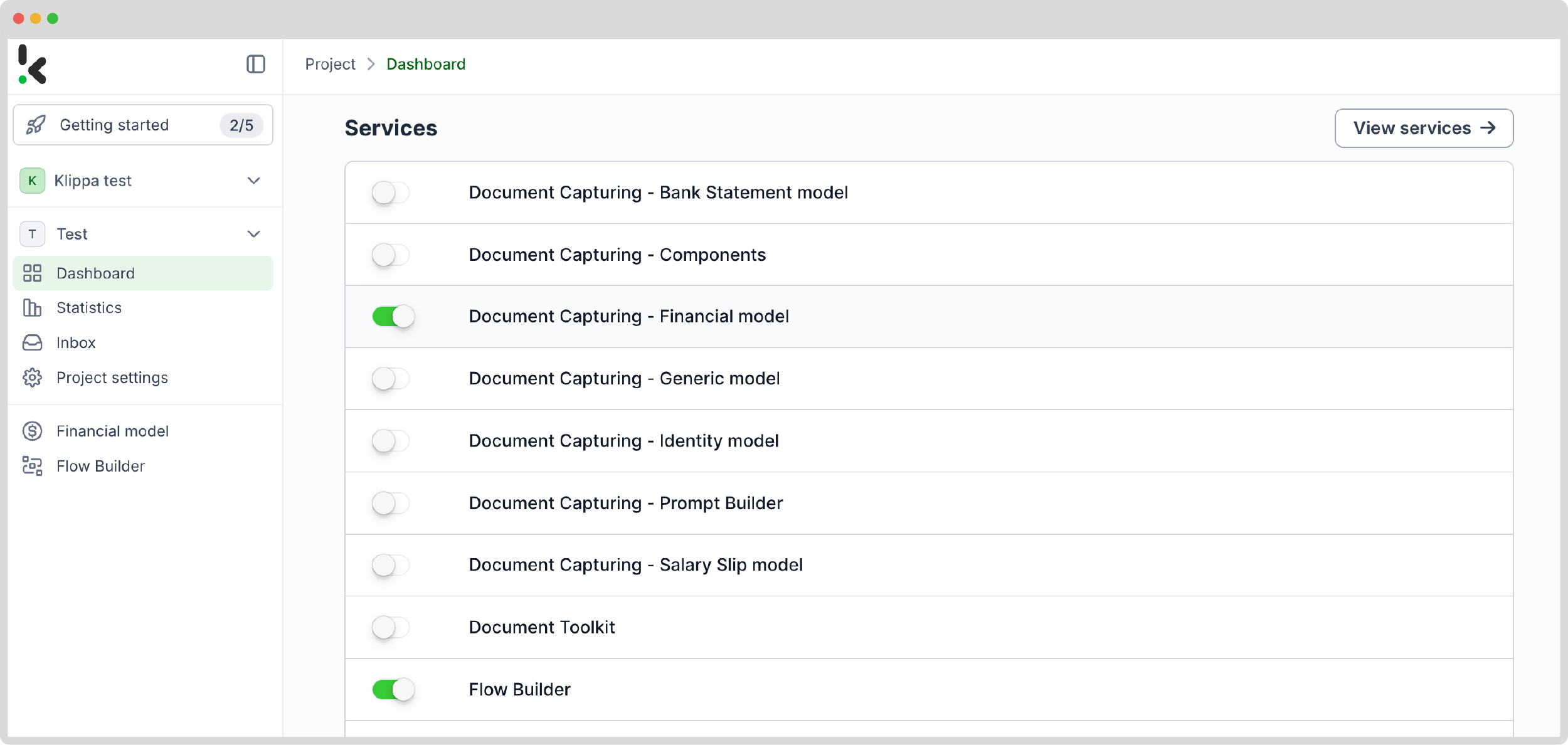

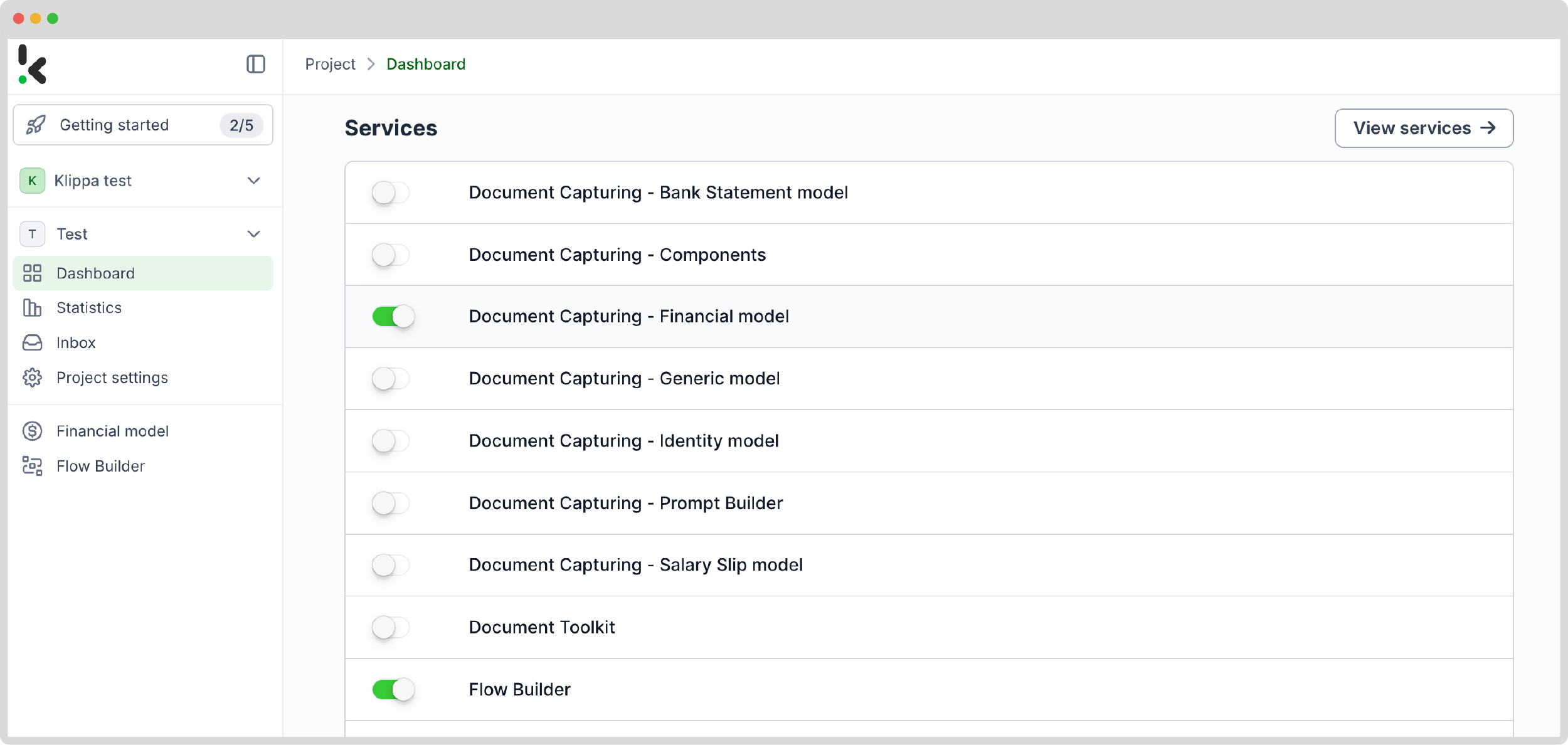

After logging in, you’ll need to create an organization and set up a project to access our services. For this use case – converting PDF invoices to Google Sheets – simply enable the Flow Builder and Financial Model services to get started. This setup ensures you have everything you need right from the start!

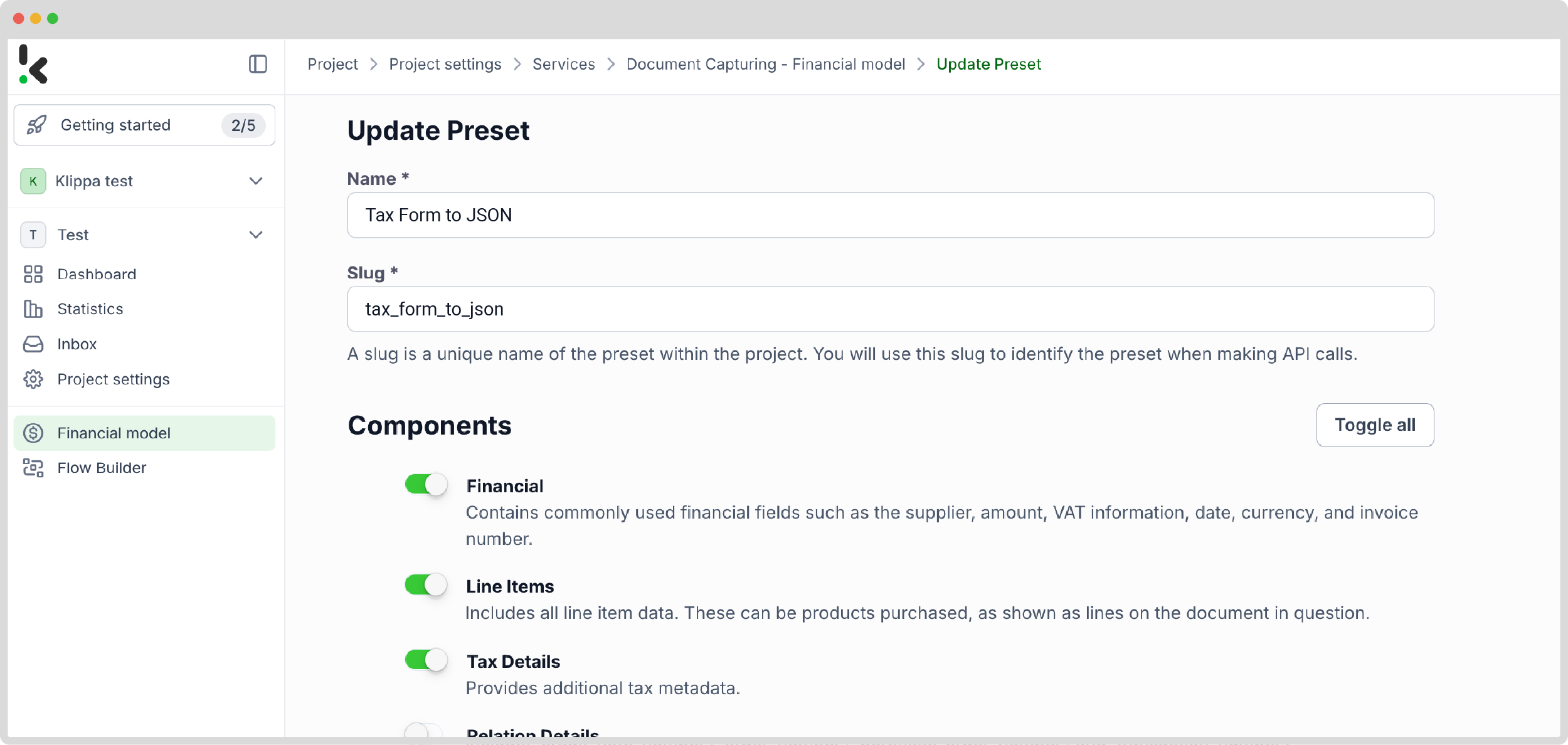

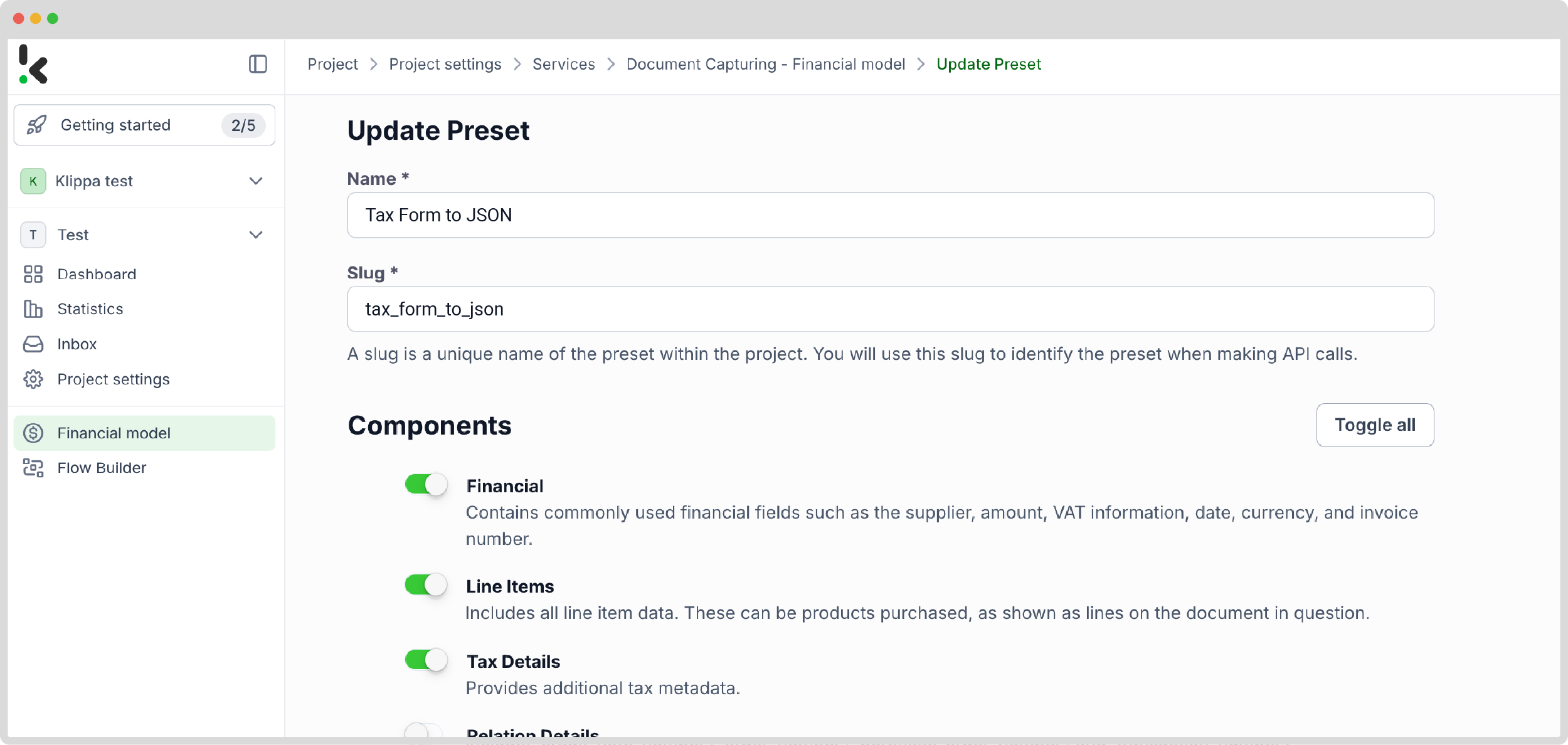

2. Create a preset

With the Financial Model, you can simplify your financial workflows by extracting, analyzing, validating, and classifying data. Additionally, financial documents, such as tax statements, invoices, receipts, bank statements, and more can be processed efficiently.

Once activated, you can create a new preset. Let’s name it “Tax Form to JSON”. This preset allows you to activate the components you need for your specific use case. For this case, you’ll enable the financial, tax details, and line items components to process specific fields in your tax forms such as tax rates, tax amount, and tax details.

Here’s a tip: There’s the option to further customize the preset depending on your use case by enabling more components such as Date Details, Reference Details, Amount Details, Document Language, Payment Details, etc.

You’re nearly there! If you wish to fully automate the process of taking documents from a folder, processing them through the system, and storing the results automatically, a few more steps are needed.

The Flow Builder is what you need for bulk operations.

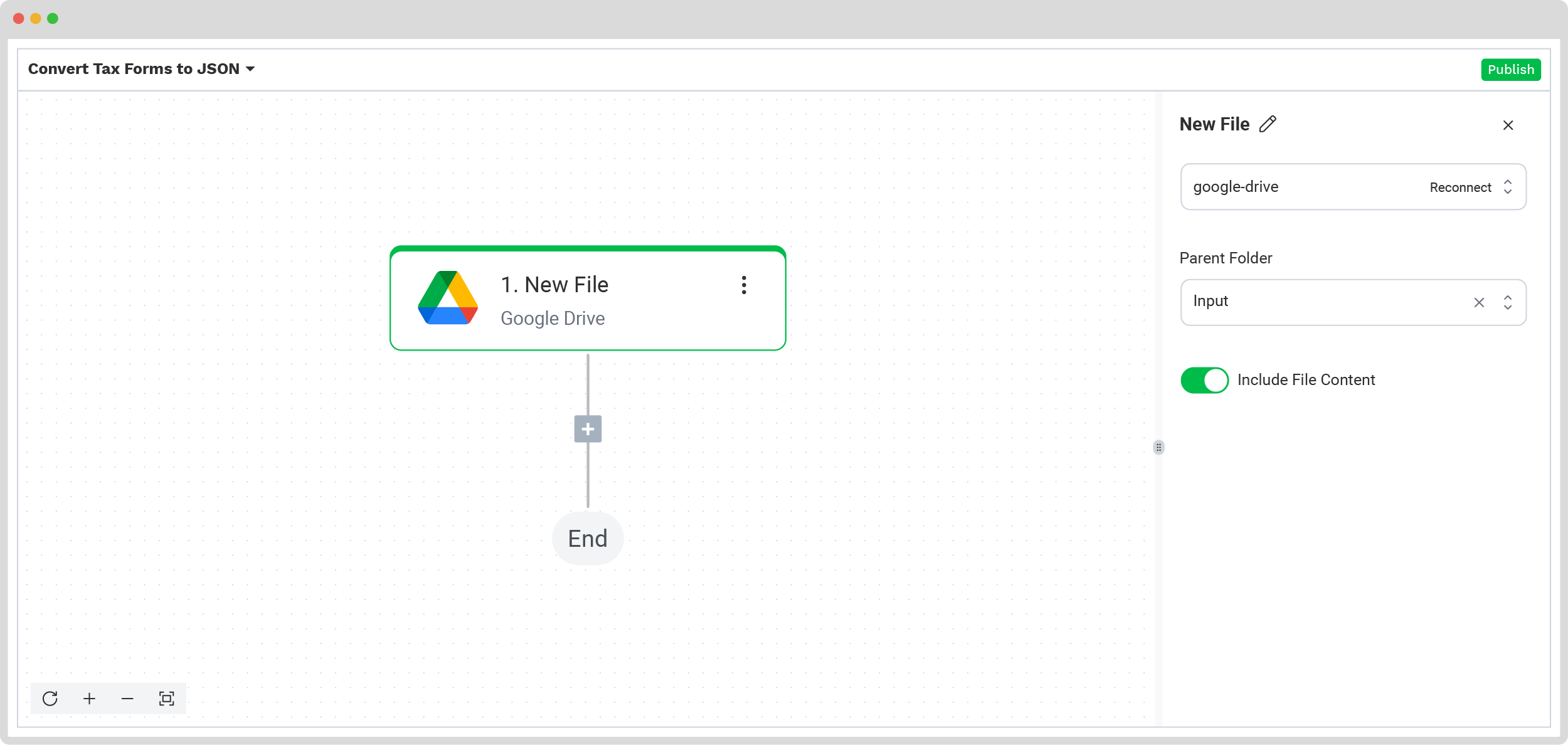

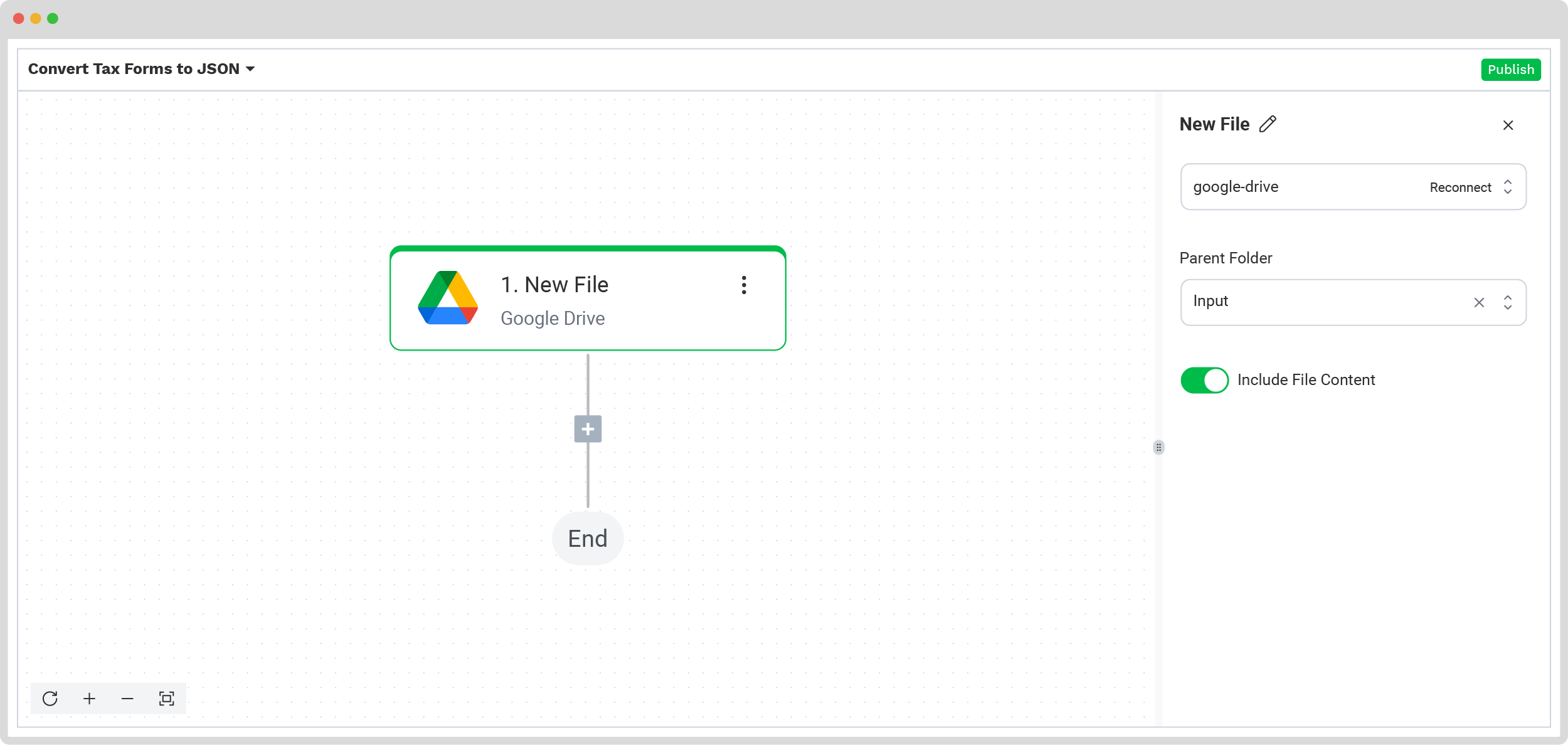

3. Select your input source

Now, it’s time for the Flow Builder to take action. Go back to the services interface and select it. From there, you can create a New Flow from scratch and assign it a name. For this example, we’ll name it “Convert Tax Forms to JSON”.

First, you need to select your input source. You can upload files directly from your device or connect to over 100 external sources like Google Drive, Dropbox, Outlook, Box, Salesforce, Zapier, OneDrive, your company’s database, or even cloud storage solutions like Amazon S3 and iCloud. Make sure to include all the tax forms in the same folder so they can be processed in bulk if needed.

For this example, we’ll create a folder named “Input” in Google Drive and upload our tax forms there.

Next, choose your input source by selecting “Google Drive” and then “New File” as your trigger. This is going to start your flow. On the right side, fill out the following sections:

- Connection: You can assign any name to your connection. For instance, we’ve named ours “google-drive”. Once named, the system will prompt you to authenticate with Google.

- Parent Folder: Input

- Include File Content: Check this box to ensure file content is processed.

4. Capture and extract data

For this step, we’ll use the previously created preset to process all the selected data fields from all the tax forms in the input folder. The platform uses Optical Character Recognition (OCR) technology to automatically scan and extract data from each tax form.

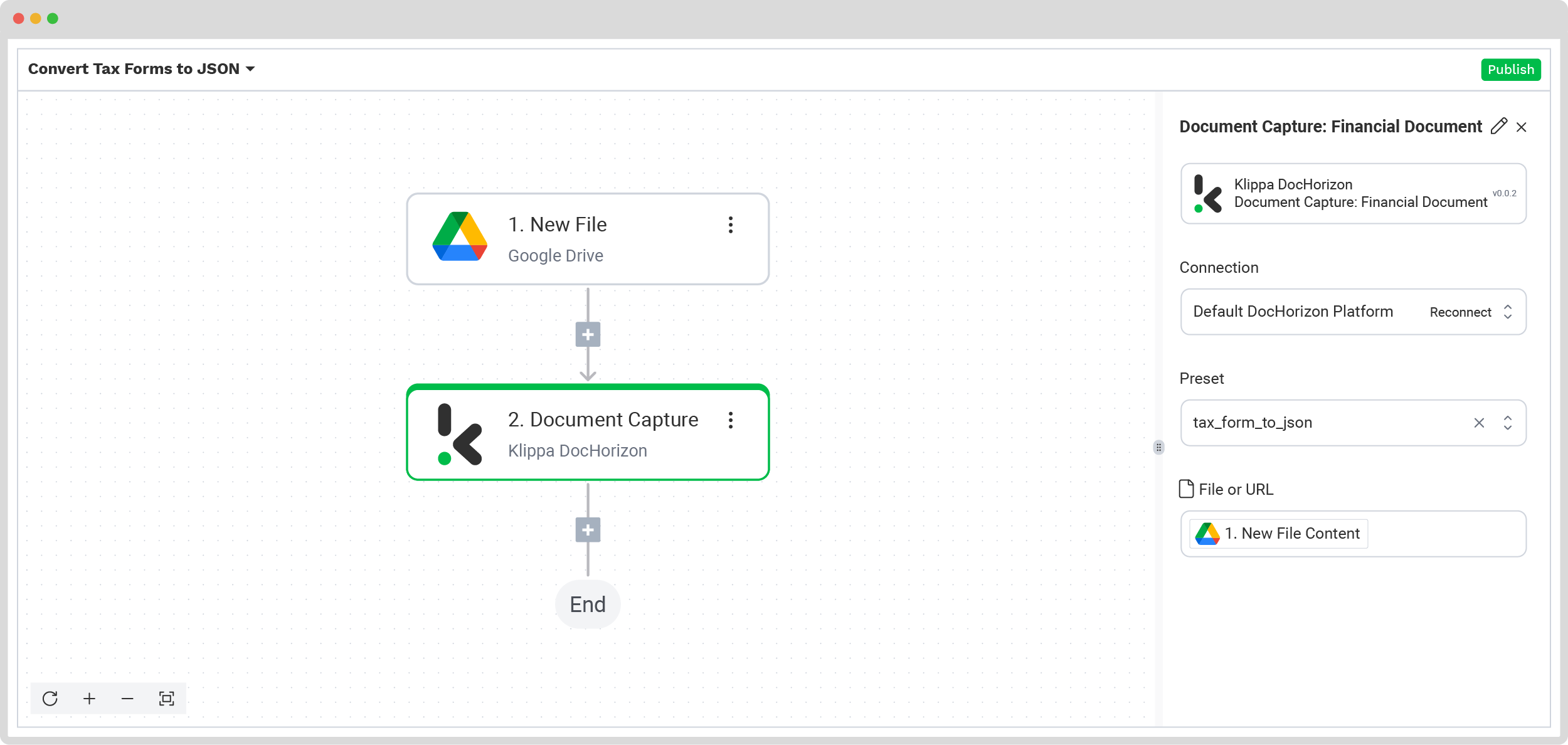

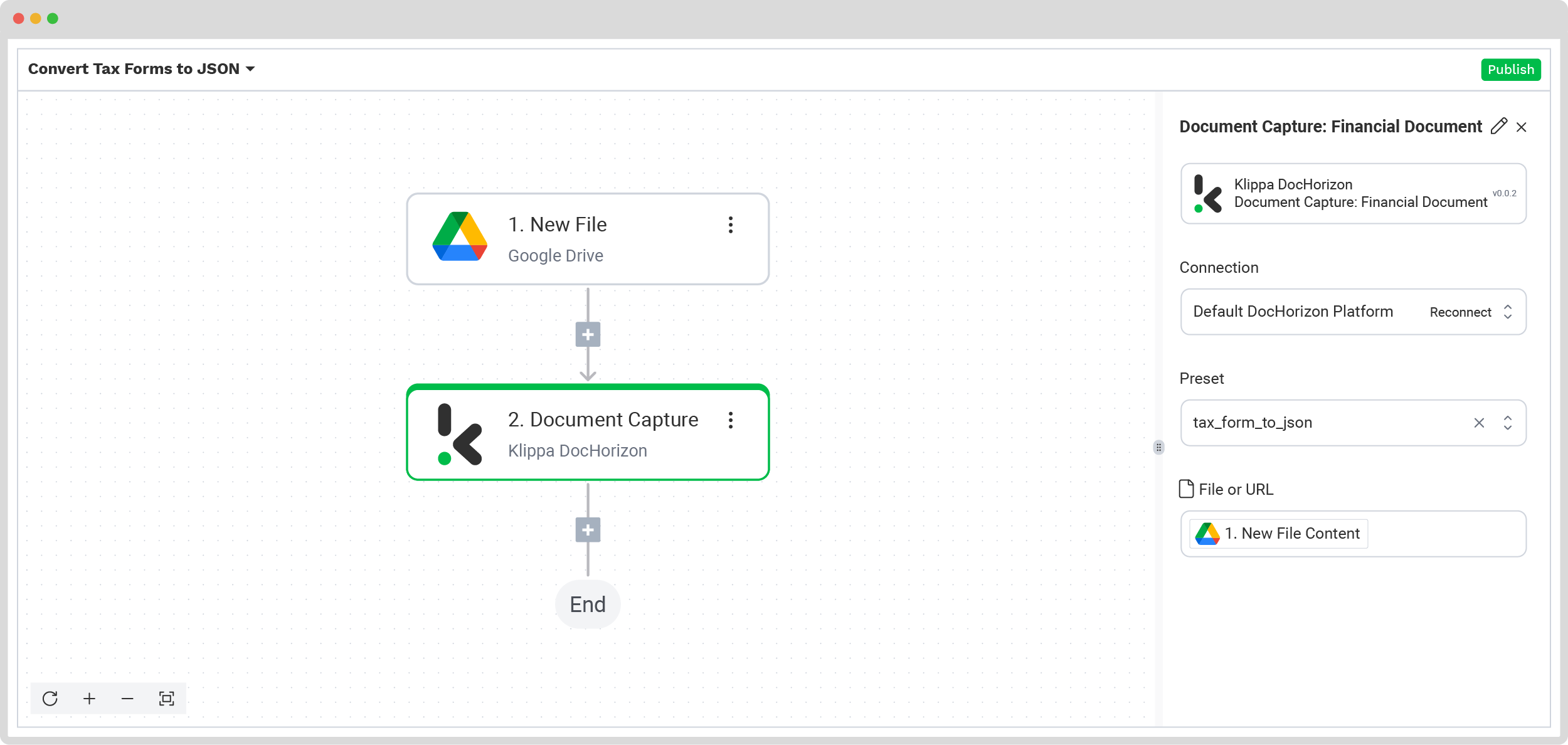

In the Flow Builder, press the + button and choose Document Capture: Financial Document.

To proceed, configure the following:

- Connection: Default DocHorizon Platform

- Preset: The name of your preset (in our case “Tax Form to JSON”)

- File or URL: New file → Content

5. Save the file

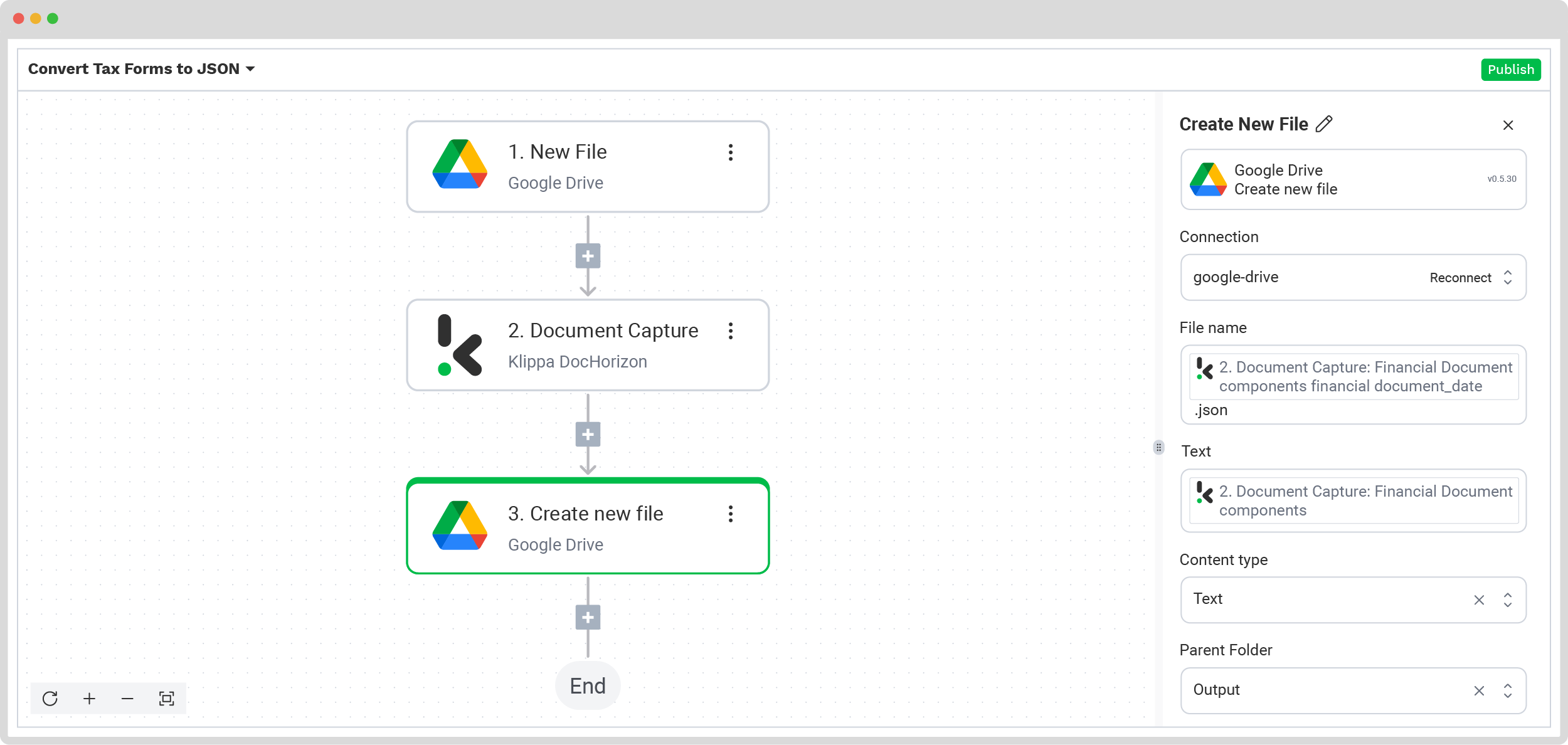

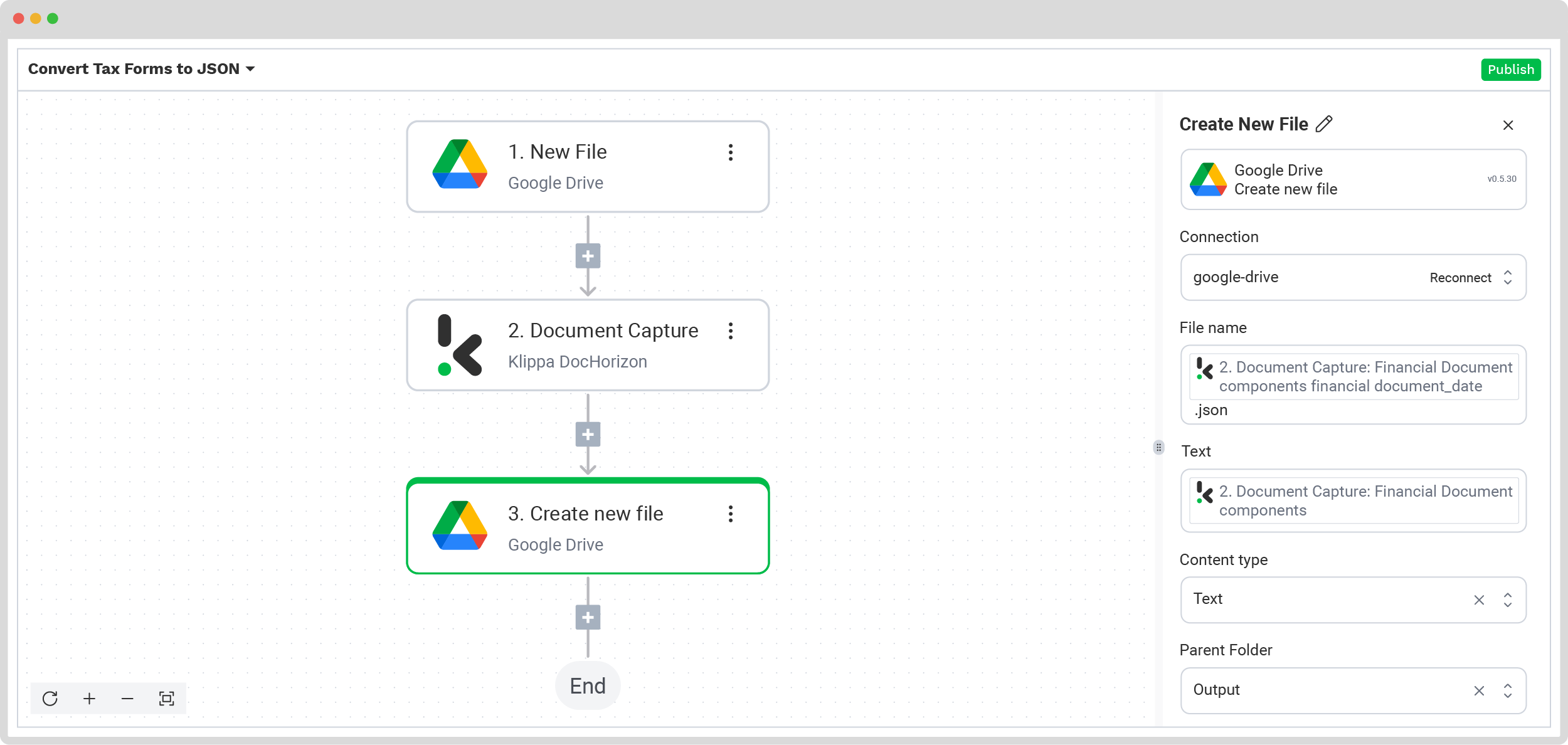

Once the tax forms are processed, you can choose how to handle the results. In this case, you can create a new file in Google Drive through the platform.

Press the + button and select Create new file → Google Drive

To proceed, configure the following:

- Connection: google-drive

- File Name: Document Capture: Financial Document → components → financial → document_date (string). Next to it, type .json

- Here’s a tip: Instead of using “.json” for the file name, you can choose other formats such as PDF, CSV, XML, and more, depending on your preference.

- Text: Document Capture: Financial Document → components

- Here’s a tip: Select the text you want to include in the new document. By selecting components you choose all the extracted elements.

- Content Type: Text

- Parent Folder: Output (the name of your output file)

Congratulations! The workflow is now complete and you can see all processed tax forms in your Output Folder on Google Drive. With this one-time setup, simply publish the flow, and any new tax form added to the folder will be processed automatically, saving you time and ensuring your data stays organized effortlessly.

Practical Use Cases of JSON in Tax Workflows

Converting tax forms to JSON is a big benefit for companies, especially the ones who want to manage, analyze, or integrate tax data efficiently. As mentioned before, JSON is a simple and flexible format which makes it perfect for seamless data exchange and workflow automation. Let’s see some practical use cases where JSON is helpful:

Seamless Integration with Accounting Systems

Tax data in a JSON format can be easily imported into accounting software or ERPs. This allows businesses, especially those that deal with a high volume of tax-related data, to ensure real-time financial tracking and accurate bookkeeping.

Automating Tax Filing Workflows

JSON makes it easy to integrate tax data with filing software and APIs, allowing businesses to automate the submission of tax forms to authorities. This reduces manual input, minimizes errors, and speeds up the filing process.

Streamlining Legal & Compliance Reporting

With JSON, tax forms can be easily validated for compliance with regulatory requirements. This allows businesses to easier generate accurate compliance reports and avoid penalties.

Data Analysis and Insights

By converting tax data into a JSON format you can easily leverage business intelligence tools. With these tools, you can extract insights like deductions, credits, and tax liabilities across forms to improve financial planning.

Cross-Platform Data Sharing

JSON is supported by almost all modern programming languages and platforms, making it a versatile tool and ideal for sharing tax data securely with third parties, such as accountants, auditors, or regulatory bodies.

No matter your use case or industry, choosing an IDP solution to streamline the conversion of tax forms to JSON is a smart choice. That’s where Klippa DocHorizon comes in. This tool not only automates the process of converting tax forms to JSON but also enhances your entire workflow, offering you more time and better accuracy.

Why Should You Use Klippa to Convert Tax Forms to JSON?

Are you ready to simplify the process of converting your tax forms to JSON? With Klippa DocHorizon, the process becomes effortless, efficient, and reliable!

Klippa DocHorizon is an advanced automated document processing platform that retrieves PDFs from your selected input source, extracts the necessary data, and converts it into structured JSON files. The output, which is in JSON format, is then delivered to your chosen destination.

Here’s why Klippa DocHorizon is the right solution for you:

- Advanced OCR Technology: Extract data with precision, even from scanned or complex PDF layouts.

- Customizable Outputs: Generate JSON files tailored to your specific needs.

- Scalable and Secure: Efficient managing of large volumes of files while ensuring data security.

- Seamless Integration: Effortless connection with APIs, cloud storage, and existing systems.

Implementing Klippa is simple thanks to our detailed documentation, user-friendly setup, and proactive customer support team.

Ready to take the next step in optimizing your workflows? Contact our experts to get all your questions answered or book a demo today to see Klippa Dochorizon in action!

FAQ

Free tools can be useful for basic tasks or occasional use. However, they often lack advanced capabilities such as OCR, bulk processing, and robust data security, making them inadequate for handling complex documents or high-volume workflows effectively.

JSON (JavaScript Object Notation) is a lightweight data format used for exchanging and structuring information. It is widely compatible with programming languages, making it ideal for integrating data into systems like APIs, databases, and web applications.

Yes. Klippa offers a free trial with €25 in credits, allowing you to explore the platform’s features and capabilities before making a decision.

Absolutely. Klippa complies with global data privacy standards, including GDPR. Your data is encrypted, securely processed, and never shared with third parties without your consent.