Whether it’s for expense management or payment reconciliation, invoices are an inevitable part of a business’s day-to-day operations. However, they can also be a source of vulnerability for your organization.

In fact, according to the Washington State Auditor’s Office, organizations make duplicate payments ranging from 0.8-2% of their total payments due to duplicate receipts and invoices. While this percentage may seem small, the impact of duplicate invoices can be significant, resulting in substantial financial losses and operational inefficiencies on every level.

To help you confront this growing issue, we’ll explore what duplicate invoices are, their potential impact, and how to effectively detect duplicate invoices. Read on!

What are Duplicate Invoices?

Duplicate invoices refer to multiple copies of the same invoice being issued for the same transaction. Whether a result of human error or deliberate fraud, if left undetected, duplicates cause administrative bottlenecks and lead to unforeseen expenses.

What Are the Causes of Duplicate Invoices?

Duplicate invoices and duplicate payments can occur due to a wide range of reasons. Here are some of the most common causes:

- Human Error: This can occur at various stages of the invoicing process, from the data entry step to the invoice reconciliation process or even the approval. Humans make mistakes, which can lead to double invoicing or undetected duplicate submissions.

- Financial Fraud: Duplicate invoices could also be a result of intentionally fraudulent efforts on the part of your employees or suppliers intending to commit expense fraud or invoice fraud.

- Lack of Oversight: Inadequate controls or oversight in the invoicing process can also contribute to duplicate invoices. Without proper checks and balances in place, duplicate invoices may go unnoticed until they are processed for payment.

- Lack of Centralization: A lack of a central destination where all incoming invoices can be submitted can lead to duplicate invoices being sent via different methods and getting lost in the system until it’s too late.

No matter the cause of duplicate invoices, their existence should be of concern to you. In the next section, let’s go into detail about the impact duplicates can have on your business.

The Impact of Duplicate Invoices

Undetected, duplicate invoices can have far-reaching consequences on all facets of your business. Here are some of the issues that often arise:

- Financial Loss: Duplicate invoices lead to overpayment, resulting in financial losses for your business, which would negatively impact your bottom line and overall profitability.

- Cash Flow Problems: Duplicate invoices can disrupt cash flow management, as the funds tied up in payments for duplicate invoices may affect the company’s ability to meet its financial obligations, causing liquidity issues.

- Compliance and Auditing Issues: Duplicate invoices often raise compliance concerns and result in failed audits. If auditors flag inconsistencies in financial records, it can lead to further scrutiny and potential fines or penalties.

- Deterioration of Vendor Relationships: Duplicate invoices that result in delayed payments or even incorrect payments can lead to frustration for suppliers and strain long-term partnerships.

- Accounting Errors: Duplicate invoices can cause discrepancies in financial records and accounting systems. This can lead to inaccuracies in financial reports, making it challenging for businesses to track their expenses and revenue accurately.

When it comes to duplicate invoices, the stakes involved are just too high. Since human errors are one of the primary causes of duplicate invoices, relying on manual detection is far from a secure choice. A more foolproof approach would be to automate invoice duplicate detection. Let’s find out how our solutions can help you with this.

How to Detect Duplicate Invoices with Klippa

At Klippa, we offer two possible ways of detecting duplicates: SpendControl, a spend management system, and DocHorizon, an Intelligent Document Processing (IDP) platform that provides various document processing solutions.

SpendControl

Klippa SpendControl is our digital solution for processing, approving, and archiving expense claims and invoices.

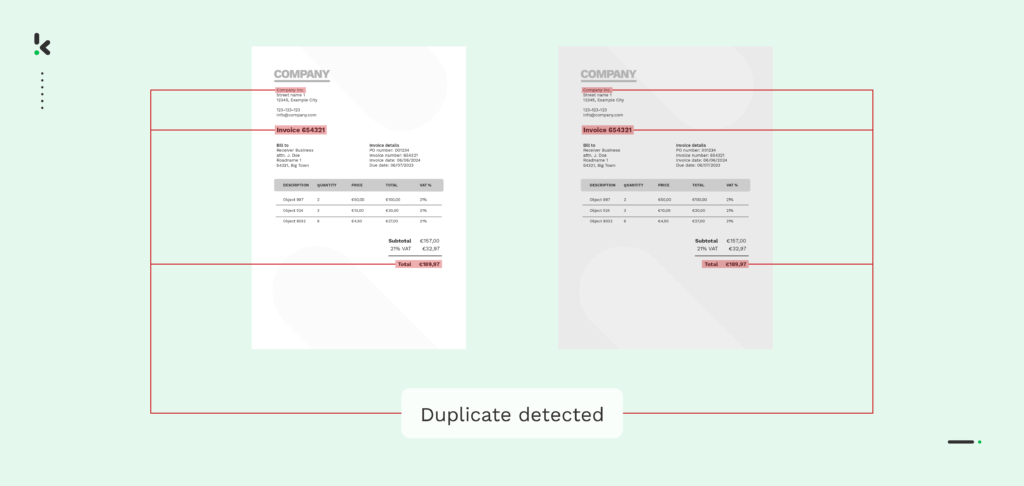

When an invoice is uploaded to the SpendControl platform, the software processes the invoices and sends a warning when three of the following fields match those of a previously uploaded invoice:

- Invoice number

- Merchant name

- Purchase date

- Amount

It is as simple as that with Klippa SpendControl. The alternative solution, Klippa DocHorizon, requires a few more steps but is just as simple.

DocHorizon

Here is how invoice duplicate detection works with DocHorizon.

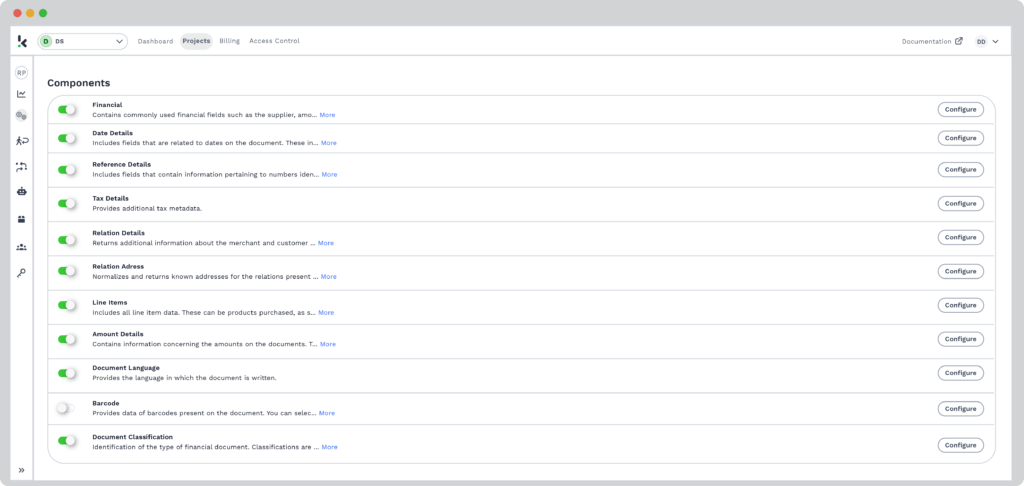

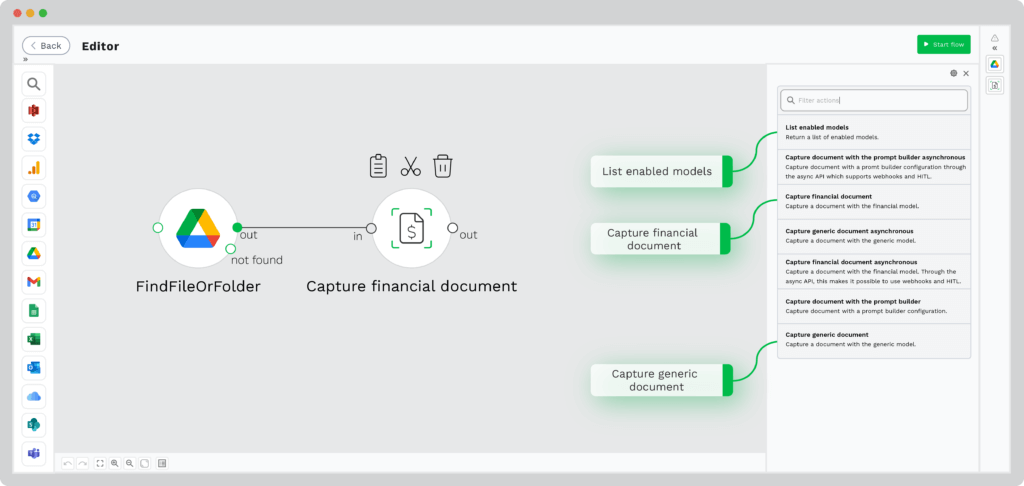

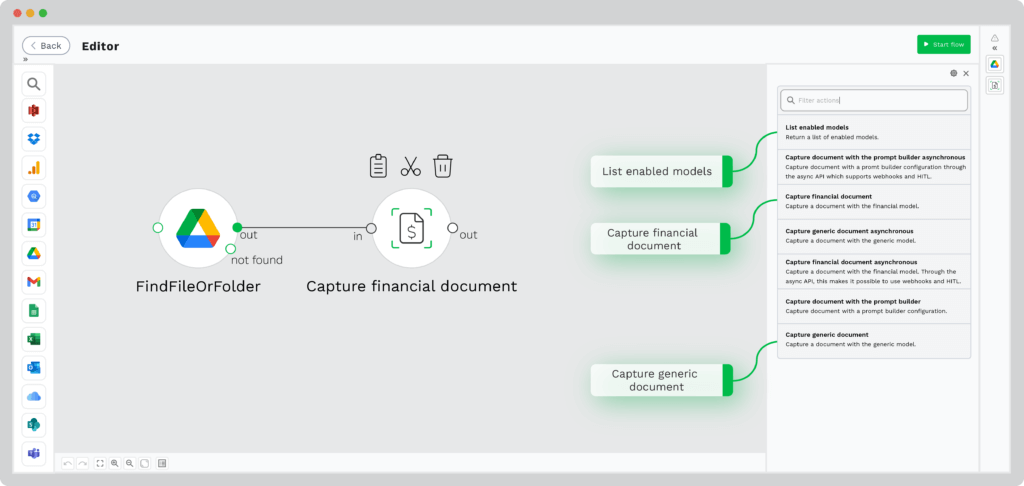

Step 1: Configuration for duplicate detection:

After signing up to the platform, configure the financial document capturing model and your presets to start the duplicate detection process. For invoice duplicate detection, you will need to activate all components relevant to the process, especially the hash component to enable duplicate detection.

Step 2: Selecting your input method:

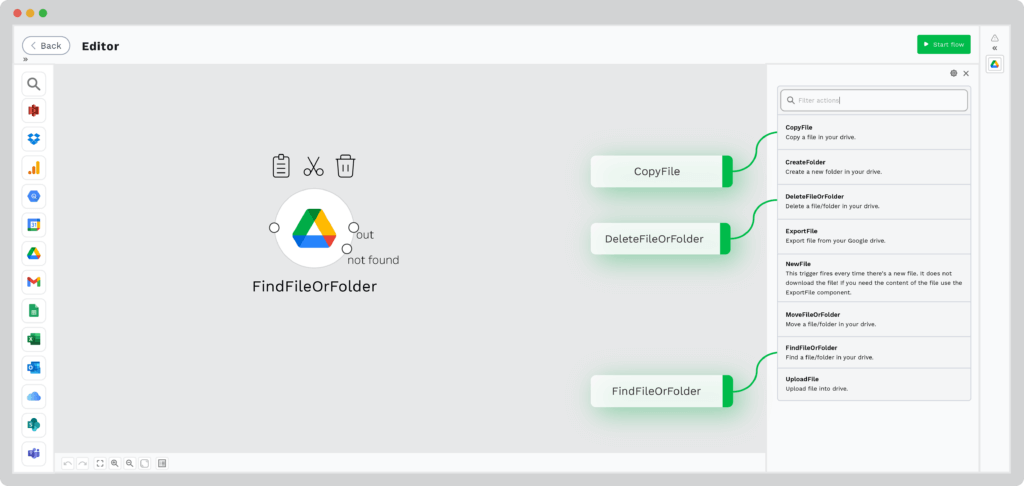

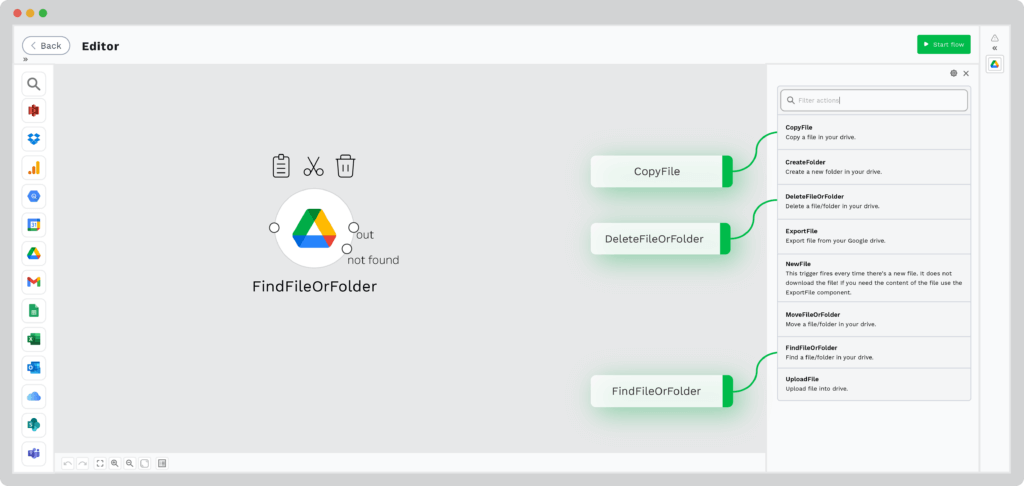

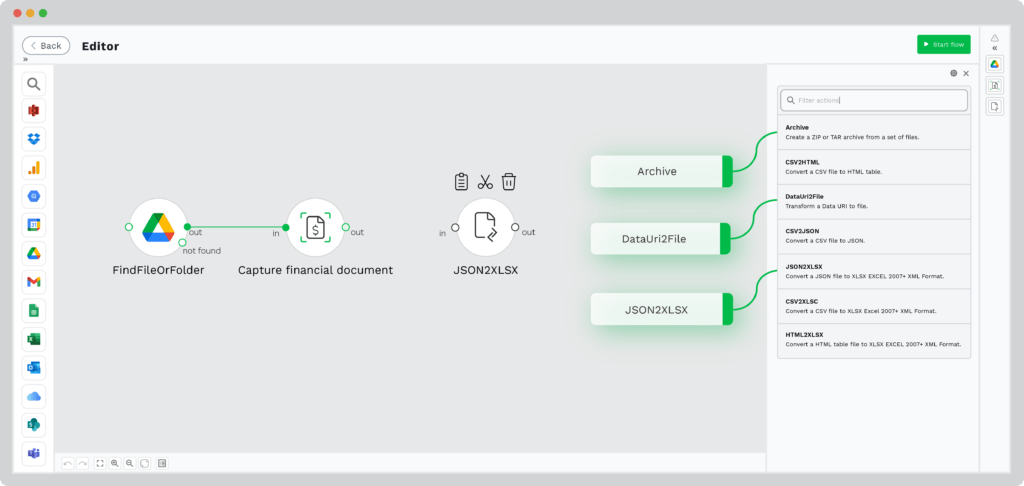

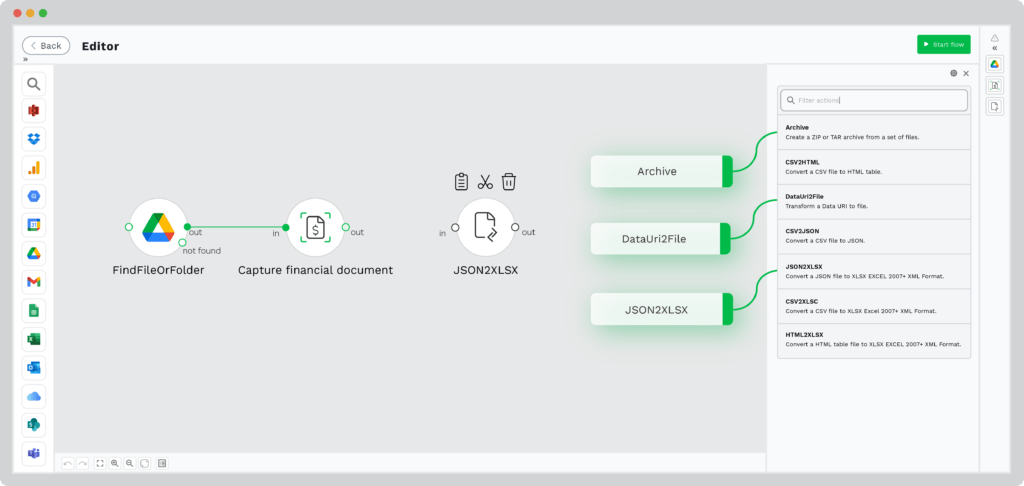

To start the flow in the flow builder, you will need to determine your input method. You can choose from various options but for this example, we will be using Google Drive.

Alternatively, the invoices can be retrieved with:

- Email Parsing: Forward invoices via email, a straightforward method for quick submissions.

- Direct Upload: Submit images or PDFs directly through our platform interface for immediate processing.

- In-App Scanning: Utilize Klippa’s advanced scanning SDK within your application for efficient on-the-go invoice capture.

Step 3: Data extraction:

The software is now able to extract the invoice data including invoice line items (invoice numbers, purchase dates, and a lot more).

Step 4: Duplication detection:

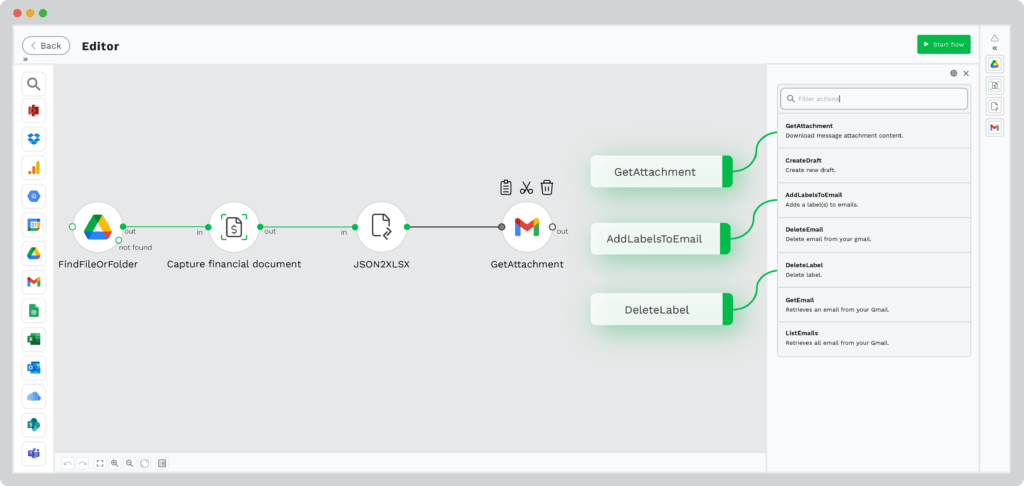

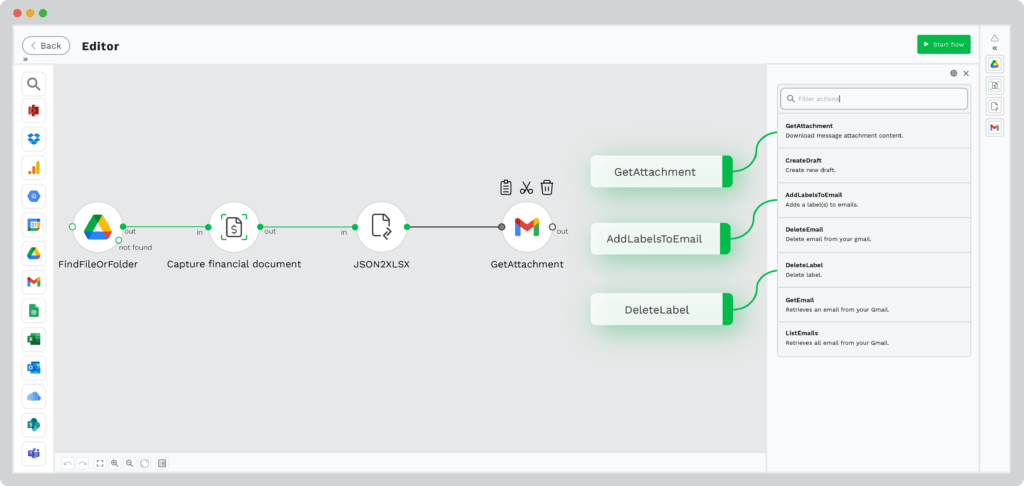

At this stage, the invoices have been submitted and the data is captured. Each submitted invoice is given a unique identifier, which you can think of as a fingerprint a.k.a. hash. This enables our software to detect if a similar document is submitted again and you will be notified.

Step 5: Data output:

For the last step of your flow, you need to select a final destination for the processed invoices. The output can be sent for you to process further. We can forward all data to your preferred software, processing interface, or even Google Drive. We have 50+ integration possibilities.

Streamline Your Invoice-Centric Workflows with Klippa

Klippa’s solutions provide your business with a range of benefits to improve your invoice workflows in the long term. With our solutions, you can:

- Save time: Save up to 70% in processing time and reduce manual tasks like data entry to optimize invoice-related workflows like invoice reconciliation, spend management, or expense management.

- Prevent fraud: Leverage our intelligent document fraud detection, to protect your organization from the efforts of fraudulent actors.

- Customize your workflow: Create custom document processing workflows to suit your invoice processing needs and much more.

- Enhance accuracy: With AI-powered Optical Character Recognition (OCR) technology integrated into our solutions, you get to achieve up to 99% data extraction accuracy and automate data entry.

- Integrate with ease: Easily integrate Klippa’s solutions with the accounting and enterprise resource planning (ERP) systems of your choice. We have 50+ integration possibilities.

Ready to find out how Klippa’s invoice duplicate detection solution can be integrated into your business flow? Book a demo below or contact one of our experts for more information!