Mortgage fraud is threatening businesses across industries, with banks and other financial institutions being no exception. In recent years, this has increased, with a CoreLogic report estimating that in Q2 2024, approximately 1 in 123 (0.81%) of all mortgage applications in the United States indicated fraud. This is an increase from the estimate of 1 in 134 for Q2 of 2023.

This alarming statistic underscores the pervasive nature of the issue, and professionals in the financial sector must stay ahead of these challenges. But how exactly can lenders get in front of these frauds?

In this blog, we will go through what mortgage fraud is, the telltale signs, and the intelligent document processing software available for lenders to prevent mortgage fraud and protect their organizations.

Key Takeaways

- Mortgage fraud is on the rise, with schemes like identity theft, income fraud, and property flipping becoming more common.

- Red flags to watch out for include inconsistent documents, fake IDs, unusual financial behavior, and rapid property sales.

- Intelligent Document Processing (IDP) helps lenders detect fraud early by automating ID checks, bank statement analysis, and document cross-verification.

- Tools like Klippa DocHorizon streamline mortgage workflows, reduce manual errors, and help ensure compliance with KYC/AML regulations.

What is Mortgage Fraud?

Mortgage fraud refers to illegal activities that involve misrepresentation or deception in the mortgage lending process, committed by borrowers or professionals in the mortgage industry. This fraud can span all stages of the lending process.

Mortgage processing is a time-consuming and extensive process, so finding ways to streamline the processing of relevant documents, including validating them, should be an important goal for businesses. In addition, spotting mortgage fraud early can also be a key step in protecting your business against non-compliance fines, including KYC (Know Your Customer) and AML (Anti-Money Laundering).

But what types of fraud are there, and what are the signs to look out for? The following sections will detail what these are and how to get in front of them.

Types of Mortgage Fraud

Mortgage fraud comes in many forms, each designed to deceive lenders and manipulate the application process. Here are some common types of mortgage fraud:

- Identity Theft: One of the most alarming mortgage fraud types is identity theft. Fraudsters may use synthetic identities or manipulated identities during the application process. Not only is this illegal in the application process, but it also poses significant risks to the individual whose identity is stolen.

- Income Fraud: With income fraud, an applicant falsifies their “stated income” to appear more financially stable and qualify for larger loans than their actual financial standing allows. These deceptions can jeopardize the lenders’ ability to accurately assess a borrower’s repayment capacity.

- Occupancy Fraud: This refers to a misrepresentation of the intended use of the property. Borrowers may claim a property as their primary residence when, in reality, it serves as an investment property. With this fraud, if the lenders are unaware of the true purpose of the use of the property, they do not provide accurate loan terms such as interest rates.

- Appraisal Fraud: Property values play a pivotal role in determining loan amounts. Appraisal fraud involves inflating or deflating property values to secure more favorable loan terms. This tactic can lead to unjust financial gain or, conversely, place borrowers at a disadvantage.

Top 4 Signs of Mortgage Fraud

The mortgage application process is intricate and complex, opening doors for fraudsters to take advantage of. It’s, therefore, important to be able to spot the signs when confronted with them. So here are the top four red flags that should raise the suspicions of industry professionals:

1. Unusual Documentation

The documents needed in the mortgage process include income, employment records, and bank statements. These documents may have discrepancies or irregularities that may suggest that the lender is trying to mislead the financial institution. Be sure to inspect financial documents and cross-check payslips, proof of income statements, employment records, and bank statements.

2. Identity Red Flags

Stolen and fraudulent identity documents pose a risk to the application process. Scrutinize personal information, flag inconsistencies, and cross-verify with official records. Equip your organization with tools to combat mortgage fraud, such as AI-driven software for spotting fake IDs.

3. Property Flipping

Frequent property transactions at unusual price points can be indicative of attempts to manipulate property values for financial gain. Keep an eye on the property’s transaction history, especially rapid buying and selling, and assess whether the prices align with market trends.

4. Suspicious Financial Behavior

Sudden changes in the financial behavior or credit history of the loan applicants should raise a red flag. During the mortgage processing, look out for shifts in financial patterns, sudden large transactions, etc, and scrutinize the source of funds to ensure KYC/AML compliance.

Spotting red flags is just the beginning. The real challenge is identifying them efficiently, without delays or human error slowing things down. That’s why more lenders are turning to automate their workflows with intelligent solutions like Intelligent Document Processing (IDP), which we’ll explore in the next section.

How to Automatically Detect Mortgage Fraud

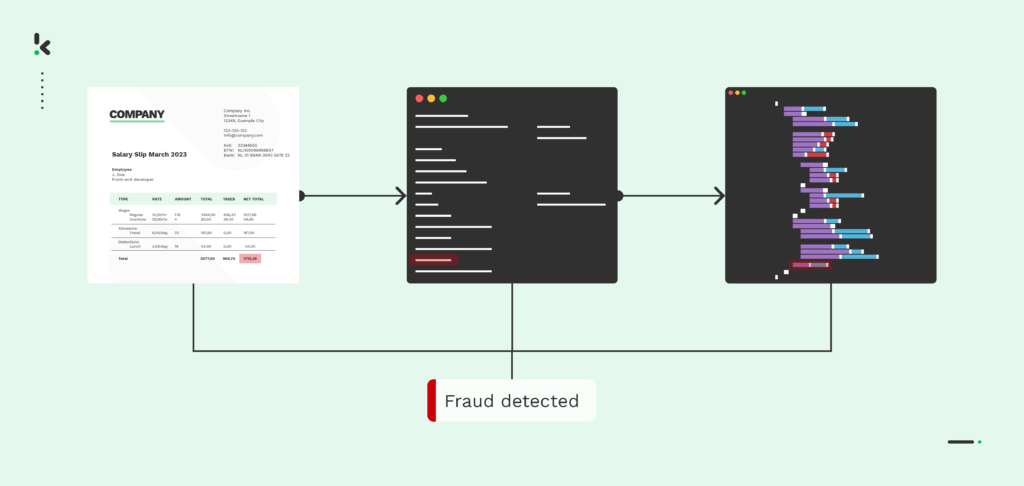

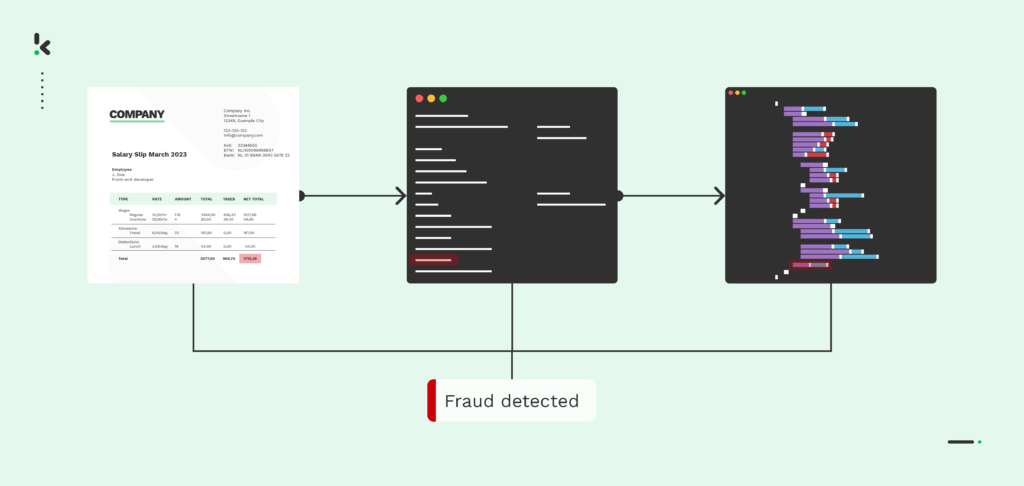

Manual checks can easily miss signs of fraud. That’s why many lenders now use Intelligent Document Processing. With the help of AI and OCR, IDP tools can quickly spot fake or changed documents, often before a person would notice anything wrong.

Here’s how you can use IDP to automatically detect mortgage fraud at different stages of the application process:

1. Spot Fake IDs with Smart Identity Verification

Manual ID checks often fail to catch altered or synthetic identity documents. IDP tools automatically scan submitted IDs for signs of fraud, such as:

- Mismatched fonts or tampered photos

- Altered birthdates or document numbers

- Irregularities in official templates or layouts

With AI-driven identity verification, even the most subtle manipulations are flagged before approval moves forward.

2. Detect Bank Statement Anomalies in Seconds

Bank statements are a critical part of mortgage applications, but reviewing them manually takes time and often leads to missed red flags. With IDP, you can automatically extract and analyze bank data to catch:

- Inconsistent or missing account details

- Unusual or unexplained large deposits

- Signs of digital tampering, like mismatched fonts or altered figures

By automating bank statement verification, IDP tools help you flag suspicious financial behavior quickly and accurately, giving your team more time to focus on real decision-making.

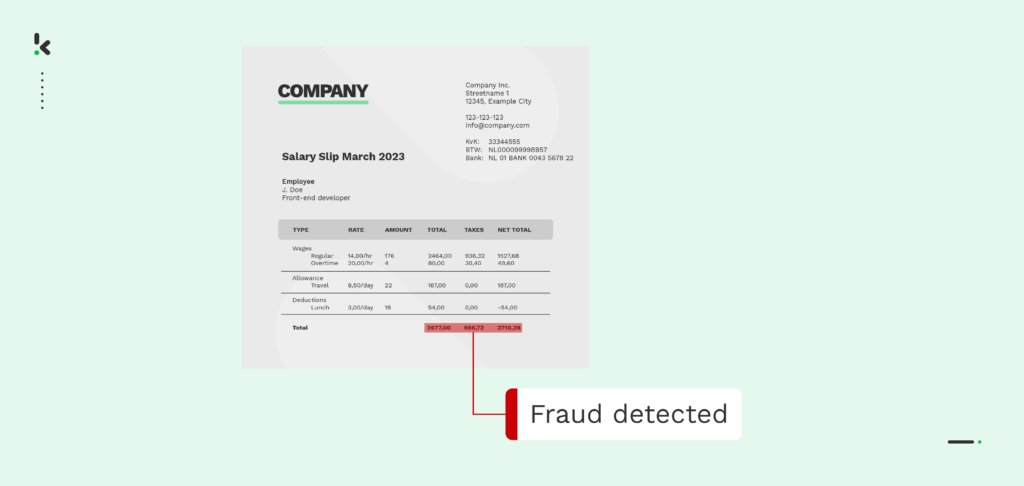

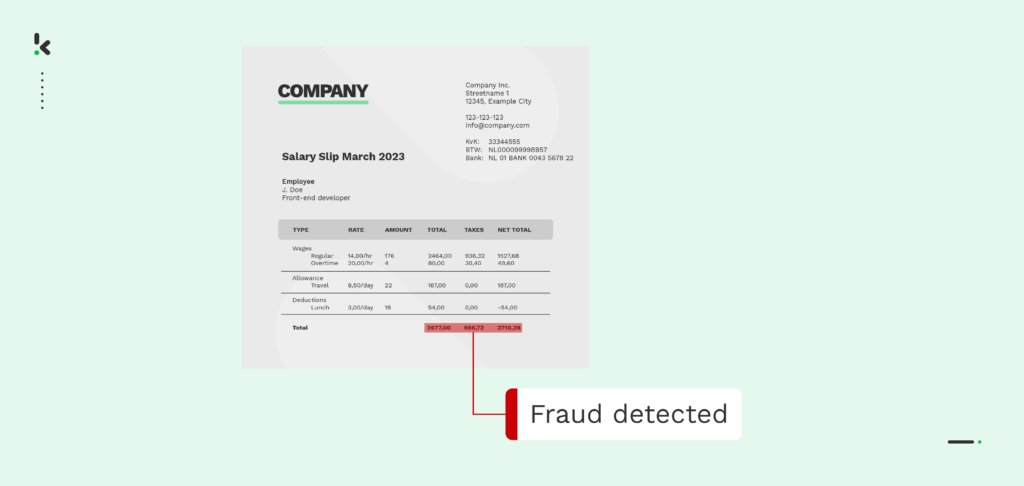

3. Catch Falsified Pay Slips with AI-Powered Validation

Pay slips are often manipulated to inflate income or fake employment history. With IDP, you can automate the detection of:

- Reused templates or unusual formatting

- Salary amounts that don’t match actual bank deposits

- Employer names or job titles that can’t be verified

By automating salary slip verification and using tools to spot fake pay stubs, lenders can quickly identify fraud before it leads to costly approvals.

4. Confirm Document Authenticity with Smart Cross-Checks

Even when documents appear legitimate, their contents may be false. IDP tools help verify authenticity by cross-checking submitted data across trusted sources. This includes:

- Matching names, addresses, and income with internal databases

- Validating tax IDs and employment records against government registries

- Screening applicants against KYC/AML watchlists and credit bureaus

By automating document verification, lenders can ensure every detail is accurate and spot fraud attempts before they escalate.

The good news is that there are smart document processing solutions like Klippa Dochorizon to confront these frauds before they put your business at risk.

Prevent Mortgage Fraud with Klippa DocHorizon

Klippa DocHorizon offers financial institutions and mortgage lenders the ability to fortify mortgage lending processing against fraud risks. The system ensures the meticulous examination of IDs, pay stubs, and financial documents, minimizing the chances of human error.

With the DocHorizon platform, you can easily build custom workflows to optimize mortgage processing in your organization while saving time and money spent on mortgage and loan processing.

Want to see how document fraud happens and how Klippa detects it? Watch our video to see how Klippa’s AI fraud detection solution spots tampering before it becomes a problem:

By leveraging Klippa DocHorizon to automate all mortgage document processing workflows, you can securely verify documents and safeguard your business against harmful fraudulent actors. In addition, you can focus on your core business and leave behind repetitive tasks for the software to handle.

Ready to safeguard your business from mortgage fraud? Book a demo with our experts today!

FAQ

Common red flags include inconsistent financial documents, fake or altered IDs, mismatched employment records, and rapid property transactions at unusual price points. These may indicate attempts to mislead lenders or manipulate the mortgage process.

Lenders can use Intelligent Document Processing (IDP) tools to automatically scan and verify submitted documents like pay slips, bank statements, and IDs. These tools use AI and OCR to detect formatting irregularities, inconsistencies, or signs of tampering that may be missed manually.

Manual checks alone are no longer reliable. With high document volumes and increasingly sophisticated fraud techniques, automated solutions like IDP offer faster, more accurate fraud detection and reduce the risk of human error.

Start by identifying key risk points in your document review process, such as identity verification or income validation. Then, implement a solution like Klippa DocHorizon to automate these steps, create audit trails, and integrate with your existing workflow.

Automating fraud detection offers several key advantages for lenders looking to improve both accuracy and efficiency:

Faster detection – Catch fraudulent documents in real time, without slowing down application processing.

Greater accuracy – AI-powered tools reduce human error and identify manipulations that may go unnoticed manually.

Consistent checks – Every document is reviewed using the same criteria, minimizing bias or oversight.

Improved compliance – Helps ensure alignment with KYC and AML regulations by logging every verification step.

Time savings – Automation frees up staff to focus on decision-making rather than repetitive manual reviews.