Fraudulent documents are an ongoing problem for companies all around the world, with criminals putting businesses at more and more risk of fines and fraud. According to a report by CoreLogic, from October 2024, income fraud increased 8.3% over the previous year and increased by 1.1% since last quarter.

Such documents pose a significant challenge to financial institutions, lenders, landlords, and employers. The consequences can range from financial losses to compromised business integrity and possible regulatory violations.

But the good news is that there are ways to protect your business from this! In this blog, we will go through some of the telltale signs when looking through pay stubs, how businesses can detect them, and how technology can help.

Let’s jump straight in!

Key Takeaways

- Fake pay stubs are a growing threat used to misrepresent income and deceive lenders, landlords, and employers.

- Telltale signs of a fake pay stub include inconsistent formatting, suspiciously round numbers, missing company details, implausible dates, and lack of security features.

- AI-powered automation enables faster, more accurate verification using OCR, metadata analysis (EXIF), and intelligent document processing (IDP).

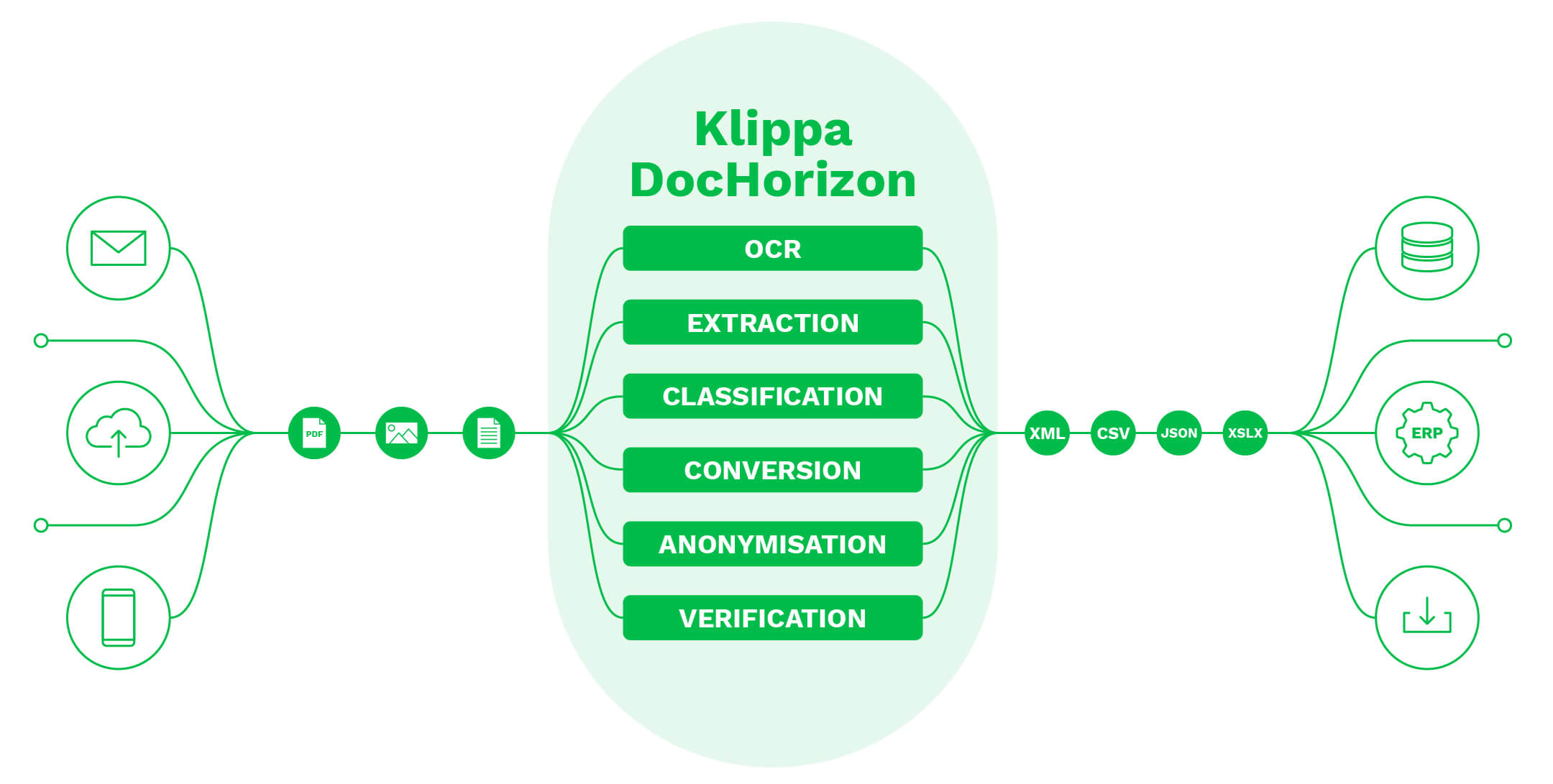

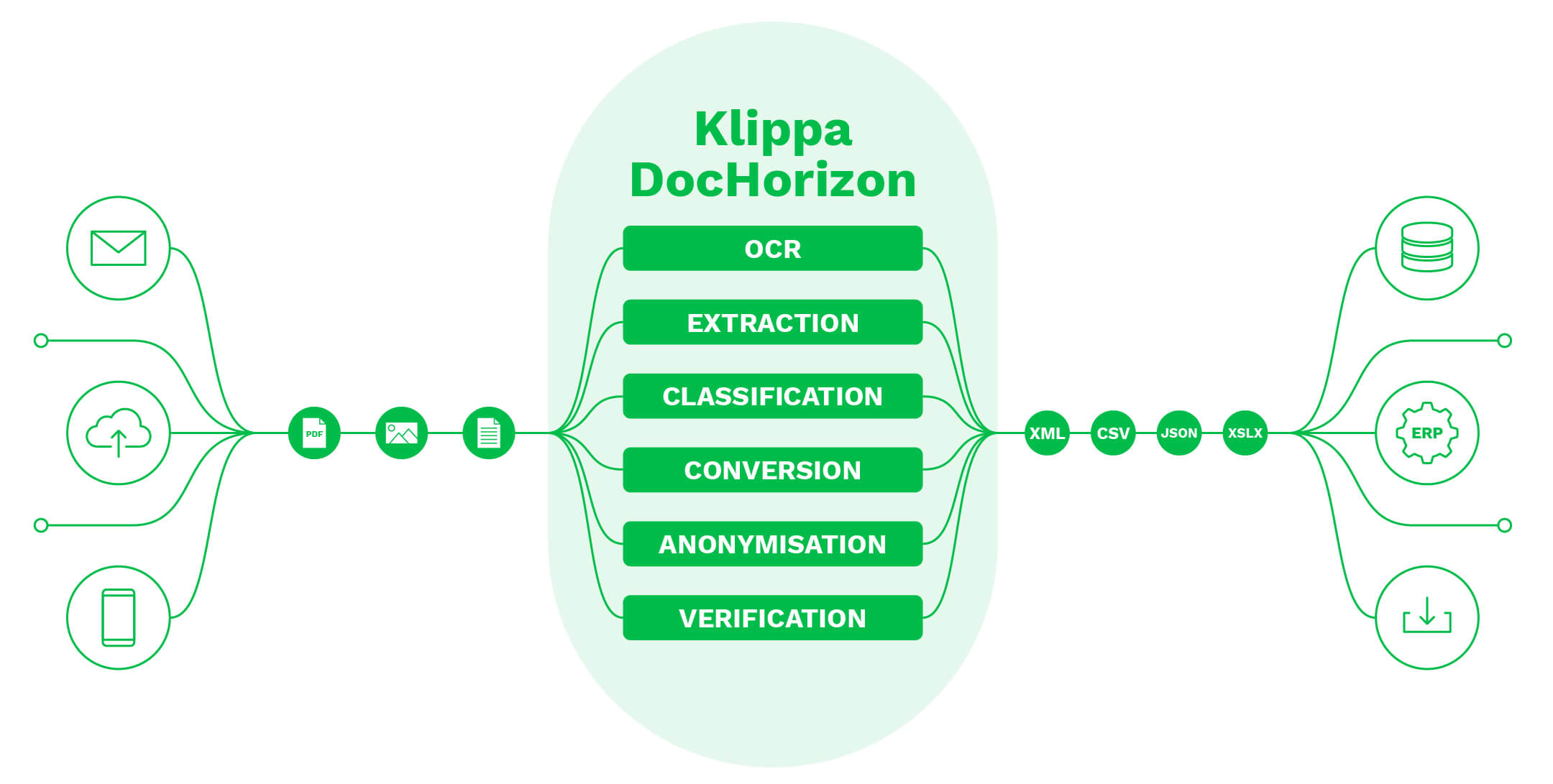

- Klippa DocHorizon offers a powerful solution to automatically verify pay stubs, detect manipulation, and streamline document workflows through seamless integration.

What Are Fake Pay Stubs?

Before we proceed, let’s define a fake pay stub. Fake pay stubs are counterfeit documents that falsely represent an individual’s income and employment details.

Often, they include details such as a person’s name, address, employer name, salary, deductions, and other financial data. These documents are typically used to deceive landlords, lenders, or employers, allowing individuals to qualify for benefits or services they might not otherwise be eligible for.

Usually, there are 2 ways through which pay stubs can be checked:

- Manual verification. A person visually inspects the documents, checking for irregularities, comparing data with other documents, and sometimes contacts the employer for confirmation.

- Automated verification. Technologies like OCR and AI extract and analyze data, detecting anomalies and instantly flagging suspicious documents for review.

5 Signs of Altered Pay Stubs

Analyzing and verifying financial documents is crucial for financial institutions and lenders to prevent fraud and enhance security. Some lenders require that applicants supply two recent pay stubs (used for cross-verification purposes) to verify their income.

Other lenders verify these documents manually. Unfortunately, manual verification is not always reliable, and lenders often look for signs of potential fraud. Some of these signs can be obvious at first glance and are a great list to have when conducting a cursory examination of a potentially fraudulent pay stub.

These are the 5 signs to look for to spot altered pay stubs:

1. Formatting

Inconsistent formatting can be a dead giveaway. Legitimate pay stubs typically follow a standard template with uniform fonts, alignment, and spacing, while fake pay stubs often have mismatched fonts, unusual formatting, or uneven spacing.

2. Unusual or Unrealistic Figures

Pay stubs should display reasonable and consistent financial figures. For example, they are on the lookout for perfectly round numbers like $10,000 instead of $1,36,0 that seem unrealistic for the industry and position.

3. Missing or Generic Company Information

Fake pay stubs may lack crucial details of the employer’s address, name, and contact details. Lenders always verify the legitimacy of the employer by cross-referencing the information provided.

4. Inaccurate Dates and Durations

Pay stubs should reflect accurate pay periods and employment durations. Fake pay stubs often contain implausible dates or durations, such as an unusually short employment period or paychecks issued on weekends or holidays when businesses typically don’t operate.

5. Absence of Security Features

Many legitimate pay stubs incorporate security features to prevent forgery, such as watermarks, holograms, or special paper. Fake pay stubs are difficult to replicate, and they usually lack these security features. So any document that lacks any visible security features becomes suspicious.

These steps are handy to know, and, in a lot of cases, they actually prove to be useful in catching fake pay stubs. However, calling previous employers to verify the information and relying on the naked eye to spot anomalies and inconsistencies leaves room for error and fraud to pass through.

Want to take this process to the next level and always have a foolproof method on your hands? Automating pay stubs verification is the answer! Let’s see how it works.

How Can You Automatically Verify a Fake Pay Stub with AI?

To many institutions, manually verifying pay stubs might feel like the way to go, without thinking that the human eye can only catch so much. Slow and unreliable as you scale up, manual verification often comes with mistakes that might have serious consequences upon your success.

So the question that naturally arises is how businesses can verify pay stubs faster and more accurately? That’s where AI-powered automation steps in.

Here’s how AI can improve your verification process.

1. With OCR for Data Extraction

Optical Character Recognition (OCR) technology is used to scan, extract, and convert pay stubs into machine-readable text. This simplifies data extraction from both digital and physical documents, making it easier to automatically analyze the content, and is a great first step in digital anti-fraud management.

2. With EXIF Analysis

EXIF analysis can be used to detect whether a document has been altered with various photo and document editing software like Photoshop. This option enables you to spot potential fake bank statements with much greater precision.

3. With Intelligent Document Processing

Intelligent Document Processing (IDP) is a solution that combines OCR, AI, and Machine Learning to analyze documents. With IDP, pay stubs can be verified using external sources such as employer databases or tax records to validate the accuracy of the information provided.

Benefits of AI-Powered Pay Stub Verification

Leveraging technologies like AI, OCR, and machine learning brings undoubted benefits to a business. For example, discrepancies that human reviewers might miss can now be instantly detected, improving accuracy in identifying fake pay stubs.

Also, these technologies streamline the verification process, reducing the time and resources required for manual checks. We’ve put together a list of the key benefits automated pay stub verification has:

- Improved Compliance and Audit Readiness. Every verification is logged and standardized, ensuring consistency and making it easier to meet regulatory and audit requirements.

- Faster Processing Times. AI analyzes and verifies documents in seconds, drastically reducing the time spent on manual reviews and accelerating onboarding or approval workflows.

- Higher Accuracy and Fraud Detection. Advanced algorithms detect subtle signs of manipulation, such as inconsistent fonts, altered figures, or tampered metadata.

- Scalability Without Extra Resources. Whether you’re reviewing dozens or thousands of documents per day, AI scales effortlessly without requiring additional staff or infrastructure.

- Reduced Operational Costs. Automating verification lowers labor costs and reduces the financial risk of approving fraudulent documents, leading to significant long-term savings.

- Tamper Detection Through Metadata Analysis. AI inspects file properties, including EXIF data and timestamps, to uncover signs of digital manipulation or forgery.

- Better User Experience. Faster decisions mean quicker approvals for customers or applicants, resulting in smoother onboarding and increased satisfaction.

Automatically Verify Fake Stubs Seamlessly With Klippa DocHorizon

Now that we’ve laid out how you can automate pay stub verification and its benefits, let’s introduce you to our solution, Klippa DocHorizon. Klippa Dochorizon is a top-of-the-line document processing solution that provides you with the tools to stand against fraudulent documents. Our document processing solution utilizes AI-powered technologies and advanced OCR to combat document fraud.

Using document validation to easily detect image manipulation and identity fraudulent pay stubs and safeguard your business. Easily detect photo editing and manipulation with EXIF data analysis.

But aside from fraud prevention, you may be asking yourself what else you get from Klippa’s document processing solution. Well, with Klippa DocHorizon, you:

- Save time: Save time using automated document processing, powered by Klippa’s OCR technology and eliminate manual input and document processing.

- Automate document workflow: With the DocHorizon platform, easily set-up workflows and automate document-related business processes.

- Save money: Using automation, easily improve efficiency and workflows to save money on operational costs.

- Seamless onboarding: Verify any documents in seconds and ensure that none of the onboarded clients or employees pose a risk to your company.

- Easy integration: Klippa DocHorizon is easy to implement in no more than 1 day via API and SDK.

- Enhance compliance: Ensure compliance with industry regulations and avoid fines.

Curious to find out how Klippa’s solution can help you take a stand against fraud? Book a free online demo below!

FAQ

You can verify a pay stub by cross-referencing the net pay with the applicant’s bank statement deposits, contacting the listed employer to confirm employment details, and using third-party income verification services for additional assurance.

Several tools can help, including AI-powered software that analyzes documents for inconsistencies, OCR (Optical Character Recognition) to extract and assess text, and metadata analysis tools that examine file properties for signs of tampering or edits.

Businesses should implement standardized verification protocols, train employees to spot red flags, and adopt AI-driven technologies to improve accuracy and efficiency in document analysis.

Yes. Klippa supports a wide range of documents, including bank statements, invoices, receipts, identity documents, and more, enabling end-to-end document verification across multiple use cases.

Absolutely. Klippa offers a REST API and SDKs that allow seamless integration into your existing software stack, whether it’s for onboarding, compliance, or finance automation.