Fake bank statements are easier to create than ever, and fraudsters are taking full advantage. Banks, lenders, and businesses that rely on financial documents are facing a surge in fraudulent activity, putting millions at risk.

According to studies, in 2024, more than 50% of financial institutions report a rise in business fraud, and a quarter have suffered losses exceeding $1 million. Could your business be next?

The good news: spotting a fake bank statement isn’t rocket science, if you know what to look for, of course. In this guide, we’ll break down the red flags of fraudulent statements and show you how automation can help safeguard your business. Let’s dive in!

Key Takeaways

- Fraudulent bank statements are rising, with over 50% of financial institutions reporting more business fraud and 25% facing losses of over $1 million in 2024.

- Manual verification is slow and unreliable — human errors and sophisticated forgery make traditional checks ineffective.

- AI-powered verification using OCR, EXIF analysis, and IDP detects fraud faster and with greater accuracy.

- Klippa DocHorizon automates bank statement verification, reducing fraud risks, cutting costs, and ensuring compliance.

How Can Businesses Spot Fake Bank Statements?

Detecting fraudulent bank statements is crucial for protecting your business from financial crime and regulatory violations. Ignoring forged documents doesn’t just put your company at risk, it can also lead to non-compliance with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations.

So, how can you stay ahead of fraudsters? Here are the key steps:

Verify the Source

Never take a bank statement at face value. Always confirm its legitimacy by contacting the issuing financial institution directly. But be cautious! Don’t rely on the contact details listed on the document itself. Instead, use official sources like the bank’s website or verified customer service lines to ensure you’re speaking with the right entity.

Cross-reference with original records

Compare the statement against other financial records, such as:

- Internal payment histories

- Digital banking transaction logs

- Receipts or invoices linked to the transactions

Any inconsistencies, such as missing deposits, altered amounts, or mismatched dates, could signal tampering or outright forgery.

Look for security features

Most banks incorporate hard-to-replicate security features into their statements. Keep an eye out for:

- Watermarks

- Holograms

- Unique fonts and layout designs

- Microprinting or fine details that blur when photocopied

If a document looks too generic or lacks these features, it’s a red flag.

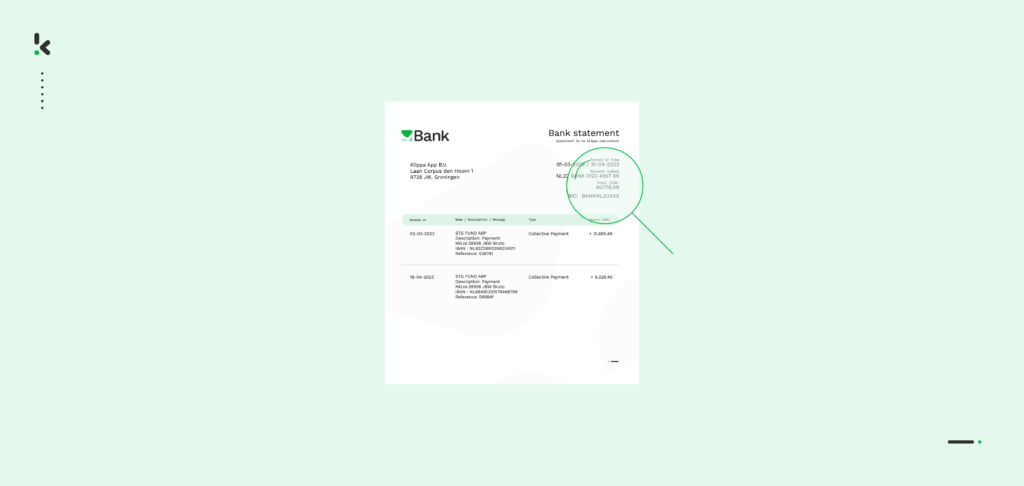

6 Signs of Altered Bank Statements

Now that you know the key strategies for verifying bank statements, let’s take things a step further. Want to know a fraud detection secret? There are clear, telltale signs that a bank statement isn’t legit – if you know where to look.

Here are six major red flags that should set off alarm bells:

1. Inconsistent Font Types

Fraudsters often copy and paste sections from different sources, resulting in mismatched fonts. If you spot different typefaces within the same document, that’s a sign of tampering or manipulation.

2. Inconsistent Font Sizes

A genuine bank statement maintains a uniform font size throughout. If numbers, names, or transaction details suddenly appear in a different size, it could mean someone has altered the data.

3. Round Numbers

Real transactions rarely end in perfect round numbers like $5,000.00 or $10,000.00. If you see too many of these, it’s likely that someone has manually adjusted the figures to appear more convincing.

4. Typographical Errors

Banks don’t make silly spelling mistakes — but fraudsters do. Watch out for typos, misplaced punctuation, or formatting issues. These small but critical details often expose a fraudulent document.

5. Incorrect Totals

Always double-check the math. If the sum of transactions doesn’t add up or the ending balance looks off, chances are the statement has been manipulated.

6. Unrealistic Numbers

If a statement shows suspiciously high deposits or balances that don’t match the client’s financial profile, that’s a huge red flag. Fraudsters love adding extra zeros — so make sure those $1,000,000 deposits aren’t actually $1,000 in disguise.

Fraudulent bank statements can be incredibly deceptive, but these six red flags will help you spot them in seconds. Want to take your fraud prevention to the next level? Automate your bank statement verification process and catch fraud before it catches you!

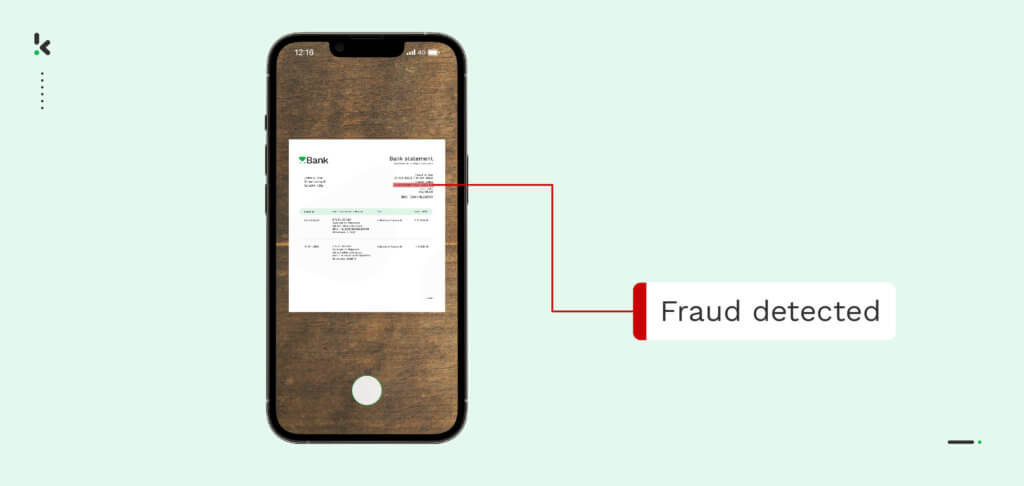

How to Automatically Verify Bank Statements with AI?

We’ve covered how to spot fake bank statements manually, but let’s be honest – can you really catch every forgery with just the naked eye?

Relying on manual verification alone isn’t just time-consuming, it’s risky! Humans make mistakes, especially when processing large volumes of documents. Fraudsters are getting smarter, and traditional checks just aren’t enough anymore.

So how can businesses verify bank statements quickly, accurately, and at scale? Enter AI-powered automation.

Here’s how AI-driven technology can transform the way you verify bank statements:

1. With Bank Statement OCR

OCR technology extracts text and data from bank statements in seconds. No more manually sifting through documents, OCR for bank statements ensures:

- Fast and accurate data extraction

- Consistent formatting across all statements

- Elimination of human errors in transcription

2. With EXIF Data Analysis

Did you know metadata can reveal if a document has been tampered with? AI-driven EXIF analysis scans Exchangeable Image File Format (EXIF) data to detect signs of:

- Photo or document editing software usage

- Altered timestamps that indicate manipulation

- Metadata inconsistencies that suggest forgery

This adds an extra layer of security, helping businesses detect fraud more effectively.

3. With Intelligent Document Processing (IDP)

AI-powered Intelligent Document Processing (IDP) software goes beyond OCR. It doesn’t just extract data, it cross-checks it against predefined rules and existing records. By analyzing:

- Transaction patterns

- Spending behaviors

- Anomalies that don’t match real-world banking activity

Machine learning algorithms can flag suspicious statements with unparalleled accuracy.

AI-powered document verification doesn’t just speed up the process, it dramatically improves accuracy and reduces fraud risks.

But how exactly does it work in real-world scenarios? Let’s dive into the key benefits of AI-driven bank statement verification.

Key Benefits of AI-Powered Bank Statement Verification

AI-driven bank statement verification transforms the way businesses handle financial documents. It improves speed, accuracy, and security, ensuring a smoother and more reliable verification process. Here’s what makes it a game-changer:

Rapid Processing Without Delays

Manual checks can take hours or even days, especially when dealing with high volumes of documents. AI cuts processing time down to seconds, allowing businesses to handle more applications without delays.

Advanced Fraud Detection

Humans can miss small inconsistencies, but AI doesn’t. Machine learning algorithms analyze transactions, metadata, and formatting to detect:

- Tampered statements

- Inconsistent transaction patterns

- Mismatched data with official records

This proactive fraud prevention helps businesses stay ahead of financial criminals.

Lower Operational Costs

AI reduces the need for large verification teams, cutting down labor costs while boosting productivity. Businesses can allocate resources more effectively and scale operations without worrying about human errors.

Compliance with KYC & AML Regulations

Failing to verify financial documents properly can lead to regulatory penalties. AI-powered tools ensure compliance with Know Your Customer (KYC) and Anti-Money Laundering (AML) guidelines by:

- Standardizing verification processes

- Maintaining audit trails for compliance reporting

- Reducing risk exposure to fraudulent transactions

Seamless Integration with Existing Systems

AI-powered verification tools can integrate with CRM platforms, banking APIs, or fraud detection systems. This allows businesses to automate workflows without disrupting their current operations.

Better Customer Experience

No one likes waiting. AI-powered verification speeds up approval times for:

- Loan applications

- Rental agreements

- Financial transactions

Faster processing means happier customers and stronger business relationships.

AI-powered bank statement verification isn’t just about speed, it’s about staying ahead of fraudsters, reducing costs, and improving compliance. With an automated fraud detection solution, businesses can eliminate human errors, increase efficiency, and streamline verification workflows.

But how do you actually put this into action?

Spot Fake Bank Statements Seamlessly with Klippa DocHorizon

If you’re ready to leave manual verification headaches behind and embrace AI-driven automation, Klippa DocHorizon has you covered!

With advanced AI-powered technology, including OCR and Intelligent Document Processing (IDP), Klippa DocHorizon helps businesses combat the rise of bank statements with unmatched accuracy.

Why Klippa DocHorizon? Here’s What You Get:

- Save Time: Automate data extraction with Klippa’s OCR technology, eliminating tedious manual entry and speeding up verification.

- Cut Costs: Reduce operational expenses by streamlining fraud detection and document processing.

- Improve Customer Onboarding: Approve customers and employees within seconds, ensuring a smooth and efficient experience.

- Minimize Fraud Risks: Detect altered or forged bank statements instantly, protecting your business from financial crime.

- Stay Compliant: Keep up with KYC, AML, and industry regulations while avoiding hefty fines.

- Seamless Integration: Connect Klippa DocHorizon to your existing systems via API or SDK for a hassle-free experience.

Curious to find out how Klippa’s automated bank statement verification solution can help? Book a free online demo below!

FAQ

Bank statement verification is the process of confirming that a bank statement is authentic and has not been tampered with. It helps businesses prevent fraud, ensure compliance with KYC and AML regulations, and assess financial credibility.

While manual verification can catch some errors, it’s slow and prone to human mistakes. Fraudsters use sophisticated techniques that often go unnoticed without AI-powered tools.

AI-powered tools like OCR, EXIF analysis, and Intelligent Document Processing (IDP) automate data extraction, cross-check transactions, and flag anomalies with higher speed and accuracy than manual verification.

Yes, solutions like Klippa DocHorizon offer seamless API and SDK integration, allowing businesses to connect their fraud detection, CRM, and banking systems for a streamlined verification process.

You can book a free demo with Klippa DocHorizon to see how AI-powered bank statement verification can protect your business from fraud and improve efficiency.