The purpose of German invoices

If you’ve ever ordered something online, you’ve been in possession of an invoice. As a consumer, you might not do much with the invoice after receiving your merchandise. However, as a business, you are eligible for VAT returns. The only way to reclaim your VAT is by proving that you actually purchased something for your business and paid VAT on it. This is where the invoice comes in, it serves exactly as that proof! Invoices are often physically, but increasingly are submitted electronically, for example via a PDF file.

Legal requirements for German invoices

Germany is often regarded as quite a well-organized and regulated country. So by nature, business-related matters such as invoices have a specific structure and information to comply with! The Umsatzsteuergesetz (tax law) prescribes which information needs to be included on an invoice. First of all, all companies selling products and services are required to emit invoices to their customers, within six months of sale. The invoice has to contain obligatory information. These are decisive for VAT tax returns by invoice recipients aka the customers. Only with the correct and complete information can the invoice recipient, such as a company who purchases on behalf of the business, receive the VAT back.

The tax law actually makes distinctions between invoices emitted by large companies and smaller companies. The only significant distinction is that small businesses do not list VAT tax rates and amounts on their invoices. So, taking into consideration the above-mentioned legal aspects, let’s break down a German invoice!

What do invoices in Germany contain?

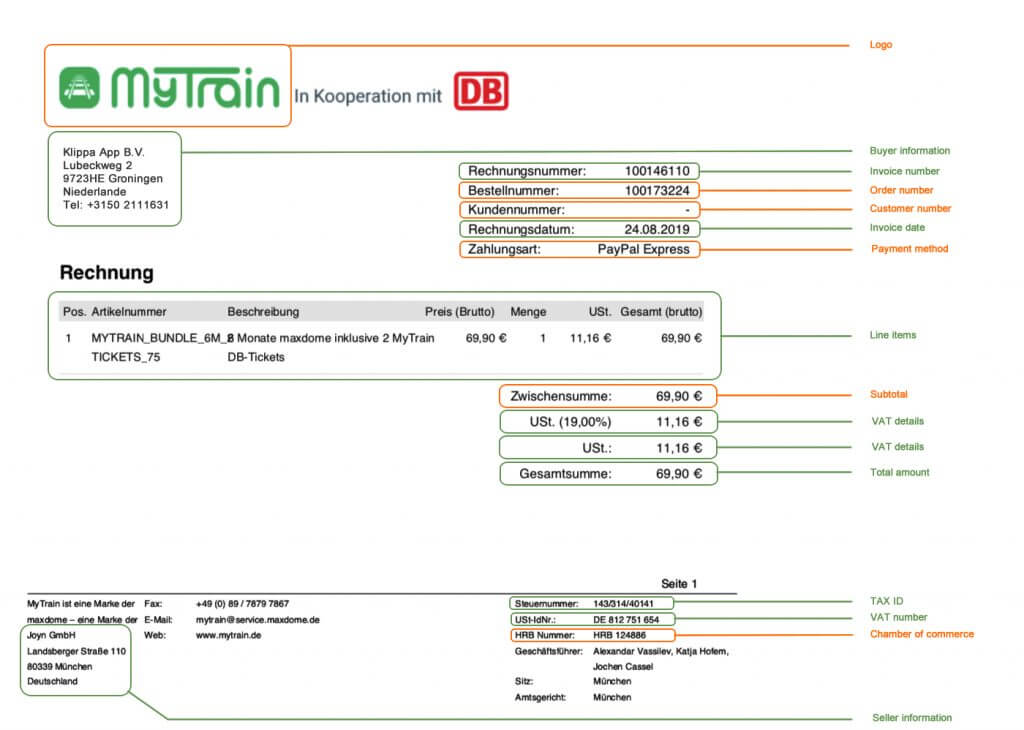

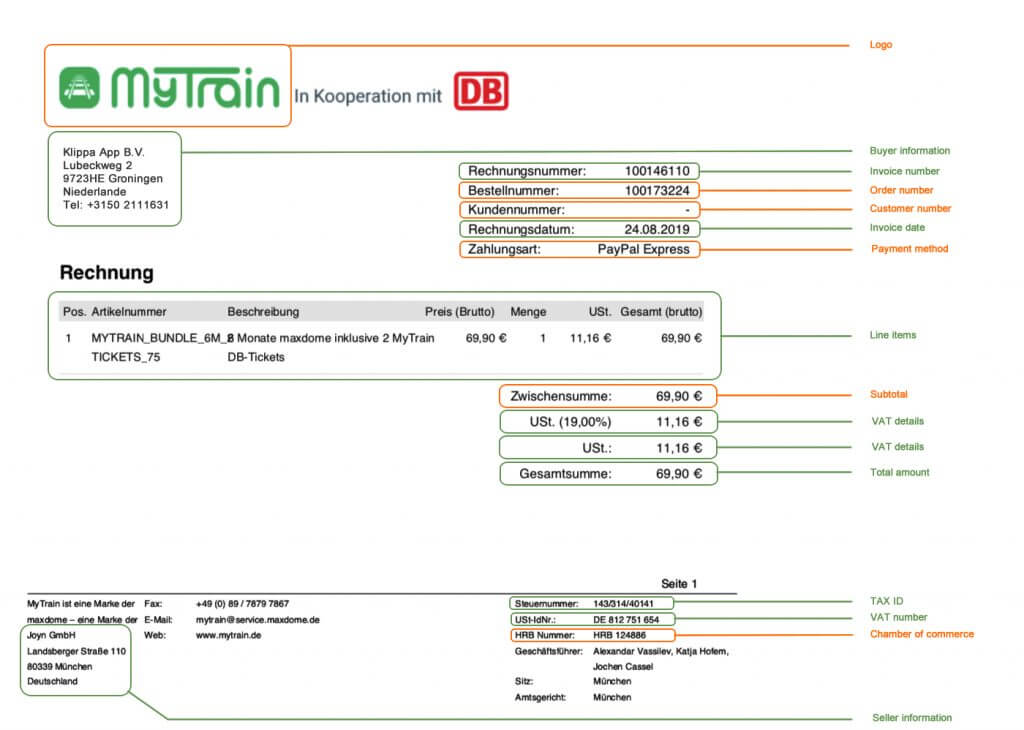

To be eligible for a VAT return, the German invoice has to contain the following fields:

- The complete name and address of the merchant as well as the recipient (Händlerinfo)

- The tax identification or VAT identification number of merchant (Steuernr. oder USt-IdNr.)

- The invoice’s date of issue (Rechnungsdatum)

- Invoice number (Rechnungsnummer)

- Amount and classification or type of merchandise (Beschreibung der Artikel)

- Time of delivery or the time at which the delivery was paid, in full or partially. The latter only has to be included if merchandise was paid, in full or partially, at the date of the issue.

- Payment for the delivery or amount of received discounts. The buyer can receive discounts through earlier payment for example (Zeitpunkt der Lieferung oder Zeitpunkt der Bezahlung)

- The total sum, including the VAT and the sum without VAT. The VAT tax rate and value are listed separately, which makes it easy to detect the taxes which can be refunded (Gesamtsumme und Mehrwertsteuer)

Even though all companies have to include above-named information fields, invoices differ in their appearance. So to visualize and make you better understand the German invoice, we actually broke down an existing invoice for you! We marked the relevant information fields in green. Additional information fields, such as company logo and IBAN are marked in orange.

If you are a company that regularly needs to process invoices, to reclaim VAT taxes, for example, you most likely experienced how time-consuming it is to find the relevant fields.

How can Klippa help you?

We at Klippa developed a sophisticated, machine-learning invoice processing application. Within this application, we implemented Optical Character Recognition technology, in short OCR. The OCR technology detects and extracts all the relevant information of an invoice for you and presents it in the desired data format. The process is completed within seconds, thus saving valuable time spent on processing invoices manually! This makes Klippa’s invoice processing solution highly suitable for companies that have to process a bunch of invoices regularly. Automating and digitalizing invoice processing so you can spend your time on your core business should be a no-brainer nowadays!

You can find out information about our invoice application here or schedule a demo with one of our Klippa invoice experts. Any further questions are welcome under [email protected] or +31 50 2111631