Klippa’s 2024 report, The State of Automation in Finance, revealed that over a third of UK businesses fail to pay their supplier invoices on time. One key reason for this costly issue is the absence or an insufficient level of automation in invoice approval workflows.

Automating your invoice approval workflow can cut processing time by more than 50%, eliminate costly manual errors, and give your finance team full real-time control over accounts payable.

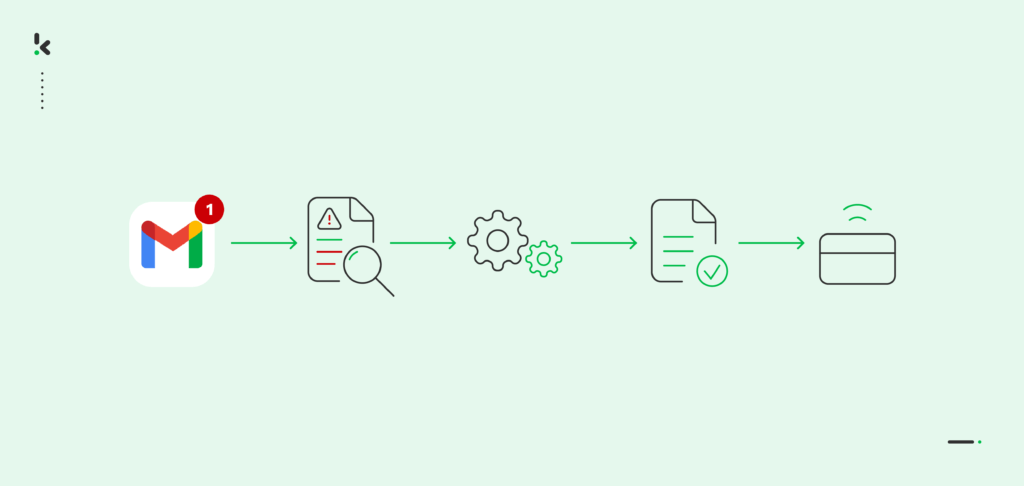

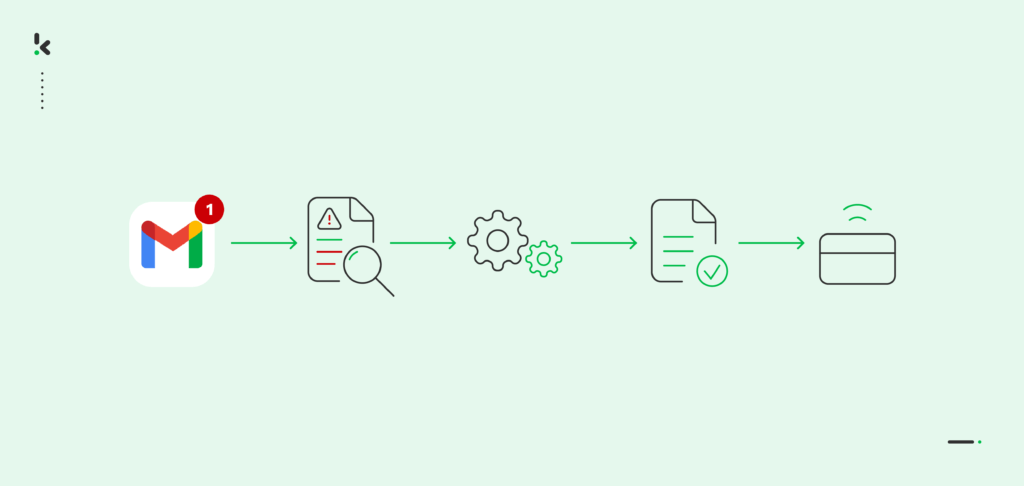

Manual approval processes often depend on printed invoices, email chains, and spreadsheets. They eat up valuable time, delay payments, and increase the risk of duplicate payments or fraud. By leveraging OCR technology, rule-based routing, and ERP integration, automation replaces repetitive, error-prone steps with a seamless digital workflow that works in the background while your team focuses on strategic tasks.

In this guide, you will learn:

- Which steps slow down manual invoice approvals and cost your business money

- How to design and implement a fully automated invoice approval process

- How Klippa SpendControl provides faster approvals, better compliance, and enhanced visibility

If your finance team is chasing signatures, handling paper invoices, or spending hours reconciling records, automation is the answer to getting invoices paid on time, every time.

Key Takeaways

- Manual invoice approvals are slow, error-prone, and costly – automation cuts processing time, reduces mistakes, and eliminates the need to chase signatures.

- OCR and approval workflows do the heavy lifting – automatically extracting data, matching with POs, and routing invoices based on rules you define.

- Real-time tracking keeps you in control – spot delays, track status, and get notified when action is needed, all in one dashboard.

- Platforms like Klippa SpendControl make invoice approvals fast, accurate, and effortless – no chasing, no chaos.

What is Invoice Approval Workflow?

Invoice approval workflows are set procedures that define how your company manages and authorizes different supplier invoices. These workflows are designed to streamline the process of verifying, approving, and processing invoices in a structured manner.

Properly organized and followed AP invoice approval workflows allow your business to ensure that all outstanding and settled payments are accurate, authorized, and accounted for, maintaining an accurate depiction of your accounts payable and the overall company’s financial health.

What are the Steps of the Manual Invoice Approval Workflow?

The number of steps and employees involved in the manual invoice approval process depends on your company’s size and how advanced your accounting tools are. Are you recording invoices by hand in a journal or entering the details manually into an Excel spreadsheet or bookkeeping software? Both approaches are considered manual but differ in how much time they require to complete the invoice cycle.

A general manual invoice approval workflow consists of the following steps:

- Receiving invoices – The process begins when an invoice is received via email or postal mail. Paper invoices are organized and filed, while emails are printed, if necessary, for consistency. All invoices are logged manually in a journal, spreadsheet, or accounting system for tracking.

- Verification of invoice details – Invoice details, such as vendor name, invoice number, date, and amount, are manually reviewed for completeness and accuracy. The details are recorded in the system or log to ensure they match the invoice document.

- Reconciliation of invoices – This involves manually comparing the invoice details against purchase orders and delivery receipts. Accountants cross-check physical or digital records to confirm that the invoiced products or services were received and aligned with the agreed terms.

- Approval routing – Invoices are manually routed to the appropriate approvers based on the company’s policies. This often involves sending emails, making phone calls, or physically delivering invoices for signatures. Higher-value invoices may require chasing multiple approvers across departments.

- Exception handling – Invoices that cannot be matched to purchase orders, have discrepancies, or exceed budget limits are flagged manually. This step involves reaching out to vendors or corresponding departments for clarifications and adjustments.

- Payment processing – Once approvals are collected, the invoice is logged in the accounting system or journal as “approved for payment.” Payment is then initiated manually, either through checks, bank transfers, or another payment method. Payment records are updated in the log or system.

- Record keeping – Approved invoices, supporting documents, and payment proofs are organized and stored physically in filing cabinets or digitally in spreadsheets or shared drives. Proper labeling ensures these records are accessible for audits and compliance purposes.

Managing and approving invoices before payment is a crucial process that ensures accuracy, completeness, and correctness.

The complexity of each step in this process demands significant time and effort from employees. Additionally, manual invoice approval workflows come with various challenges that increase the workload.

Challenges of the Manual Invoice Approval Workflows

Whether you use an accounting journal or log details in a bookkeeping system, the non-automated invoice approval process faces many of the same challenges, regardless of the tools used:

Data Entry Errors

Manual data entry is naturally prone to errors, often caused by multitasking, high workloads, or lack of focus during repetitive tasks. These errors, ranging from incorrect amounts to mismatched vendor details, can compromise payment accuracy and lead to inconsistencies in financial reporting.

A Forrester report estimates that analysts spend up to 40% of their time fixing data before it can be used for strategic decision-making. Over time, the cost of correcting these mistakes can outweigh any benefits found in manual processing.

Long Turnaround Time

Manual invoice approvals can be extremely time-consuming as every step involves human effort, from entering data to chasing approval signatures. Each delay compounds, stretching the invoice processing cycle from 2 weeks to a month. This inefficiency affects the chances of getting any early-payment benefits from suppliers and most importantly affects payment timelines.

Lack of Transparency

Tracking the status of invoices in manual workflows is notoriously challenging due to fragmented and inefficient record-keeping methods. In many cases, invoices are stored in physical files scattered across filing cabinets or logged in basic digital tools like Excel sheets. These tools often lack real-time updates and centralized access.

When invoices are physically routed between departments for approval, they can become delayed, misplaced, or lost among other paperwork, making it difficult to determine their current status.

Late Payments

Manual invoice approval procedures often require accounting clerks to chase down approvers for signatures, frequently facing challenges such as busy schedules, sickness, or “out-of-office” statuses. These obstacles lead to delayed approvals and, ultimately, missed payment deadlines. Payment delays can strain supplier relationships, expose the organization to penalties, and damage trust.

Misplaced Invoices & Duplicates

Paper invoices can easily be lost in transit between departments or buried in filing cabinets, while spreadsheets or shared drives make it difficult to track or retrieve documents as soon as needed.

In addition to organizational challenges, invoices can be accidentally paid twice if the same invoice is submitted in different formats, such as both paper and email. Without automated checks in place, duplicate entries may go unnoticed, causing overpayments and, in a worst-case scenario, skipping intentional vendor fraud that targets around 56% of U.S. companies yearly.

No matter how you view it, manual approval processes are inherently inefficient and prone to costly errors. The potential risks of mistakes and delays often outweigh any hesitation to use automation, especially when it can offer significant benefits for your company and finance team.

How Automation Improves the Invoice Approval Process

Automation has long been a powerful solution for many challenges associated with manual invoice approval processes. By leveraging advanced technologies like AI and machine learning, finance teams can automate time-consuming and repetitive tasks within accounts payable management, simplifying workflows and improving efficiency:

Time Savings

Invoice approval automation drastically reduces the time it takes to move an invoice from receipt to payment. Optical Character Recognition (OCR) can automatically extract invoice information, eliminating manual data entry. Workflow automation tools then route these invoices to the right approvers instantly, ensuring faster processing. Now, rather than waiting days for a manager to check their inbox, automated notifications can remind them to approve with just a click.

Cost Reduction

Automation helps eliminate mistakes by accurately capturing invoice details and validating them against purchase orders or predefined business rules. Smart flagging systems identify inconsistencies or duplicate invoices before payments are processed, saving resources that would otherwise be spent correcting errors.

Enhanced Accuracy

It’s easy to make small errors while manually entering invoice data, like entering the wrong amount, missing a vendor ID, or overlooking discrepancies. Automated systems use AI and machine learning to extract and validate data, ensuring all details are precise. For instance, OCR can recognize text fields, while machine learning algorithms use two-way matching to match invoice amounts against purchase orders, making reconciliation error-free.

Increased Transparency

Automation platforms provide real-time visibility into every step of an invoice cycle. Dashboards show the exact status of each invoice, and automated notifications keep authorized employees updated. This transparency in invoice management doesn’t just improve your workflow, it also helps you forecast cash flow by knowing exactly what’s pending and when payments are due.

Compliance and Audit Readiness

Automated systems securely log every action: who approved an invoice, when it was routed, and what changes were made. This gives you a detailed digital record that’s easy to access through the same system. Advanced invoice processing uses AI to organize and tag invoices for quick retrieval. By standardizing your workflows, you’ll also ensure compliance with financial regulations without needing to scramble to gather documents.

How to Automate Your Invoice Approval Workflow

Step 0: Map Your Current Process

Before you automate, document your existing manual workflow. Identify:

- Where invoices enter the system, such as email, paper, or a vendor portal

- Bottlenecks such as waiting for signatures or matching invoices to POs

- Steps prone to errors, duplication, or lost documents

Mapping your process helps you know which repetitive tasks to target first in automation.

Step 1: Choose the Right Invoice Automation Tool

Selecting the right invoice automation tool starts with understanding your company’s needs. This could be accounting automation software, invoice management software, or even dedicated invoice scanning and approval platforms.

Select software that matches your invoice volume, approval chain complexity, and current systems. Look for essential features:

- OCR for accurate data extraction from PDFs, scans, and email attachments.

- Rule-based approval workflows with multi-level authorization

- ERP or accounting integrations for seamless data synchronization

- Real-time dashboards for payment tracking and exception alerts

Pro tip: Ensure the platform supports multi-language OCR and multi-currency invoices if you work with international suppliers.

Step 2: Digitize Invoice Data with OCR

Replace manual logging with automated data capture. OCR extracts:

- Vendor details

- Invoice number and date

- Line items and amounts

Across varied formats, including scans, PDFs, and email attachments. No retyping means fewer errors and faster approvals.

Step 3: Establish Clear Approval Rules

Define the criteria for routing invoices:

- Amount thresholds, such as auto-approving invoices under €100 or escalating invoices over €1,000 to the CFO

- Conditional routing by department, vendor type, or urgency

- Compliance checks to meet budget limits or contract terms

Document these rules and configure them in your automation system for consistency.

Step 4: Integrate with Your Current Systems

Avoid data silos by connecting your automation platform to your ERP or accounting system, such as Xero, NetSuite, or SAP. Integrations allow:

- Real-time reconciliation without duplicate entries

- Automatic posting to accounts payable ledgers

- Instant PO matching for two-way or three-way validation

Step 5: Enable Notifications and Real-Time Tracking

Automation is not just faster; it is more transparent. Set up:

- Email or in-app alerts for pending approvals

- Overdue reminders if action is not taken on time

- Dashboards showing statuses such as awaiting review, approved, or paid

Transparency helps managers spot delays before they cause late payments.

Step 6: Address Exceptions

Even with automation, some invoices need human review for mismatched POs, duplicates, or high-value anomalies.

Configure your system to:

- Flag exceptions automatically.

- Route them directly to the right reviewer for resolution.

Train staff to approve routine cases quickly and escalate anomalies with documented steps.

Step 7: Scale Beyond Invoices

Advanced AP automation tools like Klippa SpendControl can also process:

- Employee expense claims

- Business credit card transactions

- Multi-currency payments

By expanding automation into these areas, you create a unified finance workflow.

Automate Invoice Approvals with Klippa SpendControl

Are you looking for a solution to a slow and costly manual invoice approval process? Trust Klippa SpendControl to automate all your invoice processing tasks and speed up your hour-long approval process into several clicks!

Klippa SpendControl is an all-in-one digital pre-accounting software that combines invoice processing, expense management, and business credit card modules.

Our software utilizes OCR technology for automatic invoice recognition to ensure accurate data capture and enable invoice scanning, approval, archiving, and booking directly to your financial administration.

Klippa SpendControl offers core features that will enhance your invoice processing and approvals in no time:

- Manage your vendor invoices, employee expenses, and business credit cards in one cloud-based platform

- Submit, process, and approve invoices via web or mobile app

- Achieve 99% invoice data extraction accuracy with Klippa’s OCR

- Regain control over your accounts payable with intuitive dashboards

- Customize your approval management with multi-level authorization flows

- Never fail to comply with tax and data privacy regulations with our ISO27001-certified and GDPR-compliant solution

- Rely on automatic multi-currency support for international payments

- Prevent invoice fraud with built-in duplicate and fraud detection

- Integrate SpendControl with your accounting and ERP software, like Xero, NetSuite, or SAP

FAQ

The invoice approval process is a structured workflow to verify, authorize, and process supplier invoices for payment, ensuring accuracy and accountability.

The automated approval process uses tools like OCR and workflow automation to extract data, route approvals, and track invoices, reducing errors and speeding up payment.

Invoice processing involves capturing data, verifying details against purchase orders, and approving invoices for payment.

Approving an invoice requires checking for accuracy, matching it to purchase orders, ensuring it fits within the budget, and flagging duplicates or irregularities.