Managing invoices can be a difficult task for CFOs and Accounts Payable (AP) teams. The process usually requires extensive paperwork, making manual labor consume 62% of total AP costs and weeks of processing time.

Implementing invoice management automation is an effective and popular practice for addressing the challenges faced by AP departments.

This guide will cover how moving from manual to automated systems can transform your invoice management. If you are ready to leave the paperwork behind and move your operations forward, this blog will show you how.

What is Invoice Management?

Invoice management is the systematic handling, processing, and filing of invoices from vendors within a company’s accounts payable department. It involves verifying, recording, and paying invoices accurately and on time, ensuring that all financial transactions align with contractual agreements.

Effective invoice management is essential for maintaining healthy cash flows, preventing AP fraud, and optimizing spend management within the accounts payable workflow.

The Importance of Good Invoice Management

Effective invoice management is crucial for maintaining the financial health and operational efficiency of your business. Here’s why:

- Cash Flow Optimization: Timely and accurate invoicing ensures that you receive payments on schedule, directly impacting your cash flow. Poor invoice management can lead to delays and inconsistencies, disrupting your financial stability.

- Client Relationships: Clear and professional invoices reflect well on your business, fostering trust and reliability with your clients. It also minimizes disputes and misunderstandings, contributing to smoother transactions and long-term partnerships.

- Operational Efficiency: Streamlined invoicing processes reduce administrative burdens and errors. Automation tools can handle repetitive tasks, allowing your team to focus on higher-value activities.

- Financial Accuracy and Compliance: Accurate invoicing is essential for maintaining precise financial records, which are crucial for audits, tax reporting, and compliance with regulatory requirements. Good invoice management helps you avoid costly penalties and legal issues.

- Resource Management: Efficient invoice management saves time and resources. By reducing manual entry and follow-up efforts, you can allocate your resources more effectively, enhancing overall productivity.

Investing in robust invoice management systems and practices not only ensures you get paid faster but also strengthens your business’s financial foundation, enabling sustainable growth and stability.

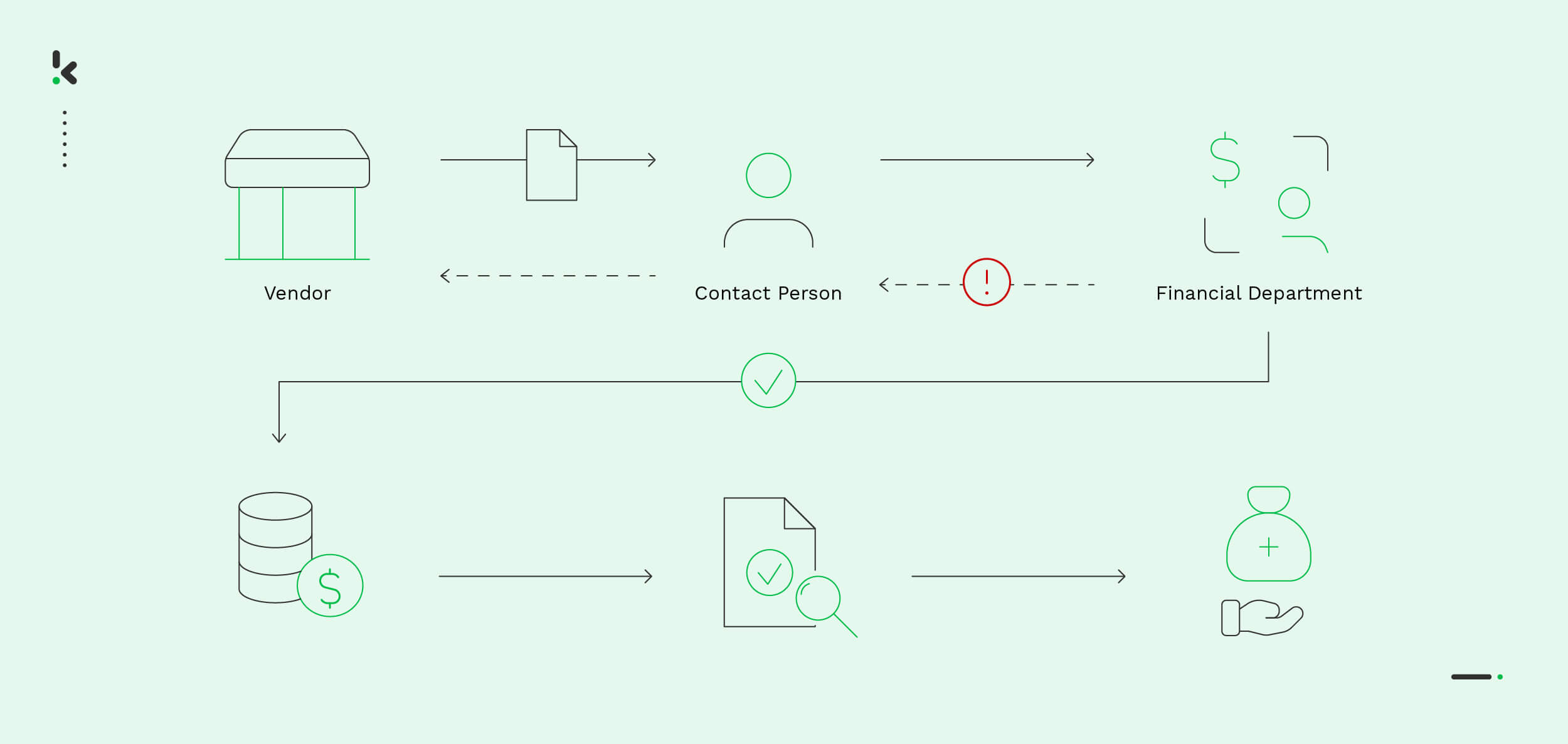

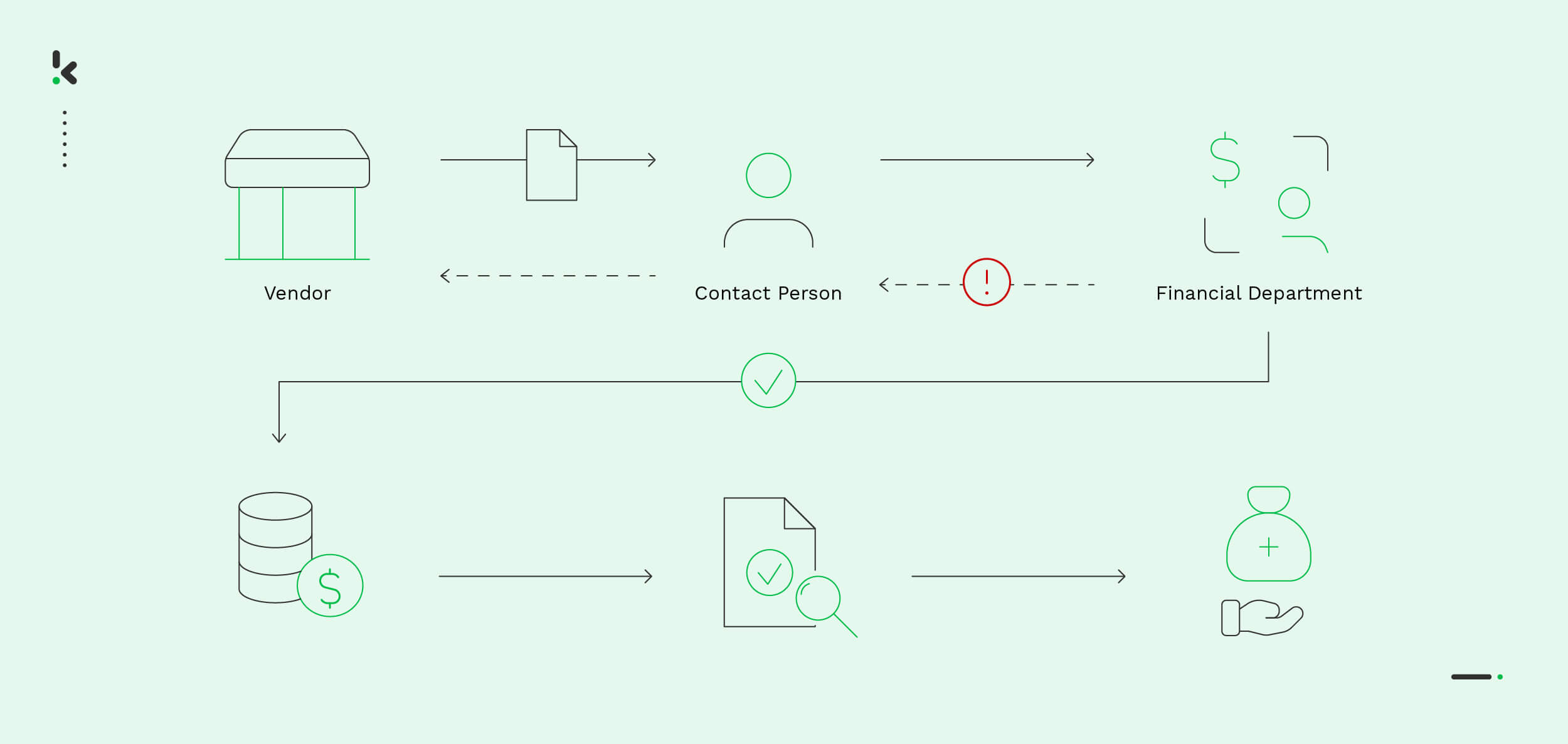

Traditional Invoice Management Process

The traditional accounts payable process, often characterized by manual workflows, involves several steps that require careful attention to detail to ensure accuracy and compliance. This process typically includes:

This seems like a straightforward process but it comes with several challenges. We will discuss the most common ones next.

Challenges of Traditional Invoice Management

Traditional invoice management, while straightforward, presents several challenges that can affect your organization’s efficiency and bottom line. The primary issues with manual accounts payable management include:

- Prone to Human Error: An average employee makes 118 mistakes per year, some of which lead to $900 million blunders. Manual data entry and processing are highly susceptible to errors, such as incorrect amounts or misplaced invoices. These mistakes can lead to payment inaccuracies and require additional resources to rectify.

- Time-Consuming Processes: The manual handling of invoices, from verification to approval and payment, involves time-consuming tasks that can delay the payment cycle for up to several weeks. This negatively impacts vendor relationships and prevents companies from taking advantage of the common 2% discount for early vendor payments.

- Increased Processing Costs: The labor-intensive nature of traditional invoice management results in higher processing costs reaching up to $20 per single invoice, affecting an organization’s overall operational efficiency.

- Lack of Real-Time Visibility: Manual systems don’t offer real-time insight into the status of your invoices and payments, making it difficult to manage cash flow effectively and respond quickly to any issues.

- Difficulty in Tracking and Retrieval: Storing physical documents makes tracking and retrieving specific invoices challenging, especially as the volume of your transactions increases. This can complicate audits and compliance efforts.

- Limited Scalability: As your business grows, the volume of invoices significantly increases, making manual processes even more cumbersome and less scalable without additional resources.

- Fraud Vulnerability: The average cost of invoice fraud to middle-market businesses is around $280,000 per year. Manual processes can be more susceptible to fraud, including duplicate payments, as they rely heavily on human oversight without the safeguards that automated systems can provide.

The bottlenecks of manual invoice management are leading many companies to seek digital solutions to automate their invoice management tasks.

Automation as a Solution to Invoice Management

Automating the invoice management process can significantly soothe the challenges associated with manual operations. Here are key invoice management tasks that can be automated with the right software, alongside the specific features that facilitate invoice automation:

Invoice Receipt and Capture

AI-powered invoice management solutions can receive invoices in various formats (PDF, images, textual documents, etc.) and accurately extract relevant data, such as due dates, amounts, and vendor information, by utilizing Optical Character Recognition (OCR) technology, eliminating the need for manual data entry.

Two-Way Matching

Automation software can perform two-way matching by cross-referencing invoices with purchase orders, or utilize three-way matching and add delivery notes to the referencing process. This ensures that payments are made only for verified transactions, reducing the risk of overpayment or fraud.

Approval Workflows

Customizable invoice approval workflows automatically route invoices to one or multiple appropriate stakeholders for approval based on predefined business rules. This speeds up the approval process and ensures accountability and compliance.

Electronic Payments

Automated systems can process payments electronically, reducing the time and errors associated with manual invoice processing. This also allows for easier tracking of payment statuses.

Real-Time Reporting and Analytics

Invoice management software provides dashboards and reporting tools that offer real-time insights into financial metrics, helping businesses manage cash flow more effectively and make informed decisions.

Document Storage and Retrieval

Digital storage of invoices allows for easy search and retrieval, improving the efficiency of audits and compliance checks. Cloud-based solutions ensure that data is securely stored and accessible from anywhere.

Fraud Detection

Advanced algorithms and machine learning models can analyze patterns and flag unusual transactions, enhancing the organization’s ability to detect and prevent invoice fraud.

By leveraging these functionalities and best practices of accounts payable, businesses can transform their invoice management workflow into a more streamlined, accurate, and cost-effective operation. Automating invoice management not only addresses the limitations of traditional methods but also positions companies for better financial health and scalability in the future.

Benefits of Automated Invoice Processing

Automated invoice management software simplifies the accounts payable process, delivering significant advantages over traditional, manual methods. Here are the key benefits of automating invoice processing:

- Increased Efficiency: Companies that manage invoices manually take longer than a week to process an invoice. AP automation reduces this time to 2.8 days or less. Automation reduces the time spent on invoice processing by automating routine tasks, allowing staff to focus on more strategic activities.

- Reduced Processing Costs: With automation, an organization could potentially save more than $450,000 for every 100,000 invoices it processes. By streamlining the invoice management process, businesses can lower the cost per invoice processed, realizing substantial savings in operational expenses.

- Improved Accuracy: Automated systems minimize human errors in data entry and calculations, ensuring up to 99% level of accuracy in invoice processing and financial reporting.

- Enhanced Visibility and Control: Real-time tracking and reporting capabilities provide businesses with immediate insights into their financial obligations, cash flow, and payment performance. This visibility enhances decision-making and financial planning.

- Strengthened Vendor Relationships: Timely and accurate payments, facilitated by automated processes, help maintain positive relationships with vendors, which can lead to more favorable terms and pricing.

- Scalability: Automation allows the invoice management process to easily scale with business growth, handling increased volumes without the need for proportional increases in staff.

- Compliance and Security: Automated invoice management solutions help ensure compliance with regulatory requirements and internal policies through consistent processes and audit trails. Enhanced security features protect against vendor fraud and unauthorized access.

By integrating automated invoice management software like Klippa SpendControl, companies not only address the inefficiencies and challenges of manual processes but also position themselves for improved operational performance, cost savings, and strategic financial management.

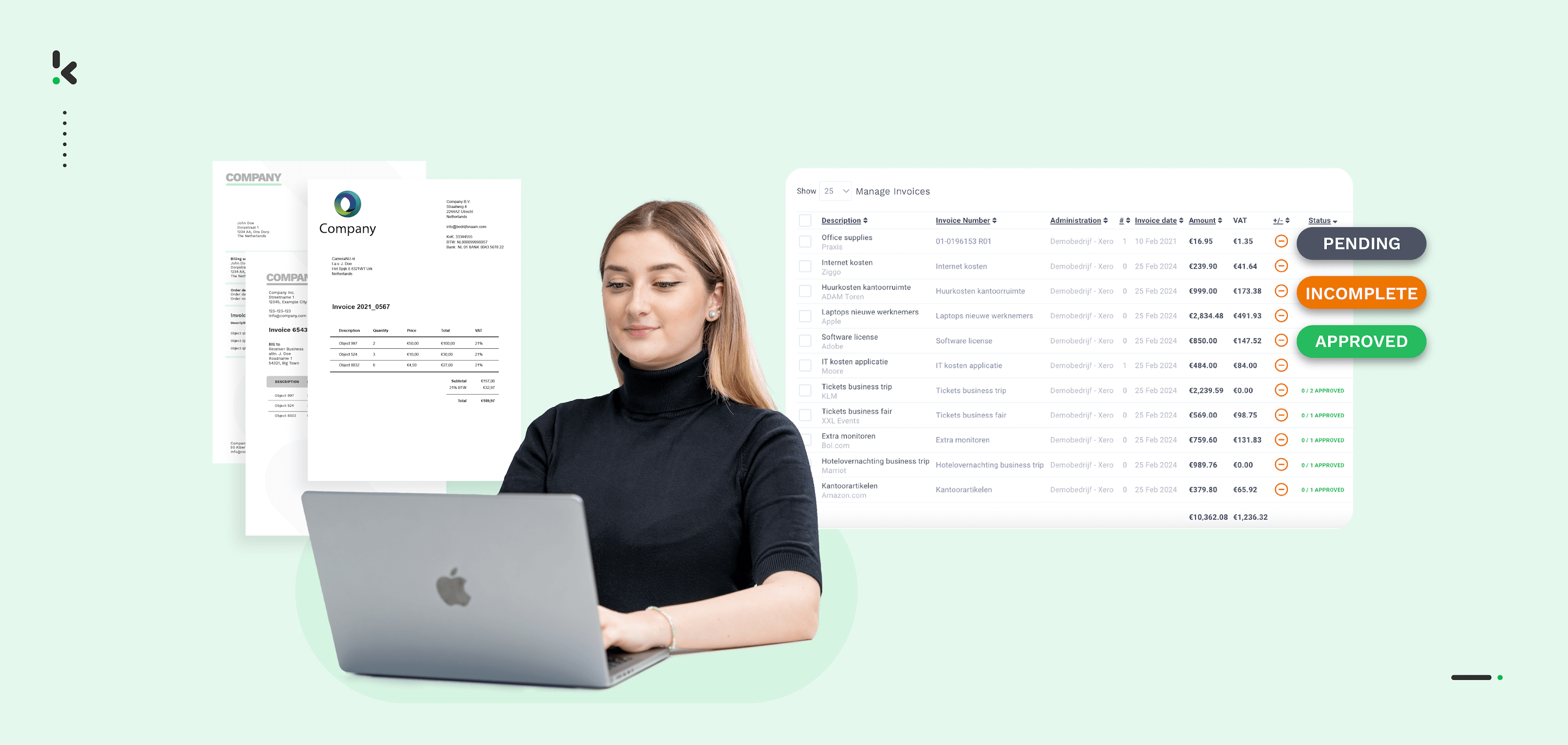

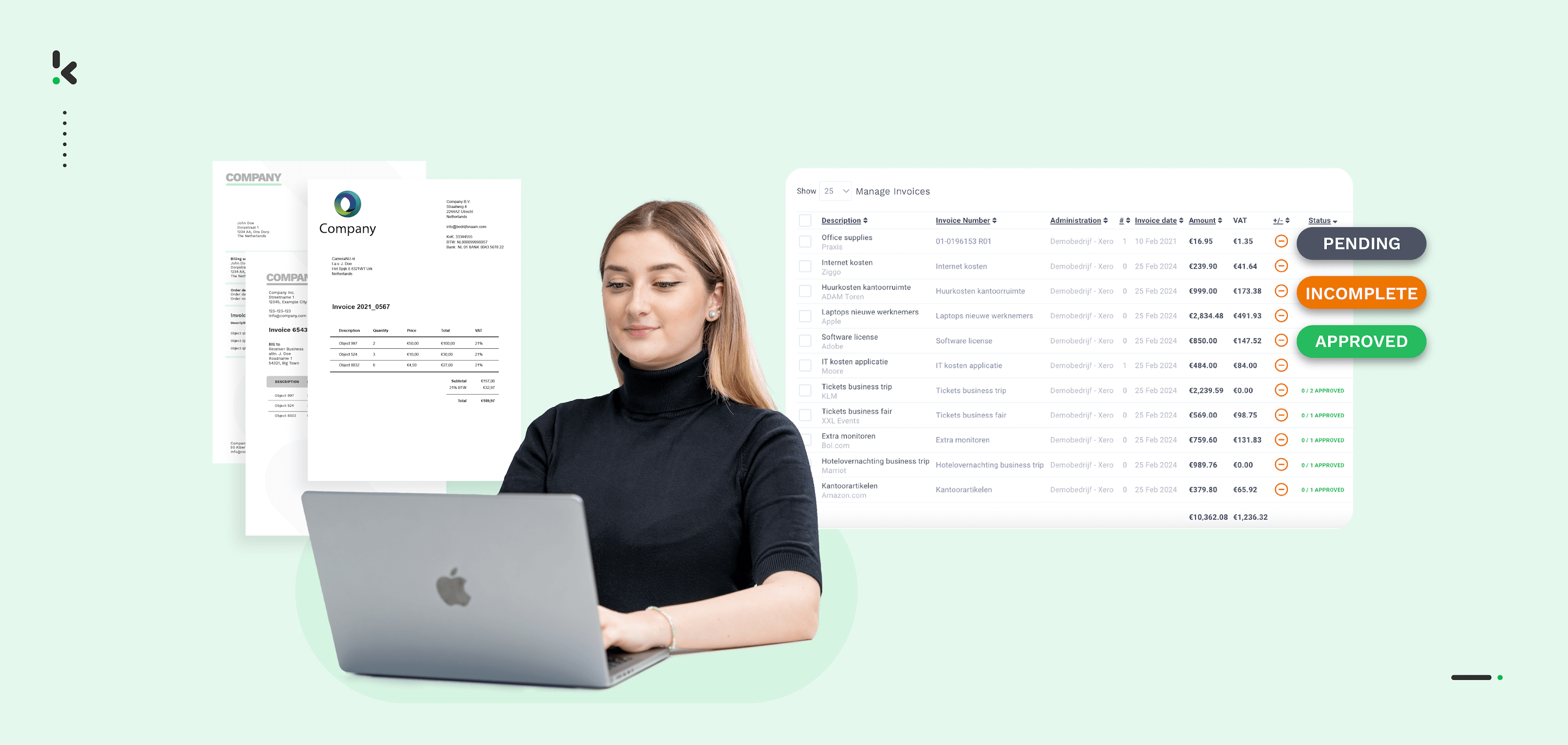

Automate Your Invoice Management with Klippa SpendControl

Managing vendor invoices can be a tedious and inefficient task, but it doesn’t have to be. Forget about the challenges of manual invoice management – entrust your invoice processing to Klippa SpendControl. Process, approve, and manage all vendor invoices with our OCR-powered pre-accounting solution. Reduce the heavy workload into just a few clicks.

Klippa SpendControl offers numerous features that will enhance your invoice management in no time:

- Manage your vendor invoices, employee expenses, and corporate credit cards in one platform

- Submit, process, and approve invoices via web or mobile app

- Achieve 99% invoice data extraction accuracy with Klippa’s OCR

- Regain control over your accounts payable with intuitive dashboards

- Customize your approval management with multi-level authorization flows

- Never fail to comply with tax and data privacy regulations with our ISO27001-certified and GDPR-compliant solution

- Rely on automatic multi-currency support for international payments

- Prevent invoice fraud with built-in duplicate and fraud detection

- Integrate SpendControl with your accounting and ERP software, like Xero, NetSuite, or SAP.

Are you ready to transform your invoice management? Schedule a free demo to see our solution in action, or contact our SpendControl specialists for more details.