Pressing payment deadlines. Expectant suppliers. Upcoming audits. Managing your vendor invoices can be a tough challenge involving a lot of time-consuming tasks. It is easy to make mistakes, miss payments, and get overwhelmed by the piles of invoices.

This is when invoice management software can save the day. The software automates invoice processing, reduces manual work, minimizes errors, and improves vendor satisfaction.

In this guide, we will explore the key features of invoice management systems, the benefits of automated invoice management, and review the top 7 invoice management software available in 2025.

The best invoice management software in 2025

What is Invoice Management Software?

Invoice Management Software automates tasks like invoice approval, tracking, and booking within the Accounts Payable (AP) workflow. By digitizing the entire lifecycle of an invoice, it minimizes manual data entry, reduces errors, and ensures timely vendor payments.

Essentially, invoice management systems capture documents in various formats, including PDFs and images, and extract relevant data using Optical Character Recognition (OCR) technology. This process allows for automatic Purchase Order (PO) matching, facilitating swift approval workflows.

Additionally, invoice management platform typically offers features for enhancing spend visibility, preventing vendor fraud, and managing compliance.

The Best 7 Invoice Management Software in 2025

Selecting the ideal invoice management software is crucial for finance teams aiming to enhance their daily operations, minimize errors and adhere to the best practices of accounts payable. The sheer volume of available options can make the decision process overwhelming.

To assist in this endeavor, we have carefully selected and evaluated the top 7 invoice management software of 2025.

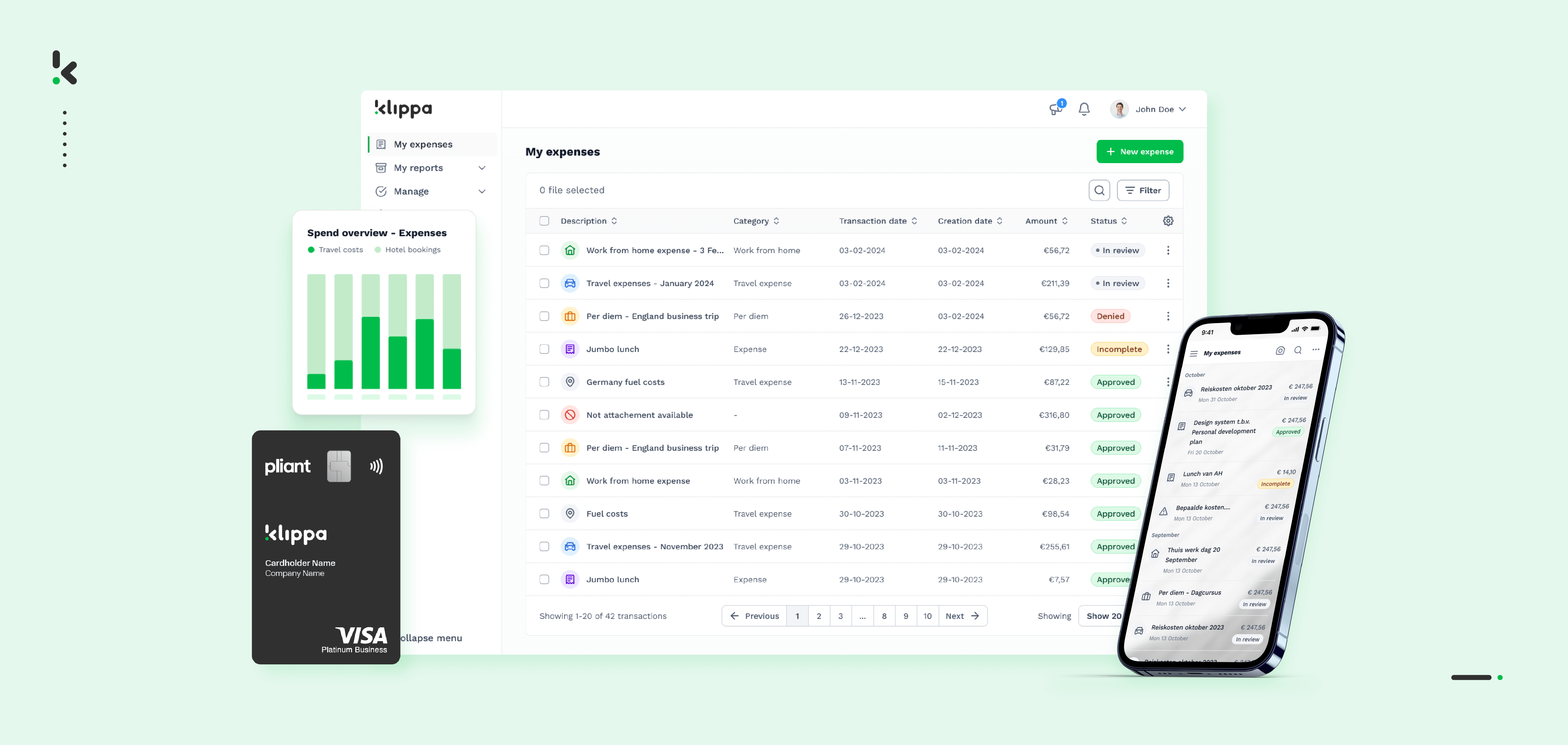

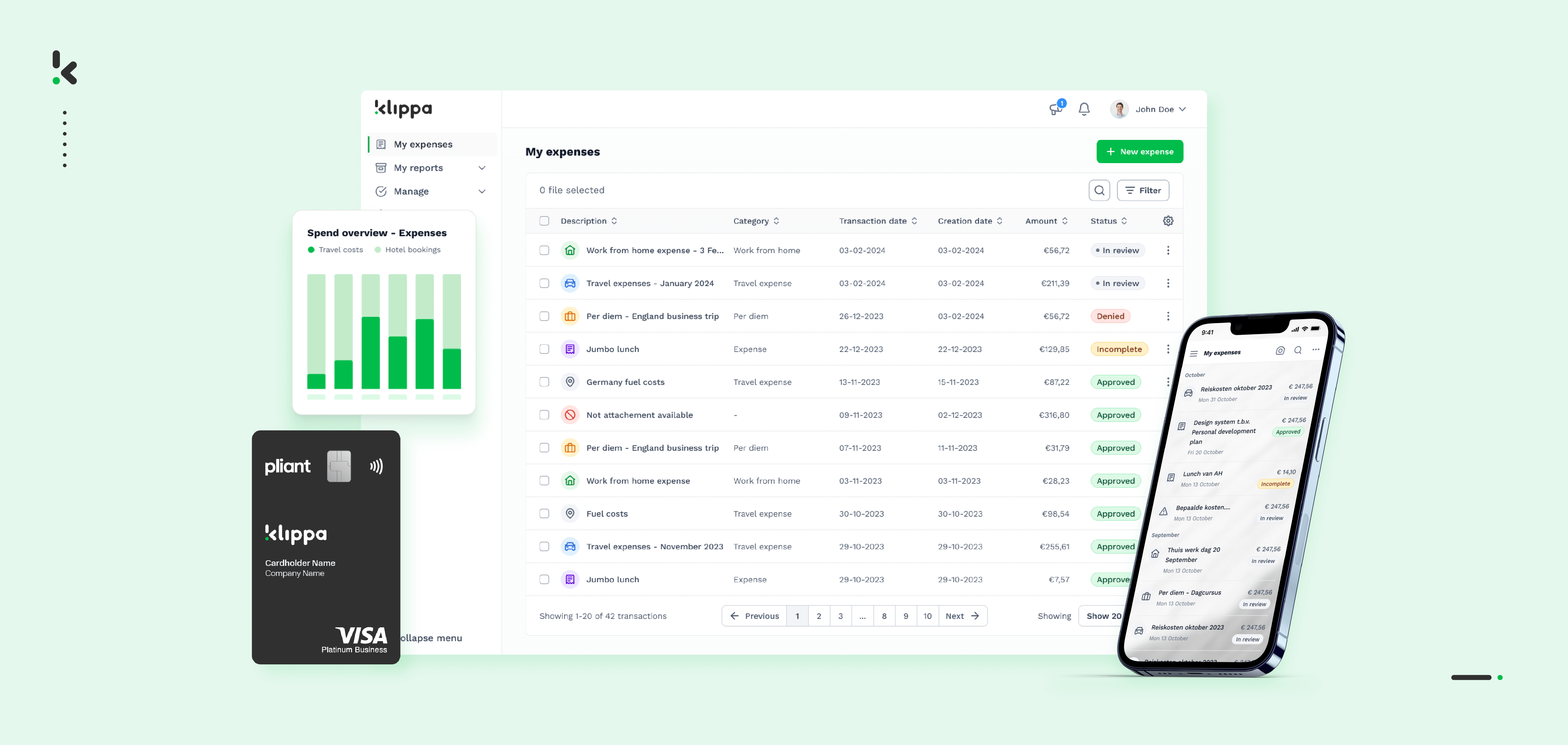

Klippa SpendControl

Klippa SpendControl is an all-in-one digital pre-accounting software that combines invoice processing, expense management, and corporate credit card modules.

Our software uses OCR technology to capture data from invoices, accurately extracting information and providing you with the ability to perform invoice scanning, approval, and booking to your financial administration.

Pros

- Invoice processing and expense management in one centralized platform

- Submission, processing, and cloud-based invoice approval via web or mobile app

- Up to 99% invoice data extraction accuracy with Klippa’s OCR

- Intuitive dashboard for centralized financial control

- Fully customizable approval management with business rules

- Compliance with tax and data privacy regulations

- Multi-currency support for international payments

- Built-in duplicate and fraud detection

- Bulk upload of invoices with split or merge options

- Integration possibilities with accounting and ERP software, like Xero, NetSuite, SAP, and many more

Cons

- No integration options for travel or productivity systems

- Currently no 3-way matching (coming soon)

Starting price: From $5 per user/month.

Ideal business type and size: Klippa SpendControl is best suited for SMEs to mid-market companies in professional services, such as consulting, advisory, and accounting.

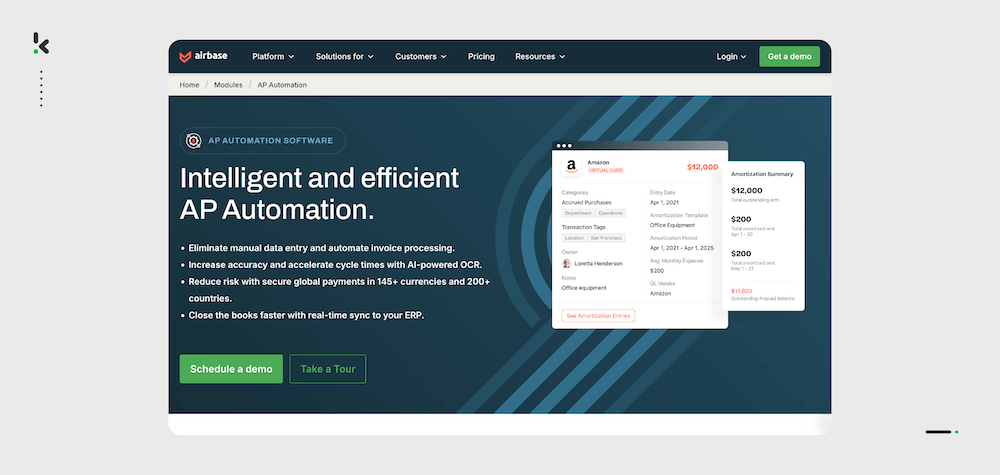

Airbase

Airbase is a digital spend management software that replaces the manual processing of invoices, purchase orders, and other financial documents. Airbase mainly focuses on payment processing, such as employee reimbursement and vendor payment.

Pros

- Ability to perform three-way matching

- Uses OCR technology to scan invoices

- Possibility to schedule and track payments

- Vendor management module

- Automated currency conversions

Cons

- Does not detect fraudulent invoices or duplicates

- No cloud storage

- Inability to integrate within an ERP system

- Only able to upload invoices via email

Pricing: Custom pricing.

Ideal business type and size: Airbase is best suited for mid-market to early-enterprise level organizations in computer software and information technology & services industries.

Xero

Xero is an accounting software that lets companies digitally approve and pay vendor invoices without additional manual processing. The software helps companies to facilitate transactions and create smooth communication between companies and vendors.

Pros

- Online invoice payment module

- Automated approval workflows

- Bulk upload of invoices

- Payment reconciliation feature

- Automated currency conversions

Cons

- Not able to store invoices in a cloud environment

- Inability to automatically detect fraud or duplicates

- Does not perform two-way matching

- Only able to process invoices through a mobile app

Starting price: From $15/month.

Ideal business type and size: Xero is best suited for small to medium-sized businesses in the accounting and computer software industries.

Coupa

Coupa is a digital invoice management solution that helps companies automate manual work, shorten invoice processing time, and eliminate paperwork.

Pros

- Can perform two-way and three-way matching

- Automatic invoice approval from the mobile app

- Integrated fraud detection

- Country-specific invoicing compliance

- Many ERP integration options

Cons

- Based on user reviews, poor data extraction accuracy

- Cannot archive invoices

- Limited integrations with bookkeeping systems

- No user-sync or 2FA

Starting price: From $549/year.

Ideal business type and size: Coupa is best suited for medium-sized to large organizations in computer software and information technology & services industries.

Tipalti

Tipalti is an accounting solution designed to automate accounts payable processes. Aimed at reducing manual work, it supports businesses in achieving faster payment cycles and compliance with financial regulations.

Pros

- Utilizes OCR for automated data extraction

- Supplier and invoice management modules

- Automated payment reconciliation

- Tax and VAT compliance

- Scheduling of invoice batches for payment

Cons

- No advanced customization of reports

- Based on customer reviews, there is a long adjustment period for new users

- Poor reviews on user interface (UI) in navigation and task management

- Relatively high fee for a base platform with additional costs for advanced features

Starting price: From $129/month.

Ideal business type and size: Tipalti is most suitable for small to medium-sized businesses in the marketing and advertising, as well as the information technology and services industries.

Stampli

Stampli is an AI-powered invoice management software that centralizes all communication, documentation, and workflows related to accounts payable in one place.

Pros

- Performs two-way and three-way matching

- Automated GL-coding

- Identification of fraudulent and duplicate invoices

- Automated approval workflows

- Integration with 70+ ERP systems

Cons

- The software doesn’t locate invoice details (such as invoice total) if the uploaded document is longer than 1 page

- No ability to split invoices

- Only 1 template for vendor onboarding

- Some ERP systems do not sync all invoice data

Starting price: Custom pricing.

Ideal business type and size: Stampli is best suited for small to medium-sized businesses in the accounting and hospital & healthcare industries.

Sap Concur

SAP Concur is an invoice management software that streamlines the supplier invoice process by automating manual tasks for faster, simpler, and safer operations. The software aims to speed up processing time, reduce manual errors, and improve cash flow visibility.

Pros

- One platform for travel, expense, and invoice management

- OCR-powered data extraction

- Automated approvals on mobile and web

- Comprehensive insights into cash flow

- Multi-currency support

Cons

- Slow ACH payment processing

- Restrictions on the number of approvers per invoice

- Slow several months-long implementation process

- Based on user reviews, the software interface is outdated and tedious

Starting price: Custom pricing.

Ideal business type and size: Sap Concur is best suited for mid-market to large enterprises in computer software and information technology & services industries.

Benefits of Using Invoice Management Software

Implementing invoice management software offers several tangible benefits that streamline accounts payable procedures, enhance efficiency, and contribute to a company’s financial health. Below are the key advantages of adopting such software:

Save Up to 77% in Time Spent

Workflow automation can save organizations up to 77% of time spent on routine tasks. Automation of invoice processing reduces the time and labor required for manual entry, verification, and approval processes. This efficiency gain not only accelerates the payment cycle but also allows staff to focus on more strategic tasks.

Enhanced Accuracy

By minimizing human intervention, invoice management software significantly reduces the risk of errors. Automated systems ensure that invoices are matched accurately with purchase orders and contracts, leading to fewer discrepancies and disputes.

Save Up to 60% in Costs

Automating invoice processing can save between 20% and 60% of baseline FTE costs. Organizations save on labor costs associated with manual processing and can also avoid late payment fees while taking advantage of early payment discounts from their vendors.

Improved Cash Flow Management

Real-time visibility into the status of invoices and payments allows for better cash flow management. Companies can forecast their financial position more accurately and efficiently manage their working capital.

Regulatory Compliance and Audit Readiness

Invoice management software helps ensure compliance with tax laws and financial regulations by maintaining accurate and accessible records of all transactions. This readiness facilitates a smoother audit process with readily available documentation.

Enhanced Vendor Relationships

Prompt and accurate payment processing strengthens relationships with suppliers. Efficient handling of invoices reflects positively on a company’s professionalism and can lead to more favorable terms and partnerships.

Scalability

As a business grows, its financial transactions become more complex. Invoice management software scales to accommodate increased volumes without a corresponding increase in errors, processing time or the need for additional workforce.

In summary, adopting invoice tracking software is a strategic move that enhances operational efficiencies, reduces costs, and improves financial health.

What to Look for in Invoice Management Software

When considering bill management software, it’s crucial to go beyond just the basic features and evaluate whether the software aligns with your current requirements and can cater to any potential changes in regulatory standards, technological advancements, and the expansion of your company.

Here are some of the features to be on the lookout for:

- Advanced OCR

- Automated approval workflows

- Security protocols and compliance

- ERP and financial system integrations

- Intelligent categorization and spend analysis

- Vendor management portal

- Mobile accessibility and cloud-based flexibility

- Detailed audit trails and reporting

- Scalability and customization

- Quality customer support

Advanced OCR

Quality invoice management software employs OCR technology to convert different invoice formats into structured data with high accuracy. This goes beyond simple text recognition, using AI to understand the context and extract key details such as dates, amounts, and vendor information accurately. Look for an OCR that continuously learns and improves from each document processed.

Automated Approval Workflows

Seek out software that offers customizable approval workflows, allowing you to set rules based on invoice amounts, vendors, or cost centers. Advanced systems provide conditional routing and exception handling, which helps in managing complex approval hierarchies and reduces bottlenecks in the payment process.

Security Protocols and Compliance

Security is non-negotiable when it comes to your company’s financial operations. The best software adheres to stringent security standards like SOC 1 & 2, and GDPR, and should be compliant with financial regulations relevant to your operational region. Features should include end-to-end encryption, role-based access control, and regular security audits.

ERP and Financial System Integrations

Look for vendor invoice management software that integrates with your accounting or ERP systems such as SAP, Oracle, Microsoft Dynamics, and QuickBooks. This ensures real-time data synchronization, reduction of manual entry errors, and provides a unified view of financial data.

Intelligent Categorization and Spend Analysis

Beyond categorizing invoices, many invoice management systems use AI to analyze spending patterns, identify saving opportunities, and even predict future budget requirements. This strategic insight can drive informed business decisions and financial planning.

Vendor Management Portal

A self-service vendor portal not only allows for electronic invoice submission but also enables vendors to update their information, track invoice status, and communicate directly within the system. This transparency improves vendor relationships and reduces administrative overhead.

Mobile Accessibility and Cloud-based Flexibility

Cloud-based invoice management solutions offer the flexibility to access and approve invoices from any device, anywhere. Mobile apps should provide access to primal features, including invoice approvals, access to reports, and vendor communications. Additionally, these apps should be available on both IOS and Android platforms.

Detailed Audit Trails and Reporting

The software should automatically log all actions taken on each invoice for a comprehensive audit trail, supporting compliance with internal policies and external regulations. Reporting capabilities should include custom reports to monitor key performance indicators (KPIs), track spending, and analyze vendor performance.

Scalability and Customization

Check for document processing limits and customization capabilities. Choose software for invoice processing that can scale with your business growth, handling an increasing volume of invoices without compromising performance. Customization options should allow you to tailor the system to your specific business needs.

Quality Customer Support

Ensure the software provider offers in-depth training materials, online resources, and responsive customer support. This is critical for smooth implementation, user adoption, and maximizing the ROI of the software.

Conclusion

Choosing the right invoice management software depends on prioritizing features that align with your business needs. While we presented some of the major players in the invoice management industry, we believe that Klippa SpendControl offers everything you need to take complete control of your accounts payable while saving precious time and costs on invoice processing.

Are you ready to leave behind the hassle of manual invoice management? Book a free demo to see our product in action, or contact our SpendControl specialists for more information. Start investing your time into things that really matter!

FAQ

What is an invoice management system?

An invoice management system automates the processing, approval, tracking, and payment of invoices, reducing manual work and improving accuracy within the accounts payable workflow.

What is vendor invoice management system?

A vendor invoice management system automates the receipt, processing, and payment of vendor invoices, ensuring compliance with company policies and improving vendor relationships by speeding up payments.

What is invoice tracking system?

An invoice tracking system monitors the status of invoices from submission to payment, providing real-time updates on approvals, payments, and potential issues like duplicates or delays.

What is the best way to keep track of invoices?

The best way to keep track of invoices is by using invoice management software that automates data entry, tracks invoice status, and integrates with accounting systems for real-time updates.

How do you manage invoices?

Invoices are managed by automating their capture, approval workflows, and payment processes using invoice management software, which helps reduce errors and ensures timely payments.

What’s the best invoice software?

The best invoice software depends on your business needs. Some top options for 2025 include Klippa SpendControl, Airbase, Xero, Coupa, Tipalti, Stampli, and SAP Concur.