In day-to-day business operations, where financial transactions flow continuously, the process of invoice reconciliation stands as a vital checkpoint for financial accuracy, compliance, and operational efficiency.

Manually reconciling invoices burdens businesses with time-consuming, error-prone processes, impacting cash flow and vendor trust.

In this blog, we’ll look at why invoice reconciliation matters, how it can be done, and how automated invoice reconciliation can help in the process. Let’s dive in!

What is Invoice Reconciliation?

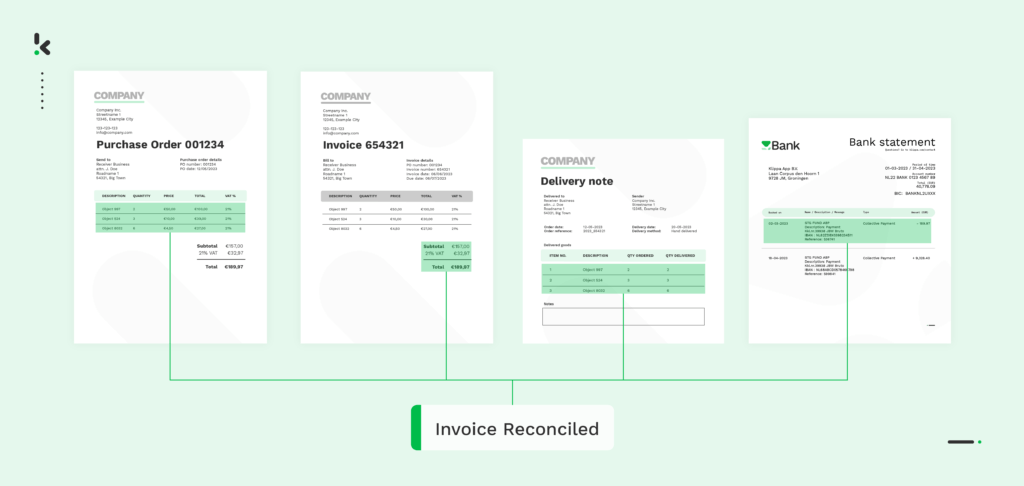

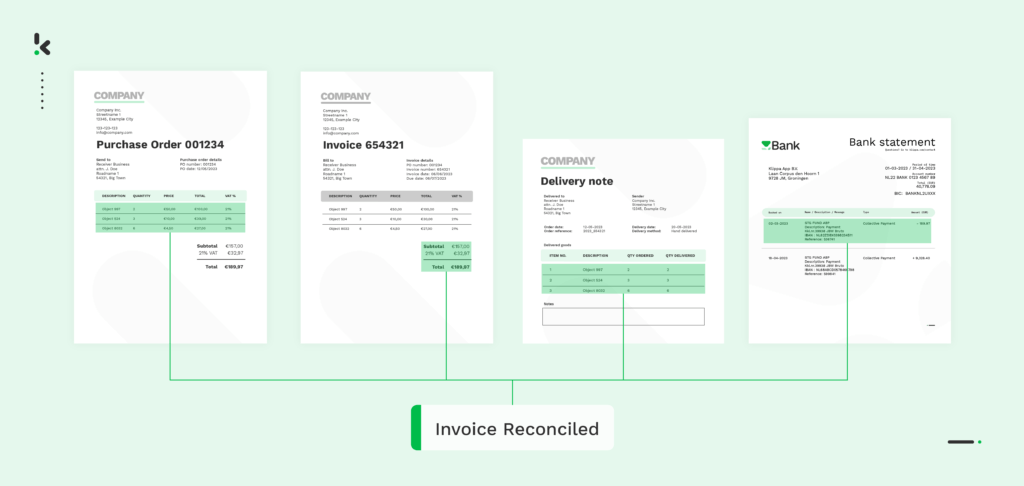

Invoice reconciliation is the process of comparing invoices received from vendors or suppliers with purchase orders, receiving reports, and other documentation to guarantee accuracy and consistency. The purpose of reconciliation is to help businesses ensure that the goods and services received match the orders placed and to verify billing details.

Invoice reconciliation is an important aspect of financial management and accounting, especially for periods like month-end and year-end closing. In the following section, we will introduce you to just how important it is for your business.

Why is Invoice Reconciliation Important?

The importance of invoice reconciliation for a business cannot be understated. It plays a pivotal role in maintaining accurate financial records, ensuring compliance, and preventing fraud within your business. Here are some of the main reasons why invoice reconciliation is important:

- Financial accuracy: Invoice reconciliation helps maintain financial accuracy. This way you can keep precise financial records and prevent discrepancies that could lead to financial losses. With invoice reconciliation, you can ensure that bills issued by vendors match the goods or services received by your organization.

- Spend management: By reconciling invoices, you can track your expenses accurately and manage your cash flow effectively. This process allows you to monitor your spending patterns, identify areas where costs can be reduced, and prioritize payments to vendors based on your budget.

- Regulatory compliance and auditing: Invoice reconciliation is vital for maintaining regulatory compliance and auditing standards. Properly reconciled invoices create a transparent financial transaction trail, which is crucial for adhering to accounting principles and regulations. It streamlines audits by ensuring accurate and verifiable financial records.

- Vendor relationships: Timely and accurate invoice reconciliation contributes to positive vendor relationships. Promptly addressing discrepancies demonstrates reliability, fostering better terms and collaboration.

- Operational efficiency: Reconciling invoices can help you spend less time on the administrative burdens that come with the accounts payable process. During reconciliation, you can better identify billing errors, prevent late payments, and make sure all financial obligations are met on time.

The level of accuracy and precision in your invoice reconciliation process is important for maintaining transparency and compliance within your organization. We will now take you through some of the different methods or types of invoice reconciliation.

Types of Invoice Reconciliation

Invoice reconciliation involves comparing invoices with other documents or records to ensure accuracy and resolve discrepancies. There are several types of invoice reconciliation methods:

- Two-way matching: Compares the invoice with the purchase order to verify that the goods or services were received as ordered and at the agreed-upon price.

- Three-way matching: Involves comparing the invoice with both the purchase order and the receiving report to ensure that the quantities and prices match and that the goods or services were received.

- Vendor statement reconciliation: Compares invoices with vendor statements to ensure that all transactions are accurately recorded and accounted for, helping to identify any missing or duplicate invoices.

- Credit card reconciliation: Matches credit card statements with invoices to reconcile transactions, ensuring that all charges are legitimate and accounted for.

- Manual invoice reconciliation: Manually comparing invoices with other documents or records, can be time-consuming but may be necessary for certain transactions or situations where automation is not feasible.

- Automated invoice reconciliation: Uses software to automatically match invoices with corresponding purchase orders or receiving reports, streamlining the reconciliation process and reducing manual effort.

Choosing the right invoice reconciliation method is crucial for upholding financial integrity. It’s essential for you to regularly assess your procedures, ensuring they adhere to compliance standards and operate efficiently. Let us now go through the steps taken in the invoice reconciliation process.

The Invoice Reconciliation Process

Here are the steps usually taken in the process of invoice reconciliation.

- Gather invoices for the period: Firstly, you need to have received and collected all the invoices you intend to reconcile. If you are reconciling invoices from Q1 for example, then you need all invoices from Q1. If you are working with spend management software, then you should have all the information and invoices readily available and easily sortable.

- Create a general ledger transaction record: Next, with the invoices you have gathered, create a detailed ledger of transactions that occurred during the period you wish to reconcile. Be sure to include the deposits and the payouts in this ledger to avoid any mistakes.

- Match invoices to transactions: At this point, you want to compare the data on the invoices with the corresponding purchase orders, receiving reports, and recorded transactions. Ensure that details between these documents such as product description, quantities, and prices match.

- Match invoice payments with recorded transactions: If you find that company A invoiced you for €1000 and you paid out €1000 to company A, that is a good sign. Invoices that are paid in full can be put aside and marked as processed. Now repeat this for all invoices for the period. If you find discrepancies, you can dig further to find where the imbalance lies. If you are doing this manually, it can be a time-consuming process depending on the size of your organization and the number of invoices to be processed.

- Resolve discrepancies: If in the previous step, you came across discrepancies this is your chance to resolve them. Did you find an unpaid invoice or did you double pay an invoice? Are you still paying vendors you no longer do business with? Then you need to take action. Revisit partially paid invoices and make any additional payments needed. Unpaid invoices need to be paid and carry over as accounts payable for the new reporting period. Take this reconciliation moment as the chance to make the necessary changes in your invoice management processes to prevent mistakes or errors from taking place in the future.

- Maintain Meticulous Record Keeping: Ensure meticulous record-keeping practices, documenting all invoices, reconciliations, approvals, and payments. These records serve crucial purposes in auditing and financial reporting, providing transparency and accountability.

By following these steps you can maintain financial accuracy and employing the right practices is the easiest way to do so to optimize efficiency and compliance, enhancing your overall financial management.

Invoice Reconciliation Best Practices

Optimizing your invoice reconciliation process is essential for financial accuracy and efficiency as well as to adhere to some of the best practices in AP. Here are 10 best practices to help you streamline your invoice-centric workflows, reduce errors, and maintain strong vendor relationships.

- Regularly reconcile: You should perform invoice reconciliation regularly, ideally on a weekly or monthly basis, to stay up-to-date with financial transactions and minimize backlogs.

- Distinguish duties: Separate the responsibilities of creating, approving, and reconciling invoices to prevent fraud or errors. Implementing segregation of duties ensures accountability and reduces the risk of unauthorized transactions and unauthorized access.

- Document everything: Make sure to keep detailed records of all invoices, reconciliations, approvals, and payments for auditing and reporting purposes.

- Maintain vendor communication: Keep open communication channels with vendors to promptly address any discrepancies or issues and ensure smooth resolution.

- Ensure invoice accuracy: You must verify the accuracy of invoice data, including pricing, quantities, and terms, against purchase orders and receipts to avoid discrepancies.

- Implement an expense policy: Implement an expense policy to centralize decision-making, keep everyone in the organization on the same page, and ensure financial oversight in vendor management.

- Continuously monitor and improve: Regularly monitor the accuracy of your invoice reconciliation process. Look at recurring patterns in the types of errors or issues that arise in your invoice processing. Gather feedback from the staff and individuals involved in the process and make the necessary changes/improvements to your procedures.

- Regular reviews and audits: Conduct regular reviews and audits of the reconciliation process to identify any weaknesses or areas for improvement and implement corrective actions as needed.

- Investigate discrepancies promptly: Address discrepancies identified during invoice reconciliation quickly find out the cause of the discrepancies and take corrective actions where necessary.

- Use automation tools: You should adopt automation tools and software instead of relying on manual efforts to speed up the reconciliation process, reduce manual errors, and improve accuracy.

By implementing these practices in your invoice reconciliation, you can take steps towards better invoice management. In the following section, we will explore in more detail how automated invoice reconciliation can help your organization.

How Automated Invoice Reconciliation Can Help Your Business

As a company grows, manual processing of documents in invoice reconciliation becomes increasingly challenging, increasing the risk of errors and fraud. However, leveraging automation can significantly improve all aspects of this process.

Automating invoice reconciliation simplifies complex workflows that come with manual processing. It ensures error-free submission, and approval of invoices, and improves the accuracy of 2-way and 3-way matching while eliminating issues like duplicate payments and reducing fraud. Moreover, automation helps maintain regulatory compliance by enforcing validation rules, flagging discrepancies, and maintaining clear records, and transparency in case of an audit.

Without automation, you have to deal with slow and inefficient processes that increase the likelihood of errors. By integrating a financial management solution into daily practices you can modernize financial management, control expenses, and mitigate risks more easily.

Klippa SpendControl is one of these solutions that can help you kickstart your automation journey for a seamless invoice reconciliation experience. In the next section, we’ll tell you how Klippa can improve your invoice reconciliation.

How Klippa Can Help Streamline Your Invoice Reconciliation Process

With Klippa SpendControl, the reconciliation of invoices is a breeze. You can easily integrate our reconciliation solution with your ERP or accounting system in place to empower your financial and accounting departments. With Klippa SpendControl, you can:

- Submit and approve receipts and invoices easily via the mobile app or web application.

- Reconcile payments automatically with intelligent two-way matching.

- Extract data by using AI-driven data extraction technology that recognizes all required invoice data, such as invoice number, total sum, and even multiple currencies.

- Prevent financial fraud with the automatic detection of duplicate invoices.

- Establish business rules within the approval management system, dictating the actions to take based on document conditions being met or not.

- Integrate the solution with a wide variety of ERP and accounting software, such as NetSuite, SAP, Xero, and many other integrations.

Do you want to improve your organization’s invoice reconciliation right now? Feel free to contact us directly or book an online demo!