Even though technology has become a big part of our daily lives, some companies still have to discover the wonders of automating their business processes. Take, for instance, a task like invoice processing. According to recent statistics, 86% of SMEs still rely heavily on paper invoice receipts and manual data entry. Not only is this a tedious and repetitive task, but it takes up a lot of precious time.

Companies that extract information manually from invoices spend approximately 25 days on a single invoice. And that is, of course, if the invoice does not present any errors beforehand. Why spend so much time manually extracting and typing important data points from invoices when you can facilitate the automatic invoice recognition process with invoice scanning software?

In this blog, we will explain what invoice data capture software is, the criteria for choosing the one that fits your organization, and we will look at a breakdown of the 8 best invoice capture software in 2025. Let’s start!

Key Takeaways

The 8 Best Invoice Scanning Software for 2025 are:

- Klippa SpendControl – Best all-in-all solution for automating invoice scanning, approval, and management with integrated fraud detection and invoice data extraction using OCR.

- Klippa DocHorizon – Ideal AI-powered platform for complete invoice workflow automation, including invoice scanning, data extraction, fraud detection, and seamless ERP integration.

- Docsumo – Specializes in data extraction and conversion of invoices from various formats, including PDFs and images, with AI-powered OCR.

- Rossum – Cloud-based AI-powered invoice processing that integrates real-time transaction visibility and invoice fraud detection.

- Nanonets – Automated data extraction from unstructured invoices, down to SKU-level line items, with OCR and custom integration options.

- Tungsten Automation (formerly Kofax) – Offers high-speed capture and validation of invoices from paper, PDF, and email, with two-way and three-way matching.

- Docparser – Cloud-based invoice parsing solution that processes PDFs, Word documents, and other formats into structured data.

- Hyperscience – An advanced AI-driven data extraction solution for structured, semi-structured, and unstructured formats, including invoice processing.

Comparison of the best invoice scanning software in 2025:

What is Invoice Scanning Software?

Invoice scanning software is a specialized tool that automates data extraction from vendor invoices. By using OCR and AI, it automatically scans and captures information from invoices, turning complex data into a structured format without manual input.

Instead of spending valuable time entering details manually, this software automates invoice processing and extracts key information such as:

- Vendor Information: Company name, address, VAT/Tax ID, and contact details.

- Invoice Details: Invoice number, issue date, due date, and currency.

- Line Items: Product descriptions, quantities, prices, taxes, and totals.

- Amounts & Totals: Subtotals, VAT amounts, discounts, and final payable amounts.

- Payment Information: Bank account details, IBAN, BIC, and payment terms.

- PO & Reference Numbers: Purchase order numbers and internal project references.

- Delivery Information: Retrieves delivery dates, addresses, and tracking numbers.

By implementing an invoice scanning solution, you can drastically speed up the time it takes to process invoices. This efficiency not only reduces the chance of human error but also enhances data accuracy. Moreover, using automated tools like this helps safeguard against potential invoice fraud by quickly flagging inconsistencies or anomalies in the data.

Why is Invoice Scanning Software Important?

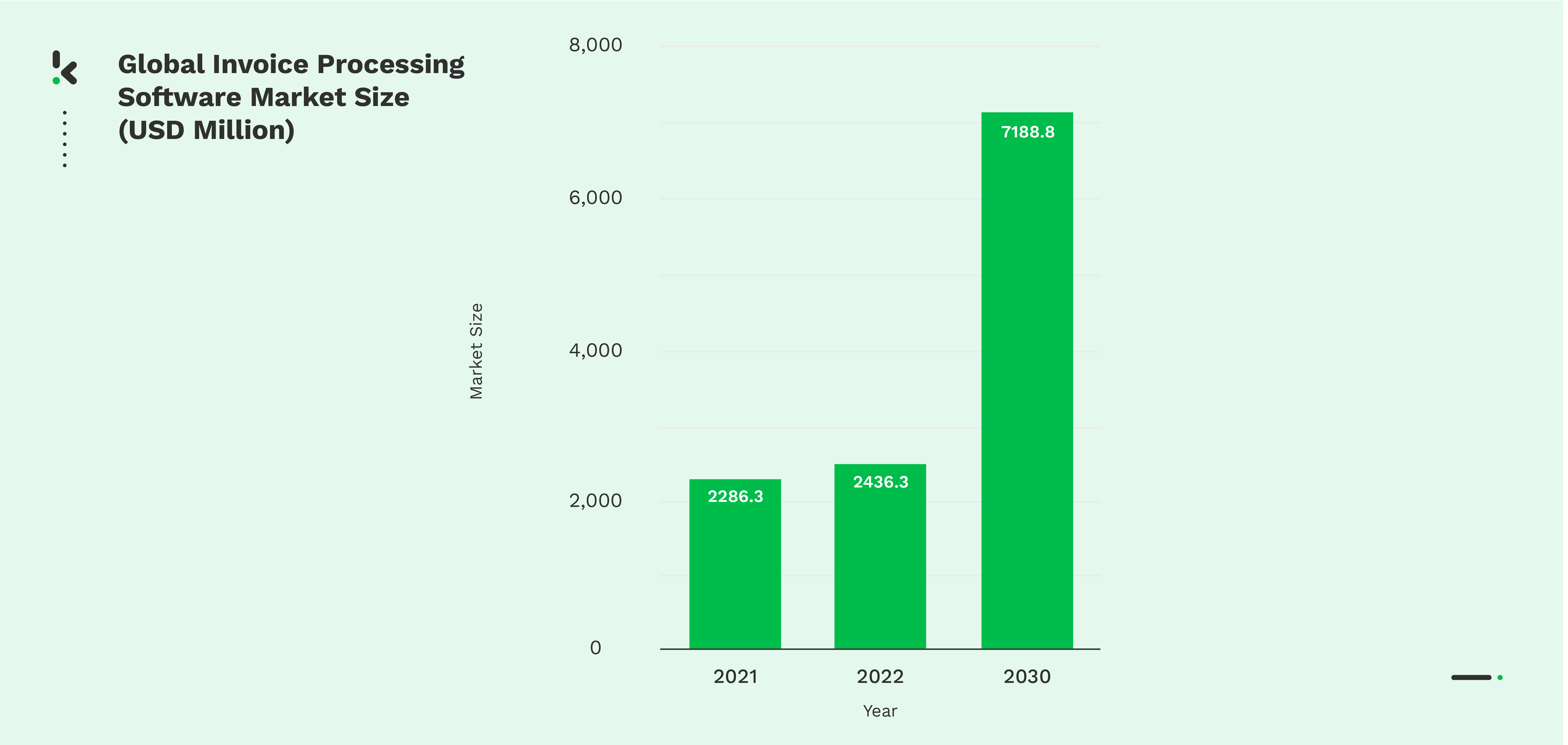

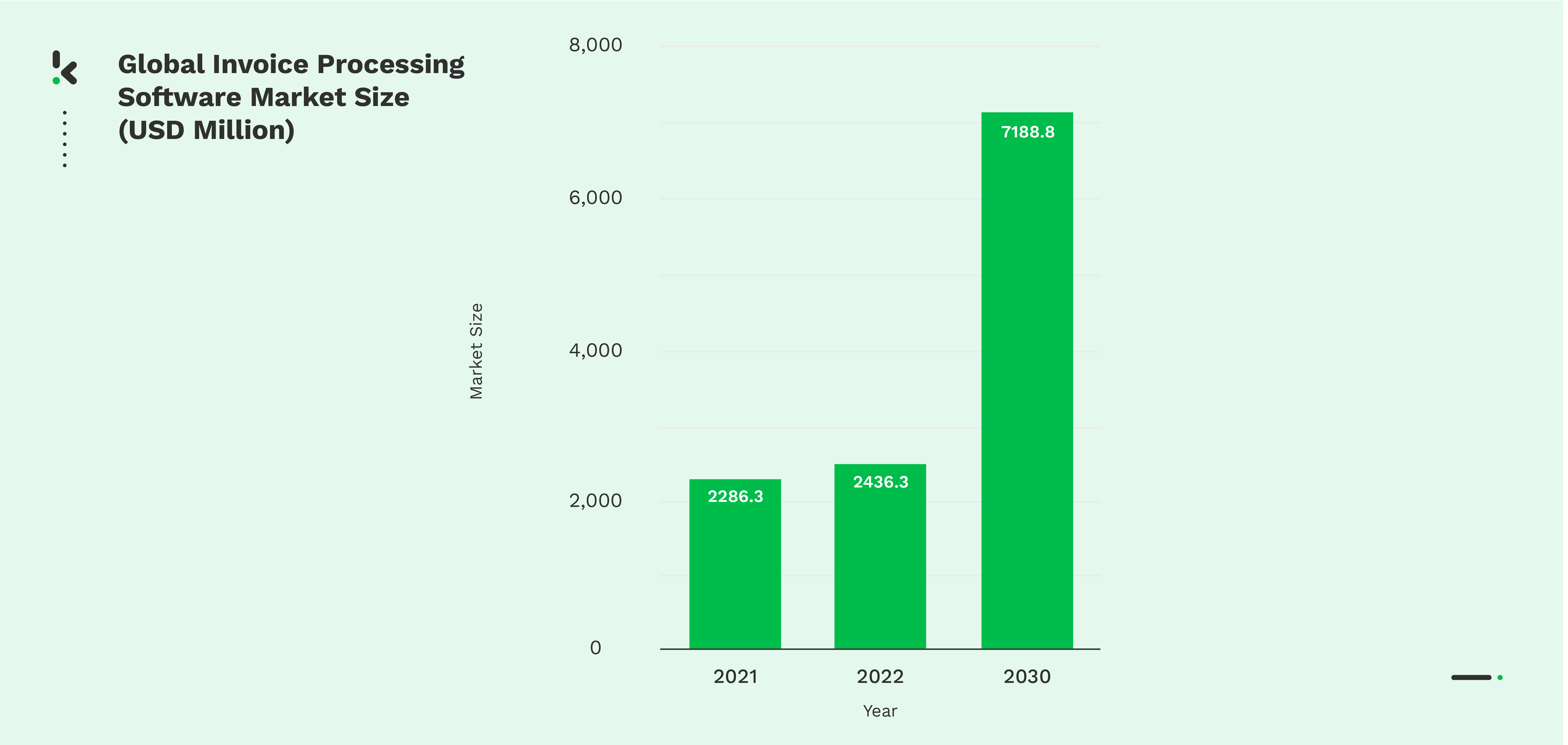

The adoption of invoice automation systems, such as invoice scanning software, is rapidly increasing across industries, driven by the need for efficiency and accuracy in financial operations. Businesses are recognizing the immense value of automating their invoice processing workflows, leading to significant growth in this market segment.

The global invoice processing software market was valued at USD 2286.3 million in 2021 and is projected to expand from USD 2436.3 million in 2022 to an impressive USD 7188.8 million by 2030.

The data cannot lie; the invoice recognition software is no longer a luxury but a necessity for businesses aiming to optimize their financial operations and maintain a competitive edge.

However, with this abundance of options on the market, how can you decide which invoice capturing technology is most suitable for your company? In order to assist you, we curated a comprehensive list of the best invoice scanning software for your business.

Best Invoice Scanning Software in 2025

To help you, we’ve selected some of the most popular tools, looked into their features, and explored real user feedback from trusted review platforms. The result is a clear overview of what each app does well and where it might fall short based on what actual users are saying.

1. Klippa SpendControl

Klippa SpendControl is an all-in-one digital pre-accounting software that combines invoice processing, expense management, and corporate credit card modules.

Our software utilizes Optical Character Recognition (OCR) technology for automatic invoice recognition to ensure accurate data capture and enable invoice scanning, invoice approval, archiving, and booking directly to your financial administration.

Pros

- Manage your vendor invoices, employee expenses, and corporate credit cards in one platform

- Scan, submit, process, and approve invoices via web or mobile app

- Achieve 99% invoice data extraction accuracy with Klippa’s OCR

- Regain control over your accounts payable with intuitive dashboards

- Customize your approval management with multi-level authorization flows

- Never fail to comply with tax and data privacy regulations with our ISO27001-certified and GDPR-compliant solution

- Rely on automatic multi-currency support for international payments

- Prevent invoice fraud with built-in duplicate and fraud detection

- Integrate SpendControl with your accounting and ERP software, like QuickBooks, NetSuite, or SAP

Cons

- No integration options for travel or inventory systems

- Currently, no 2-way matching (coming in 2025)

- No support for non-Latin alphabets

- No document storage

Pricing

- A free online demonstration is available

- Effective plan: For up to 4,000 invoices per year and 10 users, $95/month

- Premium plan: For up to 12,000 invoices per year and 30 users, $275/month

- Custom plan: A fully customizable solution tailored to your company’s needs with SSO for user and workflow management.

Learn more about our invoice processing modules and their pricing here.

Ideal business type and size: Klippa SpendControl is best suited for small to medium-sized companies seeking a scalable AP automation solution that processes vendor invoices, employee expenses, and credit card transactions in one platform.

2. Klippa DocHorizon

Klippa DocHorizon is an intelligent document processing platform that uses AI-powered OCR software to accurately scan, extract, and process information. The solution helps businesses automate their entire document workflows with classification, extraction, invoice validation, fraud detection of invoices, and any other document types.

Pros

- Fast and accurate data extraction with in-house developed invoice OCR

- Built-in detection of fraudulent invoices

- Two-way matching of purchase orders and invoices

- Three-way matching also available for extra security

- Cross-checking between documents and data points

- Verification of invoice authenticity

- Classification, labeling, and sorting of files and line items

- Data masking, data anonymization, and data redaction

- Fully customizable to your specific needs

Cons

- No support for non-Latin alphabets

- Not an all-in-one financial management solution

Pricing

- €25 free credit to try out the platform

- License or usage-based pricing model

- Contact the team for pricing details

Ideal business type and size: Klippa DocHorizon is a versatile platform that can benefit small, medium, and large enterprises, including but not limited to financial, retail, and identity sectors.

3. Docsumo

Docsumo is a document AI platform that extracts and converts documents such as payslips, invoices, and bank statements into readable data.

Pros

- AI-powered data scanning from structured and unstructured documents

- Extraction and validation of data from any format: PDF, image, or Excel

- 2 levels of accuracy checks – automated validations and manual reviews

- Invoice data ingestion from email inboxes, scanners, or other document management systems

- Auto-classification and splitting of documents

Cons

- Based on user reviews, the platform is relatively expensive to suit small businesses (G2)

- Does not provide fraud or duplicate detection

- Does not include two or three-way matching

- Does not include data categorization, classification, validation, and email parsing in the basic module

Pricing

- Growth plan: For businesses that need to automate one or two document types, from $500+/month

- Business plan: Platform for businesses that need to capture specific data points from documents and train on their data, with custom pricing

- Enterprise plan: for enterprises that need to process multiple document types, train on their data, and implement custom workflows, with custom pricing

Ideal business type and size: Docsumo is best suited for small to medium-sized businesses that mainly process and scan relatively simple, structured documents.

4. Rossum

Rossum is a file-processing platform that digitally processes various documents and stores them in the cloud. This feature allows for cloud access, which leaves out additional maintenance costs for storing documents.

Pros

- AI-powered document processing

- Built-in invoice fraud and anomaly detection

- Automated data entry, invoice verification, & validation

- Real-time transaction visibility

- Automated invoice approval workflows with business rules

Cons

- Based on user reviews, the platform has limitations in processing and extracting data from documents written in languages other than English (GetApp)

- Based on user reviews, Rossum cannot correctly scan lines from documents with unusual layouts (Capterra)

- Based on user reviews, the platform might be challenging for small businesses to afford and manage due to its high operational costs and complexity (Software Advice)

Pricing

- Custom pricing, depending on the business’s requirements and needs

Ideal business type and size: Rossum is best suited for medium to large-sized businesses that handle a high volume of invoices primarily in the English language.

5. Nanonets

Nanonets is an automated data entry software that uses artificial intelligence. It lets you scan invoices, bills, and receipts and extract data in real time.

Pros

- OCR-powered invoice data scanning

- Data extraction from unstructured invoices, down to SKU level line-items

- Import of PDFs or images via email, API, desktop, Drive, Dropbox, RPA, or cloud storage

- Automated approval workflows with custom policies

- Integration with popular accounting systems, such as QuickBooks, Microsoft Dynamics, Sage, and more

Cons

- The software requires self-serve setup, and personalized training and support are available only with the premium “Enterprise” plan

- The software can be relatively expensive for small businesses

- Based on user reviews, the platform can be costly for businesses with moderate invoice volumes (G2)

- Based on user reviews, the platform is not very user-friendly and can take a lot of time to master (Capterra)

Pricing

- Starter plan: Platform tryout with limited features. The first 500 pages are free, then $0.3/page + $0.5/step of workflow integration

- Pro plan: Advanced on-platform tools. $999/month/workflow

- Enterprise plan: Custom workflow add-ons, custom pricing

Ideal business type and size: Nanonets is best suited for small to medium-sized businesses with some technical support infrastructure due to its advanced features that require significant training and its high processing power requirements.

6. Tungsten Automation (formerly Kofax)

Tungsten Automation is an automated data entry software created for automating financial-focused processes and tasks. It helps the user capture data from invoices and validate them.

Although Tungsten Automation helps with automating the process of scanning invoices and is able to convert data into multiple formats, it lacks the ability to customize actions within the software. This means the user has a small variety of tasks they can perform with the scanned data.

Pros

- Capture and validation of invoices from paper, PDF, email attachments, and electronic formats using OCR technology

- Performs two-way and three-way matching

- Automated approval and exception workflows with business rules

- Visibility into invoice status with real-time dashboards

- Integrates with popular ERP and accounting systems, such as Microsoft D365 and Oracle

Cons

- Based on platform reviews, the invoice verification software displays occasional issues with data extraction accuracy (Trust Radius)

- Based on user reviews, the software lacks customization options, particularly for reporting and workflow adjustments (Capterra)

Pricing

- Information on pricing models is not available on the official website

Ideal business type and size: Tungsten Automation is best suited for medium to large-sized enterprises with high invoice volumes and multi-entity operations.

7. Docparser

Docparser is a cloud-based invoice parsing and automation tool. It lets you extract data from scanned images, PDF files, and Word documents and convert it to JSON, CSV, XML, and Excel.

While it offers the user the ability to convert the scanned data to various extensions, it lacks the capacity to filter and divide it. Essentially, the software has trouble separating data and differentiating names, locations, line items, numbers, and dates.

Moreover, Docparser does not automatically read the file as it is uploaded. The user is required to manually select the data that needs to be scanned and mention what type of document they have uploaded.

Pros

- Data extraction from invoices received in PDF, by fax, or snail mail

- Invoice import from Box, Dropbox, Google Drive, OneDrive, and more with built-in cloud integrations

- Processing of invoices with known and unknown layouts with custom document parsers

- Automated processing of purchase orders, shipping, and delivery notes

- Conversion of PDF documents into CSV, XML, Excel, and JSON

Cons

- Does not perform two or three-way matching

- Based on user reviews, the high cost of the software might not be justifiable for smaller businesses (GetApp)

- Based on user reviews, the platform experiences occasional performance issues, such as delays in saving changes or loading pages (Software Advice)

- Based on user reviews, filtering and division of scanned data can be an issue for the software (Software Advice)

Pricing

- Starter plan: Processing of 1200 documents per year with 15 different parsers, from $32.50/month, billed yearly

- Professional plan: Processing of 3000 documents per year with 50 different parsers, from $61.50/month, billed yearly

- Business plan: Processing of 12000 documents per year with 500 different parsers, from $133/month, billed yearly

- Enterprise plan: Custom package built for specific parsing requirements, custom pricing

Ideal business type and size: Docparser is best suited for small to medium-sized businesses that require custom document parsers.

8. Hyperscience

Hyperscience is an automated data entry software that uses a combination of OCR technology, computer vision, machine learning, and natural language processing to read and extract data from invoices.

While it preaches that the intelligent document processing software has the ability to accurately extract data from documents such as invoices, it still requires implementing a human-in-the-loop. On its own, the software encounters errors; therefore, human input is required.

Moreover, users have reported that Hypersciene’s customer service is still to be improved, as the level of service and help that was offered to them was unsatisfactory.

Pros

- Data extraction from structured, semi-structured, and unstructured formats using machine learning technology

- Automated classification of all document types

- Automated document duplicate detection

- Invoice processing workflows with business rules

- Integration with Blue Prism, Salesforce, Box, Pega, Bizagi, NICE, and ImageTrust systems

Cons

- Based on publicly accessible information, Hyperscience does not offer invoice fraud detection

- Limited integration options, no direct integrations with accounting or ERP software

- Users report issues with semi-structured extraction and occasional lagging in character detection in languages other than English (G2)

- While offering advanced features, the platform can be very expensive, particularly for small to medium-sized businesses

Pricing

- Information on pricing models is not available on the official website. Users report that the platform cost starts at $50,0000/year.

Ideal business type and size: Hyperscience is best suited for medium to large-sized businesses that require advanced features and utilize supported integrations.

There are many things to take into account when implementing an automated solution for invoice scanning. So let’s take a look at the most important factors that need to be taken into consideration when choosing invoice processing automation software.

How to Choose Invoice Scanning Software

As previously mentioned, there are many things that you need to keep in mind when choosing automated invoice capture software. Take a look at some of the most important criteria when considering an invoice scanner:

Accurate Data Extraction

Ensure the invoice capturing software has a high accuracy rate in extracting data from various invoice formats. Look for invoice scanning solutions that utilize advanced OCR technology, which can reduce manual data entry errors and ensure consistent reliability across diverse document types.

Duplicate and Fraud Detection

Advanced duplicate and fraud detection capabilities are vital for maintaining financial integrity. The invoice verification software should be able to identify and flag duplicate invoices, as well as detect anomalies that may indicate fraudulent activities. Key functionalities include:

- Two-Way Matching: This involves comparing the invoice details with the corresponding purchase order to ensure that the billed amount and items match what was ordered.

- Three-Way Matching: This process goes a step further by also matching the invoice and purchase order with the receiving report (goods receipt). This ensures that the items billed were actually received and are in the correct quantity and condition.

Integration Capabilities

Your chosen software should seamlessly integrate with your existing ERP, accounting, and other financial systems. Compatibility with major platforms such as QuickBooks, SAP, or Oracle is crucial for a streamlined workflow and real-time data synchronization.

Additionally, consider the software’s ability to connect with older systems via API integrations or custom connectors. This ensures that even legacy systems can benefit from the new software, preserving your existing infrastructure and avoiding costly overhauls.

Approval Workflows

Look for software that can automatically route invoices to the correct approvers based on predefined business rules. Effective approval workflows are crucial for ensuring that invoices are reviewed and authorized in a timely and accurate manner. Consider the following features when evaluating approval workflow capabilities:

- Multi-Level Approvals: Allowing higher-value invoices to be routed through various tiers of authorization based on amount, department, or other criteria.

- Approval Hierarchies: The software should allow you to set up hierarchies that reflect your organizational structure, including alternate approvers and escalation paths for exceptions.

- Mobile and Remote Approvals: Remote approvals are essential for maintaining workflow continuity, especially for approvers who are frequently on the move or working remotely.

Security and Compliance

Verify that the software complies with industry standards and regulations such as GDPR, HIPAA, or SOC 2. Features like encryption, user access controls, and audit trails are essential for maintaining the integrity and confidentiality of your data.

Customization Options

Every business has unique needs. Ensure the software provides customization options to tailor workflows, templates, and reporting tools to your specific requirements. This can enhance operational efficiency and ensure the software aligns perfectly with your business processes.

Customer Support and Training

Reliable customer support is crucial for addressing any issues that may arise. Look for vendors that offer comprehensive support services, including live chat, phone support, and email. Additionally, access to training resources such as webinars, tutorials, and user manuals can help your team maximize the software’s potential.

There are numerous Intelligent Document Processing software used for scanning invoices, as we have just discovered. While they all fulfill the purpose of scanning invoices, many lack important features that actually improve the invoice scanning process.

Klippa SpendControl, however, meets the most significant needs and fulfills all necessary criteria to successfully automate invoice scanning, without any kind of compromise. Why settle for software that can perform only part of the task?

Let’s find out together how you and your business can benefit from using Klippa SpendControl Invoice Processing software.

What makes Klippa a Perfect Choice for Invoice Scanning?

Klippa isn’t just another tool – it’s a fully AI-powered receipt scanning and processing platform. Klippa combines AI-powered pre-processing, smart automation, and fraud detection to deliver the fastest and most accurate, and secure invoice scanning workflows in 2025.

Klippa SpendControl is an all-in-one financial management solution that significantly improves the accounts payable process within your organization. Using OCR technology, it can automatically read, scan, and process invoices within a matter of seconds.

What makes Klippa stand out from the rest?

When it comes to invoice scanning software, Klippa SpendControl leads the pack with its comprehensive pre-accounting solution. It combines powerful features like invoice scanning, approval workflows, fraud prevention, and seamless integration with your accounting and ERP systems. Klippa DocHorizon, on the other hand, specializes in document workflow automation, providing advanced features like two-way matching and document fraud detection.

Now part of the SER Group, a recognized Leader in the Gartner® Magic Quadrant™ for Document Management, Klippa brings enterprise-grade workflow automation capabilities to teams across industries. Whether you’re in finance, logistics, or healthcare, DocHorizon and SpendControl are the most powerful and flexible software available in 2025.

How can automated invoice scanning benefit your organization? These are just some of the advantages of using Klippa SpendControl:

- Easily submit files via the Klippa app, website, or email. Submitting them in bulk is also possible to reduce effort and maximize efficiency.

- Gain access to all past invoices, located in a designated cloud environment. Keep track of all invoices and be well-prepared for your next audit.

- Extract data using AI-data extraction technology, which helps recognize details such as the invoice number, payment address, and even different currencies.

- Prevent fraud with the help of a built-in analysis that detects duplicates and protects you from invoice fraud.

- Automate approval processes and improve your organization’s productivity course. Create fixed or variable invoice approval processes and facilitate the workflow of your business.

- Experience seamless integration with a variety of ERP or accounting software, such as NetSuite, SAP, Xero, and many more.

Our experts would be happy to assist you with any questions or inquiries you might have. Contact us or schedule a free demo and get more information about Klippa SpendControl.

FAQ

Invoice scanning software uses Optical Character Recognition (OCR) to automatically scan, extract, and process data from invoices, reducing manual data entry.

OCR invoice scanning converts printed or handwritten invoice information into digital text that can be processed automatically by accounting systems.

The best invoice scanning software depends on your business size, needs, and workflow requirements. Here’s a quick comparison:

– For full invoice workflow automation, Klippa DocHorizon stands out, offering AI-powered OCR, fraud detection, and seamless integration with financial systems.

– For SMEs with moderate invoice volumes, Klippa SpendControl is an excellent choice for automating invoice approval, processing, and management in one platform.

– For high-volume data extraction, Docsumo is ideal for extracting data from invoices with AI, though it lacks fraud detection features.

– For real-time transaction visibility, Rossum excels with its AI-powered document processing and anomaly detection.

– For businesses needing SKU-level extraction, Nanonets specializes in unstructured invoice data extraction with customizable workflows.

That said, Klippa SpendControl is the most versatile and efficient solution for businesses seeking a scalable and secure invoice management system.

You can scan an invoice using mobile apps from invoice management software like Klippa SpendControl, which captures the invoice and processes it automatically.

Invoice scanning automates data extraction, reduces human error, speeds up processing, prevents fraud, and enhances efficiency in managing invoices.

Yes, scanned invoices are legal if they comply with tax regulations and local laws and are stored securely with appropriate audit trails.