Invoice-to-pay in accounts payable refers to a document that contains the details of goods or services that an organization has received from a vendor or a supplier. In a nutshell, it states the amount that the company owes the vendor or supplier for those goods or services.

Many businesses deal with suppliers and vendors on a monthly basis, leaving them with a large amount of invoice-to-pay to be processed. It is a process that covers invoice receipt, approval, documentation, and eventual payment. It also requires that the transaction is recorded in a company’s general ledger.

While this may seem straightforward, managing invoices and payments can be a tedious and time-consuming task, with businesses spending an average of 120 hours per month on manual invoice processing according to a recent study.

Thankfully, automating the invoice-to-pay process with accounting software can provide a concrete solution to this problem. A well-executed invoice-to-pay process can lead to cost savings, improved cash flow, stronger supplier relationships, and greater financial control for both businesses and suppliers.

In this blog post, we will take a closer look at the invoice-to-pay process. We’ll cover the necessary steps and provide a brief overview of the benefits and drawbacks associated with invoice processing.

What is the invoice-to-pay process?

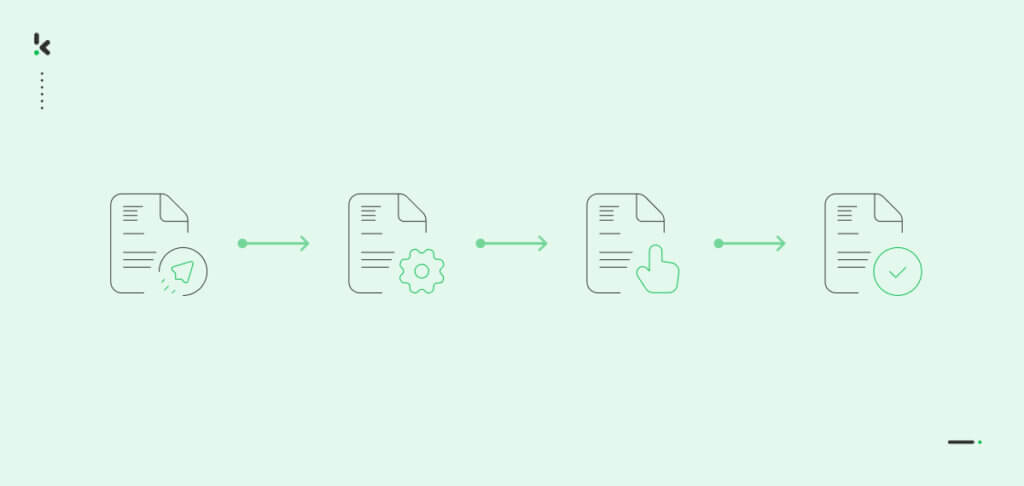

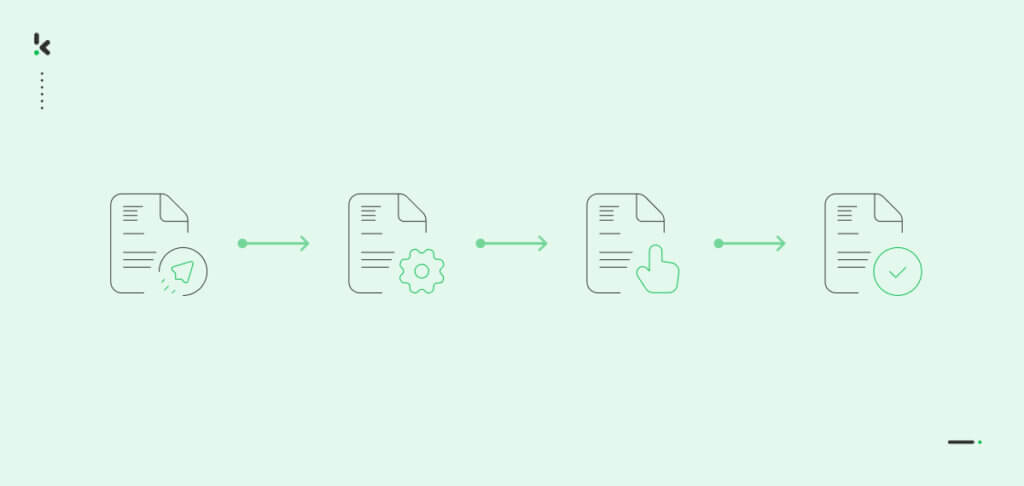

The invoice-to-pay process refers to a series of steps that a business goes through to process received invoices, including approving and finally paying the suppliers. Although the preferred method of processing an invoice for payment may vary for businesses of different sizes, the invoice-to-pay process usually involves the steps below, beginning with an invoice and ending with an agreed payment.

- Supplier sends invoice: A supplier sends an invoice to the accounts payable department of a company. The invoice mentions all relevant transaction details including the due date.

- Invoice is received and information retrieved: The invoice-to-pay is received by the AP department. Depending on available resources, the data from the invoice is manually entered or digitally processed into an existing ERP system and assigned a unique billing code.

- Invoice is sent for approval: The invoice is then forwarded for buyer approval or checked for mistakes or potential accounts payable fraud, by matching with a corresponding purchase order of the requested amount (also known as 2-way matching).

- Invoice is approved: In this step, the invoice details have been examined by the buyer and the invoice-to-pay is approved. Therefore, the payment is scheduled to be sent to the supplier, based on the previously mentioned due date in Step 1.

As stated in the introduction, there are several challenges companies face when completing the invoice-to-pay process manually. We will discuss the most important ones below.

Common invoice-to-pay challenges

The traditional invoice processing method comes with numerous challenges resulting from a series of manual tasks. The most common invoice processing problems are:

- Human errors – Data entry mistakes, incorrect coding, and validation errors are some human errors that frequently occur. Although unintentional, these errors are costly and can lead to supplier disputes and inaccurate payments.

- Time-consuming – Manual tasks can be time-consuming and can lead to delays in the invoice-to-pay process. For example, manually routing and approving a bulk of invoices increases the time taken to reach a payment conclusion.

- Delayed payments – Delayed payments are always bad for a company’s reputation. Since supplier relationships are also affected, they should be avoided at all costs. For instance, issues with the accounts payable system, errors in data entry, or delays in invoice approval can result in delays in payment processing.

- Repetitive work – The traditional system of processing invoices involves manual tasks such as data entry and validation. They can increasingly become repetitive and eventually be considered as tedious and boring. This impacts employee productivity and creates bottlenecks in the invoicing processing workflow.

- Slow approval channels – Delays resulting from slow approval and routing channels can be frustrating and comes across as incompetent. Prolonging the invoice processing time and delaying payment to suppliers can affect the long-term credit health of your company.

- Paper storage – The traditional invoice-to-pay processing method heavily relies on paper invoices and manual approvals such as a stamp of confirmation or a signature of approval. Some of the reasons why companies should steer away from piles of documents include limited storage space and high storage costs.

If these challenges did not convince you to consider using software to automate your invoice-to-pay process yet, have a look at the benefits that come with automation.

Why you should automate the invoice-to-pay process

Overcoming the drawbacks of manual invoice-to-pay processing is not the only reason why you should automate your invoice management system. There are various benefits for your business in doing so, including the following:

- Scalability – An automated workforce grants companies the ability to scale their accounts payable operations by automating the invoice-to-pay process, reducing manual and redundant tasks. Even with an increase in the number of invoices that need to be processed, automation can speed up the process of handling a large number of invoices.

- Time-saving – Added time spent on processing invoices for payment is usually a casualty of manual activities such as opening envelopes, typing invoice information into a financial system, and taking steps to approve specific statements. Optimizing your P2P process using automation can help process more documents, ensure timely payments, and avoid wasted effort.

- Faster payment processing – Automating the invoice-to-pay process can create faster turnaround times as invoices are automatically processed with greater speed and accuracy. Even with a bundle of invoices, this eliminates the need for lengthy approval steps, preventing late payments and increasing the relationship with vendors.

- Invoice batching – Invoice batching involves grouping multiple invoices together for processing and payment. This approach can benefit the invoice-to-pay process in several ways, including improved process efficiency, saving time and effort by skipping repetitive tasks like data input and ultimately reducing the risk of human error.

- Real-time insight – Invoice-to-pay process automation provides clarity over financial management decisions. It offers realistic control over the entire invoice-to-pay process and enables the use of real-time data for monitoring, tracking, and reporting. This facilitates payment progress and helps eliminate the necessity for manual follow-ups.

- Compliance – Automated invoice-to-pay processing can help to reduce the risk of compliance violations by ensuring that all transactions are fully documented. By automating approval rules, standardizing processes, and enabling real-time monitoring and reporting, organizations can reduce the risk of compliant-related violations and ensure a more compliant invoice-to-payment process.

- Cost-effective – Since fewer people are needed to do the same amount of work, an automated system can significantly reduce the costs required to process invoices. Eliminating paper invoices can also reduce the overall print and storage costs for companies.

It is clear that there are various benefits for businesses, regardless of size. Are you ready to innovate your invoice management process and start enjoying the benefits of automating the invoice-to-pay process?

If yes, then continue reading to discover how Klippa can transform your finance department into a powerhouse of productivity and efficiency. Let’s dive in and unlock the future of automation together.

Automate the invoice-to-payment process with Klippa

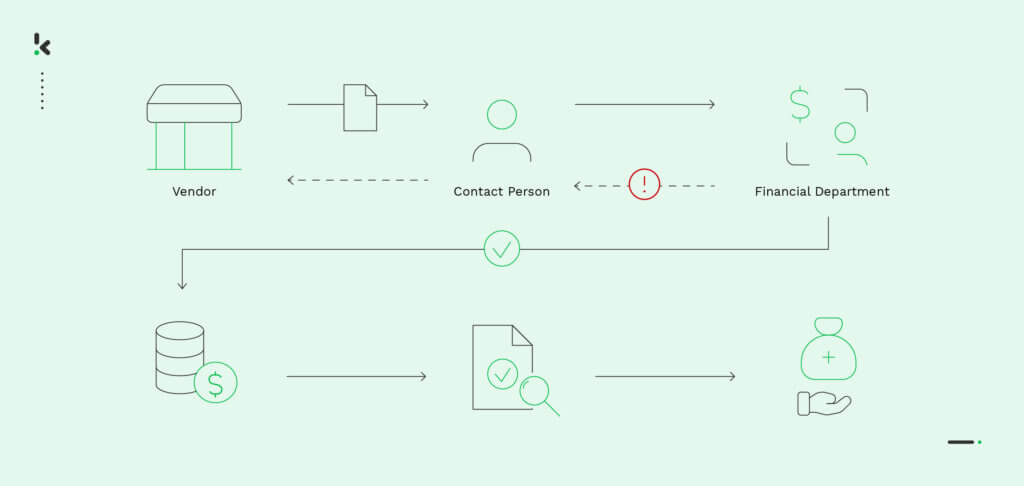

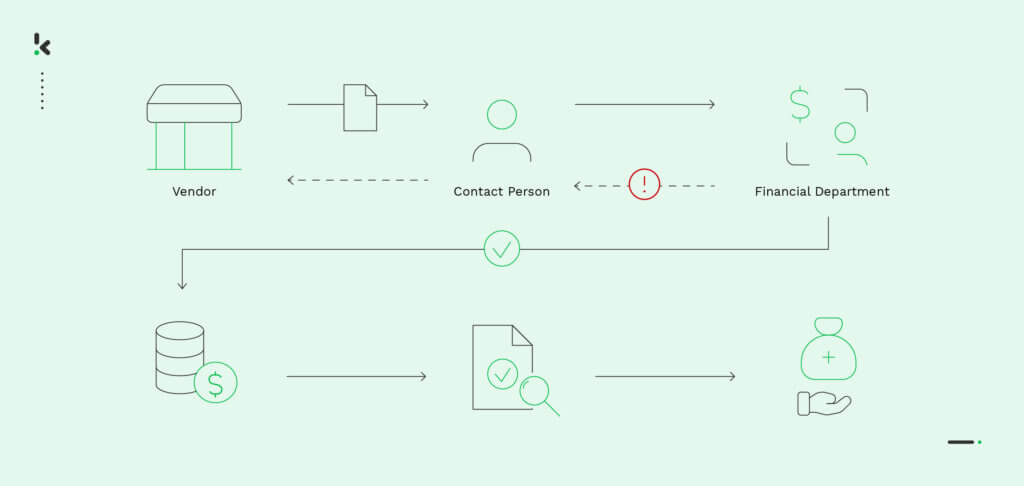

Klippa SpendControl is an all-in-one financial management software that can streamline your accounts payable processes with automated invoice processing. This dynamic accounts payable software is powered by machine learning and OCR technology, which can turn images or scans of invoice-to-pay into business-ready data. Its features can maximize the precision and accuracy of your financial and administrative engine.

With SpendControl you can:

- Extract data from invoices accurately with Klippa’s OCR technology and eliminate manual data entry

- Automate part of the approval process and fully customize approval workflows with smart business rules

- Detect duplicate and fraudulent invoices with sophisticated AI technology to minimize invoice fraud

- Save more than 70% on your invoice processing time by eliminating endless manual retyping of invoices with automated data extraction

- Integrate it seamlessly into your existing accounting or ERP software such as Xero, NetSuite, and SAP for a better overview of your AP process.

With SpendControl you can prevent delayed payments, reduce fraud, streamline and optimize your invoice-to-pay process steps and essentially shorten turnaround times.

Take control of your financial management process today by simply scheduling a free demo below or contacting our team of specialists.