Aren’t you tired of dealing with the constant back-and-forth of invoice approvals and the delays that come with outdated processes? Invoice validation is essential, but it’s often a drain on time and resources for accounts payable teams, leading to inefficiencies, mistakes, and compliance risks.

By automating the invoice validation process, you can reduce manual workloads, eliminate errors, and speed up payments, all while improving accuracy and ensuring compliance.

In this blog, we’ll explore how automation can transform your invoice validation process. From understanding what invoice validation is, to recognizing the challenges of the manual process, we’ll show you the steps to take toward implementing an automated system that works for your business.

Key Takeaways

- Invoice validation ensures accuracy and compliance – It helps businesses avoid errors, fraud, and unauthorized payments by verifying invoices before approval.

- Manual validation is inefficient and costly – Traditional processes lead to delays, human errors, high processing costs, and compliance risks.

- Automation improves efficiency and accuracy – Automating invoice validation reduces manual workloads, accelerates approvals, and enhances financial control.

- Key automation steps – Implementing OCR for data extraction, automating invoice matching, setting approval workflows, and integrating with accounting systems streamline the process.

What is Invoice Validation?

Invoice validation is a step within the invoice management workflow responsible for verifying invoices for accuracy or fraud before approving them for payment. It ensures that businesses only pay for goods and services that were correctly delivered and billed. This step helps maintain financial accuracy, prevent errors, and ensure compliance with company policies and tax regulations.

The process is primarily handled by the accounts payable (AP) department, often in coordination with procurement teams and department managers for invoice approvals. Proper validation helps prevent unauthorized payments, duplicate invoices, and errors that could affect financial reporting.

Steps of the Invoice Validation Process

- Invoice Receipt: Invoices are received through various channels, including email, EDI, or physical mail. The accounts payable department collects and organizes them for invoice processing.

- Data Entry and Documentation: The invoice details, such as invoice number, vendor name, amount, and due date, are entered into the company’s accounting or enterprise resource planning (ERP) system. The invoice is also categorized based on its type and payment terms.

- Matching and Cross-Verification: For PO-based invoices: The invoice is compared against the corresponding purchase order and delivery receipt (two or three-way matching) to confirm accuracy. For non-PO invoices: The invoice is reviewed against contract terms or internal approvals before proceeding.

- Compliance and Policy Review: The invoice is checked to ensure it follows company policies, tax regulations, and contractual agreements. Any deviations will require further verification.

- Approval Workflow: If necessary, the invoice is forwarded to department managers or designated approvers for review and authorization. Invoices exceeding a predefined limit may require additional approvals.

- Issue Resolution: If discrepancies are identified, the accounts payable team communicates with relevant stakeholders, such as vendors, procurement, or internal departments, to clarify and resolve the issues before proceeding.

- Final Validation and Payment Processing: Once all validations are complete, the invoice is approved for payment and scheduled based on the agreed-upon terms. It is then recorded in the company’s financial system for auditing and reporting purposes.

This process exists to ensure that only valid invoices are processed, helping to keep the books accurate, avoid audit issues, and prevent delays in month-end closing.

Challenges of Manual Bill Validation

Manual invoice validation remains a standard practice in many organizations, but it comes with significant inefficiencies and risks. Finance and accounting professionals dealing with invoice approvals, payment delays, and compliance audits are well aware of the bottlenecks this process creates. Below are the most pressing challenges businesses face when relying on manual invoice validation.

Human Error and Data Entry Mistakes

Manually entering invoice details into accounting systems is time-consuming and error-prone. In fact, finance departments waste up to 25,000 hours of avoidable rework caused by human errors every year. A simple typo in an invoice number or a misplaced decimal point can lead to duplicate payments, underpayments, or compliance discrepancies. For example, if an invoice for €15,000 is mistakenly entered as €1,500, it could either delay a vendor’s payment or trigger unnecessary disputes.

Slow Approval Workflows and Payment Delays

Manual processes often require invoices to be physically routed or emailed to multiple people, creating delays, especially when key approvers are unavailable. An invoice that should take two days for approval can stretch into weeks due to bottlenecks. Delayed approvals not only slow down operations but can also lead to missed early payment discounts or late payment penalties.

Lack of Visibility and Tracking Issues

Tracking invoice status manually often means searching through email chains, paper files, or spreadsheets. AP teams spend valuable time chasing down missing approvals or verifying if an invoice has been processed. Without a centralized system, duplicate inquiries from vendors become common, adding to the administrative burden.

Difficulty in Matching Invoices with Supporting Documents

Three-way matching – cross-checking invoices with purchase orders and delivery receipts, can be difficult when documents are scattered across different systems, emails, or even physical folders. If a PO is missing or the receipt doesn’t match, finance teams must manually investigate the issue, leading to additional delays and frustration for both the team and vendors.

Increased Risk of Fraud and Compliance Violations

The average cost of invoice fraud to mid-sized businesses is $280,000 per year. Without automated validation controls, fraudulent invoices can slip through unnoticed. A vendor invoice without a matching purchase order or a duplicate submission might get paid if proper checks aren’t in place. Additionally, compliance risks increase when invoices lack the necessary tax details or fail to meet regulatory standards, exposing businesses to audits, fines, or legal issues.

High Processing Costs

Every manual touchpoint (e.g., receiving, entering, validating, and approving an invoice) adds labor costs. Studies suggest that manually processing a single invoice can cost companies between $5 and $20 when factoring in administrative time, approval delays, and error resolution. For companies handling thousands of invoices per month, these inefficiencies translate into substantial operational expenses.

The Need for a More Efficient Approach

The inefficiencies of manual invoice validation go beyond simple inconvenience, they directly impact cash flow, operational efficiency, and financial compliance. The next section will explore how automation of invoice processing can solve these challenges and simplify the validation process.

How to Automate Invoice Validation in 8 steps

Automating invoice validation can significantly improve efficiency in your accounts payable department by reducing manual workloads and minimizing errors. If you’re ready to transition to a simplified process, here’s our step-by-step guide for implementation:

1. Audit Your Current Process

Start by evaluating your current invoice validation workflow. Map out the steps, from receiving invoices to processing payments. Pay close attention to areas where human errors are common, like mistyping invoice amounts or manually matching documents. Identify bottlenecks, such as invoices stuck in approval chains. This audit will help you prioritize which tasks can benefit most from automation.

2. Choose the Right Automation Solution

Not all automation tools are created equal, so choose one that integrates well with your existing accounting system. Look for a solution that offers:

- Intelligent OCR: Extracts data from various invoice formats and eliminates the need for manual data entry. It should handle a variety of invoice layouts, including those from suppliers that send non-standardized documents.

- Invoice Matching: Automatically matches invoices to POs and receipts to confirm that amounts align, reducing the need for manual checks.

- Approval Routing: Allows you to configure rules for routing invoices for approval, based on factors like amount, department, or vendor.

For example, if you’re using an ERP system like SAP or Oracle, make sure the automation tool integrates directly with it to prevent data silos and manual entry errors.

3. Standardize Invoice Formats

One of the easiest ways to improve the effectiveness of automation is to encourage vendors to submit invoices in digital, standardized formats (like PDFs or EDI). Standardization simplifies the extraction process, reducing errors associated with reading handwritten invoices or poorly formatted documents.

For instance, you could set a policy with your suppliers to submit invoices via EDI or standardize PDF templates that include clearly marked fields for invoice number, amount, and vendor details. This ensures that OCR technology can correctly capture all relevant data, reducing manual intervention and improving processing times.

Transition to E-Invoicing for Compliance and Standardization

Once you’ve standardized formats in your existing invoice processing, check if your region is moving towards mandatory e-invoicing. This process involves sending and receiving invoices in a standardized digital format that complies with specifications from the tax authorities.

In countries like Germany, e-invoicing is required for B2G (business-to-government) transactions, where businesses must submit invoices in unique formats such as ZUGFeRD or XRechnung to comply with tax regulations. If your business operates in a region with upcoming e-invoicing mandates, adopting e-invoicing software instead of AP automation software will better ensure compliance with these regulations.

4. Implement OCR and Data Capture Technology

Next, implement OCR technology to digitize invoices and automatically capture the essential data. With this step, you eliminate the need to manually transcribe invoice details, which is one of the most common sources of error.

An OCR system automatically pulls the vendor name, date, and amount from the document. If the system identifies any discrepancies, such as a mismatched PO number, it flags the invoice for further review before processing.

5. Set Automated Matching and Validation Rules

With automation in place, it’s time to configure rules to automate invoice matching. For instance, if your organization uses a three-way matching process, set the system to automatically compare the invoice against the purchase order and delivery receipt. If there’s a mismatch, the system can flag the invoice for manual review.

6. Automate Approval Workflows

Automating the approval process ensures invoices are routed to the right people without delays. You can set up approval workflows that are based on unique business rules, such as invoice amounts or departments. For example, small invoices may be automatically approved, while larger ones are routed to senior management for sign-off.

An example could be an invoice for €50,000 that requires approval from the finance manager, while an invoice for €5,000 only requires department head approval. With automation, these rules can be configured in advance, reducing delays and accelerating payment cycles.

7. Enable Real-Time Tracking and Notifications

Set up real-time tracking and notifications. Automated notifications can alert approvers when action is required, ensuring that invoices are processed on time and preventing delays caused by missed approvals. For example, if an invoice is about to reach its payment due date, the system can automatically send a reminder to the approver.

8. Integrate the Automation Tool with Your Accounting System

After automating data extraction and approval workflows, ensure your invoice validation system integrates with your accounting or ERP software. This step eliminates the need for double data entry, reducing the chances of discrepancies between systems.

Once an invoice is validated, the automation system can automatically update your accounting system with the invoice details, making it ready for payment. This integration speeds-up your payment processing, reduces manual oversight, and ensures that all financial reports are accurate.

Conclusion

Automating invoice validation is a clear step towards reducing manual workloads, minimizing errors, and speeding up payment processing. By following this guide, you can implement a system that improves accuracy, enhances operational efficiency, and reduces costs. With the right tools, clear workflows, and ongoing optimization, your business will be well-equipped to handle the complexities of invoice validation in a faster and reliable manner.

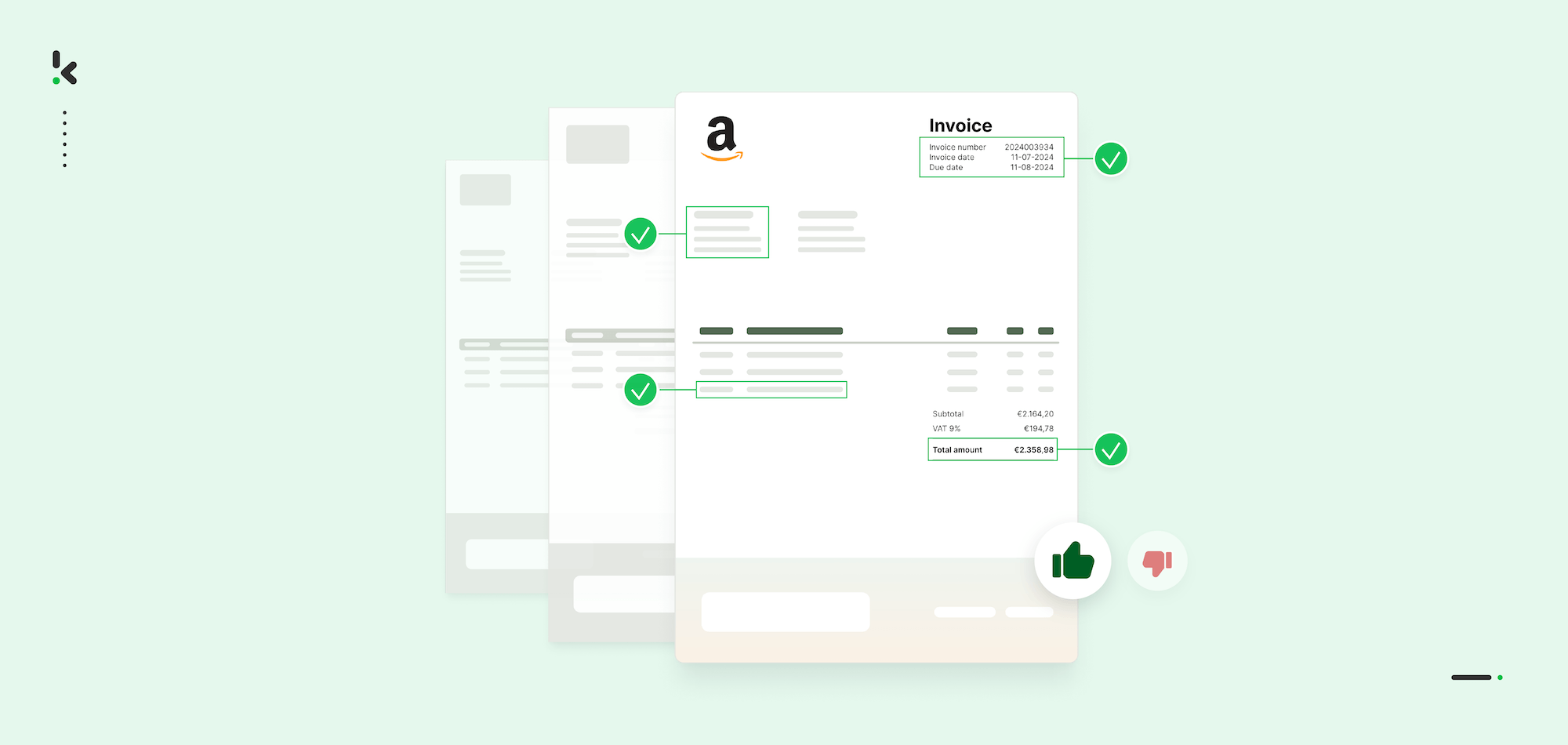

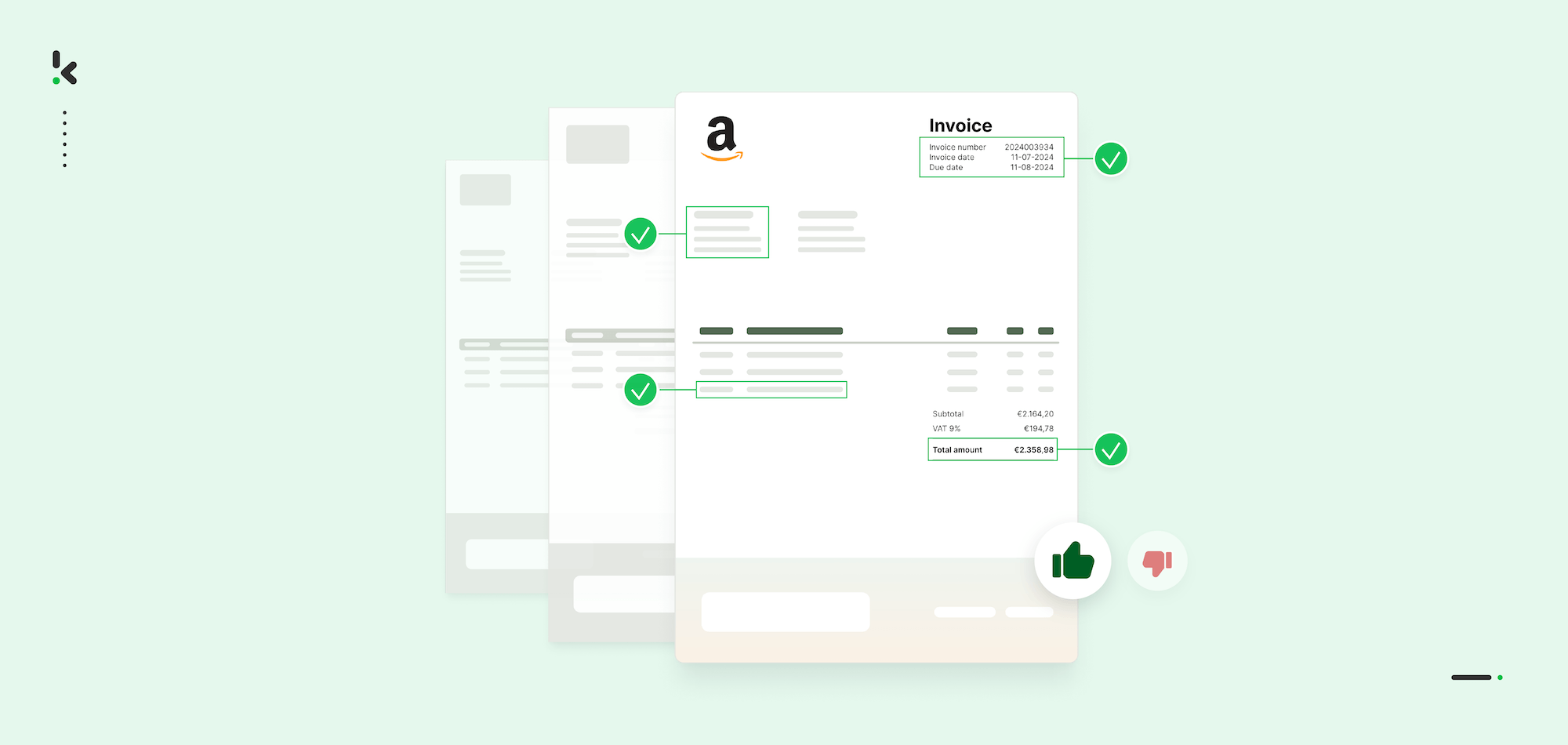

Start Automatically Validating Your Invoices with Klippa

Forget about the tedious process of manual invoice validations. Employ a solution like Klippa SpendControl and start validating your bills within seconds.

Klippa SpendControl is an all-in-one digital pre-accounting software that combines invoice processing, expense management, and corporate credit card modules.

Our software utilizes OCR technology to ensure accurate data capture and enable invoice scanning, approval, archiving, and booking directly to your preferred accounting or ERP system.

With Klippa SpendControl you can:

- Manage your vendor invoices, employee expenses, and corporate credit cards in one platform

- Scan, submit, process, and validate invoices via web or mobile app

- Achieve 99% invoice data extraction accuracy with Klippa’s OCR

- Control your accounts payable through intuitive dashboards

- Customize your approval management with multi-level authorization flows

- Comply with tax and data privacy regulations with Klippa’s ISO27001-certified and GDPR-compliant solution

- Prevent invoice fraud with built-in duplicate detection and IBAN check

- Integrate SpendControl with your accounting and ERP software, like Quickbooks, NetSuite, or SAP

FAQ

Invoice validation involves verifying invoice details for accuracy, compliance, and fraud prevention before approval. The process includes data entry, matching invoices with purchase orders or contracts, compliance checks, and approval workflows. Automating this process reduces errors and speeds up payment processing.

An invoice is validated when it has been reviewed and confirmed to be accurate, compliant with company policies and tax regulations, and approved for payment. This ensures that businesses only pay for legitimate invoices and avoid duplicate payments or fraud.

Invoice validation typically includes:

1. Data extraction and entry – Capturing invoice details in an accounting or ERP system.

2. Matching and verification – Comparing invoices with purchase orders and delivery receipts.

3. Compliance review – Ensuring invoices meet company policies and tax regulations.

4. Approval workflow – Routing invoices for necessary approvals before processing payment.

Invoice verification is a key step in accounts payable where invoices are checked against supporting documents like purchase orders and delivery receipts to ensure accuracy. This process includes matching invoice details, resolving discrepancies, obtaining approvals, and finalizing the payment. Automation enhances efficiency and reduces errors in verification.