The KYC process is difficult. Determining whether or not to do business with someone presents significant cost, time, and resource challenges. Almost half of the respondents in Thomson Reuter’s Anti-Money Laundering Report agreed to this and said that the inability to validate information was their biggest obstacle.

The good news? Automation is changing the game. With recent advances in AI, machine learning, and optical character recognition (OCR), automation is transforming KYC by enabling fast, secure identity proofing, document verification, and risk assessment in seconds, not days.

In this article, you’ll learn what KYC is, why traditional methods fall short, how automation solves key challenges, and where it’s already delivering real-world results.

Let’s get started!

Key Takeaways

- Manual KYC drains time and money – legacy processes can cost up to $6,000 per client and delay onboarding by days.

- Automation boosts speed and accuracy – verify IDs, extract data, and screen users in under 5 seconds.

- Improved compliance, less risk – automated workflows help meet AML and GDPR requirements with audit-ready logs.

- Klippa makes adoption easy – API-ready, scalable, and built to fit your existing onboarding flow.

What Is KYC and Why It’s Crucial for Compliance

KYC, or Know Your Customer, is a mandatory process that financial institutions and regulated businesses use to verify the identity of their customers, assess risk, and ensure compliance with anti-money laundering (AML) and counter-terrorism financing laws.

At its core, KYC helps businesses answer a critical question: “Is this person really who they claim to be?”

By verifying identity documents, confirming personal details, and spotting any warning signs, KYC helps your company:

- Avoid big risks that could lead to fines, legal trouble, or damaged trust

- Keep fraudsters and fake identities out

- Stay on the right side of financial regulations

Why is KYC Important?

KYC procedures help your business truly understand who it’s working with. That means fewer chances for bad actors to slip through and a much better chance of staying compliant with local and international regulations. Done right, KYC reduces your risk of fines, legal issues, and damage to your reputation.

Fraud comes in many forms: identity theft, tax scams, money laundering, and false declarations. But two of the most common (and costly) are identity fraud and age fraud.

Identity Fraud

This happens when someone uses fake or stolen information to open an account or access services. It’s often used to commit crimes like money laundering or tax evasion.

Example: A scammer opens a bank account under a stolen identity and uses it to transfer illicit funds.

Age Fraud

People, often minors, lie about their age to use age-restricted services like gambling, alcohol delivery, or adult content platforms.

Example: A 16-year-old uploads a fake ID to join an online betting site.

Without a proper KYC process in place, these threats can go undetected, and the consequences can be serious.

The Traditional KYC Process

Picture this: A new customer wants to sign up. They fill out a long form, upload their ID, maybe even email over extra documents. Then your team steps in, manually checking files, entering data, cross-referencing details… over and over again.

It’s slow. It’s repetitive. And it’s expensive.

Even with online forms, the back end is still manual. That means long turnaround times, more chances for human error, and skyrocketing compliance costs. Some financial institutions spend up to $500 million a year just on KYC processes.

Disadvantages of the Traditional Process

It’s safe to conclude that the traditional KYC process is time-consuming and tedious. Let’s review the many challenges and disadvantages of manual KYC management.

- Time-consuming: Verifying IDs by hand, cross-checking details, and retyping data into internal systems takes hours, sometimes days. Multiply that by dozens of customers, and it adds up fast.

- Long turnaround times: Every delay in your process is a delay for your customers. Manual KYC means long turnaround times, which frustrates users and creates friction right at the start of their journey.

- A major risk of error: Between typos, mismatched names, and overlooked details, the error rate in manual KYC can reach 2–5%. And in regulated industries, even one slip-up can be costly.

- High costs: Some businesses spend $6,000 or more per new client just to complete onboarding, mainly due to time-consuming manual work. That’s time your team could spend on high-value tasks instead.

- Data security and privacy: The more hands that touch sensitive customer data, the more vulnerable you are to leaks or GDPR violations. With manual processes, data gets passed around, and that’s a problem.

These disadvantages can lead to more problems for your organization. Think of team exhaustion, customer frustration, a bad reputation, and so on. Fortunately, many KYC procedures can be automated, allowing your company to take one more step toward efficiency.

In the next section, we will discuss an automated KYC process and share the most important reasons why you should automate your KYC process.

How to Automate Your KYC Processes

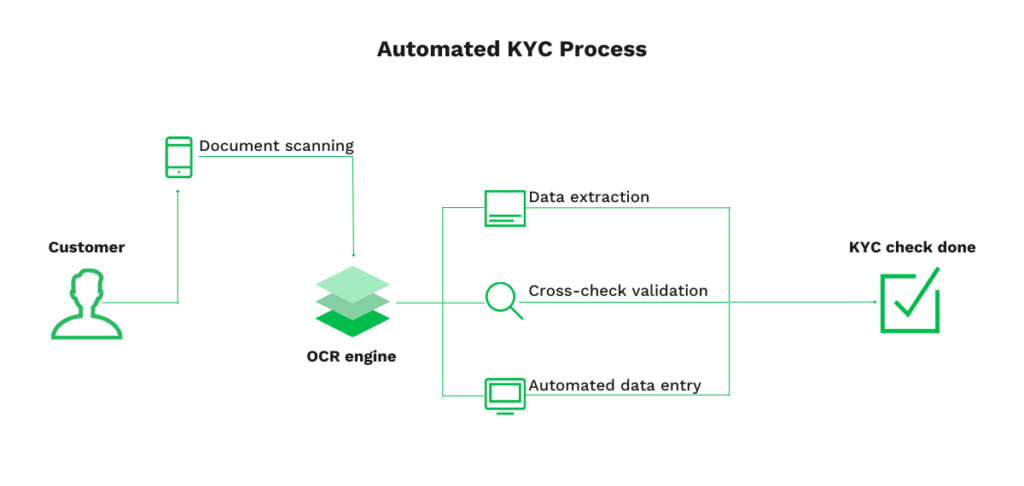

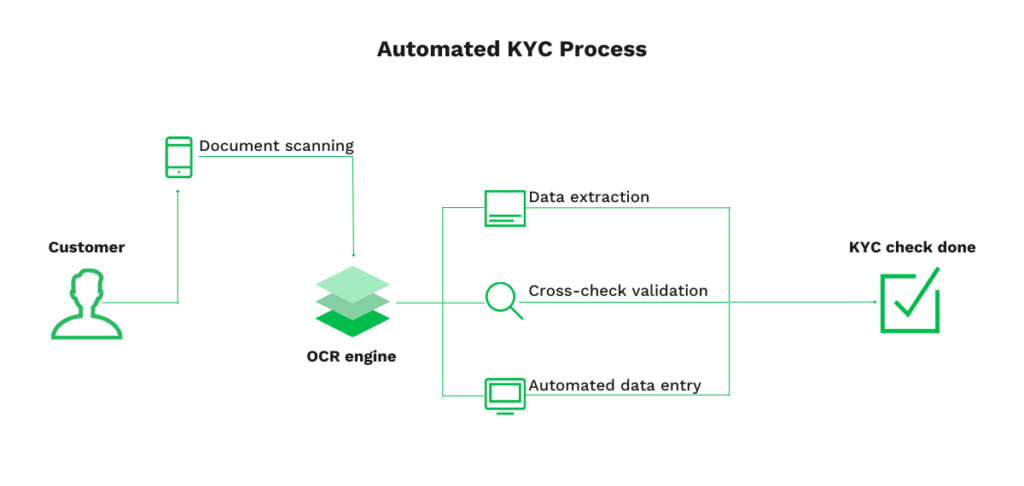

Manual KYC is slow and error-prone. But automation can change that! Here’s how to build a modern, streamlined KYC process using today’s most effective technologies:

Step 1: Digitize Document Collection

Start by replacing paper forms with a secure online portal where customers can upload documents like passports, ID cards, or proof of address.

- Use mobile-friendly forms for easy access

- Allow uploads in common formats (PDF, JPEG, PNG)

- Enable drag-and-drop or camera capture for convenience

Step 2: Use OCR to Extract Customer Data

Once documents are submitted, Optical Character Recognition (OCR) software scans them and pulls out key details like names, birthdates, and addresses.

- Eliminates manual data entry

- Reduces typing errors

- Works across multiple languages and document types

Step 3: Apply AI for Document Validation and Fraud Detection

Artificial Intelligence reviews the documents for authenticity and consistency. It can detect forged IDs, mismatched data, and unusual patterns that signal risk.

- Automates identity checks

- Flags suspicious activity in real time

- Learns and improves with use

Step 4: Connect to Trusted Data Sources via APIs

For extra security, use third-party APIs to cross-check data against global watchlists, government registries, or credit bureaus.

- Verify identities instantly

- Screen for politically exposed persons (PEPs) or sanctions

- Ensure compliance with AML and KYC laws

Step 5: Automate the Workflow End-to-End

Bring it all together with a smart workflow engine that handles the full KYC process, from form submission to approval, without manual intervention.

- Set up triggers and rules for each stage

- Route exceptions for human review if needed

- Keep logs for audits and compliance

Benefits of the Automated KYC Process

Once your KYC process is automated, the impact is immediate, both for your internal teams and your customers. Here’s what you gain:

Save Time (A Lot of It)

Automation saves a lot of time and money. Automated KYC verification can be performed in seconds, usually between 3 to 5 seconds. Your teams are thus freed from this task and can focus on more impactful actions for your company.

Fewer Errors, More Accuracy

By entrusting data extraction and identity verification to a software, you drastically reduce the risk of error because the information is extracted and integrated into your database automatically.

Better Experience for Everyone

On the one hand, your customers receive the answers to their forms much faster. They no longer have to wait for days. On the other hand, your teams are relieved from a repetitive and frustrating task. They are more productive in tasks that are essential to the growth of your business.

Built-In GDPR Compliance

Handling the identity documents of many people can be a real challenge. The data is sensitive and subject to strict GDPR. With an automated solution, you can automatically mask documents or remove certain data points in order to comply with them. The data remains confidential and is only read by the software.

Whether you’re onboarding new users, screening drivers, or verifying ages, automating your KYC process is a smart move toward faster operations, lower costs, and stronger compliance.

Up next: let’s look at three real-world use cases that show KYC automation in action.

Use Cases of KYC Automation

How does KYC automation work in practice? How are the different steps performed? Here are three use cases that will allow you to see exactly how an automated solution can transform your KYC process.

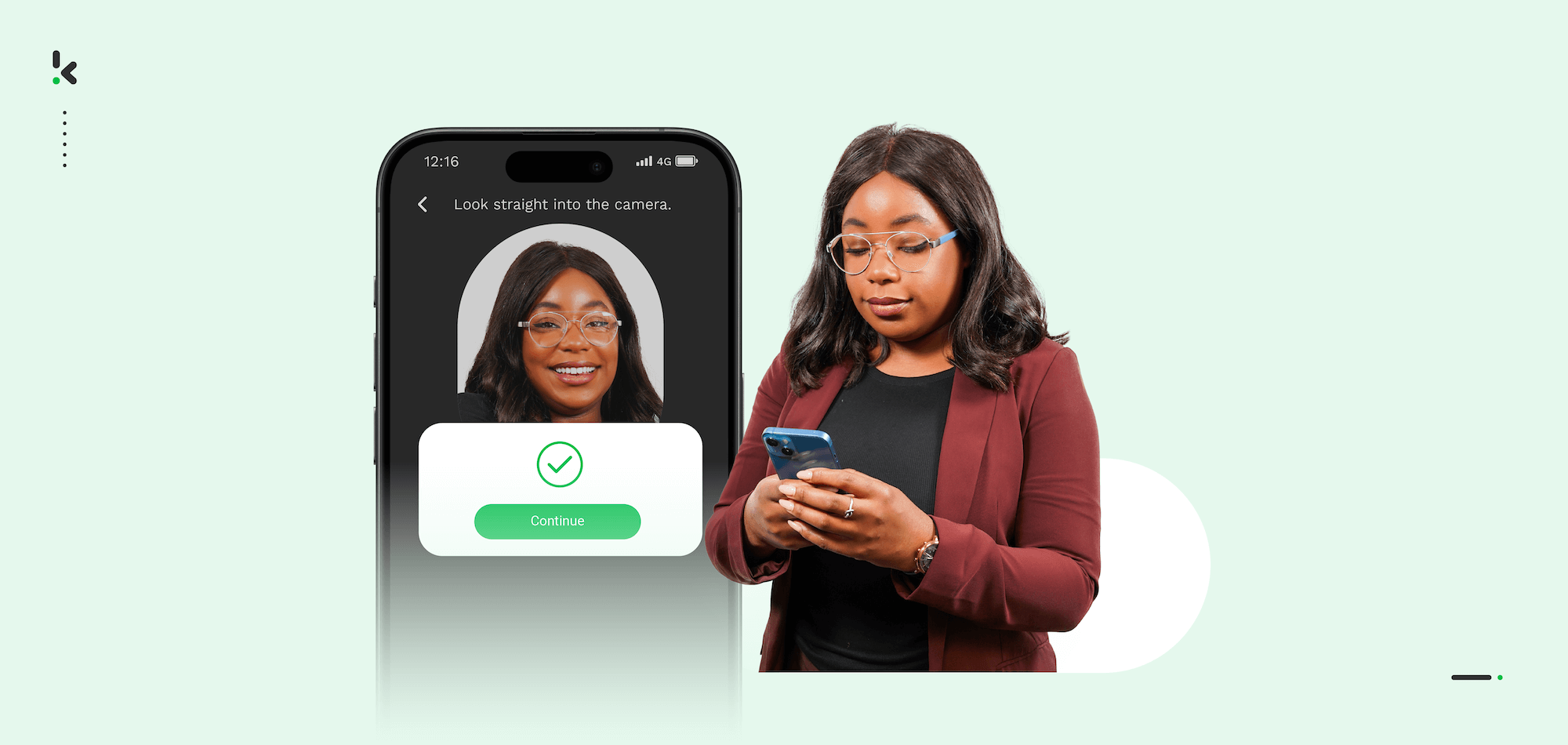

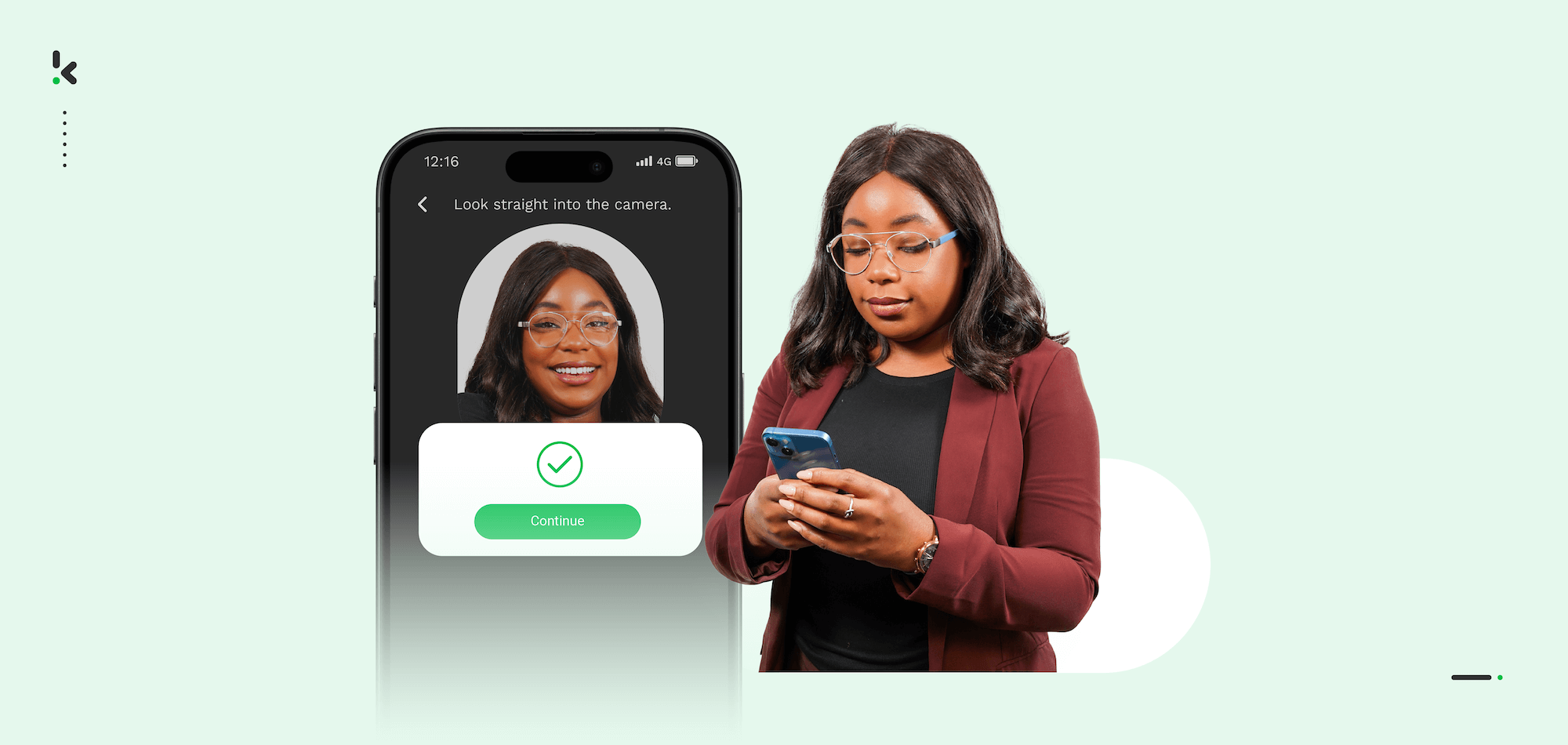

Digital Customer Onboarding

The customer onboarding process gives customers a first glimpse of what they can expect from your company. It is, therefore, an essential part of the customer experience. Digital onboarding can be a serious game-changer in this process as it covers every step.

For example, many insurance providers now use automated KYC to handle online registrations. It helps them quickly verify that new policyholders are who they claim to be without adding unnecessary steps or delays.

Here’s how it works:

- The customer fills out a digital form and uploads their ID.

- OCR scans the document and pulls out key details.

- AI compares the ID info to what was entered in the form.

- Optionally, the system cross-checks the identity with watchlists or public databases.

- If verified, the information flows directly into the company’s database – ready for use.

Why it works:

It’s fast, reliable, and reduces manual effort to nearly zero while ensuring only verified policyholders get through.

Remote Driver Registration

More and more companies in industries like logistics and rental services make use of digital KYC solutions. They want to catch bad actors before they enter their platform and damage their fleet. For these companies, it is therefore essential to know their users’ identities.

It acts as a discouragement for bad behavior and can save significant costs from vehicle theft, damage or fines. But how do these companies streamline the process of a background check without compromising the onboarding experience for the user?

The process looks like this:

- Drivers snap a photo of their driver’s license and, optionally, a second ID.

- OCR analyzes the documents and checks for authenticity.

- The system extracts driver eligibility (e.g. allowed to operate trucks or buses).

- A selfie is uploaded and automatically compared to the ID photo to verify identity.

- If everything checks out, the driver is verified and assigned a vehicle.

Why it works:

Fraud risks are filtered out early, and good drivers are onboarded quickly with minimal friction.

Automatic Age Verification

As part of the customer onboarding process, companies may carry out identity checks to ensure they onboard the right customers for age-restricted services, such as alcohol or tobacco websites and video games with objectionable content. Age verification can be done by requiring users to provide their ID documents and then verifying the data.

Take, for example, online betting platforms that have strict legal requirements. They are prohibited to minors and therefore must ensure that customers opening an account are at least 18 years old.

Here’s how age verification is automated:

- The user uploads their ID document.

- The system reads the date of birth and confirms whether they meet the age requirement.

- A selfie is submitted and matched to the ID photo using facial recognition.

- Optionally, the platform checks the identity against external databases or blacklists.

Why it works:

It keeps your platform compliant with age-restriction laws and helps build trust—without long approval wait times.

Automate Your KYC Process with Klippa

KYC automation can transform how your business handles identity verification, streamlining processes, reducing errors, and keeping you compliant without the manual workload.

You might still have a few questions: How do you get started? Is KYC automation right for your business? And is Klippa the right partner to guide you through it?

That’s exactly what we’re here for.

Klippa DocHorizon is a powerful solution for automating identity checks, document processing, and compliance workflows, built to scale with your needs. Whether you’re exploring options or ready to implement, our product specialists are happy to walk you through it all.

Schedule a demo via the form below or get in touch with us.

FAQ

KYC automation is the use of technologies like OCR and AI to verify a customer’s identity digitally without manual data entry. It streamlines onboarding, reduces errors, and helps companies stay compliant.

Very secure if you’re using the right provider. Platforms like Klippa DocHorizon follow strict data protection standards, offer end-to-end encryption, and comply with GDPR to keep sensitive identity data safe.

Automated KYC checks are typically completed in 3 to 5 seconds, depending on the complexity of the verification. That’s a massive time-saver compared to manual reviews, which can take hours or even days.

Definitely. Advanced AI-powered systems are trained to detect forged IDs, tampering, or anomalies in document layout, fonts, photos, and metadata – often more accurately than human reviewers.

Klippa supports a wide range of global ID documents: passports, driver’s licenses, national ID cards, proof of residence, and more – across multiple languages and formats.

Yes. Klippa DocHorizon offers easy-to-use APIs, like the Identity Verification API, that integrate with your existing platforms, whether it’s a CRM, onboarding flow, or backend system.

Not at all. KYC automation is scalable and works for companies of all sizes – startups, SMEs, and large enterprises alike. It’s especially helpful for businesses looking to grow without adding manual overhead.