Can Know Your Customer (KYC) automation for banks put an end to terrorism financing and money laundering?

According to estimates from the United Nations Office on Drugs and Crime (UNODC), between 2% and 5% of the global GDP is laundered every year. That’s between 715 billion and 1.87 trillion euros on a yearly basis. Therefore, it is no one’s surprise that banks are looking to reinforce their traditional customer onboarding processes. The first step to prevent further fraudulent activities is to identify the real identity of customers.

However, identifying customers’ real identities comes with many challenges. The traditional process is time-consuming and inefficient and has been exploited by ill-willed customers providing false identities. All these factors result in longer turnaround times, low customer satisfaction, and high costs for banks. This is why KYC is a sensitive task in banking.

Fortunately, the KYC process for banks can be automated with sophisticated technologies. But before we dive in and discover these technologies, let’s first explore why KYC automation for banks is necessary, and what exactly is required.

Ready?

Key Takeaways

- KYC (Know Your Customer) in banking is essential for verifying customer identities to prevent money laundering, terrorism financing, and fraud.

- Traditional KYC processes are time-consuming, inefficient, and prone to errors, leading to longer turnaround times, low customer satisfaction, and high costs.

- Automating KYC using technologies like OCR and AI can significantly enhance efficiency, reduce errors, and improve customer satisfaction.

- Key elements of KYC policies include customer policy, Customer Identification Program (CIP), Customer Due Diligence (CDD), and continuous monitoring.

- KYC automation can lead to substantial cost savings (up to 90%), enhanced data security, and better compliance with regulations like GDPR.

What does KYC mean in Banking?

KYC, or Know Your Customer, in banking refers to the process banks and financial institutions use to verify the identity of their customers.

Banks collect and verify documents like IDs and proof of address to confirm a customer’s identity, address, and financial activities. This process reduces risks such as money laundering, terrorism financing, and other types of fraud.

Why is KYC in Banks Necessary?

By law, banks and other financial institutions must constitute the legitimacy of their customer’s identities and determine their risk factor. But why and when did this become mandatory?

Before the 9/11 attacks, banks were not yet designed to detect or disrupt the types of withdrawals, deposits, and wire transfers that helped facilitate the attacks. Changes to customer identification had been in the works prior to 9/11. However, this attack provided the political momentum needed to enhance them, which took place as part of the Patriot Act.

Laws for KYC in banking were introduced as a means of deterring terrorism financing and financial crimes. Nowadays, sophisticated technologies have been developed to comply with these changes. This has made KYC requirements for banking processes automated as a safeguard against ill-intended customers.

Elements of KYC Policies for Banks

Policies for KYC in banking are mandatory frameworks that banks and other financial institutions have to incorporate in their customer identification process. Most banks frame their KYC policies around the following four key elements.

1. Customer policy

Customer policies are documentation of principles and actions that an organization itself determines. These policies guide and help employees when approaching and handling customers.

2. Customer Identification Program

The Customer Identification Program (CIP), often referred to as the Customer Identification Procedure, includes data collection, identification, verification, and cross-checks of databases with politically exposed persons and sanctions.

3. Customer Due Diligence

While CIP deals with collecting identity information, Customer Due Diligence (CDD) refers to the ongoing monitoring and collection of identity information, such as a customer’s name, address, and social security number, to determine their risk factor.

4. Continuous monitoring and record-keeping

Even after a customer opens an account with a bank, KYC checks are continuously ongoing. Clients can be asked to provide the bank with additional documents at times. Additionally, banks keep records of their client’s transaction history. The continuous monitoring and record-keeping process help identify suspicious activity even after onboarding new customers.

To sum it up, the goal of KYC in banking is to continuously gather sufficient information from their customers in order to determine their risk factors.

The Traditional KYC Process

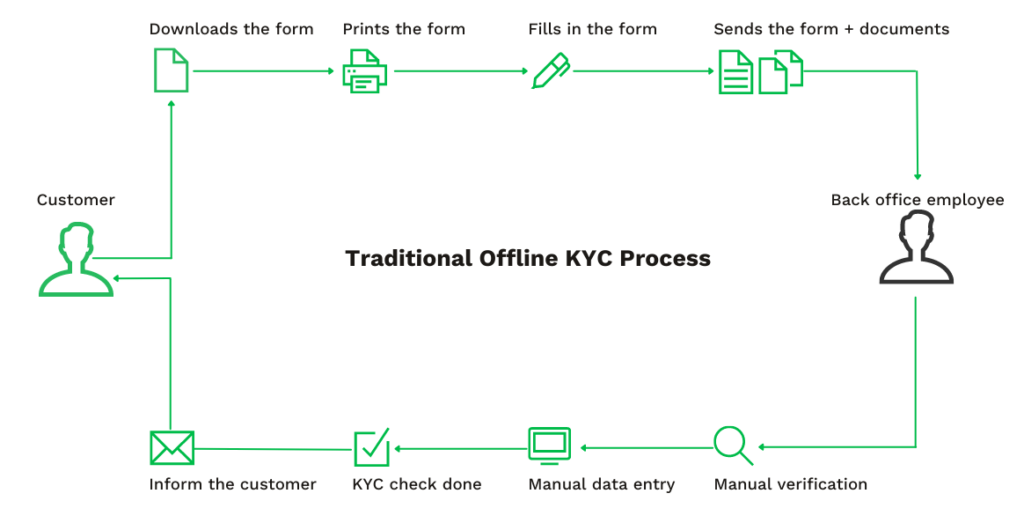

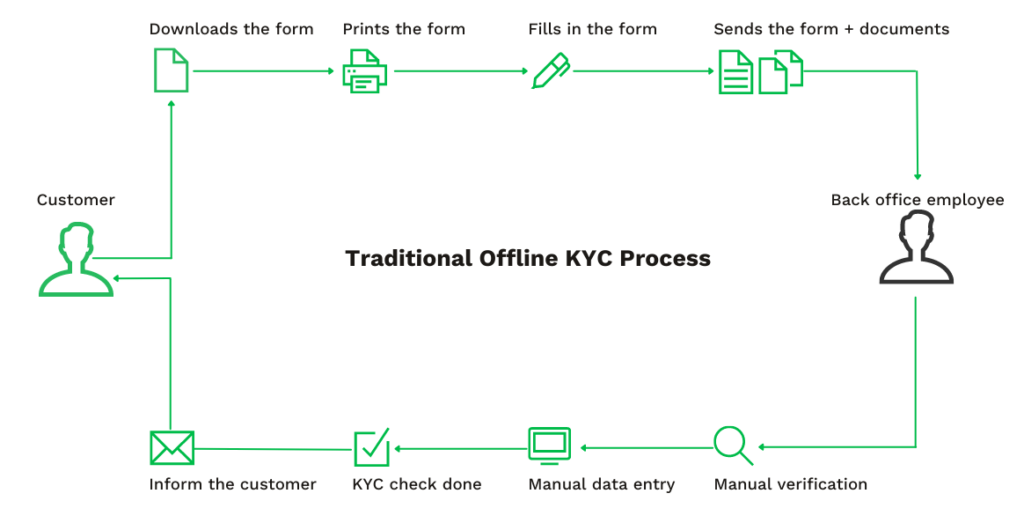

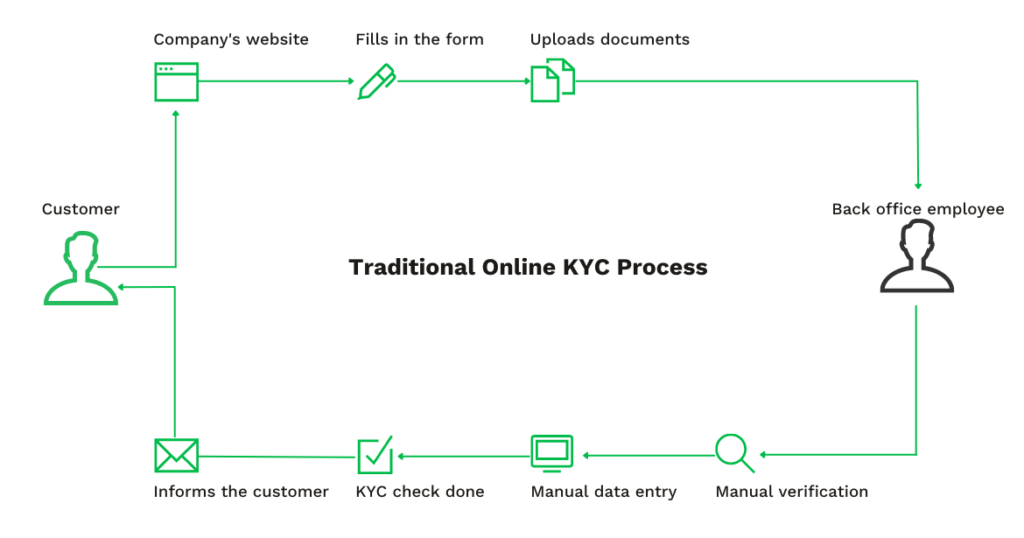

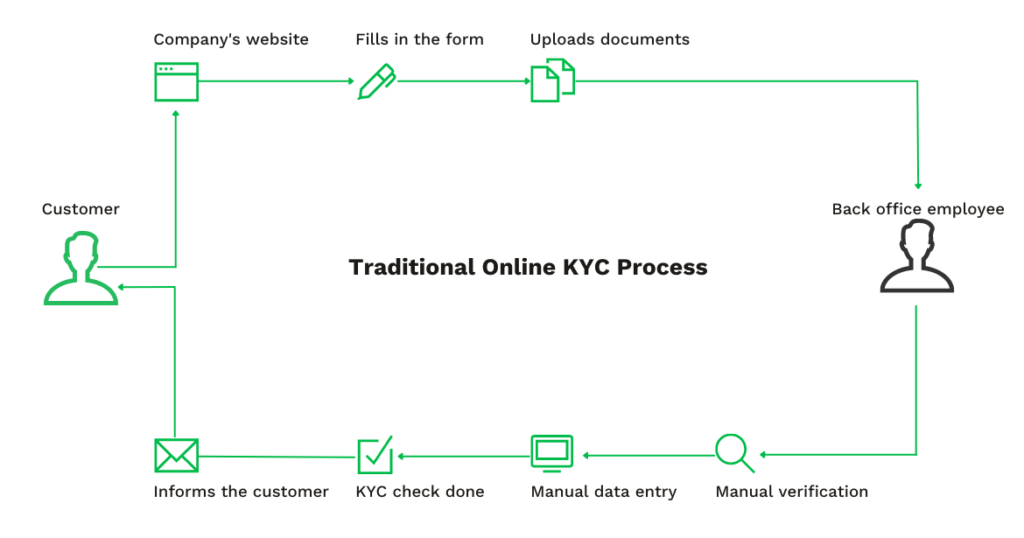

Before KYC automation for banks was a thing, new customers had to follow the traditional KYC process. Well, what is the traditional KYC process you might ask?

Essentially, the traditional KYC process in banks requires new customers to provide information about their financial activities and identity which can be done in two ways, offline or online.

The authentication and verification process that occurs after a customer has submitted the required documents is then performed manually.

Commonly used document types used for KYC

To verify one’s identity at the time of applying for an account two mandatory document types are required for KYC in banking. Proof of identity and proof of address.

These are some of the most common document types used for Proof of Identity:

- Driver’s license

- Passport

- ID card

- Other government-issued identification cards with photo

Commonly accepted document types for Proof of Address:

- Utility bill (not older than six months)

- Bank or credit card statement

- Lease agreement

- Employer’s certificate for residence proof

The required documents can vary from one country to another and even from state to state. Let us now see how these documents are processed during the offline and online KYC process.

Offline and online KYC procedures

The offline and online KYC processes in banks do not differ much from one another. However, let’s have a quick look at both of them.

Offline – the customer has to fill out a customer registration form with the required information that they download and print. Besides that, copies of additionally requested identification documents have to be sent to the bank by mail.

Online – customers can fill out a digital customer registration form and upload necessary identification documents on a bank’s website directly.

After a customer submits the registration form and any additional required identification documents, back-office employees proceed with manually verifying and transcribing important data into the bank’s database. Eventually, the KYC check is completed and the customer is informed.

Often, each client submits multiple documents that have to be manually checked in the traditional process. This inefficient process usually leads to multiple disadvantages which we will delve into next.

Biggest Disadvantages of the Traditional Process

You are probably already acquainted with some of the disadvantages that come with the traditional KYC process in banks, and issues that solutions like KYC automation for banks can solve. Let’s have a more extensive look at what the biggest disadvantages are.

1. Time-consuming

Traditional KYC processes in banking require back-office employees to manually check all the submitted documents and manually transfer that information into the bank’s database. When dealing with only a couple of applications this might be doable. However, imagine trying to complete hundreds or even thousands of applications each day. This would make this tedious and repetitive task impossible to accomplish in a reasonable time. Time that would be better utilized for more significant tasks.

2. Long turnaround times

Since the traditional KYC process requires manual work, it takes much time before back-office employees have completed the verification process. Additionally, employees can get overwhelmed by the amount of work they have to complete which negatively affects their productivity. The long turnaround times will eventually have a negative impact on customer satisfaction as well.

3. High risk of error

With manual work, human errors are always involved. This is especially risky throughout KYC processes. Back-office employees deal with highly sensitive information about customers’ identities where even a minor mistake can end up being highly critical. Unfortunately, these errors occur in any bank still using the traditional process, since on average the error rate of manual data entry is about 1%.

4. Results in high costs

The KYC process in banks has a significant impact on a bank’s total spending per year. The total cost of KYC for banks on average is $60 million a year. Moreover, back-office teams working on administrative tasks are not cost-effective and should rather be used for much more valuable work that has a positive impact on the core business.

5. Data security and privacy

The chance of data leaks increases the more employees handle sensitive data. And no one likes their personal information to be handled by several different people. This is a serious risk banks take on each and every single day.

Any of these disadvantages can cause a bank huge problems. These issues are the main reasons why KYC automation for banks is becoming sought out.

Enhancing KYC with Automation: A Faster, Smarter Approach

Now that we have established that the traditional process comes with plenty of bottlenecks, let’s explore how KYC in banking can be automated to cope with today’s requirements.

As we discussed earlier, financial entities must gather and verify identity information at the point of onboarding new customers. KYC automation can then fulfill the process without any human interference and with greater results.

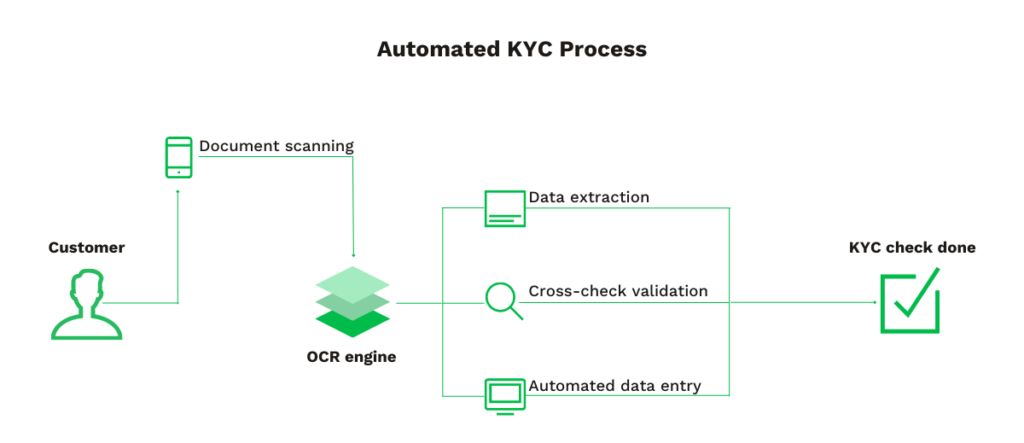

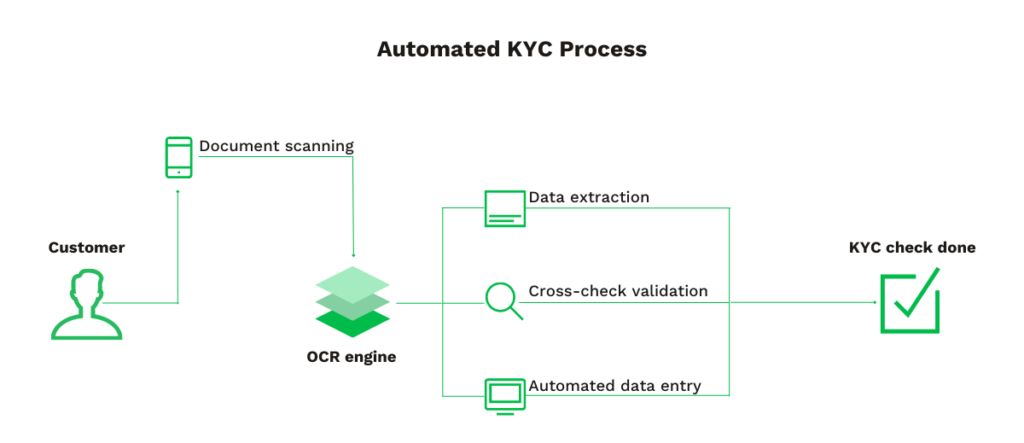

Text recognition, data extraction, cross-check validation, and data entry can all be automated. It makes KYC processes in banking significantly more efficient with faster turnaround times, reduced errors, and higher customer satisfaction. Let’s have a closer look at the automated process for banks.

How does KYC Automation Work for Banks?

Nowadays, it’s common for KYC automation solutions to apply AI algorithms combined with Optical Character Recognition (OCR) and other machine learning techniques. This approach provides a more robust and secure KYC process.

Documents are scanned or sent directly to an OCR engine which then automatically detects, extracts, validates, and records the data into a bank’s database. The entire process is completed within seconds, freeing your workforce to focus on more important tasks.

So what are the other benefits of using KYC automation? Let’s go into that next.

Advantages of the Automated KYC Process

KYC automation for banks offers many advantages, we will have a look at the most important ones here.

1. Save 90% in KYC processing cost

Trying to calculate the costs of KYC in banking is difficult since there are many factors involved. From manual hours and staff hires to the price of the compliance tool.

However, let’s say you need to complete 1000 KYC checks per working day. On average one manual KYC check takes about 5 minutes to complete. In order to accomplish the target of 1000 KYC checks, you will need 10 employees to process 100 submissions each. With an average hourly wage of 25 euros, manual KYC processing will cost you 2083 euros daily, or 43 750 euros per month.

With automation, this can be drastically reduced. Automatic KYC processing takes only 3 to 5 seconds. This means that you would save 83 employee hours daily and 40 417 euros per month in KYC processing costs.

2. Eliminate human errors

OCR ensures that information is extracted correctly. Then AI technology is used to complete cross-check validation to comply with anti-money laundering (AML) regulations. Automation eliminates human error and transfers the extracted data into a database instantly.

3. Increased customer and employee satisfaction

KYC automation for banks decreases the processing time dramatically and eliminates human errors which results in increased customer satisfaction. Additionally, employees are relieved from these frustrating tasks which allow them to spend more time on more meaningful work.

4. GDPR compliance

Handling the personal identity documents of clients while keeping sensitive personal information safe is a challenge to overcome. Complying with GDPR standards means ensuring data privacy and protection. Therefore, it’s essential to handle personal identity documents with great care.

With an automated solution for KYC in banking, data masking or removal of sensitive information is made easy. This means that retrieved data remains confidential and is only read by software.

As you can tell, KYC automation for banks can transform a current bottleneck into a competitive advantage. If you want to know how Klippa can help you achieve that, keep on reading further!

Automate your KYC Processes with Klippa

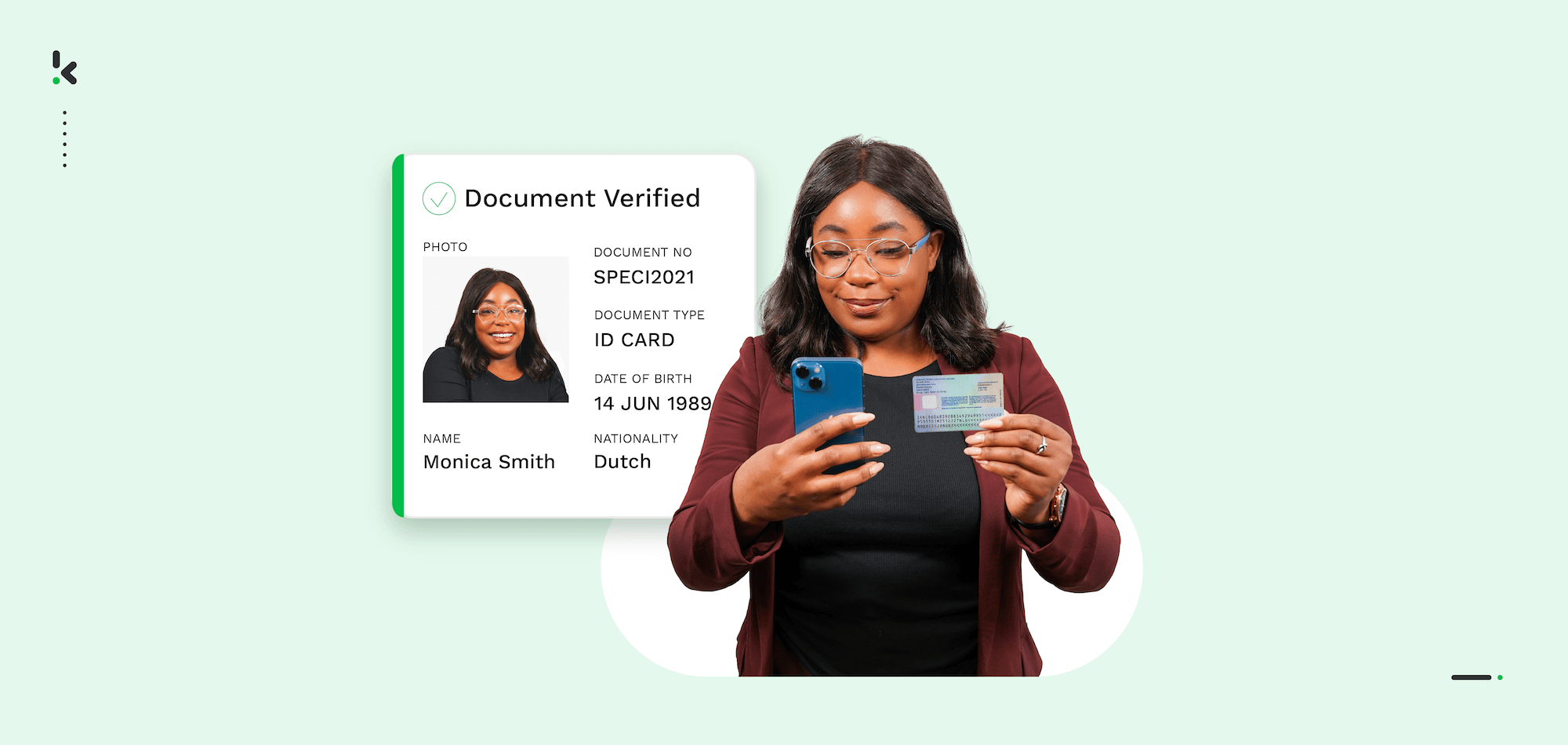

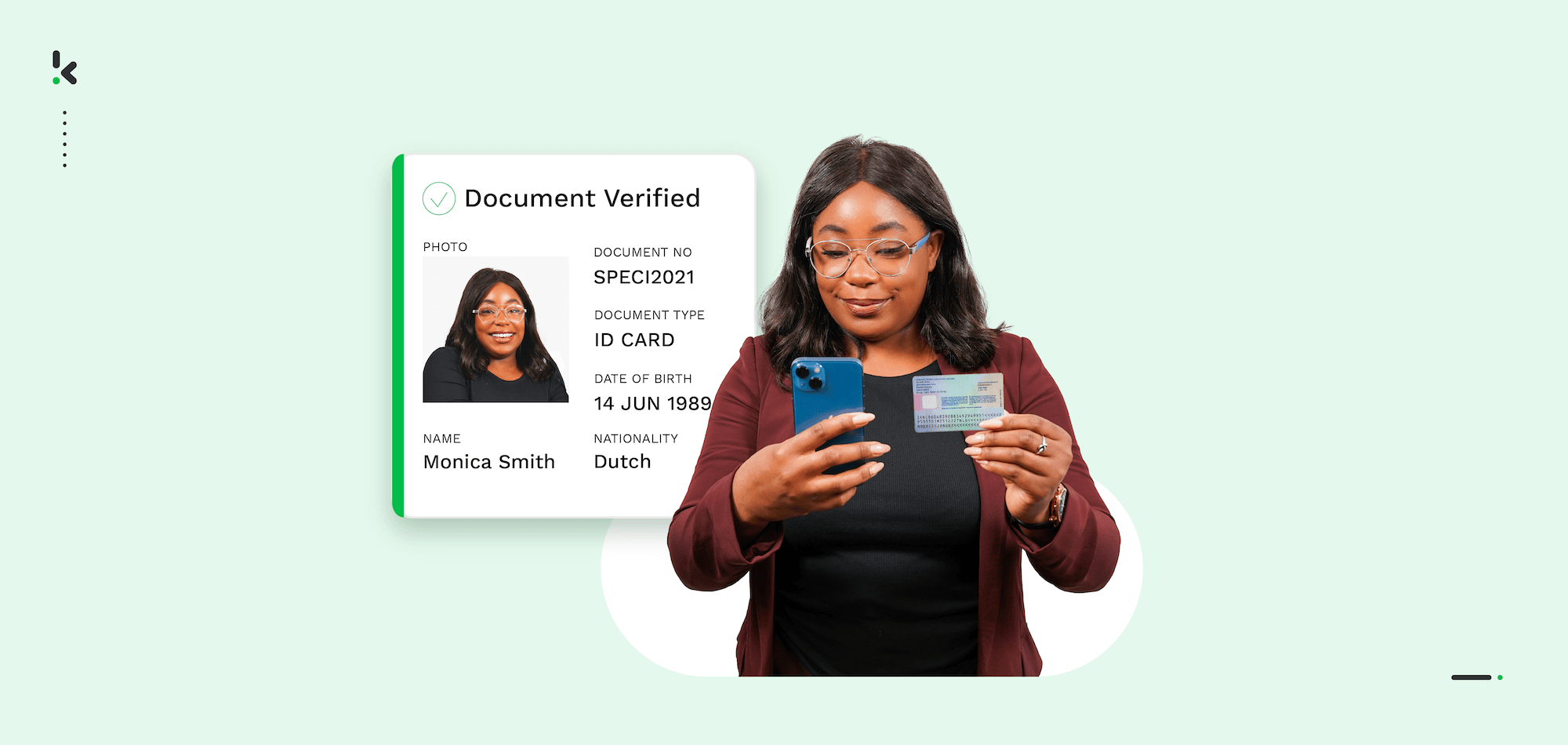

We at Klippa are specialized in automated document processing. We offer various solutions for multiple use cases with our KYC software. The most popular solution amongst our banking clients is the ID verification SDK. Our SDK includes a camera module, which helps take higher-quality pictures that OCR software can process for greater results.

The Klippa ID verification SDK can automate your KYC checks for a faster and more pleasant onboarding process which is provided for both mobile and web. We also provide an NFC ID verification that allows your customers to scan the RFID chip on their ID document to further fortify your KYC process, with data anonymization options that comply with GDPR standards.

If you’re curious to know more about our solutions or how they can benefit your bank, get in touch with us today or book a free online demo with the form below.

FAQ

KYC stands for Know Your Customer, a process that banks use to verify the identity of their customers. This ensures compliance with regulations and helps prevent fraud, money laundering, and other financial crimes.

KYC is critical because it helps banks identify their customers, assess risks, and comply with anti-money laundering (AML) regulations. It also safeguards the financial system from illegal activities and protects the bank’s reputation.

Typically, banks require proof of identity, such as a passport or driver’s license, and proof of address, like a utility bill or bank statement. These documents help verify the customer’s identity and residence.

KYC automation uses technologies like Optical Character Recognition (OCR) and Artificial Intelligence (AI) to scan, extract, validate, and store customer data. This streamlines the onboarding process, reduces human error, and ensures compliance with regulatory standards.