In recent years, sustainability and responsible consumption have gained significance in consumer purchasing decisions. Online marketplaces, such as Vinted, enable users to sell used products, extending their lifespan and minimizing landfill waste. As consumers increasingly turn to these platforms to reduce their global footprint, the growing popularity has unfortunately also attracted more fraudsters.

A recent European Commission survey, for example, found that 23% of consumer fraud is related to buying scams. At the same time, the value of e-commerce losses to online payment fraud is expected to increase from $41 billion in 2022 to $48 billion in 2023.

Yet, the losses are not the only concern. Marketplaces like Amazon, Etsy, and Vinted rely on the mutual trust between the buyer and the seller. Trust is the lifeblood of these marketplaces.

Marketplaces can adopt various solutions to counter online fraud and improve trust within the platform. Identity verification stands out as one of the most effective measures. This process instills trust in customers, as they are confident that all involved parties have undergone thorough verification. Such a mechanism fosters mutual trust between buyers and sellers, a crucial element for the success of any marketplace.

To address marketplace fraud, it’s crucial to develop a comprehensive understanding of the current landscape. This blog will take you through the various types of marketplace fraud, examine existing safeguards, and propose a tailored solution for enhancing the security of your online marketplace.

What is Marketplace Fraud?

The term “marketplace fraud” holds a range of illegal activities that transpire within online marketplaces. It involves individuals or entities employing deceptive strategies to deceive and exploit customers, sellers, or the platform itself.

Nevertheless, various factors contribute to making marketplaces an appealing target for fraudsters.

Why do Fraudsters Target Marketplaces?

A growing number of customers are shifting towards digital shopping to discover appealing deals on items that may be elusive through traditional means. This surge in online activity, with both new and returning customers, presents an opportunity for fraudsters to exploit marketplace stakeholders into falling victim to fraudulent activities.

The inherent characteristics of an online environment also do not help the cause. Fraudsters are given a cloak of anonymity and the ability to conceal their true location, facilitating their deceptive maneuvers.

Typical factors that frequently make marketplaces the preferred avenues for fraudulent activities involve:

- Large transaction volume: The larger the user base, the greater the pool of potential victims – it’s that straightforward. Fraudsters focus their efforts on marketplaces with extensive listings and high levels of activity, aiming to engage with a broader range of targets.

- Payment processing options: In their pursuit of buyer convenience, marketplaces have embraced a wide range of payment processing systems. While this has simplified transactions for consumers, it has also unintentionally opened up opportunities for fraudsters. They prey on both buyers and sellers by exploiting the vulnerabilities inherent in the marketplace’s payment infrastructure.

- Limited identity verification measures: Ineffective identity verification for marketplaces provides an opportunity for scammers to exploit vulnerabilities. Fraudsters commonly resort to tactics such as creating fake profiles, using stolen identities or misrepresenting themselves to establish trust with their targets. This results in an increase in unreliable transactions, negatively impacting the marketplace’s reputation.

However, simply knowing the reasons for the action won’t provide a complete solution to stop them. It’s essential to grasp the patterns of various fraudster practices. Let’s explore some of the commonly observed instances of marketplace fraud.

5 Examples of Marketplace Fraud You Should Know

Detecting when you’ve fallen victim to a scam sometimes can be quite challenging. As the influence of artificial intelligence (AI) continues to grow, fraudsters constantly innovate new methods to deceive unsuspecting individuals. While it’s good to be aware of all types of fraud, this blog pivots on the 5 most common examples of marketplace fraud involving both buyers and sellers:

- Chargeback Fraud

- Account Takeover (ATO) Fraud

- Triangulation Fraud

- Listing Fraud

- Phishing for Sensitive Data

1. Chargeback fraud

Frequently recognized as friendly fraud, chargeback fraud occurs when a buyer attempts to initiate a chargeback by making fraudulent claims. Rather than directly contacting the merchant to request a refund, the consumer contacts their card issuer and falsely claims issues such as product defects, non-delivery, or unauthorized transaction authorization.

2. Account takeover (ATO) fraud

An account takeover is a digital theft where an unauthorized individual gains access to an account without the owner’s permission. Perpetrators employ ATOs to obtain sensitive information, such as credit card details, enabling them to conduct subsequent fraudulent transactions.

3. Triangulation fraud

Triangulation fraud strategically inserts the fraudster as an intermediary (retailer) between a genuine customer and a merchant. The customer initiates the order through the fraudster (retailer), who, using a stolen credit card, acquires the customer’s goods from a legitimate merchant. While the merchant fulfills the order and the customer obtains the goods, it is the merchant who bears the brunt of substantial losses. Typically, the compromised credit card owner detects the unauthorized transaction, triggering a chargeback that leaves merchants not only without the funds but also without the product.

4. Listing fraud

In contrast, listing fraud is performed from a seller’s account. Deliberately, the seller provides misleading information through inaccurate descriptions, misrepresented product details, or images that do not align with the actual product. In addition, these fraudulent individuals generate listings for counterfeit products, frequently incorporating details and features from authentic products found elsewhere.Listing fraud

5. Phishing for sensitive data

Fraudsters require personal information to establish seemingly trustworthy online identities, allowing them to engage in unlawful activities like opening bank accounts or securing loans. Marketplace listings serve as a prime source for fraudulent sellers to harvest this data, given the necessity of sharing personal details for coordinating item shipments.

Fraudulent buyers usually perform phishing by contacting the seller to propose a direct pickup rather than delivery. The pickup arrangement allows the buyer to request the seller’s home address, email address, phone number, and full name. This substantial amount of personal information provides fraudsters with ample material to engage in identity spoofing or synthetic identity theft for malicious purposes.

Faced with similar types of marketplace fraud in 2022, retail giant Amazon invested $1.2 billion and hired over 15,000 workers. However, not all platforms are responding to the threat with the same urgency. In the absence of a robust solution, marketplaces are living on borrowed time.

How to Safeguard Your Marketplace Against Fraud

Faced with the growing need for an efficient and secure means of detecting fraudsters, various online marketplaces have developed strategies to combat fraudulent activities. The most common approaches include:

- Device Fingerprinting: Just as a human fingerprint is unique to each person, a device fingerprint is unique to each device. Device fingerprinting is a method used to identify and track devices based on their unique characteristics, like operating system, device type, language settings, and others.

- Behavior and Transaction Monitoring: Unusual behavior and irregular transactions are identified in real-time, triggering quick responses for heightened security. Additionally, the legitimacy of the transactions can be verified based on the user’s geographic location.

- Verify Identities Using Customer Onboarding: The implementation of identity verification measures stands as a paramount security measure against fraud. Yet, with the escalating prevalence of fraud, marketplaces may grapple with the limitations of manual verification processes being time-consuming, error-prone, and lacking scalability.

This sets the stage for the final section, emphasizing the necessity for a more sophisticated solution. Consequently, the narrative shifts to the potential benefits of automation and artificial intelligence (AI) in identity verification.

How to Prevent Marketplace Fraud with Klippa

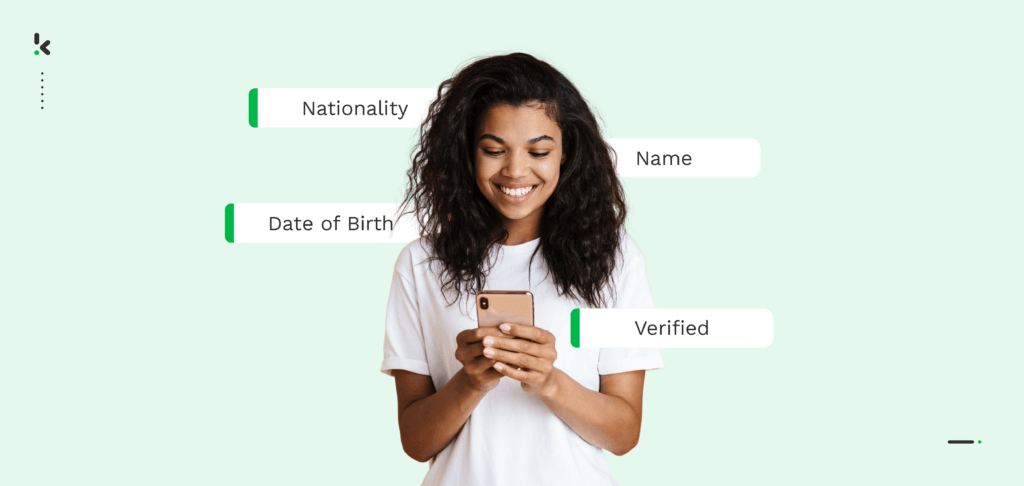

Klippa’s DocHorizon offers an innovative identity verification solution, providing support for your online marketplace in authenticating new merchants and customers. In mere minutes, Klippa adeptly extracts, converts, and categorizes a diverse array of documents. The onboarding experience is streamlined, allowing new users to effortlessly and independently verify their identities through a user-friendly process with just a few simple steps:

- To start, a customer has to capture or upload their identity document(s)to the marketplace’s website or app.

- Next, Klippa’s OCR technology will extract the requested information from the document(s) and compare it to the user’s input.

- Optionally, the user proceeds to biometric verification. With the use of AI algorithms, an individual’s unique characteristics can be compared to the input (the identity document).

- Upon successful verification, the user gains access to participate in the marketplace.

Customized to enhance both the security and efficiency of this process, Klippa can also:

- Provide fast user age verification;

- Eliminate the risk of identity spoofing through liveness checks or selfie (identity) verification;

- Automate Proof of Address verification;

- Use Data Anonymization to add an extra layer of security and be GDPR-compliant;

- With the help of our SDK and API, seamlessly integrate DocHorizon within your marketplace website or mobile application.

These additional features constitute a comprehensive security framework, mitigating risks and fortifying your marketplace against potential fraud. Moreover, DocHorizon’s customization options allow tailored verification processes, aligning seamlessly with the unique requirements of your marketplace.

If you’re interested in learning more about how Klippa can help your business, feel free to get in touch with us or book a free online demo below.