The month-end close is a tedious task for financial teams worldwide. In fact, it takes up to 6 working days to complete this process. It might not sound like much, but if you look at it from a yearly perspective, the month-end close takes up to 3 months of your time.

No company wishes to spend a whole quarter processing financial documents and certainly, you don’t wish to either. If you’d like to make a change in your financial practices and improve the efficiency of drawing up the month-end close, then keep reading!

In this blog, you will learn about what the month-end close is and why it’s needed in accounting, a list of key steps to follow in this process and lastly, you will get tips on how to improve this financial process.

What is the Month-End Close?

The month-end close is the monthly financial reporting of a company. It involves reviewing and reconciling accounting data, and helping businesses keep accurate records throughout the year.

In accounting, the month-end close process helps your organization be consistent in its financial reporting and increases financial transparency, maintaining your company compliant with legal and financial regulations.

But the month-end close has many more benefits than meets the eye. To give you a better understanding of how the month-end close benefits your organization, let’s look at some of the advantages:

- It gives a clear overview of monthly assets and liabilities

- It archives all transactions, preparing you for an unannounced audit

- It prevents you from misplacing documents or making accounting errors

- It facilitates tax filing processes

A streamlined month-end close leads to fewer mistakes in financial reporting, increasing the accuracy of the year-end close. Paying extra attention to this process can only bring long-term benefits to your organization. To benefit from this, it’s crucial to integrate a few key steps for maximum efficiency and successful monthly closing. Curious about what these steps are? Let’s find out!

6 Key Steps for Month-End Accounting Success

There is no perfect recipe for completing the month-end close process. However, there are a few key steps that all organizations, regardless of their industry, should integrate into this financial process.

These are the 6 steps you need to take for your month-end close:

- Record the accounts receivable

- Register the accounts payable

- Perform account reconciliation

- List fixed assets

- Organize financial statements

- Plan ahead

Record the Accounts Receivable

The first step in optimizing your month-end close is to record the accounts receivable your organization is set to receive. This means registering all upcoming income, be it cash, invoices, loans, or revenue.

Besides simply keeping track of your income, recording the accounts receivable also helps you identify any internal employee fraud that might occur. Being able to detect very early on if documents have been tampered with, the risk of document fraud is reduced significantly.

Register the Accounts Payable

Contrary to accounts receivable, accounts payable represents all the money you spend each month on purchases or bills. Registration of these accounts helps your finance department keep track of all types of expenses, for instance, accrued expenses.

This step helps your business minimize its chances of acquiring debt or getting fined for late payments, but also detect malicious activity. For example, registering accounts payable as soon as the transactions have been completed with the help of AP automation, keeps your company clear from invoice fraud or vendor fraud.

Perform Account Reconciliation

This step involves matching and verifying the documents of all transactions that took place that month against the corresponding bank, vendor, or business. For instance, account reconciliation involves performing two-way matching between an invoice and a purchase order to ensure that all accounts are balanced and there is no mismatch between the two documents.

List Fixed Assets

Fixed assets, such as heavy machinery, hardware, or software, are written down as cash in a company’s ledger. As they are usually expensive assets, their value decreases every year, meaning organizations need to spread the costs of depreciation in the form of monthly expenses.

Listing the fixed assets in the month-end close might not seem like an important detail, but it can significantly improve financial processes. Recording any changes that might occur in the value of the assets, be it repair or amortization, improves the accuracy of the books.

Organize Financial Statements

After all financial statements have been recorded and registered in the bookkeeping system, it is time to organize them accordingly. This step involves taking care of the profit and loss statement, and revenue and expense accounts. To do so, you need to make sure that all transactions have been placed on the corresponding side of the balance sheet.

Plan ahead

It is never too early to start preparing for the upcoming month-end close. Planning ahead helps your department better assess monthly transactions and address key risks that may have been overlooked.

Following these steps can help you go through the month-end close much easier while enhancing the accuracy of your administration. However, there is always room for improvement, especially in financial processes, where you can never be too sure. To maximize the efficiency of your workflow, you might want to look into some tips on how the month-end close can be enhanced.

5 Tips for a More Efficient Month-End Close

Change the traditional way of completing the month-end close and follow these tips for added value in your monthly accounting close process:

- Use checklists: Checklists help you keep track of all financial operations so that no transaction is left unregistered. They also improve the communication between departments, making it easier to follow business rules.

- Create SMART goals: Breaking down the process into multiple, more attainable tasks will help your team complete the month-end close in no time. Setting SMART goals will also improve the quality of the work, as every task is carefully processed.

- Backup your data: Having a record of all transactions, past and present ones, maximizes the transparency of accounting operations in your organization. Therefore, archiving all invoices and contracts helps you gain easier access to financial information, preparing you for your next audit.

- Complete all financial tasks on time: Before drawing up the month-end close, it is recommended to have all other financial tasks settled. This means, for instance, that registration of expenses and payslips should be finalized before the monthly close. Completing these financial tasks in advance ensures an accurate representation of the cash flow in your organization’s records.

- Automate the month-end close: The best tip by far is to automate the month-end close process. It shortens processing times, reduces human errors, and simplifies the overall process. Completing the monthly closing becomes much easier and helps your financial department improve its workflow.

Having a detailed list of steps to follow might help your business, but only for a short period of time. If you want to see real improvement in your monthly close and adhere to the best practices within accounts payable, you might want to look into spend management software, such as Klippa SpendControl.

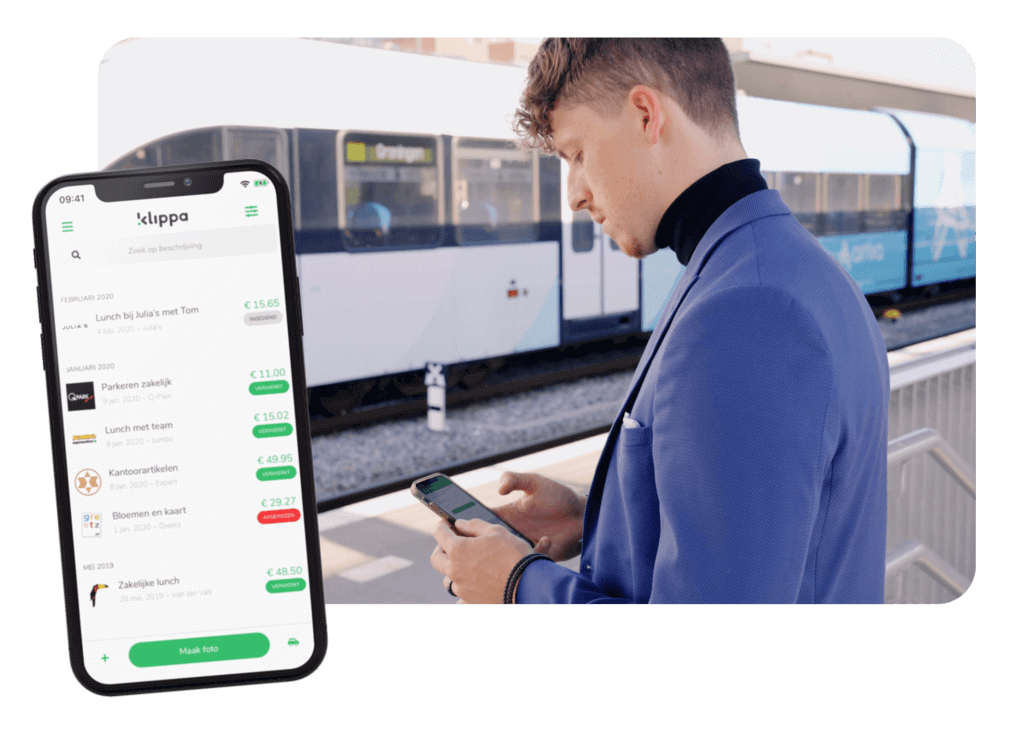

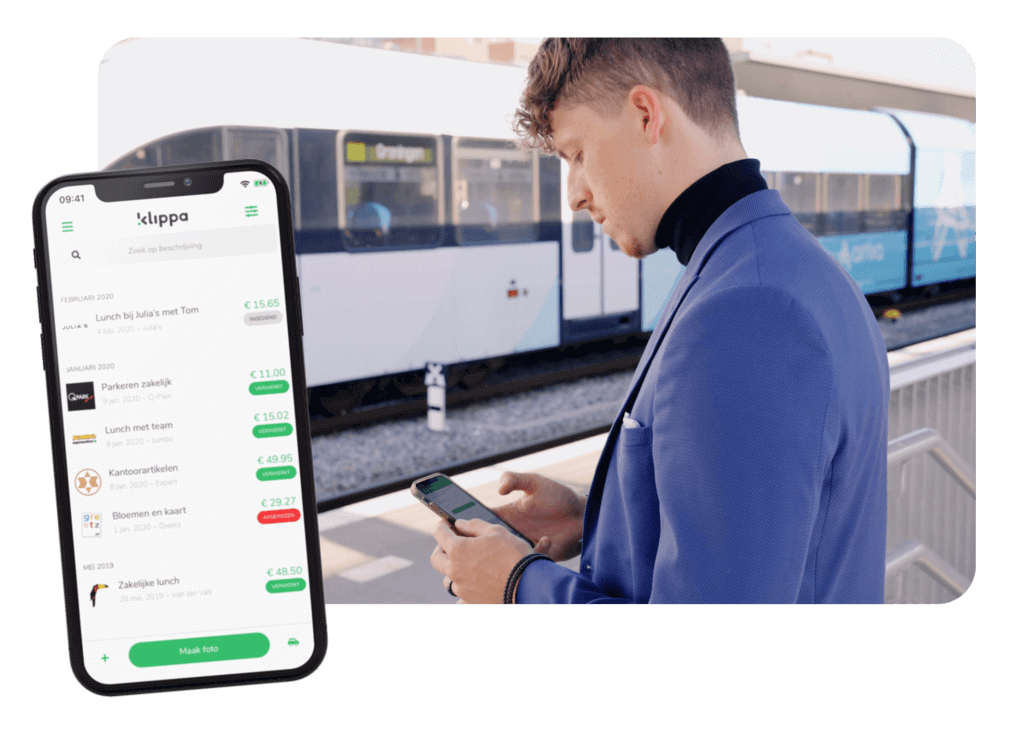

Automate Spend Management with Klippa

Klippa SpendControl is an all-in-one financial management solution to automate your expense management and invoice processing. It consists of two modules, which can be used separately or combined, and can be fully customized according to your needs.

Among other things, it allows you to:

- Submit expenses and purchase invoices conveniently via the app or website

- Accurately scan and extract information using OCR technology

- Create a secure authorization flow, with advanced approval options

- Easily approve expense claims and submitted invoices, via app or website

- Benefit from seamless integrations with your ERP system, which helps keep the bookkeeping system up-to-date

- Have a clear overview of all expenses and your company’s financials

- Maximize cost control with employee expense cards

Forget the hassle of manually completing the month-end close and embrace the help of automation! Book a free demo down below or contact our experts and see for yourself how Klippa can help improve financial processes in your organization!