Managing the finances of multiple entities is a significant challenge for many organizations. The task of multi-entity accounting becomes even more demanding for finance teams when it involves businesses in various countries, with different subsidiaries, accounting systems, and unique financial practices.

But what exactly is multi-entity accounting, and what are the common challenges connected to its practices? Our blog will answer these questions by providing real-life examples and offering practical solutions for simplifying the overall approach to managing the accounting of multiple entities.

What is Multi-Entity Accounting?

Multi-entity accounting is the practice of managing, recording, and reporting the financial health of multiple businesses (entities) that are legally separated but are all owned or controlled by one parent company.

The process of multi-entity accounting includes consolidating financial statements while maintaining the ability to report on each company’s financial results individually. The overall logic behind this practice is simple: It is efficient to separately manage companies that operate in various industries and is required if you have a legal entity in a certain jurisdiction.

Not to mention that in case of a buyout, acquired companies can take a long time to readjust from their long-established systems to those of the parent company. Acquisition of other businesses, mergers, and introduction of subsidiary brands are among the most common reasons for the following financial management structure.

Examples of Multi-Entity Companies

Multi-entity accounting is standard among organizations that broaden their business scope but separate entities from their primary operations to enable targeted strategic decisions.

In 2005, Google famously acquired Android, investing in a young mobile operation systems company. It is safe to assume that the financial administration of a start-up didn’t quite match that of a large multinational technology company and had to be handled separately.

Similarly, in 2002, eBay merged with PayPay. The arrangement proved to be one of the most successful deals in the company’s history, as eBay was able to integrate PayPal’s transactional technology with its own and continued to develop the fintech firm as a separate entity.

On the other hand, companies like Disney continuously expand their corporate umbrella by opening original subsidiary companies for different business niches and country codes, efficiently delegating tasks and resources between smaller enterprises.

As of now, the company owns many original brands like The Walt Disney Pictures, Disney Cruise Line, Disney Parks, Experiences and Products, together with 200 other businesses. All are active in different industries while operating under their parent, The Walt Disney Company.

While the stories behind each case differ, the CFOs of these organizations share the joint challenge – overseeing the finances of several individual companies that often use different tools and techniques to record the company’s financial transactions.

Challenges Within Multi-Entity Accounting

The challenges of multi-entity accounting can vary depending on the company’s size, the diversity of its operations, and the regulatory environments in which its entities operate. CFOs can encounter a range of challenges.

Consolidation of financial statements

Consolidating financial data from multiple entities can quickly turn into chaos. The process includes eliminating intercompany transactions and reconciling accounts between subsidiaries without standardized accounting practices.

Currency translation

Entities spread across multiple countries require currency conversion and accounting for exchange rate fluctuations, which can significantly affect the time and effort spent on financial reporting.

Regulatory compliance

Different companies may be subject to different financial regulations, including tax laws and accounting standards (such as GAAP, IFRS, etc.). Ensuring compliance with all relevant regulations is crucial to avoid any penalties.

Data accessibility

Effective governance and strategic planning require timely and structured financial data from all subsidiaries, ensuring data availability for necessary audit documentation and decision-making support.

Diverse accounting systems

Some companies may use different accounting software or ERP systems, making integrating and structuring data for consolidated reporting time and resource-consuming.

More often than ever, companies with subsidiary businesses turn to advanced accounting solutions, like ERP systems, that can effortlessly handle multi-currency transactions, consolidation, and compliance management to address these and other challenges of multi-entity accounting.

Benefits of Automated Multi-Entity Accounting

Automated multi-entity accounting streamlines and simplifies the complexities of managing financials across multiple entities. Here’s how it benefits your business:

- Efficiency and Accuracy: Automation reduces manual data entry and the risk of human errors, ensuring accurate financial consolidation. You save time and resources, allowing your team to focus on strategic tasks.

- Real-Time Visibility: Gain immediate insights into your financial status across all entities. Automated systems provide real-time updates, enabling you to make informed decisions swiftly and confidently.

- Compliance and Consistency: Ensure compliance with various regulatory standards and maintain consistency across all financial reports. Automated solutions standardize processes and reporting, minimizing the risk of non-compliance and audit issues.

- Scalability: Easily manage growing complexities as your business expands. Automated systems can handle increased data volume and additional entities without a significant increase in workload or operational costs.

- Intercompany Transaction Management: Simplify the management of intercompany transactions. Automated solutions accurately track and eliminate intercompany transactions, preventing duplication and ensuring clean, consolidated financial statements.

By leveraging automated multi-entity accounting, you enhance financial control, improve efficiency, and support scalable growth for your business.

Solution: Multi-Entity Accounting Software

Multi-entity accounting software can improve financial control with standardized processes and complete financial oversight across all entities connected to the bookkeeping systems. Using a multi-entity accounting system correlates with some of the best practices in accounts payable.

A comprehensive software should simplify many procedures by providing key features like:

- Comprehensive account management: Multi-entity accounting software should provide the means to handle all accounts payable data in one system by offering support for financial procedures, multiple ledger codes, cost center management and intercompany transaction management.

- Integration capabilities: Software with multi-entity accounting support should integrate with various subsidiaries’ accounting and ERP systems for seamless data flow and unified operations.

- Centralized control with decentralized management: Accounting software for multiple businesses should offer role-based access controls that allow different levels of authorization, ensuring that staff in each entity can only access relevant information.

- Compliance Management: Mandatory submission fields within multi-entity accounting software ensure that each entity complies with local, regional, and international financial reporting standards and tax regulations.

- Cloud-Based Accessibility: Cloud-based deployment options provide easy access from different locations, enhancing collaboration and data accessibility across entities.

- Real-time financial insights: Real-time reporting and analytics tools offer immediate visibility into all entities’ financial health and performance, enabling timely and informed decision-making.

- Multi-currency support: If entities operate in different countries, the software must support multiple currencies, handle currency conversion, and comply with the accounting standards of each country, ensuring more accurate and consistent financial reporting.

By addressing these specific needs, multi-entity accounting software simplifies complex financial processes and empowers businesses to make more informed decisions, maintain compliance, and enhance overall financial integrity. This becomes possible with spend management software like Klippa SpendControl.

Multi-Entity Spend Management Software

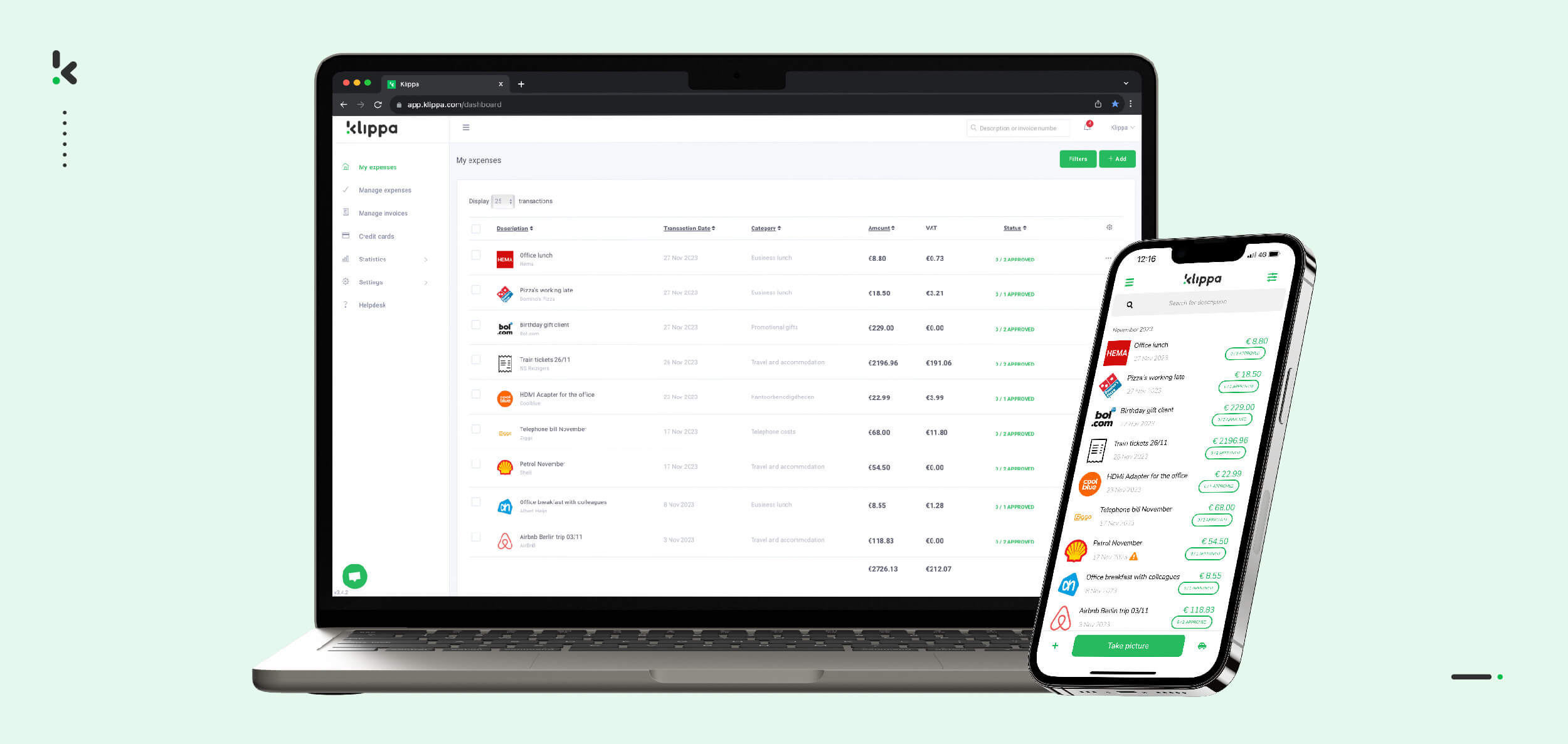

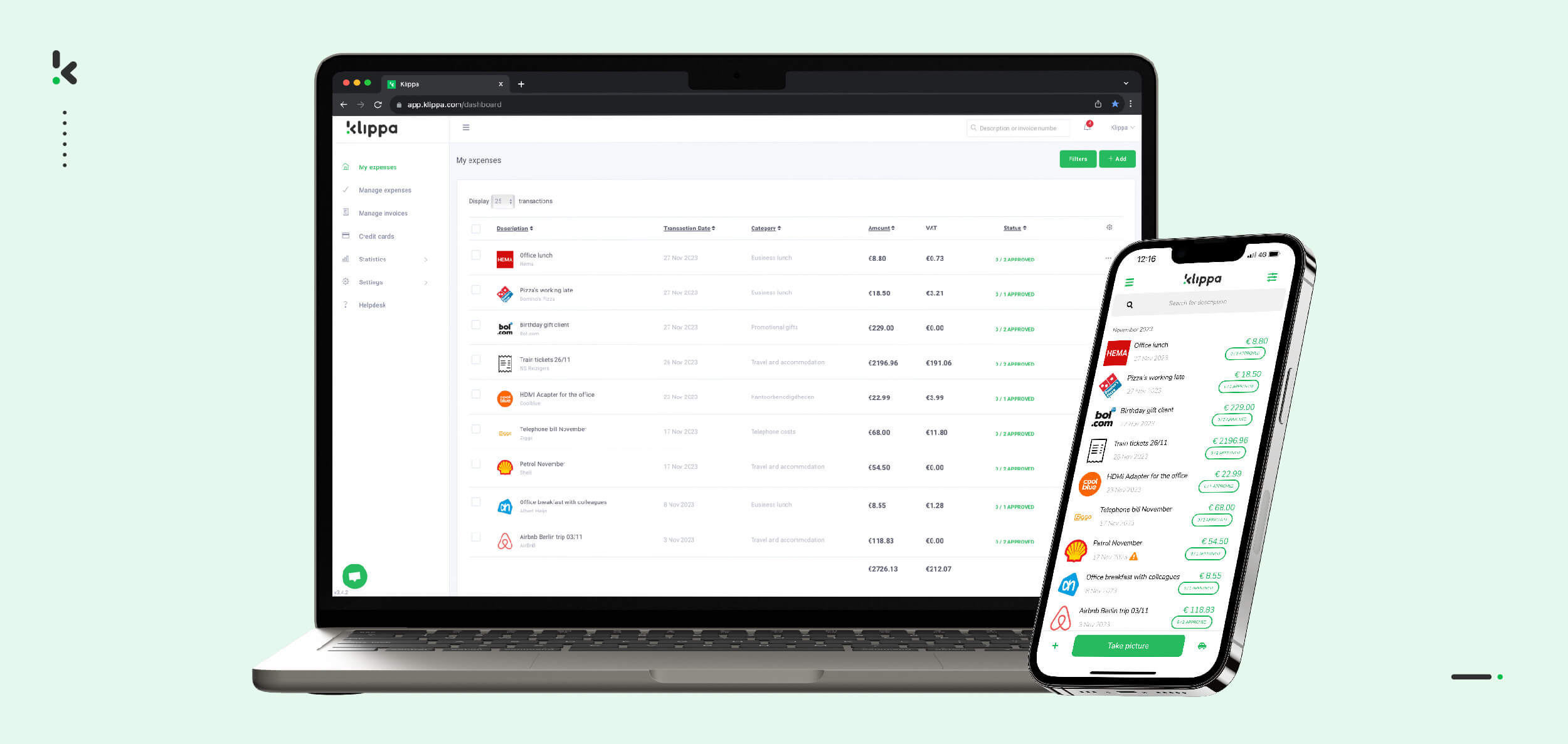

Navigating the complexities of multi-entity accounting can be a daunting task. But it doesn’t need to be. With our award-winning solution, Klippa SpendControl, you can bring transparency, efficiency, and accuracy to your multi-entity financial management.

No matter which accounting system you are using, the currencies you are dealing with or how many subsidiaries you have, Klippa has got you covered.

Klippa SpendControl provides key features for upgrading your multi-entity accounting process:

- A centralized spend management system with invoice processing, expense management and business expense cards modules.

- A containerized environment with centralized control for the parent company and limited oversight for subsidiary managers.

- Customized approval management, business rules and mandatory submission criteria, depending on the local regulations and accounting standards.

- Built-in fraud detection that reduces the risk of invoice fraud with machine learning.

- Flexible data export and import for old-school systems that don’t have API connections.

- Plug-and-play integrations with many accounting and ERP systems.

- Real-time statistics and financial insights of all entities in an intuitive expense dashboard.

- Automatic foreign currency conversion for expense & invoice processing from all regions.

Using our sophisticated spend management solution, you can automate data entry, ensure compliance, prevent fraud, and get real-time financial insights across multiple entities in one platform saving you time and money. Book a free demo to see our product in action, or contact our SpendControl specialists for more information.