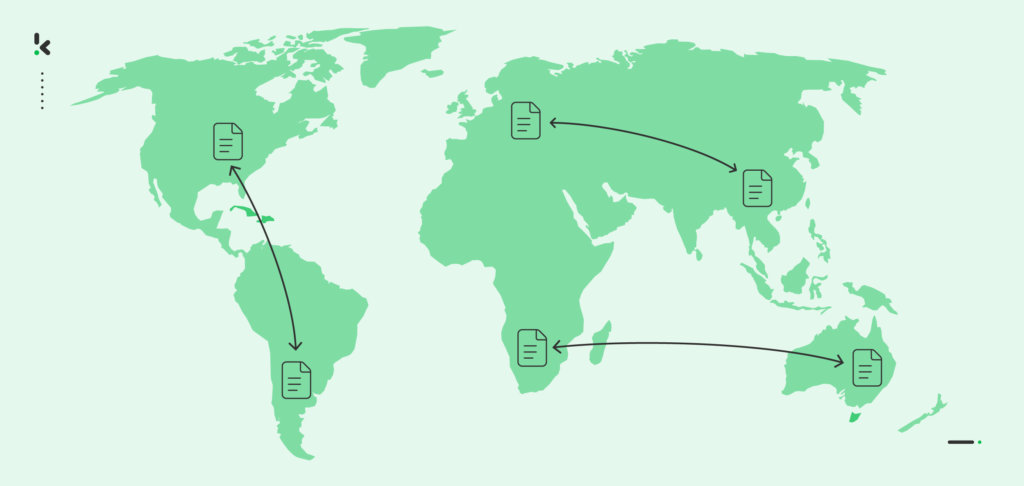

Since 2022, the global payments industry has been growing steadily by 11%, making international transactions a monthly activity for both public and private organizations. Due to the increase in global payments, the European Legislation has promulgated a directive introducing e-invoicing for global procurement practices, leaving PDF invoices behind.

PDF invoices were the norm in the past. However, their unreliable nature was a burden to companies. The inability to manage currency exchanges or to process data efficiently has led companies to e-invoicing. In order to streamline the process of managing online transactions for companies, the European Commission has provided funding to support the development of Peppol.

If you’re not yet familiar with Peppol, don’t fret; we have it all covered. In this blog, we will explain what Peppol is, how it works, and the benefits of switching to electronic invoicing. We will also show you a smart and efficient way of turning PDF invoices into e-invoices.

Let’s begin!

Quick Guide: Converting PDF Invoices to E‑Invoices

Step 1: Choose an e-invoicing OCR tool — for example, Klippa DocHorizon or other compliant platforms.

Step 2: Upload your PDF invoice to the platform.

Step 3: Automatically extract invoice data using OCR or AI.

Step 4: Validate the data against standards like XML, UBL, Peppol BIS, or XRechnung.

Step 5: Convert to structured, machine‑readable format.

Step 6: Integrate with ERP or send directly via Peppol Access Point.

What is Peppol?

Peppol (Pan-European Public Procurement Online) is a secure international e‑invoicing network used for exchanging standardized business documents. It simplifies cross-border trade by ensuring invoices follow formats such as Peppol BIS, UBL, and XRechnung, making them machine‑readable and compliant with regulations in over 40 countries, including across Europe, Singapore, Australia, and New Zealand.

To send or receive e‑invoices via Peppol, companies connect through a certified Access Point. This provides encryption, interoperability between ERP/accounting systems, and adherence to legal frameworks, without the complexity of manual setup.

With adoption growing globally in both B2B and B2G transactions, Peppol has become a preferred alternative to PDF invoicing, enabling faster payments, fewer errors, and easy compliance with regional and international standards.

Understanding the Transition from PDF Invoices to E-Invoices

PDF invoices are created, sent, and received electronically, but they store data in a human‑readable format. This prevents systems from processing their content automatically.

E‑invoices, by contrast, are created from the start in structured formats, such as XML, UBL, or Peppol BIS, that computers can read instantly. This allows data to be imported directly into an ERP or accounting system without manual entry.

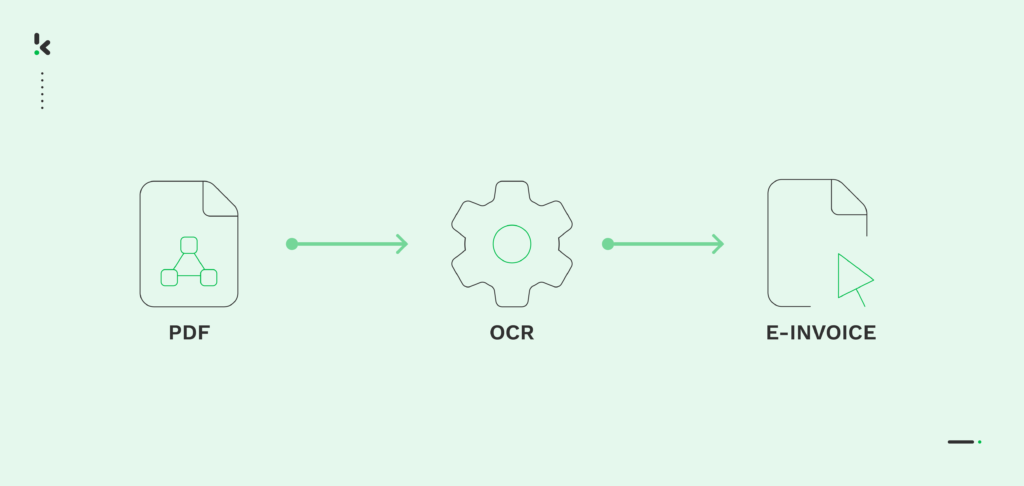

To convert existing PDFs, organizations use OCR (Optical Character Recognition) software. OCR scans the PDF and extracts, converts, and classifies key data points into a compliant, machine‑readable format – ready for integration or secure delivery through Peppol.

What are the Benefits of E-Invoicing?

Electronic invoices offer clear, measurable advantages over PDF or paper-based invoicing:

- Cost Savings: Automates manual entry and reduces printing, mailing, and processing costs, saving businesses up to $40,000 per year.

- High Efficiency: Transactions move seamlessly between ERP and accounting systems via structured XML or UBL formats, reducing cycle times by up to 70%.

- Accuracy: AI-powered OCR achieves up to 99% data extraction precision, minimizing human error.

- Fraud Prevention: Secure, Peppol-encrypted exchanges make it harder for scammers to alter invoices or payment details.

- Global Trade Compliance: Supports multiple e‑invoice standards (Peppol BIS, XRechnung, ZUGFeRD) for rapid cross-border transactions without manual reformatting.

If you also want to implement e-invoicing in your company but do not know where to start, we have just the solution. Klippa DocHorizon is a digital platform that can help your organization convert, extract, anonymize, classify, and verify documents, including PDF invoices.

How to Convert PDF Invoices into E-Invoices with Klippa?

With Klippa DocHorizon, you can easily make the transition from PDF files to an XML format for Peppol, with the help of OCR technology. In just 4 easy steps, you can convert existing PDF files into electronic invoices:

Step 1: Upload or take pictures of PDF invoices

Upload the PDF invoice via email, website, or by simply taking a picture of it using your mobile device and uploading it to the software.

Step 2: Extract data

Klippa DocHorizon reads the PDF file and then extracts the data using OCR technology.

Step 3: Convert and structure the data

For a seamless transition to a machine-readable format, the software completes data parsing. The extracted information is now verified and converted into a structured data format, such as XML, UBL, and many more.

Step 4: Send the e-invoice to an ERP system or database

After successfully converting the data, the software is ready to send the e-invoice to an existing system, such as an accounting or ERP system. This is possible by integrating our OCR API.

And that’s it! Simple, effective, and straightforward, Klippa DocHorizon can help your company improve business processes and embrace automation in its global procurement practices.

Streamline Your E-Invoicing Process with Klippa DocHorizon

Klippa DocHorizon is an Intelligent Document Processing (IDP) platform designed to help businesses automate their e-invoicing processes efficiently. Key benefits include:

- Smooth PDF-to-E-Invoice Conversion: Extract, classify, and convert invoice data into Peppol-compliant formats such as XML or UBL with up to 99% accuracy.

- Enhanced Fraud Detection: Ensure invoice authenticity and prevent duplicate or illegitimate payments with advanced verification tools.

- Accelerated Processing Times: Save up to 70% of your time with bulk processing capabilities for high-volume document workflows.

- Seamless Integration: Connect with over 50 systems, including ERP, CRM, and accounting software, to streamline operations.

- Global Language Support: Process invoices in more than 100 languages to facilitate international transactions.

- Direct Access to Peppol: Use Klippa’s certified Peppol Access Point for secure and reliable e-invoicing.

With ISO-certified security and GDPR compliance, Klippa DocHorizon simplifies invoice management while reducing costs and errors. Book a free demo today or get in touch with our team to learn more!

Frequently Asked Questions

A PDF invoice is human‑readable and requires manual entry, while an e‑invoice is structured in formats like XML or UBL, allowing systems to process data automatically.

Upload the PDF to a platform like Klippa DocHorizon. OCR extracts invoice data, validates it against Peppol standards, and converts it into a machine‑readable XML or UBL format ready for secure delivery.

Yes. You need access to a certified Peppol Access Point, either through your own setup or via a provider like Klippa DocHorizon.

No. Peppol is not mandatory everywhere, but many countries, especially in Europe, require it for B2G and increasingly B2B transactions.

Peppol supports formats such as Peppol BIS, UBL, and region‑specific standards like XRechnung, ensuring interoperability across systems and borders.

Advanced OCR can achieve up to 99% accuracy, even for scanned invoices. Accuracy varies by image quality and layout complexity.

Yes. With API and batch processing capabilities, Klippa automates large‑scale conversions efficiently and securely.

Peppol ensures encrypted, standardized transmission, avoiding fraud risks and manual errors common with email.

Klippa is ISO‑certified and GDPR‑compliant, using encryption to protect sensitive invoice data during extraction and transmission.

Setting up your own Access Point involves registration and maintenance fees. Using a certified provider like Klippa can be more cost‑effective and faster to implement.