For office managers, accountants, and finance teams, petty cash reconciliation is a necessary but often tedious part of maintaining accurate financial records. When done manually, it requires collecting receipts, counting cash, checking records, and investigating mismatches – often pulling valuable time away from higher-priority financial tasks.

But there’s a better way. Automation simplifies petty cash reconciliation by reducing human error, streamlining record-keeping, and ensuring every transaction is properly accounted for. In this guide, we’ll walk you through the five essential steps to reconciling petty cash efficiently, while also exploring how automation can eliminate common headaches and make the process faster, more accurate, and hassle-free.

Key Takeaways

- Manual petty cash reconciliation is inefficient and error-prone – Missing receipts, calculation mistakes, and cash discrepancies make it a frustrating and time-consuming process.

- Automation eliminates errors and speeds up reconciliation – AI-powered solutions like Klippa SpendControl extract receipt data, detect duplicates, and automatically record transactions.

- AI-powered solutions save finance teams valuable time – Instead of chasing receipts and balancing petty cash manually, businesses can automate submissions, approvals, and reconciliation in real time.

What is Petty Cash Reconciliation?

Petty cash reconciliation is the process of verifying that the cash on hand matches recorded transactions. Businesses use petty cash for small, everyday expenses, such as office supplies, minor reimbursements, or transportation costs. The responsibility for reconciling petty cash typically falls on an office manager, accountant, or finance team member.

The process of reconciling petty cash involves reviewing receipts, counting the remaining cash, and ensuring all transactions are properly recorded in the accounting system or a petty cash book. If discrepancies arise, they must be investigated and resolved.

Companies usually reconcile petty cash on a set schedule, weekly, monthly, or whenever the fund needs replenishment. It is especially important before audits or financial reporting periods, like month-end close or year-end close, to identify and correct any inconsistencies.

How to Reconcile Petty Cash

Reconciling petty cash is a straightforward but essential process to ensure financial accuracy. Traditionally, the manual process of reconciling petty cash would consist of the following steps:

Step 1: Gather Petty Cash Records

Start by collecting all receipts, vouchers, and transaction logs associated with petty cash expenses. If your company uses a petty cash ledger or tracking system, have it on hand for reference.

Step 2: Count the Cash on Hand

Physically count the remaining cash in the petty cash box or drawer. Compare this amount with the expected balance based on recorded expenses.

Step 3: Verify Transactions

Review each receipt and expense record to ensure they match the entries in your petty cash log. Confirm that all transactions are properly categorized and approved according to the company’s petty cash policy.

Step 4: Identify Discrepancies

If the actual cash balance doesn’t match the expected balance, investigate the discrepancy. Common issues include missing receipts, miscalculations, or unauthorized expenses. If an error is found, correct it in the records and document the adjustment.

Step 5: Record the Reconciliation

Document the reconciliation by noting the counted cash, total expenses, and any adjustments made. This ensures transparency and provides an audit trail for future reference.

The Main Challenges of Petty Cash Reconciliation

Reconciling petty cash sounds simple – match the receipts to the cash, and everything should balance. But in reality, accountants often run into problems that make the process frustrating and time-consuming. Here are some of the most common challenges.

Missing or Incomplete Receipts

One of the biggest headaches is missing receipts. Employees forget to hand them in, lose them, or submit ones that don’t have key details like dates or amounts (e.g., handwritten receipts from small businesses). Without proper documentation, verifying expenses becomes a guessing game.

Cash Shortages or Overages

There’s nothing more frustrating than finishing a reconciliation only to realize the numbers don’t match. If there’s less cash than expected, it could mean unrecorded expenses, mistakes in counting, or even employee fraud. If there’s extra cash, it’s just as concerning – something was likely left out of the records, which means the books aren’t accurate.

Calculation Errors

Nearly 59% of accountants make several errors every month as already excessive workloads grow heavier. When everything is done manually, even small mistakes in calculations can throw the entire reconciliation off. A miscounted bill, an extra zero, or a forgotten entry can mean a lengthy process of retracing steps to find the mistake.

Lack of Transparency

If multiple employees use petty cash, tracking who spent what can be tricky. Without a clear system in place, an accountant may end up sorting through handwritten notes or vague descriptions, making it hard to verify if the expenses were legitimate.

Time-Consuming Process

Manually collecting receipts, counting cash, checking records, and investigating discrepancies is tedious. When reconciliation takes longer than it should, it pulls accountants away from more important financial tasks.

Higher Risk of Fraud or Misuse

Employee theft is costing U.S. businesses $50 billion annually. Without a strict process, petty cash can be an easy target for expense fraud. Employees might inflate expenses, submit a duplicate receipt, or use cash for personal purchases. When everything is tracked on paper or spreadsheets, catching these issues early is difficult.

These challenges show why manual petty cash reconciliation isn’t just a minor inconvenience, it’s a process prone to errors and inefficiencies. The good news? With the right controls and automation, these problems become much easier to manage.

Automatically Reconcile Petty Cash with Klippa

Stop wasting precious time on manual petty cash reconciliation. Forget about the missing receipts, duplicate submissions, or risks of expense fraud. Use AI-powered spend management software Klippa SpendControl to automate your expense management and simplify petty cash reconciliation.

Our pre-accounting software combines expense management, invoice processing and business credit card modules in one platform. Perfect for automating receipt submissions, processing and approval, SpendControl helps your finance team save precious time and money on manual document processing.

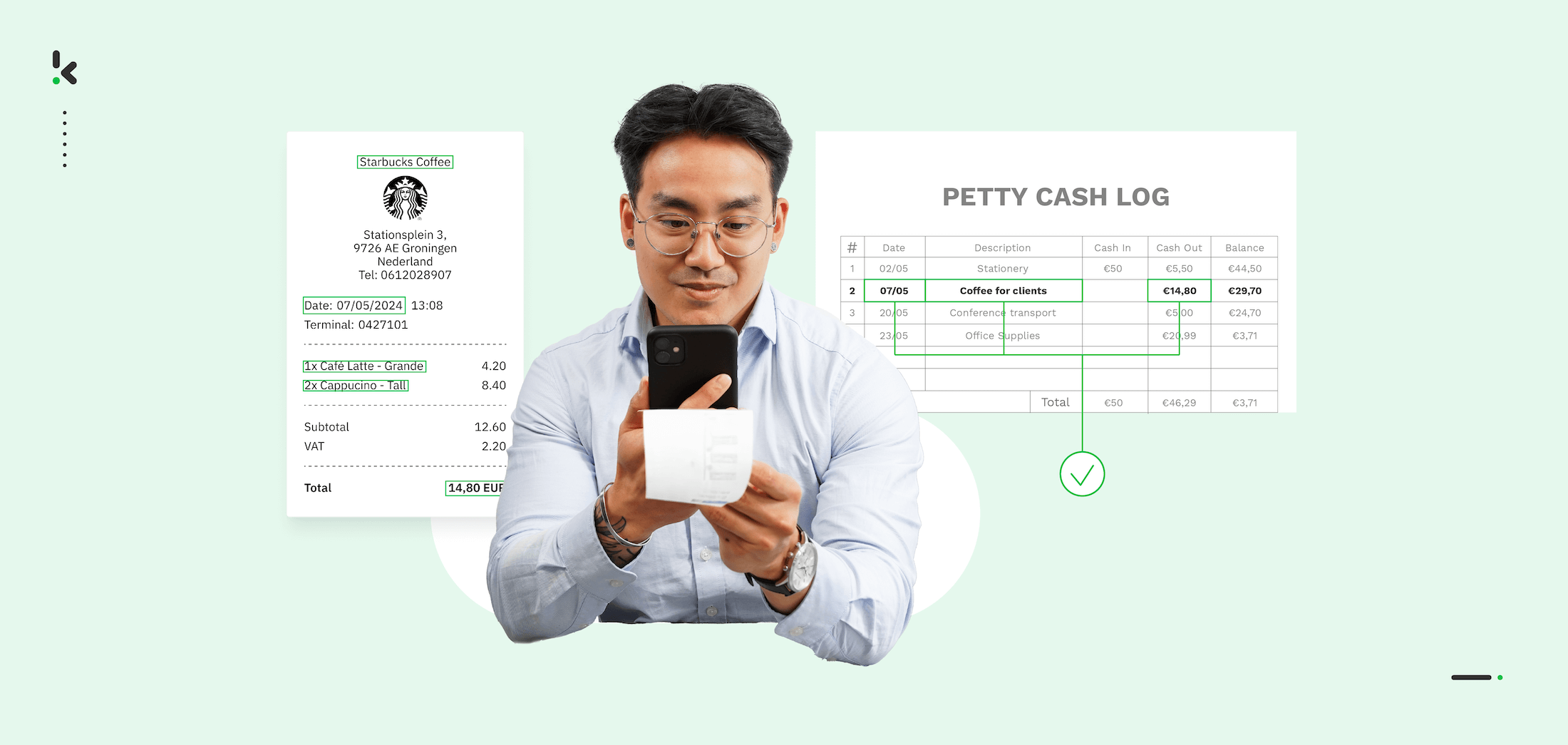

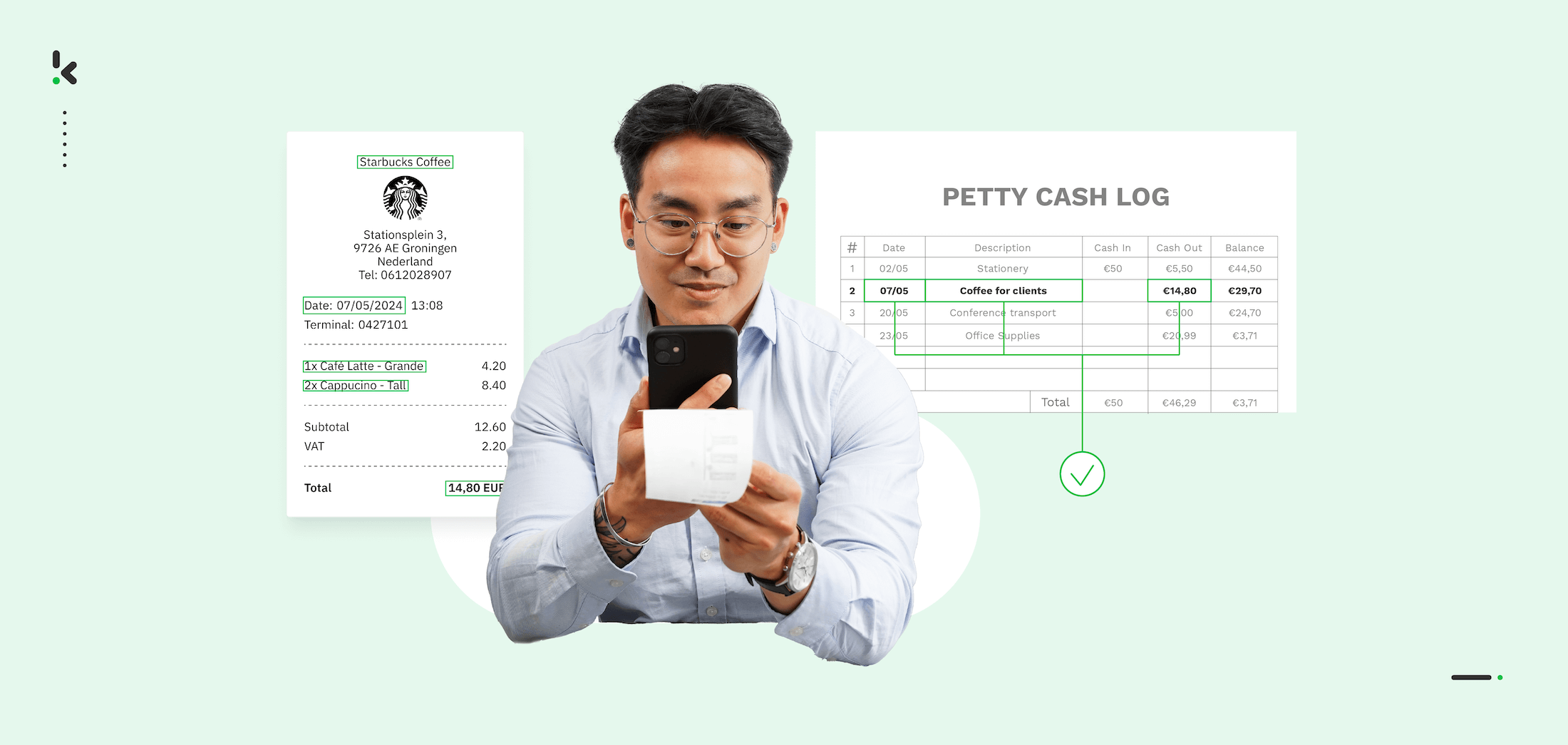

Here is how Klippa SpendControl transforms an hours-long process into several clicks:

- Employees can submit their receipts by taking pictures or uploading files through a web or mobile application. They fill in the required information, such as the purchase description and any other fields specified by the company’s expense policy.

- SpendControl uses receipt OCR to scan the submitted receipts and extract relevant data, including the date, amount, merchant, and line items. It also checks for fraud, duplicates, and submission errors.

- When submission is complete, the expense is routed to one or more approvers based on the company’s business rules. For example, expenses over $100 are sent to the finance manager for approval, while expenses under $5 are automatically approved. Approvers receive notifications about each new expense to speed up the authorization process.

- Once an expense is approved, transactions can be recorded automatically in your preferred financial administration system or exported in your chosen file format, eliminating the need to track down receipts or reconcile expenses manually.

With Klippa SpendControl you can:

- Manage your vendor invoices, employee expenses, and business credit cards in one platform

- Automatically reconcile credit card transactions

- Submit, process, and approve business expenses via web or mobile app

- Prevent financial fraud and discrepancies with built-in duplicate and fraud detection

- Bundle and approve multiple expenses in a single report based on a project, cost center, or unit

- Achieve 99% data extraction accuracy with Klippa’s OCR

- Regain control over your finances with intuitive dashboards

- Customize your approval management with multi-level authorization flows

- Never fail to comply with tax and data privacy regulations with our ISO27001-certified and GDPR-compliant solution

- Rely on automatic multi-currency conversion for international payments

- Integrate SpendControl with your accounting and ERP software, like Xero, NetSuite, or SAP

FAQ

Cash reconciliation involves verifying that the actual cash on hand matches recorded transactions. The process includes gathering receipts, counting remaining cash, checking records for accuracy, identifying discrepancies, and documenting the reconciliation to ensure financial transparency.

Petty cash should be reconciled regularly, depending on company policy. Common schedules include weekly, monthly, or whenever the fund needs replenishment. It is especially important before audits or financial reporting periods, such as month-end or year-end close.

The most effective way to reconcile petty cash is through automation. AI-powered solutions like Klippa SpendControl streamline the process by digitizing receipts, detecting duplicates, and automatically recording transactions, reducing errors and saving time.