The development of Web 2.0 to 3.0 has indeed created many new businesses. With that, new avenues for crimes like cybercrime, AI-driven fraud (e.g., deepfakes), and financial statement fraud were born. According to BDO UK’s Fraud Survey 2024, 48% of businesses lost 1-4% of turnover to fraud.

The total reported UK fraud losses reached £2.3 billion, a 104% increase from the previous year. Despite these numbers being very shocking and the threat growing, not all companies take adequate measures to prevent fraud. Only 13% of businesses increased spending on fraud detection tools like AI and data analytics.

So how can companies ensure they are well-equipped to protect themselves against fraud? What technologies can help them prevent fraud in the earliest stage possible?

Follow our practical guide to financial fraud prevention to guard your organization against such scams.

Key Takeaways

- Financial fraud is rising rapidly, causing severe financial and reputational damage to businesses; procurement fraud is among the top 3 most disruptive economic crimes.

- Manual financial processes create vulnerabilities that fraudsters easily exploit, leading to costly fraud incidents.

- AI-driven document processing significantly reduces fraud by automating data extraction, identifying suspicious patterns, and enforcing compliance.

- Klippa SpendControl protects your company by automating expense and invoice management, ensuring accuracy, compliance, and enhanced financial security.

What is Financial Fraud?

Generally, fraud is the act of deceiving someone to gain financial or personal benefits through dishonest means. Financial fraud, on the other hand, refers to this type of deception, but related to finances, such as money, assets, or other things of value.

As businesses continue embracing digital transformation, fraudsters are finding new ways to commit financial crimes. Still, not all companies have the technical knowledge to keep up with the changes within the online environment. Companies adopting new technologies often face gaps in cybersecurity, compliance, and fraud prevention, thus creating a particular vulnerability for financial fraud to take place.

To keep yourself up to date with what is currently happening, we have collected statistics from several sources:

- Procurement fraud is among the top three most disruptive economic crimes; 55% of companies recognize it as a widespread issue in their country, but many are not using available tools to combat it.

- International scammers have siphoned away over $1.03 trillion globally in 2024

- Most respondents of the Nasdaq Verafin 2024 Global Financial Crime Report trust the new technologies as potential solutions to financial crimes.

In order to prevent fraud, the first step is to be able to identify different types of fraud. Below, we have listed a few examples of financial fraud.

The types of financial fraud

Fraud can be committed by people or parties inside and outside an organization. The types of fraud that we often come across in various industries are business identity theft, invoice fraud, and expense fraud.

Business identity theft

Business identity theft, also known as corporate identity theft, refers to a criminal party that impersonates a company’s identity to sell goods or to apply for government support funds or loans from creditors for financial gain.

By stealing a company’s identity through phishing, email interceptions, or abusing their relationship with employers, thieves can get information (registration number, invoice number, client number, etc.) about the business relationship between parties.

The extracted data can then be used according to your needs, such as passing it on to any desired system. With the acquired knowledge, they are able to create convincing fake invoices and establish a line of credit with retailers, investors, or banks to gain money.

Even governments are not safe as fraudsters have been successful in receiving support funds from governments in times of crisis.

Both external and internal stakeholders can engage in this type of fraud as long as they can get their hands on essential information and invoices.

Invoice fraud

Invoice fraud is a type of fraud in which a fraudster changes the payment details to an invoice in order to deceive companies or individuals into sending the fraudster money.

Fake invoices are created when the fraudster has knowledge of the relationship between the buyer and the seller concerning payments. Recovering money from fraudulent accounts can be extremely difficult.

Many companies lose money to internal stakeholders, such as employees who participate in this fraudulent activity. As the employees have knowledge and access to essential information, they can exploit the company’s policy or process vulnerabilities.

In one case, CPC Commodities lost more than $765,000 to an accountant as he created duplicate accounts payable invoices from vendors over a five-year period.

Expense fraud

Expense fraud is an attempt to inflate an organization’s reimbursements in the form of expense claims. This type of expense fraud occurs when an employee knowingly takes advantage of the employer by engaging in inaccurate claims.

Not all expense frauds are done intentionally, as there are cases of simple human error or missing receipts. The most common scenarios of reimbursement fraud submitted by employees:

- Items that were never purchased are being claimed for

- Auto mileage reimbursement while carpooling

- Reimbursement of unused trips

- Using “business dinner” as a way to dine with friends and family

- Overstating the expenses

- Duplicating receipts for reimbursement

Whether the fraud is small or large, it drives up the costs of a business and cuts into a company’s bottom line. Below, you can find a detailed explanation of the most common negative effects any type of financial fraud has upon a business and its customers.

What is the Impact of Financial Fraud?

Fraud isn’t just a risk – it’s a reality that businesses and consumers deal with every day. The worst part? Its consequences can be long-lasting and difficult to undo.

For financial companies, it’s not just about spotting fraud when it happens but staying ahead of it before it causes real damage. So, what does fraud actually cost, and who feels the impact the most? Let’s break it down.

| Impact of Fraud | Impact on Businesses | Impact on Consumers |

| Financial Loss | Direct financial losses from fraudulent transactions, chargebacks, and theft. | Loss of funds due to unauthorized transactions or identity fraud. |

| Reputation Damage | Negative publicity reduces customer trust and deters potential investors and partners | Trust in financial institutions or service providers diminishes, leading to a loss of customer loyalty. |

| Operational Disruptions | Fraud investigations and mitigation efforts consume internal resources, delaying key operations. | Fraud-related disruptions in banking or payments delay transactions and impact financial planning. |

| Identity Theft & Data Breaches | Data leaks can expose sensitive customer information, leading to further legal and financial repercussions | Personal information can be sold or used for further fraudulent activities, impacting financial stability. |

| Customer Trust Loss | Clients lose confidence in the business, reducing retention rates and long-term profitability | Consumers become more hesitant to share personal information, affecting digital engagement. |

When fraud strikes, businesses and consumers both pay the price. A single case of fraud can mean lost money, stolen identities, and broken trust.

Having the right technology, like expense management policies and automated document processing in place can go a long way in anticipating threats and creating a safer experience for customers. Let’s see what businesses can practically do to prevent financial fraud.

How Can Organizations Prevent Financial Fraud?

Undoubtedly, companies must pinpoint where the losses come from and prevent fraud before shrinking the bottom line. Fighting a battle against financial fraud can be dreadful as fraudsters are organized and know how to exploit an organization’s vulnerability using sophisticated techniques.

There are certain measures that organizations can take to protect themselves proactively. These preventive measures can save a lot of time and money in the short and long run.

Here are five ways you can protect your company.

Anti-fraud training

One way to prevent fraud is to provide anti-fraud training without any exemptions based on an individual’s position within the organization. The training should aim to raise awareness about the ethics, policies, and code of conduct revolving around fraud.

The employees and the management need to know what is considered fraud and how to act when fraud is suspected. It is essential to have mandatory attendance with regular updates and refresher sessions to create practical training.

By having a zero-exemption policy for the training, organizations can create an anti-fraud culture where every individual is equally responsible. When leaders follow the rules, employees will do the same.

Such a culture can only positively impact the results and lead to a decreased risk of fraud.

Selective auditing

Having selective auditing to monitor expense claims, especially for new hires, is a great way to verify compliance with the expense policy. Auditing could be performed for every 5 or 10 expense claims, for instance, to correlate receipts with specific events or trips.

Frequent monitoring allows management to identify and report fraudulent activities much more rapidly. For further inspection, the expense claims and payroll accounts can be examined for unusual transactions, amounts, or irregularities.

This preventive measure is a proactive way to assess fraud risks. Often, technology and tools can help the management identify vulnerabilities that are not feasible with human effort alone.

Examination of Documents

Passive fraud prevention methods may consume less effort and money to implement. However, the fraud schemes can drag on for a long time before being detected, thus draining a company’s bottom line.

A proactive fraud prevention measure, like document examination, can lead to a shorter time to discover a fraud as well as a lower median loss associated with it.

Replacing the manual examination of receipts, invoices, and other documents related to expenses with a digital approach can reduce the costs of human error and prevent fraud.

With the digitization of documents, organizations can examine the records more efficiently with the latest technology available. After all, there is only so much that the naked eye can detect.

Reporting mechanism and a hotline

As the cases above illustrate, internal stakeholders commit many financial frauds. A reporting mechanism and a hotline help organizations detect fraud and reduce losses faster.

According to the Association of Certified Fraud Examiners (ACFE), most tips regarding fraud by employees are received from other employees. However, a significant amount of tips were received from external stakeholders such as customers and vendors.

Therefore, educating both internal and external parties about anti-fraud measures, mechanisms, and an organization’s hotline increases the likelihood of fraud detection through tips.

It is essential to know that crafting reporting mechanisms and educating internal and external stakeholders can consume time and effort.

Even so, it is likely to save your company a significant amount of money in the long run.

Implement AI-powered technologies

Fraudsters are becoming more and more sophisticated. As they can gather real-time data about vendors, suppliers, and partners through various methods, preventing fraud requires implementing the right technology.

Manually processing documents such as invoices and receipts leaves many fraudulent documents undetected. There is a limit to what the naked eye can detect, especially when processing a large volume of documents.

Currently, most fraud is detected with the help of artificial intelligence. AI solutions can analyze vast amounts of data in real time, identifying suspicious patterns and flagging anomalies that may indicate fraud by inspecting them visually and examining their EXIF data. Machine learning models continuously improve by learning from new fraud cases, making detection more accurate over time.

Automated systems can also cross-check identities, validate documents, and detect inconsistencies faster than manual reviews. This reduces false positives, speeds up fraud prevention, and helps businesses stay ahead of emerging threats.

Benefits of Automated Financial Fraud Prevention

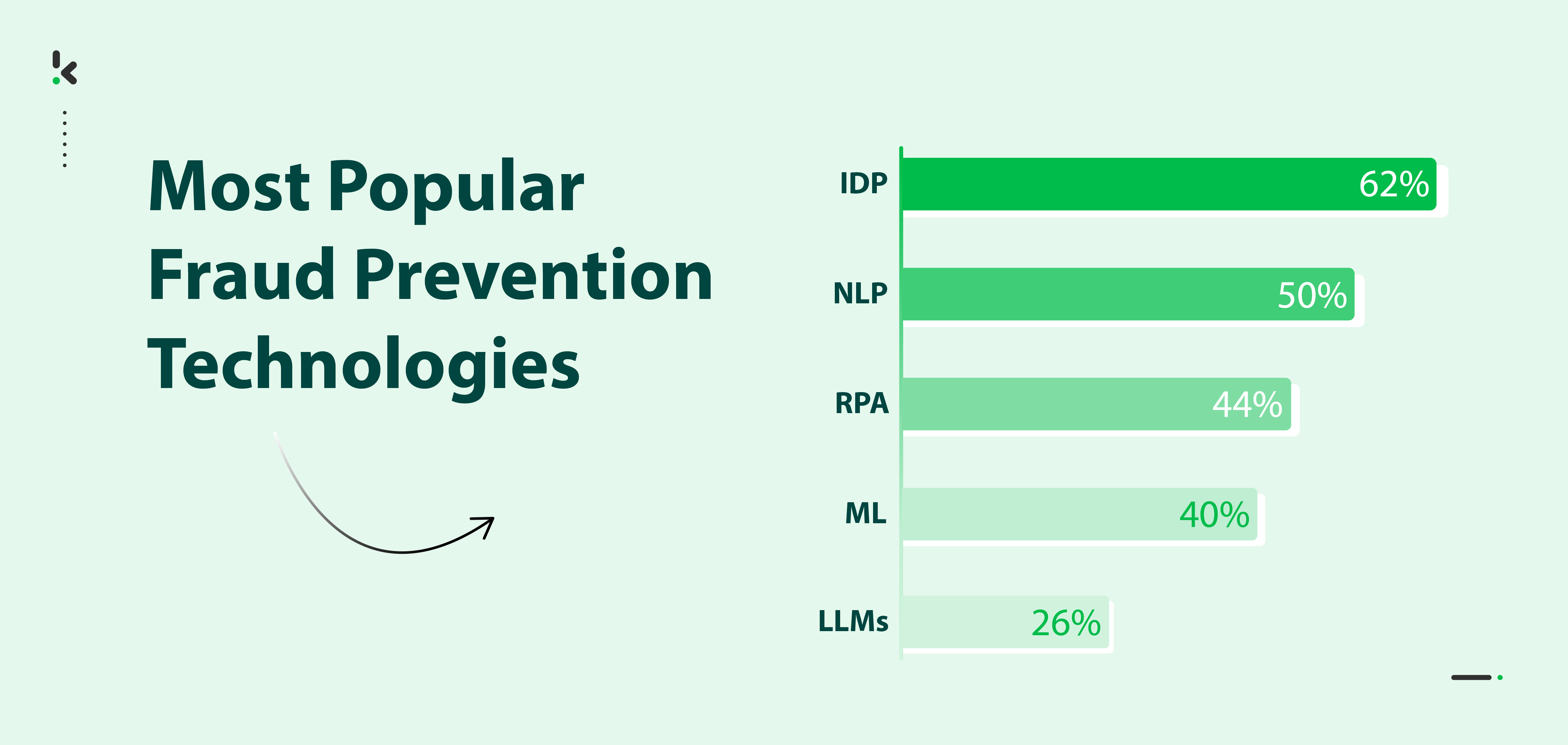

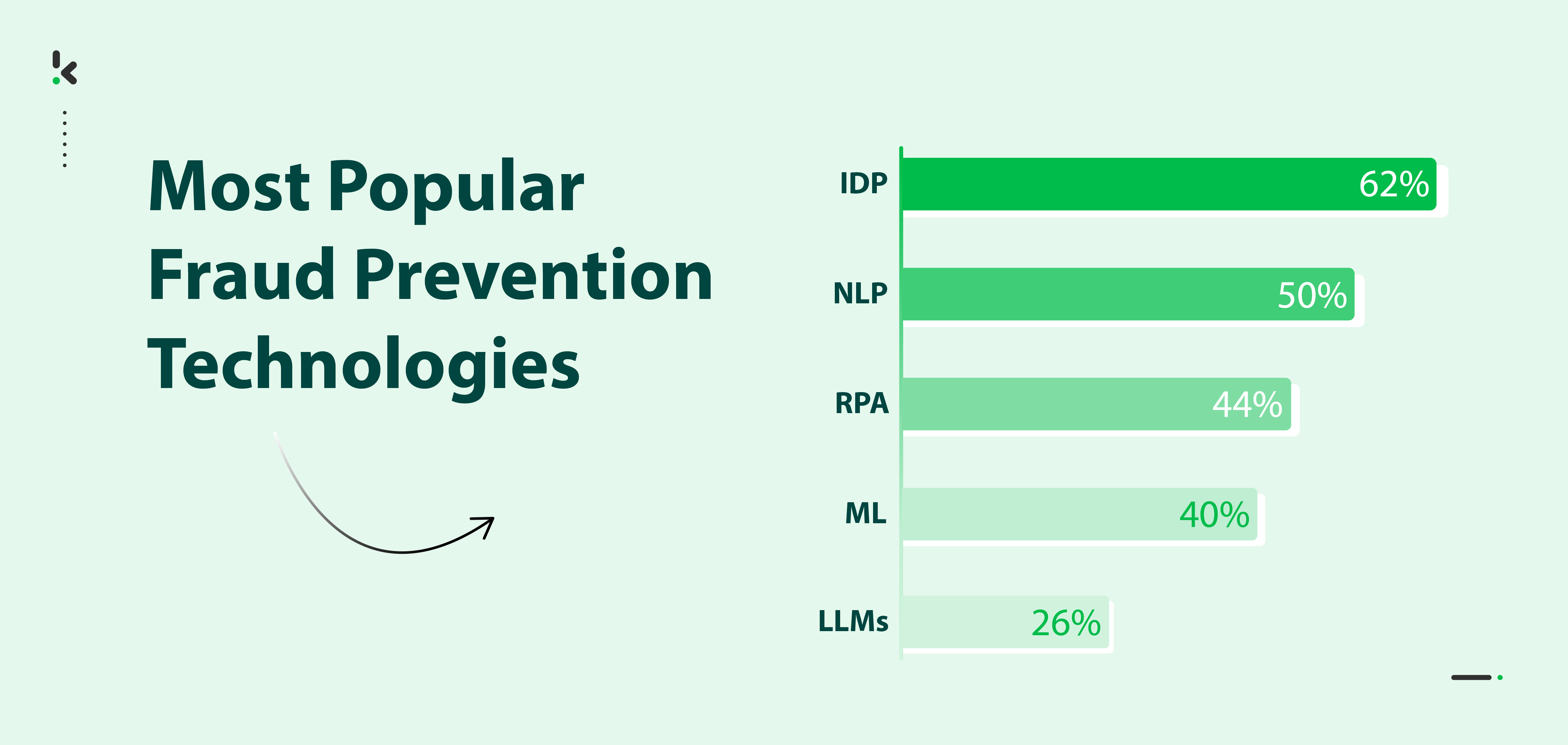

It’s necessary for companies to automate their document processing with an AI solution to stay one step ahead of the attackers. This is where Intelligent Document Processing (IDP) solutions and OCR software can help with fraud prevention and:

- Faster detection: These technologies can analyze transactions in real-time, instantly flagging suspicious activity and reducing response time.

- Higher accuracy: Machine learning continuously improves by learning from new fraud patterns, reducing false positives while catching more sophisticated fraud attempts.

- Cost savings: Automating fraud prevention reduces the need for manual reviews, cutting operational costs while also minimizing financial losses from fraudulent activities.

- Compliance: AI-driven fraud detection ensures a thorough and consistent verification process, helping organizations meet compliance requirements without adding unnecessary workload.

- Scalability: AI systems can handle large transaction volumes without slowing down, making them ideal for growing businesses.

- Improved customer experience: By reducing unnecessary transaction blocks and verification delays, businesses can offer a smoother and more secure experience for their customers while keeping fraud at bay.

Many organizations have already implemented AI-driven fraud prevention solutions, enhancing their financial security and operational efficiency. Here’s how businesses like InSpark and Storm Digital serve as prime examples of how automation strengthens fraud prevention while streamlining expense management.

InSpark, a Microsoft Gold Partner and award-winning leader in digital transformation, enjoys automated security and access control, dynamic approvals and no manual intervention in expense workflows – all while having full compliance and auditability.

Storm Digital, a leading growth marketing agency with high-profile clients such as ABN Amro and KLM, now spends 68% less time processing expense claims, improved their financial control and fraud prevention, and saved significant costs.

But what happens when you just can’t timely prevent fraud and it happens anyway?

Below, you can find a couple of cases that describe how fraudsters managed to exploit the vulnerabilities of different entities.

Financial fraud cases

Even some of the most well-known companies globally are not safe from fraudsters. Frauds are hard to detect as often the losses incur a slow drain of funds or a drop in profitability that can spread out to several years.

To illustrate this, we have prepared two financial fraud cases for you: one from KIA Motors America and the other from PACE Worldwide.

Invoice fraud: KIA Motors America

In this case, where KIA Motors America lost nearly $1 million, the fraud was committed by an employee in the accounting department. With the help of her family members, she set up a fictitious business name and opened a bank account under it.

After the initial setup, she altered a fresh copy of a valid U.S. Customer Services invoice by changing the date. Additionally, she replaced the bank routing number with the bank account opened before under a fictitious business name.

As the fabricated invoices were processed by the accounts payable department without further questions, KIA wired $889,000 in total to the bank account set up by the fraudsters before they ended up being caught and sentenced to prison.

This case shows how easy it is to alter documents. Nowadays, it is even more frightening with all the available technologies.

Expense fraud: PACE Worldwide

In the case of PACE Worldwide, a couple used forged receipts and invoices in a seven-year scheme between 2002 and 2009 to engage in corporate credit card fraud. They managed to receive $1 million from their employer until they were found guilty.

How did they do it? They simply used corporate credit cards for personal gains and submitted reimbursements to PACE, falsely describing them as “business expenses”. Additionally, they fraudulently billed PACE Worldwide and PACE Europe Ltd. for their “business expenses” to obtain reimbursements twice.

As executives of the organization, both took advantage of their position, which made the scheme successful. One of them repeatedly fabricated invoices and receipts in a way that made them look legitimate to be considered as business expenditures.

To avoid these types of cases, having expense management policies and automated document processing in place can go a long way in spotting duplicates and detecting fraud.

How to Automate Financial Fraud Prevention with Klippa

Prevent employee fraud by automating expense and invoice processing with an expense management solution. Gain control over your expenses by eliminating paper-based workflow, manual data entry, and unsupervised physical approvals with Klippa SpendControl.

Klippa SpendControl is an all-in-one digital pre-accounting software that combines invoice processing, expense management, and corporate credit card modules for all your financial needs.

Our software utilizes Optical Character Recognition (OCR) technology to ensure 99% accurate document data capture, which eliminates manual data entry for secure approval, archiving, and booking of statements directly to your financial administration.

- Manage your invoices, expenses, and credit card transactions in one platform

- Control the submission, processing, and approval of transactional documents via email, web, or mobile app

- Ensure segregation of duties with custom roles and controls

- Customize your approval management with multi-level authorization flows

- Prevent expense report fraud with built-in duplicate and fraud detection

- Accurately track business mileage through our Google Maps integration

- Set strict business spending limits with our company credit cards

- Get real-time insights into your finances with our expense dashboards

- Never fail to comply with your local tax and data privacy regulations with our ISO27001-certified and GDPR-compliant solution

- Integrate SpendControl with your accounting and ERP software, like Quickbooks, NetSuite, or SAP.

Ready to protect your company against financial fraud with Klippa? Let us help you in the fight against fraud. Plan a free demo with our experts or contact us if you have any questions.

FAQ

Common financial fraud schemes include invoice fraud, expense reimbursement fraud, procurement fraud, and business identity theft. These methods exploit weaknesses in financial processes to misappropriate funds.

Techniques like phishing emails, invoice manipulation, identity theft, and interception of communications are used. Fraudsters impersonate businesses through deceptive messages, tricking victims into providing personal details or clicking malicious links. Invoice fraud involves altering payment information to redirect funds, while identity theft involves obtaining personal or corporate information to create fake accounts or financial documents.

Klippa’s OCR technology digitizes and validates invoices and expense claims, automatically flagging anomalies such as duplicate submissions, altered documents, or unusual expense patterns, helping to prevent financial fraud proactively.

Absolutely! Klippa DocHorizon scales to suit businesses of all sizes, from SMEs to large enterprises, offering tailored solutions that fit varying business needs and budgets to combat financial fraud.