Before agreeing on a deal, businesses negotiate the terms and conditions (price, discounts, delivery date, etc.) of the deal beforehand.

Once the negotiations are over, it is common for a business to send a preliminary draft of the invoice stating all agreed-upon deliverables to the buyer. This document serves as a provisional agreement and is called a pro forma invoice.

Even though pro forma invoices are widely used, they are regularly confused with regular invoices. To avoid this confusion and help you use pro forma invoices to your advantage, this blog explains what a pro forma invoice is, when it is used, and how it differs from other invoices.

Let’s start.

Key Takeaways

- Clear Transaction Terms: A pro forma invoice outlines agreed-upon terms before the final invoice, ensuring transparency for both buyer and seller.

- Flexible & Non-Binding: It serves as a quotation and can be adjusted before the final sale, but it is not legally binding or used for accounting.

- Key Business Benefits: Helps streamline sales, facilitate negotiations, and improve buyer-seller relationships.

- Comparison to Other Invoices: Differs from quotations, sales invoices, commercial invoices, and purchase orders in purpose and legal standing.

- Smart Invoice Processing: Klippa SpendControl automates pro forma invoice handling, reducing errors, saving time, and ensuring compliance.

What is a pro forma invoice?

A pro forma invoice serves as an agreement of “good faith” between a buyer and seller that both sides are committed to the purchase/sale of the goods or services before they are supplied.

That way, buyers are protected from any sudden or unexpected overcharging that might be made by the seller. At the same time, the seller can be reassured that the order will be completed and paid once the final sales invoice is issued.

It is crucial that a pro forma invoice is visibly labeled as a “pro forma invoice” and that it has no invoice number. This means that the invoice should never be included in the accounting records, as it is not useful for accounts payable.

Even though the pro forma invoice already contains an issue date, a description of what is being sold, the total amount payable, and any taxes or fees that may be incurred, the terms of sale can still be changed.

So what would then be the right time to send out a pro forma invoice?

When should you send a pro forma invoice?

Usually, a pro forma invoice is sent to a customer when they commit to purchasing from a supplier, but because final details still need to be confirmed, an official invoice cannot be issued yet.

Another moment to make use of a pro forma invoice is when shipping goods internationally. Customs laws require information about the goods being shipped, weight, packaging, and delivery fees, which is where the pro forma invoice comes in handy. It makes details about the shipment easily accessible and visible, which ensures speedy customs clearance.

Now we know when a pro forma invoice can be sent to a customer, but is the invoice immediately legally binding once it’s received? And if so, is there a chance to cancel the invoice again? Let’s have a look at that.

Is a pro forma invoice legally binding?

The pro forma invoice is not legally binding, as it should be more regarded as a quotation. As previously mentioned, even though a pro forma invoice often entails pretty much all information like a final sales invoice, it can not be used for accounting purposes. This is because information can still be negotiated and changed. Thus, it doesn’t carry the same legal weight as a final sales invoice.

Can a pro forma invoice be canceled?

Since a pro forma invoice is not legally binding and is not an actual invoice, it doesn’t need to be canceled. It is more like an estimate of what the buyer and seller can expect from the purchase. That means, if changes are made, a new pro forma can be sent or if the sale doesn’t go through, no further actions are needed.

If you aren’t fully involved in accounting processes, the context of the pro forma invoice might still be a little confusing. Therefore, it makes sense to have a closer look at the different types of invoices next.

Pro forma vs. Other Types of Invoices – What are the differences?

Previously, we already mentioned that a pro forma invoice is comparable to a quotation. But there are also differences, especially in their purpose. Next, we want to go into more detail about how a pro forma invoice differs from other types of invoices used in day-to-day business.

Quotation

When a potential customer expresses interest in buying from your business and is requesting details about, e.g. the pricing, a quotation could be sent. A quotation is considerably less formal than a pro forma invoice and is typically sent during the early stages of a sale.

Just like the pro forma invoice, a quotation is not legally binding or with any kind of expectations behind it. The sale can either be accepted by the potential buyer or easily just canceled without any consequences.

Sales invoice

A sales invoice is used when the goods/services have been delivered and need to be paid for. Unlike the pro forma invoice, this invoice is legally binding and is highly relevant in the accounts payable process. Furthermore, it can also serve as a tax invoice, as it includes VAT and other taxes.

Commercial invoice

Commercial invoices are primarily used for international shipments and state the exact quantity that is being shipped. They are used as shipping documents and by customs at every port because they assure customs officials that export compliance requirements have been met.

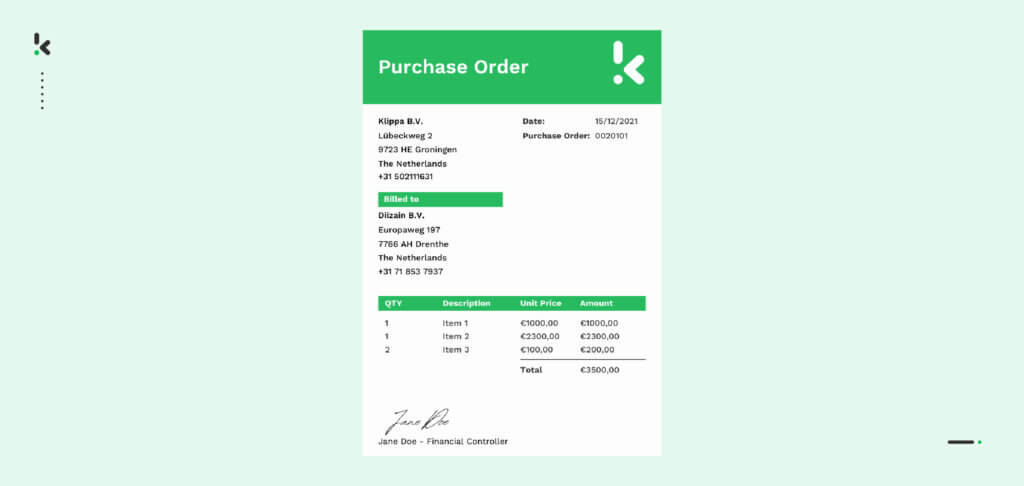

Purchase Order

Purchase Order (PO) is sent by the buyer to the seller. It is a commercial document that confirms the purchase of goods. This document is legally binding, because the terms and conditions cannot be negotiated anymore.

Even though both documents, pro forma invoice and purchase order, are both sent before the goods have been delivered, there is one main difference. The pro forma invoice is issued by the seller to the buyer, whereas a PO is issued by the buyer to the seller.

Now we’ve talked about the different types of invoices, we should quickly discuss how taxes are included on a pro forma invoice.

How are taxes included on a pro forma invoice?

As previously mentioned, a pro forma invoice states all taxes that apply to the purchase. Therefore, the VAT registration number of both the buyer and supplier needs to be clearly visible.

But even though taxes are stated, the pro forma invoice is not a final sales invoice and can not be used for tax purposes. This is because the sale is not fully completed yet, and the pro forma invoice doesn’t fit the “tax point”, which is always the time of supply. Only the final invoice with the data of the transaction (the actual time of supply) fits the tax point and can be used for claiming VAT.

So now that we learned all these different things about pro forma invoices, we should also talk about why they are beneficial for business transactions.

What are the benefits of a pro forma invoice?

There are a couple of benefits of a pro forma invoice that make the use of them very necessary. Let’s see what those are:

- Transparency → A pro forma invoice creates transparency for both parties over the agreed-upon terms and conditions (delivery date, pricing, quantity, etc.) of the purchase.

- Streamlines sales process → The pro forma invoice is great for streamlining the sales process between the seller and buyer prior to confirming the purchase.

- Functions as a tool for negotiations → Buyer and seller can use this invoice to negotiate better terms and to make changes to the order since the pro forma invoice is not legally binding.

- Better customer relationships → As previously mentioned, a pro forma invoice serves as a “good faith” agreement. This shows trust between the two parties and ensures that both are committed to the purchase.

With these benefits in mind, we should definitely have a look at how a pro forma invoice is structured.

How to structure a pro forma invoice?

In general, a pro forma invoice is very similar to the final sales invoice. It basically contains the same information and can easily be created with, e.g. your accounting software. So what should be included in the invoice?

What to include?

A pro forma invoice should always contain all the information a buyer needs to confirm an order. The information to include are:

- Date of issue

- Seller & buyer details (Address, contact details, etc.)

- Details of services/goods

- Prices

- Payment method

- Taxes

- Total amount

- (If applicable) pro forma invoice number

- Label “pro forma invoice”

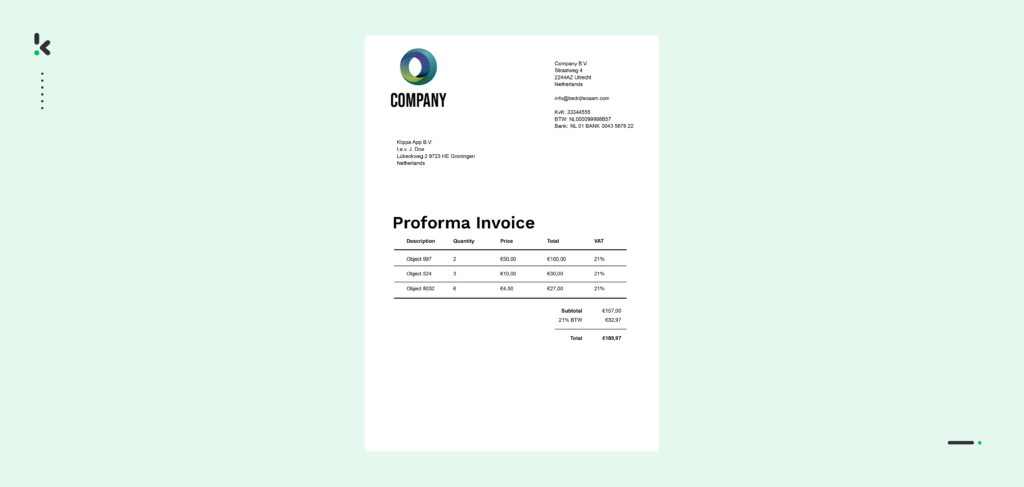

Pro forma invoice example

Let’s have a look at an example of a pro forma invoice. As you can see, the invoice is clearly indicated as a pro forma invoice and doesn’t display an invoice number. All other information is included on the invoice.

Throughout this blog, we talked about several invoices that a business works with and receives. For most businesses, day-to-day transactions and interactions with customers and other companies result in a large amount of invoices.

Having accounts payable to manually take care of hundreds or even thousands of these invoices is very time-consuming, expensive and can lead to unnecessary mistakes. This is why many software companies have developed software solutions with which you can easily automate invoice processing.

How can Klippa help you process invoices?

At Klippa we help you to automatically process your invoices. From sales invoices and purchase orders to pro forma invoices, with Klippa SpendControl you can easily automate your invoice processing.

With a single photo of a pro forma invoice, our OCR & AI-based invoice processing software can extract all relevant information within a couple of seconds. Since our software can easily be integrated into any accounting or ERP software used by your company, all extracted information is automatically saved in your database.

This doesn’t only save you time and effort, but also drastically reduces your accounting expenses.

On top of that, Klippa SpendControl can automatically identify and prevent invoice fraud, streamline your invoice approval processes and allows you to view financial data in real time.

FAQ – Pro Forma Invoice

A pro forma invoice is a preliminary invoice issued before the final sale to outline the terms and conditions of a transaction. It serves as a non-binding agreement between the buyer and seller.

A pro forma invoice is commonly used when: 1) A buyer commits to a purchase, but final details still need confirmation or 2) International shipments require documentation for customs clearance.

No, a pro forma invoice is not legally binding and cannot be used for accounting or tax purposes. It functions as a quotation rather than a final sales invoice.

A pro forma invoice is issued before goods/services are delivered and is not legally binding.

A sales invoice is issued after delivery and is legally binding, serving as a payment request.

While both outline pricing and details, a quotation is a general price estimate, whereas a pro forma invoice is a more formal document that reflects a commitment to proceed with the transaction.

Since it is not a final invoice, a pro forma invoice does not require cancellation. If terms change, a new pro forma invoice can be issued.

Yes, they include applicable taxes, but they cannot be used for tax reporting as they do not meet the tax point (time of supply).

A pro forma invoice should contain: Issue date, seller & buyer details, goods/services description, prices & payment terms, taxes and total amount, clearly labeled as “Pro Forma Invoice”.

Businesses can use Klippa SpendControl, which automates invoice extraction, and processing, and reduces manual work and errors.