Is this draining you as well?

The idea of keeping track of receipts, invoices, and credit card statements for your business expenses? It can be overwhelming, especially when you have countless other things to worry about.

But here’s the thing: without proper proof of purchase, you could end up losing money on reimbursable expenses. And nobody wants that. So, what exactly counts as valid proof of purchase, and what should you do if you’ve lost one?

In this blog post, we’ll guide you through everything you need to know about proof of purchase for business expenses. We’ll discuss exceptions, and special cases, and even provide a solution to digitalize the process of managing proof of purchases.

Get ready to take control of your business expenses and never lose money again!

What is a (valid) proof of purchase?

Proof of purchase (PoP) is a document that proves a transaction. It includes purchase details like the date, amount, and items bought. PoP is required for reimbursement of expense claims and tax purposes, and usually includes receipts, invoices, or credit card statements.

Having a valid proof of purchase is important for various purposes. As stated above, proof of purchase is commonly used to claim reimbursements for business expenses, such as travel, meals, and supplies. A proof of purchase is also important for tax purposes, as it provides documentation of deductible expenses and helps businesses and individuals avoid penalties for inadequate record-keeping.

How to use proof of purchases

The standard way of claiming business expenses is to submit a proof of purchase along with an expense declaration form. This form provides details about the nature of the expense, such as the purpose, date, and amount. It may also require additional information, such as the client or project associated with the expense.

Some companies use expense management software, like Klippa SpendControl, to automate this process and streamline expense reimbursements. With this software, employees can capture digital copies of their proof of purchase (e.g. receipts) and complete the necessary forms online, which saves time and reduces errors.

Before telling you more about these solutions, it is important to know the ins and outs of handling proof of purchases. Like any other topic, there are exceptions and special cases when it comes to proof of purchases, which we will explore in the next section.

Proof of purchase exceptions and special cases

Generally, the rules for reimbursing expenses are quite straightforward. Employees are required to keep a receipt and present it in a dedicated report (see our free travel expense report template). Some expenses are reimbursed with a unique set of requirements. In such cases, the standard rules for proof of purchase do not apply. Let’s take a look at a few of these exceptions and special cases:

Mileage claims

Employees who use their personal vehicles for business purposes may be eligible for mileage claims. However, to make a claim, they must provide certain details, such as:

- The trip’s purpose

- Starting and ending points

- Total distance covered

In some countries, additional information, such as the vehicle’s make, model, registration, and horsepower, is required as well. And for additional expenses like fuel or toll gates, a valid proof of purchase is necessary.

It’s worth noting that mileage reimbursement is typically tax-free when using official government rates. But if a company pays a higher mileage rate, the excess amount will be considered part of the employee’s salary and subject to taxes.

Daily allowances / Per diems

During a business trip, employees may receive a fixed amount of money from their employer to cover expenses such as meals or accommodation. This amount is known as daily allowance or per diems, and it varies based on the employee’s location and the duration of the trip. Employers usually calculate and include these allowances in the employee’s salary without requiring specific supporting documents.

Meal expenses

If an employee spends money on food as part of their work duties, they may be eligible for reimbursement. As always, they need to provide valid documentation that includes the purchase date, location, and amount. If the meal is shared with others, the reimbursement claim should include:

- Names of any guests, whether external or internal colleagues

- Guests’ titles

- Company name

These requirements may differ depending on the company’s expense policy, but it’s generally a good idea to include them. Also keep in mind that if the employee receives a daily allowance or meal vouchers, they should deduct these amounts from their meal reimbursement claim to avoid double payment.

Accommodation expenses

When it comes to claiming reimbursement for accommodation expenses, it’s important to ensure that the receipt or invoice includes all the necessary information. This typically includes:

- The duration of the stay

- The category of the room

- Any additional charges (such as meals, mini bar, wellness services, etc.) that are not covered within the room charge.

These additional expenses should be listed and itemized separately from the room rate. Additionally, some companies have their own policies regarding what types of accommodation expenses are eligible for reimbursement, so it’s always a good idea to check with your employer or HR department to make sure you’re submitting your claim correctly.

Expense reimbursement with a missing proof of purchase

When you don’t have a proof of purchase for your business expense, there are still ways to get reimbursed. Some employers allow you to submit a written explanation of the expense, along with a signed statement verifying its accuracy. However, it’s important to note that not having a proof of purchase may raise red flags with tax authorities and could potentially lead to legal consequences for the business.

To avoid any issues, it’s best to keep track of all receipts and invoices related to business expenses. In some cases, digital copies or credit card statements are accepted as proof of purchase. It’s always better to avoid the risk and have proper documentation, rather than facing legal or financial repercussions for lack of proof.

But what if you do lose the proof of purchase receipt? How to get reimbursed without a proof of purchase? We will answer these questions in the next section.

How to get your expenses reimbursed without a proof of purchase?

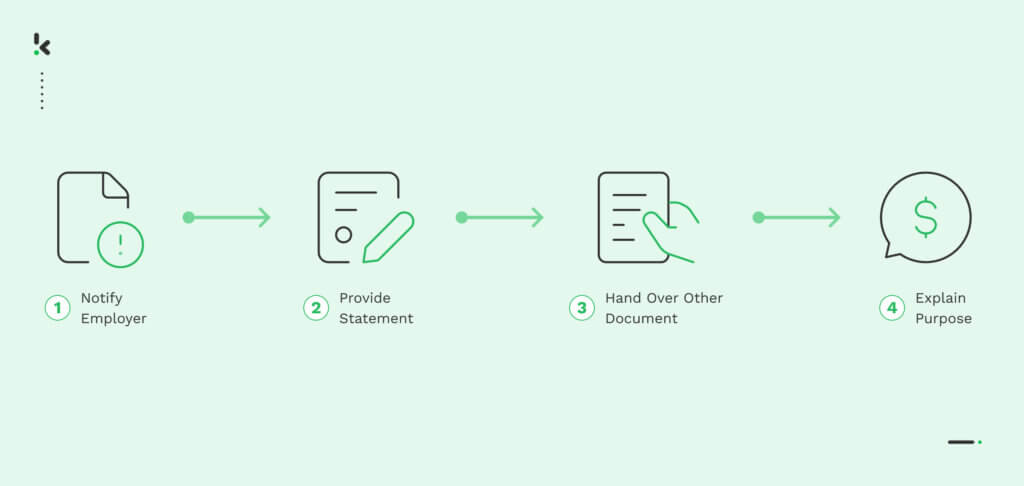

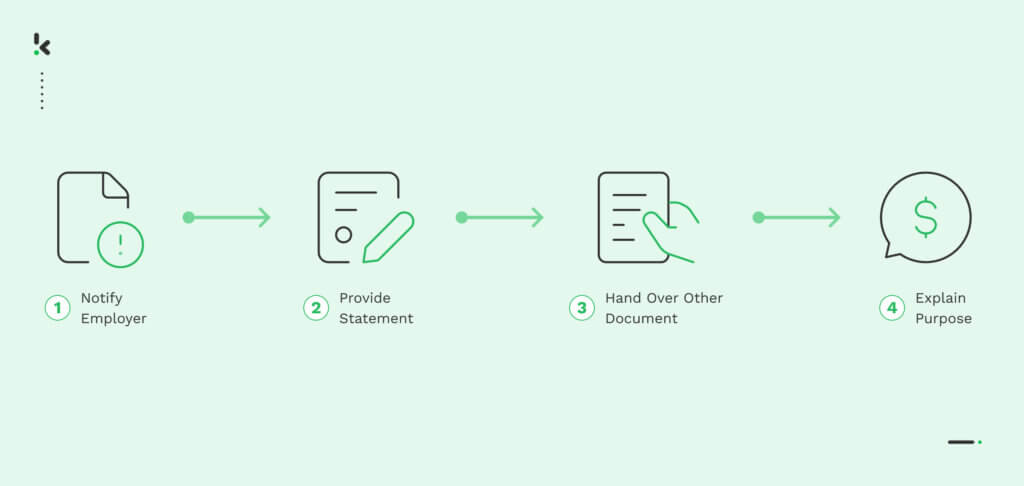

Getting expenses reimbursed without a proof of purchase can be hard. However, here are some steps that can help you:

- Notify your employer immediately about the missing documentation.

- Provide a signed statement justifying the expense with as much detail as possible, including the amount, date, location, and reason for the expense.

- Provide any alternative documentation you may have, such as a credit card or bank statement.

- Explain why the expense was necessary for business purposes.

Keep in mind that the reimbursement of expenses without proof of purchase is at the discretion of the employer and may not always be possible. It is always best to keep proper documentation for all business expenses to avoid any issues.

To keep your proof of purchase safe and secure, digitalizing them by adapting receipt capturing is the way to go. A possible solution is to use expense management software such as Klippa SpendControl. In the following section, we will provide you with all the information you need about this solution and how it can help your business avoid unnecessary complications.

Automate your expense management with SpendControl

Klippa SpendControl is an innovative expense management platform that simplifies and streamlines the expense claim process. Its user-friendly mobile app allows employees to submit expenses with a valid proof of purchase in just 30 seconds.

The solution also facilitates efficient approval of claims, while storing all documents safely. Next to that, you can integrate SpendControl with your desired accounting software to guarantee compliance and reliable bookkeeping.

Say goodbye to the hassle of saving and sharing your proof of purchase later. With Klippa SpendControl, you can easily submit your proof of purchase directly, streamlining your expense reporting process. No more paperwork, no more fuss.

The main benefits of using Klippa SpendControl as your expense management solution, include:

- Increased efficiency: Automating and digitizing the expense claim process saves time and effort for both employees and managers. This means they can spend more time on their core business.

- Improved accuracy: With automatic text recognition, driven by OCR, the chances of human error are significantly reduced. This leads to fewer errors and saves time.

- Better compliance: Laws and regulations can be complex and vary by region. Klippa SpendControl helps ensure compliance by storing all documents for 10 years for possible audits.

- Reduced fraud risk: By manually processing proof of purchase receipts, there is always a risk of fraud. With Klippa SpendControl, on the other hand, you minimize this risk through its built-in fraud detection and duplicate check feature.

- Easy mileage reimbursement: With the Google Maps integration you can easily claim your mileage expenses by filling in the starting and ending position of your trip. The solution will automatically display the total distance covered and calculate the travel reimbursement.

- Greater visibility: With digital claims and automated processing, it’s easier for budget holders to track expenses in real time, reducing the risk of overspending.

- Reduced paperwork: By going paperless, Klippa SpendControl reduces the need for physical storage and makes it easier to access expense information from anywhere.

- Seamless integration: Klippa SpendControl integrates seamlessly with various accounting systems, like NetSuite or SAP. This makes it easy to reconcile expenses and create accurate financial reports.

Overall, Klippa SpendControl can lighten up your job by making proof of purchase processing effortless. With the added benefits and advanced features, submitting claims, organizing expenses, and processing them in your accounting solution will be a breeze.

Are you interested in what Klippa SpendControl can do for your proof of purchase management process? Book a demo or get in touch with one of our experts!