Tracking a high volume of purchase requests, managing extensive documentation, and keeping accurate records with scattered data can be difficult when navigating the manual Purchase-to-Pay (P2P) process.

These challenges can put a strain on your finance team, resulting in higher operational costs and missed opportunities with vendors. As companies grow, the complexity of managing these elements increases, making it essential to automate the P2P process to ensure efficiency and accuracy.

In this blog, we will explore the P2P process and introduce the benefits of automation. You will learn how to streamline your operations, reduce errors, and enhance compliance. Additionally, we will provide best practices and insights on selecting the right automation solutions to transform your purchase to payment workflow.

What is Purchase-to-Pay?

Purchase-to-Pay (P2P) is the process of acquiring goods and services and ensuring timely payment to suppliers. This process starts with the submission of purchase requests from employees and includes approvals, the creation of purchase orders, and supplier invoice processing. Key steps involve invoice data capture, verification, two-way or three-way matching, invoice approval, and finally, the successful payment for the received goods or services.

Purchase-to-Pay vs Procure-to-Pay

Often, the terms “Purchase-to-Pay” and “Procure-to-Pay” (P2P) are used interchangeably; however, there are subtle differences between them:

- Purchase-to-Pay: Focuses on the transactional side of procurement, starting with a purchase order and ending with payment

- Procure-to-Pay: Encompasses the entire procurement lifecycle, from identifying needs and sourcing suppliers to the final payment, including strategic elements

Understanding these differences can help you choose the right solution and effectively optimize procurement and payment workflows within your finance team.

Understanding the Purchase to Payment Process

In simple terms, the Purchase-to-Pay process contains stages of purchasing goods or services from vendors and paying for them. This process involves several key steps to ensure a smooth transaction between your company and a supplier.

Let’s take the example of an office that decides to order new computers:

- Identifying Needs: The employees communicate the need for new computers by submitting a purchase requisition to a procurement department, office manager, or other responsible administrative staff in the office

- Creating a Purchase Order: If a purchase requisition is approved, the procurement department creates a purchase order (PO) document that specifies details such as item descriptions, quantities, prices, delivery dates, and terms

- Sending the Purchase Order: The procurement department sends the purchase order to a selected computer supplier, asking for a quote or immediately placing an order

- Receiving Goods/Services: The vendor delivers the new computers to the office

- Inspecting the Delivery: The office checks whether the computers are in good condition and match the PO specifications

- Processing the Invoice: The vendor sends an invoice for the computers, and the office verifies that the invoice matches the received goods

- Making the Payment: The finance or accounts payable department processes the payment and pays the vendor for the received computers

Every step involves coordination and accuracy, from creating and sending purchase orders to processing invoices and making payments. Companies employ various practices to optimize these stages to make this process less labor-intensive.

Common P2P Pitfalls

Navigating the Purchase-to-Pay (P2P) process can be complex, and several common pitfalls can hinder your efficiency and effectiveness:

- Lack of Standardization: Without standardized procedures, you may encounter inconsistencies and errors.

- Poor Data Management: Inaccurate or incomplete data can lead to incorrect orders and payment delays.

- Manual Processes: Relying on manual steps is prone to human error and time-consuming. Automate where possible to enhance accuracy and free up valuable resources for strategic tasks.

- Ineffective Communication: Poor communication between departments can cause delays and misunderstandings.

- Supplier Management Issues: Failing to manage supplier relationships effectively can result in supply chain disruptions.

- Inadequate Compliance Monitoring: Overlooking compliance can lead to legal and financial repercussions.

Best Practices of the Modern P2P Process

Optimizing your purchase-to-pay process can lead to significant efficiencies and cost savings. Here are some best practices to help you maintain compliance, ensure data accuracy, and leverage technology for better visibility and control:

Maintain Compliance

- Standardize procedures: Implement standardized procurement procedures across your organization, ensuring consistency and compliance with internal policies and external regulations.

- Regular audits: Conduct regular audits of your P2P process to identify and address any compliance issues promptly.

- Training: Provide continuous training for your procurement team on compliance requirements and updates.

Ensure Data Accuracy

- Automate data entry: Use automated systems to minimize manual data entry errors. Automation reduces the risk of inaccuracies and ensures that your data is reliable.

- Data validation: Implement data validation systems, such as two-way matching, within your P2P system to catch and correct discrepancies before they cause issues. This includes verifying supplier details, purchase order information, and invoice data.

- Regular reconciliation: Perform regular reconciliation of purchase orders, deliveries, and invoices. This practice ensures that discrepancies are identified and resolved quickly.

Leverage Technology

- Use integrated systems: Implement integrated P2P solutions that connect procurement, finance, and inventory systems. This provides a seamless flow of information and enhances visibility across the process.

- Real-time tracking: Utilize real-time tracking tools to monitor the status of purchase orders and payments.

- Analytics and reporting: Leverage advanced analytics and reporting tools to gain insights into your P2P process. Use these insights to identify trends, improve efficiency, and make strategic decisions.

Enhance Supplier Management

- Supplier portals: Use supplier portals to improve communication and collaboration with your vendors. Portals enable suppliers to update their information, submit invoices, and track payments, reducing the administrative burden on your team.

- Performance monitoring: Regularly monitor supplier performance using key performance indicators (KPIs) for consistent service quality.

Implement Approval Workflows

- Automate approvals: Set up automated approval workflows to speed up the purchase order and invoice approval process. Automated workflows ensure that approvals are timely and follow predefined rules, reducing any bottlenecks.

- Multi-level approvals: For higher-value transactions, implement multi-level approval processes to ensure that purchases are reviewed and authorized by the appropriate personnel. This adds an extra layer of oversight and control.

Implementing these best practices in your P2P process can significantly enhance efficiency, accuracy, and compliance. However, the true potential of P2P optimization can be achieved with automation.

Benefits of Automating Your Purchase-to-Pay Process

Automating your purchase-to-pay process offers numerous advantages that can completely transform your procurement operations. Here are some of the key benefits of adopting automation within your purchase-to-pay process:

- Increased Efficiency: According to McKinsey, on average, automation can increase operational efficiency by more than 39%. Automation streamlines the entire purchase-to-pay workflow by eliminating manual tasks such as data entry and invoice processing. This leads to faster transaction processing and reduced cycle times.

- Cost Savings: Deloitte reports that by adopting intelligent automation, organizations can expect to achieve an average cost reduction of 31 % or reach up to 70% using multiple automation tools. By reducing the need for manual intervention, automation helps decrease labor costs and minimize errors that lead to additional work.

- Improved Accuracy: Automation minimizes the risk of human errors in data entry, invoice matching, and payment processing. This leads to more accurate records and fewer discrepancies. The UiPath 2023 Automation Generation Report indicates that automation can increase data accuracy by as much as 60%, particularly in invoice processing and data entry tasks.

- Better Compliance: Automated P2P solutions enforce compliance with procurement policies and approval hierarchies, ensuring that all transactions adhere to internal guidelines and regulatory requirements. These systems maintain detailed audit trails of all transactions, making it easier to track and review activities for compliance purposes.

- Enhanced Supplier Relationships: Automation ensures that suppliers are paid on time, improving your reputation and fostering stronger relationships. Prompt payments can also help you negotiate better terms and discounts.

- Enhanced Visibility and Control: Automation provides real-time visibility into the status of purchase orders, deliveries, and payments. This allows you to make informed decisions and quickly address any issues that arise. In addition, automated P2P systems offer advanced reporting and analytics capabilities, giving you insights into spending patterns and process efficiency.

By automating your purchase to payment process, you can achieve significant improvements in efficiency, cost control, accuracy, compliance, and supplier relations. These benefits not only streamline your operations but also contribute to a more competitive business.

What to Look For in a P2P Solution?

Selecting the right solution is crucial for optimizing your purchase-to-pay processes and ensuring seamless operations. Here are some of the key features to consider when choosing a P2P solution:

User-Friendly Interface

The solution should be intuitive and easy to navigate for all users within your team, minimizing the learning curve and facilitating quick adoption. Additional features like customizable dashboards help users focus on priority tasks and quickly access relevant data.

Document Processing Automation

Search for a solution with automated invoice processing that automates the capture, validation, and processing of invoices, reducing manual entry errors and speeding up the approval process. Choose purchase-to-pay system with centralized cloud-based digital storage for all documents (purchase orders, vendor invoices, receipts) with easy retrieval and search functionalities.

Two or Three-Way Matching

Ensure the solution provides automated two or three-way matching (invoice, purchase order, and receipt) to verify the accuracy of transactions and prevent discrepancies.

Workflow Automation

Choose a P2P solution with automated workflows for purchase order and invoice approvals to ensure timely processing and adherence to company policies. Consider automated alerts and workflows for handling exceptions and discrepancies for prompt problem-solving.

Compliance and Security

The solution should help ensure compliance with relevant regulations such as SOX, GDPR, and other industry-specific standards. Robust security features, including data encryption, access controls, and regular security audits, are essential to protect sensitive financial information.

Advanced Analytics and Reporting

Real-time analytics provide insights into spending patterns, financial performance, and process efficiency. Choose software that enables you to generate customizable reports tailored to specific business needs and regulatory requirements.

Mobile Access

Ensure the solution is accessible via mobile devices, allowing users to approve documents, review reports, and manage tasks on the go.

Integration Capabilities

Ensure the P2P solution seamlessly integrates with your existing ERP, CRM, accounting software, or inventory management system. This facilitates smooth data flow and reduces the risk of data silos. For older or less common tools, the solution should support APIs and pre-built connectors to integrate with any essential systems used by your team.

Key Performance Indicators (KPIs)

Once you’ve found the P2P solution of your liking, make sure to regularly monitor KPIs to evaluate its performance. We advice to keep an eye on the following:

- Purchase order cycle time: The time taken from the creation of a purchase order to its approval and issuance to the supplier. For measurement, you can calculate the average time (in days or hours) between the creation and issuance of POs

- Average costs to process a purchase order or invoice: Total processing costs divided by the number of POs or invoices processed within a specific period

- Lead time: The time taken from the submission of a purchase requisition until the delivery of goods or services

- Average time to process and approve an invoice: For measurement, you can calculate the average time (in days or hours) between invoice receipt and approval

- Invoice exception: Note the percentage of invoices that require manual intervention due to discrepancies or errors. Measured by the number of exception invoices divided by the total number of invoices processed, multiplied by 100

- First-time match rate: The percentage of invoices that match the corresponding purchase orders and receipts without manual corrections. Measured by the number of invoices that match correctly on the first attempt divided by the total number of invoices processed, multiplied by 100

- Realized savings and discounts captured: Calculate the monetary value of discounts received and savings achieved over a specific period. Compare actual spending against budgeted amounts to identify cost savings

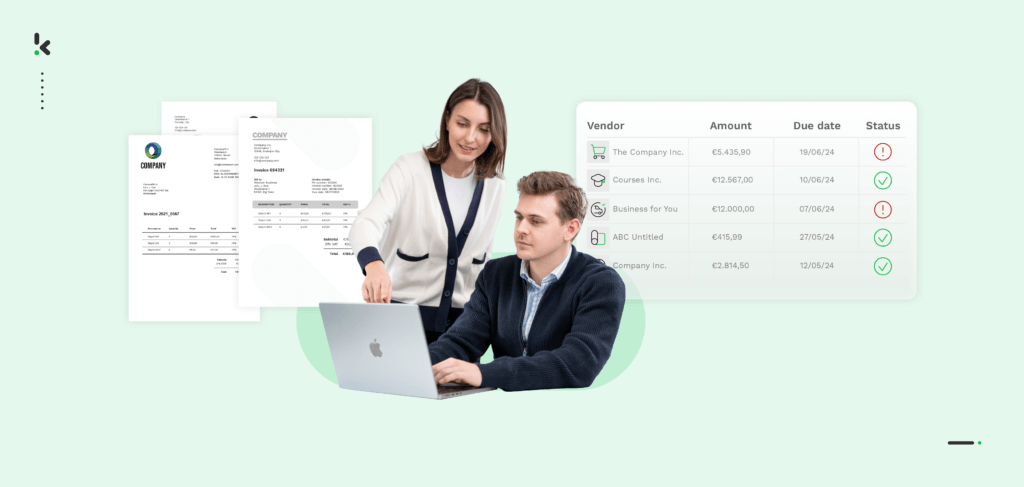

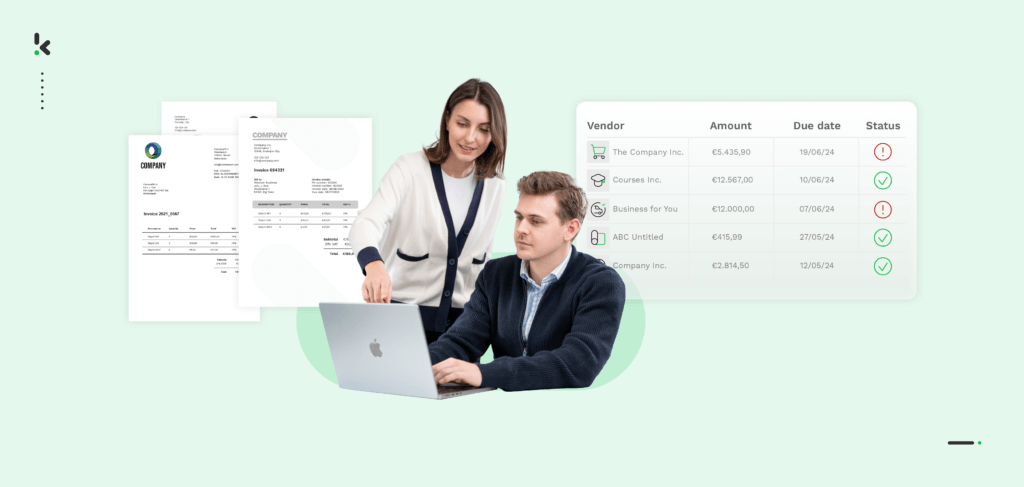

Automate Your Purchase-to-Pay Process With Klippa

Navigating the stages in the purchase to payment cycle can be time-consuming and labor-intensive, but it doesn’t have to be. Say goodbye to the challenges of manual invoice processing by entrusting your invoices to Klippa SpendControl.

Process, approve, and manage all vendor invoices with our OCR-powered pre-accounting solution. Reduce the heavy workload into just a few clicks.

- Manage your vendor invoices, employee expenses, and corporate credit cards in one platform

- Submit, process, and approve invoices via web or mobile app

- Achieve 99% invoice data extraction accuracy with Klippa’s OCR

- Regain control over your accounts payable with intuitive dashboards

- Customize your approval management with multi-level authorization flows

- Never fail to comply with tax and data privacy regulations with our ISO27001, SOC1, & SOC2 certified and GDPR-compliant solution

- Rely on automatic multi-currency support for international payments

- Prevent invoice fraud with built-in duplicate and fraud detection

- Integrate SpendControl with your accounting and ERP software, like Quickbooks, NetSuite, or SAP

Are you ready to leave behind the hassle of manual vendor invoice processing? Book a free demo to see our product in action, or contact our SpendControl specialists for more information. Start investing your time into things that really matter!