Slow processing times. Manual data entry errors. Duplicate payments. Processing receipts can present a challenge, especially for businesses that heavily depend on managing loyalty programs or reimbursing employee travel.

The good news is that you can leverage receipt scanning software to effectively digitize, organize, manage, and capture receipts, turning what was once a cumbersome process into a streamlined and secure operation.

In this guide, we will dive into the essentials of software for receipt scanning, explore the mechanics of automated receipt management, and review the 10 best receipt scanning apps available today.

Key Takeaways

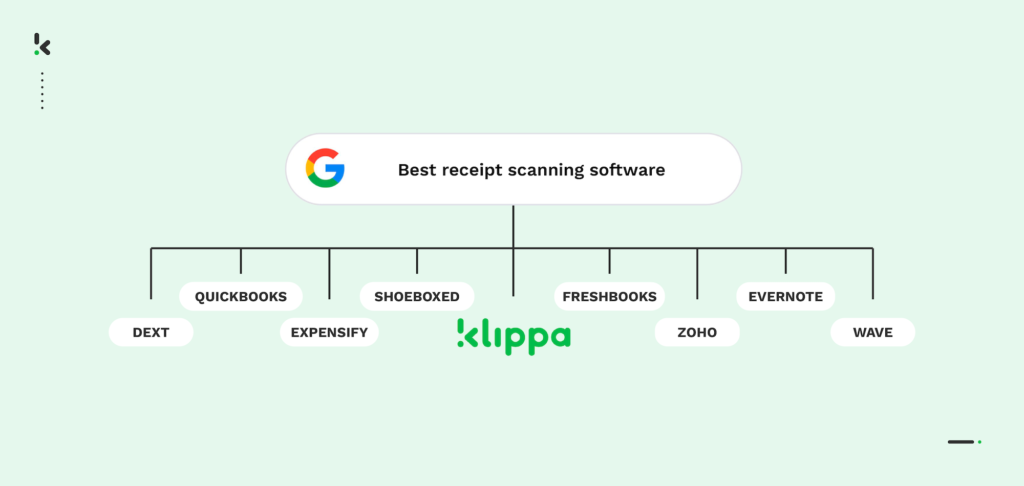

The 10 Best Receipt Scanning Software for 2025 are:

- Klippa SpendControl

- Klippa DocHorizon

- Zoho Expense

- Freshbooks

- Wave Accounting

- Expensify

- Shoeboxed

- Quickbooks Online

- Dext Prepare

- Evernote Scannable

Comparison of the best receipt scanning apps in 2025:

What is a Receipt Scanning Software?

Receipt scanning software is a tool that digitizes and manages your financial documents by reading, scanning and extracting data from a receipt. The software uses Optical Character Recognition (OCR) technology, turning static images into valuable data.

Along with OCR, Artificial Intelligence (AI) analyzes the extracted text to understand its context. It intelligently identifies different components of a receipt, such as the total amount, merchant name, VAT percentage, and individual line items, making sense of the data in a way that mirrors human understanding but at a fraction of the time.

This seamless integration of OCR and AI facilitates a rapid transformation of physical receipts into categorized, actionable data within seconds, optimizing data extraction and classification for businesses.

What is a Receipt Scanning App?

While receipt scanning software provides the backbone for digitizing and interpreting receipt data, a receipt scanning app serves as the user-friendly interface that brings this technology directly to your fingertips.

Specifically designed for mobility and convenience, these apps allow users to capture receipts through a smartphone camera. The app then leverages the receipts scanning software to extract and process the data on the go, offering a practical solution for businesses to manage reimbursable expenses without the need to manually input data or carry around physical copies of receipts.

How Does a Receipt Scanner Work?

As we already established, a receipt scanner app simplifies the way businesses manage their expense tracking by digitizing receipts using a smartphone camera. Still curious on how to save receipts? Here is a brief overview of how do receipt scanners work:

- Capture: The user takes a photo of their receipt with their smartphone.

- Extraction: Once captured, the app uses OCR to ‘read’ the text on the receipt. This technology scans the receipt and converts the printed details into digital text.

- Interpretation: After extraction, AI steps in to interpret the data. The AI understands and categorizes the text based on what it represents — such as total cost, date, VAT, and merchant name.

- Categorization: The app then organizes these details into categories. For instance, it can separate food expenses from lodging based on the merchant or the nature of the expense listed on the receipt.

- Integration: Finally, the digitized data can be integrated into accounting software or expense reports. This integration often allows for real-time expense tracking and more efficient financial management.

Best Receipt Scanning Apps in 2025: Comparison

Receipt scanning and organizing apps can bring countless benefits to your company’s financial management. However, it is important to study and match the functionalities of the software with your business needs.

Below is a comparison table offering a snapshot of leading receipt scanners, evaluated on key features. For comprehensive insights, including detailed module pricing, functionalities, and the scope of free plans, refer to the next section.

10 Best Receipt Scanning Apps in 2025

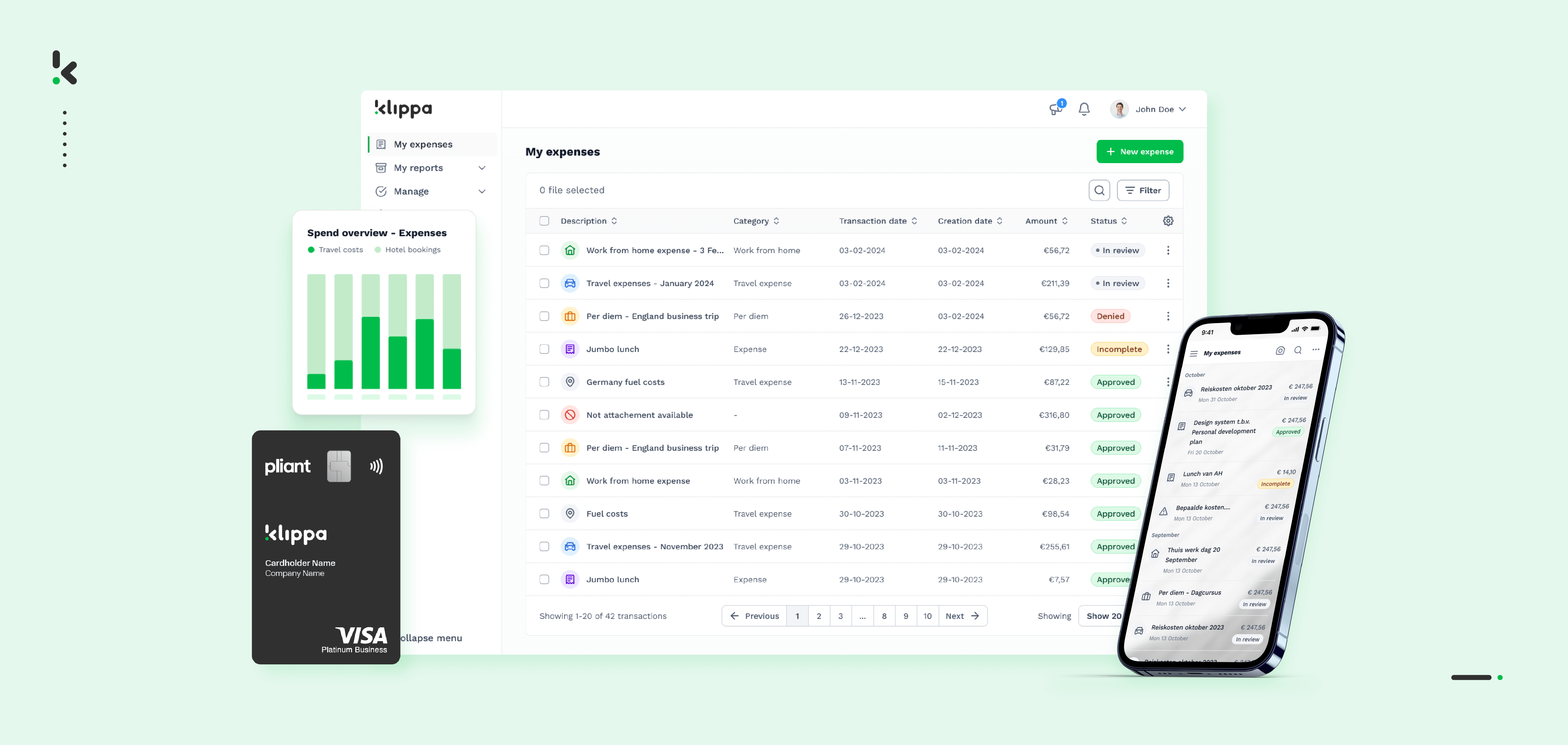

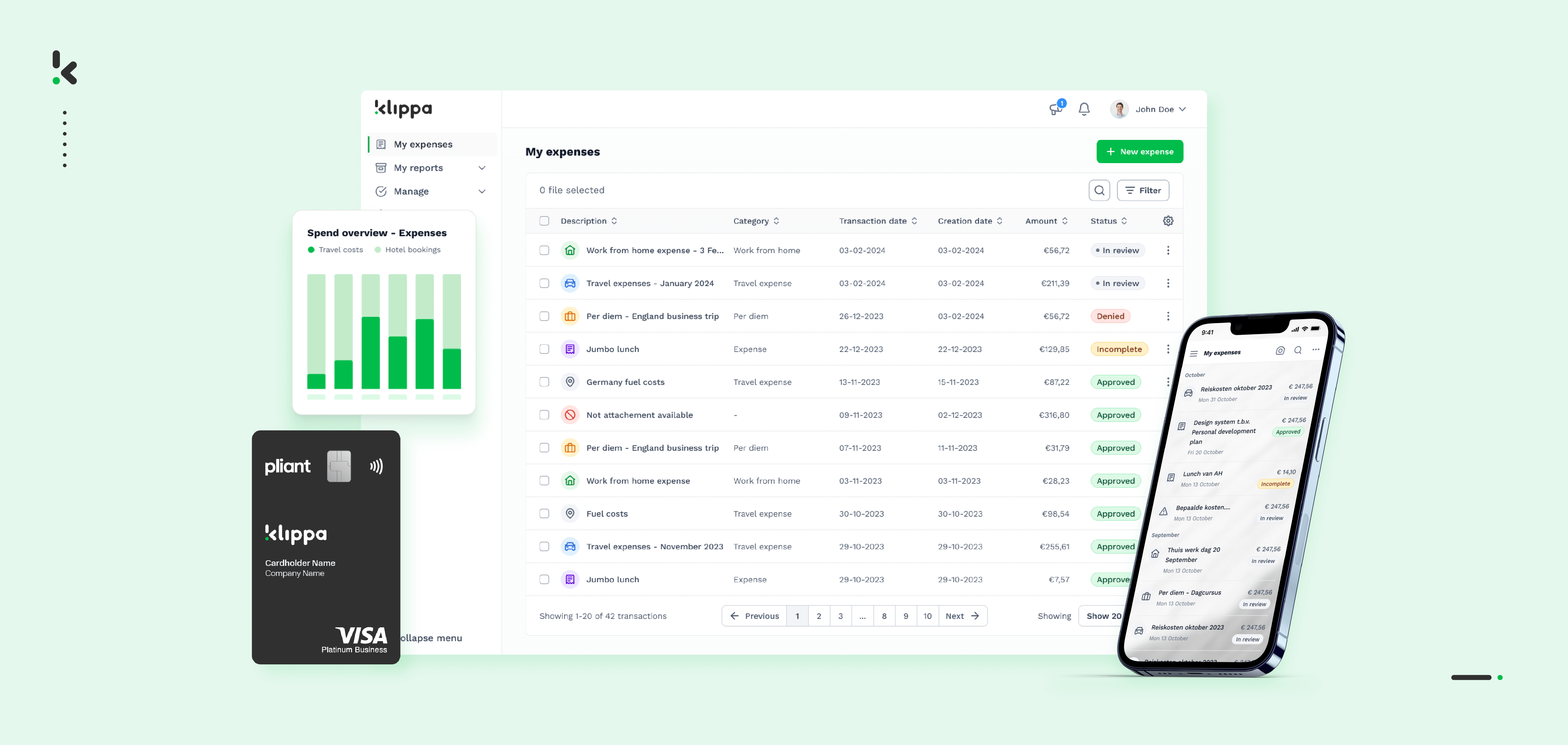

1. Klippa SpendControl

Klippa SpendControl is a powerful pre-accounting software that combines expense management software, invoice processing software and corporate credit card modules in one platform. Perfect for automating receipt submissions, processing and approval, SpendControl helps your finance team save precious time and money on manual document processing.

Pros

- Manage your vendor invoices, employee expenses, and corporate credit cards in one platform

- Scan, submit, process, and approve receipts via web or mobile app

- Achieve 99% receipt data extraction accuracy with Klippa’s OCR

- Regain control over your expenses with intuitive dashboards

- Customize your approval management with multi-level authorization flows

- Never fail to comply with tax and data privacy regulations with our ISO27001-certified and GDPR-compliant solution

- Rely on automatic multi-currency support for international payments

- Prevent fraud with built-in duplicate and fraud detection

- Integrate SpendControl with your accounting and ERP software, like Quickbooks, NetSuite, or SAP

Cons

- No integration options for travel or productivity systems

- Currently no 2-way matching (coming in 2025)

Pricing

- Effective plan: $5 per user/month for an expense management module with automated submissions, approvals and reporting features as well as a credit card module

- Premium plan: $6 per user/month for an expense management module with additional comprehensive customization and financial regulation compliance features

- Custom plan: A fully customizable solution tailored to your company’s needs. Contact us for pricing

For the most up-to-date pricing plan and a full list of features, please refer to our pricing page.

Ideal business type and size: Klippa SpendControl is best suited for small to medium-sized companies seeking a scalable spend management solution.

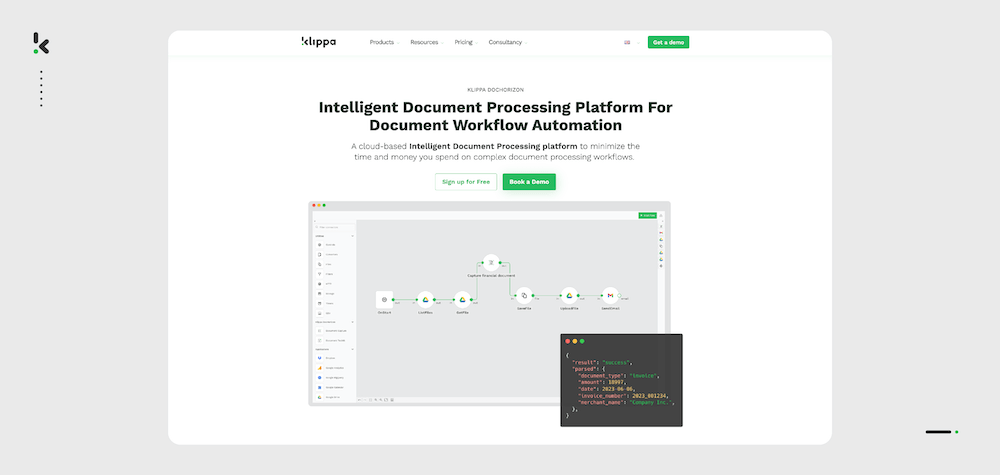

2. Klippa DocHorizon

Klippa DocHorizon is an intelligent document processing platform that uses AI-powered OCR software to accurately scan, extract, and process information. The solution helps businesses automate their entire document workflows with classification, extraction, verification, fraud detection of receipts and any other document types.

Pros

- Fast and accurate data extraction with in-house developed Receipt OCR

- Built-in detection of fraudulent receipts

- Cross-checking between documents and data points

- Verification of document authenticity

- Classification, labeling, and sorting of files and line items

- Anonymization or masking of sensitive data

- Document conversion from and to various formats such as JSON, XML, PDF, XLSX, and CSV

- Fully customizable to your specific needs

Cons

- No support for non-Latin languages

- No document storage

- Not an all-in-one financial management solution

Pricing

- €25 free credit to try out the platform

- License or usage-based pricing model

- Contact the team for pricing details

Ideal business type and size: Klippa DocHorizon is a versatile platform that can benefit small, medium and large enterprises including but not limited to financial, retail and identity sectors.

3. Zoho Expense

Zoho Expense is a receipt scanning software that offers a range of features designed to simplify the tracking, submission, and reimbursement of business expenses, particularly travel-related expenses.

Pros

- Offers a free plan for up to three users

- Praised for its user-friendly interface

- Supports receipt auto-scan

- Multi-currency support across all plans

- Robust integration capabilities with credit card providers

Cons

- Based on user reviews, the app has limited option of customizing reports and dashboards (G2)

- Based on user reviews, the app has limited reporting capabilities in comparison to other expense management platforms (G2)

- Features like ERP integration are only available in the higher-tier plans

Pricing

- Free plan: For up to 3 users with basic features

- Standard plan: $5 per active user/month, offering unlimited receipt storage and additional features like travel requests and advanced approval

- Premium plan: $8 per active user/month, includes ERP integration and other advanced features

- Enterprise plan: $12 per active user/month for large enterprises, adding specialized support like a dedicated account manager and advanced audit trails

For the most up-to-date pricing plan, please refer to Zoho’s official website.

Ideal business type and size: Zoho is best suited for small to medium-sized businesses that are already part of the Zoho ecosystem.

4. Freshbooks

FreshBooks is an expense management solution that is primarily recognized for its invoicing and accounting capabilities. It offers a comprehensive suite of features designed for ease of use and efficiency in managing financial tasks, including receipt scanning.

Pros

- Automatic receipt scanning on mobile apps

- Mileage tracking feature included in all plans

- Expense and billable hours tracking

- Automated bank reconciliation process

- User-friendly web and mobile interface

Cons

- Comes with limitations on the number of users and billable clients, potentially making it more expensive for businesses looking to scale

- Limited inventory management features make it less suited for businesses with extensive inventory needs

- According to reviews, the software is not suitable for large business (Forbes)

Pricing

- Free trial: 30-day trial of the receipt scanning app

- Lite plan: $19/month for up to five billable clients

- Plus plan: $33/month for up to 50 billable clients, including automatic receipt scanning and double-entry accounting

- Premium plan: $60/month for an unlimited number of billable clients, with advanced features like project profitability tracking

- Select plan: Custom pricing for businesses that need dedicated support and advanced features

For the most up-to-date pricing plan, please refer to Freshbooks’ official website.

Ideal Business Type and Size: Freshbooks is best suited for freelancers, self-employed professionals, and small to medium-sized businesses, particularly those in service-based industries.

5. Wave Accounting

Wave Accounting is a free accounting software coupled with a range of optional paid services for enhanced functionality. This platform offers several features designed to facilitate invoicing, expense tracking, and financial management.

Pros

- Fee-for-life accounting software plan

- Unlimited invoicing capabilities

- An unlimited number of billable clients

- Straightforward account setup

- The free plan includes expense tracking, accounts payable, basic inventory, and various reports

Cons

- The software’s capacity to accommodate growing businesses is restricted with limited scalability

- Users looking to integrate Wave with other business management apps must resort to third-party services like Zapier, which may entail additional costs and complexities

- Based on product reviews, the app lacks time tracking and project features (PCMag)

Pricing

- Free plan: $0, covering most basic accounting needs

- Wave Payroll plan: Starting at $20/month plus $6/month per employee, offering payroll services

- Wave Payments plan: Processing rates starting at 2.9% + $0.60 per transaction for credit cards, and ACH rates at 1% per transaction

For the most up-to-date pricing plan, please refer to Wave Accounting official website.

Ideal Business Type and Size: Wave is best suited for small businesses and freelancers who prioritize affordability over extensive features or deep third-party integrations.

6. Expensify

Expensify is a spend management solution for personal and business use that automates expense management with its advanced features like expense tracking and bill payment. It also offers a business credit card called Expensify card.

Pros

- Automatic scanning of receipts emailed and captured on the mobile app

- Mileage tracking for business travel reimbursements

- Business credit card with spending limits and up to 2% cashback

- Expense duplicate and fraud detection

- Automated approval workflows

Cons

- Business credit cards are only available to companies with a US bank account and US documentation

- Reviews on poor customer support, with some users experiencing difficulties in canceling subscriptions or obtaining refunds

- Based on user reviews, the app’s OCR (SmartScan) can be slow and often inaccurate (Capterra)

Pricing

- Free plan: With up to 25 SmartScans monthly

- Collect plan: For 1-10 employees. Starting at $5 per user/month on an annual subscription

- Control plan: For 10-1000 employees. Starting at $9 per user/month on an annual subscription

For the most up-to-date pricing plan, please refer to Expensify’s official website.

Ideal Business Type and Size: Expensify is suitable for SMEs and large enterprises.

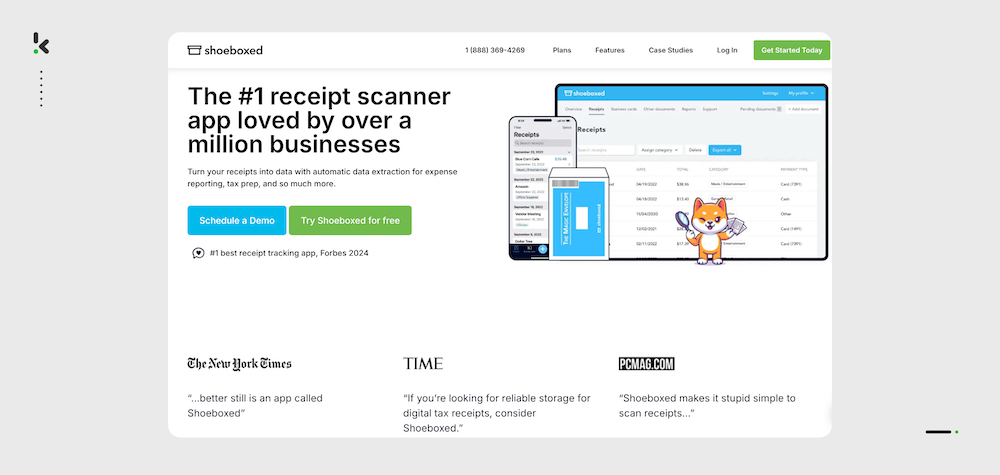

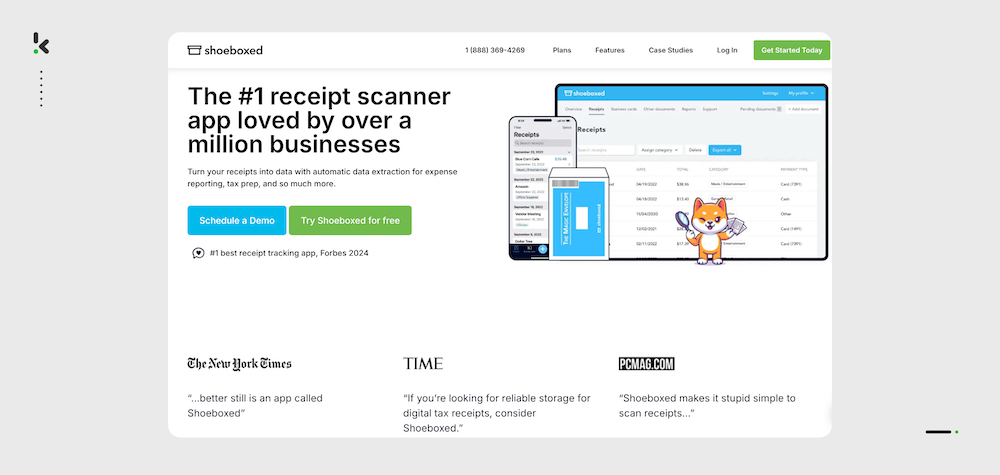

7. Shoeboxed

Shoeboxed offers a streamlined solution for digitizing, organizing, and storing financial documents, making it a practical tool for expense tracking and preparation for tax audits.

Pros

- Receipt scanning and categorization in the mobile app

- Receipt upload via smartphone or email

- IRS-complaint processing and storage of digital receipts

- In-app mileage tracking for travel expense reimbursements

- The Magic Envelope service allows to send physical receipts directly to Shoeboxed for scanning and categorization

Cons

- All plans include monthly limits for digital and physical receipt processing

- Overage fees are applicable for documents processed over the set limits, increasing costs for users with high volumes of receipts

- The fees of comprehensive features can be costly for small businesses

- Based on product review, the app is not suitable for business card data extraction (FounderPass)

- Based on product review, OCR-usage is limited as scanned documents count toward your monthly allowance (FounderPass)

Pricing

- Free trial: 30-day trial of the receipt scanning app

- Startup plan: $29/month ($23/month if billed annually) for 50 digital and 25 physical documents per month

- Professional plan: $59/month ($47/month if billed annually) for 150 digital and physical documents per month, with unlimited document mail-in

- Business plan: $89/month ($71/month if billed annually) for 300 digital and physical documents per month, with unlimited document mail-in and returns

For the most up-to-date pricing plan, please refer to Shoeboxed official website.

Ideal Business Type and Size: Shoeboxed is particularly suited for small to medium-sized businesses that manage a moderate to high volume of physical receipts and business documents.

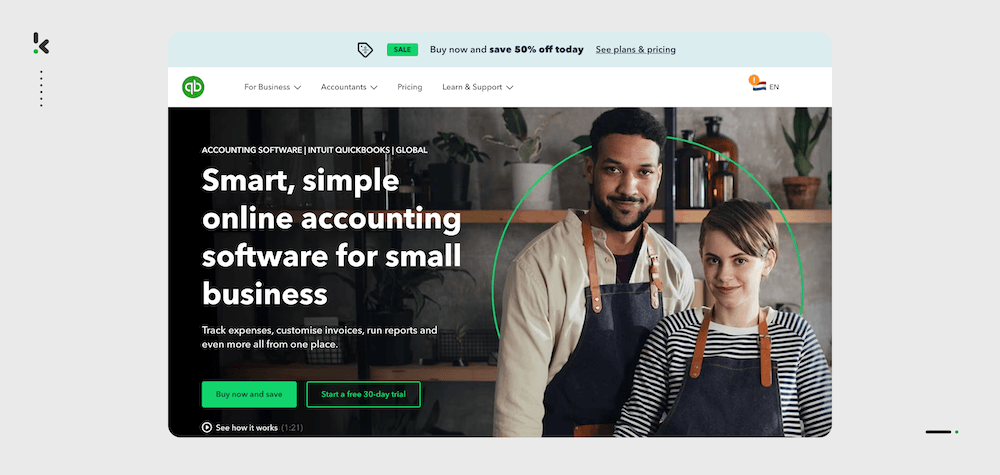

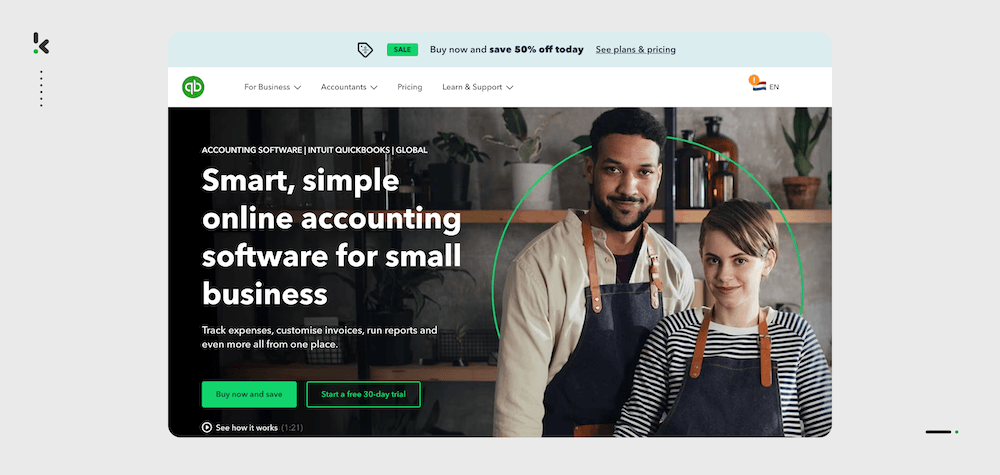

8. Quickbooks Online

QuickBooks Online (QBO) is an accounting solution with integrated receipt scanning capabilities. QuickBooks provides a platform for tracking income and expenses, invoicing, and financial reporting, with receipt scanning being one of its many features.

Pros

- Automatic receipt scanning via the app

- Receipt upload via computer, mobile device, or email

- Multi-currency support for expenses made in foreign currency

- Real-time calculations for VAT-related transactions

- Reports on profit & loss, expenses, and balance sheets

Cons

- The app can be expensive for small businesses

- Based on user reviews, with all the updates and new features, the app is becoming increasingly harder to use (GetApp)

- Users report frequent system crashes due to file size constraints and performance issues when handling large volumes of transactions or multiple users (GetApp)

Pricing

- Free trial: 30-day trial of the receipt scanner

- Simple start plan: $18/month for 1 user, plus an accountant. For document capturing, tracking and organizing

- Essentials plan: $27/month for 3 users, plus an accountant. For managing bills and payments in multiple currencies and tracking employee time

- Plus plan: $38/month for 5 users, plus an accountant. For inventory tracking, managing project profitability and budget management

For the most up-to-date pricing plan, please refer to Quickbooks official website.

Ideal Business Type and Size: QuickBooks Online is suitable for freelancers, and small to medium-sized businesses requiring detailed financial tracking and reporting. The following app is the best receipt scanner for existing Quickbooks users.

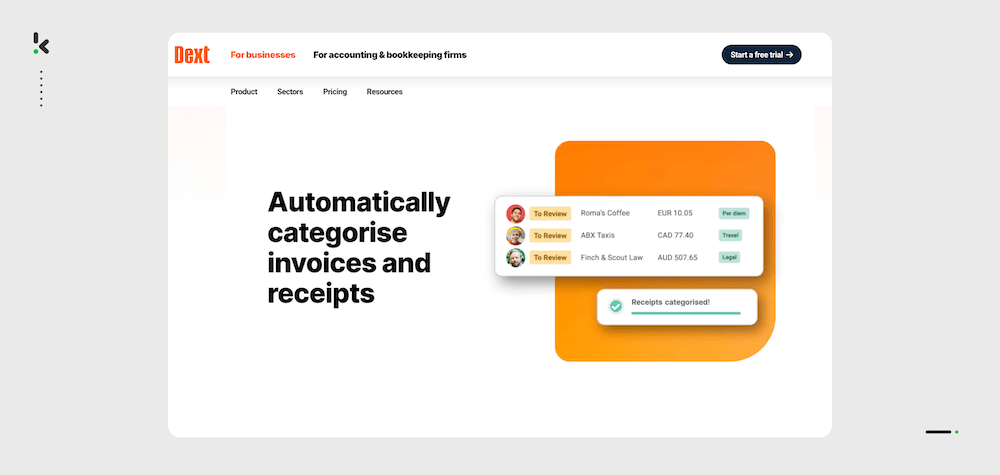

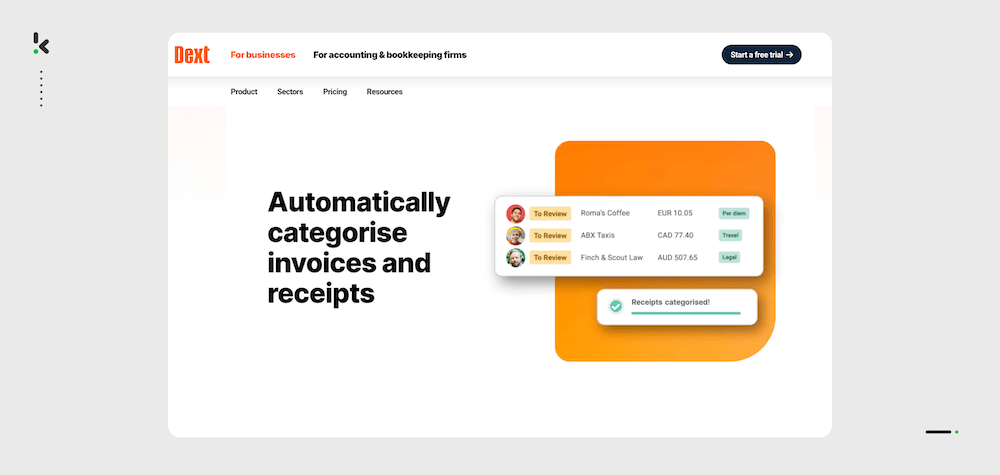

9. Dext Prepare

Dext Prepare, formerly known as Receipt Bank, is a comprehensive software for scanning receipts and managing documents that consolidates all paperwork in a uniform digital format.

Pros

- Expense and invoice upload via mobile app, email or auto-invoice fetch

- Advanced OCR technology for accurate data extraction

- Automated expense reporting system in the app

- Automated approval workflows

- Creation of bank rules for cash-coding clients (set categories on transactions)

Cons

- The need for separate accounts for each business and extra charges for additional users

- Has limitations on bank statement extractions across all plans

- Might be costly for small businesses and freelancers

- Based on user reviews, it can be challenging to contact Dext’s customer service (Capterra)

Pricing

- Free trial: 14-day trial of the receipt scanner

- Essentials plan: $199.99/month for 10 clients, unlimited users. Covers basic accounting needs

- Advanced plan: $214.99/month for 10 clients, unlimited users. Includes automated approval flows, advanced expense reports and spending insights

For the most up-to-date pricing plan, please refer to Dexts official website.

Ideal business type and size: Dext Prepare is best suited for small to medium-sized businesses and accounting firms.

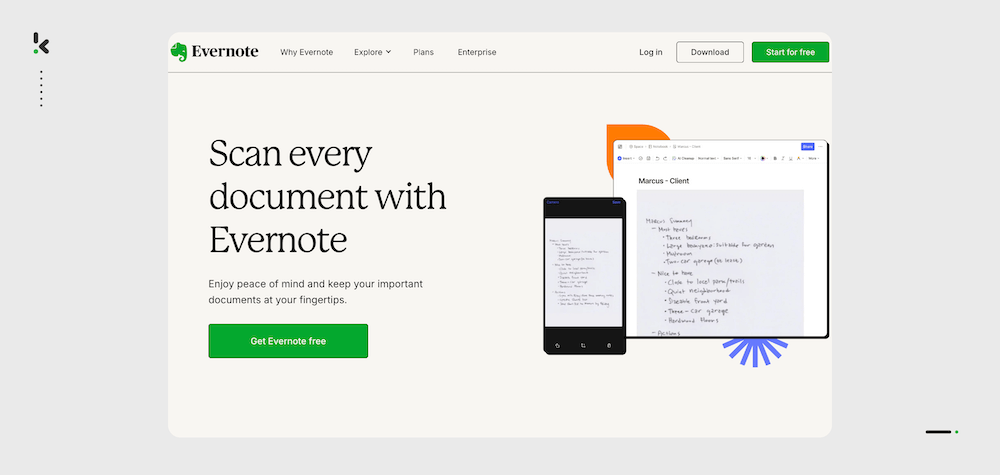

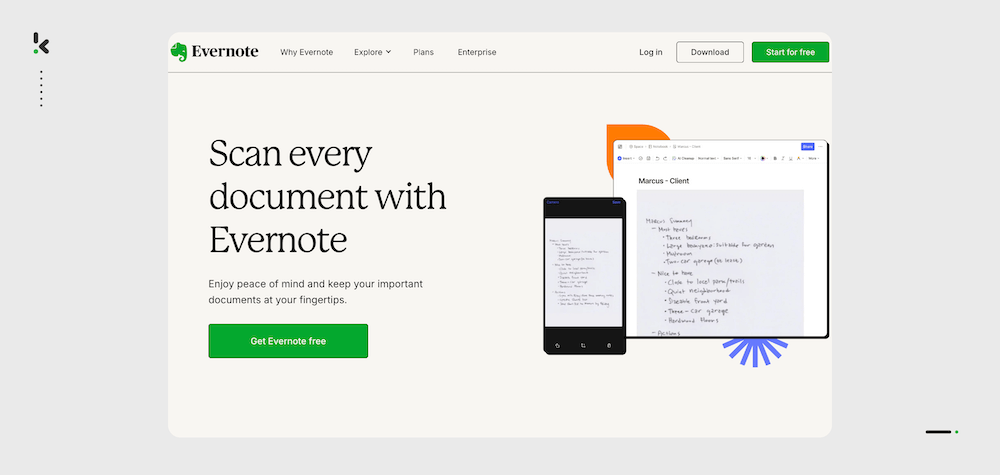

10. Evernote Scannable

Evernote Scannable is an app that extends the functionality of Evernote, focusing on the digitization of documents, including receipts, using a smartphone camera. It’s part of the broader Evernote ecosystem, known for its note-taking and organizational capabilities.

Pros

- Apps for iOS, Android, Web, Windows, Mac, and Linux (beta)

- OCR-powered scanner for receipts, handwritten notes, whiteboards and more

- Sync across unlimited devices

- Connect Google Drive to add files for quick access and editing

- Two-step verification for added data security

Cons

- Lacks document management system

- Doesn’t integrate with accounting and ERP systems

- Doesn’t offer multi-level approval workflows

- Based on user reviews, the latest update has limited access to previously free notes, requiring a paid subscription to view them. Many users feel frustrated, as their stored information is now locked behind a paywall without prior warning. (TrustPilot)

- Based on user reviews, the app lacks good customer service (TrustPilot)

Pricing

- Free plan: $0/month for 50 notes and 1 notebook

- Personal plan: $12.99/month or $99.99/year for 100,000 notes & 1,000 notebooks

- Professional plan: $14.99/month or $129.99/year for 100,000 notes & 1,000 notebooks + task management

- Teams plan: $19.99 per user/month or $199.99/year for 500,000 notes & 10,000 notebooks

For the most up-to-date pricing plan, please refer to Evernote’s official website.

Ideal business type and size: Evernote Scannable is best suited for existing Evernote users looking for a straightforward solution for note taking, project planning and document scanning.

How to Choose The Best Receipt Scanning App?

Staying on top of your financial transactions is not just a necessity but a strategic advantage in business. As we delved into the selection of the best apps for receipts in 2025, understanding the key features that set the best tools apart is crucial.

Receipt Scanning and Automatic Data Extraction

This feature allows you to snap a picture of your receipt and have all critical information—date, vendor, amount, etc.—automatically extracted. This not only saves time but reduces human error, making your expense tracking more accurate and reliable.

Modules: Look for advanced receipt OCR capabilities that can identify and extract text from any part of the receipt, including line items and tax details. The ideal software should offer batch processing for handling multiple receipts at once.

Features: Automatic categorization based on merchant, date, and expense type; currency conversion for international expenses; and duplicate detection to prevent double entries.

Approval Workflows

Especially vital for larger teams, approval workflows enable managers to review and approve expenses quickly. This feature streamlines the process, ensuring transparency and accountability while maintaining a steady flow of expense management tasks.

Modules: Customizable approval chains, where expenses can be routed through a predefined sequence of approvers based on business rules such as expense amount, category, or department.

Features: Real-time notifications to approvers, status tracking for submitters, and a mobile approval option to ensure processes keep moving even on the go.

Real-Time Expense Tracking

Knowing where your finances stand at any given moment empowers you to make informed decisions quickly. Real-time tracking provides a live overview of your expenditures, helping you identify trends and manage budgets effectively.

Modules: Dashboards that provide an instant overview of expenses, including pending approvals, reimbursed expense claims, and overall spending trends.

Features: Alerts for budget thresholds to prevent overspending and the ability to drill down into specific expenses for detailed analysis.

Mileage Tracking

For businesses that reimburse and manage travel expenses, mileage tracking is indispensable. This feature automates the tracking of distances traveled, ensuring accuracy and compliance with company policies, and simplifying the reimbursement process.

Modules: GPS-enabled tracking that records distances traveled automatically, along with the start and end locations for each trip.

Features: The option to classify trips as business or personal, integration with maps for route optimization, and automatic calculation of reimbursements based on set rates.

Expense Reporting

The ability to generate comprehensive and customizable expense reports allows you to aggregate and analyze your spending data, offering insights that can lead to cost-saving measures and budget optimization.

Modules: Dynamic reporting tools that allow for the creation of custom reports based on specific criteria like time period, project, or department.

Features: The ability to export reports in various formats (PDF, Excel, etc.), share them directly with stakeholders, and schedule periodic reports for automatic generation and distribution.

Multi-Platform Accessibility

Whether you’re on a desktop at the office or using a smartphone on the go, seamless access ensures that expense management can happen anytime, anywhere.

Modules: A cloud-based architecture ensuring access from any device, be it desktop, tablet, or smartphone, with apps available for both iOS and Android platforms.

Features: Syncing across devices to keep all data up-to-date, offline functionality for capturing receipts when not connected to the internet, and seamless transitions between devices.

Security and Privacy

With financial data at stake, the importance of robust security measures cannot be overstated. Look for software that employs encryption, two-factor authentication, and complies with relevant data protection regulations to safeguard your sensitive information.

Modules: Encryption of data in transit and at rest, user authentication mechanisms, and compliance modules for adhering to GDPR, HIPAA, or other relevant regulations.

Features: Role-based access controls, audit trails for monitoring changes and access, and secure backups to protect against data loss.

Integration with Your Accounting Software

Choose receipt scanner that integrates with your existing accounting systems. This synergy eliminates the need for manual data entry, reducing redundancy and the potential for errors, thereby enhancing overall efficiency.

Specific Integrations: Direct connections with leading accounting platforms like QuickBooks, Xero, Sage, and NetSuite, ensuring seamless flow of expense data into your financial records.

Features: Automatic posting of expenses into the correct ledger accounts, synchronization of vendor and customer lists, and the ability to reconcile credit card transactions directly within the accounting software.

These features collectively enhance the functionality and user experience of receipt scanning software, making it an essential tool for financial management and efficiency.

Benefits of Using a Receipt Scanning App

There are many reasons why you should use automated receipt scanning software. Below, you’ll find the 5 main benefits of using such a solution.

- Minimize fraud with automated fraud detection

- Shorten turnaround times

- Eliminate human error

- Lower costs by up to 75%

- Ensure security and compliance

Minimize Fraud with Automated Fraud Detection

The first benefit of using receipt scanning software is fraud prevention and security. The ACFE states that organizations around the world lose an estimated 5% of their annual revenues to occupational fraud, this figure translates to a potential total fraud loss of more than 3.5 trillion dollars worldwide. Expense fraud takes a significant part of these financial losses.

Many receipt scanners can automatically recognize whether a particular receipt has been previously submitted. In addition, the software can check if the receipt has been altered: it looks for Photoshop activity, checks the Exif data for anomalies, and can detect whether elements, such as the total amount, have been changed.

Shorten Turnaround Times

In a world where everything goes fast, your clients and employees expect their reimbursement as fast as possible. A receipt scanning app offers a solution here, as it helps to shorten turnaround times significantly.

For the best receipt scanning software, the data extraction happens within 3 to 5 seconds. Compare this to a manual process of sorting receipts, reading and checking the data, and entering it into a program.

Eliminate Human Error

The error rate for manual data entry ranges from 0.55% to 3.6%, with outliers as high as 26.9%. Leveraging receipt scanner app can significantly reduce mistakes by eliminating distractions and keystroke errors.

Software typically achieves over 90% accuracy in data extraction and entry, which can be further enhanced by incorporating Human-in-the-Loop (HITL) automation. This method involves human supervision to validate the software’s output, where the receipt scanning software triggers additional authorization levels based on business rules related to users, merchants, or expense categories.

Lower Costs by Up to 75%

With receipt scanning software, you can free up your team’s time and reduce costs by up to 75%. All because your employees will save time on repetitive data entry tasks and have more time to focus on essential operations.

There is no magic formula for this, but studies have shown that intelligent automation typically results in cost savings of 40% to 75%, with the payback period ranging from several months to several years.

For example, consider the time required for manual processing of a single receipt. On average, experienced employees process 50 receipts per hour (i.e. 1.2 minutes per receipt). With an average hourly wage of $35, processing just one receipt costs approximately $0.70.

However, if that same employee uses the receipt scanning software, they could process at least 200 receipts per hour (approximately 18 seconds per receipt), leading to a processing cost of around $0.18. When we add the software price ($0.05 per receipt), the total cost comes to $0.23. That’s a direct improvement of more than 60%!

Ensure Security and Compliance

Some receipts may contain sensitive customer information such as card numbers, names, and addresses. When processing such sensitive data, companies have to be GDPR compliant. Otherwise, in case of infringement on the processing and management of personal data, you can face a fine of up to 2% of your annual revenue.

Receipt scanning software can define sensitive data fields, such as fields with personally identifiable information (PII), and use data masking to redact them or apply data anonymization. This helps companies ensure compliance with data privacy regulations like the GDPR or HIPAA.

Automate Receipt Scanning with Klippa SpendControl

Finding the right receipt scanning app for your business depends on which features you deem the most important. While we presented a summary of some of the best apps to scan receipts, we believe that Klippa SpendControl has it all to help your organization save precious time and money by providing complete control over your expenses.

FAQ

Receipt scanning software uses OCR technology to extract data from receipts, converting it into structured information for accounting, expense reporting, and tax purposes.

How does receipt scanning software work?

Users upload or take pictures of receipts, and the software extracts key data like date, amount, and merchant details for easy storage and management.

What are the benefits of using receipt scanning software?

It saves time, reduces manual errors, improves organization, and helps businesses stay compliant with tax regulations by maintaining accurate records.

Can receipt scanning software be integrated with accounting software?

Yes, many solutions, including Klippa’s, integrate with accounting systems to automate expense reporting and streamline financial processes.

Is receipt scanning software secure?

Yes, it uses encryption and secure cloud storage to protect sensitive data and ensure compliance with data protection regulations.

Is receipt scanning software suitable for both small businesses and large enterprises?

Yes, it benefits businesses of all sizes by automating expense management and improving financial accuracy.