Navigating reimbursable expenses is crucial for employees to cover costs incurred doing their jobs. However, the reimbursement process can be riddled with challenges and struggles.

Approval delays, fraud, and tracking complexities are but a few of the challenges that arise in the reimbursement process. Even large companies like Amazon are not immune to expense fraud. An investigation found that between 2021 and 2022, Amazon had mistakenly paid an employee $350,000 due to fraudulent expense claims.

In this article, we’ll explore the definition of reimbursable expenses, the reasons why you may need to consider them, the challenges you may face, and solutions. Let’s dive in!

Key Takeaways

- Reimbursable expenses cover business-related costs – Employees can claim reimbursement for work-related expenses such as travel, meals, office supplies, and training, provided they align with company policies.

- Expense reimbursement processes come with challenges – Delays in approval, manual tracking inefficiencies, receipt management issues, and fraud risks can complicate the reimbursement workflow.

- Effective expense tracking improves compliance and efficiency – Using expense management software like Klippa SpendControl helps automate receipt capture, streamline approvals, and detect fraudulent claims.

- Reimbursed expenses are typically not taxable – If expenses meet accountable plan criteria (business-related, properly documented, and submitted on time), they are not considered taxable income.

What are Reimbursable Expenses?

In a business context, reimbursable expenses refer to costs incurred by one party on behalf of another, which are later compensated. These expenses are outlined in agreements, which specify the covered costs and the conditions for reimbursement.

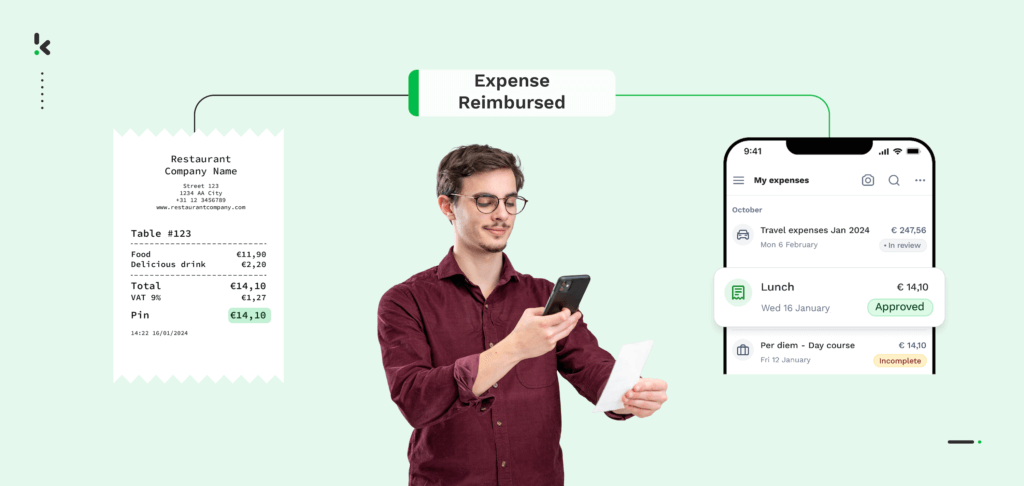

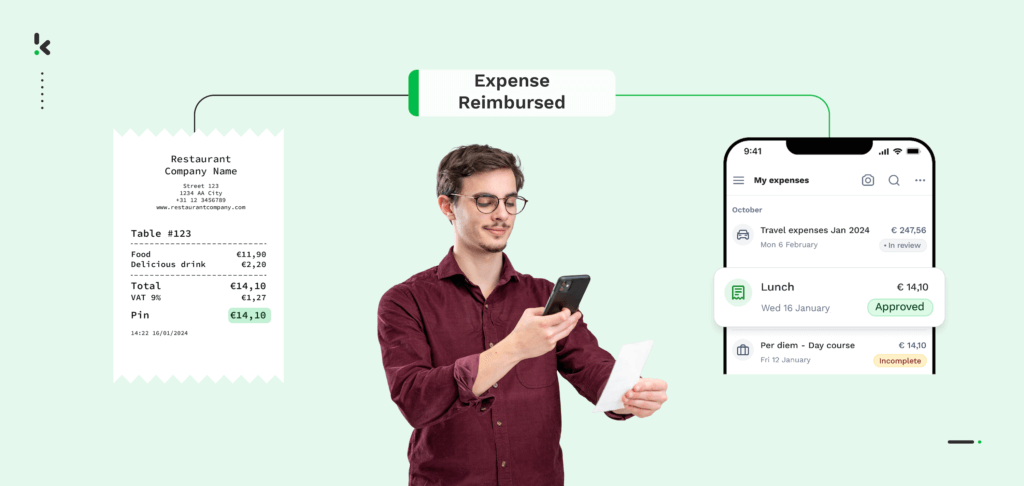

The process of reimbursement often involves the employee submitting receipts, invoices, or other documentation as proof of the expenses, which are then reviewed and approved for payment. Reimbursement may be made in the form of direct payment, reimbursement checks, or through payroll.

But what can be declared in expense reimbursement? Let’s find out more about the types of reimbursable expenses.

What Types of Expenses are Reimbursable?

Reimbursable expenses encompass a wide range of costs that your employee may incur while conducting business on behalf of the company. While specific policies can vary depending on the organization, industry, and local regulations, common types of reimbursable expenses include:

- Travel costs: You may receive reimbursement claims for travel costs including airfare, train tickets, rental cars, and mileage for personal vehicles used for business purposes. It may also cover lodging expenses for overnight stays, as well as expenses related to meals and incidental expenses incurred during travel.

- Meals and entertainment: Your employees may declare meals and entertainment costs for reimbursement, incurred while conducting business meetings, entertaining clients, or attending conferences and networking events.

- Communication expenses: You or your employees may have costs related to business communications, such as mobile phone bills, internet service fees, and postage expenses, eligible for reimbursement if they are incurred as part of performing job responsibilities.

- Training and education: Your employees may claim reimbursement for expenses related to furthering their education or personal development, such as tuition, books, and course fees.

- Office expenses/supplies: You may receive reimbursement claims for expenses related to maintaining a functional workspace, including the purchase of office supplies such as stationery, printer cartridges, and cleaning supplies. Additionally, expenses for office equipment, furniture, and maintenance may also be reimbursable.

While we’ve covered some typical reimbursable expenses, it’s important to also consider non-reimbursable ones. We’ll dig into those differences shortly. But remember, the rules around what can be reimbursed vary depending on where you’re located and your company’s expense policies.

What’s the difference between reimbursable and non-reimbursable expenses?

Reimbursable expenses are costs incurred by individuals and employees on behalf of you their employer, governed by your company’s expense policies or contracts. Non-reimbursable expenses, however, are not covered by company policies, and employees are expected to cover them without seeking reimbursement.

Your business and financial departments must have clear and explicit policies and explanations of the distinctions between reimbursable and non-reimbursable expenses. Understanding the distinctions can help you manage expense claims effectively while ensuring accurate financial reporting and a satisfied workforce.

Challenges of Expense Reimbursement Processes

While the reimbursement process is essential for ensuring employees are fairly compensated for business-related expenses, employers and employees can face several challenges. Here are some common challenges associated with reimbursement processes:

- Approval delays: You may experience bottlenecks and delays in your approval workflows as certain approvals may require review by multiple parties within the organization, leading to delays in processing. These bottlenecks or lack of clarity regarding who has the authority to make approvals for example can prolong the reimbursement timeline and frustrate employees.

- Manual processes: You, like many other organizations, may rely on manual processes and approvals for reimbursements, such as paper-based expense reports or email submissions. While this may work for small-scale businesses, larger businesses cannot effectively manage expenses this way. These manual processes are time-consuming, prone to errors, and, lead to inefficiencies in the reimbursement workflow.

- Tracking and reporting: Properly tracking and reporting your reimbursable expenses are essential for financial transparency and compliance. However, manual tracking methods or disparate systems for expense management can make it difficult for you to generate accurate reports and reconcile expenses efficiently.

- Receipt management: Employees may struggle with managing and retaining receipts for their expenses, leading to difficulties in providing adequate proof of purchase for reimbursement requests. Lost or illegible receipts can further complicate the process.

- Expense fraud: You may have weak/inadequate controls and oversight in the reimbursement process that leave your organization vulnerable to fraud and abuse. Employees may submit false or inflated expense claims, leading to financial losses and reputational damage for the company.

The challenges associated with expense reimbursement underscore the importance of a well organised and efficient reimbursment process. In the following section we will explore the methods available for you to track and manage expenses.

How to Track and Manage Reimbursable Expenses

Tracking and managing reimbursable expenses effectively is crucial for ensuring accurate financial reporting, compliance with policies, and timely reimbursement for employees. This can be carried out in several ways, we’ll explore these ways here. Some are more secure than others.

Traditional Expense Management

Traditionally, this approach to expense tracking relies on manual paper-based methods. This entails manually gathering and arranging receipts and documents related to expenses on paper. For small-scale operations or individuals with limited expenses, this method may work fine however, it can be labor-intensive and prone to human errors. There is also a risk of losing track of physical documents and receipts.

Spreadsheets for Expense Management

Businesses can use spreadsheet software like Microsoft Excel or Google Sheets for expense management purposes. Using spreadsheets to automate expense management can be a method for small enterprises with bigger teams and more expenses to track.

Expenses are meticulously documented and sorted into rows and columns within these platforms, facilitating calculations and rudimentary analysis.

Now, in comparison to traditional paper-based manual management, spreadsheets offer you better organization and control over the reimbursement process but still rely on manual input and consume considerable time.

Expense Management Software

This method embraces modern technology as a means to optimize the expense management process. With expense management software, you can easily reduce errors from manual data entry with optical character recognition (OCR) technology. This allows you and your employees to easily scan, classify, sort, and digitize receipts and invoices as well as verify submitted expense documents.

There are a range of spend management solutions on the market for you to choose from depending on your needs including Klippa SpendControl.

But what sets SpendControl apart from other expense management solutions?

Reimbursable Expenses with SpendControl

Klippa SpendControl is an easy-to-use expense management solution that can help optimize and improve the way you approach reimbursable expenses in your business. With minimal effort, you can integrate our solution with your ERP or accounting system and give your financial departments the power to make informed decisions.

With our solution, you can enjoy several benefits that can streamline and optimize the way you approach expense reimbursements. These include:

- Automated receipt capture: Your employees can easily scan, capture, and declare business-related expenses with our OCR-powered solution.

- Customizable approval workflows: Your financial departments can easily streamline their approval process ensuring proper authorizations of expense declarations within your organization.

- Business cards: Say goodbye to out-of-pocket expenses and easily control employee expenditures with Klippa’s business expense cards. Klippa’s corporate expense cards are available both as physical and virtual cards.

- Minimize fraud: Our software can help you detect document fraud attempts using Photoshop detection and EXIF data analysis. You can stay ahead of expense fraud, easily detecting duplicate receipts and duplicate invoices to protect your organization from fraudulent expense claims.

- Seamless integration: Synchronize Klippa SpendControl with your preferred accounting or ERP system, enabling smooth data transfer and efficient invoice reconciliation.

Are you ready to revolutionize your approach to reimbursable expenses? Then don’t hesitate to contact one of our experts or book a free demo.

FAQ

An expense reimbursement is how an employer compensates an employee for reimbursable expenses incurred while performing job-related duties. Employees typically submit receipts or invoices as proof, and once approved, reimbursement is provided via payroll, direct payment, or reimbursement checks.

A common example of a reimbursable expense is business travel costs. This includes airfare, hotel accommodations, mileage for personal vehicle use, and meals incurred during business trips. These expenses are reimbursed according to company policies and require proper documentation for approval.

Reimbursable expenses should be properly tracked and categorized for financial reporting and compliance. Businesses can use manual methods like spreadsheets or implement expense management software such as Klippa SpendControl to automate tracking, streamline approvals, and ensure accurate reimbursements.

Generally, expense reimbursements are not considered taxable income if they comply with an accountable plan. This means expenses must be business-related, properly documented, and submitted within a reasonable timeframe. If these conditions are not met, reimbursements may be classified as taxable income.