Accounting as we know it, is a core activity for every business. It helps manage the turnover of organizations and, if not done correctly, can negatively impact the balance sheet and other financial statements. Incorrect calculations or cases of fraud can leave companies with huge financial losses.

The Association of Certified Fraud Examiners mentions that SMEs lose on average $200,000 yearly due to accounting fraud cases alone. Part of the issue in these cases lies in the fact that accounting used to be a manual process. However, many organizations have seen the flaw in this procedure and decided to automate their accounting processes by implementing robotic accounting.

In case you are not familiar with the term robotic accounting, don’t worry! In this blog, we will cover what robotic accounting is, take a look at its benefits, as well as some of the most common use cases. Lastly, we will discuss some ways in which you can automate accounting processes.

Let’s get started!

What is Robotic Accounting and How Does It Work?

Robotic accounting is a form of robotic process automation or RPA, which is used in the accounting field. It uses software bots, in order to eliminate the need for human input in accounting processes.

Software bots are computer programs designed to perform certain actions, in this case, accounting tasks. This is in a nutshell the description of robotic accounting software. It can be utilized using a rule-based approach or implementing AI algorithms to automate accounting tasks performed by bots.

Robotic accounting centralizes data from different bookkeeping systems and helps the financial department optimize accounting operations, for instance, managing payslips or processing invoices.

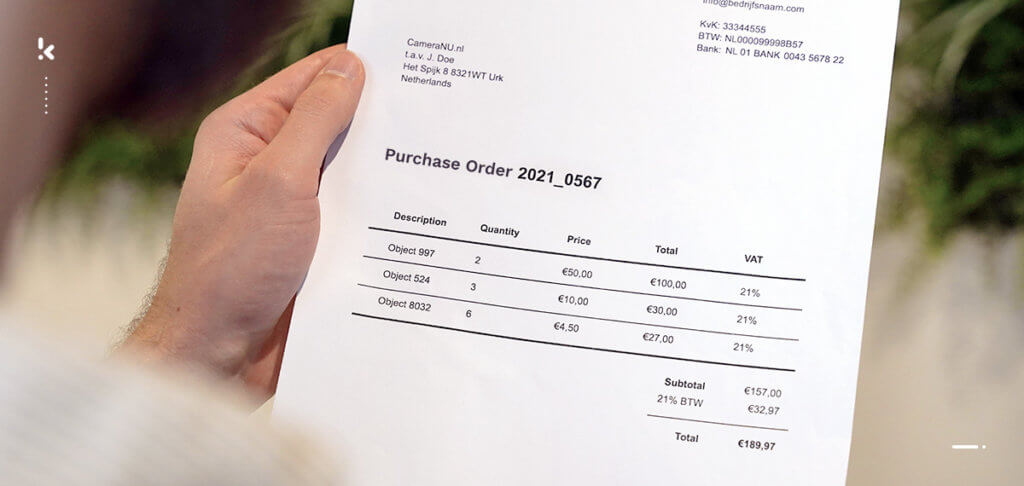

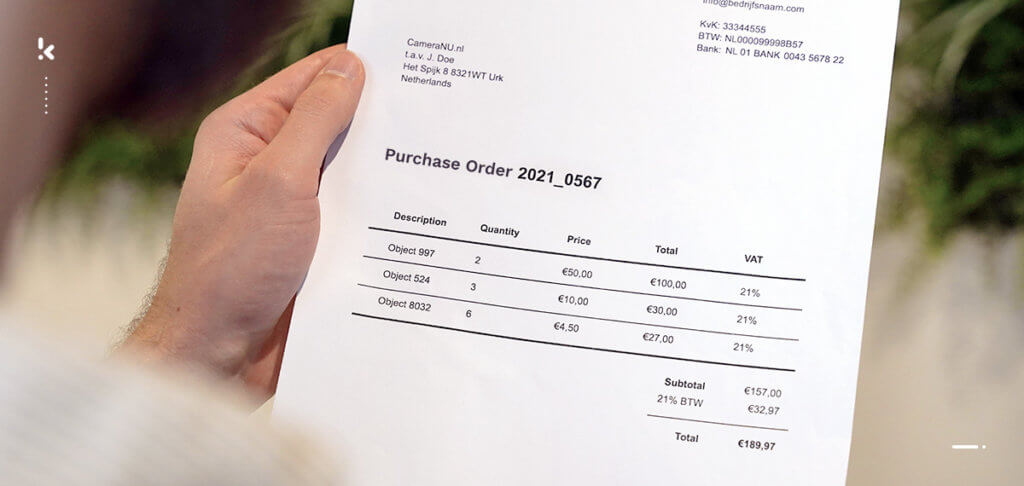

Take invoices as an example. With robotic accounting, the software bots take the invoice and check it, extract information, and transfer the data to an accounting system, without human input. Additionally, RPA in accounting minimizes the risk of fraudulent transactions occurring, as it helps identify document fraud.

See how robotic accounting can bring a lot of benefits to organizations. If you want to discover the advantages of making the switch to robotic accounting, keep reading!

Benefits of Robotic Accounting

RPA in accounting brings several improvements to financial operations within a company. Let’s take a look at some of the reasons why robotic accounting benefits organizations:

- It is cost-effective: Robotic accounting allows companies to eliminate unnecessary expenses on repetitive and straightforward tasks, saving up to $878,000 yearly.

- It increases workflow efficiency: Automating repetitive accounting processes improves the workflow in any organization, as financial experts can focus on tasks that require more attention.

- It reduces errors: RPA in accounting streamlines financial tasks, reducing human errors in the process and improving output quality.

- Reduces processing time: By implementing robotic accounting, businesses can save up to 52 days per year.

Implementing robotic accounting can become one of the strong suits of financial departments. Luckily, RPA tools do not solely resume basic accounting tasks. Let’s discuss some of the use cases of robotic accounting.

Use Cases of RPA in Accounting

As previously mentioned, RPA in accounting helps streamline tasks such as managing the balance sheet or the profit and loss statement. However, other financial processes also benefit from robotic accounting tools, such as:

Invoice Processing

Implementing robotic accounting software in invoice processing helps speed up transactions in a flawless manner. As invoices arrive in large volumes and different formats, they pose a real challenge for back-office employees trying to process them.

With RPA, the invoices can be scanned and all data is transferred to the accounting system accurately, reducing the need for manually processing invoices or payment confirmations. In addition, the software detects any duplicates and forged invoices, therefore reducing the risk of invoice fraud.

Accounts Payable

Managing accounts payable processes can easily be done with robotic accounting software. Keeping track of any upcoming payments, for instance, accrued expenses can now be an automated task. The robotic accounting software transcripts all the information directly in the bookkeeping system, improving balance sheet accuracy in real time.

Expense Management

Organizations can use robotic accounting to facilitate the time-consuming task of expense management. Instead of manually processing company expenses, this tedious task can now be automated with the help of RPA.

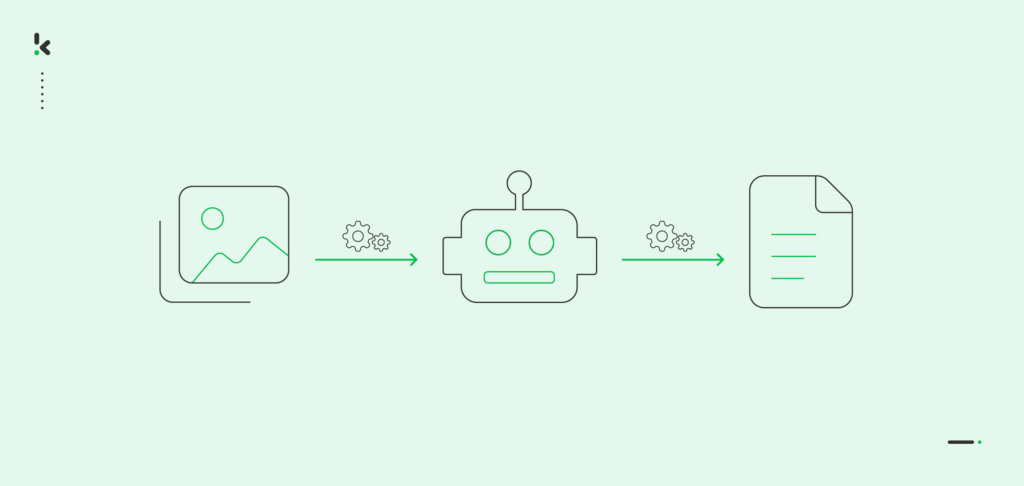

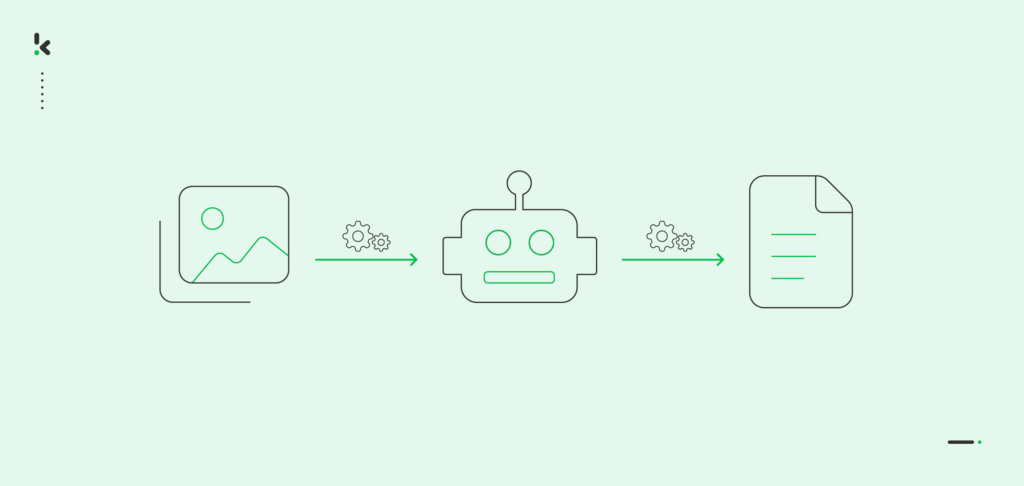

As an example, purchases made by employees can be registered and processed in an accounting system by simply scanning the receipt of the transaction. The data is read, extracted, and automatically transferred in the accounting system, based on certain business rules. The same process follows for debit and credit cards, bank statements, credit card statements, and other financial documents.

Purchase Order Processing

Using robotic accounting to manage the purchase order process represents a big asset to any organization. RPA allows companies to scan the purchase order and set up an automatic approval process, which only reaches authorized employees.

The software registers the information extracted from the PO automatically and transfers it to the accounting system. To make accountants’ lives even easier, the software performs two-way matching, by checking for any similarities or discrepancies between the invoice and the purchase order. This procedure enables businesses to identify any risk of vendor fraud.

Robotic accounting is an important tool for any organization looking to improve its financial processes. However, this is only possible if the software is well-performing and has the necessary features to automate accounting in an efficient manner, such as Klippa’s automation solutions.

Robotic Accounting Automation with Klippa

Klippa’s automation solution, Klippa SpendControl, offers organizations the necessary support and features to successfully automate accounting processes. Based on their specific needs, businesses can automate accounting tasks with smart business rules and OCR technology that can extract information from any images or scanned documents.

Klippa SpendControl offers a variety of advantages, such as:

- Both expense management software and invoice processing software in one platform

- Ability to send financial documents such as invoices and receipts via app, website, and email

- Proprietary OCR engine that can extract data with up to 99% accuracy

- Automated data entry for better operational efficiency

- Digital approval workflows for shorter AP days

- Smart duplicate invoice and receipt detection

- Experience seamless integration with a variety of ERP or accounting software, such as NetSuite, SAP, Xero, and many more.

If you’re curious about how Klippa can help your organization implement robotic accounting, book a free demo down below! For more information on the products, don’t hesitate to contact our experts!